XRP News: $1 Billion Flows Into XRP ETFs, XRP Price To Skyrocket

The post XRP News: $1 Billion Flows Into XRP ETFs, XRP Price To Skyrocket appeared first on Coinpedia Fintech News

XRP is finally having its breakout moment on Wall Street. Since the launch of XRP ETFs in March 2025, over $1 billion has flowed into these funds, showing strong demand from both institutions and retail investors.

With the SEC expected to decide on multiple spot XRP ETF applications soon, Ripple’s native token is positioning itself for a potential big breakout.

Strong Inflows Drive XRP ETF Growth

XRP ETFs have seen remarkable growth, attracting over $1 billion in inflows since their launch, including about $350 million in July alone. Leading funds like the Rex Osprey XRP ETF and Teucrium’s leveraged XRP ETF have driven much of this momentum, with assets surpassing $100 million and $366 million, respectively.

These numbers are similar to the early days of Ethereum and Solana ETFs, showing that XRP is becoming a top choice for serious investors.

The steady money coming in shows people are thinking long-term, supported by XRP’s growing use in global payments and Ripple’s network of over 300 financial institutions.

Road to a Spot XRP ETF

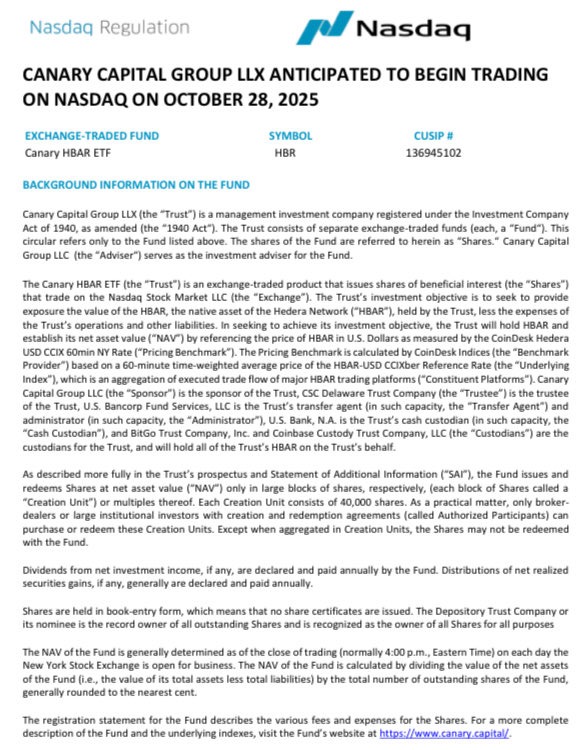

At present, the U.S. Securities and Exchange Commission (SEC) is expected to rule on at least seven spot XRP ETF applications between October 18 and November 14, including Grayscale’s highly anticipated proposal.

Meanwhile, Polymarket, a well-known Prediction market, shows a 99% probability that the SEC will approve a spot XRP ETF by the end of 2025.

These decisions could bring billions more from institutional investors, boosting XRP’s price and ETF activity. However, JPMorgan estimates $4– $8 billion in the first year, while some analysts see potential inflows up to $20 billion as XRP adoption grows.

XRP Price Analysis

As of now, XRP price is trading around $2.62, slightly down in the last 24 hours. Thus, renowned chart analyst Ali Martine sees potential for a bullish breakout, projecting prices could rise to the $3.40–$4.20 range in the coming months, particularly if ETF approvals come through.

The introduction of XRP ETFs would not only open new investment opportunities but also bring more stable, institutional-driven liquidity to the XRP market.

Fed Liquidity is Here: The Crypto Melt-Up Starts Now

Fed Liquidity is Here: The Crypto Melt-Up Starts Now