SUI Price on the Edge: Could a 950% Rally Repeat Before 2026?

The year is ending soon, and market watchers are looking for signs of an altcoin rally. Among the most discussed tokens is Sui. The SUI price is now in a critical phase after a strong performance in 2024.

The token recorded a 950% rise from $0.49 to $5.32 before entering consolidation. The current pattern could determine its next move.

Traders and analysts are paying attention to whether the SUI price will hold its momentum and possibly even hit new highs in 2026. The strength of Sui network as a whole and consistent on-chain development has kept long-term investors interested.

SUI Price Consolidates Ahead of Major Breakout

The SUI price has been trading sideways for several months within the symmetrical triangle pattern. Market participants interpret this as an accumulation phase rather than a downturn. The key support sits at $2, which has so far acted as a strong defensive level for buyers.

Also Read: ETF Delays Hit Institutional Crypto Demand: Solana, Cardano, and Sui See Pullbacks

If the SUI price remains above this point, bullish sentiment is expected to strengthen. However, a break below could open the door for a decline back to the $0.49 range.

The narrowing of this trading range suggests that pressure is building for a breakout. Historically, when digital assets consolidate in such patterns, a decisive move often follows.

Network Expansion Strengthens Fundamentals

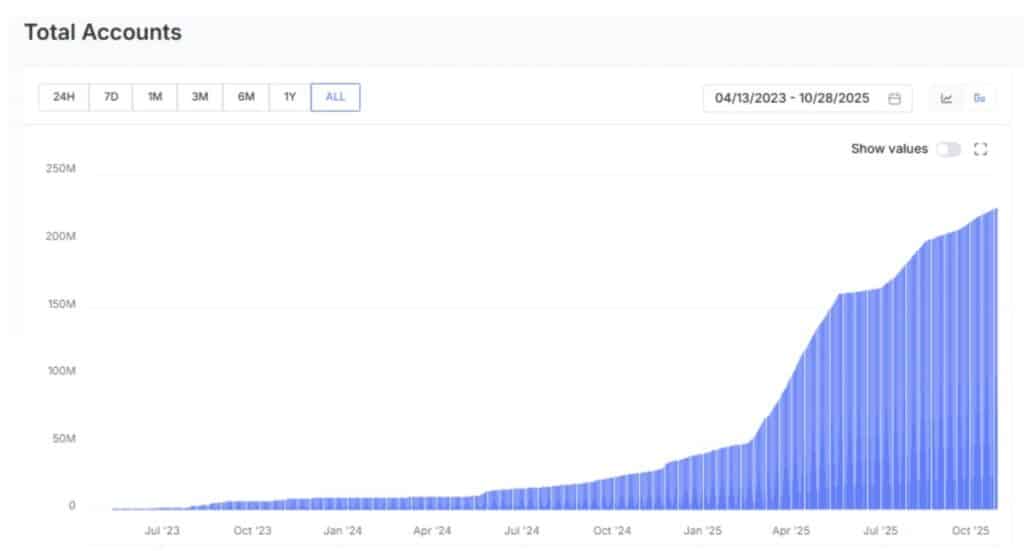

The expansion of Sui’s network remains one of its greatest strengths. The blockchain has seen an all-time high of 225 million total accounts, reflecting huge growth in the number of users. On October 28, almost 924,000 new accounts were registered.

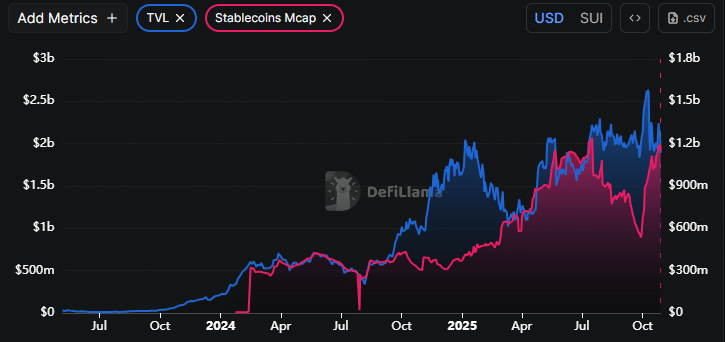

Stablecoin Activity Reflects Growing Liquidity

Stablecoin flow within the Sui ecosystem has surged and liquidity is more sufficient, and user engagement is further improved. Between October stablecoin market cap in the network increased from $560 million to $1.15 billion.

There is typically an association with increased DeFi participation with these types of gains as stablecoins enable trading, lending and yield opportunities. This development is indicative of increased trust in the ecosystem’s financial soundness and long-term viability.

DeFi Strength and Total Value Locked

TVL for Sui is still strong. The TVL has been fluctuating but remains around $1.89 billion, down from $2.62 billion earlier this month.

A high TVL level often represents a capital flowing into the network’s protocols, suggesting that every day people are using Sui’s staking, lending and liquidity programs.This resilience indicates that investors are leaving funds in the ecosystem.

Technical Analysis: Triangle Tightens Toward Breakout

The symmetrical triangle on the SUI price chart is still squeezing and indicating a breakout. Analysts point out that the narrower the range, the greater the chances a breakout will occur.

| Month | Min. Price | Avg. Price | Max. Price | Change |

|---|---|---|---|---|

| Oct 2025 | $ 1.75 | $ 1.98 | $ 2.50 |

0.54%

|

| Nov 2025 | $ 1.90 | $ 1.96 | $ 2.03 |

-18.40%

|

| Dec 2025 | $ 2.01 | $ 2.01 | $ 2.01 |

-19.05%

|

In case buying pressure increases, the SUI price may rise further and break above this level to the upside; however, investors should expect a retest of $5.32 which is its ATH. An established break above this price point could bring back new investor interest.

Market Sentiment and Analyst Outlook

Analysts are still bullish on Sui in the long run. They highlight on-chain growth, strong liquidity, and increasing developer activity as indicators of continued value.

Despite global market uncertainty, the price of SUI has held its own well, it is one contender that upholds its stability, unlike other weak alts. Institutional interest in blockchain infrastructure is increasing, and Sui’s emphasis on scalability and efficiency fits that trend.

Conclusion

SUI price is at one of its most crucial points days after the record-breaking rally in 2024. After several months of consolidation in a symmetrical triangle, market is getting ready for the next big move.

Network growth, increasing stablecoin liquidity and continued DeFi adoption all suggest underlying strength. If the momentum is sustained, SUI might retest and even exceed its previous $5.32 high before mid-2026.

Also Read: Sui’s DEX Volume Surges to All-Time High: What’s Driving Traders to the Network?

Appendix Glossary of Key terms

SUI – The native cryptocurrency of the Sui blockchain network.

Symmetrical Triangle – A chart pattern signaling potential breakout after price consolidation.

Support Level – A price point where buying pressure prevents further decline.

Breakout – A strong price move beyond established support or resistance.

Total Value Locked (TVL) – The total amount of assets staked or locked in DeFi protocols.

Stablecoin – A cryptocurrency pegged to a stable asset like the U.S. dollar.

DeFi – Decentralized Finance; blockchain-based financial applications without intermediaries.

Frequently Asked Questions SUI Price

1. What is driving the current SUI price trend?

Strong on-chain activity, expanding user adoption, and increasing stablecoin inflows are reinforcing the current SUI price trend.

2. What support levels are crucial for SUI?

The $2 support level remains the key area to monitor for any breakdown or continuation of the bullish structure.

3. Could the SUI price reach a new all-time high soon?

If the asset breaks out from its symmetrical triangle, analysts predict a potential return to the $5.32 mark before the end of 2025.

4. How does network growth impact the SUI price?

More user accounts, higher liquidity, and rising DeFi participation all strengthen the long-term foundation for sustained SUI price growth.

Read More: SUI Price on the Edge: Could a 950% Rally Repeat Before 2026?">SUI Price on the Edge: Could a 950% Rally Repeat Before 2026?