Tron Shows Bullish Divergence As Active Addresses Surge To 6.2M – Network Demand Explodes

Tron (TRX) is consolidating this week as the broader crypto market braces for the upcoming US Federal Reserve decision on interest rates and quantitative tightening (QT). Investors are treading carefully, with uncertainty surrounding whether the Fed will maintain its restrictive stance or pivot toward easing—an outcome that could shift liquidity flows across digital assets. Despite the cautious market mood, on-chain data from CryptoQuant highlights a powerful surge in Tron’s network activity that stands out from the rest of the market.

On October 27, 2025, Tron flagged one of its most significant on-chain events to date. The number of daily active addresses skyrocketed from a steady baseline of roughly 3.5 million to an astonishing 6.23 million, marking the second-highest activity ever recorded in the network’s history. This massive uptick underscores a sharp increase in network demand and utility, suggesting that users are actively engaging with decentralized applications and stablecoin transfers within the Tron ecosystem.

While price action remains in a consolidation phase, this sudden burst in on-chain participation paints a different picture—a growing fundamental strength that could position Tron as one of the few networks expanding its real-world activity amid macroeconomic uncertainty.

Fundamentals Show Strength As Tron Price Corrects

According to a recent CryptoOnchain report published on CryptoQuant, Tron’s latest on-chain surge reveals an intriguing dynamic between network activity and market price. What makes this event particularly compelling is the clear bullish divergence it forms. While Tron’s fundamentals are strengthening, its price has been steadily declining—a pattern that often precedes a reversal.

Specifically, the number of daily active addresses jumped from 3.5 million to 6.23 million on October 27, 2025, marking one of the network’s most active days ever. Meanwhile, TRX has been in a soft downtrend since August, slipping from a high near $0.36 to roughly $0.29. This divergence—rising on-chain engagement amid falling prices—suggests that market participants are underpricing Tron’s growing real-world utility.

Historically, such divergences between on-chain strength and price weakness have often acted as leading indicators for trend shifts. In Tron’s case, the data implies that network demand and user adoption are increasing faster than market sentiment reflects.

Analysts point to several possible catalysts behind this activity, including new decentralized application (dApp) launches, higher stablecoin transaction volumes, and effective user acquisition campaigns across the ecosystem.

The key factor now is sustainability. If this elevated level of activity holds through the coming weeks, it would confirm that Tron’s network growth is structural rather than temporary. Such validation could lay the groundwork for a significant bullish reversal, especially if macro conditions—like the Federal Reserve’s rate and QT decisions—shift toward easing, boosting liquidity across risk assets.

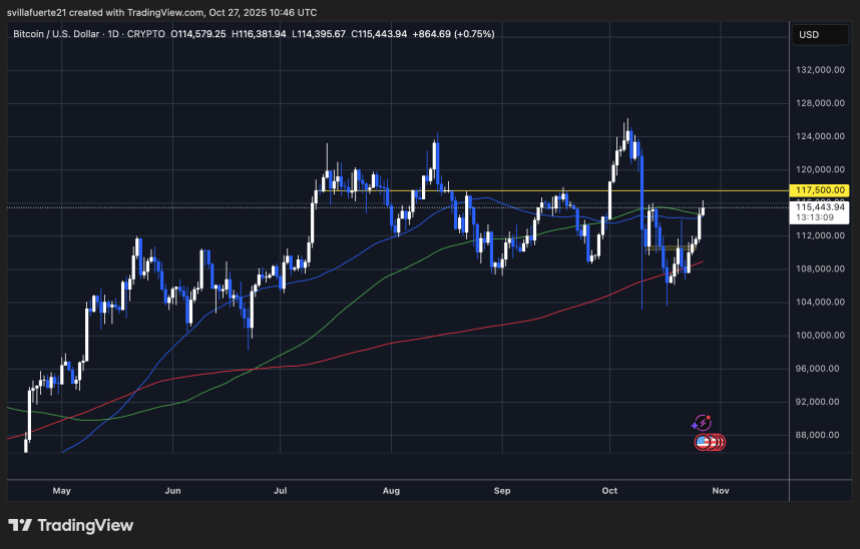

TRX Tests Key Moving Average As Bulls Defend Support

Tron’s (TRX) price is showing signs of consolidation around the $0.29–$0.30 range after an extended pullback from the August high of $0.36. The daily chart reveals that TRX has now reached the 200-day moving average (red line) — a key technical support that has historically served as a major inflection point for trend reversals. The asset briefly dipped below this level earlier in the week but has since recovered slightly, suggesting that buyers are attempting to stabilize momentum.

The 50-day (blue) and 100-day (green) moving averages are trending lower, reflecting short-term weakness after months of bullish structure. However, holding above the 200-day MA could mark the beginning of a base formation before a potential rebound. A confirmed close below this level, by contrast, would open the door for a deeper retracement toward $0.27 or even $0.25, where previous accumulation zones exist.

Trading volume remains moderate, hinting that the market is in a wait-and-see mode ahead of the US Federal Reserve’s interest rate and QT decision. If broader market sentiment turns risk-on and on-chain activity remains elevated, TRX could soon attempt a recovery toward $0.32–$0.33, reclaiming its medium-term trend.

Featured image from ChatGPT, chart from TradingView.com

A Fully Regulated Digital Yen Bridging Japan’s Finance and Web3

A Fully Regulated Digital Yen Bridging Japan’s Finance and Web3