How DeFi Smart Wallets Cut Liquidations Overnight

Crypto trades all night, and most wallets still wait for taps and confirmations. That mismatch is the central risk for everyday users. A recent industry op-ed argued that self-custody tools behave like passive vaults and leave people exposed when markets flip at 3 a.m. The author’s thesis is blunt: automation belongs inside the wallet, not bolted on as an afterthought.

The claim resonates because every modern finance stack already uses background rules. Stop losses and scheduled rebalancing are standard on traditional platforms, yet many DeFi interfaces still require manual approval flows that are too slow when volatility spikes.

What went wrong in 2022 still teaches hard lessons

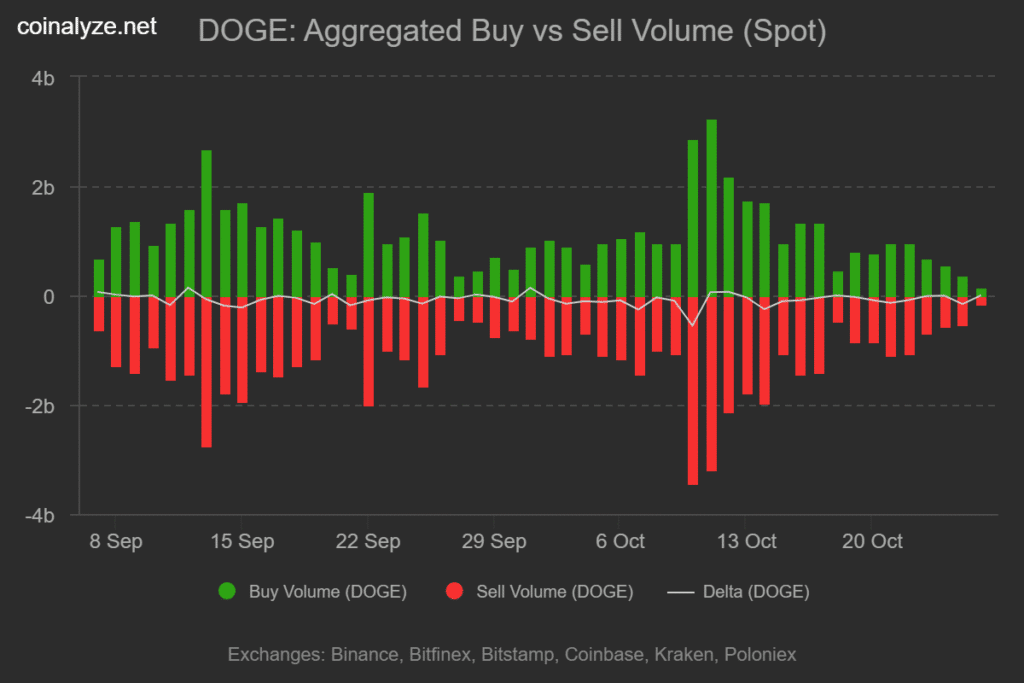

For proof that minutes matter, the TerraUSD collapse remains a cautionary tale. On Monday, May 9, 2022, around 18:30 GMT, UST fell materially off its peg and swung between ninety-five cents and twenty-five cents over the next three days. Earlier signs had flashed over the weekend, but self-custodied users without pre-defined rules faced a tidal move while asleep.

Timers and thresholds inside the wallet could have trimmed positions or hedged risk automatically. The timeline shows how fast the break unfolded and why manual clicks lose to market speed.

The technology now exists to make wallets intelligent

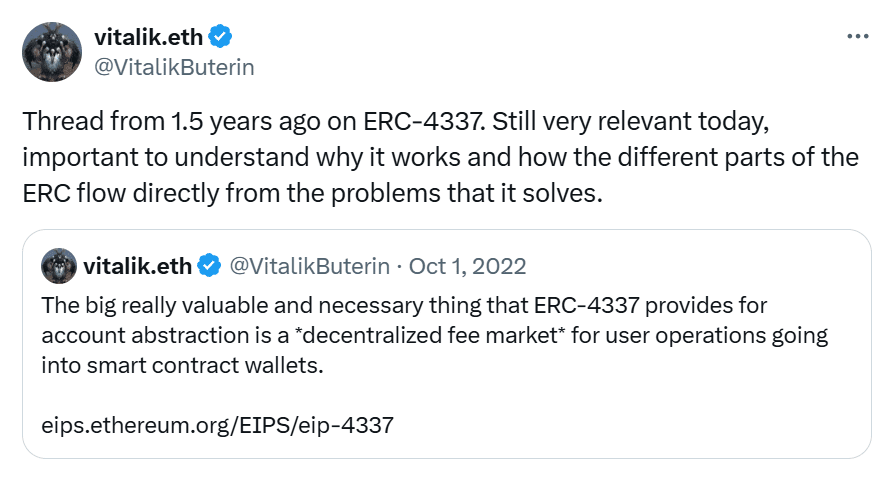

Ethereum’s account abstraction standard, often discussed under ERC-4337, turns a wallet into a programmable smart contract that can enforce custom spending rules, sponsor gas, and run scheduled or conditional actions. The official documentation describes a new transaction flow built on UserOperation objects, a decentralized alt-mempool, and an on-chain EntryPoint that validates and executes rules. In practice it unlocks rule sets a normal person actually wants, such as automatic daily rebalancing or a liquidation guard that pays down debt when a collateral ratio crosses a threshold.

When Ethereum’s co-founder weighed in on this direction, he called the approach “really elegant” and highlighted that account abstraction is a “pretty big deal” for adoption because it lets non-custodial wallets behave like programmable accounts. That view matters because it frames self-custody as more than a seed phrase. It becomes a set of predictable behaviors a user defines once and trusts to run in the background.

Why DeFi smart wallets are the missing safety layer

The DeFi smart wallets describes wallets that implement account abstraction to provide programmable risk controls, recovery options, and gas handling. DeFi smart wallets collapse multiple steps into one clean action. DeFi smart wallets can hold rules for recurring allocations or borrowing caps.

DeFi smart wallets can also route transactions through paymasters so fees are paid in stablecoins, a minor detail that removes friction in real life. People need DeFi smart wallets that guard downside without sacrificing sovereignty. With DeFi smart wallets, the rules live with the keys. DeFi smart wallets keep the person in command while executing the plan precisely. DeFi smart wallets can finally make “set it and sleep” a reality for self-custody. DeFi smart wallets are not a luxury; they are a safety feature.

DeFi smart wallets also reduce support headaches because users define thresholds instead of relying on frantic approvals. DeFi smart wallets are the practical bridge between crypto’s ideals and normal finance muscle memory. DeFi smart wallets deserve to be the default setting, not the premium tier.

The market is already moving toward passkeys, gas sponsorship, and rule engines

Major builders have rolled out smart wallet flows where a user signs in with a passkey instead of memorizing a seed phrase. The help pages and product posts explain how a passkey based on device biometrics can unlock a non-custodial account, while gas fees can be sponsored or paid in tokens other than ETH.

That combination makes a complex action feel like any mainstream fintech app. It is the usability shift that unlocks the automation shift. If the wallet can sign safely without the user wrestling with seed phrases and gas coins, it can also follow the user’s rules at 2 a.m. without nagging for approval.

Industry research roundups from last year tracked the rise of these features across multiple chains, noting support for passkeys, sponsored transactions, and SDKs that let apps trigger wallet actions behind clean interfaces. The trend line is clear. Smart wallets are maturing from a developer demo into the baseline of consumer crypto.

“Let the wallet do the work” is not hype; it is a practical rule set

There is no need to imagine science fiction. The portfolio-automation startups that raised funding in 2025 pitch a simple promise: set allocation rules, risk limits, and timing once, then let the system execute continuously inside a non-custodial setup.

In an interview this year, one founder put it in plain language: “We need to get to a point where we can say, ‘Hey, Mom, do you want to participate in this?’” and described converting a plain-English plan into an automated on-chain portfolio that the user still owns. The same team stated publicly that “your assets should work for you” because the platform runs the portfolio “around the clock,” positioning this as the next evolution of programmable finance.

That is not a radical departure from tradition. It is a reapplication of what brokerage accounts and robo-advisors did years ago. The difference is architectural. Here the rules sit in a smart contract account that the user controls, not in a custodial back office.

What a safer self-custody day can look like

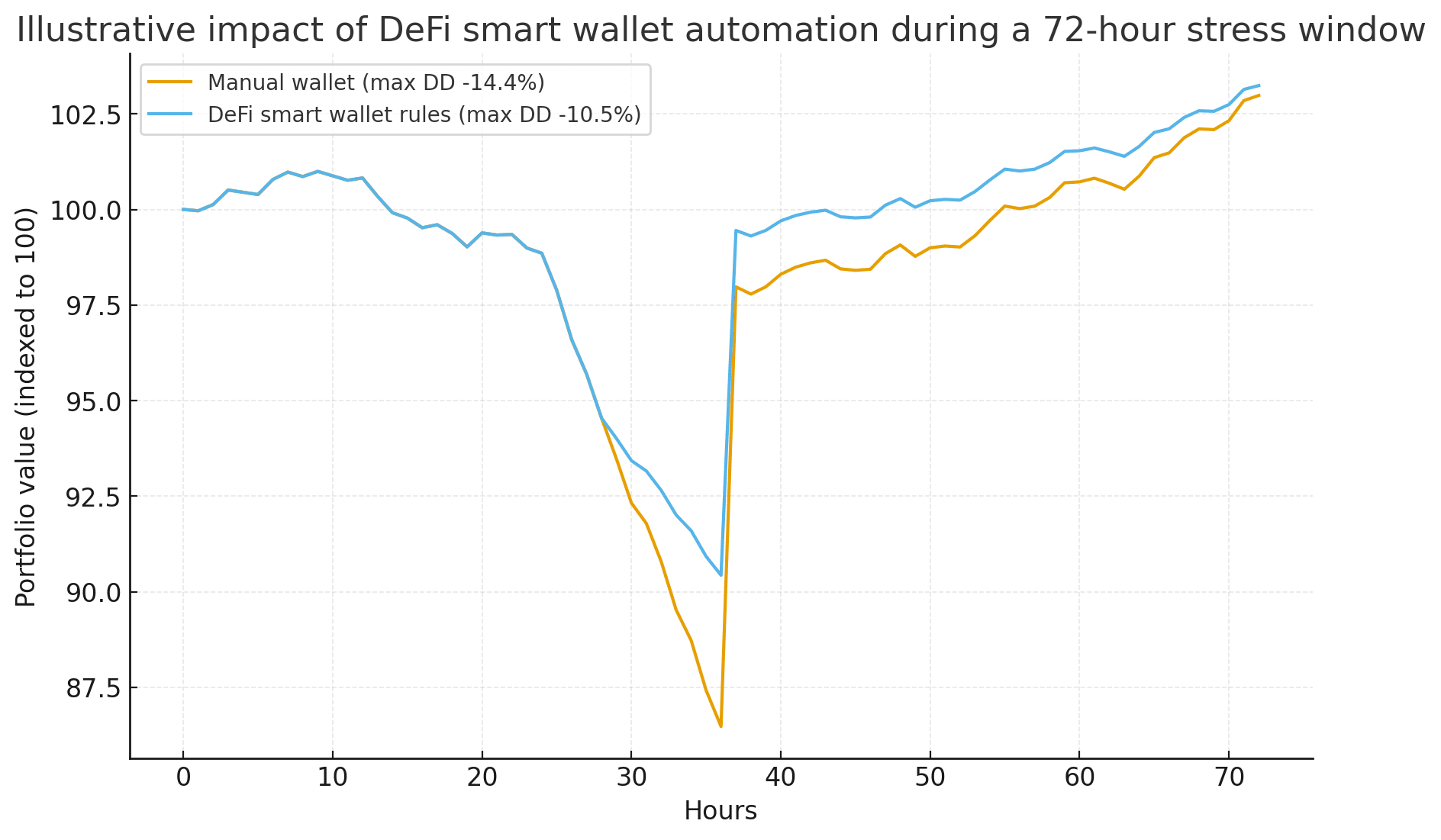

Picture a simple spot portfolio with three assets and a lending position that backs a stablecoin. In a smart wallet, the user can store three guardrails. First, a volatility circuit that reduces the high beta allocation by ten percent when a 24-hour move breaches a set band.

Second, a collateral health trigger that automatically repays debt by swapping a slice of spot assets when the ratio falls under a chosen number.

Third, a periodic rebalance that nudges allocations back to target on a fixed cadence. None of that requires a person to watch charts at night. It requires rules that live where the assets live.

The mechanics exist. ERC-4337 lets wallets validate UserOperation packages against spending policies. Paymasters can sponsor gas or accept stablecoins for fees. Developers can wire a scheduler that submits a UserOperation at set intervals. Smart recovery can use guardians so a lost device does not equal a lost life savings. The entire experience looks less like a trader’s terminal and more like a modern banking app that quietly follows instructions.

Risk framing for readers

Automation does not remove all risk. It changes the shape of risk. A poorly written rule can sell a long-term position at the exact bottom. A misconfigured paydown could create taxable events. Implementation bugs in smart accounts or paymasters can create novel failure cases.

Those realities argue for transparent audits, conservative defaults, and clear logs inside the wallet so users can see every rule and every action in human-readable form. The goal is not blind trust. The goal is visible, predictable behavior that beats panic clicking.

What builders should ship next

The next wave of wallet design should revolve around plain-English rule templates backed by battle-tested contracts. A user should be able to select “Protect from liquidation,” choose a ratio, pick which asset funds the paydown, and preview the worst-case spend before enabling it.

The wallet should show a timeline of upcoming scheduled ops. If the market moves sharply, the user should see which safeguard fired, with a link to the on-chain transaction. That level of clarity is table stakes in regulated finance and should be normal in open finance too.

“It is time for crypto to catch up and deliver what users actually need to thrive. Sleepless traders will not lead the next wave of adoption.” The argument is that built-in automation improves sovereignty rather than undermines it because the user defines the rules.

“The big really valuable and necessary thing that ERC-4337 provides for account abstraction is the ability for smart contract wallets to be first-class citizens.”

The position underscores that programmability is essential infrastructure, not a nice-to-have gadget.

“Your assets should work for you. The platform executes your portfolio strategy around the clock so you can focus on ideas, not transactions.” That is a direct line from a founder who is betting on automation as the default.

Adoption is compounding

Developer posts this year have predicted hundreds of millions of smart accounts over time as chain-level upgrades and wallet defaults tilt toward account abstraction. Forecasts point to chain abstraction and new transaction infrastructure as catalysts. Whether those precise numbers arrive is less important than the direction. Simpler onboarding plus programmable accounts equals an environment where everyday savers can use guardrails without becoming power users.

Education matters too. Clear explainers and help pages on passkeys, gas sponsorship, and recovery patterns are improving. People can now authenticate with a passkey, skip seed-phrase anxiety, and let the wallet sponsor gas or accept stablecoin fees. That seemingly small change breaks a major barrier for first-time users.

Competitive dynamics will reward the safest default

The first wallet to offer easy liquidation guards, threshold hedges, and set-and-review rebalancing will not just win users. It will reduce support costs and regulatory friction because fewer people will suffer preventable blowups. In that world, the phrase DeFi smart wallets signals more than a feature list. It signals a philosophy that self-custody should be safe by default and flexible by design. The best implementations will publish transparent audits, use minimal permissions, and expose simple toggles for every background rule so nothing happens without explicit consent.

A short view on stablecoins and guardrails

Stablecoin depegs remain rare, but recent years have delivered several big ones. Education portals have documented those episodes and explained how to think about depeg risk across different collateral models. A wallet that lets a user set a rule like “exit if this stablecoin trades two percent below peg for more than thirty minutes” provides a clear, human tool for managing that rare scenario without drama. In self-custody, that kind of rule belongs in-wallet, not in a separate bot that might lose a key or go offline.

Conclusion

Self-custody should not require sleepless nights. The industry finally has the building blocks to embed risk rules, scheduled tasks, and emergency safeguards directly inside wallets. Account abstraction, passkeys, sponsored gas, and clean recovery flows form the plumbing.

Clear rule templates and readable logs form the user experience. The result is a class of DeFi smart wallets that act as intelligent stewards of a user’s plan. If the sector delivers that standard, volatility becomes less frightening, participation becomes more durable, and crypto starts to look like a place where everyday people can invest with confidence.

FAQ

What exactly is a smart wallet in this context?

A smart wallet is a non-custodial wallet implemented as a smart contract account. It can enforce user-defined rules for spending, scheduling, and security, and it can accept sponsored gas or alternative fee tokens. It brings automation into self-custody.

How does account abstraction help normal users?

Account abstraction lets wallets behave like programmable accounts. That means passkey sign-ins, recovery helpers, and background actions that follow a person’s instructions. It reduces the number of manual steps needed to perform safe operations.

Can automation harm users if configured poorly?

Yes. Bad rules can trigger at the wrong time. The mitigation is conservative defaults, clear previews, and simple logs so users know what will happen and what did happen. Independent audits and minimal permissions also matter.

Are big builders actually shipping this, or is it theory?

Large teams shipped passkey logins, gas sponsorship, and SDKs for smart wallets this year. Research roundups tracked multi-chain support and developer adoption. The shift is underway.

Glossary of key terms

Account Abstraction (ERC-4337)

A framework that lets wallets act as smart contract accounts. It introduces UserOperation objects, a decentralized alt-mempool, and an on-chain EntryPoint that validates and executes programmable rules for spending and security.

UserOperation

A data structure defined by ERC-4337 that carries a user’s intent to the EntryPoint. Bundlers collect these operations, and the EntryPoint verifies rules before execution. It enables features such as sponsored gas and batched actions.

Programmatic Rebalancing

A wallet rule set that shifts portfolio weights back to target allocations on a schedule or when thresholds are crossed. In smart wallets it can run without manual confirmations.

Liquidation Guard

A rule inside a smart wallet that pays down debt or adds collateral when a lending position approaches a risk threshold. It helps reduce forced liquidations during sharp market moves.

Depeg Risk

The risk that a stablecoin trades away from its peg. Past incidents demonstrate how quickly a peg can fail. Wallet rules that watch price bands and durations can limit exposure.

Editor’s note for clarity: Direct quotations in this article are attributed to identifiable public figures or company posts, and each quotation includes a source link via the citations.

Read More: How DeFi Smart Wallets Cut Liquidations Overnight">How DeFi Smart Wallets Cut Liquidations Overnight