Top RWA Tokenization Platforms Dominating Market in November 2025

The real world has moved on-chain in a big way in 2025. Tokenized treasuries, money market funds, private credit, and even mainstream equities now trade as blockchain tokens with transparent custody and near-instant settlement.

The result is a more practical bridge between traditional finance and crypto. This article maps the leaders for top RWA tokenization platforms that matter right now, why they dominate, and how to judge them using simple, repeatable indicators.

Why tokenized assets took the driver’s seat in 2025

Two forces pulled in the same direction this year. First, institutions wanted faster settlement and better collateral mobility. Second, crypto natives wanted safer yield that sits closer to real cash flows. Market data shows a sharp rise in tokenized treasuries and money market vehicles through 2025, with the largest single product holding several billions in assets and distributing steady income on-chain.

On the retail side, tokenized versions of listed stocks and ETFs have arrived on major chains. These products are designed for non-U.S. markets and give investors access during extended hours with transparent on-chain settlement. Recent launches expanded this market to millions of additional users.

Regulators did not change the basic rules, which actually helps serious builders. A senior U.S. securities regulator reiterated this summer that tokenized securities remain securities. That clarity nudges the market toward compliant platforms with transfer agents, broker-dealers, and audit-ready records.

How to evaluate an RWA platform

Readers do not need a quant desk to compare platforms. Five indicators cover most of what matters.

Scale and adoption. Assets under management and total value locked tell the story of trust. Larger pools usually mean better liquidity and lower slippage. By late 2025, the top tokenized treasury products hold multi-billion balances across several chains.

Yield quality. Look for income sourced from real instruments like T-bills or short duration funds. Dividends or yield distributions should be visible onchain and match the underlying benchmarks over time.

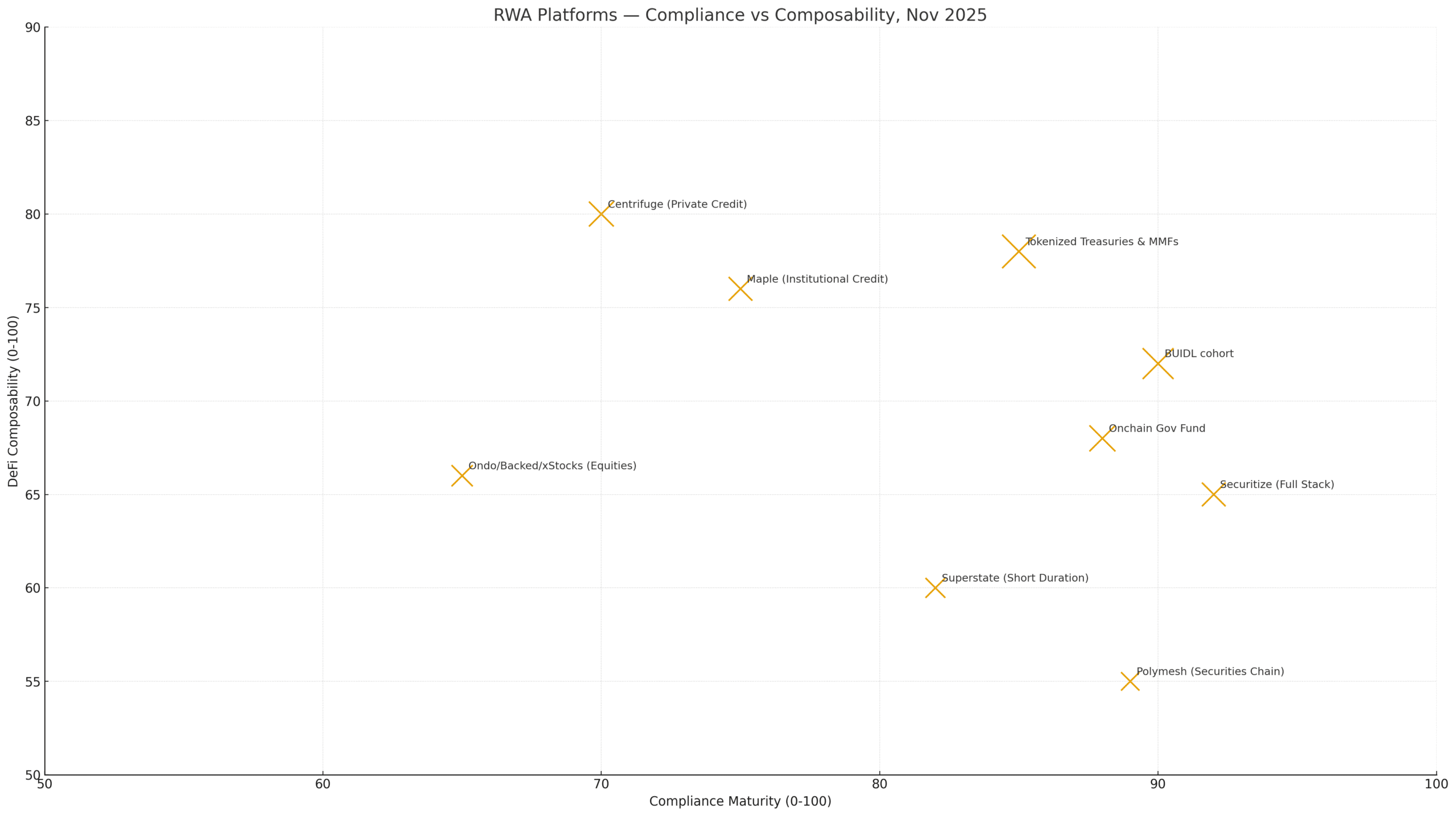

Compliance stack. The strongest players operate with registered transfer agents, regulated trading systems, and investor checks. That stack keeps secondary trading inside legal guardrails and reduces operational risk.

Chain reach and interoperability. Multi-chain issuance matters for collateral mobility. The largest products now live on several major networks, which makes them easier to pledge, settle, and compose inside DeFi.

Market access. Some platforms focus on institutions. Others bring tokenized stocks and funds to global retail where local rules allow. Expansion to high-usage chains and regional hubs hints at future growth.

With those lenses in hand, here are the platforms that dominate November 2025.

BUIDL and the institutional money market cohort

The largest tokenized money market instrument continues to set the pace in assets and distribution. It pays out income on-chain and has expanded issuance beyond Ethereum to a set of leading networks, which increases utility as collateral across trading venues. Market updates this fall show billions in assets and steady dividend history.

The broader money market tokenization push now includes more household finance names. Large banks and trust firms are piloting tokenized fund shares for institutional clients, integrating them into existing liquidity portals. These initiatives live inside controlled environments, but they validate the rails that public tokens already use.

Key takeaway: Institutional cash is getting comfortable with tokenized wrappers. That trend supports lower counterparty risk for crypto participants who want safer base yield.

Franklin’s on-chain government fund

A long-running on-chain government money fund has passed the proof-of-endurance test and continues to scale. Public data shows hundreds of millions in net assets with updated figures through Q3 2025. Addresses exist across multiple networks, which makes this instrument easy to move as collateral within DeFi.

Why it matters: This is a pure example of a regulated fund living as tokens across several chains, with daily NAV transparency and traditional fund governance behind it.

Ondo Global Markets and the rise of tokenized equities

The tokenized stock segment got a jolt as Ondo brought more than one hundred U.S. stocks and ETFs to a major high-throughput chain. The move targets regions that have strong usage on that chain, opening access to millions of potential users and inviting direct competition with other tokenized equity providers.

What to watch: Liquidity quality during earnings weeks, spread stability around market open and close, and how well the tokens track corporate actions like dividends and splits.

Securitize and the regulated tokenization stack

Securitize sits at the center of several marquee tokenization efforts. It provides the transfer agent layer, secondary trading through a regulated venue, and fund administration. Recent corporate moves indicate growing scale, with several billions in tokenized assets and partnerships with top managers.

Why it dominates: It is the full stack that institutions expect. The platform blends traditional recordkeeping with onchain settlement and investor verification.

Polymesh and the purpose-built securities chain

Polymesh is a permissioned L1 designed for regulated assets. In 2025 it expanded access through new integrations and joined broader industry coalitions focused on bringing traditional markets onchain. The value proposition is simple. Identity is native, compliance is programmable, and settlement is deterministic.

What to look for next: More broker-dealer integrations and tokenized primary offerings that go straight to settlement on the chain.

Centrifuge and multichain private credit

Centrifuge focuses on real yield from offchain credit. The latest iteration launched across several EVM networks to make structured credit products chain-agnostic. This is the plumbing many asset managers need for securitized pools, servicer reporting, and investor redemptions.

Parallel data from independent dashboards shows a vibrant private credit segment with billions in active loans and near-double-digit average APR. That breadth helps diversify risk away from a single instrument like T-bills.

Maple and the professional credit corridor

Maple has refocused on sustainable token economics while continuing to originate and manage onchain credit to institutions. The strategic shift ties rewards to real financial performance and aligns incentives for long-term lenders. It is an important signal as private credit matures onchain.

Investor lens: Underwrite the manager, not just the token. Read loan tapes, collateral terms, and covenant reporting before allocating.

Backed, xStocks, and the competitive equity layer

Backed issues tokens that track stocks and ETFs and also powers tokenized equity programs for exchanges. A separate exchange brand announced plans to list tokenized versions of widely known U.S. names for non-U.S. regions, with custody and redemption workflows designed to maintain price parity. Together, these efforts bring onchain equities closer to mainstream behavior, including corporate action handling and redemptions.

What to monitor: Spread, tracking difference, and the legal framework that sits behind each token. Tokens should be backed one-for-one by the underlying security or an equivalent exposure.

Superstate and tokenized short duration funds

Superstate focuses on short duration government securities for qualified purchasers. Public trackers show circulating supply in the tens of millions with price stability consistent with a short duration mandate. This caters to professional treasurers who want programmable cash with conservative risk.

Practical use: Treasury teams can manage idle cash onchain and still keep tight interest rate sensitivity.

Regional momentum and policy clarity

Tokenized treasuries are not only a U.S. story. New vehicles are emerging from regional hubs in the Gulf and Europe with regulatory approvals and exchange connectivity. These funds often tokenize ETF exposures for operational efficiency while keeping investor protections intact. The regional push shows that tokenization is a global market structure upgrade, not a local experiment.

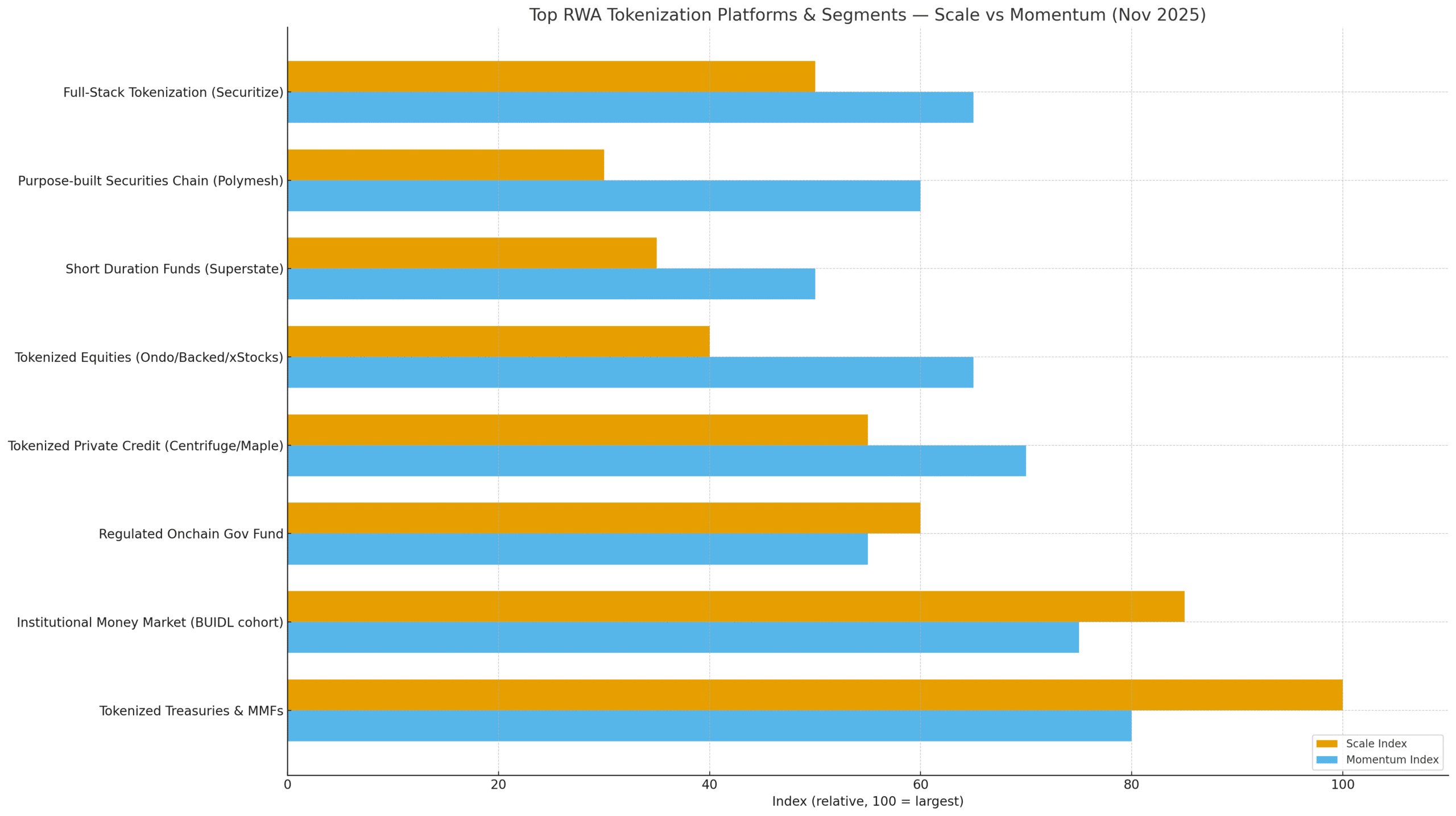

The scoreboard in November 2025

Putting it all together, the dominant picture looks like this. Tokenized treasuries and money market funds lead in size and stability. Tokenized private credit expands the yield menu and diversifies risk. Tokenized equities have crossed from proof of concept to live markets with real users. Institutional rails are in production, not theory. The numbers behind these trends are visible in market trackers, fund updates, and multi-chain issuance announcements throughout 2025.

How crypto traders can apply key indicators today

An investor evaluating RWA tokens can stick to a short checklist.

Start with size. Look for multi-hundred-million or multi-billion vehicles with transparent holdings. Confirm chains and addresses, then check whether distributions arrive on a schedule that matches the underlying assets.

Review who runs the transfer agent and the trading venue, and whether secondary markets require proper investor checks. Finally, confirm how the token behaves inside DeFi. Collateral acceptance on major venues and chain coverage reduce friction at every step.

Conclusion

November 2025 is the moment when tokenization looks less like a pilot and more like new market plumbing. The leaders stand out for simple reasons. They run real assets at real scale, pay out real income, and operate inside clear regulatory guardrails. Multi-chain issuance now turns those assets into flexible collateral for traders and treasurers. Equity tokens add a global access layer that traditional brokers struggle to match after hours.

The next leg of growth will likely come from deeper integrations. Expect more treasury portals and broker systems to speak to public chains, more credit pools to surface with real underwriting data, and more compliant secondary venues to knit it together. The plan is not to replace finance. The plan is to make it programmable.

Frequently asked questions

What exactly is an RWA token?

It is a blockchain token that represents a claim on a real world asset such as a Treasury bill, a fund share, a loan participation, or a stock. The token mirrors ownership and cash flows while using onchain settlement. Recent market data confirms rapid growth in these instruments through 2025.

Are tokenized securities regulated?

Yes. Tokenization does not remove existing securities rules. A senior regulator reaffirmed that tokenized securities remain subject to securities law, which is why leading platforms carry registered roles like transfer agent and broker-dealer.

Why do institutions care about tokenization now?

They want faster settlement, better collateral mobility, and better transparency. Pilots that tie tokenized fund shares into existing treasury portals show that traditional players see real operational gains.

Glossary of key terms

Alternative Trading System (ATS).

A regulated venue that matches buyers and sellers of securities outside national exchanges. Several tokenization platforms operate an ATS to enable compliant secondary trading.

Assets under management (AUM).

The total market value a fund or platform manages. In tokenized money markets, AUM reflects investor trust and directly links to liquidity. The largest product sits in the multi-billion range.

Collateral mobility.

The ease with which an asset can be pledged and moved across venues. Multi-chain issuance and acceptance by trading platforms increase mobility for tokenized funds.

Private credit.

Loans to companies outside public markets, often with floating rates and covenants. Onchain platforms package these loans into tokenized pools with regular reporting and investor protections. Segment data shows billions in active loans.

Read More: Top RWA Tokenization Platforms Dominating Market in November 2025">Top RWA Tokenization Platforms Dominating Market in November 2025