SHIB Whales Trim Holdings As Range Tightens: Can Bulls Reclaim Momentum?

SHIB whales are back in motion

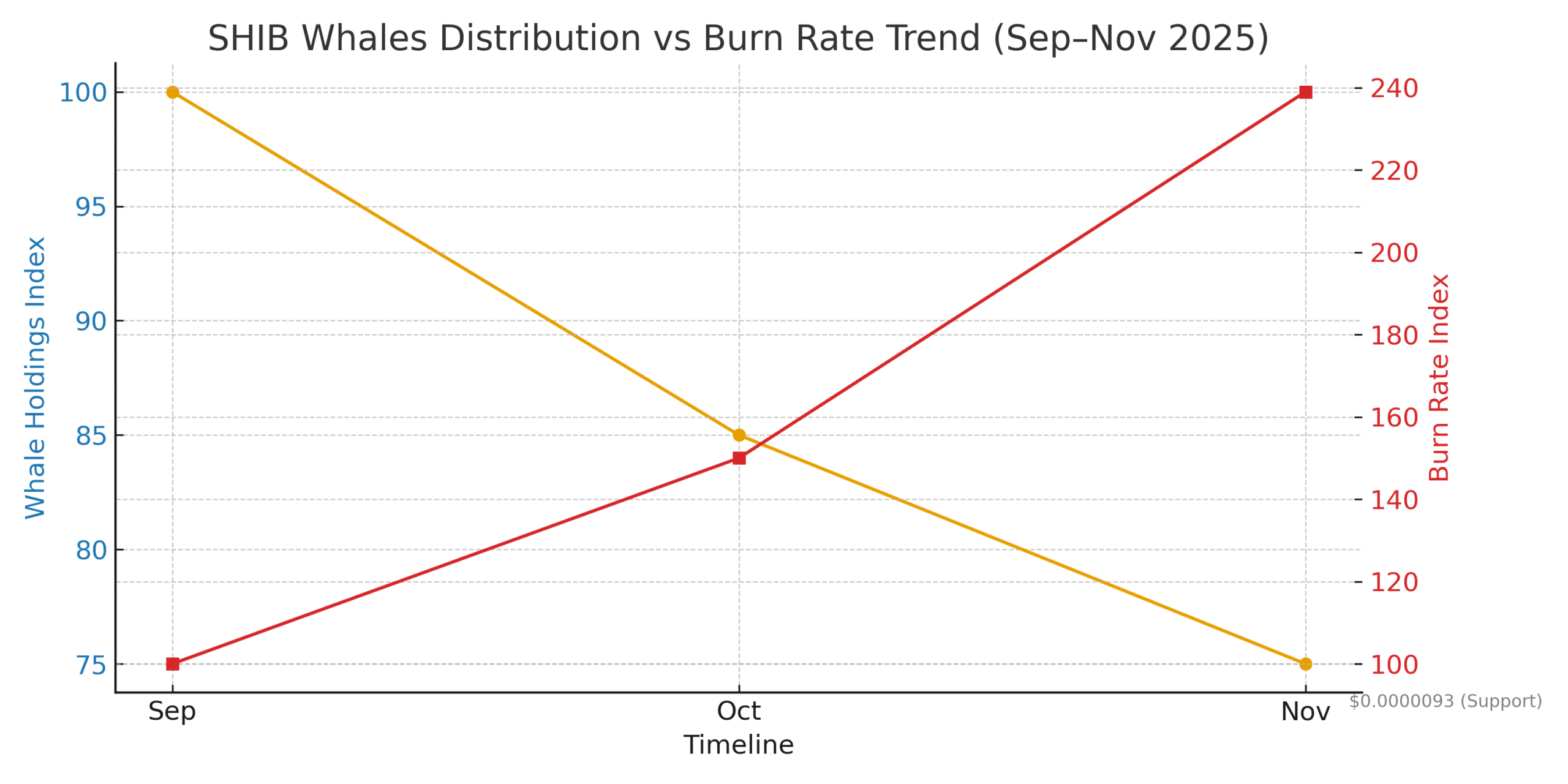

Markets rarely move in straight lines, and Shiba Inu is proving that again. Over recent weeks, SHIB whales reduced exposure while price coiled inside a narrow band. The story here is simple to read and hard to trade. Distribution has weighed on sentiment, and the chart keeps nudging traders to respect support and resistance first, opinions second. Data shows the largest holders have been cutting their share since early September, with sharp bursts of selling after 10 October, a backdrop that has capped rebounds.

The selling pressure overlaps with a steady pickup in older tokens moving again. Dormant circulation spiked on 19 October and 26 October, a classic sign of supply unlocking in weak phases. Those dates lined up with pullbacks and a reset in bullish appetite. The message is not subtle. When long-idle coins wake up, rallies tend to stall unless demand overwhelms the fresh flow.

Range math, not wishful thinking

After breaking below an eight-month range in October, SHIB settled into a short-term zone between $0.0000093 and $0.0000113. The mid-level near $0.0000103 has acted like a ceiling, rejecting multiple attempts to push higher and sending price back toward the floor. Traders who treat the band like a boxing ring have fared better than those chasing breakouts that never confirmed.

The supply held by SHIB whales continues to trend lower, which matters more than talk. Lower whale share during bounces often signals distribution into strength. That dynamic has kept the recovery fragile and left bulls negotiating for inches rather than yards. Until that curve flattens or turns higher, sustained upside will need a catalyst that refills demand.

Signals that count right now

On the four-hour chart, MACD leans bearish, a clean reflection of fading strength. At the same time, On-Balance Volume has carved higher lows for roughly three weeks, a small but important positive that hints at quiet accumulation. For traders shadowing SHIB whales, the mix is tricky. Momentum says respect the range. Volume says leave room for a squeeze if sellers blink.

Token burns tell their own story. Daily burn totals cooled in the last 24 hours, but the seven-day burn rate climbed about 139 percent week over week. Burns do not cancel distribution on their own, yet they can help stabilize the tape when sell pressure eases. If SHIB whales slow distribution while burns stay firm, the top of the short-term band comes back into view.

Levels, scenarios, and what flips the script

If the lower edge near $0.0000093 gives way on convincing volume, bears will try to press into fresh lows. If price holds the floor and reclaims $0.0000103, attention shifts to the band top and the liquidity sitting just above it. Price acceptance over the range would tell readers that supply has thinned and late sellers are getting absorbed. In that case, even SHIB whales who have been net sellers could pause, which often softens volatility and allows the trend to reset.

Risk management still rules. SHIB whales often sell into strength during uncertain times, and that has punished late buyers. Position sizes, invalidation levels, and patience matter more than headlines. When the data flips, it will likely show up first in the supply-held curve stabilizing, dormant circulation cooling, and OBV breaking higher with price. Those are the breadcrumbs worth following.

Conclusion

The path forward is clear, even if it is narrow. The tape remains range-bound, momentum is soft, and on-chain distribution from large holders keeps a lid on rallies. A clean reclaim of $0.0000103 would be a start, but the lasting shift comes when supply trends stabilize and volume confirms it. Until then, the market trades the range it has, not the breakout it wants. The near-term bias stays cautious while SHIB whales appear to lean defensive.

FAQs

Is the recent selling from large holders new information?

Yes. On-chain metrics show the supply share of large holders has been falling since early September, with notable distribution after 10 October.

Do burns offset selling pressure?

Burns help reduce circulating supply, but they rarely overwhelm sustained distribution without rising demand. The seven-day burn rate recently rose about 139 percent.

Which indicators best capture trend quality here?

MACD for momentum, OBV for flow confirmation, and dormant circulation for supply shifts are the most helpful reads right now.

Glossary of Key Terms

Dormant circulation

A measure of older coins moving after long inactivity. Rising dormant circulation often signals supply entering the market from long-term holders.

On-Balance Volume (OBV)

A cumulative volume indicator that adds volume on up days and subtracts it on down days to gauge whether money is flowing into or out of an asset.

Moving Average Convergence Divergence (MACD)

A momentum tool that compares short- and long-term moving averages and uses a signal line to identify potential shifts in trend strength.

Range trading

A market condition where price oscillates between defined support and resistance. Traders focus on buying near support and selling near resistance until a breakout confirms.

Supply held by large holders

An on-chain metric tracking the percentage of total tokens controlled by the biggest addresses, often used to gauge distribution or accumulation pressure.

Read More: SHIB Whales Trim Holdings As Range Tightens: Can Bulls Reclaim Momentum?">SHIB Whales Trim Holdings As Range Tightens: Can Bulls Reclaim Momentum?