Dogecoin ETF Countdown: Bitwise Filing Puts DOGE Approval Just 20 Days Away

Last updated on November 07, 2025

This Article Was First Published on The Bit Journal.

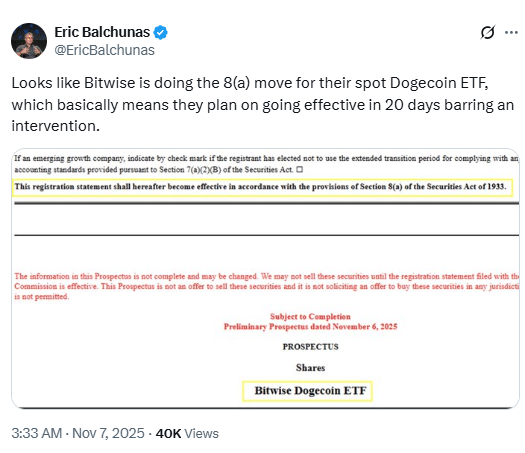

A Dogecoin ETF could become a reality within 20 days after Bitwise Asset Management updated its S1 registration. According to the source, the company removed a delaying amendment under Section 8(a) of the Securities Act.

With that change, the clock begins ticking. Unless the U.S. Securities and Exchange Commission (SEC) steps in, the registration becomes effective automatically.

What the Filing Updates Indicate

Bitwise’s update removes the delaying amendment, so the S1 becomes effective approximately 20 days later. The proposed ETF would hold real DOGE tokens. Coinbase Custody is listed as the custodian for the digital assets, and BNY Mellon will handle cash components. The benchmark is the CF Dogecoin Dollar Settlement Price, and the expected venue is NYSE Arca. The ticker and fee are not yet disclosed.

Why the Dogecoin ETF Matters

A Dogecoin ETF would give more investors access to DOGE who prefer regulated financial products rather than using direct crypto exchanges. It would place DOGE in a familiar investment wrapper, attracting a broader audience.

Live market data shows that Dogecoin is trading around $0.166 with a market cap of about $25.5 billion as of November 7, 2025. Forecasts suggest a price range of $0.18 to $0.20 at the end of 2025 under current conditions.

Regulatory Path and Timing

The key step ahead is the exchange rule change filing (19b4) for NYSE Arca’s listing. If the SEC clears that and does not intervene in the S1 auto-effect process, the Dogecoin ETF could be approved by late November. Should the SEC issue comments or delay the 19b4 approval, it could stretch into December or beyond.

Potential Market Impact

Here’s how the launch of a Dogecoin ETF could influence the market:

| Factor | Possible Effect |

|---|---|

| Accessibility | Easier exposure to DOGE for retail and institutional investors |

| Liquidity | More capital could flow into DOGE through the ETF structure |

| Price stability | Potential for steadier flows that reduce wild price swings |

| Perception | Could signal that DOGE is entering a more mature investment phase |

Investors should remember that success depends on the ETF’s structure. The fee, tracking accuracy, liquidity, and how the underlying DOGE is stored and valued will all shape its performance.

Conclusion

The race to bring a Dogecoin ETF to market signals a significant shift for this meme coin. From internet humor to a regulated investment product, DOGE now stands on the verge of another milestone. If the expected launch goes ahead in late November, it could change how DOGE is traded, held, and viewed by both crypto traders and mainstream investors.

Glossary of Key Terms

- ETF (Exchange Traded Fund): A fund that holds assets and trades on an exchange, similar to a stock.

- S1 Registration: A filing with the SEC to register new securities for public offering or listing.

- 19b4 Filing: A rule change application submitted by an exchange to list a new financial product.

- Custodian: A company that safely holds assets for others.

- Spot Price: The current market price for immediate settlement of an asset.

FAQs About Dogecoin ETF

When might the Dogecoin ETF launch?

If filings continue without SEC intervention, it could go live by late November 2025.

Will this ETF hold DOGE directly?

Yes. The proposed fund would hold actual DOGE tokens rather than futures or derivatives.

How will the ETF affect the DOGE price?

It could improve liquidity and accessibility, but price movement will still depend on market conditions.

Can any investor buy the Dogecoin ETF?

Once listed on NYSE Arca, it should be available to both retail and institutional investors through brokerage accounts.

What are the risks?

Delays in approval, regulatory changes, and DOGE’s natural volatility all remain possible challenges.

Read More: Dogecoin ETF Countdown: Bitwise Filing Puts DOGE Approval Just 20 Days Away">Dogecoin ETF Countdown: Bitwise Filing Puts DOGE Approval Just 20 Days Away