Cardano Whales Trim Positions – 4M ADA Sold in 7 Days

Cardano has entered a difficult phase as selling pressure intensifies across the crypto market. The price of ADA has fallen below the $0.60 level, a critical threshold that previously acted as both support and a psychological anchor for traders. With this breakdown, bullish momentum has faded, and the asset now faces mounting resistance amid a broader market downturn dominated by caution and fear.

Market sentiment toward Cardano has turned notably bearish, reflecting growing uncertainty about short-term price stability. However, several analysts view the current decline as part of a natural market reset, potentially setting the stage for a healthier recovery once selling pressure subsides.

According to recent on-chain data, whales — large holders responsible for significant portions of ADA’s supply — have been offloading millions of tokens in recent days. This selling activity has contributed to the latest drop, underscoring how institutional and large investor behavior continues to shape price direction.

Whales Offload 4 ADA, Raising Fears of Panic Selling

According to Santiment data, Cardano whales have offloaded more than 4 million ADA over the past week, signaling rising uncertainty among large holders. This wave of selling has added to the broader weakness seen across the market, as investors react to increasing volatility and fading confidence following Bitcoin’s recent dip below $100K.

Analysts warn that such whale activity often triggers short-term panic selling, as retail traders interpret these moves as a sign of deeper distribution or loss of conviction from major holders. While the scale of the selloff remains moderate relative to Cardano’s overall supply, it has nevertheless amplified bearish sentiment around ADA’s short-term outlook.

For the market to stabilize, much now depends on Bitcoin maintaining its current demand zone and Ethereum reclaiming higher levels above $3,400. Both assets continue to serve as the key drivers of broader crypto market sentiment and liquidity flow. If BTC can hold above $100K and ETH resumes its uptrend, confidence could quickly return to altcoins like Cardano.

ADA Struggles Below $0.60 as Selling Pressure Persists

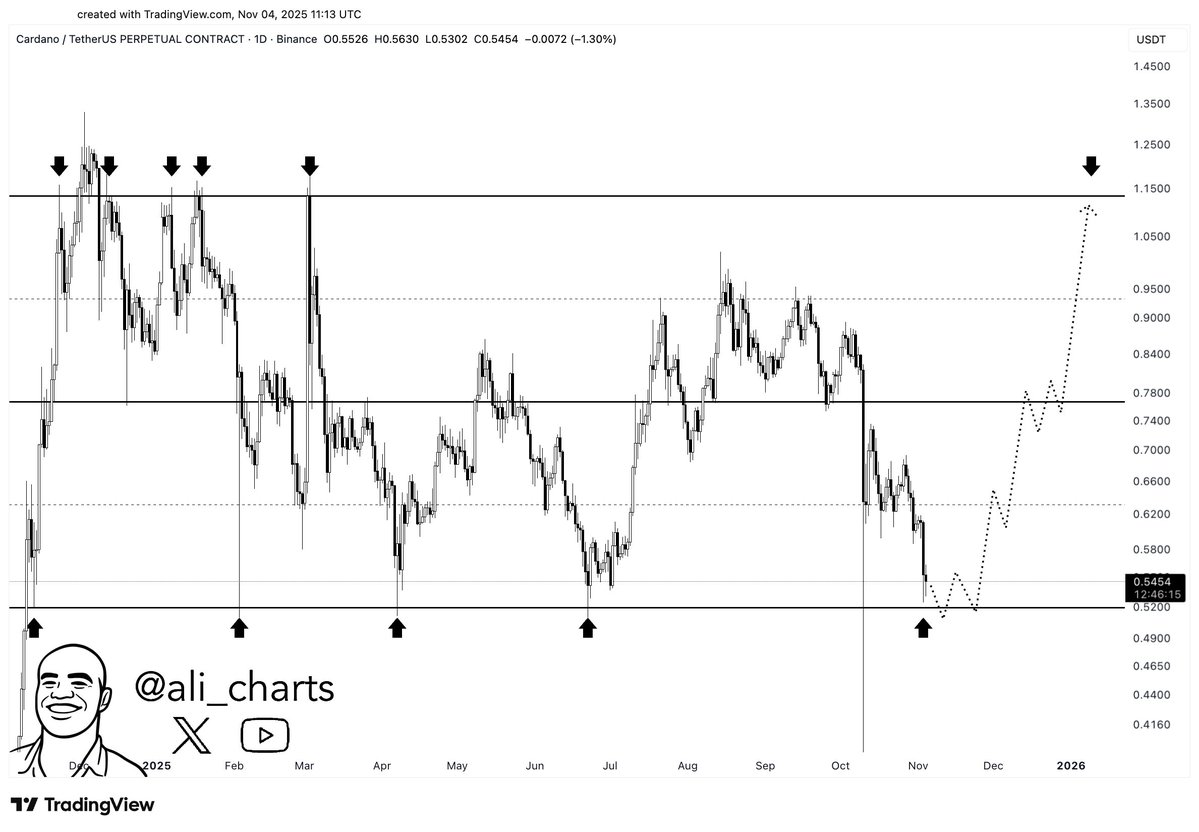

Cardano’s (ADA) price remains under significant selling pressure, currently trading around $0.54 after losing the critical $0.60 support level earlier this week. The daily chart shows ADA struggling to gain traction above its 50-day, 100-day, and 200-day moving averages, which now act as layered resistance between $0.70 and $0.75 — levels that must be reclaimed to shift momentum back in favor of the bulls.

Recent price action reflects clear bearish control, with lower highs and lower lows forming since late September. The sharp rejection from $0.70 and subsequent decline below the 200-day moving average confirm that short-term traders remain hesitant to buy dips. However, the presence of a local demand zone around $0.50–$0.52 could provide temporary relief, as historical data shows this region acting as a strong accumulation area in prior market cycles.

Volume spikes suggest active selling, likely driven by whale offloading identified by on-chain analytics. For a reversal, ADA would need to sustain a daily close above $0.60, supported by an increase in volume and a broader recovery across BTC and ETH. Until then, the outlook remains cautious, with risks of further downside if macro sentiment fails to stabilize.

Featured image from ChatGPT, chart from TradingView.com