Chainlink Price Prediction 2026, 2027 – 2030: Will LINK Price Reach $100?

The post Chainlink Price Prediction 2026, 2027 – 2030: Will LINK Price Reach $100? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of the LINK token is $ 9.05357905.

- Price prediction for 2026 suggests a potential high of $55.

- Long-term forecasts indicate LINK could reach $195 by 2030.

Chainlink has emerged as a game-changing decentralized oracle network, enabling smart contracts to connect seamlessly with real-world data, APIs, and traditional financial systems. As the crypto market evolves, Chainlink’s role continues to expand, especially with its Cross-Chain Interoperability Protocol (CCIP) gaining traction. Its native token, LINK, not only powers the ecosystem but has also caught the attention of investors and analysts. As a result, institutional interest surged, leading to the launch of the LINK ETF by Grayscale in early December 2025.

With LINK price showing signs of a potential breakout and strong on-chain fundamentals backing its rise, the big question remains: Can LINK coin price hit $50 in December 2025? Let’s dive into this detailed Chainlink price prediction 2026–2030 to find out.

Table of Contents

Chainlink Price Today

| Cryptocurrency | Chainlink |

| Token | LINK |

| Price | $9.0536

|

| Market Cap | $ 6,410,839,057.59 |

| 24h Volume | $ 1,162,383,509.9678 |

| Circulating Supply | 708,099,970.4526 |

| Total Supply | 1,000,000,000.00 |

| All-Time High | $ 52.8761 on 10 May 2021 |

| All-Time Low | $ 0.1263 on 23 September 2017 |

Coinpedia’s Chainlink Price Prediction 2026

A long-term ascending trendline on LINK/USD’s weekly timeframe chart is observed, which has been reliable over the years, often leading to upward price movements. The Chainlink price prediction for 2026 indicates a strong potential for a significant price surge, reminiscent of the 2020 rally, possibly reaching $48 to $55 due to positive market momentum. For a more conservative outlook, predictions suggest a lower range of $32 to $36 by 2026, offering a favorable risk-reward scenario for investors.

Chainlink Price Targets February 2026

In January, the LINK price firmly continued its downtrend, reaching a significant long-term ascending trendline support above $9.0 on the daily chart in early February. This pivotal moment suggests LINK/USD is poised for a reversal this month, with a strong likelihood of recovering to $15. However, if it fails to hold above $9, the bullish outlook will be negated, leading LINK to new lows. Should the $9 support level be surpassed, we could see the price target for February soar to $18.

Chainlink Price Prediction 2026

On the weekly chart, a long-term ascending trendline has been consistently in effect over multiple years. This trendline has proven its reliability by producing upward price movements on numerous occasions, reinforcing its credibility as a key technical indicator.

Looking ahead, the Chainlink price prediction 2026 suggests that the potential for a significant price surge reminiscent of the explosive rally observed in 2020, remains high. Analysts suggest that such a rally could see prices target the range of $48 to $55, driven by strong market momentum and bullish sentiment.

For those taking a more conservative outlook, even the lower end of the targets suggests a promising rally, with predictions pinpointing a price range of approximately $32 to $36 by 2026. This presents a favorable risk-reward scenario for investors monitoring this trendline and assessing their market strategies.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 35 | 50 | 55 |

Chainlink On-Chain Analysis

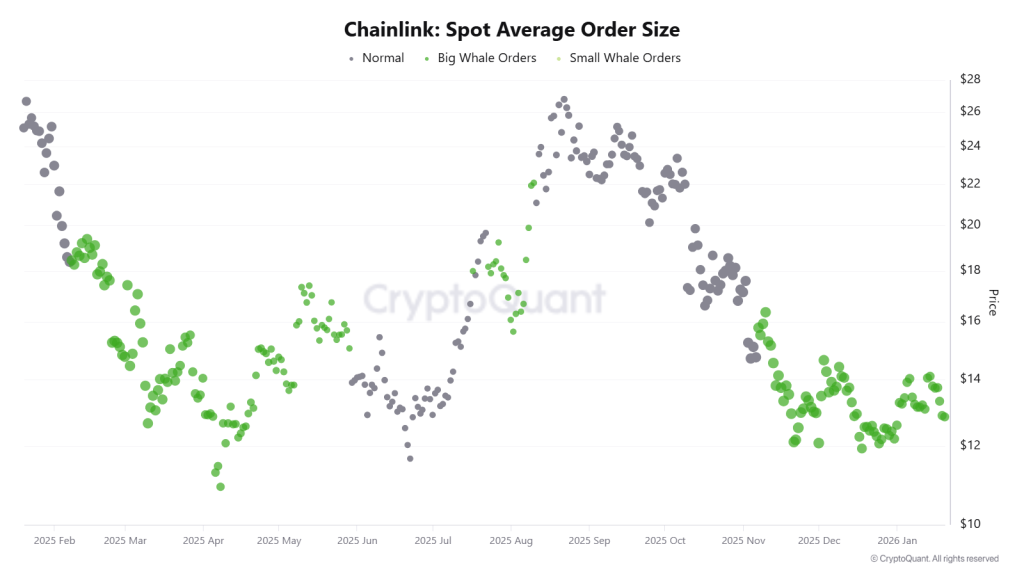

In the LINK on-chain metrics, both spot and futures markets are clearly exhibiting a Taker Buy-Dominant phase. It shows that buyers are actively executing at market prices without waiting for pullback opportunities. This is simply a strong sense of conviction rather than speculative strategies.

Additionally, the Average Order Size in both the spot and futures markets has escalated into the “Big Whale” category. This shift signals the involvement of institutional participants, who significantly influence LINK’s market structure, rather than retail trading flows.

Chainlink Price Targets 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 35 | 50 | 55 |

| 2027 | 48 | 64 | 80 |

| 2028 | 58 | 85 | 104 |

| 2029 | 70 | 108 | 141 |

| 2030 | 85 | 147 | 195 |

This table, based on historical movements, shows Chainlink price to reach $195 by 2030 based on compounding market cap each year. This table provides a framework for understanding the potential LINK price movements. Yet, the actual price will depend on a combination of market dynamics, investor behavior, and external factors influencing the cryptocurrency landscape.

LINK Crypto Price Forecast 2026

As per Chainlink’s Price forecast for 2026, the high price could be $55, the low may reach $35. This makes the average around $50.

LINK Price Prediction 2027

Moving to 2027, the LINK Price projects that it might hit a high price of $80 potentially. With a $48 low and an average of $64.

Chainlink Price Analysis 2028

Moving to 2028, the Chainlink Price Forecast predicts a high price of $104. On the flip side, the low may fall to $58, and the average is projected to be around $85.

LINK Coin Price Prediction 2029

As per Chainlink Price Forecast 2029, LINK’s high price is predicted to be $141, with a low of $70 and an average of $108.

Chainlink Price Prediction 2030

Finally, as per the Chainlink Price Forecast 2030, LINK’s price can reach a high price of $195. With a low of $85 and an average of $147.

Market Analysis

| Firm Name | 2026 | 2030 |

| Changelly | $25.83 | $140.70 |

| coincodex | $6.44 | $14.79 |

| Binance | $18.43 | $22.40 |

| Mitrade | $32.22 | $139.2 |

| Investing Haven | $54.10 | $80 |

| Flitpay | $62.6 | $110 |

*The aforementioned targets are the average targets set by the respective firms.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

At the time of writing, the value of one LINK crypto token was $ 9.05357905.

Chainlink price prediction for 2026 suggests LINK could trade between $35 and $55, with an average price near $50 under bullish conditions.

By 2030, 1 Chainlink could be worth between $85 and $195, depending on adoption, market cycles, and long-term crypto growth.

In five years, Chainlink is expected to be a core Web3 infrastructure, with broader adoption and a potential price range of $80–$140.

Chainlink is considered strong long term due to its real-world utility, oracle dominance, institutional adoption, and expanding cross-chain ecosystem.

LINK price is driven by oracle demand, CCIP adoption, staking growth, institutional interest, crypto market cycles, and global liquidity trends.

Russia's Moscow Exchange announces plans to launch cryptocurrency indices for Solana, Ripple,

Russia's Moscow Exchange announces plans to launch cryptocurrency indices for Solana, Ripple,  |

| (@Xaif_Crypto)

(@Xaif_Crypto)  Russia to roll out crypto regulatory framework this July, allowing retail participation.

Russia to roll out crypto regulatory framework this July, allowing retail participation.