IoTeX Suffers $8 Million Hack After Private Key Compromise

The post IoTeX Suffers $8 Million Hack After Private Key Compromise appeared first on Coinpedia Fintech News

As the crypto industry adopts AI-focused blockchain netowrk it is exposing itself to more security risks. IoTeX, a blockchain platform built for real-world AI, recently suffered a major security hack, resulting in nearly $8 million in losses.

Here’s how the IoTeX $8 million hack happen & how the IoTeX team is responding to it. Are users’ funds safe?

How IoTeX $8 Million Hack happen?

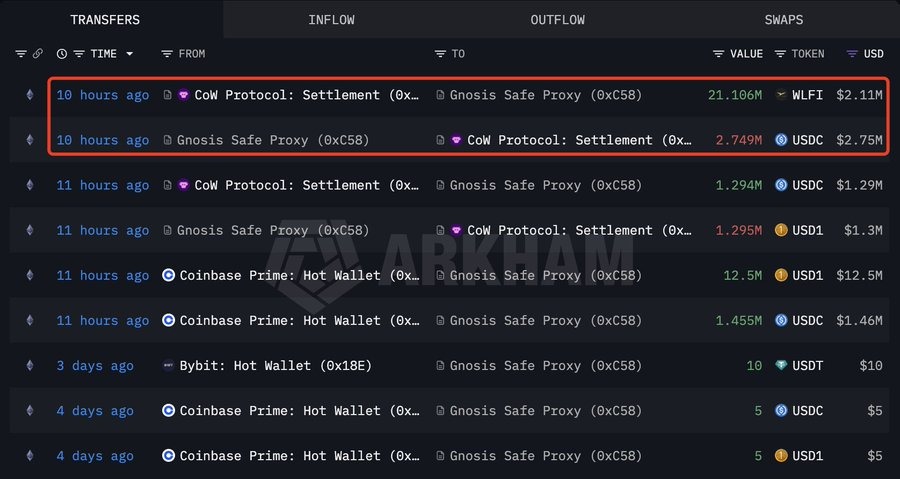

PeckShield, a blockchain security firm, said the hacker carried out the attack after compromising a private key. As a result, the hacker had complete access to the token safe and could take out various cryptocurrency assets.

The hacker compromised several tokens, including USDC, USDT, IOTX, PAYG, WBTC, and BUSD. They withdrew these assets directly from the smart contract vault, showing they had authorized access rather than exploiting a smart contract bug.

The attack turned serious when the hacker allegedly used the same access to create 111 million CIOTEX tokens.

This unauthorized token creation increased the scale of the damage and raised concerns about token supply integrity.

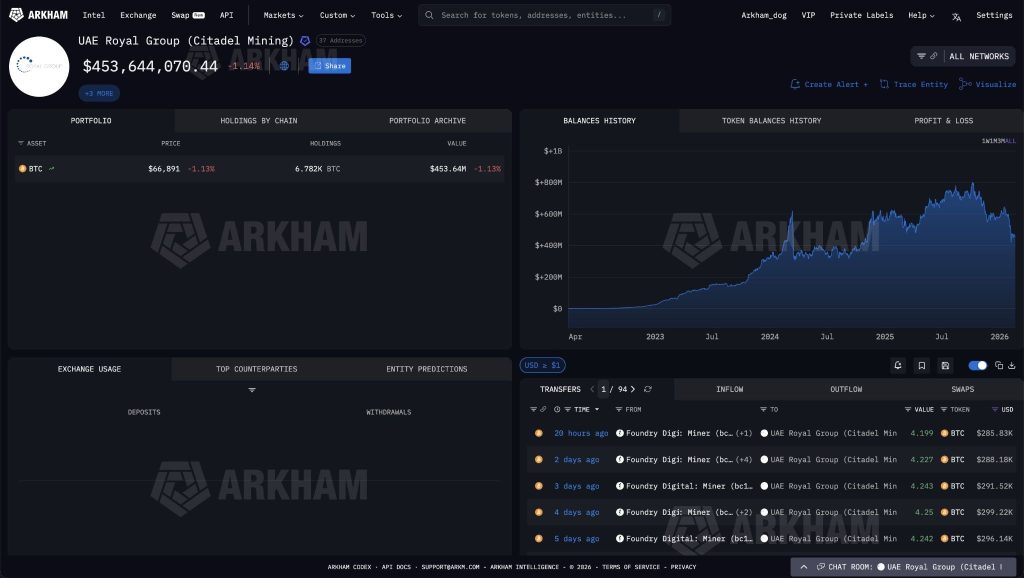

Stolen Funds Converted From ETH to Bitcoin

The hacker quickly began the process of transferring the stolen assets after stealing the money.

Later, the hacker traded the stolen tokens for Ethereum. The hacker then used the THORChain cross-chain protocol to bridge Ethereum to Bitcoin.

This step makes tracking and recovery more difficult, as funds move across different blockchain networks and become harder to freeze.

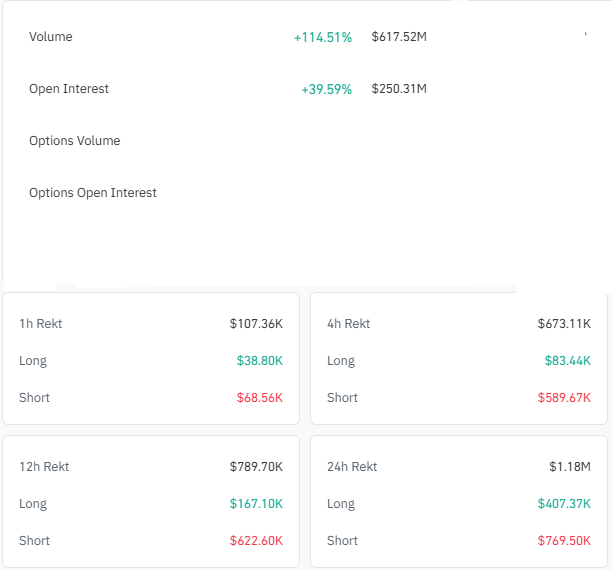

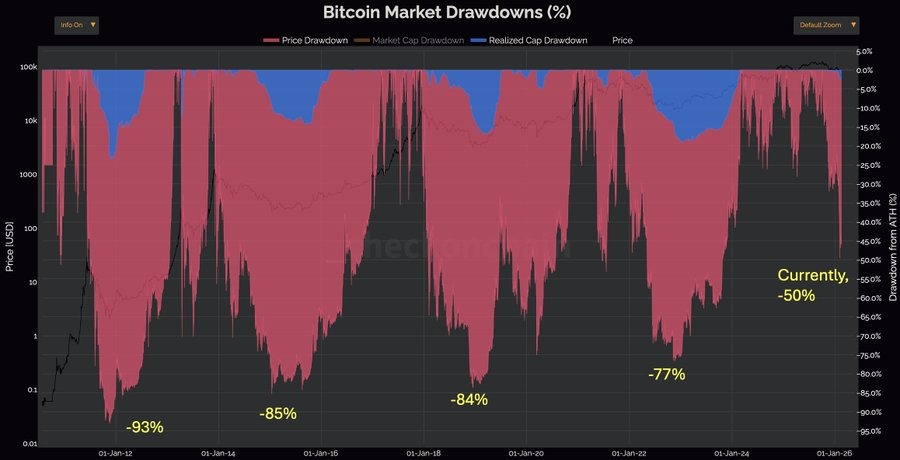

Following the hack, the IoTeX native token IOTX drop 7%, trading below $0.050 with a market cap hitting $47.46 million.

IoTeX Team Responds With Investigation

In reaction to the hack, IoTeX was quick to post on X confirming that they were aware of the hack and were working to investigate the issue.

The team confirmed that they were working with major crypto exchanges and blockchain security partners to trace back the stolen funds and stop any further movement.

We are aware of recent reports regarding suspicious activity involving an IoTeX token safe. Our team is fully engaged, working around the clock to assess and contain the situation.

— IoTeX (@iotex_io) February 21, 2026

Initial estimates indicate the potential loss is significantly lower than circulating rumors…

At the same time, exchanges and partners are helping monitor wallets linked to the attacker and may freeze assets if they enter centralized platforms.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The hacker compromised a private key, gaining full access to IoTeX’s token safe to withdraw assets and create 111 million unauthorized CIOTEX tokens.

The recent security breach resulted in approximately $8 million in losses across multiple tokens, including USDC, USDT, and IOTX.

IoTeX is collaborating with blockchain security firms and major exchanges to track the stolen funds and freeze assets if they enter centralized platforms.

Treasury Secretary Scott Bessent defends the US having a Strategic Bitcoin Reserve:

Treasury Secretary Scott Bessent defends the US having a Strategic Bitcoin Reserve:

Next up is v19.9 — the final step before v20. Node operators should make sure they’re upgraded and stay tuned for further instructions:

Next up is v19.9 — the final step before v20. Node operators should make sure they’re upgraded and stay tuned for further instructions:

False

False