Avalanche Price Prediction 2025, 2026 – 2030: Will AVAX Price Hit $100?

The post Avalanche Price Prediction 2025, 2026 – 2030: Will AVAX Price Hit $100? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of the Avalanche is $ 19.72232474.

- Price predictions for 2025 suggest highs of $50 and potential ETF approval.

- Long-term forecasts indicate AVAX could reach $518.50 by 2030.

Avalanche (AVAX) has become a go-to platform for developers, especially after its Avalanche 9000 mainnet upgrade and the launch of the AVAX card in early 2025. With lower fees and growing real-world use cases, plus backing from giants like Mastercard and SMBC, AVAX is gaining serious traction.

As a result, many are intrigued to know Avalanche prediction and are wondering: “How high can AVAX price go?” or “Will AVAX reach $50?” or “Does Avalanche have a good long-term future?” So, if you’re planning an investment in Avalanche (AVAX). Explore our in-depth Avalanche Price Prediction 2025 to 2030.

Table of Contents

Avalanche Price Today

| Cryptocurrency | Avalanche |

| Token | AVAX |

| Price | $19.7223

|

| Market Cap | $ 8,415,286,101.87 |

| 24h Volume | $ 508,011,674.3413 |

| Circulating Supply | 426,688,344.9972 |

| Total Supply | 460,024,244.9972 |

| All-Time High | $ 146.2179 on 21 November 2021 |

| All-Time Low | $ 2.7888 on 31 December 2020 |

CoinPedia’s Avalanche Price Prediction

According to Coinpedia’s AVAX price prediction, the altcoin may surpass the $49.46 mark in 2025. Moreover, the upcoming years are expected to be bullish, with a conservative momentum.

With an optimistic outlook, we expect the AVAX coin price to reach $50 in 2025.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $12.36 | $30.91 | $49.46 |

AVAX Price Prediction 2025

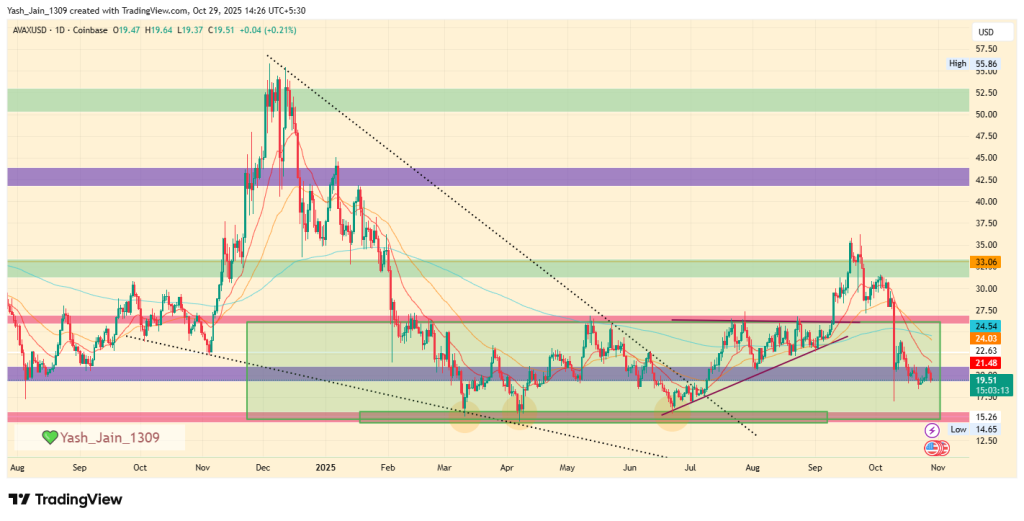

Avalanche (AVAX) showed signs of a major market shift after a long period of capped price action throughout 2025. In September, the token initiated a promising bullish rally by breaking the upper boundary of a ascending triangle pattern.

However, this optimism quickly dissipated as profit-taking satrted as soon as AVAX hit $35 this instantly led to a reversal, completely shattering the short-lived bullish outlook. The price correction intensified dramatically on October 10th when a significant crypto-market liquidation event, reportedly triggered by geopolitical tension, forced AVAX down to $17.50.

Despite this the immediate buy-back efforts by bulls to minimize the damage were not enough as a result the recovery faltered, and they only managed to establish and sustain support just above the $20 mark.

This sharp reversal has technically invalidated the pattern breakout, sending AVAX tumbling back inside its previous horizontal sideways trading channel. The token is now clinging precariously to the $20 support level. The market faces a pivotal moment because the odds suggest that either AVAX will continue a sideways consolidation within its range, or a new, convincing bullish catalyst will be required to reignite upward momentum and initiate another rally attempt.

Looking ahead, for AVAX to secure a strong finish to the year, it must first defeat the $26 range’s upper resistance. A successful push past this level, followed by flipping $35 into support during November, would set the ambitious target for the year-end close at $55.

However, should AVAX fail to hold the line and continue its decline, the immediate risk is a fall to $15 support, which would likely lead to prolonged sideways movement within the bearish $15 to $26 range throughout the remainder of the year.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $25 | $33 | $50 |

Avalanche Price Target November 2025

The optimism following AVAX’s failed September breakout quickly dissolved into a severe correction in October. a crypto-market liquidation event that forced AVAX to a low of $17.50. While immediate buy-back efforts have positioned just above the $20 support level.

AVAX has returned to its previous trading channel. Now, for AVAX to regain its momentum then in November is the month, it must first reclaim the $26 resistance. Also, flipping $35 into support this month is necessary to unlock the ambitious year-end target of $55.

Failure to hold the $20 support would drag AVAX to hit lower supports.

| Month | Potential Low ($) | Potential Average ($) | Potential High ($) |

| AVAX Price Target November 2025 | 15.00 | 26.50 | 42.50 |

Avalanche Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 20.00 | 50.00 | 80.00 |

| 2027 | 31.50 | 79.00 | 126.50 |

| 2028 | 50.50 | 126.50 | 202.50 |

| 2029 | 81.00 | 202.50 | 324.00 |

| 2030 | 129.50 | 324.00 | 518.50 |

AVAX Price Prediction 2031, 2032, 2033, 2040, 2050

Based on the historic market sentiments, and trend analysis of the altcoin, here are the possible AVAX price targets for the longer time frames.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | 209 | 270 | 331 |

| 2032 | 259 | 344 | 430 |

| 2033 | 307 | 418 | 529 |

| 2040 | 1,212 | 2,055 | 2,899 |

| 2050 | 8,679 | 13,010 | 17,341 |

Market Analysis

| Firm | 2025 | 2026 | 2030 |

| Changelly | $24.72 | $40.82 | $232.67 |

| Coincodex | $32.63 | $28.42 | $19.98 |

| Binance | $25.64 | $26.92 | $32.72 |

*The aforementioned targets are the average targets set by the respective firms.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Yes, AVAX is a profitable investment for the long term, factoring in the strengths of the network. And the sprawl of the network in terms of utility.

At the time of writing, the price of 1 AVAX crypto was $23.99.

AVAX could reach up to $50 by the end of 2025, driven by ETF rumors, tech upgrades, and growing adoption.

Considering you invested $100 in $AVAX on 1st January 2021 at an average price of $3, your investment would have increased to $643.64.

AVAX is available for trade across prominent cryptocurrency exchange platforms like Binance, OkX, and Huobi, amongst others.

The transactional finality of the Avalanche network is 0.8 seconds.