ETF Delays Hit Institutional Crypto Demand: Solana, Cardano, and Sui See Pullbacks

Institutional crypto demand is losing momentum amid ongoing regulatory uncertainty. Delayed ETF approvals have further slowed capital inflows into non-Bitcoin assets.

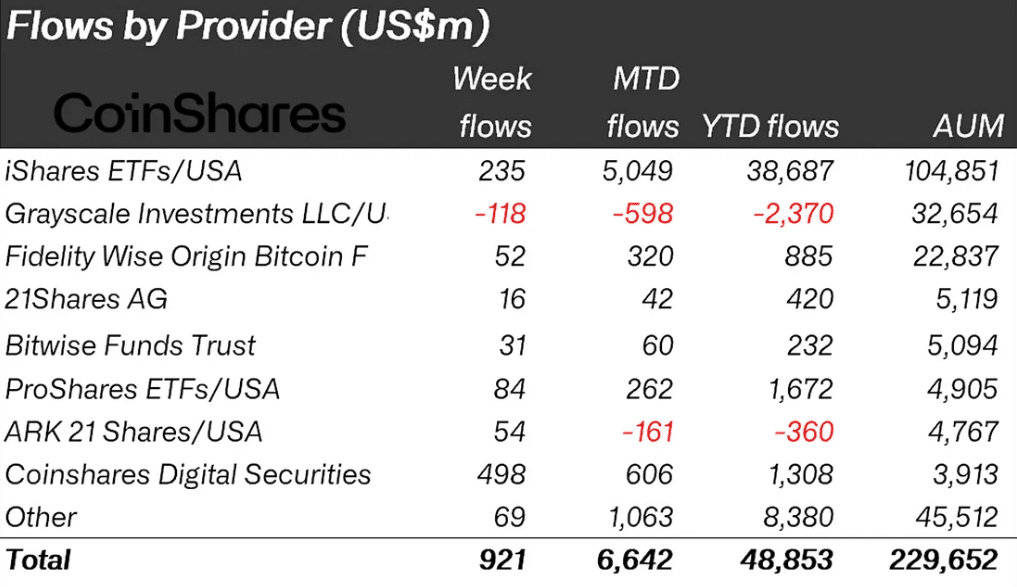

Despite overall market resilience, the latest CoinShares report reveals that institutional crypto demand for major altcoins such as Solana, Cardano, and Sui has cooled sharply in recent weeks.

Institutional Crypto Demand for Altcoins Sees Sharp Decline

CoinShares’ weekly data highlights a pronounced drop in institutional crypto demand across several leading altcoins. Solana recorded inflows of $29.4 million, while XRP saw $84.3 million, both far below their October peaks.

Just weeks ago, Solana saw a record-breaking $706.5 million in inflows that highlighted just how fast institutional sentiment can change. Cardano saw a flip from $3.7 million in inflows to $0.3 million outflows, as Sui slid into redemptions of $8.5 million.

Also Read: Major Win for Metaplanet as It Joins CoinShares Index – What This Means for Investors

Analysts observe that a lot of funds are dialing back on accumulation plans. Until they have a clear picture as to when ETFs will be approved and warn that institutional demand for crypto could continue to tread water in the short term.

Bitcoin Strengthens Amid Uncertainty

With altcoins in the struggle, Bitcoin maintains its grip on global investment. Institutional crypto demand for Bitcoin soared last week, with inflows totaling $921 million.

Investors appear increasingly confident in Bitcoin’s ability to perform as a macro-hedge as inflation cools and the Federal Reserve prepares for another rate cut.

This renewed confidence has lifted cumulative Bitcoin investments to $9.4 billion since the last rate adjustment, highlighting how institutional crypto demand remains concentrated in the world’s largest digital asset.

Ethereum Faces Temporary Setback

Ethereum’s performance diverged from Bitcoin’s strength. After five consecutive weeks of positive inflows, Ethereum recorded $169 million in outflows, suggesting that institutional crypto demand for the asset is fading.

U.S. spot Ethereum ETFs also reported three straight days of net outflows, even as ETH briefly rallied above $4,200 before traders locked in profits. Market strategists link Ethereum’s weakness to regulatory uncertainty and profit-taking after its recent rally.

Regional Breakdown

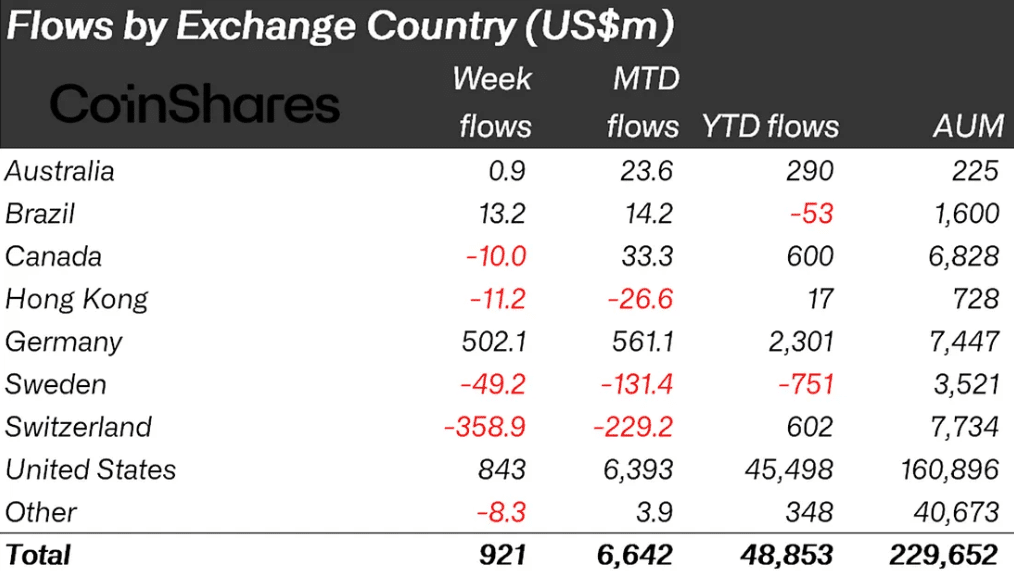

The U.S. remained the leader in institutional crypto demand, recording $843 million in inflows. Germany followed with a record-high $502 million, indicating sustained institutional participation in Europe’s largest economy.

Switzerland, however, registered $359 million in outflows, a figure analysts say largely reflects internal asset transfers rather than outright selling. These patterns illustrate a split market: strong institutional crypto demand in the U.S. and Germany versus cautious positioning in Switzerland and other European regions.

Solana Holds Technical Momentum

Despite lower institutional inflows, Solana continues to display technical strength. The token trades near $199, up 3.5% for the week.

Analyst curb.sol noted that Solana’s breakout from the $200 resistance zone signals a potential macro expansion, with long-term price targets near $1,000 and $2,000. If institutional crypto demand improves, Solana could spearhead the next phase of altcoin growth, much like its explosive rally in 2021.

Analysts’ Long-Term Outlook

Analyst Crypto Patel maintains a bullish long-term perspective. He projects that Solana could replicate its earlier 27,560% growth cycle, potentially reaching $9,200 by 2029. Patel described the current market as a Wyckoff-style accumulation phase.

He emphasized that a rebound in institutional crypto demand will likely depend on ETF approvals and renewed macroeconomic stability, both of which could trigger a strong capital rotation back into altcoins.

Crypto Funds Defy Altcoin Slump

Despite weakness in altcoins, global crypto funds saw a combined inflow of $921 million last week. Daily data from Farside showed that Bitcoin exchange-traded products attracted $477 million on October 21 alone.

Global trading volumes remained high at $39 billion, indicating strong market activity. Liquidity and participation stay healthy even as institutional crypto demand cools temporarily.

Conclusion

The drop in institutional crypto demand also highlights a market that continues to be highly sensitive to U.S. regulatory news. EOS, ADA and Sui lost short-term momentum altcoins like Solana, Cardano andSUI have lost short-term resistance is possible profit taking into Bitcoin.

Analysts expect institutional crypto demand to return as ETF approvals advance. As monetary policy settles, paving the way for a fresh boom in the digital-asset space.

Also Read: $2 Billion Liquidity Incoming for BlackRock’s Bitcoin ETF as UK Traders Pile Into IBIT

Appendix: Glossary of Key Terms

Institutional Crypto Demand – Investment interest and capital inflows from large financial institutions into digital assets.

ETF – A regulated investment vehicle that tracks the price of an asset, such as Bitcoin or Ethereum.

Altcoins – Cryptocurrencies other than Bitcoin, including Solana, Cardano, XRP, and Sui.

Inflows/Outflows – The amount of money entering or exiting crypto investment products over a given period.

Regulatory Uncertainty – Lack of clear government policies affecting crypto investment decisions.

Liquidity – The ease with which assets can be bought or sold without affecting their price.

Frequently Asked Questions About Institutional Crypto Demand

1. What does institutional crypto demand mean?

It refers to investment activity from large financial institutions, including hedge funds, asset managers, and banks, allocating capital to cryptocurrencies.

2. Why is institutional crypto demand slowing?

Delays in ETF approvals and regulatory uncertainty have reduced confidence among major investors, leading to temporary pullbacks in altcoin investments.

3. Which cryptocurrencies are most affected?

Solana, Cardano, Sui, and XRP have seen the largest drops in institutional crypto demand in recent weeks.

4. Is Bitcoin still attracting institutions?

Yes. Institutional crypto demand for Bitcoin remains robust, as it’s viewed as a stable and liquid hedge during market uncertainty.

Read More: ETF Delays Hit Institutional Crypto Demand: Solana, Cardano, and Sui See Pullbacks">ETF Delays Hit Institutional Crypto Demand: Solana, Cardano, and Sui See Pullbacks