Injective’s TVL Climbs 14% Amid Buyback Launch, But INJ Token Sinks 8%

Last updated on October 30, 2025

This Article Was First Published on The Bit Journal.

The TRUMP token may be entering a new phase. According to the source, issuer Fight Fight Fight LLC is in talks to acquire Republic’s U.S. crowdfunding business, a well-known startup investment platform backed by Galaxy Digital and Binance Labs.

The discussions suggest a shift toward real financial infrastructure rather than meme-driven speculation.

Reports indicate that Fight Fight Fight LLC aims to expand its reach beyond token issuance. By exploring the Republic deal, the firm could merge startup fundraising with its digital asset ecosystem. That would allow future users to engage with the TRUMP token inside regulated fundraising frameworks.

If the acquisition succeeds, it could provide an entry into licensed crowdfunding, bridging cryptocurrency and traditional finance. Such integration would give the TRUMP token practical use beyond branding appeal. It also suggests a shift from speculation to utility, a move that could attract a wider pool of investors. Many see this as a sign that the issuer wants to build lasting credibility, not just short-term hype.

Fight Fight Fight LLC is developing a digital asset treasury, a reserve fund reportedly targeting a range of $200 million to $1 billion. The goal is to buy back tokens from the open market to help stabilize prices.

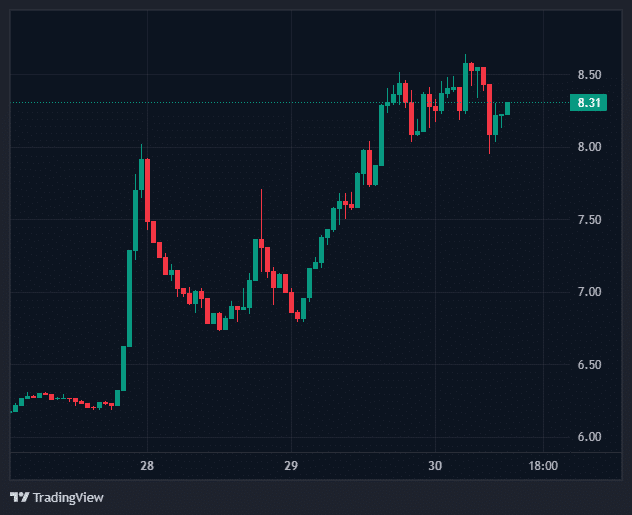

According to the source, the token trades around $8.31 and has a market capitalization of roughly $1.66 billion. The circulating supply stands at 199,999,241 tokens out of a maximum of 999,999,993. Its all-time high of $75.35, reached earlier in 2025, remains a distant memory.

Analysts believe this treasury plan could strengthen investor confidence while providing the project with steady revenue from Republic’s regulated operations. The buyback model, if executed well, could also reduce volatility and set a benchmark for other politically branded tokens. Traders have noted that transparency and timely updates will decide how much trust the plan earns in the coming months.

The project has faced legal hurdles. Earlier this year, Fight Fight Fight LLC received a warning from another Trump-linked crypto company over an “unauthorized” digital product. The Republic deal seems to be part of a broader effort to professionalize its image and reduce regulatory risk.

A partnership with Republic, a company recognized for compliance and venture partnerships, could help the issuer rebuild trust and gain legitimacy in traditional markets. Aligning with a regulated platform might also calm concerns from cautious investors. Beyond legality, it could give the project a more transparent governance structure, which many see as key for long-term growth.

Traders have responded cautiously to the potential acquisition. Some view it as a step toward maturity, while others are waiting for tangible progress. If finalized, this would be the first time a meme coin issuer controls a regulated U.S. crowdfunding platform, merging retail investing with political branding in a new way.

The TRUMP token stands at a crossroads. The Republic acquisition could open doors to compliant fundraising, long-term investors, and sustainable revenue. However, challenges like execution risk and political scrutiny remain. For now, it represents one of the most ambitious attempts to transform a meme coin into a structured digital asset.

To gain access to a regulated U.S. crowdfunding platform and expand fundraising capabilities.

At least $200 million, potentially reaching $1 billion, for a digital asset treasury.

Approximately $8.31 as of October 30, 2025.

It blends crypto innovation with regulated investment, setting a precedent for other meme coins.

Read More: TRUMP Token Eyes Republic Acquisition in $1B Expansion Plan">TRUMP Token Eyes Republic Acquisition in $1B Expansion Plan

The team revealed that the event burned 6.78 million INJ coins, worth roughly $32.28 million.

The first $INJ Community BuyBack is now officially complete!

Injective is the only chain where token buybacks directly reward the community.

1. INJ is burned forever

2. The community earns from a reward pool for their contributionsStay tuned for the next burn in November 🔥 pic.twitter.com/5KUiMDiyaI

— Injective 🥷 (@injective) October 29, 2025

Rather than the foundation or team repurchasing tokens and burning them privately, Injective prioritizes user participation.

The layer 1 network creates a system that merges deflation with community incentives.

Such an approach ensures that active network participants benefit from Injective’s ecosystem expansion, aligning rewards between INJ holders, traders, and developers.

The announcement read:

Injective is the only chain where token buybacks directly reward the community.

Notably, Injective opened the first community buyback event for the public on October 23, with the actual repurchase and token burn occurring after a week, on October 27.

Injective’s community buyback mechanism adopts two powerful yet simple ways.

First and foremost, the platform permanently burns native tokens to reduce the overall supply.

Secondly, it distributes some of the value to reward users who contribute to the INJ’s ecosystem.

According to the official blog:

The Community BuyBack is a monthly on-chain event that allows anyone to take part in Injective’s deflationary mechanism. Participants commit INJ, and in return receive a pro rata share of the revenue generated across the Injective ecosystem. The INJ exchanged is then permanently burned, reducing the total supply of INJ.

Notably, the Community BuyBack basket comprises various tokens, including USDT and INJ, valued at 10,000 Injective tokens.

That design introduces a robust deflationary model, while incentivizing loyal users.

Injective maintains transparency, with all buyback information available on the dashboard.

Injective’s latest announcement is part of its broader mission to build a community-centered, sustainable token economy.

By burning native tokens every month, the project aims to reduce INJ inflation while encouraging long-term holding.

Most projects across the decentralized finance sector are embracing such mechanisms.

However, Injective has added a significant twist, involving its users in the process.

Besides strengthening trust, such an approach keeps INJ holders engaged in the ecosystem’s growth.

Also, holders will benefit from scarcity as every buyback reduces the circulating asset supply permanently.

The next burn will happen next month, in November.

The native token remained relatively muted over the past 24 hours, as bears moved the broader market.

INJ is trading at $8.66. It has consolidated between $9 and $8 over the previous week, gaining over 3% in that timeframe.

Its daily trading volume has increased by 17%, signaling renewed optimism, likely following the buyback announcement.

Nevertheless, broad market sentiments will influence the altcoin’s price trajectory in the coming sessions.

The post Injective (INJ) completes its first community buyback worth $32 million appeared first on CoinJournal.

Last updated on October 29, 2025.

This Article Was First Published on The Bit Journal.

The WLFI airdrop is live as World Liberty Financial launches a major rewards program for early adopters of its USD1 stablecoin. The company confirmed that 8.4 million WLFI tokens will be distributed to early users through its USD1 Points Program, marking one of the most significant reward events tied to a stablecoin ecosystem this quarter.

According to the source, the initiative has already generated more than $500 million in transaction volume in under two months, showing strong demand and growing trust in the USD1 ecosystem across major partner exchanges.

The WLFI airdrop rewards users who traded or held USD1 on exchanges such as Gate.io, KuCoin, LBank, HTX, Flipster, and MEXC. Each partner platform will manage its own eligibility criteria, claim timelines, and reward distribution.

World Liberty Financial stated that the program’s purpose is to build liquidity and long-term engagement for USD1 pairs while giving WLFI holders a way to participate in ecosystem governance. In a recent update from a leading crypto news outlet, the company described the initiative as a “user-first rewards model” that merges stablecoin adoption with real-world utility.

The rollout comes as WLFI continues to gain ground among top-traded governance tokens, with trading activity rising sharply following the announcement.

This WLFI airdrop follows a busy month for World Liberty Financial. Earlier in October, the company announced a debit card connected to USD1 and compatible with Apple Pay. The card aims to make stablecoin payments as seamless as traditional transactions.

The team also revealed plans to tokenize real-world assets such as real estate and commodities, alongside a treasury partnership with Bitcoin miner Hut 8. These efforts aim to link blockchain finance with everyday spending, turning the WLFI token into more than a speculative asset.

At the time of writing, WLFI trades around $0.114, up roughly 9 percent over the past 24 hours. Analysts believe the ongoing airdrop could keep trading momentum high as new users join the USD1 network.

Market analysts view the WLFI airdrop as a calculated push to cement user loyalty. One industry researcher noted that the structure “rewards actual engagement rather than passive holding,” adding that token distribution tied to activity often leads to stronger on-chain participation.

However, observers also note that World Liberty Financial continues to face scrutiny over USD1’s reserve attestations and the transparency of token unlocks. The company has pledged to expand third-party audits and publish regular reports to reinforce user confidence.

Despite mixed sentiment, the strategy of linking stablecoin rewards with governance tokens could influence future models across decentralized finance.

The WLFI airdrop is a clear signal of World Liberty Financial’s long-term vision to make stablecoin use both rewarding and functional. By distributing 8.4 million tokens to early USD1 participants, the project has tied user loyalty to real utility.

Whether WLFI maintains its current market momentum or faces short-term volatility, one thing is sure. This airdrop shows how incentive-driven ecosystems can fuel stablecoin adoption while strengthening community trust.

It’s the distribution of 8.4 million WLFI tokens to early USD1 users as part of the USD1 Points Program.

Users who traded or held USD1 on partner exchanges like KuCoin, Gate.io, and MEXC, following each exchange’s criteria.

Timelines differ per exchange, though most distributions are expected in the coming weeks.

Analysts expect short-term volatility and long-term value growth tied to USD1 adoption.

Read More: WLFI Token Jumps 9% After World Liberty Financial Confirms 8.4M Token Airdrop">WLFI Token Jumps 9% After World Liberty Financial Confirms 8.4M Token Airdrop

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.