XRP Price Prediction For November 3

The post XRP Price Prediction For November 3 appeared first on Coinpedia Fintech News

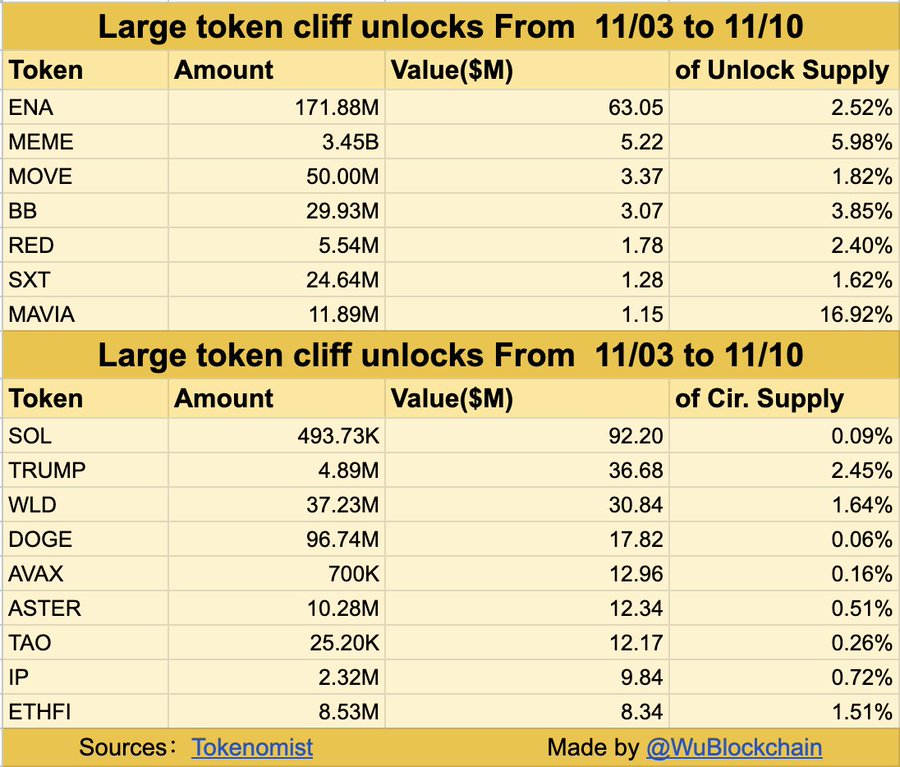

The crypto market remains on shaky ground after the recent Federal Reserve rate decision. Traders had expected aggressive rate cuts, with market confidence running as high as 95% before the FOMC meeting. But as often happens in crypto, the opposite played out. Large holders began selling hours before the announcement, driving prices down while retail traders were still buying the rumor.

XRP Price Analysis: Rangebound Between $2.30 and $2.70

XRP is still moving sideways, holding support near $2.30–$2.40 and resistance at $2.60–$2.70. The coin remains stuck within this narrow band despite broader market swings. The weekly chart continues to flash bearish divergence, meaning upward momentum remains limited for now.

A decisive move above $2.70 could open the door to a rally toward $3.00, while a drop below $2.30 might mean another round of selling. For now, XRP is holding its ground, showing resilience despite weak sentiment across altcoins.

Analysts Expect Relief Rally Ahead

According to Brian from Santiment, XRP’s 30% decline since mid-July may have run its course. He sees a potential relief rally forming as most leveraged traders have already been flushed out. “There’s been a ton of pain for XRP traders,” he said, “and a short-term bounce makes sense.”

Still, sentiment remains fragile. Analysts warn that markets could stay choppy until investors gain more clarity on the Fed’s next steps and inflation outlook.

Long-Term View: Holders Stay Patient

Long-term XRP holders continue to outperform short-term traders, who often get trapped during market swings. Data shows that those who’ve held through past cycles tend to see better returns once volatility settles. For now, XRP is consolidating, stuck between uncertainty and opportunity, waiting for the next major catalyst to drive direction.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

XRP is down as traders react to weak market sentiment, profit-taking, and uncertainty over the Fed’s next policy move.

Analysts and AI forecasts project XRP could reach $5.05 by the end of 2025, driven by ETF approvals, partnerships, and regulatory clarity.

Based on compounding growth and adoption, projections estimate XRP could trade around $26.50 by 2030, with averages near $19.75.

XRP is considered a strong investment due to its institutional adoption, regulatory progress, and role in cross-border payments. However, it carries volatility risks like all cryptocurrencies.