Crypto Analyst Calls XRP a “Zombie Asset” Despite Ripple’s Growth

The post Crypto Analyst Calls XRP a “Zombie Asset” Despite Ripple’s Growth appeared first on Coinpedia Fintech News

Ripple’s native token XRP has been under debate almost since the day it launched. While Ripple continues to grow as a blockchain payments company, many argue that XRP’s price no longer reflects how much it is actually used.

Now, those questions are back in focus again.

Crypto analyst Atlas recently shared an on-chain analysis, calling XRP the most useless token.

Ripple Thrives, But XRP Lags Behind

In a detailed breakdown of Ripple’s business model and on-chain data, Atlas argues that while Ripple as a company remains active and profitable, its native token XRP is becoming increasingly disconnected from real-world usage.

His main point is simple: Ripple can operate without XRP, and in many cases, it already does. Banks and institutions can use Ripple’s payment technology without holding or using the XRP token at all.

Atlas highlights a growing gap between XRP’s market value and its actual demand. XRP’s market cap is close to $100 billion, yet activity on the XRP Ledger tells a very different story.

DeFi usage on XRPL is still small, with total value locked in the tens of millions, not billions. For Atlas, this isn’t just a small mismatch, it’s a fundamental problem.

Ripple, XRP, and XRPL Are Not the Same Thing

Another key point Atlas stresses is that Ripple, XRP, and the XRP Ledger are not the same thing. Ripple sells software and payment infrastructure to banks and institutions, but those services do not always require XRP.

Due to this, Ripple’s success does not automatically increase demand for XRP.

Atlas also raises concerns about decentralization, noting that the XRP Ledger relies on trusted validator lists that remain closely tied to Ripple.

Activity Spikes Don’t Equal Adoption

AAtlas questions recent increases in XRP transaction activity. He points out that Ripple has admitted some of this growth came from micro-transaction spam, meaning higher transaction counts did not reflect real economic use.

He also notes that past adoption was often supported by incentives. Programs such as XRP rebates helped create liquidity, but partners like MoneyGram reportedly sold the tokens quickly, suggesting demand was artificial rather than organic.

- Also Read :

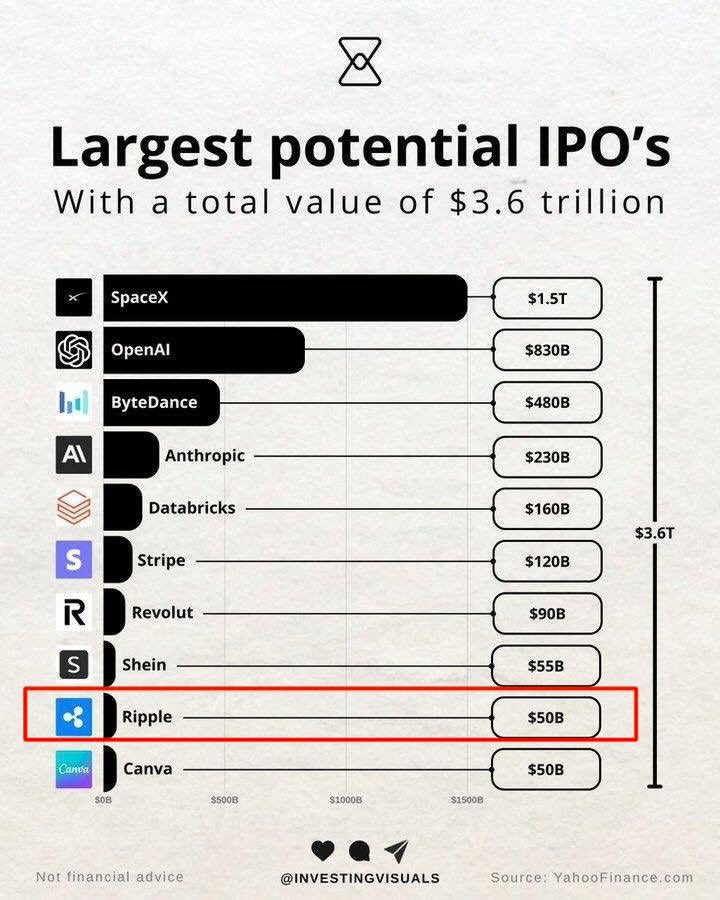

- Ripple IPO Back in Spotlight as Valuation Hits $50B

- ,

Atlas Calls XRP a “Zombie Asset”

Despite his criticism, Atlas does not expect XRP to collapse. Instead, he calls it a “zombie asset,” one that survives on belief, liquidity, and supply control rather than growing utility. For now, he believes XRP’s price remains driven more by faith than usage.

➠ 9

— Atlas (@crptAtlas) December 26, 2025

◈ This is why “zombie asset” fits

◈ XRP doesn’t collapse

◈ It doesn’t grow in utility either

◈ It survives on belief, liquidity, and supply control

Atlas says the SEC lawsuit kept XRP alive through headlines, not usage. When the SEC sued Ripple in December 2020, XRP was trading near $0.60, then dropped to $0.17 as exchanges delisted it.

Now, SEC lawsuits have ended, XRP price is trading around $1.85 with a market cap hitting $111.89 billion.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

XRP is seen as a long-term bet on payments and institutional adoption, but its price will depend on market trends, regulation, and real-world usage.

XRP price prediction for 2026 ranges between $1.75 and $5.05, depending on market recovery, adoption growth, and overall crypto sentiment.

Major risks include regulatory setbacks, weak market liquidity, competition from other payment-focused blockchains, and prolonged bearish market cycles.

Triple-digit targets assume massive global adoption and long-term dominance in payments, making them highly speculative rather than guaranteed outcomes.

JUST IN:

JUST IN:  Bank of Lithuania warns crypto firms must get licensed by Dec 31.

Bank of Lithuania warns crypto firms must get licensed by Dec 31.