Ethereum Treasury Giant BitMNR Stakes $219M in ETH

The post Ethereum Treasury Giant BitMNR Stakes $219M in ETH appeared first on Coinpedia Fintech News

The world’s largest Ethereum treasury firm, BitMNR, has officially entered Ethereum staking for the first time, marking a major shift in how large ETH holders manage their assets.

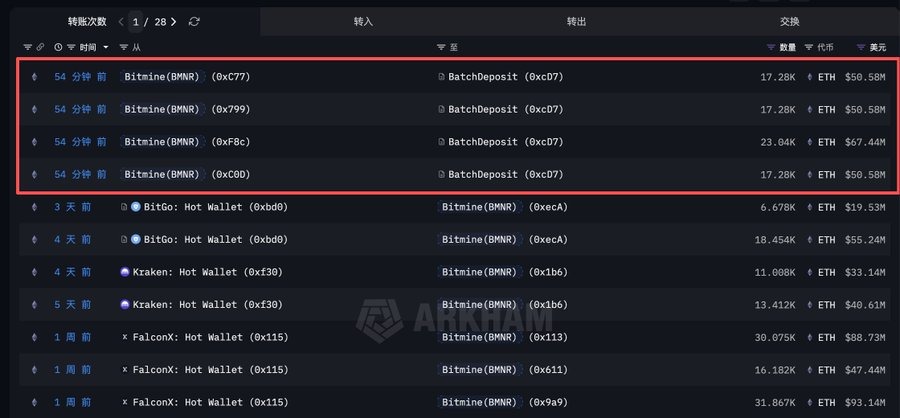

On-chain data shows the firm deposited around 74,880 ETH into Ethereum’s proof-of-stake system, worth nearly $219 million.

Bitmine Stakes $219 Million in Ethereum

According to on-chain data shared by Arkham Intelligence, BitMNR deposited around 74,880 ETH into Ethereum’s proof-of-stake system, roughly valued at nearly $219 million, making it one of the most notable staking moves by a corporate treasury in recent times.

This is the first time Bitmine has staked any of its Ethereum holdings. Until now, the company had kept its ETH untouched, even though it holds one of the biggest Ethereum treasuries in the market.

Instead of relying only on long-term price growth, the company is now aiming to earn steady income directly from the Ethereum network. By staking its ETH, Bitmine helps secure the blockchain while earning regular rewards in return.

How Much ETH Does BitMNR Hold?

On-chain data shows Bitmine holds about 4.066 million ETH, valued at $11.9 billion. This represents roughly 3.37% of Ethereum’s total supply, making Bitmine one of the largest ETH holders globally.

With Ethereum’s current staking yield around 3.12% per year, the potential returns are significant. If Bitmine were to stake all of its ETH, it could earn close to 126,800 ETH annually. As of today’s price of around $2,927, that would be worth roughly $371 million.

Commenting on the move, Thomas Tom Lee, Chairman of Bitmine, said the company is moving quickly toward its 5% return goal and is already seeing clear benefits from its large Ethereum holdings.

Ethereum Price Outlook

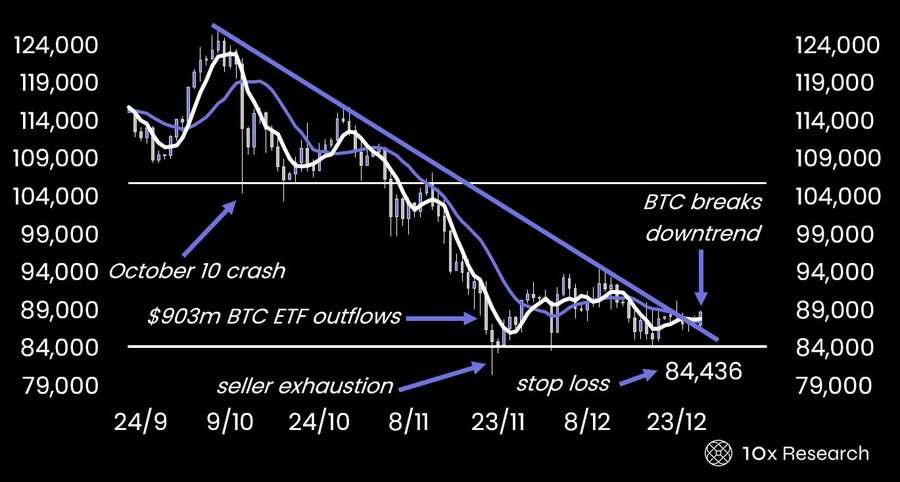

Ethereum’s price has been moving in a tight range between $2,900 and $3,000, as low year-end trading activity keeps the market quiet. Recently, Thomas Tom Lee has remained optimistic, saying asset tokenization could push ETH to $7,000–$9,000 range by early 2026.

— CryptoGoos (@cryptogoos) December 27, 2025

BREAKING:

TOM LEE PREDICTIONS:

– $9,000 $ETH in early 2026

– $200,000 $BTC in 2026

– $20,000 ETH long-term

– Crypto Supercycle

Here we gopic.twitter.com/T2ydRBI8yh

As of now, Ethereum is trading near $2,928, down about 1% in the last 24 hours, with its market value standing around $354 billion.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

BitMNR began staking to earn ongoing yield from its ETH while supporting network security, rather than relying only on long-term price gains.

BitMNR staked about 74,880 ETH worth $219 million, marking one of the largest first-time staking moves by a corporate ETH holder.

BitMNR holds roughly 4.06 million ETH, about 3.37% of total supply, making it one of the largest Ethereum treasury holders worldwide.

At current yields near 3.1%, staking all its ETH could generate over 126,000 ETH per year in rewards.

Large staking reduces liquid supply and signals long-term confidence, which can support prices but doesn’t guarantee short-term gains.

Bank of Lithuania warns crypto firms must get licensed by Dec 31.

Bank of Lithuania warns crypto firms must get licensed by Dec 31.