Bonk (BONK) Price Prediction 2026, 2027 – 2030: Will BONK Price Reach $0.00013 by 2030?

The post Bonk (BONK) Price Prediction 2026, 2027 – 2030: Will BONK Price Reach $0.00013 by 2030? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of the BONK token is $ 0.00000623

- Price predictions for 2026 range from $0.0000160 to $0.0000330

- BONK could extend toward $0.0001300 by 2030, if recovery structure holds.

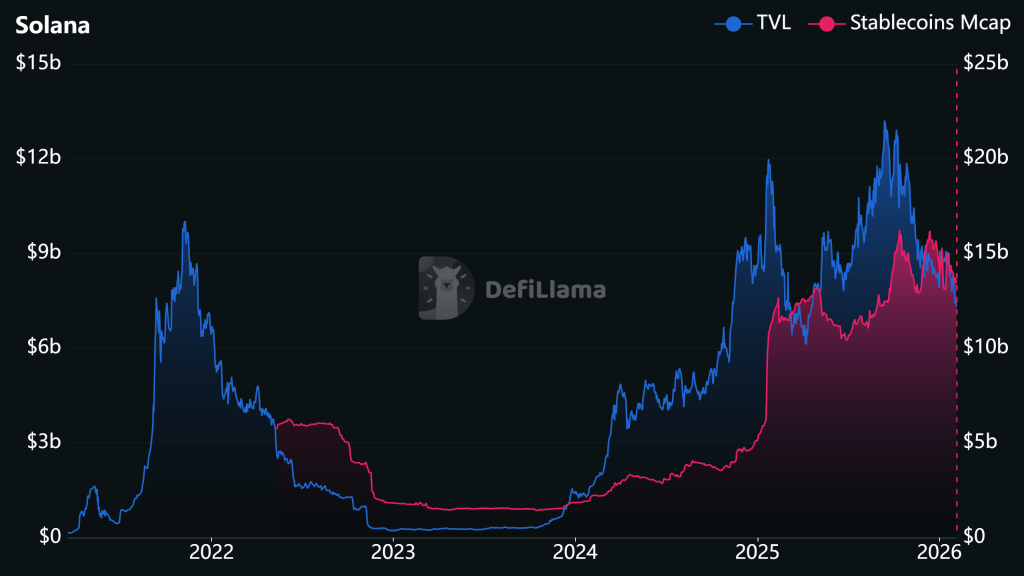

Bonk (BONK) has entered a phase where price action matters more than narrative. After witnessing sharp upside volatility followed by an extended cooldown, the Solana-based meme token is now trading within a clearly defined structure, signaling that speculative froth has largely settled.

Unlike its early cycles driven by hype alone, BONK’s current movement reflects broader market positioning, liquidity shifts, and technically respected demand zones. As the market turns its attention toward 2026, BONK’s chart suggests it may be approaching a pivotal phase where consolidation gives way to directional expansion provided key resistance levels are reclaimed.

Table of contents

Bonk Price Today

| Cryptocurrency | Bonk |

| Token | BONK |

| Price | $0.0000

|

| Market Cap | $ 547,959,325.76 |

| 24h Volume | $ 131,161,328.2097 |

| Circulating Supply | 87,995,158,654,161.20 |

| Total Supply | 87,995,158,654,161.20 |

| All-Time High | $ 0.0001 on 20 November 2024 |

| All-Time Low | $ 0.0000 on 30 December 2022 |

Bonk (BONK) Price February 2026 Outlook

As February unfolds, BONK continues to trade above a critical demand band near $0.000015–$0.000017, a zone that has repeatedly absorbed selling pressure in recent months. This area has now become a structural base, indicating that downside momentum is weakening. On the upside, BONK faces immediate resistance around $0.000022, followed by a more decisive barrier near $0.000026. A sustained hold above these levels would signal growing bullish participation, while failure to break higher could result in continued range-bound movement through the month. From a technical standpoint, February’s price behavior is likely to act as a tone-setter, either confirming accumulation or extending the consolidation phase into the second quarter.

Bonk (BONK) Price Prediction 2026

The broader 2026 outlook for BONK hinges on how price reacts to its long-term compression structure. On higher timeframes, BONK is trading within a narrowing range formed by descending resistance and a stable horizontal base, a setup often associated with volatility expansion once resolved.

In the early part of 2026, BONK may continue oscillating between $0.000016 and $0.000024, allowing liquidity to build. However, a confirmed breakout above the upper boundary of this range could trigger a shift in market structure, opening the path toward higher price discovery zones.

If bullish momentum strengthens alongside broader market recovery, BONK could advance toward $0.000028, with an extended upside scenario placing the token near $0.000033 by the latter half of 2026. Importantly, pullbacks during this phase are expected to remain corrective as long as price holds above its established base.

Bonk Crypto Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($ | Potential High ($) |

| 2026 | 0.0000160 | 0.0000245 | 0.0000330 |

| 2027 | 0.0000280 | 0.0000410 | 0.0000560 |

| 2028 | 0.0000450 | 0.0000670 | 0.0000850 |

| 2029 | 0.0000720 | 0.0000980 | 0.0001150 |

| 2030 | 0.0000950 | 0.0001120 | 0.0001300 |

Bonk (BONK) Price Forecast 2026

In 2026, Bonk price could project a low price of $0.0000160, an average price of $0.0000245, and a high of $0.0000330.

Bonk Price Prediction 2027

As per the Bonk Price Prediction 2027, BONK may see a potential low price of $0.0000280. Meanwhile, the average price is predicted to be around $0.0000410. The potential high for BONK price in 2027 is estimated to reach $0.0000560.

Bonk (BONK) Price Prediction 2028

In 2028, Bonk price is forecasted to potentially reach a low price of $0.0000450 and a high price of $0.0000850.

Bonk Coin Price Prediction 2029

Thereafter, the Bonk (BONK) price for the year 2029 could range between $0.0000720 and $0.0001150.

Bonk Price Prediction 2030

Finally, in 2030, the price of Bonk is predicted to remain steadily positive. It may trade between $0.0000950 and $0.0001300.

Bonk Price Prediction 2031, 2032, 2033, 2040, 2050

The long-term projection assumes Bonk sustains relevance in enterprise blockchain use cases, with growth moderating over time as the asset matures.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | 0.0001100 | 0.0001450 | 0.0001750 |

| 2032 | 0.0001400 | 0.0001900 | 0.0002400 |

| 2033 | 0.0001800 | 0.0002400 | 0.0003200 |

| 2040 | 0.0004200 | 0.0006800 | 0.0009500 |

| 2050 | 0.0008500 | 0.001300 | 0.001900 |

Bonk (BONK) Price Prediction: Market Analysis?

| Year | 2026 | 2027 | 2030 |

| Changelly | $0.0000350 | $0.0000500 | $0.0001350 |

| CoinCodex | $0.0000300 | $0.0000590 | $0.0001120 |

| WalletInvestor | $0.0000280 | $0.0000510 | $0.0001200 |

CoinPedia’s Bonk Price Prediction

Coinpedia’s price prediction suggests that BONK could trade between $0.000016 and $0.000033 in 2026, provided the asset sustains its demand zone and confirms a higher-timeframe breakout. Looking ahead, if BONK maintains relevance within high-beta market phases, the token may extend toward $0.000130 by 2030, though price volatility is expected to remain elevated across cycles.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 0.0000160 | 0.0000245 | 0.0000330 |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

In 2026, BONK could range between $0.000016 and $0.000033, depending on breakout confirmation above key resistance levels.

Yes, if bullish momentum continues, BONK may reach up to $0.000130 by 2030 while maintaining a stable long-term base.

BONK’s price moves are shaped by market positioning, liquidity zones, resistance levels, and broader crypto market trends.

If BONK sustains demand zones and market relevance, it shows potential for long-term growth, though volatility remains high.