Bitcoin Shorts Surge as Funding Turns Deeply Negative—Is a Short Squeeze Coming?

The post Bitcoin Shorts Surge as Funding Turns Deeply Negative—Is a Short Squeeze Coming? appeared first on Coinpedia Fintech News

The Bitcoin price is yet again facing significant upward pressure as the token has plunged below $66,000 from an intraday high of over $68,400. Observing the current trade dynamics, it appears that the star crypto is entering a high-tension phase as traders are now expecting the price to plunge. The short bets are increasing notably and have reached a level that usually results in sharp volatility. This suggests the BTC price may get exposed to more sell pressure or a sudden short squeeze may catch bears off-guard.

With Bitcoin hovering near key technical levels, the imbalance between rising short interest and cooling spot momentum is creating a fragile setup. The question now is whether this wave of bearish bets will push BTC lower or fuel the next breakout.

Bitcoin Short Positioning Hits Extreme Levels

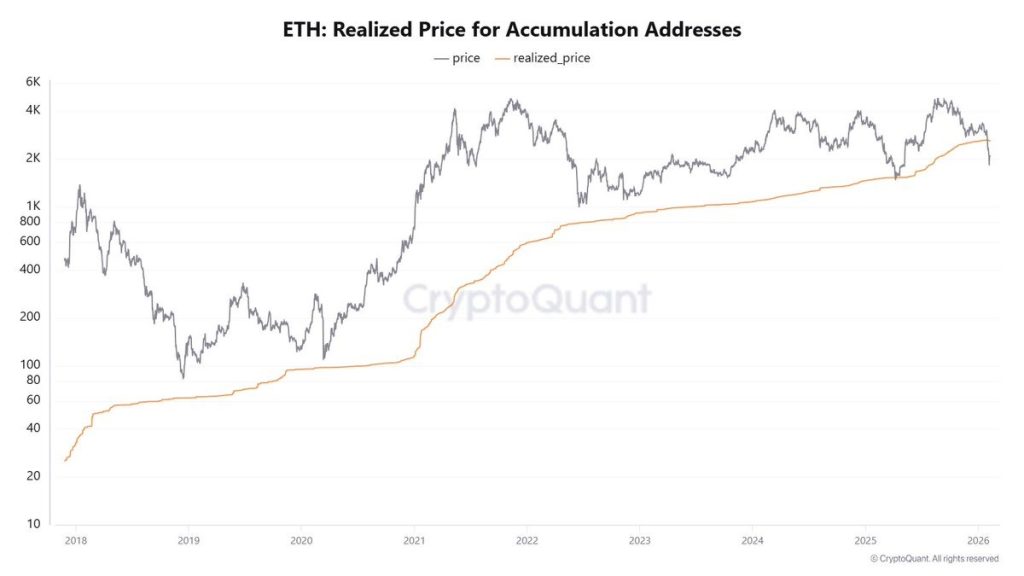

Recent derivatives data from Santiment show a clear spike in short exposure, with funding rates slipping deeply into negative territory. Negative funding means short traders are paying longs to keep their positions open, a sign that bearish sentiment has become crowded.

When funding stays mildly negative, it often reflects healthy hedging. But when it turns sharply negative, it suggests positioning is becoming one-sided. Markets tend to punish extreme consensus. If too many traders lean in the same direction, even a small upward move can trigger forced liquidations, accelerating the price higher in a short squeeze.

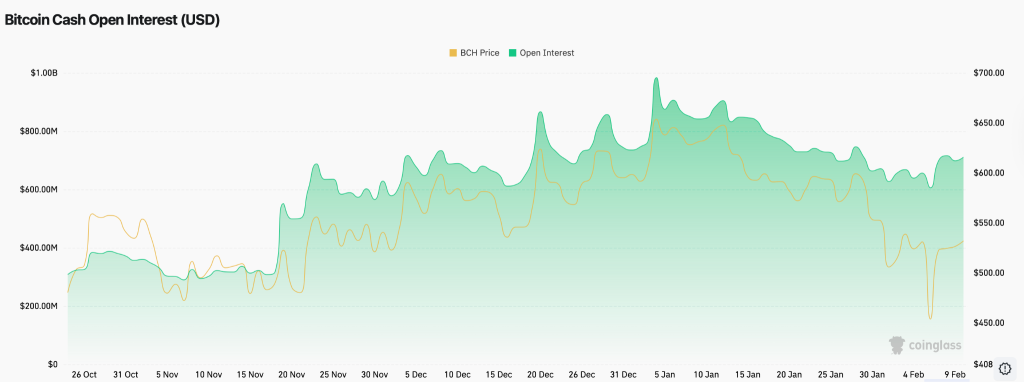

At the same time, open interest remains elevated, indicating that leverage is still active in the system. High open interest combined with negative funding creates a volatility setup, price does not stay compressed for long under these conditions.

The key now is whether spot demand can absorb selling pressure. If buyers defend support levels, the imbalance in shorts could fuel a rapid breakout. If support breaks, however, the crowded short trade may continue to build, reinforcing downside momentum.

Key Levels That Could Trigger the Next Move

Bitcoin is compressing between clear technical boundaries, and with funding deeply negative, these levels now carry even more weight.

Immediate Resistance: $70,000–$72,000

This zone has capped recent recovery attempts. A strong daily close above $72,000 with expanding spot volume could trigger a short squeeze. If that happens, liquidation clusters sit near $75,500, followed by $78,000. A squeeze extension could target the $82,000–$85,000 liquidity pocket, where prior distribution occurred.

Immediate Support: $59,000 – $60,000

This is the current pivot zone. A decisive breakdown below $59,000 on rising volume would invalidate squeeze expectations in the short term. In that case, downside targets sit at $54,000, followed by the major demand block around $50,000–$52,000.

Open interest remains elevated, meaning leverage is still active. If price breaks either boundary with conviction, volatility could expand quickly. For traders, the setup is clear: above $72K favors squeeze dynamics; below $59K shifts the structure toward a deeper correction.

What’s Next for Bitcoin Price as Shorts Crowd the Market?

Bitcoin price is sitting at a leverage-heavy turning point. Deeply negative funding shows that traders are leaning aggressively short, but extreme positioning alone does not guarantee a squeeze. It simply increases the probability of volatility.

If the BTC price reclaims $72,000 with strong spot demand, the imbalance in shorts could fuel a move toward $75,500 and potentially $78,000. However, without real buying pressure, rallies may continue to fade. On the downside, losing $59,000 would confirm that sellers remain in control, opening the door to $54,000 and possibly the $50,000–$52,000 demand zone.