MAGA’s ‘Golden Calf’: Trump statue at the heart of a dramatic crypto gamble

Crypto traders usually view negative funding rates as a buy signal, but this week’s volatility US earnings outcome may cloud the value of the signal for ETH investors.

The enforcement action over wagers on sports event contracts followed Coinbase announcing the launch of prediction markets in all 50 US states.

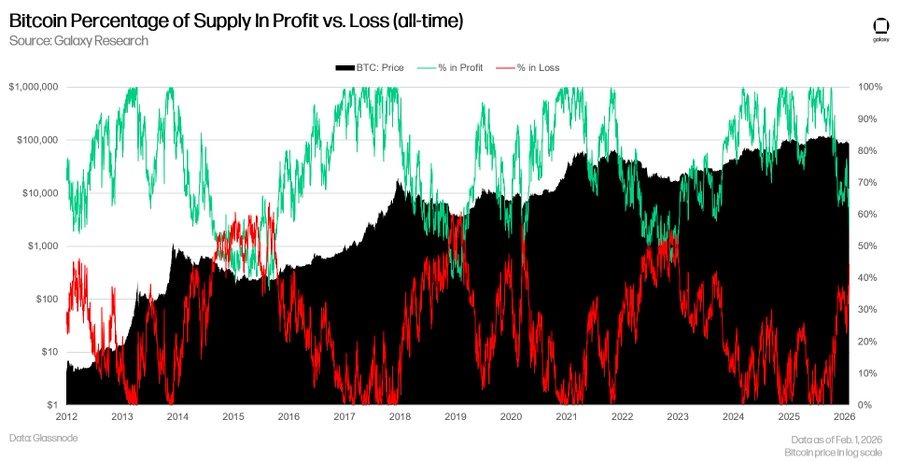

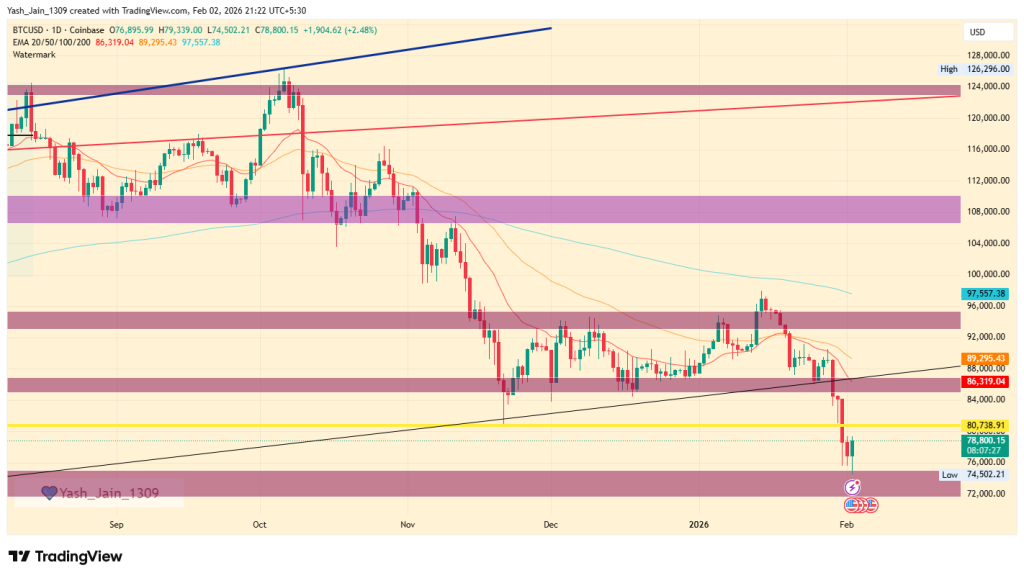

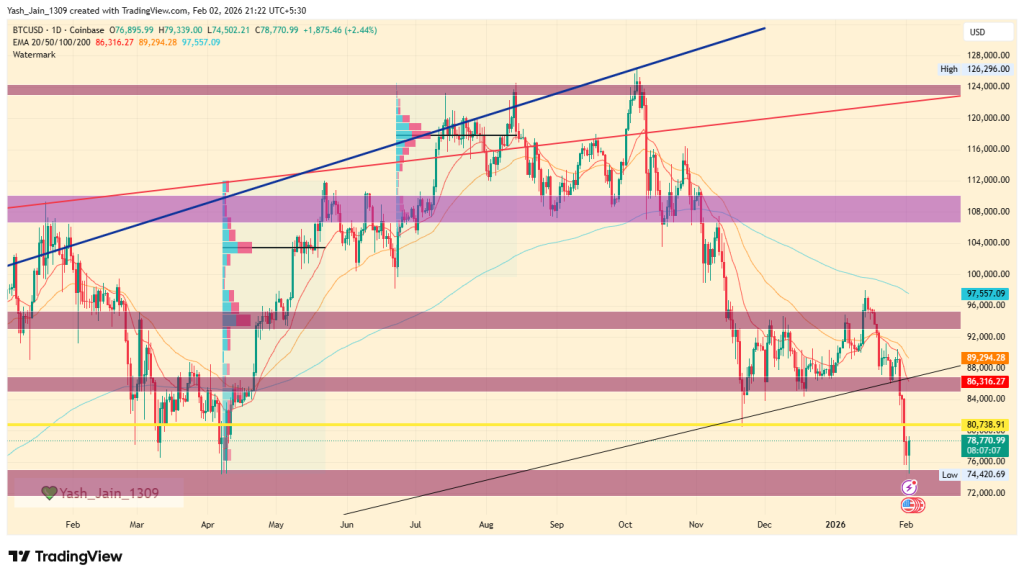

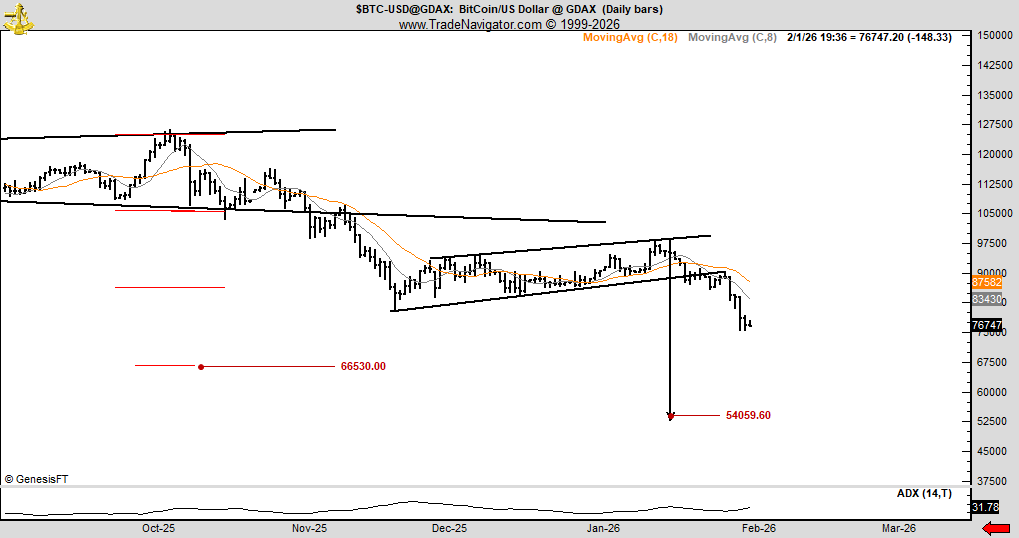

Bitcoin’s volatility spiked, and its price plummeted to fresh lows as worrying US economic conditions emerged. Will credit stress data signal the next accumulation phase for BTC?

The Nasdaq-listed insurance brokerage said an unnamed investor would contribute BTC as part of a deal that also includes an AI- and crypto-focused strategic partnership.

The post Bitcoin Price Hits $72.8k, Bitwise CIO Turns Bearish; Is Sub-$70k Next? appeared first on Coinpedia Fintech News

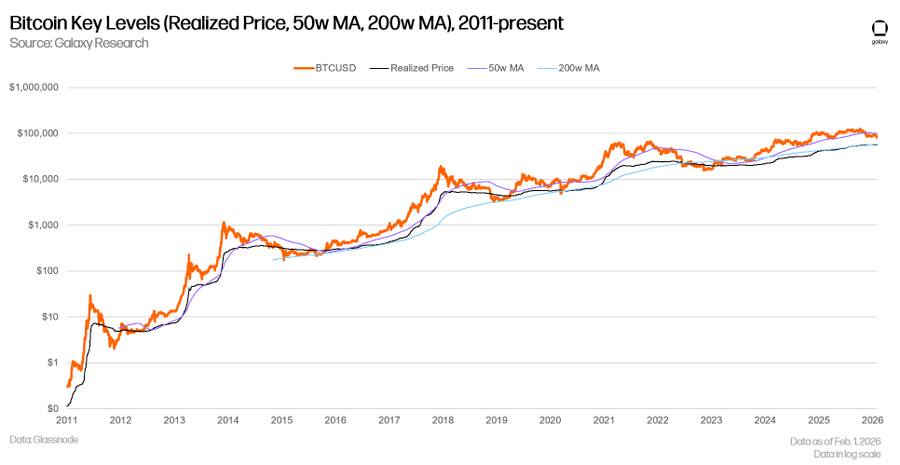

Bitcoin (BTC) price has led the wider crypto market in a further selloff. After slipping below its crucial buy zone around $80k last week, Bitcoin price extended its selloff today to hit $72,889 on Tuesday, February 3, for the first time since the first week of November.

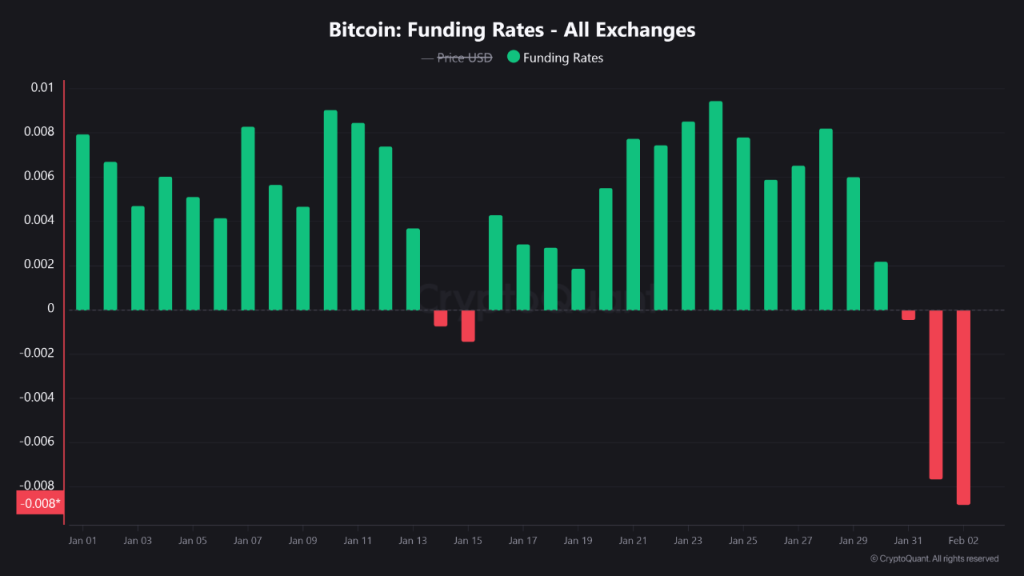

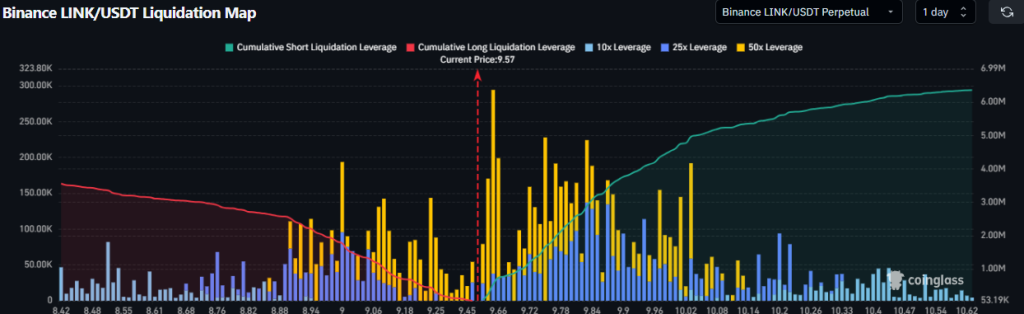

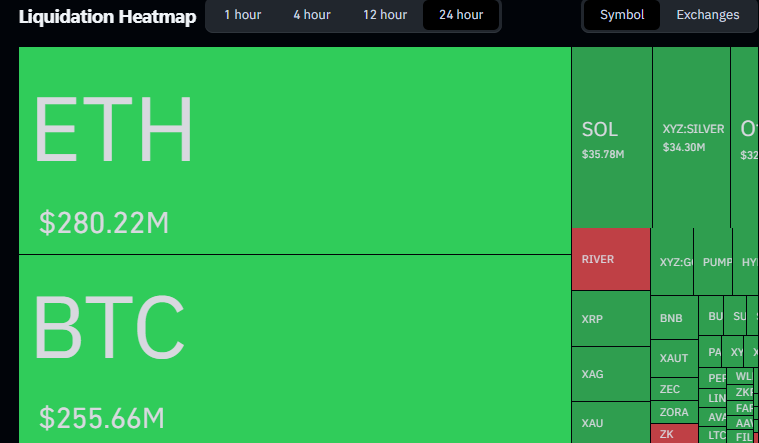

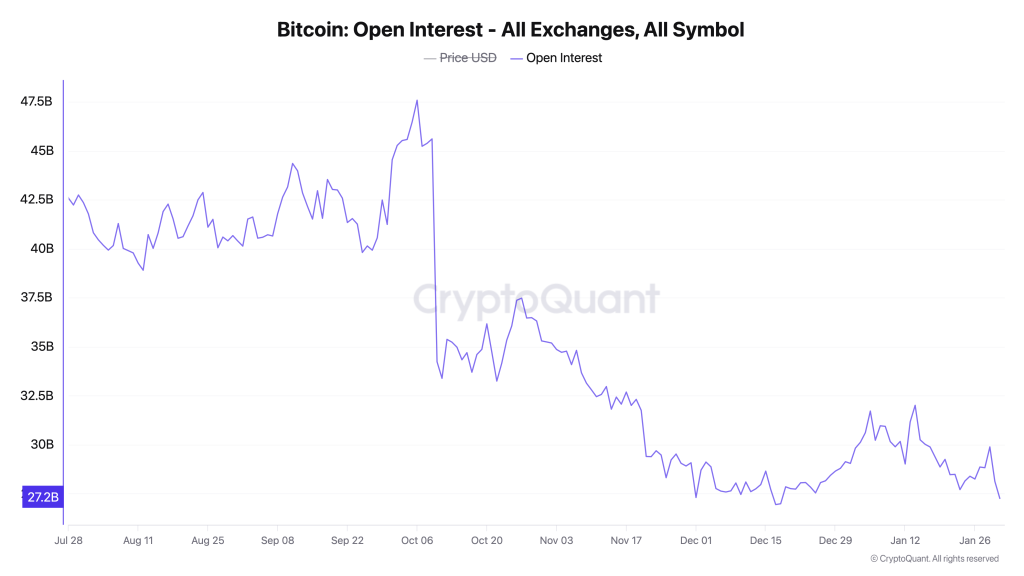

As such, more than 167k leveraged traders were flashed out, with more than $730 million liquidated during the past 24 hours. Out of this, more than $528 million involved long traders, amid the notable decline in Bitcoin’s Open Interest (OI).

According to market data analysis from CoinGlass, Bitcoin’s OI has continued to shrink since the October 11 crypto capitulation to hover about $52.7 billion at press time.

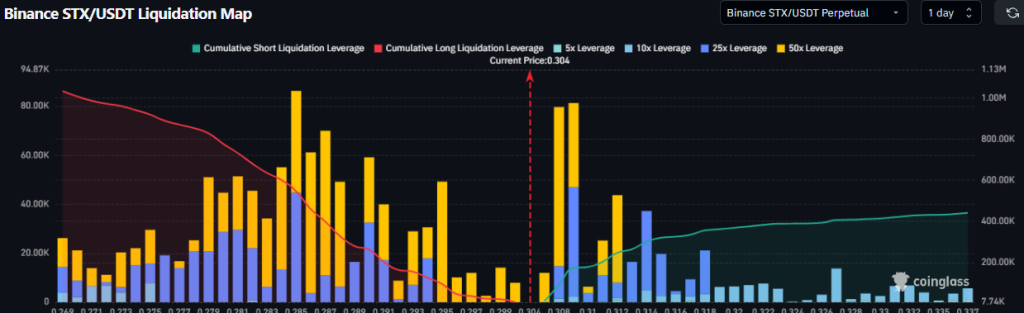

Source: Coinglass

Following today’s BTC price capitulation to $72k today, Matt Hougan, Bitwise CIO, stated that the flagship coin is under the influence of a multi-month bear market. Hougan stated that the Bitcoin price has been in a bear market since early 2025, but the high institutional adoption and regulatory clarity have blinded investors.

“This is not a bull market correction or a dip. It is a full-bore, 2022-like, Leonardo-DiCaprio-in-The-Revenant-style crypto winter set into motion by factors ranging from excess leverage to widespread profit-taking by OGs,” Hougan stated.

Hougan, however, stated that the Bitcoin bottom is closer as its four-year bear cycle is in the last phase. Moreover, Hougan believes that Bitcoin investors are banking on regulatory progress and high institutional adoption, to drive a bullish rebound ahead.

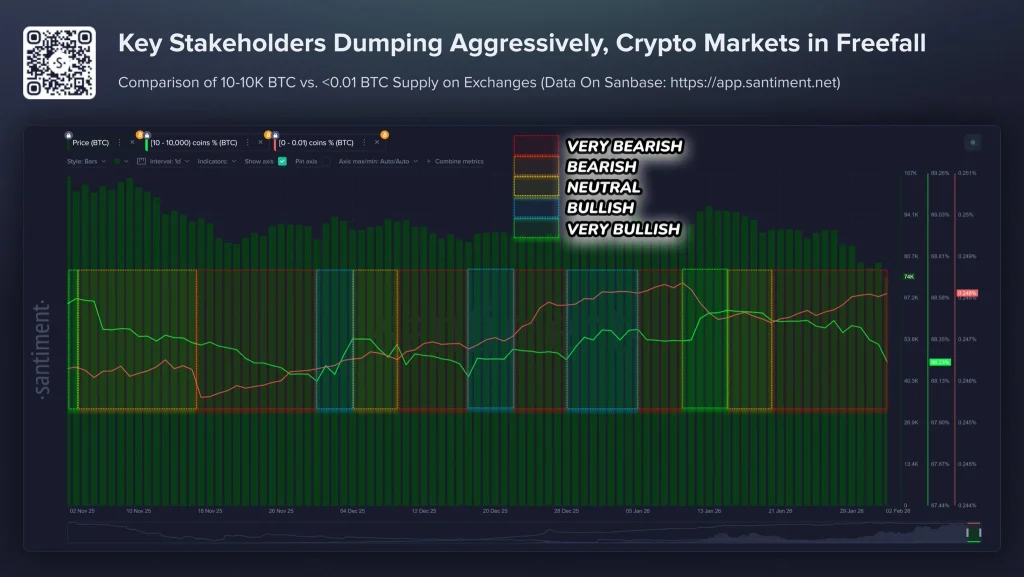

Source: X

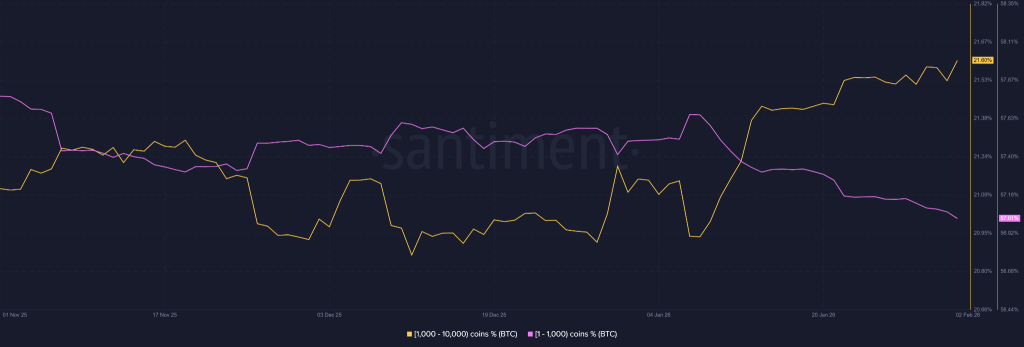

Nonetheless, onchain data from Santiment shows that key Bitcoin investors have been aggressively selling while retail buys-back, a classic sell signal. From a technical analysis standpoint, if Bitcoin buyers fail to defend $73k in the coming day, a further correction towards $69k will be inevitable.

The post CoinRoutes Co-Founder Alleges “Coordinated” Manipulation Behind October Crypto Crash appeared first on Coinpedia Fintech News

Dave Weisberger, co-founder of CoinRoutes and the man who built Morgan Stanley’s first program trading system, thinks October’s crypto crash was a coordinated attack. He shared his views on the Thinking Crypto podcast with host Tony Edward.

Weisberger called it “the greatest mass liquidation event in history.” The damage, that has kept the industry talking, was $19 billion wiped out. Bitcoin alone saw $5 billion in liquidations. Many altcoins dropped 20-70% at the bottom.

“Was it manipulation? I damn well think so. I have no proof. But it was just too damn obvious a time for an incredibly profitable attack,” he said.

Weisberger broke down the playbook. Attackers spend weeks building a position: long spot, short perpetual futures. Then they wait for a low-liquidity window and dump spot holdings. They place bids far below market price in perpetuals.

When prices fall, leveraged traders get liquidated. Forced selling kicks in. The attackers scoop up assets at rock-bottom prices and walk away with massive profits.

DeFi exchanges got hit hardest because positions were visible on-chain. Binance’s auto-deleveraging system, Weisberger said, was “broken” during the event.

Also Read: Was Binance Behind the $19B October Crypto Crash or the Target of It?

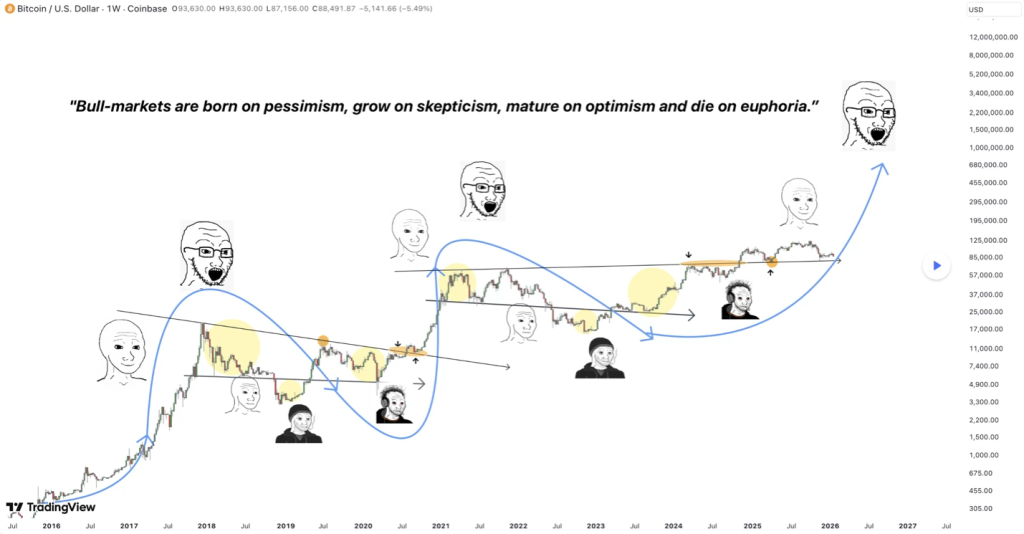

Weisberger has no patience for the halving cycle theory. He pointed out it’s based on just three data points.

He compared it to the Super Bowl Indicator, a 16-year streak that linked NFL wins to stock market performance. That correlation was “complete and unadulterated bullshit,” he said. The four-year cycle, in his view, is no different.

Weisberger stays bullish long-term. Hash rate is now 6x what it was in 2022. Around 10-30% of Bitcoin supply has moved from early holders with cost basis between $10 and $1,000 to newer buyers who paid more.

New institutional holders are making multi-year allocations, not leveraged bets, he noted.

His portfolio reflects that confidence: Bitcoin as his main holding, Solana and BitTensor as secondary plays, and smaller positions in Zcash and XRP.

The US House of Representatives approved a bill on Tuesday that will fund most of the government through the end of September.

Bitcoin fell under $73,000 as futures liquidations soared and worries over this week’s US corporate earnings triggered a stock sell-off. Will traders finally step in to buy “discounted” BTC?

The crypto company reported significant net losses to its balance sheet in 2025 due in part to “lower digital asset prices and approximately $160 million of one-time costs.“

The NYSE-listed BTYB allocates most of its assets to US Treasurys while using options strategies to provide weekly income and Bitcoin-linked exposure.

Pedro Sánchez announced that Spain would implement several changes to laws impacting social media platforms starting next week, with potential criminal liability for executives.

Bitcoin failed to attack $80,000 resistance as gold sought a $5,000 reclaim, while analysis argued that "crypto winter" began in January 2025.

The post Coinbase Accuses Australia’s Big Four Banks of ‘Unlawful’ Crypto Debanking appeared first on Coinpedia Fintech News

Coinbase has taken its fight against crypto debanking to Australia’s parliament, filing a formal complaint that accuses the country’s biggest banks of shutting legitimate crypto businesses out of the financial system.

Here’s the scoop.

The submission, sent to the House of Representatives Standing Committee on Economics, names Commonwealth Bank, Westpac, ANZ, and National Australia Bank. Coinbase said these banks are closing accounts without warning and blocking transactions tied to digital assets.

“There is nothing that degrades trust in an economy faster than being told you cannot use your own money,” Coinbase wrote.

The exchange warned that debanking has gone from a rare problem to a “systemic feature of the Australian financial landscape.” With four banks controlling most of the country’s payment rails, losing access amounts to an “unlawful regulatory ban” on lawful businesses.

Data cited in the filing shows 60% of fintech businesses faced denial of service from banks in 2021. That problem remains unresolved.

Coinbase urged lawmakers to pass five transparency measures that regulators recommended years ago. The government backed these reforms in August 2022, but they were never put into law.

The measures would require banks to explain account closures, give 30 days’ notice, and provide access to dispute resolution.

Also Read: Why Was Coinbase’s Brian Armstrong Snubbed by Top US Bank CEOs at Davos?

The exchange pointed to how other countries handle the issue. The EU guarantees a basic bank account for all legal residents. Canada allows account access even with a bankruptcy history. In the U.S., President Donald Trump signed an executive order last August to stop crypto-related debanking.

Australia’s $4 billion fintech sector now waits on parliamentary recommendations expected later this year. The outcome could determine whether crypto innovation stays or moves elsewhere.

The post Why Is Moscow Exchange to Launch Solana, XRP, and TRX Futures Now? appeared first on Coinpedia Fintech News

Recently the prices across the altcoin market remain under pressure. Yet a major institutional catalyst has emerged for the top blue chips of the industry. Moscow Exchange’s plans to launch cash-settled futures for Solana, XRP, and TRX adds regulated exposure at a time of heightened volatility, reshaping how these assets are viewed within long-term market frameworks.

Moscow Exchange (MOEX) is preparing to broaden its regulated crypto derivatives lineup by introducing cash-settled futures linked to Solana, XRP, and TRX. The move extends the exchange’s existing Bitcoin and Ethereum offerings and aligns with its strategy to deepen institutional access to digital asset exposure in Russia.

— Xaif Crypto

Russia's Moscow Exchange announces plans to launch cryptocurrency indices for Solana, Ripple, $XRP and Tron by the end of 2026, signaling further crypto market integration in the country. pic.twitter.com/afvbVYhSjv

|

(@Xaif_Crypto) February 3, 2026

Initially, MOEX plans to launch indices tracking these altcoins, which will then serve as the underlying benchmarks for futures contracts. At the same time, settlement will be conducted entirely in Russian rubles, removing any need for physical cryptocurrency delivery and simplifying compliance requirements.

Access to the new futures contracts will be restricted to qualified investors under Russian law. Meanwhile, contract specifications are expected to mirror MOEX’s existing crypto products, with monthly expiries and standardized risk controls.

JUST IN:

— Bitcoin Magazine (@BitcoinMagazine) January 29, 2026Russia to roll out crypto regulatory framework this July, allowing retail participation. pic.twitter.com/rSGoesFBzK

This structure reflects a broader regulatory direction. The Russian government is working toward a comprehensive digital asset framework expected by July 1, 2026, positioning regulated derivatives as a controlled gateway for institutional participation rather than direct spot market exposure.

From a market context perspective, the announcement arrives during a sharp correction across the altcoin sector. While, prices for Solana, XRP, and TRX have all been influenced by broader risk-off sentiment rather than asset-specific fundamentals.

Still, promises for derivatives listings on national exchanges is a longterm. This broadly signal a shift in how assets are classified. Rather than speculative instruments, they begin to function as monitored financial products within formal trading ecosystems. That said, futures markets also introduce leverage and hedging dynamics, which can amplify volatility in the short term.

At the same time, the current drawdown appears more consistent with a cooling phase than a structural breakdown. Market participation has thinned, forced liquidations have slowed after the event, and volatility is gradually normalizing.

Breaking developments such as MOEX’s futures expansion may not immediately reverse price trends. However, they do open the possibility of renewed interest once bearish pressure fades, particularly among long-term investors assessing regulated exposure and liquidity pathways rather than short-term price action.

From an analytical perspective, regulated futures introduce price discovery mechanisms that operate independently of spot markets. For Solana, XRP, and TRX, this may gradually influence how capital flows react during future market cycles.

While price recovery is never guaranteed, the introduction of these contracts places the trio within a more formal derivatives framework. The presence of MOEX futures suggests that Solana, XRP, and TRX are increasingly treated as enduring components of the crypto market rather than transient narratives, reinforcing their standing within long-term structural discussions.

The post Why is Crypto Crashing Again Today and What’s Next? appeared first on Coinpedia Fintech News

The crypto market is under pressure again, with prices sliding sharply during the latest trading session.

Total crypto market value has dropped 3.24% to $2.57 trillion, wiping out nearly $50 billion in a matter of hours. The selloff accelerated after the U.S. market opened, when Bitcoin suddenly fell by around $1,700.

The sharp move triggered heavy liquidations.

This happened despite positive news around the U.S. government shutdown, showing that market sentiment remains fragile.

Fear remains high, with the Crypto Fear & Greed Index stuck at 17, deep in “extreme fear” territory.

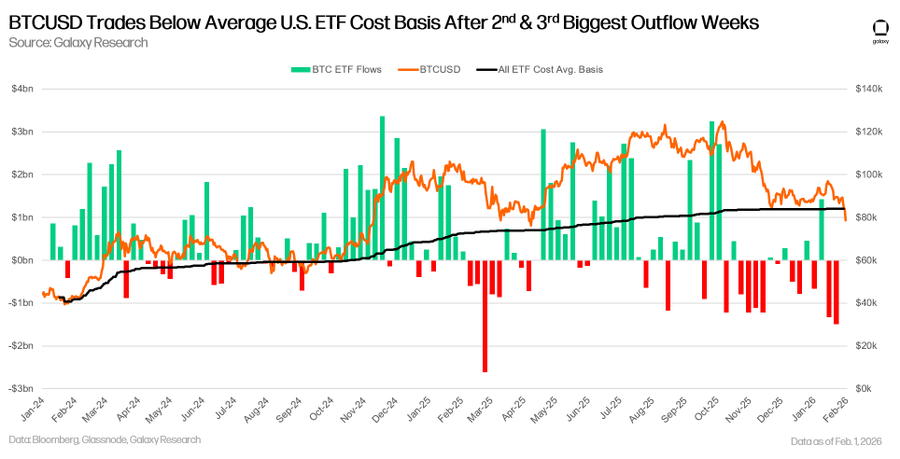

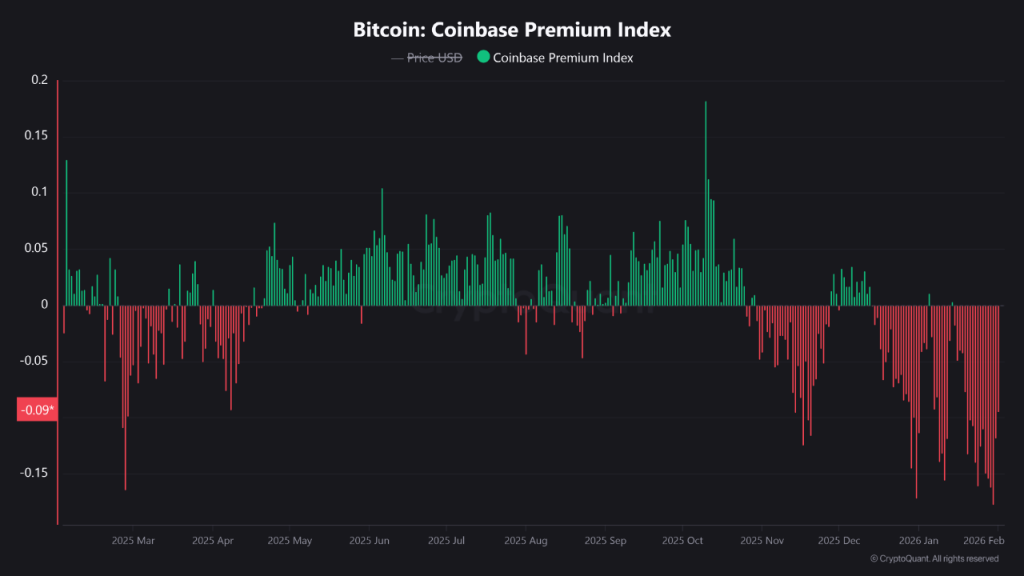

One key pressure point has been continued selling from institutional products.

Oversold conditions and low liquidity made the market vulnerable to sudden drops.

Ethereum has broken below an important support level, adding to the bearish mood.

Analysts say that Ethereum could still outperform Bitcoin later in the cycle, but only if broader market conditions stabilise.

While crypto struggled, traditional safe-haven assets surged.

Together, nearly $4 trillion flowed back into precious metals in just 30 hours, a possible sign that investors are seeking safety.

The next major catalyst will be the upcoming U.S. Federal Reserve meeting, which could set the tone for global markets.

Looking ahead, some research firms have warned that if selling pressure continues and no new catalysts emerge, Bitcoin could slide further and could even hit $58000, with long-term support levels coming into focus.

The post Crypto.com Launches OG Prediction Market Platform Days Before Super Bowl appeared first on Coinpedia Fintech News

Crypto.com is spinning off its prediction market business into a standalone platform called OG, and it’s launching just days before the Super Bowl.

The platform will offer CFTC-regulated sports event contracts along with markets covering financial, political, cultural, and entertainment events. OG will also be the first prediction market platform to offer margin trading on prediction contracts.

The first one million users to sign up will receive up to $500 in rewards.

The numbers tell the story. Crypto.com has seen 40x weekly growth in its prediction market business over the past six months. That kind of traction demanded its own home.

“Crypto.com successfully built one of the largest brands and best app experiences in cryptocurrency during a period of hypergrowth amid a complex regulatory landscape, and now we will work to replicate this experience with OG in the prediction market space,” said Kris Marszalek, Co-Founder and CEO of Crypto.com.

OG is powered by Crypto.com | Derivatives North America (CDNA), the same CFTC-registered exchange and clearinghouse that launched the nation’s first federally licensed sports prediction contracts back in December 2024.

Nick Lundgren will lead OG as CEO. He currently serves as Crypto.com’s Chief Legal Officer and was the one who led the CDNA acquisition in 2022, then the largest acquisition in crypto history.

“Sports are the natural hub of prediction markets, and we see a massive opportunity to provide fans with an all-encompassing platform where it pays to be right,” Lundgren said. He called prediction markets a “deca-billion dollar industry.”

OG will roll out a VIP program tied to Crypto.com’s existing sports deals. That includes access to experiences through Crypto.com Arena, UFC, Formula 1, and UEFA Champions League.

The launch lands at an interesting time. The CFTC said last week it would craft new rules for the prediction market industry. OG will be headquartered in the US and focused on that market first.

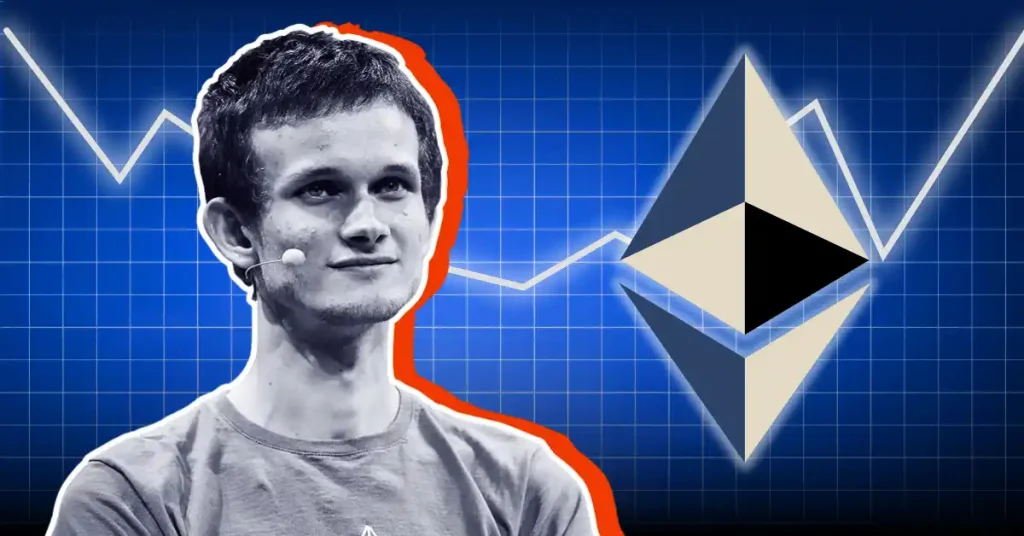

The post Ethereum No Longer Needs Its Layer-2 Crutches, Says Founder Vitalik Buterin appeared first on Coinpedia Fintech News

Ethereum founder Vitalik Buterin said the blockchain’s long-standing approach to scaling through layer-2 networks needs a rethink, as Ethereum’s core network grows faster than expected and many secondary chains struggle to meet earlier goals.

In a detailed post, Buterin said two developments have weakened the original case for treating layer-2 networks, or L2s, as extensions of Ethereum itself.

First, progress by L2s toward full decentralisation and security has been “far slower and more difficult” than expected. Second, Ethereum’s main network is now scaling directly, with transaction fees falling sharply and major increases in capacity planned from 2026 onward.

Together, those shifts mean the original vision for L2s “no longer makes sense,” Buterin said, calling for a new framework to define their role in the ecosystem.

Ethereum’s original roadmap imagined L2s as “branded shards” — tightly integrated networks that would inherit Ethereum’s security and censorship resistance while dramatically increasing transaction capacity.

But that vision has not materialised.

Some L2 developers have openly said they may never move beyond partial decentralisation, citing technical limits or regulatory demands that require retaining control. While that approach may suit certain users, Buterin said it does not align with the goal of scaling Ethereum itself.

“If you are doing this, then you are not scaling Ethereum in the sense originally intended,” he wrote.

Crucially, Buterin argued this is no longer a problem. Ethereum’s base layer is now expanding on its own, reducing reliance on L2s to deliver growth.

Rising capacity on the main network, combined with low fees, has weakened the argument that L2s must serve as near-identical replicas of Ethereum. Instead, Buterin said, L2s should be viewed as a broad spectrum — ranging from chains deeply secured by Ethereum to more independent systems with looser connections.

Users, he added, should decide how much trust or integration they require, rather than assuming all L2s offer the same guarantees.

Buterin urged L2 projects to define their value beyond simple scaling.

Possible directions include specialised features such as privacy tools, ultra-fast transaction processing, non-financial applications like identity or social platforms, and systems designed for workloads that even an expanded Ethereum mainnet cannot efficiently handle.

For L2s that rely on Ethereum-issued assets like ether, Buterin said a minimum level of security integration remains essential. Beyond that, flexibility — not uniformity — should be the goal.

On Ethereum’s side, Buterin said he has grown more confident in a proposal known as a “native rollup precompile” — a built-in feature that would allow Ethereum itself to verify advanced cryptographic proofs used by L2s.

Such a tool, he said, would reduce reliance on external security committees, improve trustless interoperability, and make it easier for L2s to build safely while adding unique features.

If flaws emerge, Ethereum would take responsibility for fixing them through network upgrades, bringing trust in the system.

Buterin acknowledged that a more open approach will inevitably lead to some L2s being less secure or more centralised than others. That, he said, is unavoidable in a permissionless ecosystem.

“Our job,” Buterin wrote, “should be to build the strongest Ethereum that we can.”

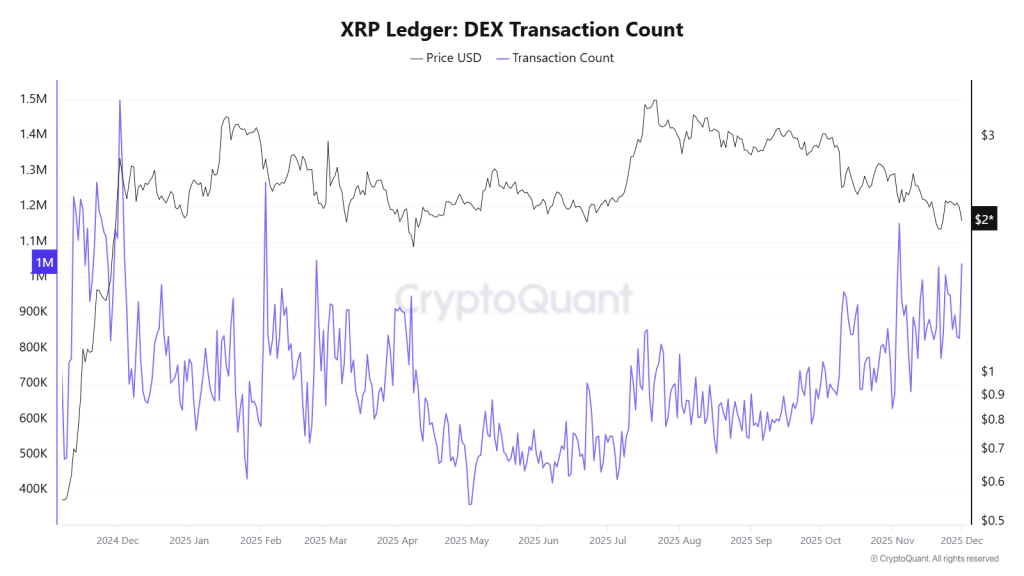

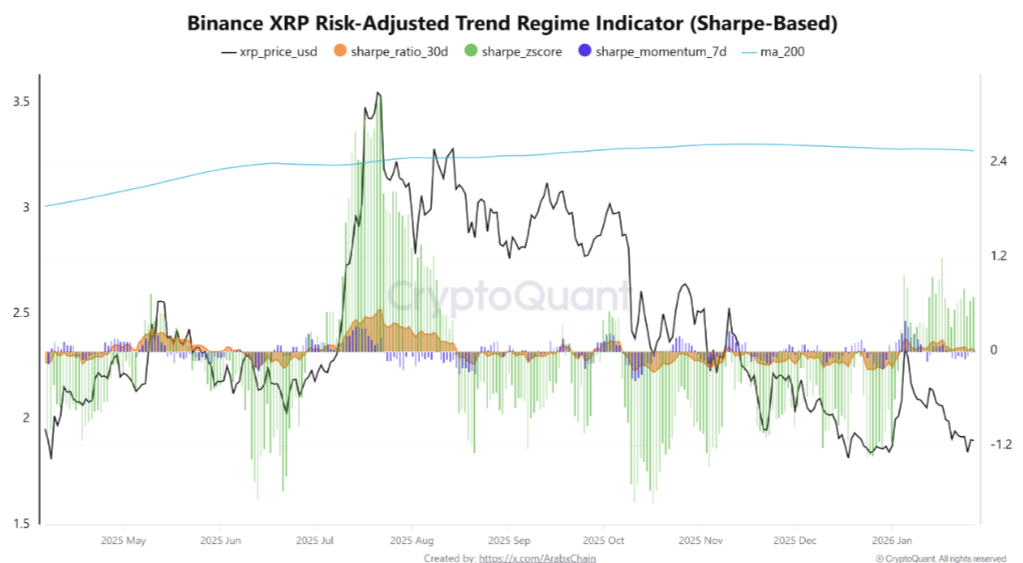

The post After the Crash, XRP’s Next Move Is Starting to Matter appeared first on Coinpedia Fintech News

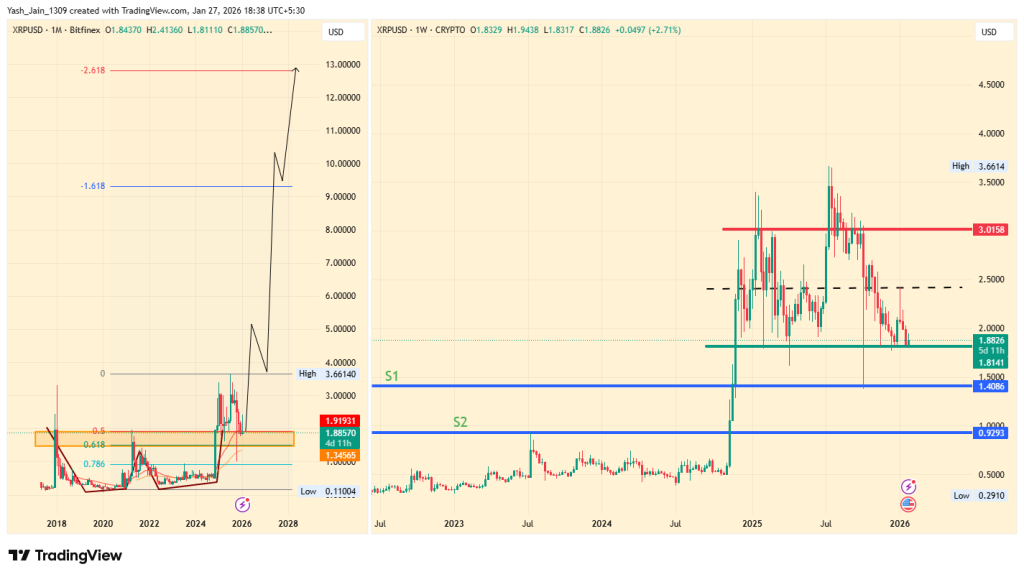

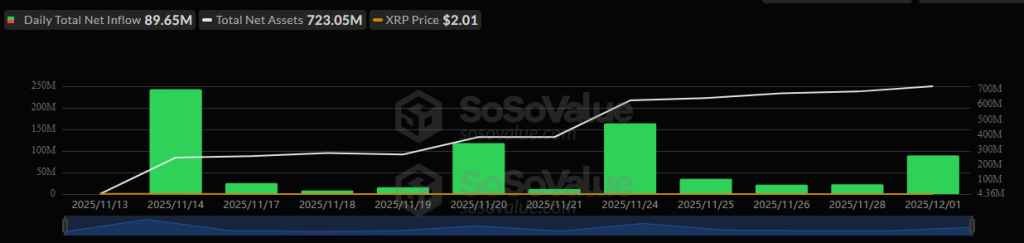

XRP is showing tentative signs of stabilization after one of its sharpest pullbacks in recent months, even as broader crypto markets remain under pressure. For investors and experts, the focus is now shifting from panic-driven selling to whether prices are beginning to form a durable base.

From its recent cycle high, XRP has declined by roughly 54%, a magnitude of correction that has historically preceded periods of consolidation or recovery rather than prolonged declines.

According to an expert, during the latest market-wide selloff, XRP briefly dipped toward recent lows but avoided setting a new breakdown point. Instead, prices rebounded quickly, suggesting that buyers are stepping in earlier than before.

This matters because in previous XRP cycles, declines in the 50–55% range have often marked exhaustion of selling pressure.

While Bitcoin and Ethereum both pushed to new short-term lows during the latest drop, XRP did not.

For investors, this relative strength is important. It could mean that XRP is being accumulated at current levels rather than aggressively sold into weakness.

XRP is now trading in a narrow recovery range, with several levels drawing attention:

A decisive break and hold above $1.80 would be an important signal that confidence is returning.

Bitcoin is still hovering near a major support zone after its deepest pullback of the cycle. As long as Bitcoin holds these levels, XRP’s downside risk appears limited. A renewed breakdown in Bitcoin, however, would likely drag the entire market lower, regardless of individual strength.

In short: XRP can outperform, but it cannot fully decouple.

Macro conditions are becoming less restrictive compared with recent months.

The post Why Are Bitcoin, Ethereum and XRP Prices Going Down Today Again? appeared first on Coinpedia Fintech News

After a brief recovery yesterday, the crypto market has turned red again.

On Monday, prices moved higher after comments from US President Donald Trump, who said he supports crypto and believes the US must lead in digital assets or risk falling behind China. That statement helped lift market sentiment for a few hours.

But the bounce did not last.

At the time of writing, the total crypto market value has fallen 3.95% in the last 24 hours, dropping to $2.62 trillion.

Bitcoin, Ethereum and XRP are all trading lower again, along with most large altcoins.

Bitcoin continues to lead the market lower.

Bitcoin is down more than 11% over the past seven days, keeping pressure on the broader market. Over $55 million worth of long positions were wiped out in just two hours as prices suddenly dropped.

The selloff came despite positive news around the U.S. government shutdown. BTC is currently down by more than 4%.

Ethereum has fallen even harder than Bitcoin.

Because Ethereum has such a large market value, its decline has added to the overall market losses.

Crypto is currently moving on its own, not in line with traditional markets.

The market is at a critical level.

Despite supportive comments from political leaders, crypto prices are falling again due to:

Until Bitcoin stabilizes and sentiment improves, the market is likely to remain volatile.

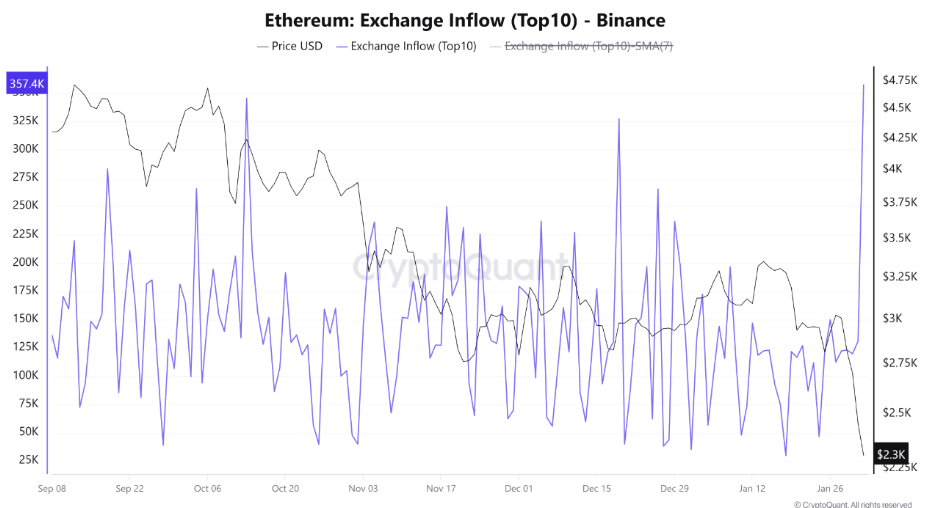

The post Analyst Warns of Deeper Correction—Ethereum (ETH) Price May Plunge Below $2000 appeared first on Coinpedia Fintech News

The rejection of $3000 has pushed the Ethereum (ETH) price into a strong bearish trajectory. The price is failing to secure an important range of around $2300, which has become a major resistance to break. Meanwhile, the bulls have been defending the pivotal support at $2,150, keeping the bullish possibilities alive. This may point towards an upcoming trend reversal, but a popular analyst, Ali, suggests the bottom has not been reached yet.

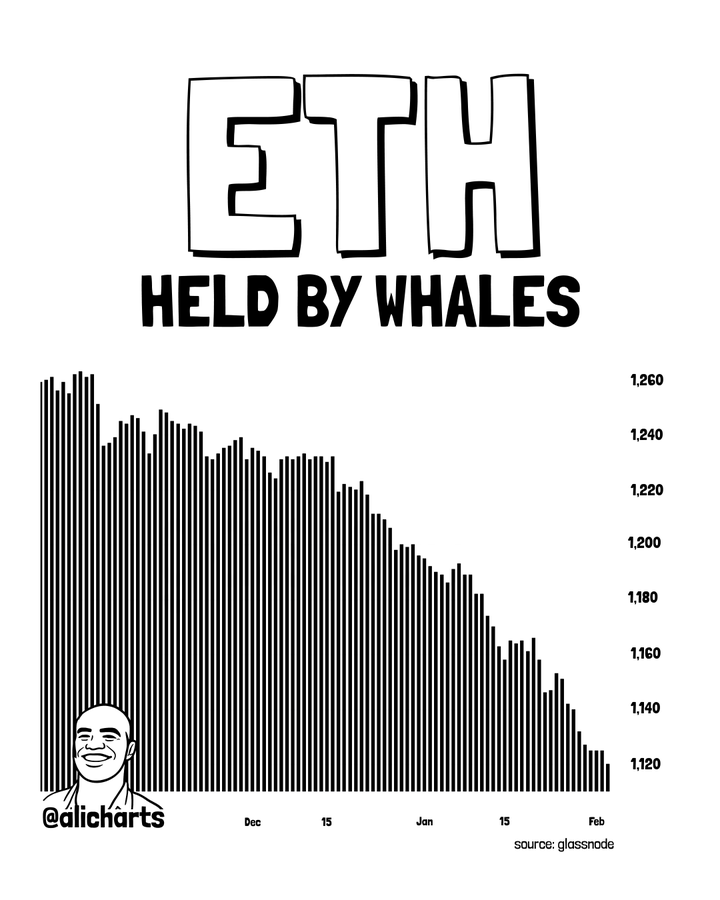

The big players seem to be not confident in the current price rebound, as they have been distributing instead of accumulating. The data from Glassnode shows that the Ethereum whales have been steadily reducing their holdings, possibly relocating them to other tokens.

The declining bars are the number of wallets holding more than 10,000, which has declined from 1,262 to 1,120. This validates the claim of a possible supply rotation, as they are not aggressively adding or holding at current levels. This points towards a weakening of upside momentum as buying pressure fades off. This may not follow a sudden crash but rather keep the price consolidated within a tight range.

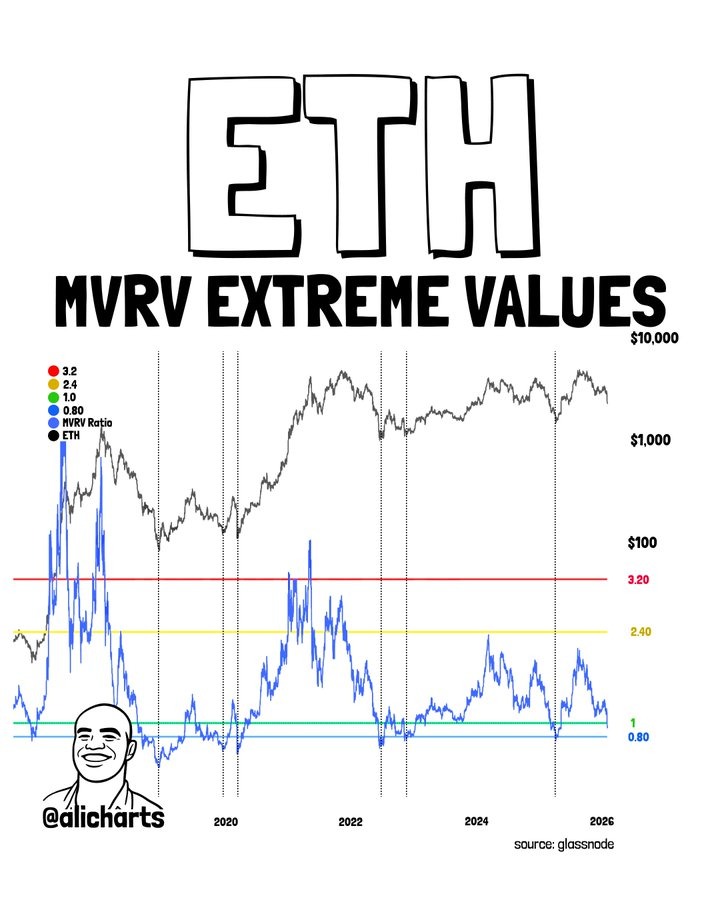

A better way to determine whether the ETH price is undervalued or overvalued is to analyse the MVRV values. The chart below shows the Ethereum MVRV ratio and how it behaves at the extreme levels over time. Historically, when ETH’s MVRV moves into the red zone above ~3.2, it has marked overheated conditions and major tops, where profit-taking tends to kick in. On the flip side, when MVRV drops toward the green zone around 0.8–1.0, it has often lined up with cycle bottoms, signaling that ETH is undervalued and long-term accumulation starts.

Right now, MVRV is sitting closer to the lower band, not in extreme greed territory. Historically, the Ethereum price bottoms when the MVRV ratio drops below 0.8. Currently, the ratio sits at 0.96, which suggests the typical bottom conditions haven’t fully formed yet.

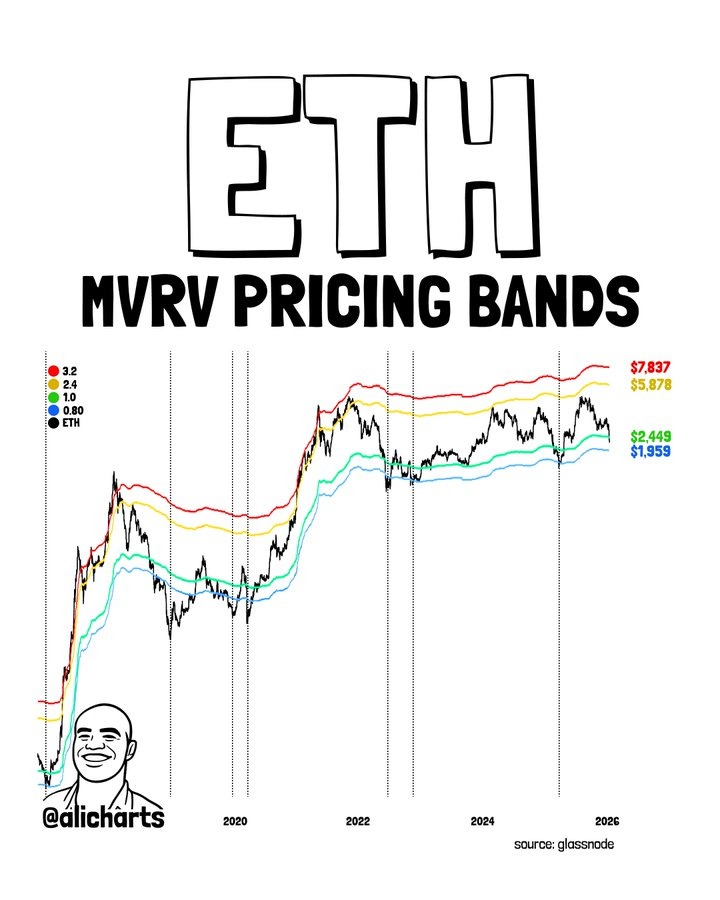

The second-largest token has been facing strong upward pressure over the past few days; still, the support at $2000 was held tight. However, the data revealed by the MVRV pricing bands suggests the ETH price may find its bottom below $2000. MVRV pricing bands are used to map out where ETH tends to be undervalued, fairly valued, or overheated based on on-chain data rather than pure price action.

Historically, when ETH trades near the lower blue/green bands (0.8–1.0 MVRV), it has marked strong accumulation zones and cycle lows. On the other hand, moves towards the yellow and red bands (2.4–3.2 MVRV) have aligned with market tops, where price becomes stretched and profit-taking increases. Right now, ETH is trading above the lower bands but well below the red zone, suggesting it’s no longer deeply undervalued, yet still far from euphoric territory. They hint that Ethereum has room to explore lower levels, and based on this model, a cycle bottom could form below $1,959.

Ethereum has long been viewed as one of the more stable assets in the crypto market, yet even the strongest ETH bulls are now deep in the red. BitMine, led by Tom Lee, is currently sitting on an estimated loss of nearly $6.8 billion. Meanwhile, prominent crypto whale Garrett Jin has faced losses of around $770 million, including a $195 million ETH long liquidation. In another major hit, Jack Yi, founder of Capital Inc., has reportedly lost close to $680 million.

These losses reflect the broader market environment, where sentiment remains firmly fearful amid extreme volatility across major cryptocurrencies, including Bitcoin and Ethereum. At the same time, buying pressure remains negligible, keeping the probability of a near-term reversal low. Given the current structure, traders may prefer to stay cautious until market conditions stabilize and bulls show clear intent. A sustained move above $3,500 would be required to confirm that ETH is breaking out of bearish influence and regaining upside momentum. Until then, downside risk remains firmly in play.

![Iran Economic Crisis [Live] Updates and Impact on the Crypto Market](https://image.coinpedia.org/wp-content/uploads/2026/01/13122147/Iran-Economic-Crisis-Live-Updates-and-Impact-on-the-Crypto-Market-1024x536.webp)

The post Iran Crypto Activity Rises Amid Sanctions and Currency Slide as U.S. Treasury Probes Possible Evasion appeared first on Coinpedia Fintech News

Crypto use in Iran is rising as the country faces ongoing U.S. sanctions and a sharp decline in the value of its currency, pushing more people to look for alternative ways for ROI. According to researchers, many users have been moving toward crypto away from local exchanges during recent periods of economic instability. At the same time, the U.S. Treasury is reviewing whether some crypto platforms may be helping users bypass sanctions, following analysis by TRM Labs.

U.S. authorities are looking into whether some cryptocurrency platforms have been used by Iranian officials to get around international sanctions. The review comes as the use of crypto has grown quickly in Iran.

Researchers estimate that crypto transactions in the country reached between $8 billion and $10 billion last year, driven by increased activity from both state-affiliated entities and everyday investors, based on data from TRM Labs and Chainalysis.

Tom Keatinge, director of the Centre for Finance and Security at UK think-tank the Royal United Services Institute, said, “The harder one squeezes the Iranian economy, the more one better be ready to deal with the consequences, one of which is the expanding use of crypto.”

Activity on cryptocurrency networks linked to Iran remained high last year, with TRM Labs estimating roughly $10 billion in transactions, slightly below the $11.4 billion recorded in 2024. Data from Chainalysis shows inflows to Iranian-linked wallets continued to rise, reaching a record $7.8 billion in 2025, compared with $7.4 billion in 2024 and $3.17 billion in 2023.

Also read: Why Iran’s Currency Collapse to ‘Zero’ Could Push Bitcoin Back Above $100K

As crypto use expands, the U.S. Treasury is assessing whether some digital-asset platforms may have helped state-connected actors evade sanctions. Ari Redbord, global head of policy at TRM Labs, said the review is focused on potential efforts to move funds overseas, gain access to hard currency or purchase goods despite restrictions.

Last week, two UK-based crypto exchanges were sanctioned by the U.S. after authorities said they processed funds linked to the Islamic Revolutionary Guard Corps, according to the Office of Foreign Assets Control. The U.S. also targeted Iranian financier Babak Morteza Zanjani over alleged support for IRGC-linked activities.

Read more: U.S. Treasury Sanctions UK Crypto Exchanges Over Alleged Iran Sanctions Evasion

Researchers say it is extremely difficult to measure how cryptocurrencies are used in Iran, and estimates differ widely on how much activity is linked to the state versus ordinary users. Data from Chainalysis suggests that about half of last year’s crypto transactions were connected to the Islamic Revolutionary Guard Corps, a group with major political and economic influence in the country and close ties to Supreme Leader Ayatollah Ali Khamenei.

Other researchers highlight a very different picture. TRM Labs estimates that most Iran-related crypto flows come from retail investors, although it has still identified thousands of wallet addresses linked to the IRGC and says those accounts have handled around $3 billion in digital assets since 2023.

The post Canton Network Strengthens Institutional Stack as CC Price Strongly Reacts to Fireblocks Integration appeared first on Coinpedia Fintech News

Canton network price today is trading near $0.189 as fresh institutional infrastructure developments reshape its market context. The catalyst comes from Fireblocks’ integration with the Canton Network, a move that strengthens regulated settlement access while drawing attention to CC/USD at a critical technical juncture.

Meanwhile, Fireblocks, which is known and trusted by more than 2,400 enterprises and securing over $5 trillion in annual digital asset transfers has announced a new integration with the Canton Network. The move expands Fireblocks’ regulated infrastructure offerings for tokenization, settlement, and institutional digital asset flows.

The @CantonNetwork is now supported on Fireblocks.

— Fireblocks (@FireblocksHQ) February 3, 2026

Financial institutions can custody Canton Coin and build on Canton's privacy-enabled infrastructure with the same security and policy controls they use across our platform.

Private settlement. Governed flows. Institutional… pic.twitter.com/uGwvVQXZNa

At the same time, the integration introduces custody and operational support for Canton Coin (CC) directly within Fireblocks’ platform. This gives financial institutions a governed and privacy-enabled environment to begin settling assets on Canton using Fireblocks’ enterprise-grade policy controls and workflow automation.

Interest from traditional financial institutions has already been accelerating Canton’s momentum. The network is increasingly being viewed as a preferred infrastructure layer for regulated tokenization, including tokenized securities, deposits, and settlement workflows. That shift places Canton network crypto closer to institutional deployment rather than speculative experimentation.

That said, custody for Canton Coin will be provided through Fireblocks Trust Company, a qualified custodian chartered by the New York State Department of Financial Services (NYDFS). This structure provides a regulatory-compliant custody framework designed to meet fiduciary and risk management standards expected by large financial firms.

Still, the update also leverages Fireblocks’ MPC security architecture and governance controls. Institutions operating on Canton now gain protections suited for institutional-scale adoption, including key management safeguards and operational oversight. These features are increasingly seen as prerequisites for regulated digital finance participation.

From a market perspective, such developments often influence how participants assess network credibility, even when broader crypto conditions remain uncertain.

From a technical perspective, the Canton network price chart suggests that CC/USD has been trending upward from a key support zone. On the daily timeframe, $0.177 has established itself as immediate support after the price flipped the $0.160 level.

Price structure aligns with both an ascending parallel wedge and a developing cup-and-handle formation. The current rally remains contained within the ascending channel, suggesting controlled momentum rather than volatility-driven expansion.

If price continues to respect this structure, the upper boundary of the wedge near $0.220 becomes a level of interest. That zone may act as resistance and could invite a pullback toward the lower channel boundary near $0.140, which would still preserve a constructive longer-term setup. However, a sustained move beyond $0.220 would open the possibility of a broader reassessment in the Canton network price forecast.

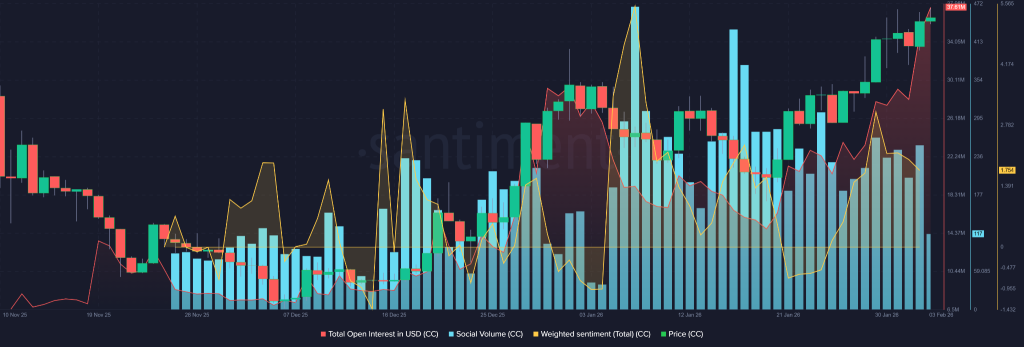

Additionally, derivatives data shows total open interest for CC/USD reaching an all-time high of $37.61 million. This indicates increasing participation, even as price action remains technically structured.

Social volume has also been building into Q1 2026, pointing to rising discussion around Canton network crypto. Weighted sentiment metrics suggest that commentary has skewed more positive than negative, reinforcing engagement without signaling speculative crowd behavior.

Taken together, these metrics suggest that the Canton network price is increasingly reflecting infrastructure-driven interest rather than short-term momentum trading, and that the price may tilt on the higher side for a longer span.

World Liberty launches a $3.4-billion stablecoin and lending platform, positioning it within onchain credit, collateralized loans and DeFi markets.

Solana price technicals suggest that the recent correction to $100 was a buy-the-dip opportunity as traders look for a recovery path toward $260.

The rollout provides access to tokenized US stocks, ETFs and commodities through Ondo GM tokens for non-US users on Ethereum, excluding 30 jurisdictions at launch.

Rails is betting that Stellar‑based smart contract vaults, onchain proofs and segregated collateral can make high‑speed perpetuals more palatable to institutions.

The integration allows institutions to custody and settle assets on the privacy-enabled blockchain built for regulated financial markets.

A new report finds most crypto press releases come from high-risk projects, raising questions about disclosure, hype and market manipulation.

The Spanish Red Cross is rolling out RedChain, a privacy-preserving blockchain aid system that gives donors cryptographic proof of impact without exposing beneficiary identities.

Permissioned blockchains and centralized layer 2s rebuild intermediaries for tokenized assets. Based rollups inherit Ethereum security while enabling compliance.

The post BTC Price Enters Fifth Month of Correction—Is Bitcoin Entering a Bear Phase? appeared first on Coinpedia Fintech News

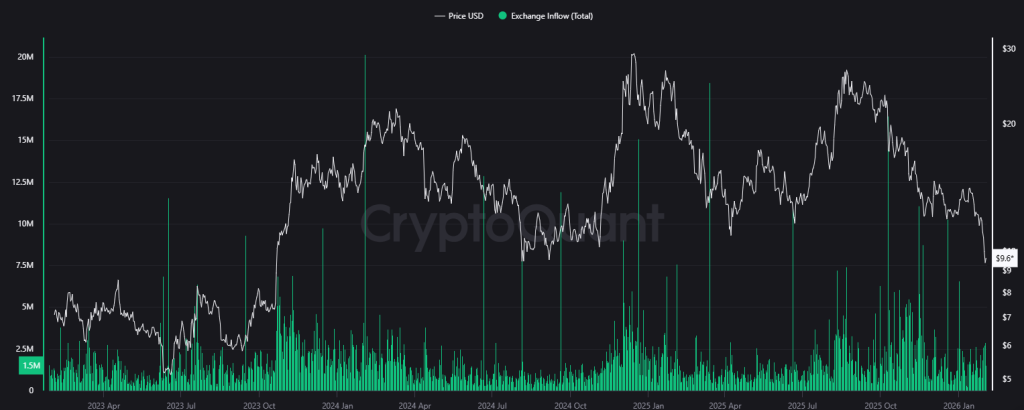

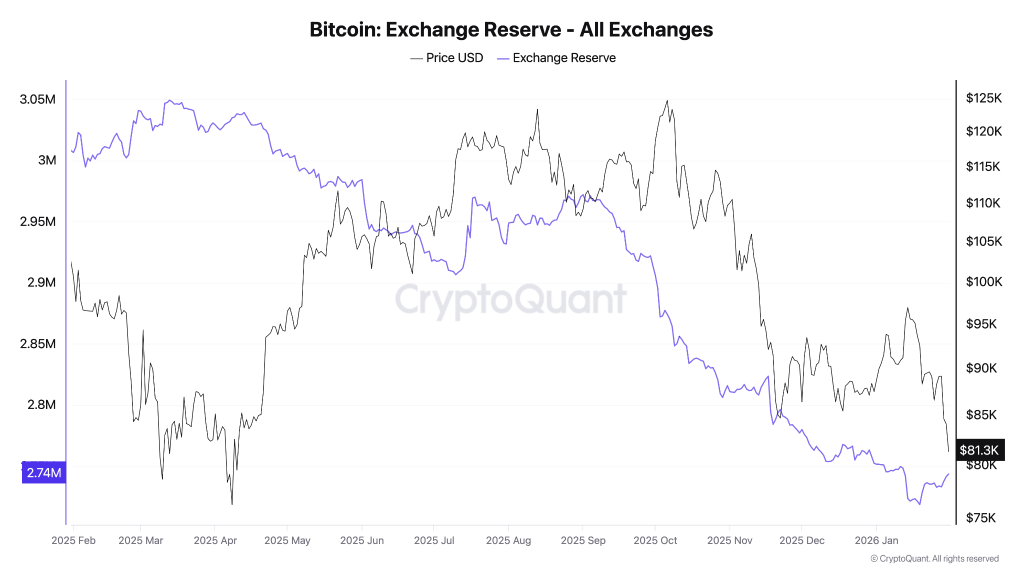

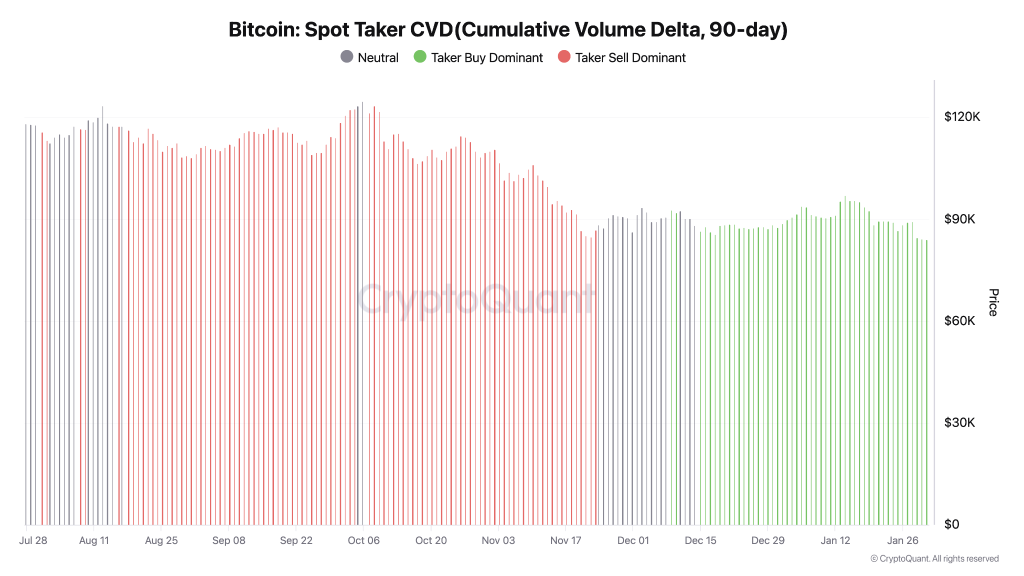

Despite the recent bounce, Bitcoin (BTC) price action continues to show clear signs of pressure as the correction stretches into its fifth straight month. Every recovery attempt has faced strong supply, with rallies repeatedly stalling below key resistance zones. This behavior points to ongoing distribution rather than a healthy consolidation phase. While buyers are stepping in near the lows, their lack of follow-through has allowed sellers to retain control of the broader trend.

As a result, BTC remains stuck in a corrective structure unless it can reclaim the critical $80,000 resistance with conviction. Until then, the market faces a near-term turning point. Traders are now watching closely to see whether Bitcoin can push above $80,000 this week—or if failure to do so leads to a breakdown below the $77,500 support zone.

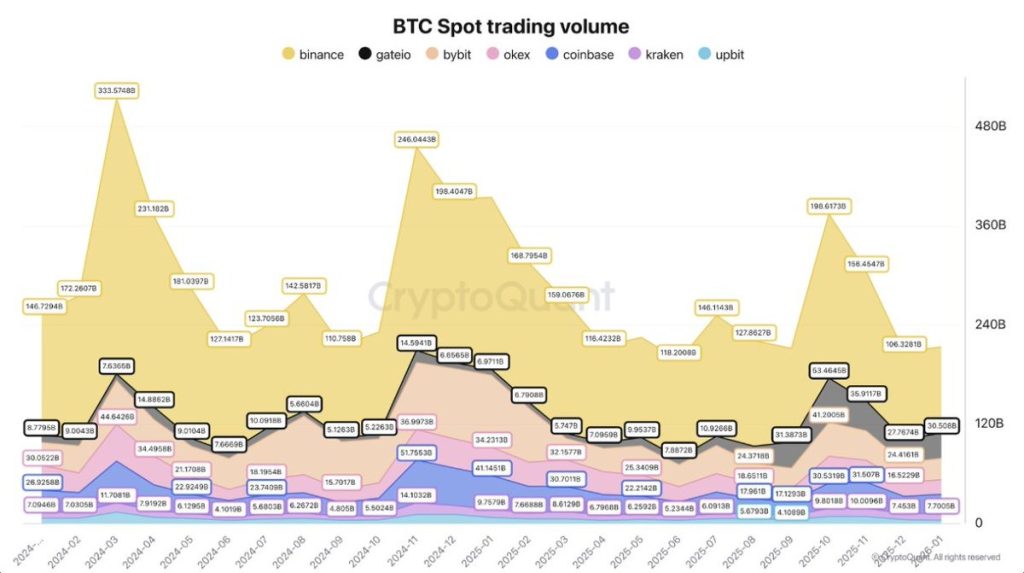

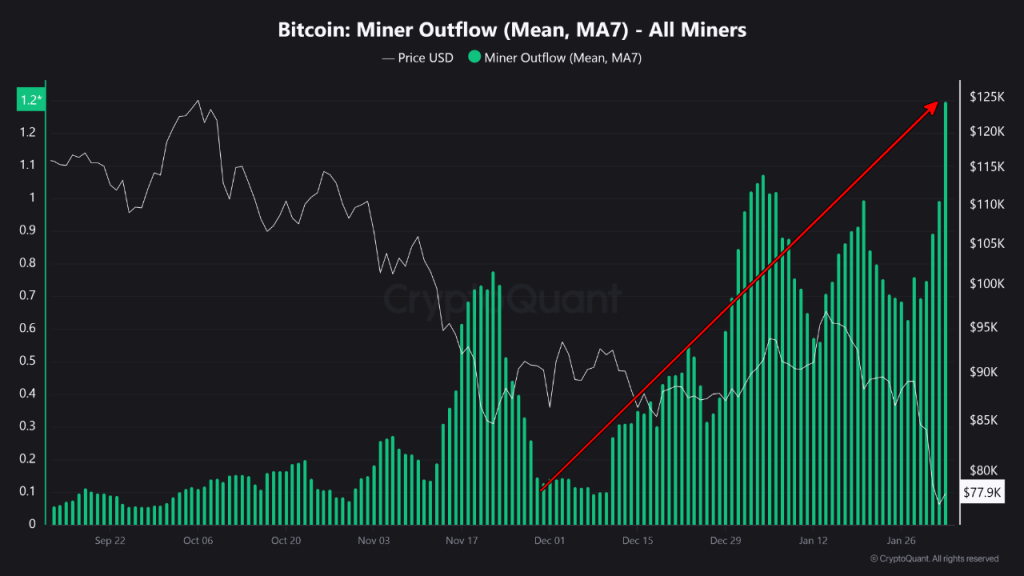

Bitcoin’s spot demand drying up is a subtle but meaningful signal—and CryptoQuant’s exchange data makes this clear. When spot volumes fall, it means real buyers are stepping back even if the price hasn’t yet cracked key levels. Historically, strong rallies in BTC have been backed by expanding spot demand on exchanges; without it, upside attempts tend to lack follow-through, and the price becomes more sensitive to headline moves or liquidations.

The CryptoQuant data shows key cycle moments: after the 2019 peak near $14K, spot demand faded, and price entered a prolonged consolidation and pullback; in late 2021, spot volumes dropped sharply after the all-time high, signaling distribution before the broader downtrend; and again in mid-2023, muted spot activity coincided with choppy range-bound price action before volatility picked back up.

As seen in these historical snapshots, drying spot demand on CryptoQuant typically aligns with consolidation, shaky breakouts, or increased volatility rather than sustained trend extensions.

The BTC price has been largely volatile since the last few days of January, which appears to have restricted the rally below the key resistance zone. The buyers and sellers are actively contributing, and as a result, volume remains elevated with no major impact on the price. The strength of the rally has been decaying since the start of the month, keeping the rally capped below an important resistance zone between $78,900 and $79,235.

As reflected on the chart, there has been a clear lack of aggressive buying interest from market participants. Since facing rejection near the $126,219 highs, price action has consistently printed lower highs and lower lows, reinforcing the ongoing bearish structure. This sustained absence of demand supports the view that spot buying interest has largely dried up over the past five months. Meanwhile, the RSI has slipped into oversold territory and is attempting a rebound, hinting at short-term relief potential rather than a confirmed trend reversal.

As a result, the Bitcoin (BTC) price is likely to remain range-bound below the $80,000 mark unless a clear surge in buying pressure pushes the price back above this bearish zone. Until then, any upside moves are expected to face strong selling pressure, keeping the broader corrective phase intact.

The post Arbitrum DAO’s X Account Hacked appeared first on Coinpedia Fintech News

Arbitrum DAO has confirmed that its official X account has been compromised. The team warned users not to click on or interact with any posts or links from the hacked account. They are actively working to regain control. Importantly, the Arbitrum protocol and user funds remain completely safe, as the breach only affects the social media account. Users are advised to stay cautious and ignore any suspicious messages until the account is fully recovered.

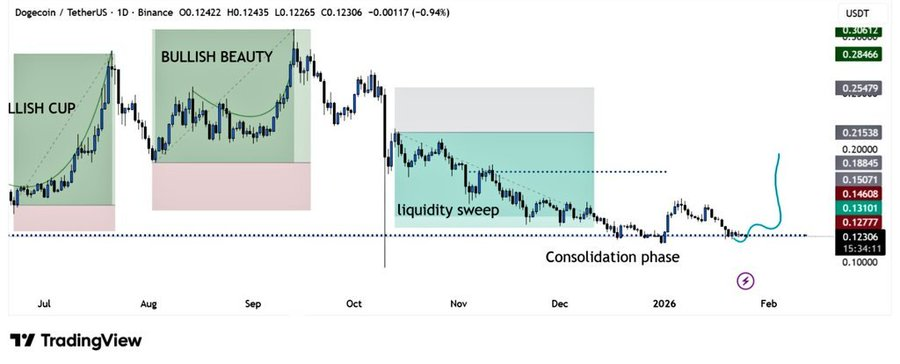

The post Dogecoin Price Today Jumps After Elon Musk Comment appeared first on Coinpedia Fintech News

Dogecoin price jumped after a fresh comment from Elon Musk renewed interest in the meme coin. The move pushed DOGE price today to the top of the crypto market’s gainers over the past 24 hours.

The latest rally followed a playful yet powerful post from Elon Musk, where he hinted that Dogecoin could finally go to the moon next year. The comment referenced his long-standing promise from 2021 and brought fresh attention to the DOGE-1 lunar mission, a SpaceX-linked project funded entirely using Dogecoin.

When @elonmusk ? pic.twitter.com/Ugc6Dcl7xe

— Tesla Owners Silicon Valley (@teslaownersSV) February 3, 2026

DOGE-1 is planned as a lunar payload mission aimed at collecting data from the Moon, while also showcasing how cryptocurrency can be used beyond Earth. Although the mission has faced several delays and was earlier expected to launch in mid to late 2026, Musk’s latest comment reignited market hopes, at least from a sentiment point of view.

Following Musk’s post, Dogecoin price surged nearly 5%, briefly reaching $0.109 before settling near $0.1068. This made DOGE the top-performing asset among the top 10 cryptocurrencies by market cap during early Tuesday trading.

The broader crypto market also moved higher, gaining around 2% during the same period. Bitcoin price today climbed above $78,000 but lagged behind Dogecoin, posting a smaller 2.4% rise. The gap once again highlighted how strongly DOGE reacts to sentiment, especially when Elon Musk is involved.

The renewed excitement has caught the attention of market analysts. Crypto trader Trader Tardigrade compared current market conditions to Dogecoin’s 2020 rally. According to the analyst, DOGE previously bottomed when the U.S. dollar index and gold peaked, leading investors to shift toward riskier assets like cryptocurrencies.

This comparison has strengthened the bullish outlook and added confidence to the idea that Dogecoin may be entering another upward phase.

Beyond hype, Dogecoin is also seeing progress in real-world use. House of Doge recently announced plans for a Dogecoin payment app, which will allow users to create wallets, buy DOGE, and make payments from one platform.

Meanwhile, Dogecoin ETFs are slowly gaining traction. After a quiet start, these products have recorded new inflows, pushing total net inflows close to $7 million. While still modest, this trend points to growing interest from institutional investors.

For now, Dogecoin’s rally remains largely driven by sentiment. Traders will be closely watching whether Musk’s comments lead to real progress or fade like previous hype-driven spikes. Until then, DOGE remains one of the most reactive cryptocurrencies, capable of strong price moves from a single social media post.

The post Remittix Wallet Attracts 50,000+ Users As Platform Rewards Presale Investors With A Huge Bonus appeared first on Coinpedia Fintech News

Remittix Wallet adoption is accelerating as crypto users increasingly look for products that offer real payment utility rather than short-term speculation. The Remittix Wallet launch on the Apple App Store marks a key step in this shift, placing Remittix directly into conversations around the top crypto to buy now as infrastructure-led projects gain momentum.

As wallet activity grows, attention is also turning to what comes next for the Remittix ecosystem, especially with its full PayFi platform launch now officially scheduled.

This growing focus on delivery aligns with broader demand for crypto with real utility, where live products and execution timelines matter more than narratives.

The Remittix Wallet is now live on the Apple App Store, where users can store, send, and manage their digital assets in a clean and scalable interface. This is Phase 1 of the Remittix DeFi Platform, and crypto-to-fiat is already in the pipeline.

Google Play deployment is currently underway, expanding access as the ecosystem grows.

This wallet adoption reflects rising interest in low gas fee crypto solutions that are designed for real use, not experimentation. Remittix targets everyday payments, remittances, freelancers, and global users who need reliable crypto tools connected to traditional finance.

The Remittix team has now confirmed that the full PayFi platform will go live on 9 February 2026. This release unlocks the first complete version of the Remittix ecosystem, enabling direct crypto-to-fiat transfers into real bank accounts.

This launch marks the transition from wallet infrastructure to full payment execution.

Remittix is priced at $0.123 per token, with development funded through over $28.9 million raised from private funding, signaling demand tied to product delivery. With the wallet already live, the platform launch completes the core utility layer that the project has been building toward.

Interest around Remittix is increasing as availability narrows. Over 701.8 million of the 750 million total tokens have already been sold, placing distribution above 93%. This leaves a shrinking window for users positioning ahead of the platform launch.

Market participants are increasingly referencing Remittix as a best crypto presale 2025 alternative due to its delivery timeline and live products.

The previously offered 200% RTX 2026 bonus has fully sold out, reflecting strong community response. A 300% bonus is currently available via email, adding short-term pressure as users race to secure remaining allocations. This demand dynamic mirrors patterns seen in early-stage payment networks that later scaled globally, often compared to early XRP adoption.

Remittix recently achieved full team verification by CertiK and is now ranked #1 on CertiK for pre-launch tokens, reinforcing trust and transparency ahead of launch. This milestone strengthens confidence as the project prepares to expand functionality.

Future centralized exchange listings have been revealed with BitMart and LBank, increasing planned accessibility without relying on speculative exposure.

The Remittix referral program has also been launched, allowing users to earn 15% rewards in the form of USDT, which can be redeemed daily via the Remittix dashboard. These developments show Remittix to be a well-thought-out DeFi project with a focus on payments, compliance, and usability, rather than trying to be a part of any short-term trading cycles.

The Remittix Wallet launch and confirmed platform release date mark a turning point for the project. With the token priced at $0.123, private funding exceeding $28.9 million, and supply nearing exhaustion, Remittix is entering a phase where execution, access, and timing intersect.

As users prepare for the PayFi rollout, the focus is shifting from early development to real-world adoption, placing Remittix among the new altcoin to watch as utility-driven crypto takes priority.

Discover the future of PayFi with Remittix by checking out their project here:

Website: remittix.io

Socials: https://linktr.ee/remittix

Is Remittix considered one of the best crypto to buy now?

Remittix is gaining attention due to its live wallet, upcoming PayFi platform launch, and focus on real payment execution.

Why is Remittix often mentioned among the best crypto presale 2025 alternatives?

The project has delivered working products, raised over $28.9 million from private funding, and confirmed future exchange listings.

What makes the Remittix DeFi project different from other altcoins?

Remittix focuses on direct crypto-to-fiat payments, connecting digital assets to real bank systems for everyday use.

The post Best Cryptos to Buy Now While the Market Bleeds: Digitap ($TAP) is the Safe Haven of 2026 appeared first on Coinpedia Fintech News

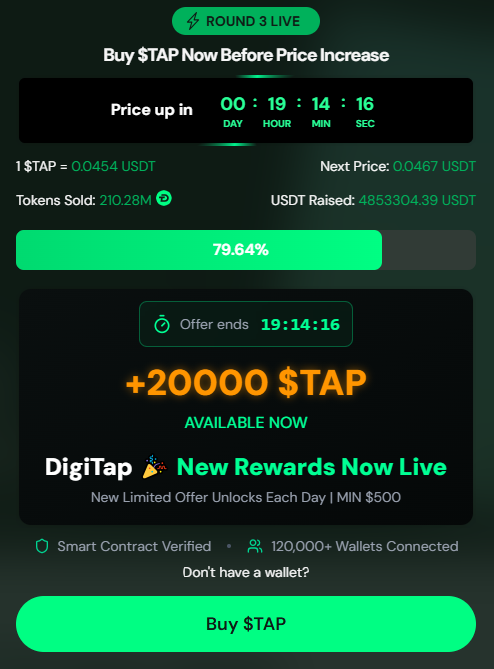

With BTC around $78K (down 11% this week), investors are rethinking their views on major cryptocurrencies. Smart money is moving towards defensive altcoins to buy, which are positioned to thrive even during downturns.

Digitap ($TAP) benefits the most from this shift, as a live omni-bank with structured crypto presale price increases. Other cryptos to buy include Solana (SOL), Polkadot (DOT), and World Liberty Financial (WLFI). These offer institutional interest and staking yields.

Digitap is a comprehensive omni-bank that offers deposits, withdrawals, swaps, payments, and transfers. The platform is already live on iOS and Android, with out-of-the-box utility for users. This utility supports Visa-compatible card payments and offers cashback rewards for purchases at terminals worldwide.

A major advantage is Digitap’s token model. The platform allocates 50% of operational profits toward burning $TAP and rewarding stakers. This creates a feedback loop where growth directly benefits token holders. Unlike many early projects that rely only on token inflation, Digitap connects usage with real value creation.

Digitap has also expanded its technical reach through Solana integration. This improves transaction speed and reduces costs, making everyday payments more practical. Combined with tiered KYC onboarding that supports both casual users and regulated businesses, Digitap is positioned for global expansion and sustained adoption.

Currently at $0.0467, the token will rise at each round before listing on an exchange at $0.14. This means that the price is immune to market downturns, and early investors will see their holdings rise steadily, offering psychological reassurance during bear conditions. $TAP holders can also benefit from 124% staking APY.

Solana remains one of the most actively used blockchains in the industry. Its core strength is transaction speed and low fees, which make it attractive for payments, gaming platforms, and consumer-focused applications. At around $100, it is well priced given its technical capabilities, institutional adoption, and overall retail popularity.

From an investor standpoint, Solana benefits from deep liquidity and strong exchange coverage. This allows smoother trading during volatile conditions and helps preserve capital flexibility. Even during market pullbacks, developers continue building because of Solana’s performance and growing ecosystem.

The continued expansion of Solana-based applications also creates opportunities for integration with new platforms. This positions Solana as long-term infrastructure rather than a short-term speculation asset, reinforcing its place among leading altcoins to buy. SOL yields remain steady in the 6% to 7% range.

World Liberty Financial has gained attention through branding tied to political and ideological narratives, with connections to the Trump family. This strategy has helped attract a highly engaged community. Regardless of ideological preferences, connections with the current US president could have positive price implications. At $0.131, it could be a value purchase.

There is considerable speculation that fiat currencies are going to migrate to digital currencies. WLFI could benefit from this trend should a new economic system emerge. WLFI aims to integrate traditional finance features (like stablecoin infrastructure and borrowing/lending) with decentralized governance tools,

But it carries unique structural and regulatory features that differentiate it from other purely technical tokens. For investors seeking exposure to narrative-driven assets, World Liberty Financial represents a speculative opportunity.

Polkadot continues to position itself as a foundation for blockchain interoperability. Its architecture allows multiple networks to communicate while sharing security, making it attractive for complex app development. DOT is an interesting candidate because it is one of the only top cryptos by market cap that has seen an all-time decrease in value, down 44% since listing.

However, all that matters is where the price is heading, not where it was. DOT has a lot of momentum behind it in terms of technical upgrades and project integration. It could easily be an underrated crypto play, a Layer 0 blockchain network in a world that is now dominated by Layer 1 blockchain networks. Once at $55, it now trades at $1.55, with an APY of up to 15%.

During weak market conditions, infrastructure-focused projects also often outperform purely speculative tokens. Polkadot benefits from active governance, ongoing upgrades, and long-term development funding.

For investors seeking safe havens, $TAP increasingly looks like the best crypto to buy for 2026. Structured price increases make it immune to market downturns, which is exactly what people look for in this environment. It also offers 124% APY and a working app, something which is reassuring to investors worried about product delivery.

Other altcoins to buy, such as SOL, WLFI, and DOT, are practical tokens to hold for diversification. But only Digitap offers the potential for both portfolio stability and price explosions. While the coin price increases throughout the crypto presale, it could 50x or more when it lists on an exchange, due to its potential as the world’s first omni-bank.

Digitap is Live NOW. Learn more about their project here:

The post Why Grayscale-Linked Firms Are Quietly Selling XRP and Solana appeared first on Coinpedia Fintech News

Grayscale-linked entities are quietly reducing their exposure to XRP and Solana as selling pressure builds across the crypto market. Recent US SEC filings show that insiders connected to Grayscale and its parent company, Digital Currency Group (DCG), have offloaded portions of their holdings in XRP and Solana-linked investment products amid a broader market pullback.

The disclosures come as the crypto market grapples with a sharp correction, wiping out nearly $5 billion in value and triggering sustained outflows from several spot and staking-based ETFs.

According to Form 144 filings, Digital Currency Group sold 15,000 shares of the Grayscale Solana Staking Trust (GSOL) on February 2, with the transaction valued at roughly $115,000. The sale was executed through Canaccord Genuity and involved shares initially acquired via a private cash transaction earlier this year.

This was not an isolated move. Over the past week, DCG is reported to have sold a total of 26,000 GSOL shares, signaling a cautious stance as Solana faced mounting downside pressure.

Solana’s price reflected this shift in sentiment, falling nearly 16% over the past week and slipping below the $100 mark, a psychologically important level for traders and long-term holders alike.

The GSOL product has now recorded outflows for four consecutive trading sessions, with net redemptions totaling approximately $5.5 million. While spot Solana ETFs collectively saw modest inflows on Monday, GSOL itself failed to attract fresh capital, highlighting investor hesitation toward staking-linked exposure during heightened volatility.

The contrast between spot inflows and GSOL stagnation suggests institutions are becoming more selective about risk as price momentum weakens.

A similar pattern has emerged in XRP-linked products. DCG International Investments Ltd disclosed the sale of 3,620 shares of the Grayscale XRP Trust (GXRP), worth around $115,000, also executed on February 2. The shares were originally acquired in September 2024 through a privately negotiated deal.

The move follows an even larger reduction last week, when the firm sold 15,000 GXRP shares as XRP dropped below the $1.60 level.

ETF flow data paints a bleak picture. Spot XRP ETFs recorded their largest daily outflow at nearly $93 million, with Grayscale’s XRP product accounting for the majority of redemptions. Additional withdrawals were seen from rival offerings, reinforcing the bearish institutional tone.

While insider selling does not necessarily indicate long-term bearish conviction, the timing is notable. With ETF outflows accelerating and prices under pressure, Grayscale-linked firms appear to be de-risking amid uncertain near-term conditions. For XRP and Solana, institutional confidence may need a clear shift in market structure before meaningful recovery can begin.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

They’re reducing exposure amid market volatility and ETF outflows to manage risk and protect institutional investments.

Yes. Large moves by prominent firms like Digital Currency Group often signal caution, prompting other institutions to reassess exposure. This can amplify short-term selling pressure even without broader market news.

Retail investors may face increased volatility as institutional rebalancing affects price swings. While it doesn’t dictate long-term trends, monitoring market structure and ETF flows can help gauge near-term risk.

Markets may stabilize if buying demand returns or macro conditions improve, but prolonged institutional caution could keep volatility high. Analysts will likely watch ETF flows, price levels, and sentiment indicators closely.

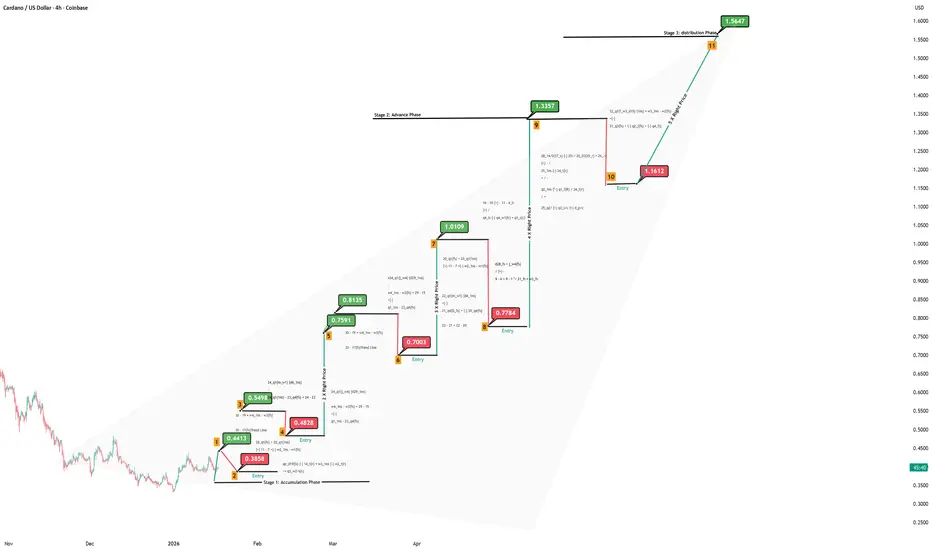

The post Cardano Price Shows Rebound Signals—Can a 10% Breakout Spark a 25% Surge in February? appeared first on Coinpedia Fintech News

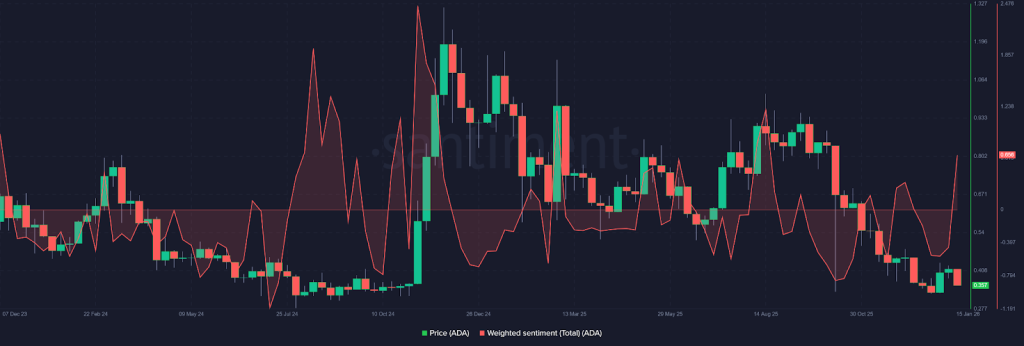

Cardano (ADA) price is drawing renewed attention after rebounding from the $0.27 level, a zone last seen in October 2023. This area has historically acted as a strong demand pocket, triggering dip-buying and short-covering activity. The bounce indicates that sellers are losing momentum near these discounted levels. From a market structure perspective, ADA is attempting to stabilize above the recent lows as liquidity begins to rebuild.

If price continues to hold above the $0.27–$0.28 range and momentum improves, traders may look for speculative long setups. A higher low or range expansion could act as confirmation for a potential breakout attempt in the near term.

Cardano price is still stuck in a clear downtrend on the daily chart, moving inside a descending channel that’s been guiding price lower since the sharp October sell-off. Every bounce has been sold into, and the latest move toward the $0.27–0.28 zone shows that bears are still in control. For now, this channel defines the trend, and ADA needs to break out of it to change the broader narrative.

Looking at indicators, RSI is sitting near 32, which shows weak momentum and hints at exhaustion, but there’s no strong reversal signal yet. CMF hovering around neutral suggests buyers are hesitant, and capital inflows remain light. As long as ADA stays below $0.34–0.36, pressure likely persists toward $0.27, with $0.24–0.25 next if support breaks. A real trend shift starts only above $0.40.

Cardano is likely to remain under pressure in the coming week as long as it trades below the descending channel resistance. In the short term, price may attempt a relief bounce toward $0.32–0.34, but this zone is expected to act as strong resistance. If selling pressure persists, $0.27 remains the key support to watch, with a deeper move toward $0.24–0.25 possible on a breakdown. For the monthly outlook, a trend shift only comes into play if ADA reclaims $0.36–0.40 with volume; otherwise, the structure favors consolidation to a mild downside rather than a strong recovery.

The post Experts Say This Is the Most Undervalued Crypto Under $1 as Q2 2026 Approaches, Here’s Why appeared first on Coinpedia Fintech News

As Q2 2026 gets closer, investors are paying more attention to low-priced crypto assets with strong upside potential. While Bitcoin and Ethereum slow down, many experts believe the next big crypto opportunity may come from a token selling out under $1.

Analysts point out that undervalued projects often show clear signs before wider market interest arrives. These include growing user demand, active development, and a clear use case. When these factors align, price usually follows.

According to market watchers, one new crypto under $1 stands out as being priced far below its potential. With key updates expected in the coming months, some experts say this could be a rare early entry window before momentum builds in Q2 2026.

Mutuum Finance is currently conducting a phased distribution for its native token, MUTM. The project has officially raised over $20.2 million, supported by a growing community of more than 19,000 individual holders. This wide distribution is a key metric for analysts, as it suggests a decentralized foundation before the token even hits public exchanges.

The pricing structure of the presale is designed to reward early participation. The journey began in early 2025 at an initial price of just $0.01. As of early February 2026, the project is in Phase 7, with the token price now at $0.04. This represents a 300% increase from its starting point.

With a confirmed official launch price of $0.06, current participants are positioned for a 50% jump before the token is expected to reach mainnet. This structured progression has allowed the project to build a massive war chest to fund its technical development and security measures.

Mutuum Finance is building a specialized ecosystem focused on decentralized lending. The primary goal is to allow users to access liquidity without selling their digital assets. By building a secure environment, the protocol addresses one of the most consistent needs in the crypto economy. Instead of a single model, the project uses a dual-market design to accommodate both instant liquidity seekers and those who need more flexible, custom terms for their loans.

A central part of this engine is the mtToken system. When users supply assets into the protocol, they receive mtTokens as a receipt. These tokens are yield-bearing, meaning they grow in value relative to the deposited asset as interest is paid by borrowers.

This is supported by a buy-and-distribute developing mechanism. A portion of the protocol’s revenue is used to purchase MUTM tokens on the open market, which are then redistributed to participants. This creates a cycle where platform usage directly supports token demand. To verify the safety of this system, the lending contracts have undergone a full security audit by Halborn Security, a firm known for reviewing top-tier DeFi crypto protocols.

The roadmap for Mutuum Finance extends beyond basic lending. The team is planning to launch a native, over-collateralized stablecoin. This asset will be backed by the interest-generating collateral within the protocol, providing a stable medium of exchange for borrowers.

To ensure that collateral valuations remain accurate, the project is integrating decentralized oracles like Chainlink. These feeds provide real-time price data, which is essential for managing the Loan-to-Value ratios and protecting the protocol from market volatility.

Because of these integrated features, experts are highly optimistic about the future valuation of MUTM. Analysts believe the token is currently undervalued given its working product and security scores.

Many market models suggest that MUTM could reach the $0.25 to $0.50 range by the end of 2026. This would represent an increase of 6x to 12x from the current presale price. As the protocol moves toward mainnet and begins capturing a share of the billion-dollar credit market, the potential for reaching the $1 mark becomes a realistic long-term target according to current analyst opinions.

The biggest milestone for the project arrived recently with the V1 protocol launch on the Sepolia testnet. This is a functional version of the app where users can test the lending flows and mtToken minting. The move from a whitepaper to a working testnet has triggered an acceleration in the presale. Phase 7 is quickly selling out as investors realize that the technical risks are decreasing while the launch date approaches.

A notable trend in this phase is the increase in whale allocations. Large-scale participants have been recorded making single contributions of over $175,000. This institutional-grade interest is crucial because it signals that major players are looking to secure large positions before the public launch at $0.06.

Whale accumulation often precedes a reduction in available supply, creating a high-demand environment for when the token finally hits exchanges. With the V1 protocol proving the technology works, the final window to secure MUTM under its launch price is closing fast.

For more information about Mutuum Finance (MUTM) visit the links below:

Website:https://www.mutuum.com

Linktree:https://linktr.ee/mutuumfinance

The post Aster CEO Denies Insider Dumping Amid Token Controversy appeared first on Coinpedia Fintech News

Aster CEO Leonard has denied recent rumors that insiders engaged in token dumping or that Binance founder Changpeng “CZ” controls the project, calling such claims baseless. He emphasized that Aster operates independently with YZi Labs’ investment locked long-term and follows published tokenomics. The DeFi perpetual exchange has completed 254 million token buybacks and burned 78 million, with automated daily buybacks planned. Future plans include deeper liquidity, a privacy‑focused Layer 1 chain, staking, and slowing token emissions to support long‑term growth.

The post XRP Tests Golden Pocket Support After 15% Weekly Drop appeared first on Coinpedia Fintech News

Amid an overall crypto market decline, the XRP price has fallen nearly 15% this week to the $1.53 zone. Despite the drop, veteran trader CasiTrades sees signs of a short-term recovery towards $2 as XRP tests a key technical support area known as the golden pocket.

XRP started 2026 on a strong bullish note, rising nearly 30% to reach a high of $2.41 in the early weeks of January. This rally was mainly driven by growing regulatory clarity and optimism around new XRP ETF approvals, which attracted millions of dollars in steady inflows.

However, that positive momentum did not last long. As market excitement cooled, many investors began booking profits, leading to a broader sell-off. XRP was not spared from this shift and soon slipped back below the important $2 level.

Fast forward to today, XRP is trading near $1.60 and showing early signs of stabilization after recently falling to a low of $1.53.

As per Casitrade’s analysis, XRP has completed a major downside move and is now sitting in what traders call the “golden pocket” support zone.

Looking at her XRP price chart, the recent drop followed an Elliott Wave pattern, with Wave 3 ending near the $1.55 to $1.60 area. This level acted as solid support and helped stop the fall.

Now traders are watching for a possible Wave 4 relief rally. As the first key resistance level to watch is around $1.78, which matches the 0.382 Fibonacci retracement and could act as a barrier.

Further, CasiTrades explains that Wave 2, earlier in the cycle, was very shallow. In Elliott Wave theory, when Wave 2 is shallow, Wave 4 usually becomes deeper. That means XRP could push higher than many expect during this relief rally.

If buyers step in with strength, XRP could move toward $1.93 or even $2.03. The $2.03 level is especially important because it represents the macro 0.5 retracement zone.

CasiTrades analysis highlights that XRP must reclaim $2.03 and hold above it to change the current bearish structure. If the price successfully breaks and stays above this level, it would reduce the chances of another drop toward $1.55 or lower.

A strong move above $2.03 could also increase the possibility that the expected final bearish wave fails, opening the door for a larger recovery.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

XRP price predictions for 2026 range between $3.45 and $5.05, depending on ETF inflows, market sentiment, and sustained demand above key levels.

By 2030, XRP forecasts suggest a potential range of $17 to $26.50 if adoption grows and Ripple maintains its role in global payments.

Long-term projections estimate XRP could trade between $97 and $179 by 2040, assuming continued network usage and institutional integration.

XRP’s outlook for 2026 depends on ETF inflows, broader crypto sentiment, and its ability to hold key support levels above $2.

The post ADA Price Holds Firm After ETF Filing Sparks Institutional Interest: Can Cardano See a Recovery Ahead? appeared first on Coinpedia Fintech News

Cardano price extended higher in today’s session as traders reacted to a regulatory development that adds a new dimension to ADA’s short-term outlook. After weeks of compression and downside pressure, price action has begun to stabilize as Cardano-linked ETFs surfaced in the U.S. Rather than triggering an impulsive spike, the news coincided with controlled accumulation, hinting that the market may be repositioning rather than chasing. That subtle change sets the stage for a more consequential question: Is ADA transitioning from correction to recovery?

The catalyst came from a filing submitted by Volatility Shares Trust, which registered Form N-1A amendments covering spot Cardano ETF exposure, alongside 2x and 3x leveraged Cardano ETFs. The products are designed to track ADA’s daily performance and remain subject to regulatory approval, but the structure itself matters. This is not an approval event, yet it signals something important. Issuers typically prepare filings only when they believe market demand and regulatory conditions are worth testing. Including both spot and leveraged variants suggests expectations of sustained liquidity and active trading interest, not just a short-lived narrative.

NEWS:

— Cardanians (CRDN) (@Cardanians_io) February 3, 2026Volatility Shares Trust filed N-1A for 3 Cardano $ADA ETFs.

The filing include Cardano ETF, 2x leveraged Cardano ETF and 3x leveraged Cardano ETF.

Now pending regulatory approval. pic.twitter.com/chZY4NdxmN

From a market perspective, such filings tend to work less as instant price triggers and more as sentiment resets. They introduce optionality. Investors begin pricing in the possibility of regulated exposure, which can alter medium-term positioning even before any decision is made. That backdrop helps explain why ADA’s reaction has been controlled rather than euphoric.

Cardano’s price action has entered a critical phase after breaking down from its prior trading range and sliding into a well-defined demand zone. The latest rebound shows a controlled accumulation and the market is reassessing whether ADA can see a recovery in the short-term. As Cardano price reached its make or break zone near $0.300, downside follow-through has weakened, with tighter candles and reduced extension lower. This behaviour typically signals seller exhaustion rather than renewed bearish conviction.

The structure forming inside the demand zone is notable. Rather than a sharp bounce, ADA appears to be building base, hinting at a potential transition from a trending phase into consolidation. If ADA holds the demand zone, it may rotate toward the 50 day EMA area of $0.4300 followed by 200-day EMA zone of $0.500 in the near term. For now, ADA is at a crucial decision point, either confirming a structural base for a recovery attempt of failing support and extending the broader corrective trend. The next directional move will depend entirely on how price behaves around this demand zone.

ADA is moving higher after ETF filings linked to Cardano surfaced, improving sentiment and encouraging controlled accumulation near key support.

The filing signals growing institutional interest. While not approved yet, it increases the chance of regulated exposure and longer-term liquidity.

If support holds, ADA may target the 50-day EMA near $0.43, followed by the 200-day EMA around $0.50.

It’s possible. A sustained hold above the demand zone would support a recovery, while a breakdown would extend the broader correction.

The post Aave Founder Buys £22M London Mansion appeared first on Coinpedia Fintech News

Aave founder Stani Kulechov has acquired a five-story Victorian mansion in London’s Notting Hill for £22 million (about $30 million), one of the few high-value property deals in the city’s luxury market over the past year. The purchase, completed in November, was roughly £2 million below earlier price guidance amid a slowdown in London’s high-end housing sector caused by higher taxes and reduced incentives for foreign buyers. The mansion offers extensive panoramic views and underscores continued global interest in prime real estate.

Xapo Bank’s Digital Wealth Report says borrowers are keeping Bitcoin-backed loans open longer during the product’s first year of activity.

A Nevada judge has temporarily barred prediction market Polymarket from offering event contracts in the state, pushing back against claims that only the CFTC can police those markets.

Bitcoin price correlation with PMI sparked disagreement among analysts after the latter spiked above 50 for the first time since 2022.

Jeffrey Epstein may have made a $3.2 million investment in Coinbase in 2014 and sold some of it for $15 million in 2018, according to the latest batch of released emails.

The return of spot Bitcoin ETF inflows could fuel a Bitcoin price recovery, as signs of a potential rebound to $80,000 and $85,000 emerge.

Spot Bitcoin ETFs drew $562 million in inflows Monday, partially offsetting $1.5 billion outflows last week, while Ether ETFs remained in the red.

Elon Musk’s xAI is recruiting a crypto specialist to train its models in onchain data, market structure and real-world trading behavior.

Almost 89% of the family offices polled by JPMorgan report zero crypto exposure, with average allocations to digital assets and Bitcoin remaining well below 1%.

ING Germany expands crypto access with Bitwise ETPs and VanEck ETNs covering Bitcoin, Ether, Solana and other major digital assets.

The post Bitcoin Cash Price Prediction 2026, 2027 – 2030: Will BCH Hit $1000? appeared first on Coinpedia Fintech News

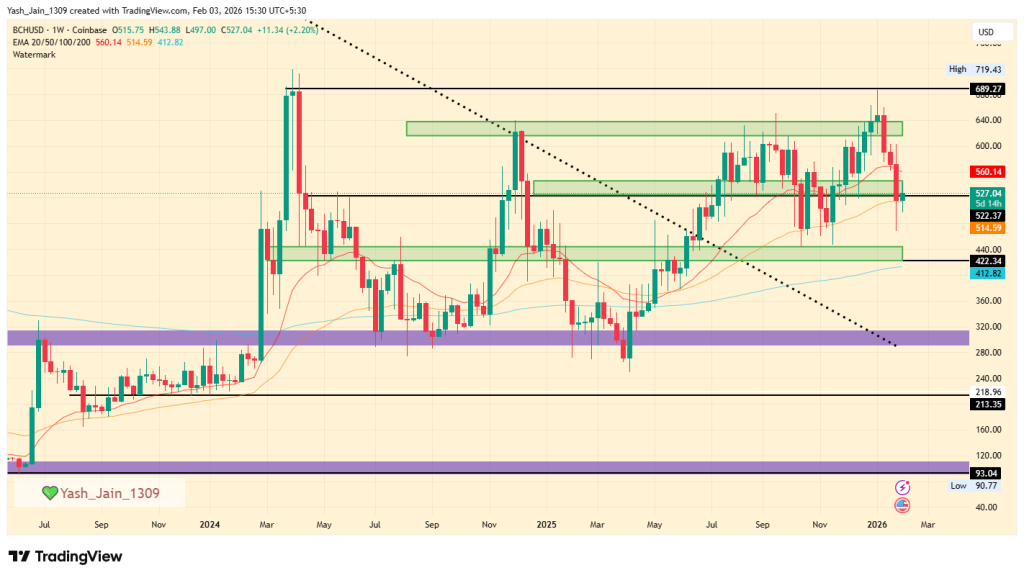

With Bitcoin smashing through the $100K barrier, all eyes are now on Bitcoin Cash (BCH) as traders wonder—will BCH price follow with a banana move of its own? Beyond hype, Bitcoin Cash is proving its value in the real world. Ranked 4th on Crypwerk’s global adoption list, BCH is gaining traction for its speed, low fees, and merchant-friendly design.

If you’re searching for answers to “Will Bitcoin Cash go up further?” — you’re not alone. In this Bitcoin Cash price prediction 2026–2030, we dive into the technicals and adoption trends shaping the next big BCH Price Prediction.

| Cryptocurrency | Bitcoin Cash |

| Token | BCH |

| Price | $526.6664

|

| Market Cap | $ 10,527,853,144.00 |

| 24h Volume | $ 507,963,580.8224 |

| Circulating Supply | 19,989,606.25 |

| Total Supply | 19,989,606.25 |

| All-Time High | $ 4,355.6201 on 20 December 2017 |

| All-Time Low | $ 75.0753 on 15 December 2018 |

Q1 2026 could initiate a rally based on the success of the multi-year descending triangle pattern. On a 1-M timeframe, BCH/USD is in a consolidation between $425 and $689. But, sustaining above $689 would signal a trend shift. However, dropping below $450 risks a quick decline, with $300 as a critical support level.

In January, the price of Bitcoin Cash (BCH) briefly reached $689 but was rejected back into the 50-day EMA band. Now, it’s trading around $522 key support level. February can be seen as BCH trading around two key areas: $422 support, which could be tested if $522 is lost. Another is its resistance, which can be tested at around $620 if bullish demand returns around $522.

Q1 2026 is set to be the most attractive period for the rally to truly kick off, because H2 2025 onwards it has broken out of a multi-year descending triangle pattern on the monthly chart, and ever since then it has mostly consolidated in a range of $425-$689. The range is quite big on a shorter timeframe, but on a longer timeframe, like monthly, it’s an ordinary consolidation whose movements are not as big as they sound compared to its historical price action.

In Q1 2026, it continues to consolidate in its range and has hit $689 once. And now, if it sustains above it in the coming months, that will signify a “Change of Character (ChoCh)” on the monthly chart, marking a significant long-term trend shift and unlocking potential for higher targets ahead.

Also, under the worst-case scenario, if the BCH price drops below critical support at $450, we could see a swift decline. The $300 level is expected to serve as a strong line of defense against further declines; however, breaking this level would completely delay the current long-term bullish sentiment

| Year | Potential Low | Potential Average | Potential High |

| 2026 (conservative) | $300 | $605 | $1200 |

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 595 | 790 | 985 |

| 2027 | 680 | 925 | 1,160 |

| 2028 | 795 | 1,135 | 1,475 |

| 2029 | 1,025 | 1,480 | 1,955 |

| 2030 | 1,350 | 2,010 | 2,675 |

This table, based on historical movements, shows BCH price to reach $2675 by 2030 based on compounding market cap each year. This table provides a framework for understanding the potential BCH price movements. Yet, the actual price will depend on a combination of market dynamics, investor behavior, and external factors influencing the cryptocurrency landscape.

In 2026, Bitcoin Cash price could project a low price of $680, an average price of $925, and a high of $1,160.

As per the Bitcoin Cash Price Prediction 2027, BCH may see a potential low price of $795. Meanwhile, the average price is predicted to be around $1,135. The potential high for BCH price in 2027 is estimated to reach $1,475.

Looking ahead to the Bitcoin Cash Price Prediction 2028, BCH is expected to have a low price of $1,025. With an average price of $1,480, the BCH price could make a high of $1,955.

Finally, by 2029, Bitcoin Cash Price Prediction anticipates a low price of $1,350, an average price of $2,010, and a high of $2,675.

For the year 2030, Bitcoin Cash Price Prediction forecasts a low price of $1809, an average price of $2705, and a high of $3410.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

BCH price prediction for 2026 ranges from $680 to $1,160, depending on whether it confirms a long-term bullish trend shift.

Bitcoin Cash could trade between $1,350 and $2,675 by 2030 if adoption rises and market conditions remain favorable.

By 2040, Bitcoin Cash could see significantly higher valuations if global payments adoption expands, though forecasts remain speculative.