Trump-Xi meeting Outcome Could Boost Bitcoin and Global Markets

The post Trump-Xi meeting Outcome Could Boost Bitcoin and Global Markets appeared first on Coinpedia Fintech News

U.S. President Donald Trump and Chinese President Xi Jinping met in South Korea this week to cool down the rising trade tensions that have been shaking global markets, including the crypto and AI sectors. The two leaders discussed reducing tariffs that recently caused volatility across industries, especially in Bitcoin mining and digital assets.

Trump hinted at progress even before the talks began, saying, “We’ve already agreed to a lot of things and we’ll agree to some more right now.” After the meeting, he called it the start of a “fantastic relationship for a long period of time,” expressing optimism about future ties between the U.S. and China.

Tariffs That Sparked Crypto Selloffs

In a video shared by the White House on X, Trump again emphasized his positive outlook on U.S.–China relations. The meeting, confirmed by the Rapid Response 47 account, was seen as a key move toward restoring economic stability.

President Donald J. Trump meets with Chinese President Xi Jinping in South Korea.

— The White House (@WhiteHouse) October 30, 2025

"I think we're going to have a fantastic relationship for a long period of time, and it is an honor to have you with us." pic.twitter.com/ISpVBzkvN3

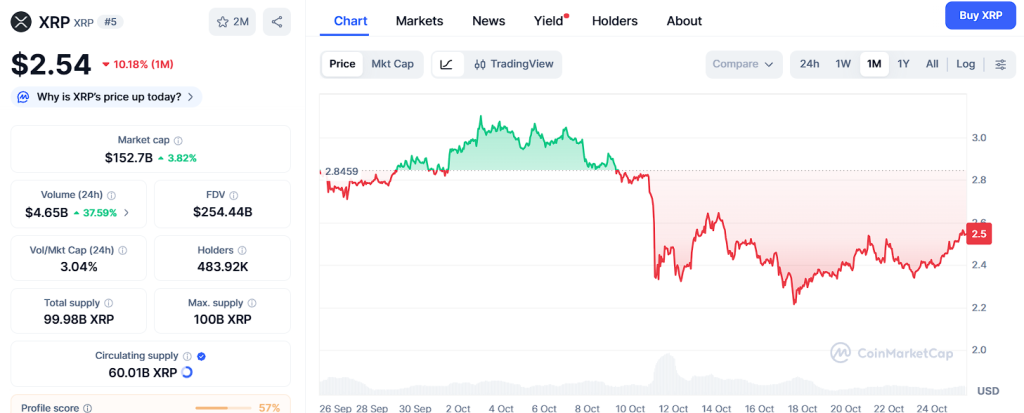

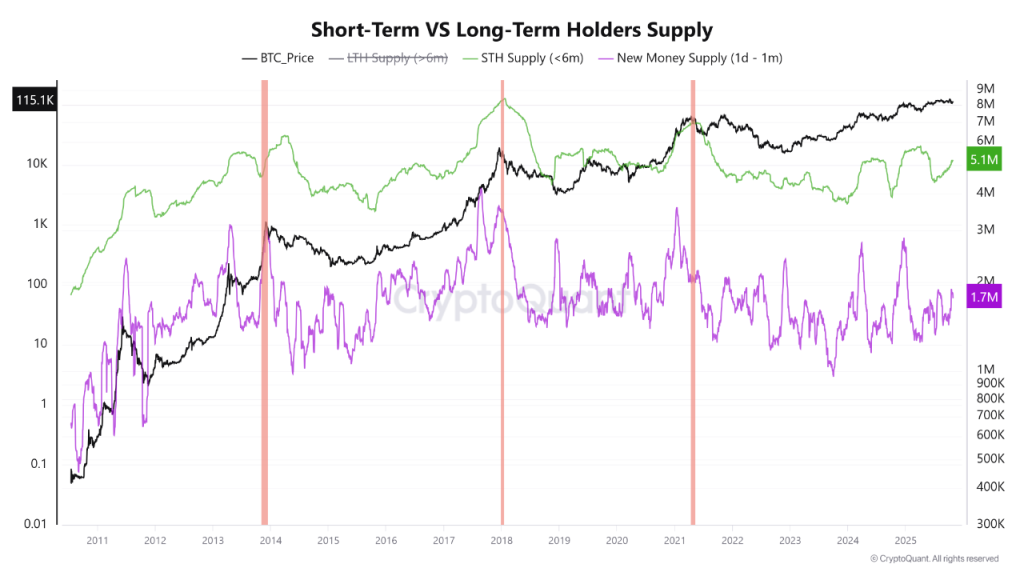

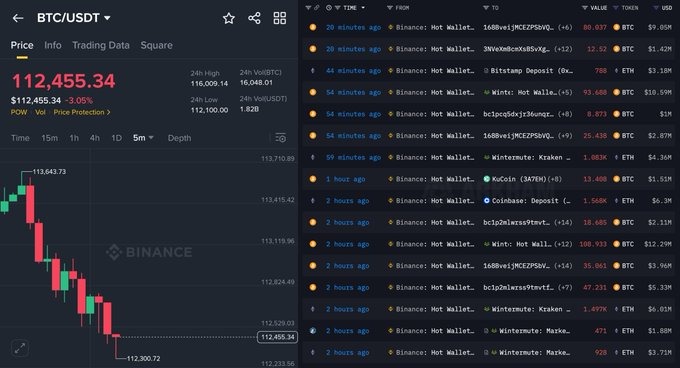

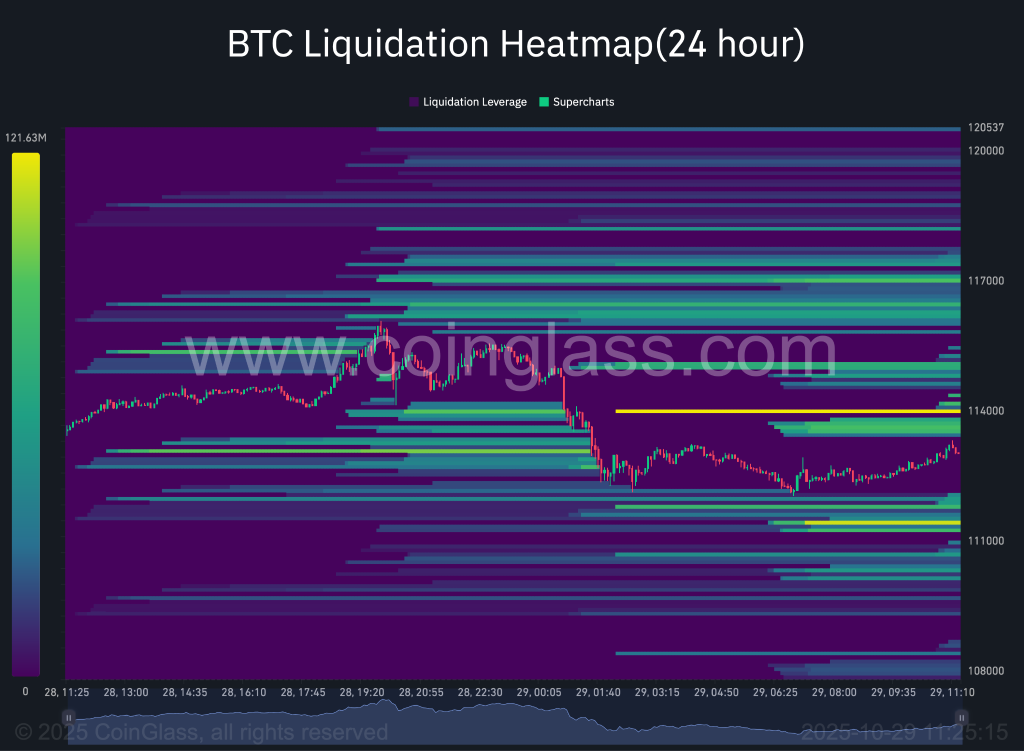

In recent months, Trump’s tough tariff policies and China’s retaliatory actions, including limits on rare earth exports, have raised fears of a global slowdown. These tensions directly contributed to the October 10 crypto market crash, when Bitcoin plunged from $121,560 to below $103,000 in just hours, wiping out billions in value.

Many traders blamed the drop on uncertainty surrounding the trade war, as tariffs threatened not just traditional markets but also sectors tied to crypto and blockchain technology.

Signs of Compromise

Reports now suggest both sides are stepping away from their most extreme positions. U.S. officials say Trump is unlikely to move ahead with his proposed 100% import tax on Chinese goods, while China may relax export limits on rare earth materials essential for tech production and Bitcoin mining equipment. Beijing may also consider resuming U.S. soybean imports.

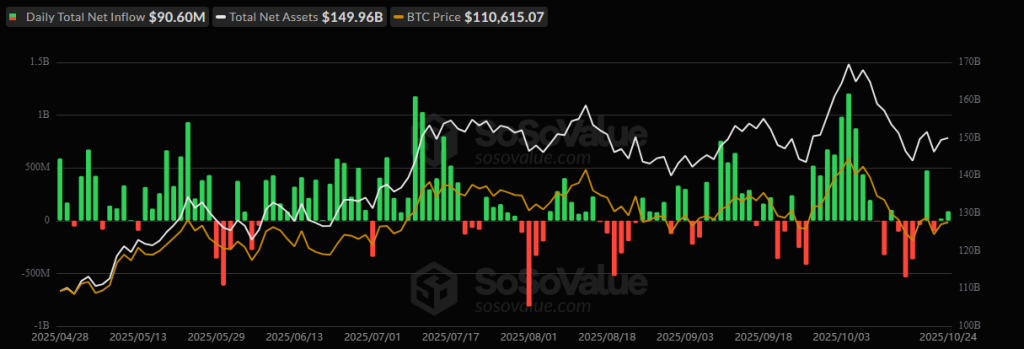

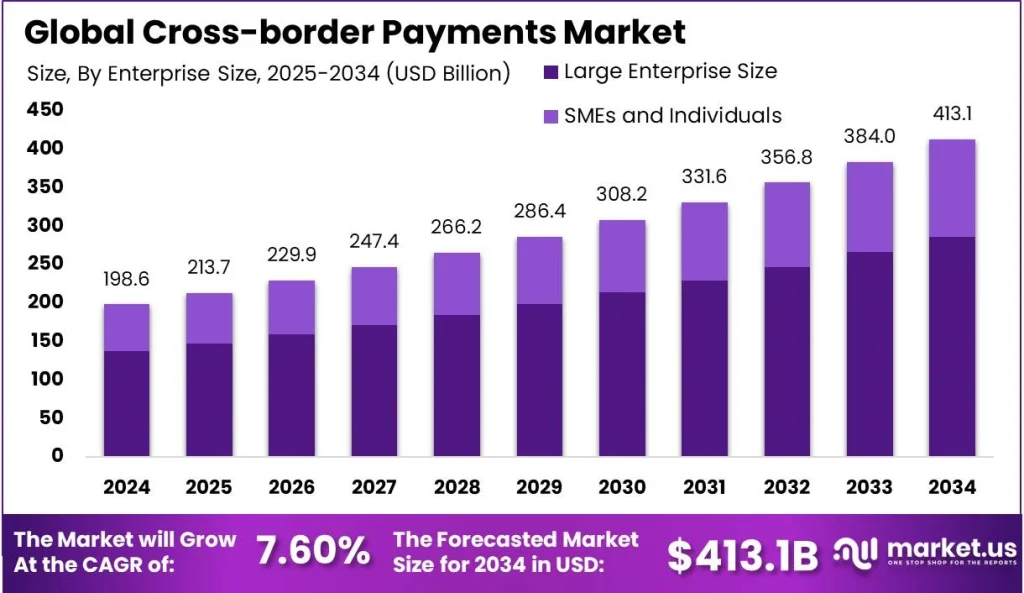

These steps could help restore confidence in global markets and provide some relief to the crypto industry, which has faced liquidity shocks driven by geopolitical uncertainty.

- Also Read :

- Crypto News Today [Live] Updates On October 30,2025 : Trump-Xi Meeting,Zcash Price,Pi Network Price

- ,

Why It Matters for Bitcoin and AI

The ongoing trade dispute has hit U.S. Bitcoin miners hard, as many rely on importing equipment from Asia, especially China and Malaysia. With Trump also meeting Malaysian officials recently, hopes are rising for smoother supply chains and possible tariff relief.

Meanwhile, China’s restrictions on rare earth exports key materials for AI chips and mining rigs have caused further worries about production delays.

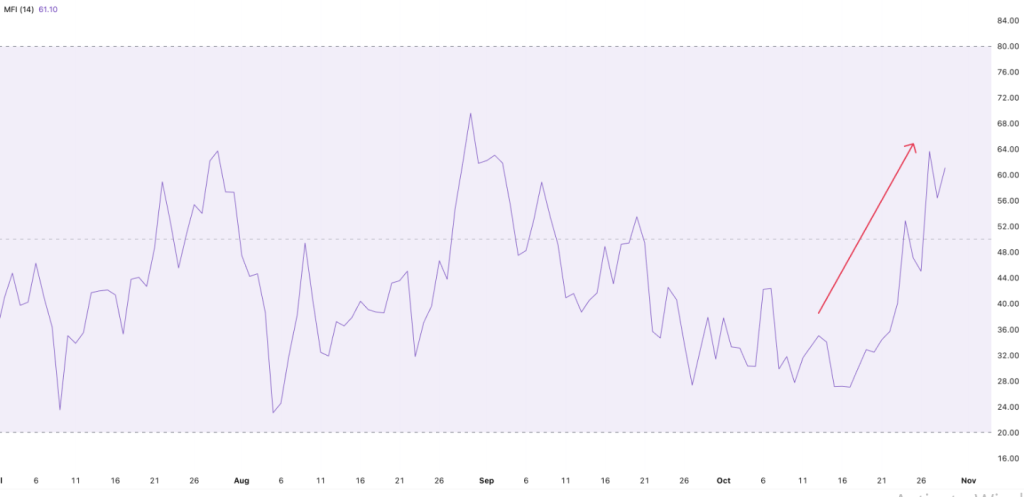

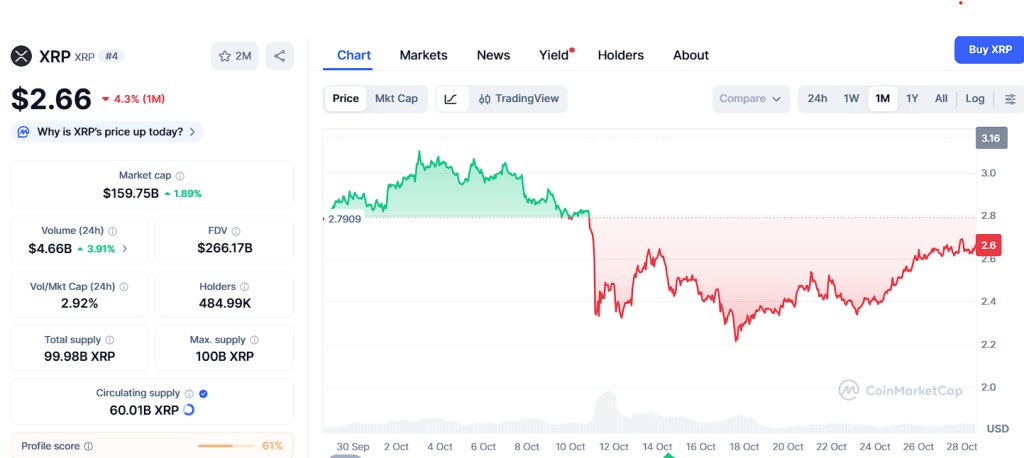

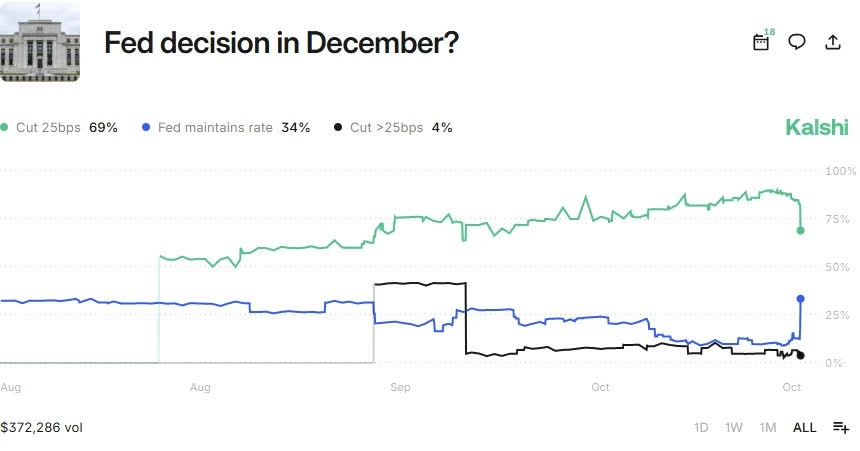

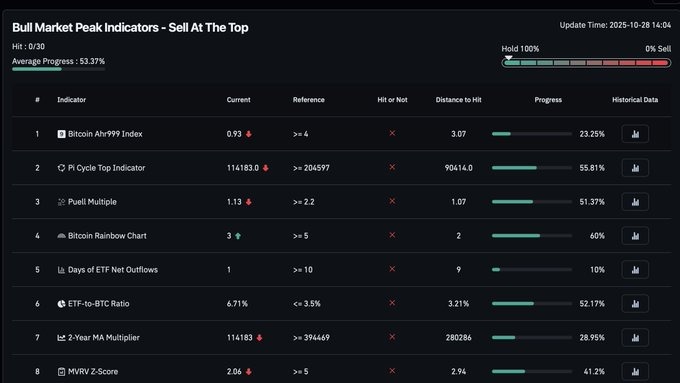

If these diplomatic efforts continue positively, markets could see a boost in sentiment. Bitcoin is currently trading around $109,689, while Ethereum sits near $3,914, both slightly lower as traders remain cautious. For now, easing tensions have brought temporary stability, but investors are still watching closely for policy updates or potential Fed rate moves that could spark the next big crypto rally.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Trump and Xi met in South Korea to ease trade tensions and discuss reducing tariffs that have been shaking global markets, including crypto and AI sectors.

Rising tariffs fueled fear and volatility, leading to a sharp crypto selloff on October 10 when Bitcoin plunged from $121,560 to below $103,000.

Bitcoin trades near $109,689 and Ethereum around $3,914 as easing tensions bring short-term stability but traders remain cautious about future policies.

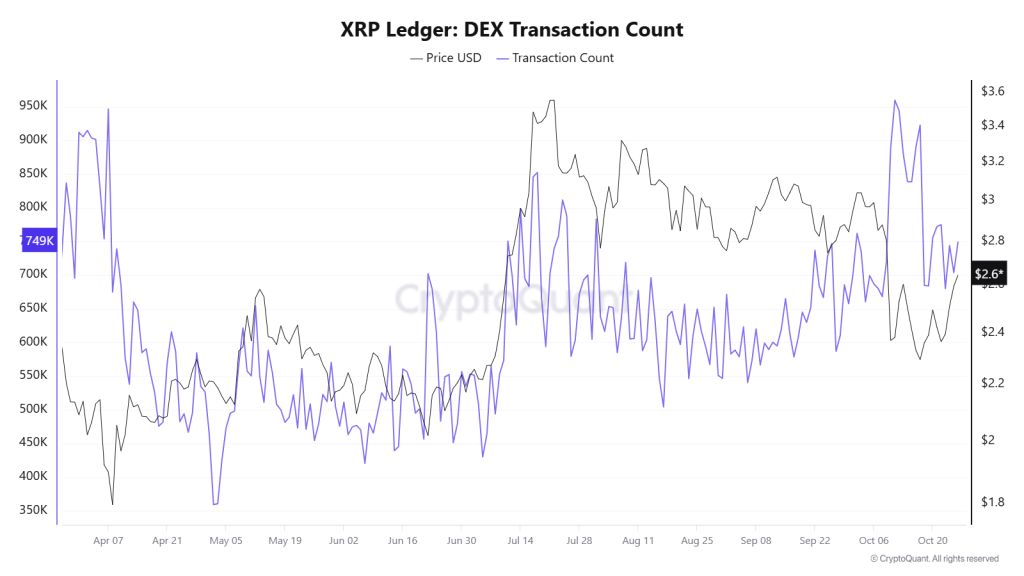

Ripple CTO David Schwartz, has confirmed that Ripple is able to sell rights to

Ripple CTO David Schwartz, has confirmed that Ripple is able to sell rights to

Convenient Solana exposure paired with staking benefits.

Convenient Solana exposure paired with staking benefits.  Exposure to a high-speed, low-cost blockchain.…

Exposure to a high-speed, low-cost blockchain.…

BNB (@cz_binance)

BNB (@cz_binance)

(@crypto_queen_x)

(@crypto_queen_x)

Germany’s AfD party has introduced a motion to establish a strategic Bitcoin reserve.

Germany’s AfD party has introduced a motion to establish a strategic Bitcoin reserve.

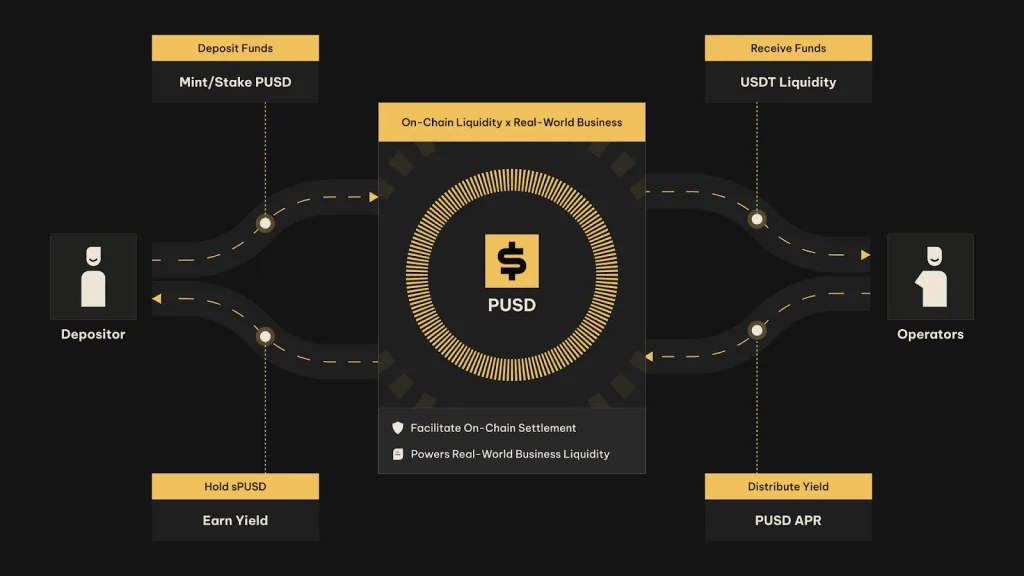

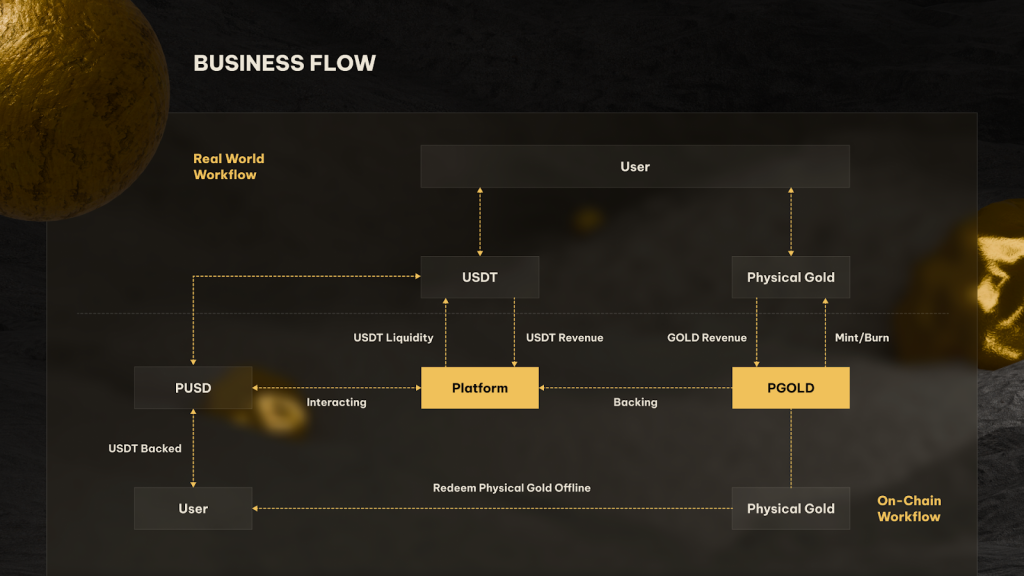

PUSD loop allows 24/7 convertibility, enabling instant movement between stable and metal-backed value—reducing settlement times from days to seconds. PUSD is fully redeemable for USDT at any time, ensuring stability and flexibility while maintaining a direct bridge between blockchain liquidity and real-world assets.

PUSD loop allows 24/7 convertibility, enabling instant movement between stable and metal-backed value—reducing settlement times from days to seconds. PUSD is fully redeemable for USDT at any time, ensuring stability and flexibility while maintaining a direct bridge between blockchain liquidity and real-world assets.