Pi Network price rebounds at Golden Pocket, why $0.29 is back in sight

Last updated on October 28, 2025.

This Article Was First Published on The Bit Journal.

The Altcoins ETFs is set to launch this Tuesday, marking a significant moment in crypto investing. According to the source, U.S. exchanges have posted listing notices for spot funds tied to these three tokens.

This move allows everyday investors to gain exposure to Solana, Litecoin, and Hedera without owning the coins directly, opening a new access point in regulated finance.

Exchanges such as the New York Stock Exchange (NYSE) and NASDAQ Stock Market have posted official listing notices for the Altcoins ETFs suite. Specifically:

Current prices at time of writing: Solana (SOL) ~ $199.64, Litecoin (LTC) ~ $100.55, Hedera (HBAR) ~ $0.21. These values reflect the market’s anticipation of the debut of the Solana, Litecoin, and Hedera ETF.

The Altcoins ETFs may provide several benefits:

Beyond Bitcoin and Ethereum, these altcoin-linked ETFs widen the field. The Solana, Litecoin, and Hedera ETF positions altcoins in a regulated vehicle format for the first time in the U.S..

The regulatory path for the Altcoins ETFs aligns with evolving U.S. rules. The U.S. Securities and Exchange Commission (SEC) has dropped delay notices and adopted generic listing standards for spot crypto ETFs, which helped clear the way for this launch. Lower procedural hurdles contribute to the Solana, Litecoin, and Hedera ETF coming into view.

Still, risks remain: trading volumes are unknown, token volatility persists, and early investors will observe how the funds perform once trading begins.

With the Altcoins ETFs about to trade, key indicators include:

The Altcoins ETFs represents a bridge between traditional finance and altcoins. Investors can now access SOL, LTC, and HBAR via regulated channels rather than buying tokens directly. Provided launch conditions hold, these funds could open the door for further crypto ETF innovations.

As trading starts, the performance of the Solana, Litecoin, and Hedera ETF will test how far the market can move beyond Bitcoin.

It is a set of ETFs offering exposure to Solana (SOL), Litecoin (LTC), and Hedera (HBAR) via regulated U.S. exchange-traded products.

The listing notices indicate trading will start this week, as early as Tuesday.

It opens regulated access to altcoins beyond Bitcoin and Ethereum through the crypto ETF format.

Yes, the Solana component is expected to include staking features within the ETF structure.

Read More: Solana, Litecoin, and Hedera ETFs to Begin Trading This Week">Solana, Litecoin, and Hedera ETFs to Begin Trading This Week

Crypto analyst CryptosRus has drawn attention to the open interest reset for XRP. The analyst also explained why this development could spark a major price surge for the altcoin.

In an X post, CryptosRus revealed that XRP’s open interest on Binance has dropped back to the same lows that were seen in May 2025. The analyst noted that back then, the liquidation flush sparked a massive rally for the altcoin, which pushed it to $3.50. He added that this time around, the open interest is at the floor again, but the price is holding around $2.6.

CryptosRus stated that this means that leverage is gone while the strong hands are still holding XRP. The analyst predicted that if new liquidity enters, this setup could signal the next leg up for the altcoin. He added that rallies usually start when leverage is low, spot demand is strong, and shorts are trapped.

Notably, XRP has witnessed new demand with the launch of the largest XRP treasury company, Evernorth. The company has already accumulated up to $1 billion in XRP with Ripple’s backing and has revealed plans to continue accumulating more, using gains from its DeFi activities. Notably, the company stated that it will purchase XRP on the open market, which is expected to impact the altcoin’s price.

Meanwhile, the SEC is expected to approve the spot XRP ETFs once the U.S. government shutdown ends. This could drive new liquidity into the altcoin, boosting its price. Moreover, experts such as Canary Capital’s CEO Steven McClurg have predicted that the XRP ETFs could see more inflows in their first month than the Ethereum ETFs did.

Crypto analyst Ether stated that XRP is quietly gearing up to melt faces and that most aren’t even aware or ready for what is coming. This came as the analyst alluded to an earlier analysis, in which he revealed that a similar scenario from a previous cycle was playing out for the altcoin.

Ethere stated that XRP’s cyclical structure is showing a striking similarity again. After the altcoin’s rally in 2017, its price was rejected from the 2013 all-time high (ATH) level and then retested the 2014 ATH level, which had previously acted as resistance. XRP then began its parabolic run after it accumulated strength in that range.

Now, this same XRP price action is playing out again, according to Ether. He noted that after the strong surge in 2024, the altcoin’s price was rejected at the 2017 ATH level and retested the 2021 ATH level, which had previously acted as resistance. The analyst added that the power accumulation phase is now underway in this region and that once it is complete, the next parabolic run will be inevitable.

At the time of writing, the XRP price is trading at around $2.63, up in the last 24 hours, according to data from CoinMarketCap.

According to market snapshots, Zcash rose about 30% in a 24-hour span, moving from roughly $272 to a peak near $355. The coin has been up more than 40% in the last week.

The token’s gain outpaced all other top 50 coins by market cap during the same window. Volume spiked at the same time, showing traders piled in quickly after a single social post touched off the move.

Based on reports on social media, the rally was partly driven by traders reacting to a bullish post from Arthur Hayes on X.

Contributors on platforms like Binance Square flagged the post, and one user known as AB Kuai Dong said an endorsement by what he called a “legendary Silicon Valley investor” pushed people into the market.

Vibe check $ZEC to $10k pic.twitter.com/tBc0WaxzZ1

— Arthur Hayes (@CryptoHayes) October 26, 2025

Another poster, Clemente, who is listed as a board member at treasury firm K9Strategy, said they joined the trade because they felt “so much FOMO I couldn’t keep myself sidelined.” These bursts of hype pushed more orders onto the books and helped lift the price in a short time.

Hayes has prompted market moves before. At a Tokyo conference in August 2025, he predicted Hyperliquid’s HYPE token could climb 126 times over three years.

That call produced a modest market response then — roughly a 5% uptick for HYPE — but it showed how a single forecast from a well-known figure can sway trader behavior.

Market participants say such calls sometimes lead to brief spikes and sometimes to longer trends. Follow-through, depth of liquidity, and general demand all matter.

Reports have disclosed that Zcash rallied close to 500% over the last 30 days and crossed a $5 billion market cap on Sunday, according to CoinMarketCap data.

At the same time, Monero, the largest privacy coin by market cap, ticked up about 3.2% to trade near $345 and remains restricted on many big exchanges, highlighting differences in access and regulatory pressure.

Technical Indicators Show Choppy Momentum

Technical Indicators Show Choppy Momentum

According to a recent Zcash price outlook, ZEC is forecast to rise about 52% and reach $558 by November 26, 2025. Current technical indicators are flagged Bullish, while the Fear & Greed Index sat at 51, a neutral reading.

Over the past 30 days Zcash posted 19/30 green days, which is 63%, and showed 37% price volatility. Those numbers point to strong recent momentum but also to a bumpy ride. Some gains may hold if new buyers arrive and liquidity tightens; other gains could fade quickly if selling pressure appears.

Based on reports and the data above, the Zcash move highlights how social signals can trigger rapid trading flows. The numbers are eye-catching. Still, traders and observers will be watching whether demand deepens or the rally is a short-lived reaction to hype.

Featured image from Gemini, chart from TradingView

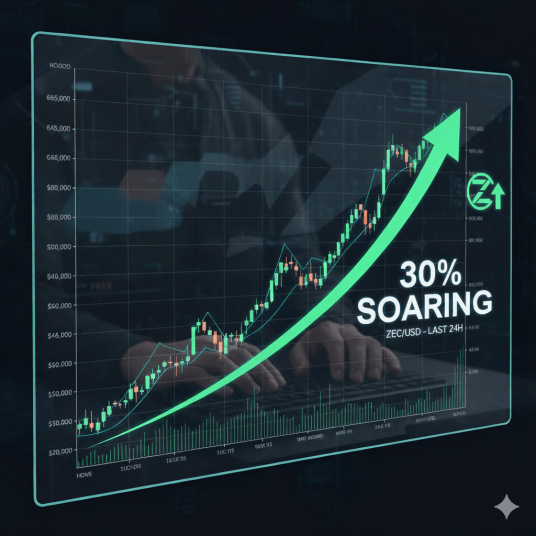

Ethereum’s largest non-exchange holders are tiptoeing back into accumulation. On-chain analytics platform Santiment reported that wallets holding between 100 and 10,000 ETH, also known as whales and sharks, have begun to rebuild positions after unloading roughly 1.36 million ETH between October 5 and 16.

Notably, the Ethereum collective holdings chart shows that nearly one-sixth of those coins have already been clawed back, as some confidence starts to return to the second-largest crypto asset.

The first half of October was highlighted by one of Ethereum’s most pronounced periods of capitulation this year. Macroeconomic fears due to US tariffs saw the Bitcoin price undergo a flash crash that dragged many altcoins to the downside. During this move, Ethereum’s price also fell very quickly, dropping from highs around $4,740 on October 7 to as low as $3,680 on October 11.

Interestingly, on-chain data shows that the selling pressure from large holders amplified this move, as the chart from Santiment shows a steep decline in their cumulative holdings from about 24.5 million ETH to roughly 22.6 million ETH. This 1.9 million ETH drop reflected clear risk-off behavior among whales and sharks, who had been net buyers since August.

However, once selling momentum began to fade, accumulation started to return. Institutional inflows started to return into Spot Ethereum ETFs, and whale/shark trades started accumulating Ethereum. Since October 16, the same cohort that contributed to the liquidation has begun adding back to their positions. Santiment noted that these holders are finally showing some signs of confidence, demonstrating an incoming extended recovery phase following the shakeout.

According to Santiment’s data, the collective holdings of addresses with 100 to 10,000 ETH have rebounded to approximately 23.05 million ETH after bottoming out in mid-October. A highlighted annotation on the chart shows that 218,470 ETH were accumulated in just the past week, signaling a tangible shift in on-chain behavior.

Ethereum collective holdings of wallets holding 100-10,000 ETH. Source: Santiment

This increase represents roughly one-sixth of the coins previously dumped, a sign that major investors are gradually re-entering the market after what appeared to be an exhaustion phase. Similar accumulation trends have often preceded a broader recovery in Ethereum’s price, especially when accompanied by stabilization in the ETH/BTC trading pair.

As it stands, the Ethereum price appears to be building a firmer base for the next phase of its recovery heading into November. When whale wallets accumulate, it reduces the circulating supply available on exchanges and reduces selling pressure.

At the time of writing, Ethereum is trading at $3,940 and is on track to break and close above $4,000 again. Both Ethereum and Bitcoin have risen a bit in recent days after inflation report showed US inflation cooling to 3% in September, below the 3.1% forecasted by economists.

Featured image from Unsplash, chart from TradingView