XRP Price Prediction After Fed Cut: Can Bulls Clear $3.00?

The Federal Reserve reduced rates by 25 basis points to a 3.75 to 4.00 percent range, then stressed that another cut in December is not guaranteed. That mix of relief and restraint kept risk assets in check and left XRP hovering around the mid-$2.60s while traders reassessed the path ahead.

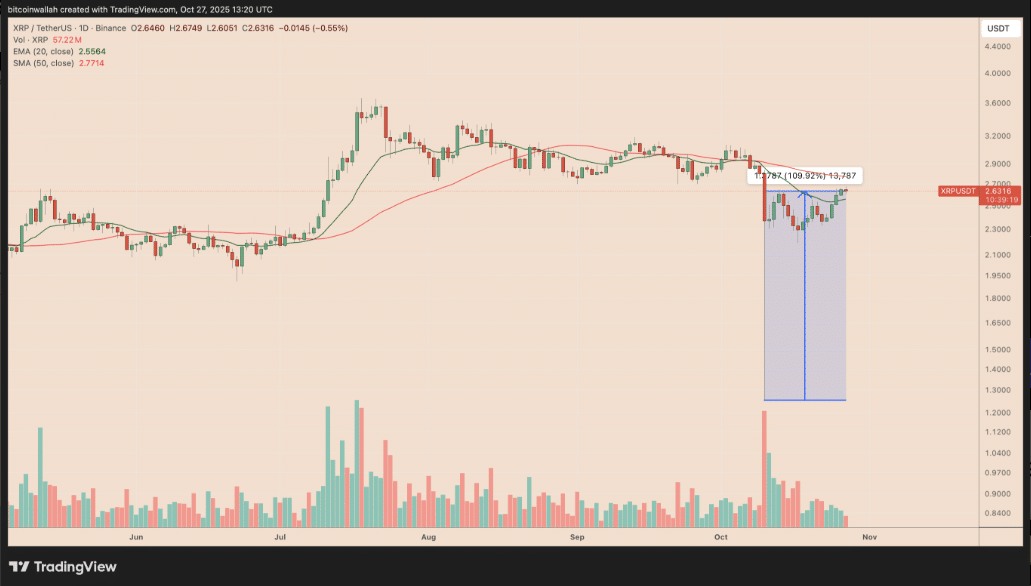

XRP traded around $2.63 into the decision and sat just below visible resistance near $2.70 to $2.80. Immediate direction hinges on whether liquidity improves and whether the market treats the cut as the start of a durable easing cycle rather than a one-off adjustment.

What Changed With The Fed

Policy is now looser at the margin, but the central bank emphasized optionality. Chair Jerome Powell told reporters that a further reduction this year is “not a foregone conclusion,” a line that cooled hopes for automatic easing and kept the dollar and yields from sliding too far. That stance matters for crypto because easier financial conditions tend to support flows into higher beta assets when growth is steady.

There is also the tone. In recent remarks, the Chair underlined that decisions remain “data-dependent,” which is another way of saying policy can move either way if inflation or jobs data surprise. For digital assets, that keeps volatility risk alive around each macro print, even while funding conditions are improving.

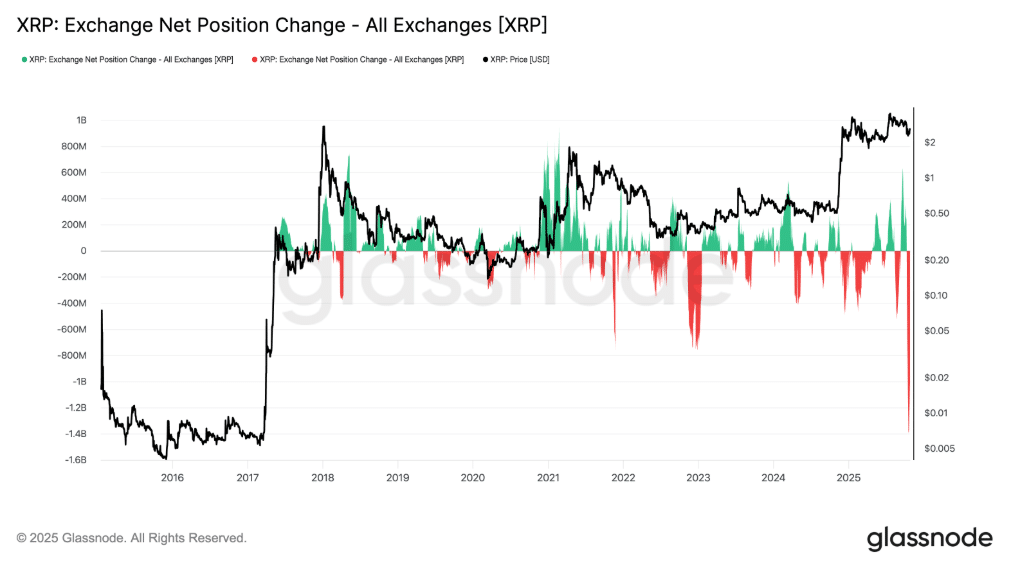

Market Structure And On-Chain Signals

Price sits above the 200-day moving average and the weekly trend structure remains constructive. Order-book dynamics show sellers defending the $2.70 to $2.80 pocket, while buyers consistently reload around $2.58 to $2.63. The article’s base case holds: a decisive close through $2.80 opens a path toward $3.00 to $3.20. A failure to hold $2.50 risks a slide toward $2.30 to $2.40.

Flows are the near-term wild card. Recent reports flagged large whale accumulation in the days leading into the meeting, a sign that deep pockets continue to build exposure on dips. If that pattern persists alongside softer yields, spot demand can offset sluggish altcoin volumes and keep the uptrend intact.

XRP price prediction: Near-Term Levels And The Long View

For the next few weeks, the market’s pivot remains $2.70 to $2.80. Clearing that shelf with rising volume would validate a momentum extension toward $3.00 first and $3.20 next. If the level rejects, a drift toward $2.50 is possible as traders digest macro headlines. This tactical map aligns with recent behavior around $2.63 and the repeated failure to close above the local ceiling.

The long-term picture is more straightforward. If policy gradually eases into 2026 and the economy avoids a sharp slowdown, digital assets tend to benefit from cheaper capital and improving risk appetite. In that environment, an XRP price prediction that revisits the cycle highs becomes reasonable, especially if network momentum improves and legal overhangs continue to fade. If growth softens faster than expected, a defensive regime can cap rallies and make any XRP price prediction more conservative.

The phrase XRP price prediction appears often in market chatter, but the version that matters is the one tied to data. Trend, liquidity, and policy do the heavy lifting. At present, the constructive bias holds above the 200-day moving average, which supports a medium-term XRP price prediction that leans positive while respecting the $2.50 line in the sand.

If spot volumes expand on breakouts, that XRP price prediction can stretch toward fresh highs over a multi-quarter window. If volumes fade, the XRP price prediction should be tempered to range outcomes until catalysts arrive.

What People In Power Are Saying

“Further reduction in December is not a foregone conclusion,” Powell said at the post-meeting press conference, reinforcing the case for a patient approach and a meeting-by-meeting path. That one sentence keeps both risk-on and risk-off scenarios on the table and explains why XRP did not sprint after the cut.

Risk Checklist For Traders

Two forces can derail the constructive path. A growth scare can flip the narrative from gentle easing to fear of recession, which usually dents speculative flows. A renewed inflation flare-up can also force guidance back toward restraint. In either case, a break below $2.50 would invite a deeper pullback and require a reset of any short-term XRP price prediction until the trend repairs.

Conclusion

The Fed delivered relief but not a green light. XRP remains range-bound below a crowded ceiling, supported by the longer-term trend and selective whale demand. Clear $2.80 and $3.00 come into view with room to $3.20. Lose $2.50 and the market likely checks back toward $2.30 to $2.40. For now, a disciplined XRP price prediction favors patient accumulation on weakness and validation on strength, with the long-term path tied to the pace of easing and the health of growth.

Frequently Asked Questions

Where are the key levels right now?

Resistance sits around $2.70 to $2.80, with $3.00 as the confirmation level. Support is near $2.58 to $2.63 and then $2.50.

What could unlock the next leg higher?

A confident close above $2.80 on rising volume as policy eases and spot demand improves.

What is the main risk to the upside case?

A macro swing to risk-off or a hot inflation surprise that curbs easing expectations.

Glossary

Federal funds rate target range

The short-term interest rate corridor set by the central bank that influences borrowing costs and risk appetite.

Moving average (200-day)

A trend indicator that smooths price over 200 sessions. Trading above it often signals a constructive long-term bias.

Whale accumulation

Large, identifiable purchases by addresses that historically influence liquidity and direction when sustained.

Read More: XRP Price Prediction After Fed Cut: Can Bulls Clear $3.00?">XRP Price Prediction After Fed Cut: Can Bulls Clear $3.00?