Fed’s $29.4B Liquidity Shot: What It Really Means For Bitcoin

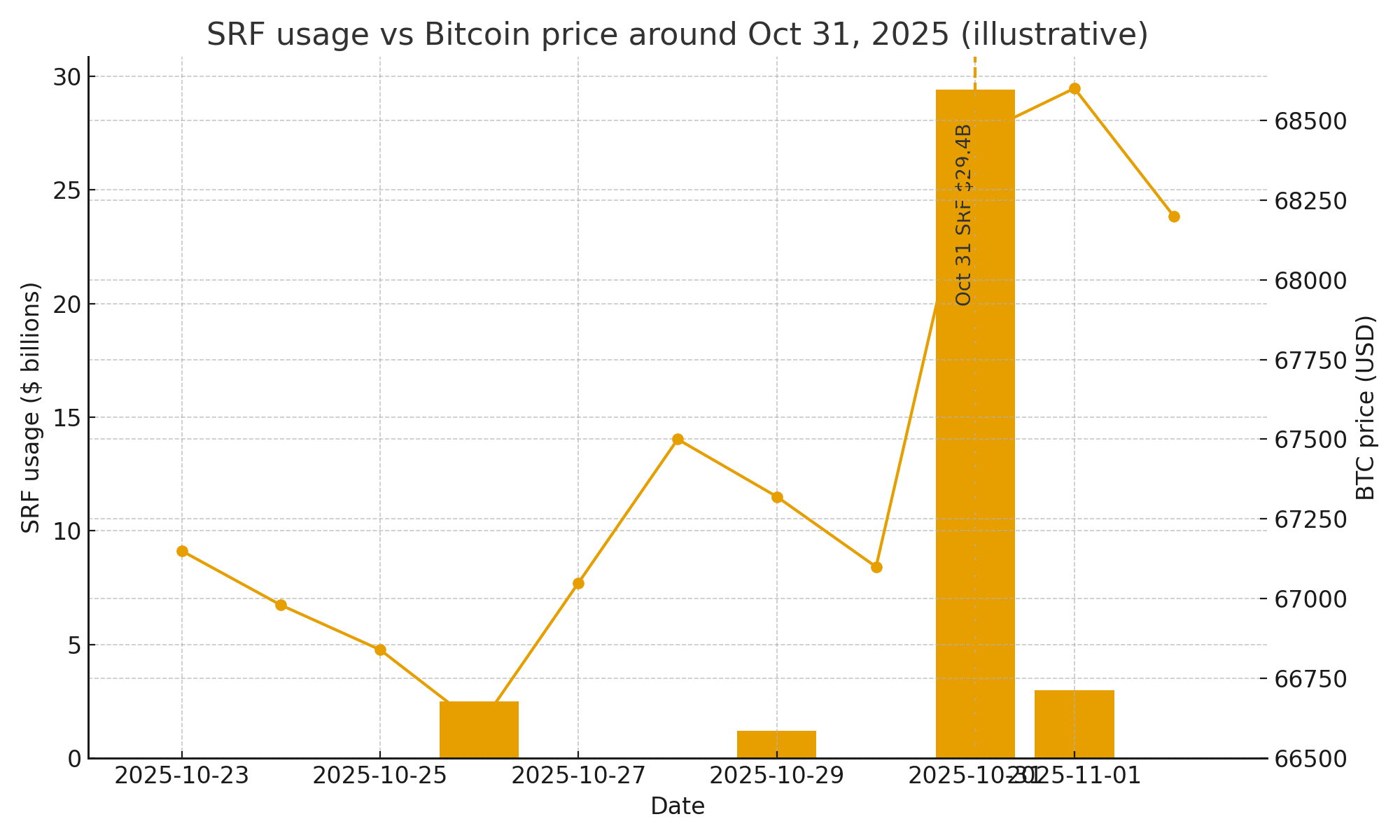

The Federal Reserve quietly added $29.4 billion of cash into the financial system through its Standing Repo Facility. The move arrived after a choppy week in money markets and just as investors were digesting the possibility that balance sheet runoff had squeezed bank reserves too far.

For crypto traders who track every twist in liquidity, the headline number turned heads. The instinct is to cheer. More cash often means friendlier conditions for risk. The truth is more nuanced. This was a pressure valve, not a new pump.

What the Fed actually did

The Standing Repo Facility, or SRF, is a permanent tool that lets eligible firms swap safe collateral like Treasuries for overnight cash, then unwind the trade the next day. Think of it as a fire hydrant on the corner. It stays closed when the streets are calm. It opens when water pressure drops. The $29.4 billion draw signaled that end-of-month funding was tight enough that banks preferred the SRF’s posted rate over private alternatives. That is notable because SRF usage is typically low in normal conditions.

Why the hydrant open

Two forces have been at work. First, quantitative tightening has been draining reserves for many months. Second, a build-up in the Treasury’s cash account can pull dollars out of bank reserves during heavy issuance and settlements.

When both press at once, repo rates creep up, and some lenders pull back. The market starts to look for the Fed backstop. Recent reporting and data pointed to reserves slipping toward the lower end of what the system digests comfortably, with several sessions of elevated SRF usage around the month-end.

Is this quantitative easing in disguise

No, the SRF is an overnight loan against high-quality collateral. It rolls off quickly unless markets keep tapping it. Quantitative easing expands the Fed’s balance sheet by purchasing securities outright. The SRF is designed to stabilize rates inside the target range and prevent a small funding squeeze from turning into a bigger problem. Funding relief can support risk appetite at the margin, but it is not the same animal as long-horizon asset buying.

The state of reserves and the policy backdrop

Tension has been building for weeks. Coverage ahead of the latest policy meeting flagged record or near-record SRF usage as a warning that the runoff of assets may be colliding with the market’s appetite for reserves. Officials have also signaled sensitivity to the risk of pushing too far.

Traders have started to price a path where balance sheet runoff slows or stops if pressures persist. Some desks expect reinvestment tweaks to keep reserves in the “ample” zone should signs of strain grow louder. The SRF burst at month end fit neatly with that narrative.

What this means for Bitcoin

Bitcoin has a long history of reacting to global dollar liquidity. When the pipes flow, risk assets breathe easier. When the pipes clog, leverage resets and prices sag. An overnight repo draw is a relief sign, not a green light for a new liquidity cycle.

It tells the market that participants needed cash for a day and the Fed supplied it. If usage fades this week, the signal is transitory. If it stays elevated or climbs, the market will infer that reserves sit too low and that policymakers may need to ease the drain on bank balance sheets. Either path is less dramatic than outright asset purchases, yet both are friendlier to liquidity than the alternative of a binding crunch.

Price drivers to actually watch after the injection

The first driver is SRF usage itself. Persistent take-up would confirm that banks prefer the facility’s terms to private funding, which implies continued tightness. The second is the weekly H.4.1 release, which offers a snapshot of reserves and facility balances.

A firming in reserves would argue that conditions are stabilizing. A further dip would say the squeeze is not done. The third is the path of Treasury bill supply and settlement calendars. Heavy issuance can tug at reserves even when risk markets look calm on the surface.

How the crypto market filters a funding shock

Bitcoin does not live in a vacuum. When repo rates jump and cash hides, basis trades shrink, stablecoin market making slows, and derivatives funding can flip. That chain shows up in spreads, open interest, and depth on major pairs. A temporary SRF burst tends to smooth those ripples.

Traders see tighter spot-perp spreads and steadier funding. If stress lingers, risk takers demand more premium to carry inventory, which shows up as wider spreads and lower liquidity. The market has already seen that dance during previous episodes when funding markets wobbled around the month-end.

Key crypto indicators that matter in this moment

Liquidity is first. Watch aggregated spot depth across top venues and stablecoin net inflows or outflows. Improving depth alongside positive net issuance in major stablecoins tends to line up with healthier risk tolerance. Next comes derivatives funding and the futures basis. A modest positive funding rate with contained basis suggests a balanced long-short mix.

A surge in positive funding with stretched basis invites shakeouts. Open interest is third. Rising open interest with flat prices can signal leverage building into tight conditions, which is fragile if funding costs jump again. Realized and implied volatility round out the picture. Calmer implieds after a funding shock point to cooling stress. A jump in implieds with light depth warns of poor market resiliency.

The short answer for Bitcoin positioning

The SRF print is a mild tailwind. It lowers the chance that a routine month-end pinch spirals into a broader crunch. It does not create a durable liquidity regime by itself. The more powerful pivot would be a clear pause in balance sheet runoff or an explicit decision to preserve reserves near recent ranges. The market is now watching for any forward guidance on runoff, plus evidence in weekly data that reserves stop sliding. Until then, Bitcoin trades the liquidity weather rather than a new climate.

A note on the reserves narrative

Commentary across desks has focused on the idea that bank reserves have fallen toward levels that make funding jumpy. Recent coverage highlighted estimates near the low 2 trillion range late in the month, which lines up with day-to-day behavior in repo and bills. That context explains why a single day SRF pull can carry outsized narrative weight. It is a signal that the safety net works, and also a sign that the floor under reserves might be too close for comfort.

What to look for next

The first is the next H.4.1 update for fresh readings on reserves and facility balances. The second is any operational notices from the New York desk that hint at calibration of repo parameters or reinvestment plans. If those point to an intent to protect reserve balances, risk assets generally respond better and crypto tends to follow. If the Fed lets tightness run, funding costs stay noisy and the market will continue to chop around liquidity pockets.

The $29.4 billion SRF drawdown eased a month-end squeeze and offered a small lift to liquidity-sensitive assets. It is not a restart of asset purchases. Bitcoin benefits at the margin when cash is easier and funding is orderly. The bigger swing factor is whether policymakers decide that reserves have reached a level that risks market stability. If they defend that floor, crypto gets a steadier runway. If they keep squeezing the system, expect more stop-and-go trading until a clearer policy inflection arrives.

Conclusion

The latest SRF usage told a clear story. Funding was tight, the Fed opened the hydrant, and money markets calmed. That action is supportive at the edges for Bitcoin because it reduces the risk of a disorderly squeeze. It is not a new tide of liquidity. The bolder shift would be a decision to guard reserves with reinvestments or to pause runoff if stress returns. Until policy delivers that clarity, crypto remains tethered to the ebb and flow of global dollar liquidity and the rhythm of funding markets.

Frequently asked questions

Is the SRF injection the same as quantitative easing

No. The SRF is an overnight loan against high-quality collateral and typically rolls off in a day. Quantitative easing is a program of outright asset purchases that expands the balance sheet for longer periods.

Why do month-end dates keep showing stress

Month-end bill settlements, balance sheet window dressing, and runoff can collide. When cash is scarce, repo rates rise and usage of the Fed’s backstop climbs.

What evidence would confirm a broader policy shift

A sustained stop to balance sheet runoff or a reinvestment change that stabilizes reserve balances would be stronger evidence than a single SRF spike. Watch official statements and the weekly H.4.1.

Glossary of key terms

Standing Repo Facility (SRF). A permanent Fed tool that provides overnight cash against safe collateral to keep short-term rates orderly.

Repurchase agreement. A short-term trade where cash is exchanged for securities with an agreement to reverse the trade the next day at a set rate.

Bank reserves. Deposits that commercial banks hold at the Federal Reserve. Reserves move with policy choices, Treasury cash balance swings, and facility use.

H.4.1 release. A weekly report that details the Fed’s balance sheet, reserves, and usage of lending and liquidity facilities.

Futures basis. The difference between futures prices and spot prices. A rising positive basis alongside heavy leverage can signal overheating in crypto markets.

Implied volatility. The market’s pricing of future price swings derived from options. Elevated implied volatility during thin liquidity warns of jump risk.

Read More: Fed’s $29.4B Liquidity Shot: What It Really Means For Bitcoin">Fed’s $29.4B Liquidity Shot: What It Really Means For Bitcoin