Over $1 Billion in BTC, ETH, and SOL Trades Liquidated as Market Slides 5–10%

Last updated on November 04, 2025

This Article Was First Published on The Bit Journal.

Bitcoin liquidation rocked the crypto market this week after Bitcoin tumbled from $112,000 to below $106,000, erasing over $1.27 billion in leveraged positions. According to the source, long traders bore the brunt of the damage, losing nearly $1.14 billion as cascading sell-offs triggered automatic closures across major exchanges.

The wave hit just as traders were bracing for the Federal Reserve’s policy decision, adding fuel to fears that tightening liquidity could squeeze crypto leverage once again.

Massive Bitcoin Liquidation Wave Hits Long Traders

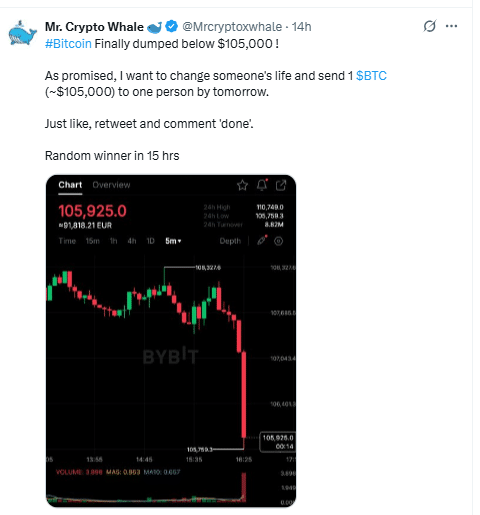

Data from leading analytics platforms showed Bitcoin liquidation activity surged to one of the highest levels since August. Hyperliquid topped the list with $374 million in forced closures, followed by Bybit with $315 million and Binance at $250 million. The single most significant liquidation, worth $33.95 million, came from a BTC-USDT long on HTX.

Bitcoin’s price has now stabilized around $106,200, but sentiment remains fragile. Analysts note that heavy long liquidations often mark “short-term bottoms”, as over-leveraged positions are flushed out before a potential rebound. However, with open interest still near $30 billion, traders remain wary of another swing before the Fed’s statement later this week.

Ethereum And Solana Join The Slide

Ethereum (ETH) and Solana (SOL) also felt the shockwave. Combined altcoin liquidations surpassed $300 million, as both tokens slid 5% to 8% over 24 hours. ETH now trades near $3,030, while SOL hovers around $160.

Market watchers say these wipeouts are part of a broader leverage reset. One trader commented on social media that “thin liquidity and stacked long positions” created the perfect storm for a rapid downturn.

Charts from an official site show dense liquidation zones between $105,000 and $107,000 for Bitcoin, suggesting these areas could act as temporary support if buyers return.

What This Bitcoin Liquidation Means For Traders

This Bitcoin liquidation serves as a reminder that using leverage increases both profits and losses. In periods of extreme market activity, even minor price adjustments can escalate into large-scale selling. Experts note that in such cases, funding rates usually decline, thereby reducing speculation and providing spot-market buyers with a better entry point.

Still, the fact that open interest remains elevated suggests traders are far from abandoning risk. Some believe another Bitcoin liquidation could occur if prices retest the $103,000–$104,000 range, while others see it as a “healthy reset” before the next rally.

Conclusion

The recent Bitcoin liquidation is a loud warning for those traders who have over-leveraged themselves. It is a reminder to the market that volatility is always present, especially as major events like the Fed’s decision approach.

Short-term discomfort could disrupt bullish sentiment, but these shakeouts usually contribute to the gradual development of stronger, more sustainable growth after the dust settles.

Glossary of Key Terms

- Bitcoin Liquidation: Forced closure of a leveraged position when margin levels drop below the exchange’s requirement.

- Leverage: Borrowed capital used to amplify potential gains or losses in trading.

- Open Interest: The total number of outstanding futures contracts yet to be settled.

- Funding Rate: A periodic fee paid between traders to keep futures prices aligned with spot prices.

FAQs About Bitcoin Liquidation

1. What caused the recent Bitcoin liquidation?

A sharp price drop from $112,000 to $106,000 triggered automatic sell-offs on leveraged long positions.

2. Which exchanges saw the highest liquidations?

Hyperliquid led with $374 million, followed by Bybit and Binance.

3. How do liquidations affect Bitcoin’s price?

They often create short-term volatility but can reset leverage for healthier price action later.

4. Are more liquidations expected this week?

Analysts are cautious, citing the Federal Reserve’s upcoming decision as a potential catalyst.

5. How can traders manage liquidation risk?

Use lower leverage, set stop-loss orders, and monitor funding rates regularly.

Read More: Over $1 Billion in BTC, ETH, and SOL Trades Liquidated as Market Slides 5–10%">Over $1 Billion in BTC, ETH, and SOL Trades Liquidated as Market Slides 5–10%