Ethereum Surge Outpaces Bitcoin as Institutional Inflows Jump 138% in 2025

This article was first published on The Bit Journal. Ethereum Surge sees the world’s second-largest cryptocurrency rapidly outpacing Bitcoin (BTC), as institutional investors increasingly shift their focus toward the leading smart contract platform dominating the digital asset landscape.

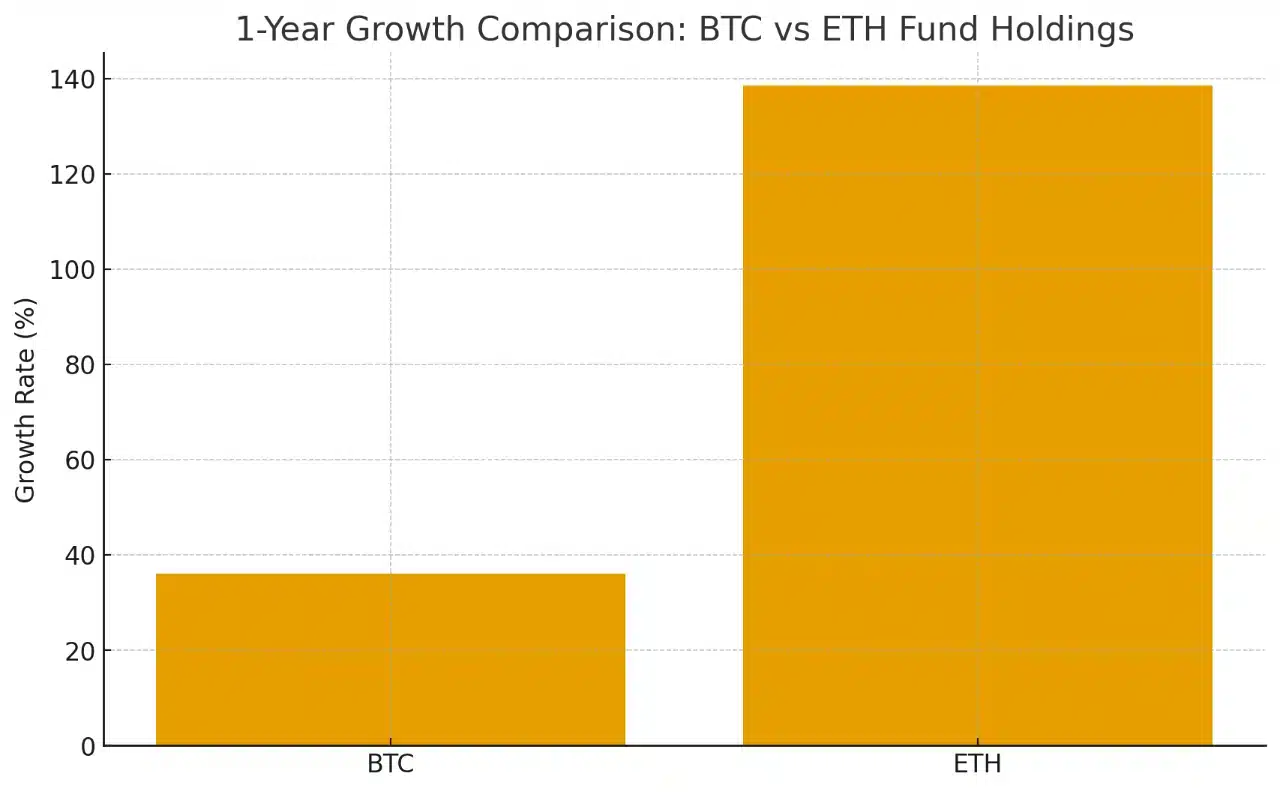

The institutional fund holdings in Ethereum have increased by an astounding 138% over the last year, making nearly four times the rate of growth of Bitcoin, indicating a significant change in market sentiment, and driving a great Ethereum surge in the global markets.

Ethereum Surge Fueled by Institutional Inflows

Once seen as merely an “alternative play” to Bitcoin, Ethereum is now stepping confidently out of Bitcoin’s shadow. Recent fund data shows that Ethereum holdings have soared to approximately 6.8 million Ethereum, which is mostly due to spot ETF inflows, enticing staking yields, and the increasing dominance of Ethereum throughout DeFi and asset tokenization.

Such institutional interest has brought additional momentum to the current Ethereum surge which has made it a dominant figure in the next crypto cycle.

Bitcoin’s Momentum Slows Amid Ethereum Surge

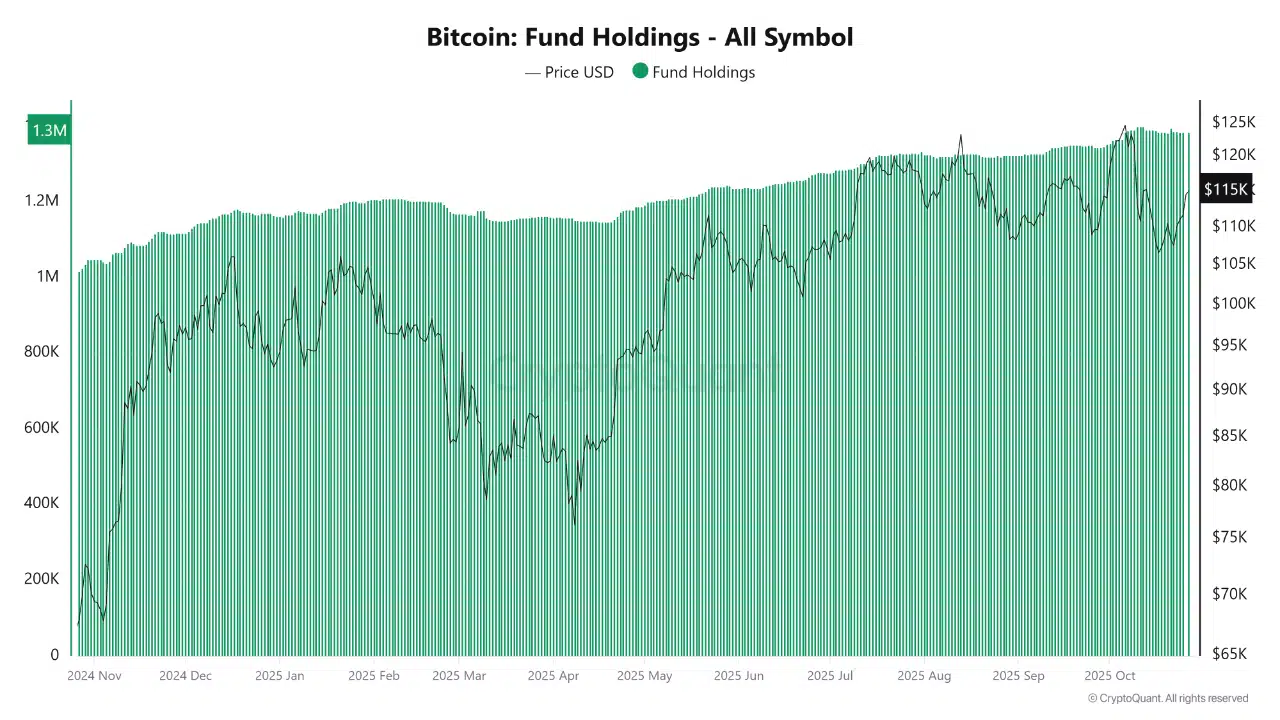

Conversely, Bitcoin still maintains its conventional purpose of a reserve asset of institutions, as there is a consistent though modest increase of 36% in the number of funds held of 1.3 million BTC.

As the number of institutional funds entering Bitcoin grows, it is slower than all other indices and may signify a slowdown in momentum, but Ethereum’s explosion signifies that investors are more willing to embrace growth and innovation.

Altcoin Market Signals Imminent Capital Rotation

Ethereum is not however the only altcoin that is gaining institutional momentum. The market first indications suggest that the long awaited altcoin rotation is possible to be already in action.

As Joao Wedson, the CEO of Alphractal, argues, the existing configuration is very similar to past crypto market cycles, where Bitcoin gains predominance only to see a dramatic shift in capitals to altcoins, usually due to a round of Ethereum surge and a fresh wave of market enthusiasm.

Altcoins Season Index shows the strongest momentum for BTC!

However, I see it as strategic to start accumulating altcoins now, anticipating the upcoming rotation from BTC to Altcoins.

Focus mainly on newer altcoins — history keeps repeating itself!Charts: @Alphractal pic.twitter.com/kE5Ve8PFVd

— Joao Wedson (@joao_wedson) October 27, 2025

Wedson pointed out that only four of the 55 trailed altcoins have shown more performance in the last 60 days than Bitcoin. However, such a narrow performance is typically followed by a wide-ranging recovery in risk appetite a traditional indication of early accumulation.

Ethereum Expansion Fuels Institutional Altcoin Growth

This period of accumulation, analysts believe, is the point where newer altcoins quietly bottom, creating the next step of the rotation. Some of the tokens like Synthetix (SNX) and Binance Coin (BNB) have already started recording an increase in relative returns, which indicated that early-cycle measures are strengthening, in part with the broader Ethereum surge throughout institutional portfolios.

This trend is also supported by historical data. A long-term comparative chart of the altcoins versus Bitcoin reveals that altcoin booms have traditionally followed Bitcoin booms, in both the 2017 and 2021 cycles.

This keeps me awake at night

If this trend line extends into 2025/6 we should see the biggest alt season of all time

While some believe altcoins will never compete with Bitcoin again

I see potential for the biggest liquidity rotation of all time pic.twitter.com/Rqe3XzHmxG

— EllioTrades (@elliotrades) October 27, 2025

Ranging into 2025, technical charts are once again showing a multi-year wedge breakout in various altcoins a pattern that has heretofore occurred before massive rallies. Should this trend continue to be true, the next market turn may already be shaping up, and the Ethereum surge may be at the forefront and reestablishing the balance of power in the worldwide crypto market.

Conclusion

As 2025 approaches, Ethereum’s dominance and the growing institutional shift toward altcoins signal a transformative phase for the crypto market. If historical patterns hold true, Ethereum could spearhead the next major rotation, setting the stage for a broader altcoin rally and redefining the digital asset landscape worldwide.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

- Ethereum holdings jump 138%, outpacing Bitcoin’s 36% growth.

- Institutional inflows and DeFi adoption drive Ethereum’s surge.

- Bitcoin stays a reserve asset, but momentum slows.

- Analysts foresee altcoin rotation led by Ethereum in 2025.

Glossary of Key Terms

Ethereum (ETH): Smart contract platform powering DeFi and tokenization.

Altcoin: Any crypto other than Bitcoin, like ETH or BNB.

Institutional Inflows: Large-scale crypto investments from funds or corporations.

Spot ETF: Fund tracking a crypto’s price without direct ownership.

Staking Yields: Rewards for locking tokens on proof-of-stake networks.

DeFi: Blockchain-based financial system without intermediaries.

Altcoin Rotation: Shift of capital from Bitcoin to altcoins.

Accumulation Phase: Period when investors buy before market uptrend.

Frequently Asked Questions about Ethereum Surge

1. Why is Ethereum rising faster than Bitcoin?

Institutional investors favor Ethereum for DeFi and ETF growth.

2. What fuels Ethereum’s demand?

Staking rewards and its role in tokenization.

3. Is Bitcoin slowing down?

Yes, its growth lags behind Ethereum’s surge.

4. What’s next for altcoins?

Analysts expect an altcoin rally led by Ethereum.

Read More: Ethereum Surge Outpaces Bitcoin as Institutional Inflows Jump 138% in 2025">Ethereum Surge Outpaces Bitcoin as Institutional Inflows Jump 138% in 2025