Is Altcoin Saturation Real? Experts See Room for a Fresh Rally

The crypto market has seen every narrative under the sun. From “Bitcoin is dead” to “DeFi is the new Wall Street,” the ecosystem is full of cycles where hype and skepticism take turns in the spotlight. Now, the debate has shifted toward altcoin saturation, the belief that the altcoin market is overcrowded, leaving little room for new projects to shine. But recent analysis suggests that this idea may be overstated.

Understanding the Altcoin Saturation Narrative

The term altcoin saturation refers to the perception that the crypto market has too many tokens chasing limited liquidity and attention. With thousands of projects listed globally, investors often assume that the next big “altseason” is no longer possible. However, this interpretation ignores the cyclical nature of crypto markets and the underlying shifts in investor behavior.

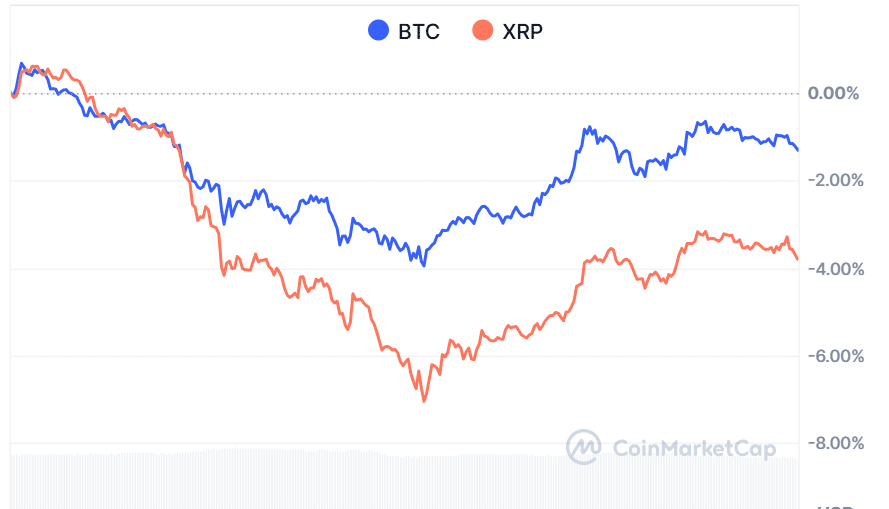

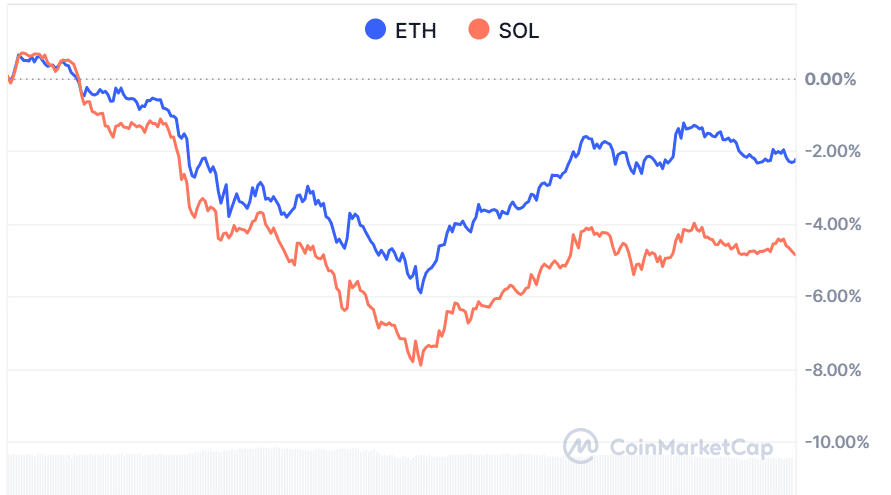

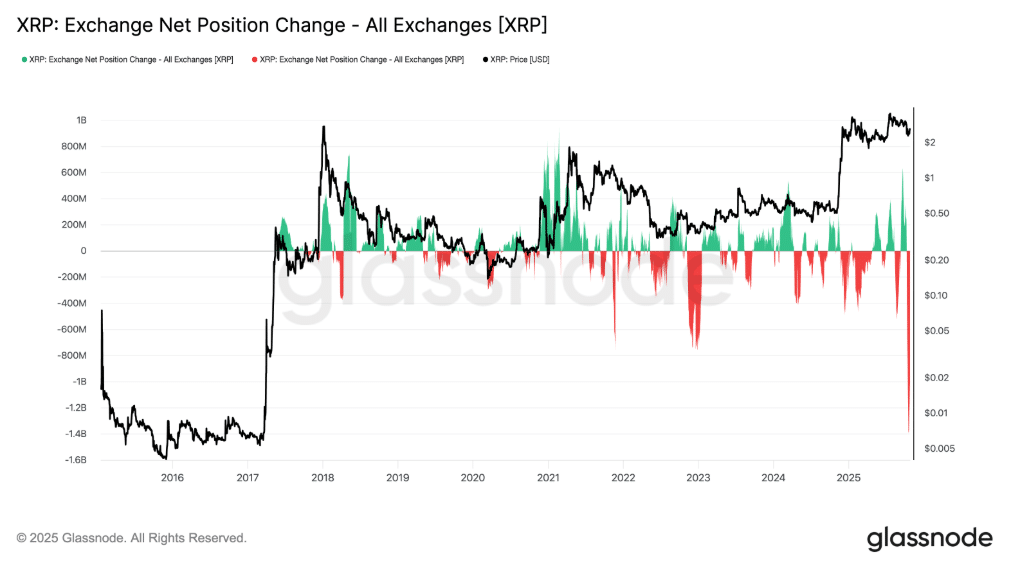

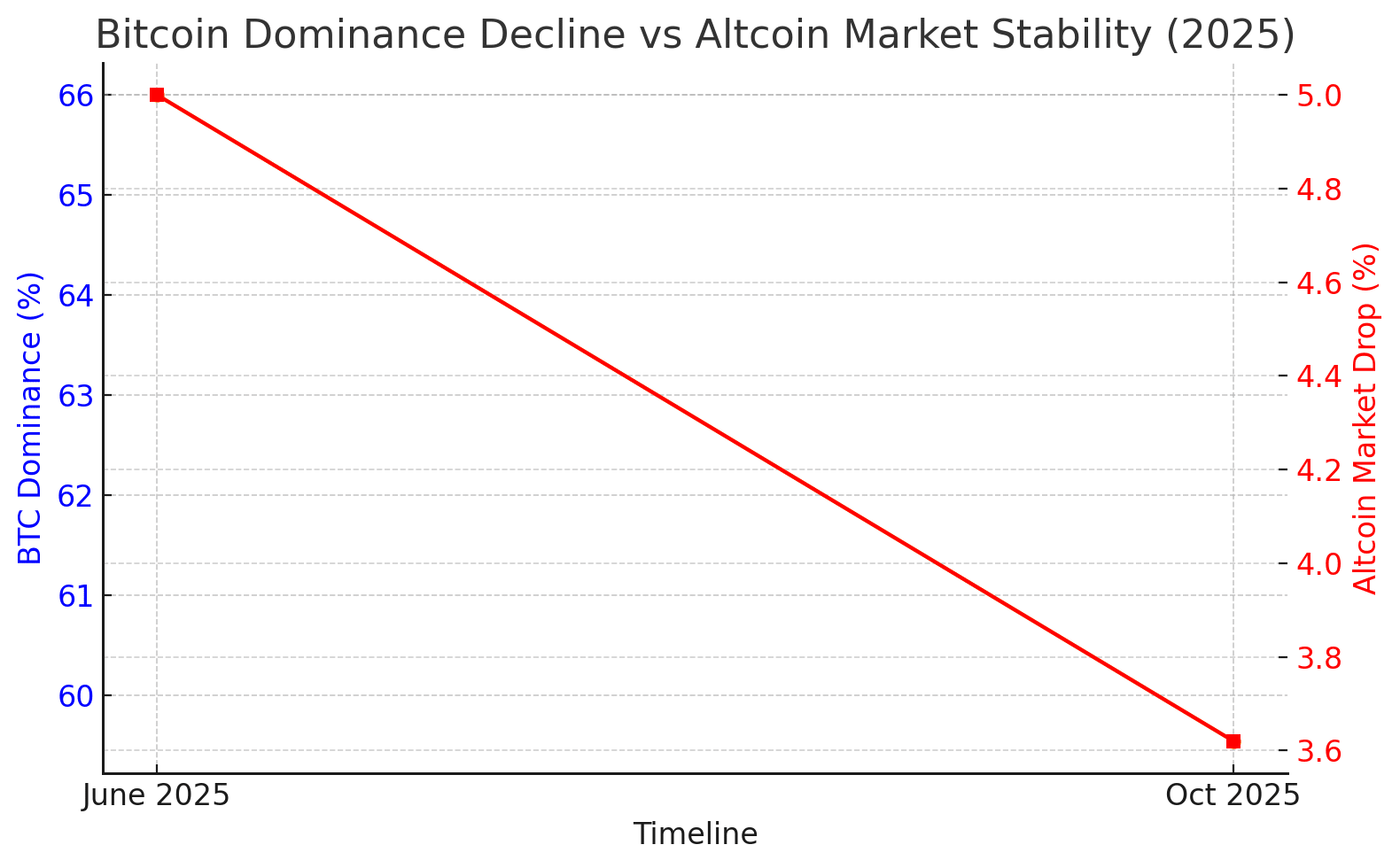

Crypto analysts note that the altcoin market continues to evolve despite its saturation. New sectors like real-world asset (RWA) tokenization, decentralized AI protocols, and cross-chain infrastructure are attracting capital. The data tells an interesting story. While Bitcoin dropped by around 5 percent over a short period, the overall altcoin market cap fell only 3.6 percent. This relative resilience implies that altcoins are still holding their ground.

Bitcoin Dominance and Its Connection to Altcoin Saturation

One of the most reliable indicators for gauging altcoin saturation is Bitcoin dominance, often referred to as BTC.D. This metric measures Bitcoin’s share of the total crypto market capitalization. Historically, when Bitcoin dominance drops sharply, altcoins rally, signaling an “altseason.”

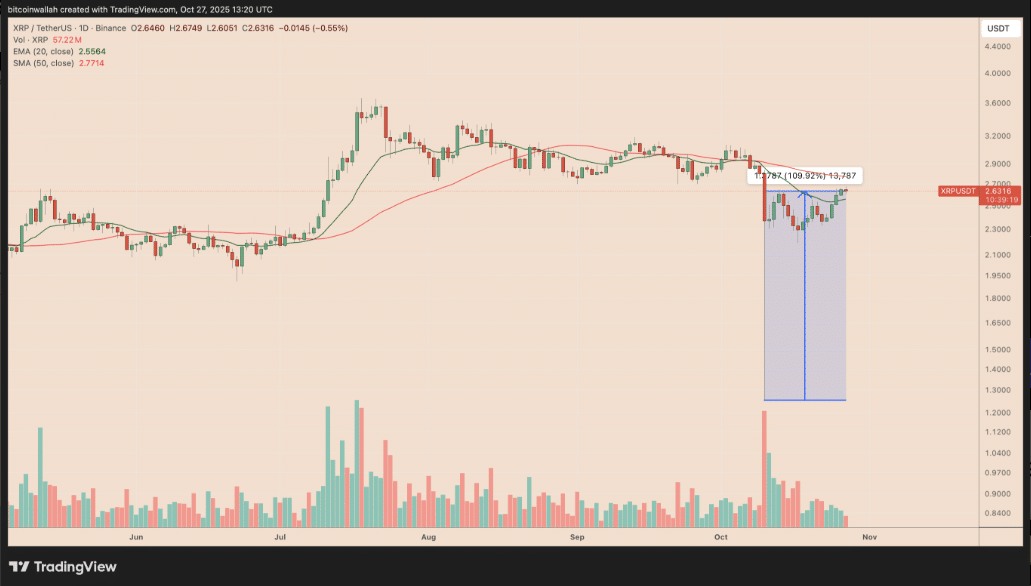

In recent months, Bitcoin dominance fell from nearly 66 percent in June to about 59 percent by late October. The decline suggests that liquidity is slowly moving toward other digital assets. However, analysts caution that the current structure of Bitcoin dominance still leans bullish, meaning altcoins may need more time before experiencing a full-scale breakout.

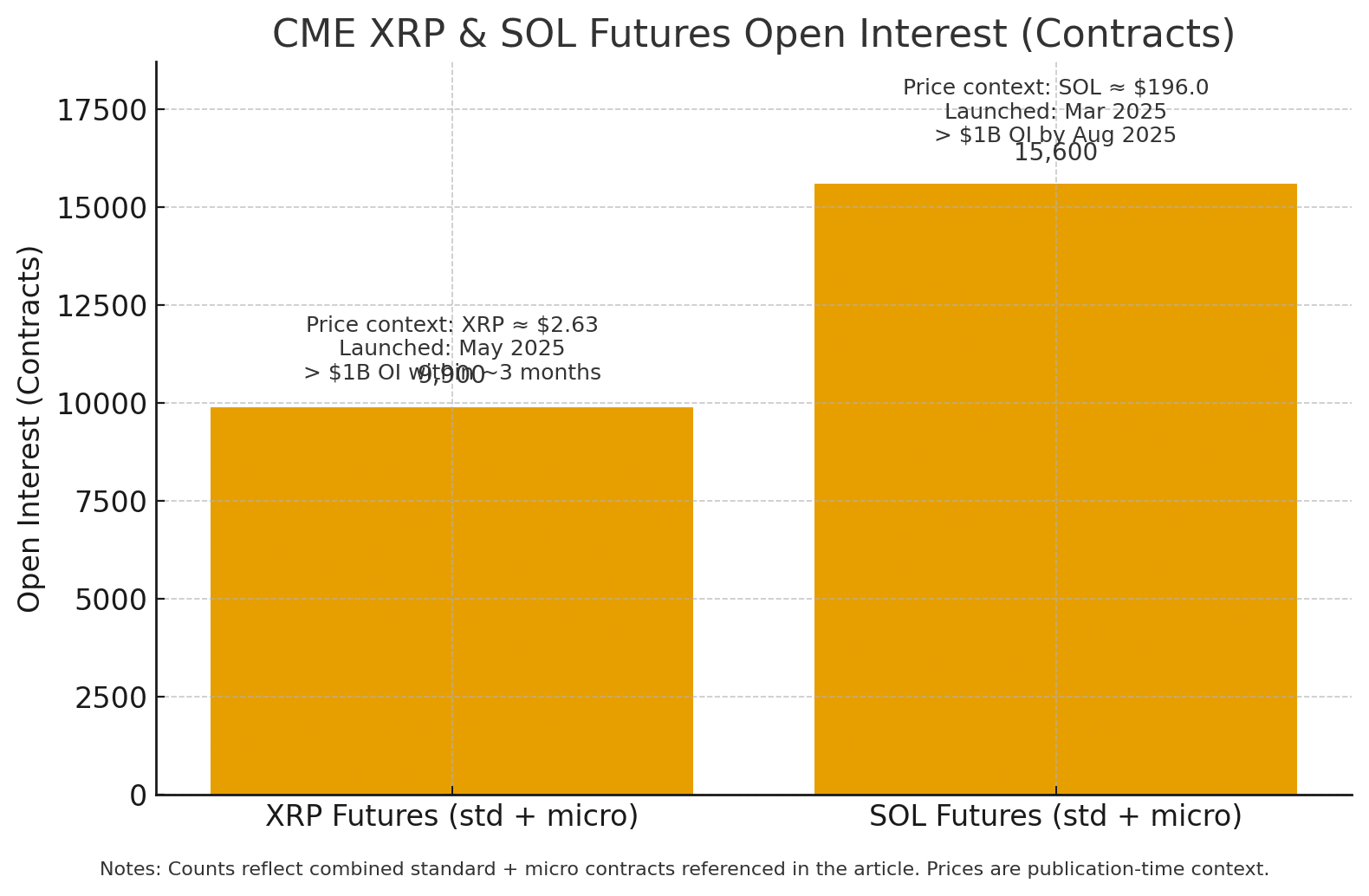

The takeaway? Altcoin saturation might not represent a ceiling but rather a transitional phase in market rotation. When investor confidence builds, funds typically trickle down from Bitcoin to larger-cap altcoins like Ethereum, Solana, and XRP, and later to mid and low-cap projects.

Why Altcoin Saturation May Be Misunderstood

To understand altcoin saturation, one must separate noise from substance. While it is true that most altcoins lack real utility, only a small percentage of projects historically drive the majority of market gains. That pattern has remained consistent across every bull cycle.

Much like the stock market, where thousands of companies exist but only a handful consistently outperform, the crypto market tends to reward innovation and network effects. Layer-2 scaling solutions, AI-integrated protocols, and tokenized real-world asset platforms have emerged as serious contenders.

Investors are beginning to differentiate between speculative tokens and those building real ecosystems. The illusion of saturation fades when the focus shifts from quantity to quality.

Market Sentiment and Long-Term Implications

Market psychology plays a crucial role in the altcoin saturation narrative. Many retail traders equate the abundance of coins with a lack of opportunity. Yet, that abundance could also represent innovation at scale. As blockchain networks mature, interoperability and token standards are improving, making it easier for altcoins to coexist rather than compete destructively.

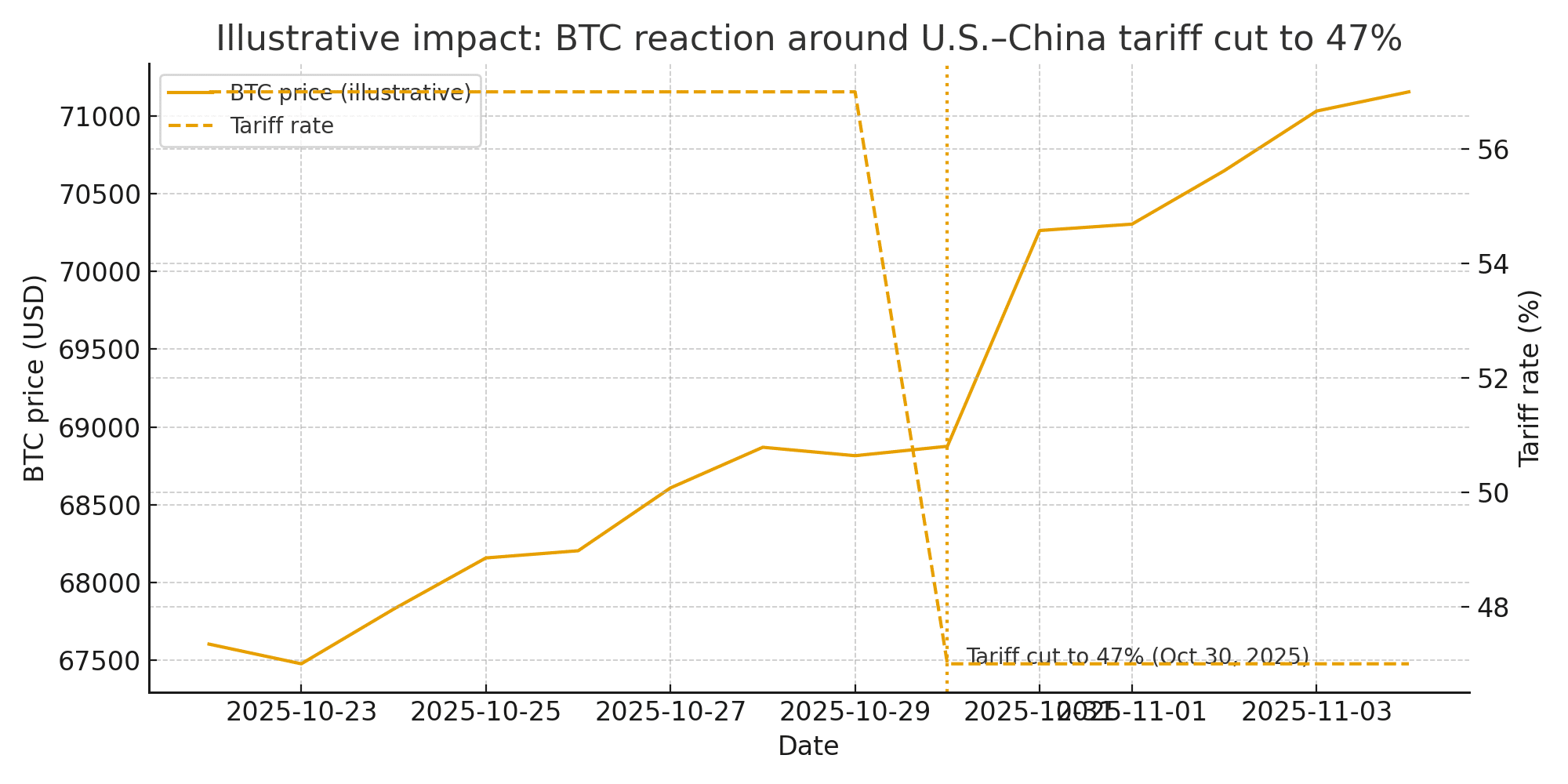

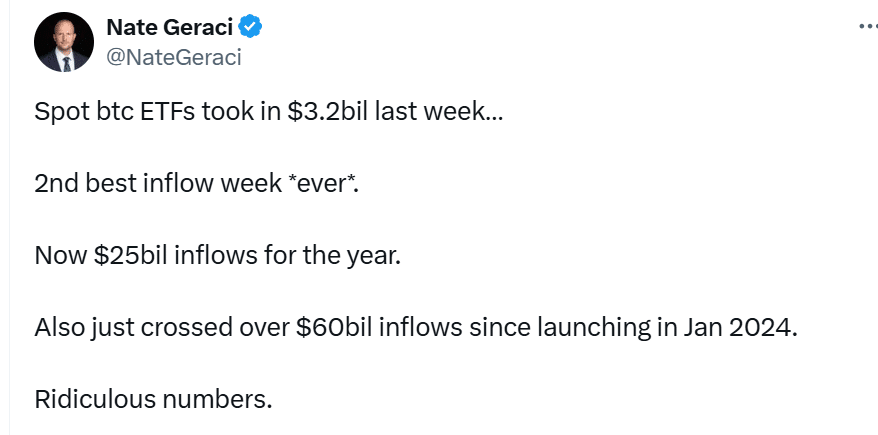

Over the long term, institutional adoption will determine how sustainable this phase becomes. If more regulated funds start exploring tokenized assets, the liquidity inflows could easily offset perceived market saturation. Moreover, advancements in layer-2 networks and decentralized exchanges are reducing the barriers to entry for smaller, more efficient projects.

Analysts Remain Divided but Optimistic

Analysts remain split on the future trajectory of altcoin saturation. Some argue that the current environment mirrors early 2020, when Bitcoin was still dominant, but innovation in DeFi and NFTs triggered a powerful altcoin rally months later. Others believe that the crypto landscape today is too fragmented, with regulatory uncertainty acting as a brake.

Still, optimism prevails. Several data points indicate renewed accumulation in select altcoins. Analysts point out that liquidity concentration in a few strong projects can spark sector-specific rallies, even if the broader market remains cautious. Historically, such phases have preceded some of the biggest gains in the space.

What This Means for the Next Market Cycle

Looking forward, altcoin saturation could reshape the crypto hierarchy. The next rally may not lift all tokens equally. Instead, investors might see a bifurcation between projects with genuine adoption potential and those surviving only on speculation.

The evolution of decentralized finance, gaming, and AI-driven protocols could play pivotal roles in defining the new leaders. As blockchain use cases diversify, the term “saturation” could become outdated. What appears crowded now might simply be the early blueprint of a multi-chain financial ecosystem.

Altcoin saturation might be more myth than reality. The abundance of tokens does not signal the end of opportunity; it highlights the maturation of a dynamic, competitive market. Bitcoin dominance continues to guide sentiment, but cracks in its supremacy are showing.

Altcoins that deliver innovation, compliance readiness, and sustainable tokenomics stand to benefit most in the next phase. The crypto market may be crowded, but in every crowd, a few voices eventually rise above the noise.

Conclusion

The notion of altcoin saturation has become a convenient scapegoat for a market in transition. The data, however, paints a different picture, one of selective resilience and shifting dominance. As Bitcoin matures, altcoins are slowly carving out their roles within a broader financial ecosystem. The market may appear crowded, but it is far from exhausted. Investors who understand this nuance may find that the next wave of opportunity lies not in escaping saturation but in navigating it wisely.

Frequently Asked Questions

1. What is altcoin saturation?

Altcoin saturation refers to the belief that the crypto market has too many coins competing for limited investor attention and liquidity.

2. How does Bitcoin dominance affect altcoins?

When Bitcoin dominance decreases, it often signals that investors are rotating funds into altcoins, leading to broader market rallies.

3. Are all altcoins affected equally by market saturation?

No. Strong projects with active ecosystems and use cases tend to outperform weaker, speculative tokens.

4. Could altcoin saturation slow down market growth?

Not necessarily. While it can fragment liquidity, innovation and institutional involvement can offset the effects.

5. What should investors watch to predict altcoin rallies?

Key indicators include Bitcoin dominance trends, total crypto market cap, and sector-based momentum in areas like DeFi or AI tokens.

Glossary of Key Terms

Altcoin: Any cryptocurrency other than Bitcoin.

Altcoin Saturation: A condition where too many altcoins compete for limited market attention.

Bitcoin Dominance (BTC.D): A metric showing Bitcoin’s percentage of total crypto market capitalization.

Altseason: A market period when altcoins outperform Bitcoin.

Tokenomics: The economic design of a cryptocurrency, including supply, incentives, and distribution.

Liquidity: The ease with which an asset can be bought or sold without affecting its price.

DeFi: Decentralized Finance, financial systems built on blockchain without intermediaries.

RWA (Real World Assets): Tokenized physical or traditional assets like bonds, property, or stocks on blockchain networks.

Interoperability: The ability of different blockchain networks to communicate and share information seamlessly.

Layer-2 Solutions: Protocols built on top of existing blockchains to improve scalability and reduce transaction costs.

Read More: Is Altcoin Saturation Real? Experts See Room for a Fresh Rally">Is Altcoin Saturation Real? Experts See Room for a Fresh Rally