Top 5 Cashback Visa Cards For 2026 – Why Digitap ($TAP) Looks Stronger With Apple Pay And Google Pay Reach

The post Top 5 Cashback Visa Cards For 2026 – Why Digitap ($TAP) Looks Stronger With Apple Pay And Google Pay Reach appeared first on Coinpedia Fintech News

The current market is struggling with tight liquidity and high inflation, and users distrust traditional banks more than ever. In this environment, users want solutions that work. They prefer using cards and ecosystems that work globally, protect value, and integrate with the way money moves.

That is where cashback Visa cards come in. These cards have become important financial tools for users who want financial freedom in 2026. This market shift explains why Digitap ($TAP), a new omni-bank ecosystem, is thriving alongside established cashback Visa cards.

While leading financial institutions dominate, Digitap is redefining what a cashback card can do, though it is still in its crypto presale. Here are the top 5 Cashback Visa cards going into 2026:

- Digitap Visa Card – Cashback Inside a Full Omni-Bank Ecosystem

- Chase Freedom Unlimited – Reliable Cashback, Limited Flexibility

- Capital One SavorOne – Strong Rewards, Still Bank-Centric

- Revolut Visa Card – Global Reach With Trade-Offs

- Crypto.com Visa Card – Rewards Tied to Market Cycles

Unlike traditional cashback cards that operate in isolation, Digitap merges crypto wallets, payments, global settlement, and spending controls into one ecosystem. With Apple Pay and Google Pay support boosting its real-world usability, Digitap is building a next-generation banking layer.

Why Cashback Visa Cards Are Making a Comeback

The financial environment has been changing rapidly over the years. Consumers prefer consistent value and protection over flashy short-term benefits. Interestingly, cashback has become a reliable way to offset rising costs without introducing additional financial risks.

While points and miles lose value and expire with time, cashback is immediate and transparent. This simplicity explains why there is renewed demand for Visa cashback cards. Nonetheless, many existing cards are linked to regional restrictions, traditional banking systems, and limited flexibility.

The gap between what consumers want and what banks offer has opened a door for fintech-driven Visa cards that mix rewards with financial control. That is where Digitap thrives and separates itself from the pack.

Despite being in its crypto presale stage, Digitap offers a utility that many established projects only crave for. Interestingly, the project is running a 12-day Christmas event to reward early investors. Every 12 hours, investors are served with free Premium, PRO accounts, and massive $TAP bonuses.

1. Beyond Cashback: Digitap’s Omni-Bank Model Sets It Apart

Digitap is taking the market by storm because its Visa card is not the product; it is just the entry point. Its omni-bank ecosystem integrates crypto wallets, fiat accounts, cashback service, and real-time settlement into one platform.

Users can accept crypto, change it automatically to fiat at the point of sale, and earn cashback without exposure to price volatility. Moreover, the Digitap Visa card is connected to Apple Pay and Google Pay, making it usable globally.

Flexible onboarding, privacy controls, and a revenue-backed buy-back and burn mechanism are features designed to enhance the ecosystem. Instead of relying on hype and aggressive marketing campaigns, Digitap has designed its cashback offer as a sustainable reward within an ecosystem built for long-term use.

All these features and utility make $TAP a good crypto to buy this December.

2. Chase Freedom Unlimited: Strong Card With Limitations

Chase Freedom Unlimited is a highly popular cashback Visa card. Users prefer it because it offers consistent rewards on daily spending categories, and it thrives on Chase’s strong brand trust.

For consumers who want to use it within the traditional banking system, this card does its job well. Nonetheless, its limitations are growing. Its cashback is restricted heavily by spending categories, and international usage can be quite expensive.

This card offers no native support for crypto income or alternative payment rails. In a world where digital payment use is growing going into 2026, Chase Freedom Unlimited works like a restrictive, domestic, traditional framework.

3. Capital One SavorOne Highlights Changing Spending Habits

Capital One’s SavorOne card is a good financial tool for users who prioritize entertainment, dining, and everyday lifestyle spending. While the cashback structure is highly competitive, Capital One has improved its digital experience.

Despite the developments, the card remains fully tied to a traditional banking model. Users must onboard into the bank’s ecosystem to enjoy the benefits that the card’s cashback offers.

Unfortunately, the cross-border transactions take a lot of time to settle, and the card does not have built-in protection against currency volatility.

As global payments become common, cards like SavorOne are designed for past spending habits instead of the future’s financial reality.

4. Revolut’s Visa Card Offers Flexibility at the Cost of Control

International usability and multi-currency support are among the factors fueling the Revolut Visa card’s increased popularity. For travellers and users who prefer to transact across borders, this card offers flexibility that traditional banks cannot currently offer.

Cashback features vary from one region to the other and from one plan tier to the next. Moreover, access is determined by subscription upgrades. While Revolut supports massive crypto exposure, it works like a brokerage and not a financial bridge.

Users do not control settlement or conversion whenever they are transacting. This loss of control could expose them to market volatility. Revolut is a large ecosystem, but its complex structure and layered pricing reduce its appeal to normal users.

5. Crypto.com Visa Card: High Rewards Tied to Market Conditions

Crypto.com’s Visa card thrived in the last bull cycle since it offered impressive cashback incentives and crypto-linked rewards. While this card still offers many exciting features, its value relies on market conditions and token performance.

However, its staking requirements change often, cashback rates can fluctuate, and rewards are linked to holding volatile assets. For users who want to enjoy stability over speculation, this card’s operating strategy creates uncertainty.

The Crypto.com Visa card works well when the market conditions are strong. But it becomes less appealing in defensive and sideways markets, which is where most users are today.

Why Real-World Payment Utility Makes Digitap a Crypto to Buy

One factor that is often overlooked when evaluating Visa cards is digital wallet compatibility. In the rapidly growing digital economy, Apple Pay and Google Pay are important features for daily life.

Digitap’s compatibility with these platforms expands its utility. Users can shop online securely, tap to pay globally, and integrate their card into existing spending habits seamlessly. This extensive reach puts Digitap on equal levels with global banks while retaining the flexibility of crypto-native platforms.

Most cashback cards claim to offer global usability, but only a few deliver the smooth experience that mobile wallet integrations provide. Digitap’s approach guarantees that users are not compelled to change their habits to access benefits. The card works where users already spend.

By letting users lock in value automatically, Digitap turns daily spending into a defensive financial strategy. Cashback becomes a bonus built on stability rather than a distraction from risk. Thus, its $TAP token is among the best altcoins to buy before 2026.

Digitap’s Christmas Event Is Driving Strong Investor Momentum

Digitap investors are already reaping big this holiday season. The project launched a 12-day Christmas event, which rewards investors on top of its heavily discounted crypto presale price. Interestingly, Digitap investors can access an exciting reward every 12 hours from December 13–24.

Many rewards are on offer, including free Premium, PRO accounts, and massive $TAP bonuses. Remarkably, 24 rewards are up for grabs during this campaign, and some are already gone. This explains why investors are buying the project aggressively.

This event has features that boost the festive atmosphere, including glowing advent boxes, green-and-gold visuals, and a snow-globe countdown. Users can log in, open the Offers tab, and collect rewards before they vanish.

Crypto Presale Thrives as $TAP Trades at a Deep Discount

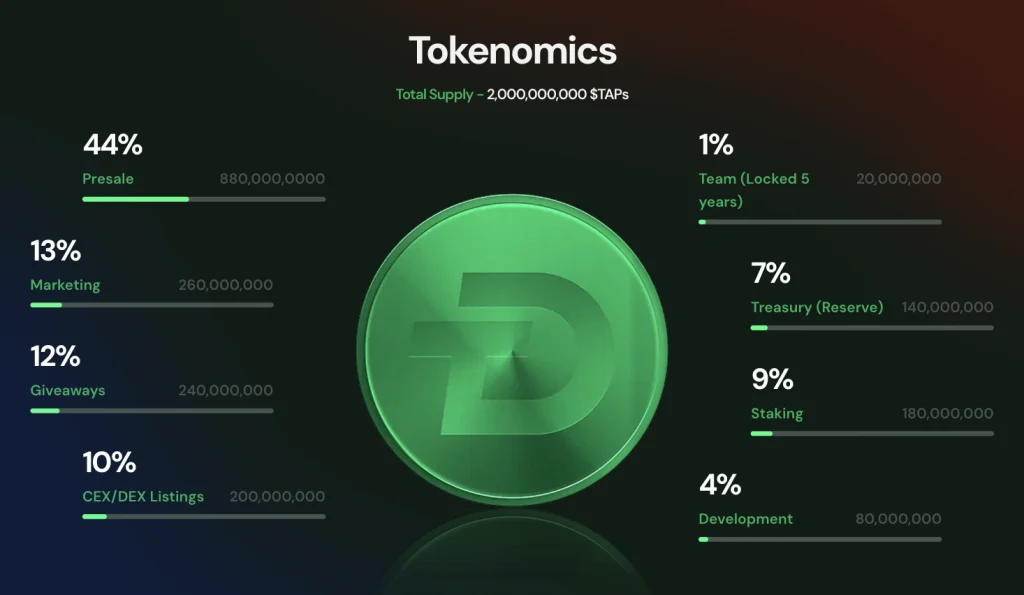

Digitap has raised more than $2.3 million in early funding, appealing to investors due to its flexible utility and an impressive cashback program.

Currently selling at $0.0371, $TAP’s crypto presale low entry price explains why investors are buying aggressively. The current token price is a 73.5% discount from the launch value of $0.14. Notably, at least 143 million $TAP tokens have been acquired.

Digitap Redefines Cashback by Putting Utility Before Rewards

Cashback is among the first features users notice, but it does not make them stay. Long-term adoption is fueled by trust, usability, and control. Digitap understands everything.

By incorporating cashback into its omni-bank ecosystem instead of setting it as a standalone benefit, Digitap is building something more long-lasting. As financial habits change and digital payments thrive, platforms that integrate rewards with real utility will win.

Going into 2026, Digitap is redefining what cashback cards can be. This utility makes $TAP a good crypto to buy for long-term investors.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

THIS WEEK IS HUGE FOR CRYPTO

THIS WEEK IS HUGE FOR CRYPTO

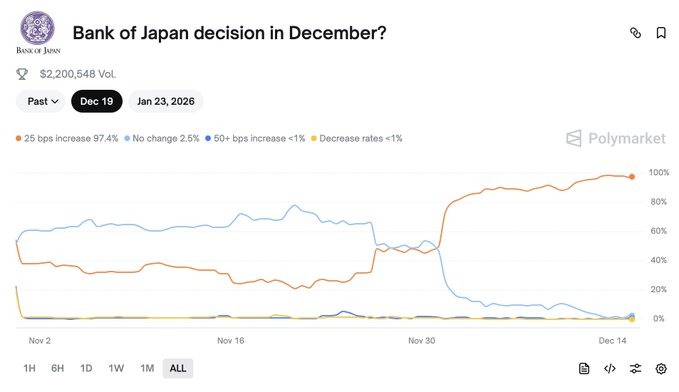

Bank of Japan is about to do a rate hike on Friday the 19th, creating massive fear surrounding the Yen carry trade.

Bank of Japan is about to do a rate hike on Friday the 19th, creating massive fear surrounding the Yen carry trade.

![XRP News [LIVE] Update](https://image.coinpedia.org/wp-content/uploads/2025/12/01124853/How-High-or-Low-Can-XRP-Price-Go-After-Fifth-ETF-Launch-Today-1024x536.webp)

Hold XRP for long-term upside

Hold XRP for long-term upside

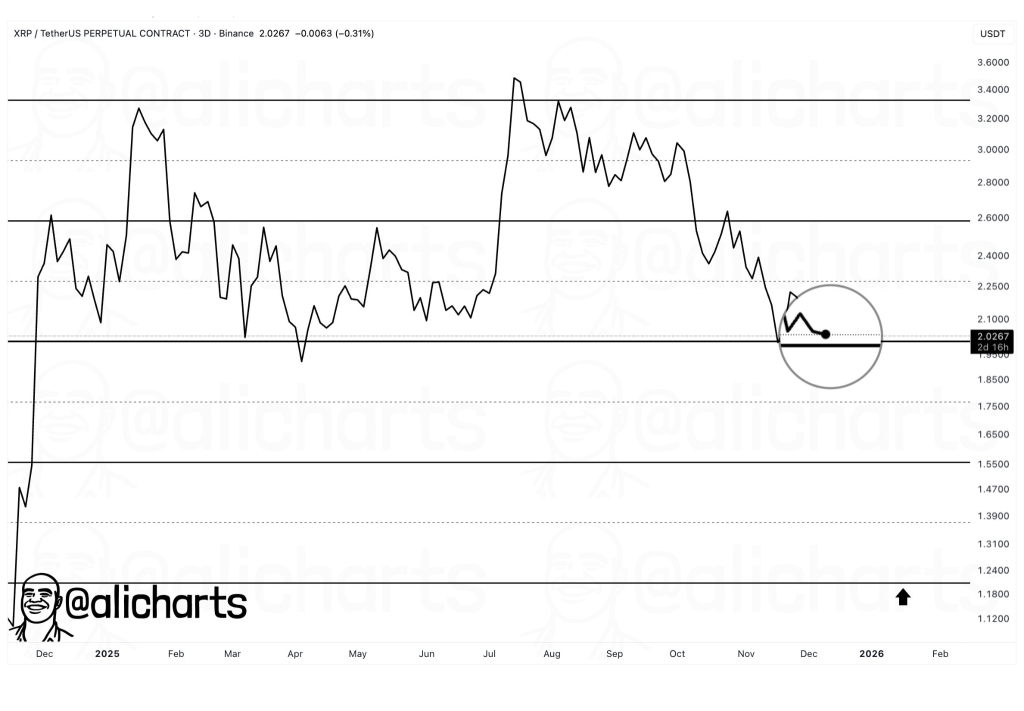

Price holding above major demand zone

Price holding above major demand zone

BREAKING:

BREAKING: STRATEGY REMAINS IN THE NASDAQ 100 INDEX ACCORDING TO REUTERS.

STRATEGY REMAINS IN THE NASDAQ 100 INDEX ACCORDING TO REUTERS.