Here’s why the crypto market is down today (Dec. 15)

The post Why Are Bitcoin, Ethereum and XRP Prices Falling Today? appeared first on Coinpedia Fintech News

The cryptocurrency market is under pressure today, with Bitcoin, Ethereum and XRP among other altcoins all seeing sharp declines. Total crypto market value has slipped to around $3 trillion, down more than 1%.

Bitcoin dropped below $87,000, Ethereum fell near $3,000, and XRP slid to around $1.92. Several other major altcoins, including Solana, BNB and Dogecoin, also moved lower.

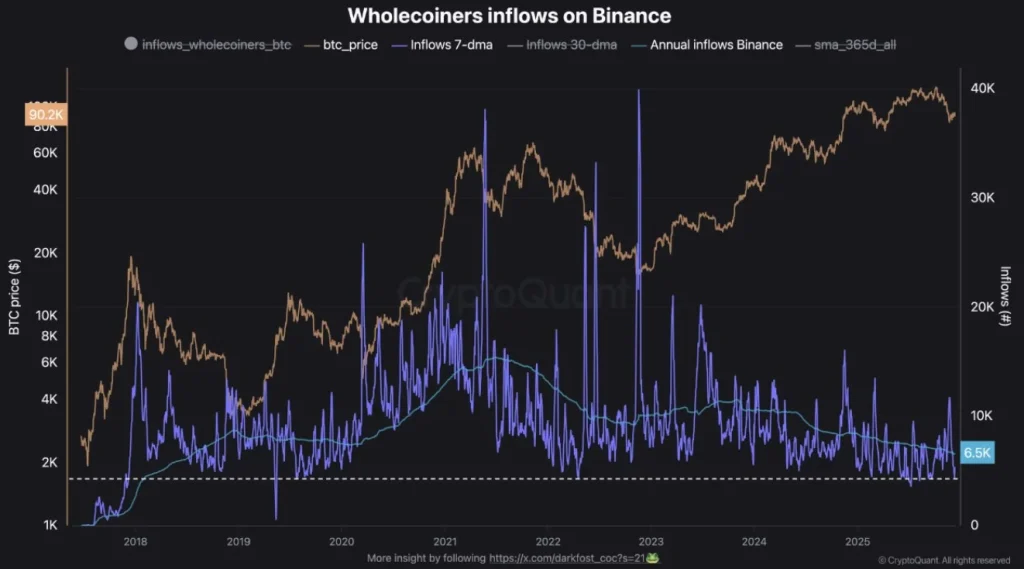

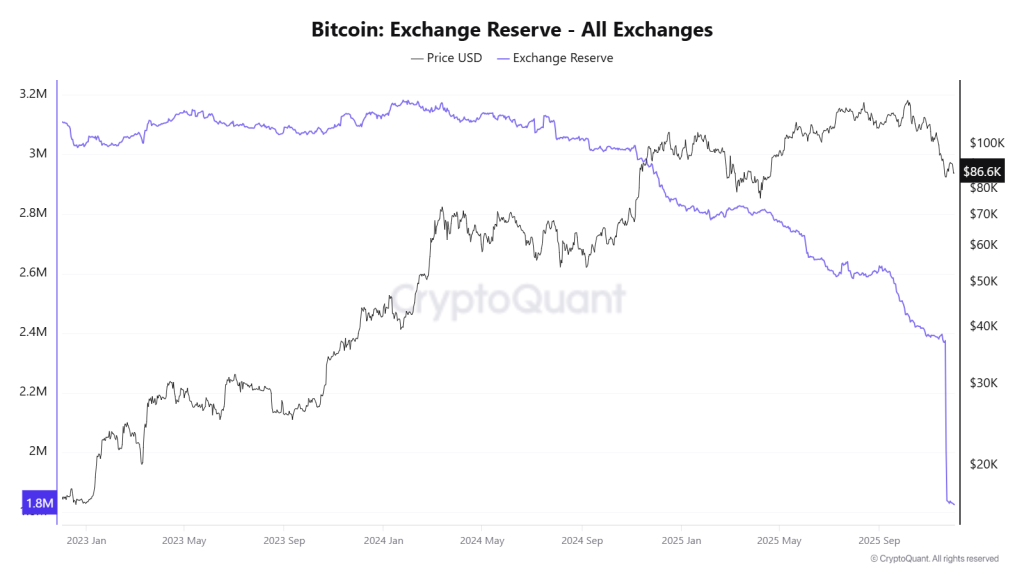

Sudden Bitcoin Drop Triggers Liquidations

Bitcoin saw a sudden sell-off shortly after U.S. markets opened, falling nearly $2,000 in just 30 minutes. This sharp move wiped out around $40 billion from Bitcoin’s market value.

At the same time, more than $125 million worth of long positions were liquidated within an hour. Liquidations happen when traders using leverage are forced to sell as prices fall, which often accelerates losses.

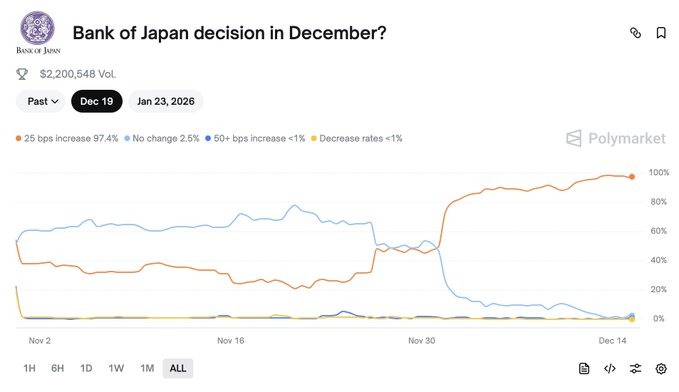

One of the biggest reasons behind today’s crypto drop is growing concern about a possible Bank of Japan (BoJ) interest rate hike later this month.

For many years, Japan kept interest rates extremely low. Investors borrowed cheap Japanese yen and invested that money into stocks, crypto and other risk assets. This strategy is known as the yen carry trade.

Now, as Japan moves toward raising rates, borrowing becomes more expensive. When that happens, investors are forced to repay loans, often by selling assets.

History shows this pattern clearly.

If Japan raises rates again around December 18–19, analysts warn a similar short-term shock could hit global markets, including crypto.

In the United States, the Federal Reserve is also adding uncertainty. While inflation has cooled, the Fed has delayed interest rate cuts. Unemployment has risen to around 4.8%, but policymakers remain cautious.

Without large liquidity injections, Bitcoin could fall further. This pressure comes even as firms like Michael Saylor’s Strategy continue buying Bitcoin. The company recently purchased more than 10,600 BTC worth nearly $1 billion, but that was not enough to stop the broader sell-off.

Despite the current drop, analysts say the bigger picture is more balanced.

Japan’s economy is already weak, with recent GDP shrinking by 0.6%. Because of this, Japan cannot raise rates aggressively for long. The Japanese government has also announced a ¥17 trillion stimulus package, which will inject liquidity back into the system.

Globally, countries like the U.S., China and Canada are slowly moving toward easier monetary policies. Over time, this adds liquidity to financial markets.

Historically, sharp sell-offs often clear out weak positions. Once panic selling ends, markets usually stabilize and begin forming a base.

The post XRP Price Is Not Broken — It’s Being Controlled, Says Macro Expert appeared first on Coinpedia Fintech News

The price of XRP has remained range-bound despite growing discussion around institutional interest, exchange-traded fund (ETF) demand and expanding use cases across global payments, leaving investors questioning why the token has not reflected those developments.

XRP has traded well below its previous all-time highs even as Ripple continues to expand partnerships with banks, payment firms and stablecoin issuers. Some market analysts argue that the disconnect shows a prolonged accumulation phase rather than a lack of demand.

Macro analyst Dr. Jim Willie said in a previous interview that large asset managers are unlikely to disclose XRP exposure while accumulating positions. According to Willie, public confirmation would push prices higher before institutions complete their allocations.

“They are never going to tell you what they’re buying while they’re buying it. If they did, the price would immediately move against them,” he said.

Willie added that several large financial firms, including asset managers and investment banks, are positioning ahead of a potential wave of XRP-based ETFs. Market participants say ETFs could serve as a trigger for broader price discovery.

The analyst said that XRP ETFs could attract between $5 billion and $8 billion in inflows within the first year of launch.

For the unversed, several XRP ETFs launched in November, drawing strong investor interest. Spot XRP exchange-traded funds have now crossed $1 billion in net assets, with total inflows reaching about $990.9 million.

“I did the math — that kind of money would imply an $8–$10 XRP based on market-cap multipliers,” he said. If ETFs bring large, transparent inflows, the argument goes, the current “quiet accumulation” model becomes public buying. That could force the spot market to catch up.

There are a few reasons the expert points to when they talk about suppressed public prices:

• Private OTC buying vs public supply — Much institutional buying happens over-the-counter or inside ETFs, so it doesn’t immediately lift exchange prices.

• Deliberate secrecy — Large buyers often avoid public disclosure to prevent front-running. That can keep official price moves muted while accumulation continues.

• Mixed narratives and fragmentation — Multiple chains and competing payment rails dilute headlines, making it hard for retail sentiment to build fast.

• Short-term selling and liquidity management — Some holders and ecosystem participants still sell into rallies, creating offsetting supply on exchanges.

The post Top 5 Cashback Visa Cards For 2026 – Why Digitap ($TAP) Looks Stronger With Apple Pay And Google Pay Reach appeared first on Coinpedia Fintech News

The current market is struggling with tight liquidity and high inflation, and users distrust traditional banks more than ever. In this environment, users want solutions that work. They prefer using cards and ecosystems that work globally, protect value, and integrate with the way money moves.

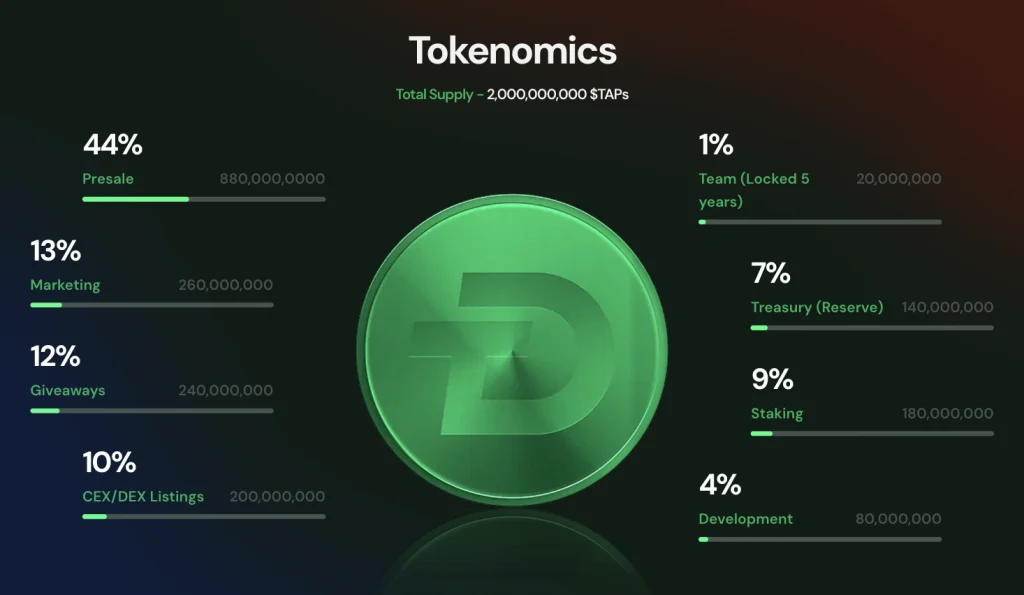

That is where cashback Visa cards come in. These cards have become important financial tools for users who want financial freedom in 2026. This market shift explains why Digitap ($TAP), a new omni-bank ecosystem, is thriving alongside established cashback Visa cards.

While leading financial institutions dominate, Digitap is redefining what a cashback card can do, though it is still in its crypto presale. Here are the top 5 Cashback Visa cards going into 2026:

Unlike traditional cashback cards that operate in isolation, Digitap merges crypto wallets, payments, global settlement, and spending controls into one ecosystem. With Apple Pay and Google Pay support boosting its real-world usability, Digitap is building a next-generation banking layer.

The financial environment has been changing rapidly over the years. Consumers prefer consistent value and protection over flashy short-term benefits. Interestingly, cashback has become a reliable way to offset rising costs without introducing additional financial risks.

While points and miles lose value and expire with time, cashback is immediate and transparent. This simplicity explains why there is renewed demand for Visa cashback cards. Nonetheless, many existing cards are linked to regional restrictions, traditional banking systems, and limited flexibility.

The gap between what consumers want and what banks offer has opened a door for fintech-driven Visa cards that mix rewards with financial control. That is where Digitap thrives and separates itself from the pack.

Despite being in its crypto presale stage, Digitap offers a utility that many established projects only crave for. Interestingly, the project is running a 12-day Christmas event to reward early investors. Every 12 hours, investors are served with free Premium, PRO accounts, and massive $TAP bonuses.

1. Beyond Cashback: Digitap’s Omni-Bank Model Sets It Apart

Digitap is taking the market by storm because its Visa card is not the product; it is just the entry point. Its omni-bank ecosystem integrates crypto wallets, fiat accounts, cashback service, and real-time settlement into one platform.

Users can accept crypto, change it automatically to fiat at the point of sale, and earn cashback without exposure to price volatility. Moreover, the Digitap Visa card is connected to Apple Pay and Google Pay, making it usable globally.

Flexible onboarding, privacy controls, and a revenue-backed buy-back and burn mechanism are features designed to enhance the ecosystem. Instead of relying on hype and aggressive marketing campaigns, Digitap has designed its cashback offer as a sustainable reward within an ecosystem built for long-term use.

All these features and utility make $TAP a good crypto to buy this December.

2. Chase Freedom Unlimited: Strong Card With Limitations

Chase Freedom Unlimited is a highly popular cashback Visa card. Users prefer it because it offers consistent rewards on daily spending categories, and it thrives on Chase’s strong brand trust.

For consumers who want to use it within the traditional banking system, this card does its job well. Nonetheless, its limitations are growing. Its cashback is restricted heavily by spending categories, and international usage can be quite expensive.

This card offers no native support for crypto income or alternative payment rails. In a world where digital payment use is growing going into 2026, Chase Freedom Unlimited works like a restrictive, domestic, traditional framework.

3. Capital One SavorOne Highlights Changing Spending Habits

Capital One’s SavorOne card is a good financial tool for users who prioritize entertainment, dining, and everyday lifestyle spending. While the cashback structure is highly competitive, Capital One has improved its digital experience.

Despite the developments, the card remains fully tied to a traditional banking model. Users must onboard into the bank’s ecosystem to enjoy the benefits that the card’s cashback offers.

Unfortunately, the cross-border transactions take a lot of time to settle, and the card does not have built-in protection against currency volatility.

As global payments become common, cards like SavorOne are designed for past spending habits instead of the future’s financial reality.

4. Revolut’s Visa Card Offers Flexibility at the Cost of Control

International usability and multi-currency support are among the factors fueling the Revolut Visa card’s increased popularity. For travellers and users who prefer to transact across borders, this card offers flexibility that traditional banks cannot currently offer.

Cashback features vary from one region to the other and from one plan tier to the next. Moreover, access is determined by subscription upgrades. While Revolut supports massive crypto exposure, it works like a brokerage and not a financial bridge.

Users do not control settlement or conversion whenever they are transacting. This loss of control could expose them to market volatility. Revolut is a large ecosystem, but its complex structure and layered pricing reduce its appeal to normal users.

5. Crypto.com Visa Card: High Rewards Tied to Market Conditions

Crypto.com’s Visa card thrived in the last bull cycle since it offered impressive cashback incentives and crypto-linked rewards. While this card still offers many exciting features, its value relies on market conditions and token performance.

However, its staking requirements change often, cashback rates can fluctuate, and rewards are linked to holding volatile assets. For users who want to enjoy stability over speculation, this card’s operating strategy creates uncertainty.

The Crypto.com Visa card works well when the market conditions are strong. But it becomes less appealing in defensive and sideways markets, which is where most users are today.

One factor that is often overlooked when evaluating Visa cards is digital wallet compatibility. In the rapidly growing digital economy, Apple Pay and Google Pay are important features for daily life.

Digitap’s compatibility with these platforms expands its utility. Users can shop online securely, tap to pay globally, and integrate their card into existing spending habits seamlessly. This extensive reach puts Digitap on equal levels with global banks while retaining the flexibility of crypto-native platforms.

Most cashback cards claim to offer global usability, but only a few deliver the smooth experience that mobile wallet integrations provide. Digitap’s approach guarantees that users are not compelled to change their habits to access benefits. The card works where users already spend.

By letting users lock in value automatically, Digitap turns daily spending into a defensive financial strategy. Cashback becomes a bonus built on stability rather than a distraction from risk. Thus, its $TAP token is among the best altcoins to buy before 2026.

Digitap investors are already reaping big this holiday season. The project launched a 12-day Christmas event, which rewards investors on top of its heavily discounted crypto presale price. Interestingly, Digitap investors can access an exciting reward every 12 hours from December 13–24.

Many rewards are on offer, including free Premium, PRO accounts, and massive $TAP bonuses. Remarkably, 24 rewards are up for grabs during this campaign, and some are already gone. This explains why investors are buying the project aggressively.

This event has features that boost the festive atmosphere, including glowing advent boxes, green-and-gold visuals, and a snow-globe countdown. Users can log in, open the Offers tab, and collect rewards before they vanish.

Digitap has raised more than $2.3 million in early funding, appealing to investors due to its flexible utility and an impressive cashback program.

Currently selling at $0.0371, $TAP’s crypto presale low entry price explains why investors are buying aggressively. The current token price is a 73.5% discount from the launch value of $0.14. Notably, at least 143 million $TAP tokens have been acquired.

Cashback is among the first features users notice, but it does not make them stay. Long-term adoption is fueled by trust, usability, and control. Digitap understands everything.

By incorporating cashback into its omni-bank ecosystem instead of setting it as a standalone benefit, Digitap is building something more long-lasting. As financial habits change and digital payments thrive, platforms that integrate rewards with real utility will win.

Going into 2026, Digitap is redefining what cashback cards can be. This utility makes $TAP a good crypto to buy for long-term investors.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

The post Can SOL Price Recover Despite a 55% Q4 Correction? appeared first on Coinpedia Fintech News

The SOL price is currently navigating a high-stakes phase in late 2025 as strong on-chain fundamentals strictly collide with bearish market sentiment. While Solana continues to dominate usage metrics and attract institutional activity, its price action reflects broader macro caution rather than network weakness.

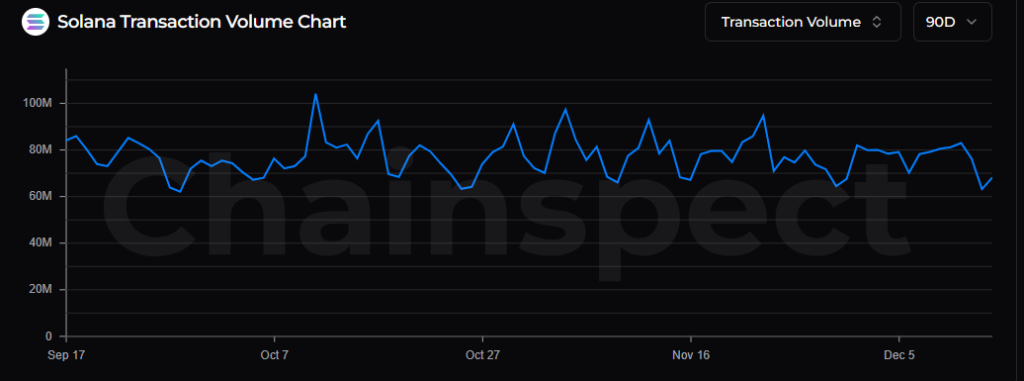

From a network perspective, Solana crypto continues to demonstrate exceptional performance. Over the past 90 days, Solana’s throughput has consistently hovered near 1,000 transactions per second, highlighting the chain’s ability to handle real-world scale.

At the same time, daily transaction volumes fluctuating around 80 million indicate stable and sustained usage rather than speculative spikes.

This consistency reinforces Solana crypto’s positioning as one of the most actively used blockchains in the industry.

In fact, commentary from ecosystem president Lily Liu suggests that Solana has processed more activity throughout 2025 than the rest of crypto combined, by a wide margin. These metrics underscore why the SOL price is often evaluated differently from smaller networks.

Beyond raw activity, institutional interest continues to build. Recently, a JP Morgan tokenized a bond on Solana, marking another step toward real-world financial adoption. Also, strengthening Solana’s credibility as an institutional-grade settlement layer rather than a purely retail-driven chain.

Similarly, ETF inflows linked to Solana have continued to rise, signaling growing acceptance from traditional capital.

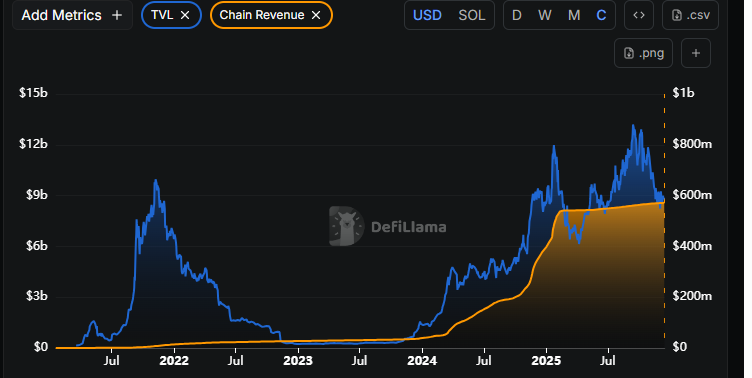

Likewise, its on-chain revenue offers further context. Solana’s cumulative chain revenue is approaching the $600 million mark, sitting near all-time highs. This figure reflects real economic activity generated by users, applications, and validators rather than short-lived hype.

However, the total value locked has declined. After peaking near $13.2 billion in mid-September, Solana’s TVL has fallen to roughly $9 billion. While this $4.2 billion drawdown appears large in absolute terms, percentage-wise it remains relatively contained given the broader bearish conditions across Q4 2025. As a result, TVL trends point to consolidation rather than big crash.

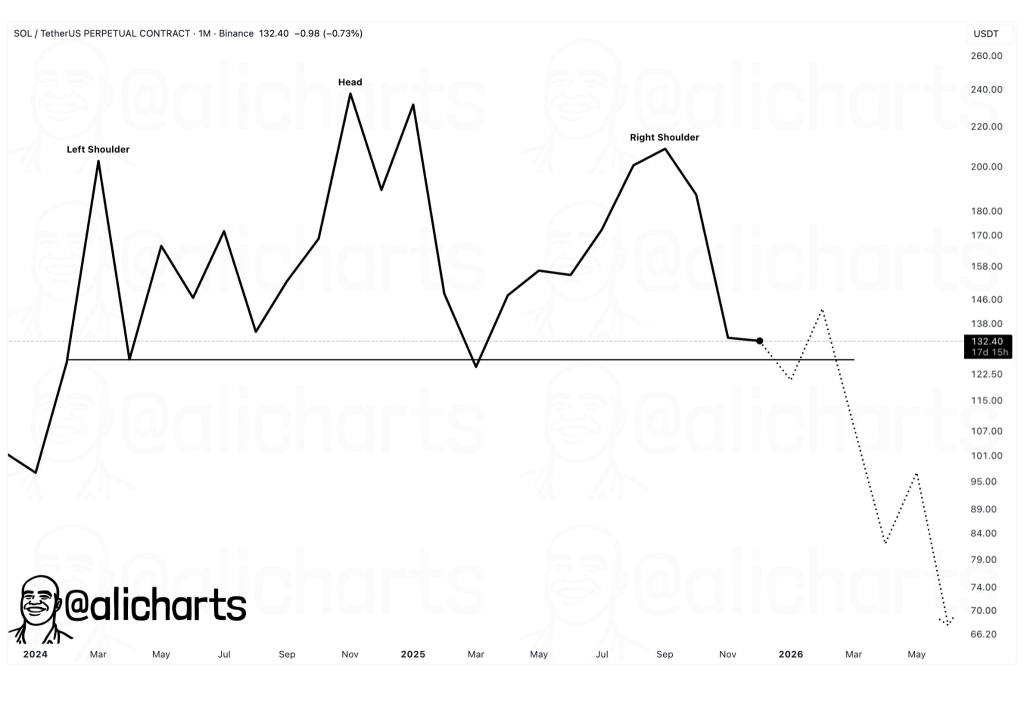

Despite these fundamentals, the Solana price chart tells a more cautious story. Since reaching an all-time high near $295, SOL has corrected roughly 55% during Q4. Market sentiment has clearly tilted bearish, overshadowing positive network data.

Technically, the SOL price continues to hold above the $120 support zone, which remains a critical area for bulls. However, if macro conditions deteriorate further, downside scenarios extend toward the $70 region.

Such a move would represent a nearly 75% decline from the peak, aligning with historical deep-cycle corrections rather than project-specific failure.

The divergence between Solana’s fundamentals and price action places SOL price at a pivotal juncture. On one hand, strong usage, rising revenue, ETF inflows, and institutional adoption argue against a prolonged collapse. On the other, macro uncertainty and technical damage continue to suppress bullish momentum.

As a result, near-term SOL price forecast scenarios remain sensitive to broader risk appetite rather than network health alone. Whether fundamentals can reclaim control over price direction will depend largely on how macro sentiment evolves in the coming months.

The post Strategy Buys 10,645 More Bitcoin appeared first on Coinpedia Fintech News

Strategy purchased 10,645 Bitcoin for $980.3 million at an average price of $92,098, pushing its year-to-date BTC yield to 24.9%, a measure of Bitcoin appreciation on capital deployed. As of December 14, the company holds 671,268 BTC, acquired for a total of $50.33 billion at an average price of $74,972 per coin, funded through at-the-market equity sales and preferred stock like STRD. CEO Michael Saylor’s strategy has made MicroStrategy the largest corporate holder of Bitcoin, benefiting from rallies above $90,000.

The post ADA Price at a Crossroads: Why 2025 Isn’t a Repeat of Cardano’s 2022 Collapse appeared first on Coinpedia Fintech News

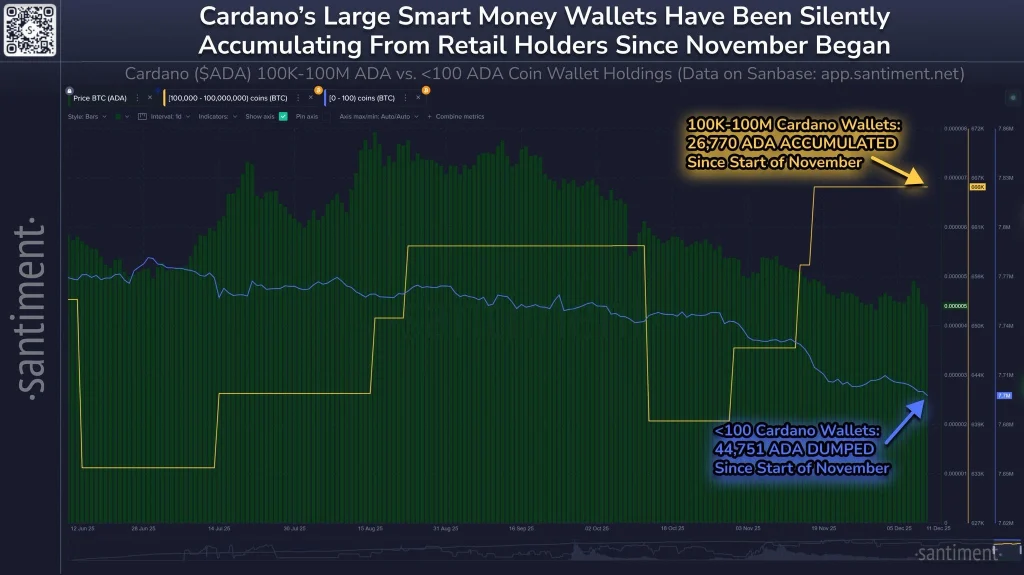

The ADA price is under renewed scrutiny as a weekly indicator revives memories of Cardano’s 2022 collapse, per an popular chartist. However, while technical signals are triggering fear, the broader context in 2025 suggests a very different environment. This one seems to be shaped by deeper utility, stronger governance, and a more mature ecosystem. Why it feels this way, please continue reading to know more in detail.

Recent discussions around the ADA price chart focus on a weekly supertrend signal that last appeared in 2022, just before an 80% correction. This was shared by popular chartist and analyst Ali Martinez on X, that doesn’t sound wrong when looking only at price action and chart.

But when we expand our view. Then, it suggests that back then in 2022, Cardano was still struggling to convert research into real adoption. As a result, technical weakness quickly cascaded into a deep structural breakdown.

In contrast, the current ADA price USD behavior reflects a market struggling with uncertainty rather than just outright collapse. While fear remains elevated witnessing such a big collapse, but the conditions that amplified downside risk in 2022 are not fully present today.

One of the biggest differences lies in Cardano’s evolving utility. In 2025, ADA crypto is no longer a single-chain smart contract experiment. Instead, it is actively working to integrate Bitcoin liquidity into its DeFi ecosystem through trustless bridges and partnerships, allowing BTC holders to deploy capital while retaining Bitcoin exposure.

This structural shift reduces the probability of a straight-line repeat of 2022. Unlike before, ADA now supports a broader economic layer that was previously absent.

Beyond price action, transactional data offers additional clarity. Over the past 90 days, Cardano’s transactional volume has remained relatively stable. If activity were collapsing, this consistency would not exist. This usage stability reinforces why Cardano remains among the top blockchain networks by relevance, with continued institutional interest.

Cardano takes a research-driven approach to blockchain, combining a secure proof-of-stake protocol with the eUTxO model for predictable smart contracts.

— Cardano Foundation (@Cardano_CF) December 9, 2025

New to Cardano? Start with the Cardano Fundamentals course on @BinanceAcademy.https://t.co/40ITAACxbG

The recent, Educational initiatives also play a role. Cardano foundation’s’s emphasis on research-driven development, secure proof-of-stake, and the eUTxO model has been highlighted publicly, signaling an effort to improve transparency and ecosystem literacy.

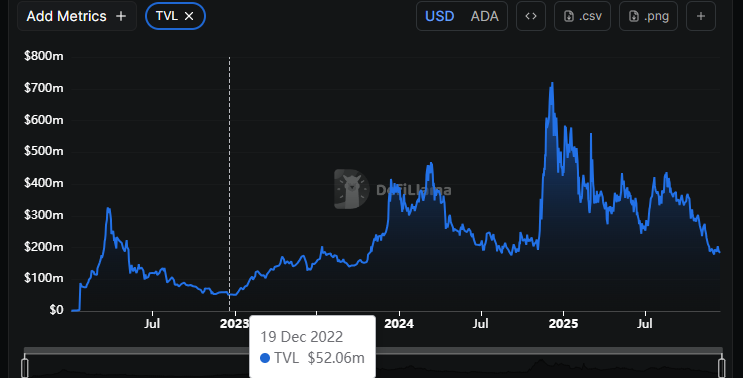

That said, verbally it’s okay but charts shows that challenges still remain. According to DeFi metrics, Cardano’s total value locked has fallen sharply from a peak near $693 million in late 2024 to roughly $182 million in December 2025. This decline is significant and cannot be ignored when assessing ADA price prediction models.

However, perspective matters. During the 2022 crash, TVL dropped to nearly $52 million. Even after the current drawdown, Cardano still holds nearly four times that level, indicating survival rather than abandonment.

More to that, the Recent governance actions approved in December introduce another differentiating factor. These measures aim to support Cardano’s next growth phase and long-term economic sustainability. While governance upgrades do not immediately move charts, they influence long-range assumptions.

As a DRep, the Cardano Foundation has cast its votes on three live Governance Actions:

— Cardano Foundation (@Cardano_CF) December 12, 2025

• Add Constitutional Committee Member: YES

• Net Change Limit Extension: YES

• Cardano Critical Integrations Budget: YES

Find our voting rationales and links to on-chain votes below.pic.twitter.com/ASsyFQTncO

As the ADA price remains sensitive to technical signals, its broader trajectory increasingly depends on whether ecosystem growth, governance execution, and usage stability can offset short-term market fear.

The CFTC gave “no-action” letters to a group of prediction markets, including Polymarket US, exempting them from swap data reporting and record-keeping regulations.

The post Visa Launches Stablecoin Advisory to Boost Digital Payments appeared first on Coinpedia Fintech News

Visa launched its Stablecoins Advisory Practice through Visa Consulting & Analytics to guide banks, fintechs, merchants, and enterprises on stablecoin strategies, tech setup, and rollout. Clients like Navy Federal Credit Union and VyStar use it for cross-border payments to volatile markets and B2B transactions, cutting costs and delays. With $3.5B in annual stablecoin settlement volume across 130+ programs in 40 countries, Visa positions stablecoins as a faster payment infrastructure.

The post Canopy Introduces ‘Progressive Autonomy’: A New Framework That Makes Launching a Blockchain Easy appeared first on Coinpedia Fintech News

Canopy’s “Progressive Autonomy” model lets teams spin up sub-chains under shared validator security, then transition to full sovereign L1s without rebuilding infrastructure or raising a separate security budget.

Canopy, the company building a next-gen Layer 1 (L1) framework with the simplicity of a Layer 2 (L2), introduces Progressive Autonomy, a new deployment model built to make launching a blockchain dramatically easier while preserving full long-term sovereignty and value capture. The framework provides developers with a complete lifecycle: teams can launch as a sub-chain secured by Canopy’s validator network, customize their chain as it matures, and graduate to an independent L1 without rewriting core infrastructure or assembling a costly security budget.

Progressive Autonomy debuts at a time when the limitations of both L2 rollups and traditional L1 development increasingly constrain teams. Rollups have made deployment simple, but at the cost of centralized sequencers, governance-only tokens, fragmentation, and ecosystems that struggle to retain value.

Sovereign L1s remain the only architecture that consistently captures long-term economics, but building one typically requires over a year of engineering, substantial upfront capital, and custom consensus development. Overall, this clunky and expensive process forces builders to make early trade-offs: either prioritize ease and sacrifice ownership, or pursue sovereignty at prohibitive cost.

Adam Liposky, CEO of Canopy, said:

“Teams were forced into a false choice between simplicity and sovereignty, so we built Canopy to remove that trade off. Sovereignty should mean developers control their network economics and capture value on their own rails. Progressive Autonomy lets teams launch fast, retain long term ownership of their chain, and build toward a future of hundreds of specialized sovereign sub chains owned by the communities behind them.”

The Progressive Autonomy model eliminates the compromises, ensuring that all chains launched on Canopy inherit shared restaked security from a growing network of professional validators, including more than 20 top-tier operators who already joined the platform’s Betanet. This gives new chains protection from day one, without relying on token inflation or external security markets.

Validator sharing removes the need for early-stage projects to assemble and incentivize their own validator sets. This reduces both the time it takes to launch and the operational complexity that’s associated with the process. Canopy’s VM-less architecture enables developers to build in any language and tailor their execution environment as their application scales, without touching consensus or modifying the underlying network.

When a project is ready, it can detach from Canopy’s shared security and transition into a full sovereign L1, carrying its history, state, community, and economics with it. The upgrade path preserves continuity for users and developers while granting teams complete control over governance, performance, and value capture. Canopy positions this as a structural shift for the industry. Rather than choosing between an L1 or an L2 at the start, teams can now naturally evolve from incubation to independence as their needs grow.

Andrew Nguyen, Co-Founder and CTO of Canopy, said:

“Progressive Autonomy allows developers to focus entirely on building useful, high-performing applications instead of wrestling with infrastructure. Our goal was to take the security and operational burdens away from the traditional L1 creation and make them completely invisible. When sovereignty becomes accessible, the entire ecosystem will expand and benefit mutually.”

Canopy’s Betanet is already live and supported by leading validators including PierTwo, Stakely, Rhino, Lavender Five, Nodes.Guru, Kingnode, Easy2Stake, and others, signalling early momentum for the shared security approach. The full mainnet launch is planned for 2026, following more than 18 months of development across the core protocol and supporting infrastructure.

Canopy makes launching a sovereign blockchain as simple as spinning up an app. Teams can deploy in days, own their network economics, and connect across chains without bridges or wrapped assets. Powered by NestBFT and layerless mesh security, Canopy provides shared protection and built-in atomic swaps for every chain on the network. Developers get predictable costs, fast deployment templates, and interoperability from day one.

The post Big Week for Bitcoin as Major U.S Economic Events This Week appeared first on Coinpedia Fintech News

This week is lined up for the key U.S. economic events, including jobs data, CPI data, and a Fed speaker’s speech. These events could strongly impact Bitcoin and the overall crypto market.

The cryptocurrency market is already under pressure, with its total value falling from $4.1 trillion to approximately $3.05 trillion. Many traders are now watching this data closely, hoping positive news can ease the stress on prices.

On Tuesday, December 16, the US will release unemployment and Non-Farm Payrolls (NFP) data. Economists expect the economy to add only 50,000 jobs, much lower than in previous months.

Last month, job numbers crossed 200,000, and Bitcoin, Ethereum, XRP, and Solana fell 3% to 7% within a day. If jobs data beats expectations again, crypto prices could face fresh selling.

The US unemployment rate is also expected to rise to 4.5%, up from 4.4%. Higher unemployment could support markets, but strong job data may hurt crypto.

— Money Ape (@TheMoneyApe) December 15, 2025

THIS WEEK IS HUGE FOR CRYPTO

➬ Tue, Dec 16 : US Unemployment Rate + NFP

➬ Wed, Dec 17 : FED speakers

➬ Thu, Dec 18 : CPI + Core CPI

➬ Fri, Dec 19 : BOJ rate decision

Markets expect “NO” Rate cuts in January.

EXPECT HEAVY VOLATILITY pic.twitter.com/PHN8PipIvm

On Wednesday, December 17, several Federal Reserve officials will speak, including Chris Waller and Stephen Miran. Markets now see a 0% chance of a January rate cut, down from nearly 25% just one month ago.

Any hint of higher rates could push crypto lower, while softer comments may bring short-term relief.

On Thursday, the US will release the November Consumer Price Index (CPI) data. The Nov data suggests inflation could rise around 3%, with core inflation close to 2%. Meanwhile, prediction platform Polymarket shows a 90% chance CPI stays near 3%.

In the last CPI release, inflation came in at 3%, lower than expected, helping Bitcoin bounce.

On Friday, December 19, the Bank of Japan will decide whether to raise interest rates. Most markets expect a 25 basis point hike, and prediction platform Polymarket shows a 98% chance of this happening. A rate hike usually pulls money away from risky assets like crypto.

Some experts warn that the increase could be larger than expected. If that happens, global markets may react sharply.

Meanwhile, crypto analyst Merlijn The Trader believes Bitcoin could fall 20–30% after December 19, possibly pushing prices below $70,000.

Looking ahead, if jobs and inflation data come in weak, crypto prices could bounce. But strong data and higher rates may trigger more selling.

Traders expect volatility to rise 1.5x to 2x above normal levels this week. Bitcoin and altcoins could move fast in either direction.

As of now, Bitcoin trades near $90,000, down almost 30% from its recent high of $126,000, showing just how sensitive crypto remains to economic news.

The post BingX Hits 40 Million Users, Doubles Growth in 2025 appeared first on Coinpedia Fintech News

BingX announced it hit 40 million global users in 2025, doubling last year’s count while reaching over $26 billion in peak daily volume. The exchange rolled out smart AI trading tools, enhanced spot and derivatives platforms, and strengthened security with full Proof of Reserves and a user protection fund. This rapid expansion highlights BingX’s strong position in the booming crypto trading world.

The post This New $0.035 Crypto Is Earning Comparisons to Early Solana with Over 250% Growth, Investors Take Notice appeared first on Coinpedia Fintech News

Some analysts believe a new wave of early-stage projects is beginning to mirror the signals once seen during Solana’s breakout phase. Market commentators suggest that one altcoin priced at $0.035 is gaining attention for its fast growth and expanding user base. Early investor sentiment indicates that the pattern forming around this project resembles the type of early momentum that pushed Solana into the spotlight. With interest rising quickly, many investors are taking notice.

Mutuum Finance (MUTM) is developing a lending and borrowing protocol that uses two connected markets to support different user needs. The first is the P2C system. Users deposit assets into a shared liquidity pool and receive mtTokens as proof of their position. These mtTokens grow in redeemable value as borrowers repay interest. A user depositing ETH would receive mtETH that becomes redeemable for more ETH as interest accumulates. This creates a clear APY model tied to real activity.

The second environment is the P2P system, where borrowers post collateral and choose loan terms. Lenders browse open requests and select which ones they want to fund. Borrow rates change based on utilization. Stable rates lock at the start of the loan. LTV rules keep positions safe. Lower-volatility assets like ETH and stablecoins can reach higher LTV ranges near 75%, while more volatile assets stay closer to 35% or 40%.

Liquidations occur if collateral value drops too far. Liquidators buy discounted collateral and repay part of the borrower’s debt. This keeps the protocol balanced and helps prevent losses during market swings. These mechanics are part of why some analysts compare MUTM’s early structure to Solana’s early technical advantage. Both projects focus on practical systems rather than hype.

Mutuum Finance has shown fast and steady growth during its early stages. The token began at $0.01 in early 2025 and now is priced at $0.035 in presale, marking a rise of more than 250%. At the official launch price of $0.06, Phase 1 participants are positioned for close to 500% growth once the demand trend continues.

The project has raised $19.30M so far. A total of 18,400 holders have joined, and 820M tokens have been purchased. Out of the 4B total supply, 1.82B tokens, or 45.5%, are reserved for the presale. Analysts say this structure helps create strong token distribution before mainnet and testnet stages begin.

Demand has increased during each phase. Phase 6 is now more than 97% allocated, and Phase 7 will introduce a price step of nearly 20%. Traders following top cryptocurrencies and crypto predictions say this creates urgency because each phase increases the token’s value, giving early buyers a clear entry advantage.

The presale’s momentum has also been strengthened by daily activity incentives. Mutuum Finance operates a 24-hour leaderboard where the top contributor receives $500 in MUTM. This keeps user engagement high and encourages steady participation throughout the day.

Mutuum Finance confirmed through its official X announcement that the V1 protocol will launch on Sepolia Testnet in Q4 2025. The V1 rollout includes the mtToken system, Liquidity Pool, Liquidator Bot and Debt Token, with ETH and USDT as the first supported assets.

Security has been another strong talking point. The project completed its CertiK audit with a 90/100 Token Scan score, and Halborn Security is performing a second code review. The team also introduced a $50K bug bounty to strengthen stability before launch.

Analysts say this level of security preparation is unusual for a project still in early stages. Because of this, some believe MUTM may deliver a strong run once borrowing activity begins. In a bullish scenario, projections show the token could climb several times above its current value if V1 adoption aligns with early presale momentum.

Mutuum Finance plans to introduce a stablecoin backed by loan interest generated inside the protocol. This gives the ecosystem another use case and increases liquidity for borrowers and suppliers. Analysts say internally backed stablecoins help strengthen retention and create deeper user engagement.

Layer-2 expansion is also part of the long-term roadmap. By moving to L2 networks, Mutuum Finance can reduce transaction fees and improve processing speed. Lending protocols rely on low fees to support high borrowing volume, making L2 support an important growth catalyst.

Together, these features help shape a broader ecosystem. A stablecoin improves liquidity, oracles ensure accurate pricing, mtTokens increase user incentives, and L2 scaling expands user access. Analysts following best crypto to buy now lists say this set of features gives MUTM a stronger long-term path than most early-stage altcoins, including many meme assets that depend only on sentiment.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

The post BOJ to Start Selling $534B in ETFs as Rate Hike Looms; Bitcoin Under Pressure? appeared first on Coinpedia Fintech News

As early as January, the Bank of Japan (BOJ) is expected to begin selling its massive ETF holdings, a portfolio valued at ¥83 trillion ($534 billion). The plan is to move slowly and avoid market shock. But even a gradual exit from ETFs by one of the world’s biggest central banks carries weight, especially at a time when global liquidity is tightening.

See how this could affect the markets.

According to Bloomberg, BOJ officials plan to offload ETFs gradually following a decision made at the September policy board meeting. The central bank has set a pace of ¥330 billion per year based on book value, a timeline that could stretch for decades.

The goal is to keep the impact minimal. Officials want the market response to be barely noticeable, similar to how Japan sold bank stocks in the 2000s without disrupting markets.

Still, the scale is hard to ignore. The ETF holdings have grown sharply in value as Japan’s stock market rallied over the past two years, leaving the BOJ with massive unrealized gains.

The ETF exit comes as markets expect a 25 basis point rate hike at the BOJ’s December 18-19 meeting. Polymarket currently shows a 98% probability of a hike, which would take Japan’s policy rate to 75 basis points, the highest level in nearly 20 years.

That shift matters because Japan has long been the world’s cheapest source of leverage.

“For decades, the Yen has been the #1 currency people would borrow & convert into other currencies & assets… That carry trade is diminishing now, as Japanese bond yields are rising rapidly,” wrote analyst Mister Crypto.

The

— Mister Crypto (@misterrcrypto) December 14, 2025Bank of Japan is about to do a rate hike on Friday the 19th, creating massive fear surrounding the Yen carry trade.

Bitcoin dumped hard the last time they hiked rates:

But why is this exactly? Let’s break it down

What is the Yen Carry Trade?

For decades, the Yen has… pic.twitter.com/YjxzOctjnx

As yen-funded leverage comes under strain, risk assets are vulnerable. Bitcoin is already trading below the $90,000 level, sitting at $89,701 currently.

That said, the market response has been relatively controlled. Many analysts note that expectations around a Bank of Japan rate hike have been circulating for weeks, giving traders time to adjust positioning. In that sense, part of the impact may already be reflected in current prices.

While markets are clearly paying attention, there is no sign of disorderly selling so far, suggesting investors are treating this as a macro adjustment rather than a sudden risk event.’

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The BOJ is selling its ETFs to normalize monetary policy after years of stimulus, but it plans to sell so gradually that the market impact is designed to be “almost unnoticeable”.

A BOJ interest rate hike and ETF sales could pressure Bitcoin by reducing global market liquidity. This could weaken the popular “yen carry trade,” where investors borrow cheap yen to buy riskier assets like crypto.

BOJ is expected to begin its ETF sales in January, moving slowly over the years to avoid sudden market reactions.

The post Japan Begins Decades-Long ETF Sell-Off in January appeared first on Coinpedia Fintech News

The Bank of Japan plans to begin selling its ETF holdings worth ¥83 trillion ($534 billion) as early as January. The sales will happen very slowly, with about ¥330 billion sold each year, meaning it could take more than 100 years to fully exit. The ETFs have a book value of ¥37.1 trillion. This gradual strategy is designed to avoid market shocks and ensure stability while the central bank slowly unwinds its stimulus-era investments.

The post Hedera Price Prediction 2025, 2026 – 2030: Will HBAR Price Hit $0.5? appeared first on Coinpedia Fintech News

Hedera has been making waves in the cryptocurrency space, with a fast and secure blockchain that offers a distinct approach to transaction processing compared to Ethereum and other smart contract chains. It’s permission-only, meaning the blockchain is managed by private companies. Limiting what types of decentralised applications are allowed is what makes Hedera stand out from the rest.

Having entered the top 20 digital assets by market cap in 2024, it is now eyeing a potential leap into the top 10 by the end of 2025. Hedera has also recently ramped up its development activities for its ecosystem. Its ecosystem is strengthening, despite its capped price action. With increasing real-world use cases, institutional interest, and strategic partnerships, many are closely tracking HBAR price chart 2025 to gauge how high the token can rise.

With major companies like Google, IBM, and Chainlink Labs backing the project, and discussions about SEC approved HBAR ETF would flood string liquidity. Many are intrigued that: Will the HBAR Price Reach $1? Let’s discuss this in our Hedera price prediction 2025 article.

| Cryptocurrency | Hedera |

| Token | HBAR |

| Price | $0.1194

|

| Market Cap | $ 5,072,282,376.36 |

| 24h Volume | $ 106,434,147.2825 |

| Circulating Supply | 42,476,304,285.1981 |

| Total Supply | 50,000,000,000.00 |

| All-Time High | $ 0.5701 on 16 September 2021 |

| All-Time Low | $ 0.0100 on 02 January 2020 |

Hedera price USD began the year on a high note, peaking at $0.40 in mid-January before a steady decline took it to a low of $0.125 in early April. This downturn was caused by external factors and waning investor interest, reflected in a decrease in the Total Value Locked (TVL).

But this tide turned in the second week of April. As a broader crypto market rally helped HBAR price break free from the wedge, it bounced off a significant support zone that had previously fueled a late 2024 rally. This support, confirmed by the Fixed Range Volume Profile (FRVP) indicator, suggested strong institutional buying interest. The momentum propelled HBAR on a remarkable surge of nearly 80%, from $0.125 to $0.228 by mid-May.

Unfortunately, this rebound was cut short by escalating geopolitical tensions, which pushed HBAR back to its April lows by the end of June. During this time, the price formed another parallel declining wedge.

The second half of the year started strong, with HBAR posting a significant rally in July from the $0.12 to $0.14 demand zone up to $0.30.

However, this upward move was firmly rejected at a critical resistance point, which strongly aligned with the upper boundary of a descending triangle established since early 2025.

This rejection fueled a sharp decline throughout August and September, which worsened further with a critical liquidation event on October 10th, momentarily pushing the price below the demand zone to $0.10.

This dip was quickly absorbed by institutional buyers, leading to a recovery attempt that failed to flip $0.20 psychological resistance, but after a decent consolidation below this hurdle buyers accumulated it and on October 28th it saw an near 20% rise that pushed its price to $0.22, this occurred as the much-anticipated launch of the Canary HBAR ETF (HBR) on Nasdaq opened the doors for institutional investors.

But that was the last briefest decent move recorded in Q4 2025, which was suppressed by bears and pushed HBAR/USD to reach the vital support zone of $0.12-$0.13 in early December. Historically, this region has demonstrated strong demand, also there was a perception that a rally could ignite here onwards, but by mid-decmber it has faintly breached $0.12, suggesting that another possibility has arised that suggests the weakness od this demand area, and perhaps can’t hold any longer and seeking solid support next which could be $0.072, target bears have for December. However, it’s one of the projects that have ETF, renewed pressure could build a rebound in Q1 2026, and if at that time this level rebounds, it would be a good rally.

In December, mid-HBAR price is teasing a breakdown below $0.12; if it succeeds in breaching, a strong decline is an option towards $0.0722.

| Month | Potential Low | Potential Average | Potential High |

| HBAR Price Prediction December 2025 | $0.125 | $0.27 | $0.40 |

| Year | Potential Low | Potential Average | Potential High |

| 2026 | $0.45 | $0.80 | $1.05 |

| 2027 | $0.60 | $0.95 | $1.20 |

| 2028 | $0.65 | $1.10 | $1.40 |

| 2029 | $0.70 | $1.35 | $1.60 |

| 2030 | $0.95 | $1.70 | $2.20 |

Moving forward to 2026, forecast prices and technical analysis project that Hedera’s price is expected to reach a minimum of $0.45. The price could escalate to $1.05 on the higher end, with an average trading price hovering around $0.80.

Looking ahead to 2027, the optimism around Hedera will lead to steady growth. Hence, the HBAR price is forecasted to reach a low of $0.60, with a potential high touching $1.20 and an average forecast price of $0.95.

As we advance to 2028, with moderate gains, the HBAR predictions indicate that the price of a single HBAR could reach a minimum of $0.65, with the ceiling potentially rising to $1.40. Within the range, the average price will be $1.10.

By the time 2029 rolls around, it’s predicted that Hedera’s price will maintain its upward trajectory, reaching a minimum of $0.70, with the maximum price possibly reaching $1.60 and an average of $1.35, reflecting cautious optimism.

By the end of this decade, HBAR is predicted to touch its lowest price at $0.95, aiming for a high of $1.70 and an average price of $2.20. Hence, the prediction suggests stable long-term growth for Hedera’s market value.

| Firm | 2025 | 2026 | 2030 |

| Changelly | $0.259 | $0.370 | $1.74 |

| priceprediction.net | $0.27 | $0.40 | $1.99 |

| DigitalCoinPrice | $0.43 | $0.50 | $1.07 |

By the end of 2025, the recovery run in HBAR prices is expected to continue with a gradual rise in momentum. Hence, by the end of 2025, Coinpedia’s HBAR price forecast expects a potential high of $0.80 with a solid support at $0.40, making an average of $0.60.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $0.40 | $0.60 | $0.80 |

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

HBAR could reach up to $0.75 by the end of 2025 if demand rises and market conditions improve, with support expected near the $0.12–$0.13 zone.

Hedera offers fast, secure transactions and steady ecosystem growth, making it appealing long-term, but investors should assess risk and market trends.

HBAR price shifts with market sentiment, network upgrades, real-world partnerships, and overall crypto conditions that influence investor confidence.

Forecasts suggest HBAR could reach around $2.20 by 2030 if adoption grows and major partnerships expand real-world blockchain use.

The post Doha Bank Goes Live With $150M Digital Bond as Gulf Embraces Tokenized Finance appeared first on Coinpedia Fintech News

Across Doha and the wider Gulf region, market sentiment is steadily shifting toward digital finance. Banks, regulators, and investors are no longer just watching tokenization trends from the sidelines. There is growing confidence that digital tools can improve speed, efficiency, and transparency without disrupting trusted financial systems. This changing mood has now translated into real action, with Doha Bank stepping forward to execute a fully digital bond deal.

Doha Bank has issued a $150 million digital bond, marking an important moment for the region’s capital markets. Instead of running a pilot or test project, the bank went straight into live issuance. The bond was built and settled using Euroclear’s distributed ledger technology platform, signaling that digital infrastructure is ready for large, regulated transactions.

This move shows how traditional banks are adopting new technology while staying firmly within established financial frameworks. The focus is not on crypto speculation, but on improving how bonds are issued, settled, and managed.

One of the standout features of the deal was instant settlement. The bond was listed on the London Stock Exchange’s International Securities Market and settled on the same day, known as T+0 settlement. In normal bond markets, settlement can take several days, tying up capital and increasing operational risk.

By using DLT, Doha Bank removed much of this friction. Transactions were recorded instantly, ownership was clear, and settlement was completed without delay. Standard Chartered played a central role as the sole global coordinator and arranger, overseeing the structuring, execution, and distribution of the bond.

Rather than using a public blockchain, the bond was issued on a permissioned DLT system run by Euroclear. This choice reflects a clear industry preference. Regulated platforms offer controlled access, legal certainty, and seamless integration with existing custody and settlement systems.

For institutional investors, this matters. They get the efficiency benefits of digital assets while maintaining the safeguards they expect from traditional markets. Euroclear highlighted that this structure proves digital bonds can be fast, secure, and fully compliant at the same time.

The deal fits into a wider regional effort to modernize financial infrastructure. Across the Middle East and Asia, banks are embedding DLT into existing systems instead of building entirely new crypto-native markets. Platforms from major institutions like HSBC and JPMorgan are being used in a similar way, helping tokenized bonds connect smoothly with familiar post-trade processes.

According to Standard Chartered, client interest in digital issuance is rising quickly. Institutions are no longer just curious about tokenization. They are actively using it to improve how capital markets function. Doha Bank’s digital bond adds to a growing list of live issuances and signals that tokenization is becoming a practical tool, not just a concept. For regulated markets, permissioned DLT now looks like the preferred path forward.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

A digital bond is a traditional bond issued using blockchain technology, improving settlement speed and transparency while operating within regulated financial systems, like Doha Bank’s recent issuance.

Digital bonds can settle instantly (T+0) on a distributed ledger, unlike traditional bonds which take days. This reduces capital lock-up and operational risk for banks and investors.

Tokenization makes bonds faster to settle, increases transparency of ownership, and improves operational efficiency, all while maintaining the safeguards of the traditional regulated market.

Yes, Qatar’s financial sector is actively adopting digital finance, as shown by Doha Bank’s live digital bond deal, part of a wider Gulf region shift to modernize capital markets with blockchain technology.

The post BREAKING: JPMorgan Debuts Ethereum Tokenized Money-Market Fund appeared first on Coinpedia Fintech News

JPMorgan is making another meaningful move into crypto – this time with one of Wall Street’s most traditional products.

According to a Wall Street Journal exclusive, the banking giant’s asset-management arm has launched its first tokenized money-market fund, built on the Ethereum blockchain and backed by $100 million of JPMorgan’s own capital. The fund is expected to open to outside investors this week.

For a firm that manages nearly $4 trillion in assets, this is a major signal.

The post Ondo Price Prediction 2025, 2026 – 2030: Can Ondo Hit $10? appeared first on Coinpedia Fintech News

ONDO Finance in the RWA sector is a hot topic, investors are closely eyeing its future potential. Especially as its native token ONDO continues to build credibility and momentum through high-profile developments.

Moreover, Ondo Finance is known to be a leading RWA provider on the Solana chain and it is witnessing growing institutional interest, ONDO has solidified itself as a major player in the Real World Asset (RWA) space.

With such attraction, ONDO price prediction 2025 is what analysts and retail investors are intrigued about. But how far can it go from here? Let’s dive into the detailed ONDO price forecast from 2025 to 2030.

| Cryptocurrency | Ondo |

| Token | ONDO |

| Price | $0.4516

|

| Market Cap | $ 1,426,651,864.03 |

| 24h Volume | $ 63,228,203.9215 |

| Circulating Supply | 3,159,107,529.00 |

| Total Supply | 10,000,000,000.00 |

| All-Time High | $ 2.1413 on 16 December 2024 |

| All-Time Low | $ 0.0835 on 18 January 2024 |

The biggest rise in the ONDO price was when Donald Trump won the election last year, hitting $2.148 by mid-December on Coinbase. Since then, it has continuously declined, and by April 2024, it fell to a low of $0.70.

In the entire Q2, it has seen its price action trapped in a range, despite being a leading performer in tokenized RWA’s based on Coingecko’s report that came in June 2025.

In Q2, many were anticipating that this altcoin could at least gain like last year’s first half movement, but met with a strong supply level by mid-May and declined.

By the third week of June, it fell 35% from the mid-May high, hitting $0.61, due to geopolitical uncertainty. The H1 closed negatively, but ceasefire news between the US, Israel, and Iran gave relief to investors, and they turned their hopes to H2.

The performance of the ONDO price USD during the latter half of the year has certainly been captivating. From July’s price of $0.62, it saw a remarkable ascent to $1.10 in mid-September, testing a key trendline resistance.

However, when it was unable to maintain this upward momentum, bearish sentiments took over, leading to a decline as December approached, with projections targeting the $0.20 all-time low range.

Looking ahead, the ONDO price movement this month hinges on market demand. If there remains a lack of activity, a downturn may be on the horizon.

Conversely, should a bullish trend emerge in December, potentially stabilizing around $0.40, we could see an ambitious goal of surpassing $0.80, which would not only break the trendline resistance but also signal a significant shift in market dynamics.

The unfolding in the remaining December days will be crucial in determining this outcome, also a falling wedge has also manifested, that gives more odd on the bullish side for now

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $0.80 | $1.20 | $2.10 |

The ONDO/USD price action in December opened with a clear rejection from the 20-day EMA band, indicating a strong bearish dominance that suggests the price is likely to decline further without a significant market catalyst to shift sentiment back to bullish.

However, there is a promising support level at the lower border of the falling wedge, currently around $0.40. If this level attracts demand, we can expect a potential bounce in the future. Conversely, if the price breaks below $0.40, we should anticipate even lower lows for ONDO.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $0.80 | $1.20 | $2.10 |

The on-chain data indicates that although the price is currently capped and has been consolidating for several months, the on-chain metrics have strengthened significantly despite the weak ONDO price action.

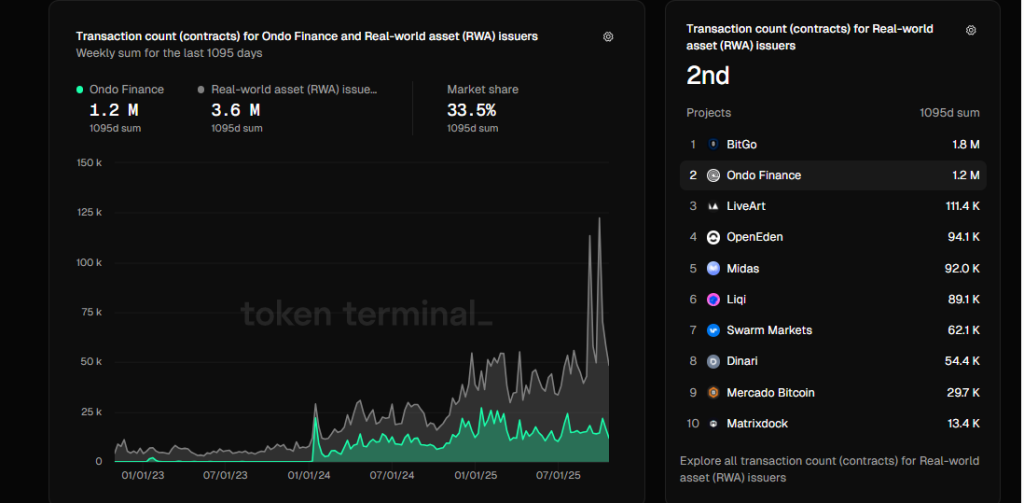

Since January 2024, the number of confirmed transactions sent to a project’s contracts has increased. By October 2025, the project had surpassed 1.2 million transactions, making it the second-largest project for real-world asset (RWA) issuance after BitGo.

Additionally, the Ondo TVL (Total Value Locked) metric indicates that the total USD value of outstanding tokens across Ondo’s tokenized yield product has reached an all-time high of $1.4 billion. This suggests that adoption is increasing, as well as the influx of funds into ONDO at a favorable rate.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 1.65 | 2.75 | 4.15 |

| 2027 | 2.20 | 3.65 | 5.25 |

| 2028 | 2.95 | 4.30 | 6.90 |

| 2029 | 4.75 | 5.60 | 8.45 |

| 2030 | 5.35 | 7.45 | 9.30 |

The price projection of ONDO crypto for 2026 could range between $1.65 to $4.15, with an average trading price of roughly $2.75.

This altcoin could hit a potential high of $5.25 in 2027, with a potential low of $2.20, and an average price of $3.65.

By 2028, forecasts indicate a potential low of $2.95 and a high of $6.90. This could bring the average price to $4.30.

During 2029, the price of the Ondo token is anticipated to reach a minimum of $4.75, with a maximum of $8.45, and an average price of $5.60.

ONDO coin price may reach a high of $9.30 in 2030. With a potential low of $5.35. With this, the average price could settle at around $7.45.

| Firm Name | 2025 | 2026 | 2030 |

| Changelly | $1.32 | $1.87 | $8.26 |

| priceprediction.net | $1.34 | $2.03 | $8.43 |

| DigitalCoinPrice | $2.01 | $2.29 | $5.01 |

CoinPedia’s price prediction for Ondo is extremely volatile. This is due to this altcoin’s highly fidgety nature. If the crypto market successfully regains momentum, this ETH-based token may surge toward a new high.

With this, the Ondo Price Prediction for this year could range between $3.05 as its high and $1.19 as its potential low.

We expect the Ondo Price to reach $3.05 in 2025.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $1.19 | $2.12 | $3.05 |

Also read, Arbitrum Price Prediction 2025, 2026 – 2030!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

At the time of writing, the price of the Ondo token was $ 0.45159965.

Ondo project is a Decentralized Financial (DeFi) platform. It is known to offer risk-isolated, fixed-yield loans backed by yield-generating cryptocurrency assets.

The token is available for buying and selling on all the major centralized exchange platforms.

For the Ondo token to reach $100, it will require a surge of 9800.99% from its current valuation.

One can buy, hold, or sell Ondo crypto tokens by creating a wallet on a centralized cryptocurrency exchange.

The project made its presence in 2021. However, its native token “ONDO” made its first appearance in 2024.

With a potential surge, this altcoin may record a high of $11.75 during 2030 with an average trading price of $9.30.

The post JPMorgan Launches $100M Tokenized Fund on Ethereum appeared first on Coinpedia Fintech News

JPMorgan Chase is launching its first tokenized money market fund directly on the Ethereum blockchain, seeding it with $100 million. This groundbreaking move allows qualified institutional investors to trade fund ownership as digital tokens, enabling faster, smoother settlements compared to traditional systems. By building on a public blockchain, the $4 trillion banking giant signals a major shift: treating crypto infrastructure as a serious, efficient tool for global finance rather than just a niche experiment.

The post “Crypto Cases Were Dropped Under Trump’s Second Term”, NYT Investigation Says appeared first on Coinpedia Fintech News

A new report from The New York Times has stirred controversy by claiming that President Donald Trump and his family may have financially benefited from the settlement or rollback of several crypto cases during his second term. According to the report, a noticeable number of enforcement actions against crypto firms were either dropped or softened after Trump returned to the White House, raising concerns about conflicts of interest.

The NYT investigation found that more than 60% of crypto cases active at the start of Trump’s second term were later paused, reduced, or dismissed. This level of pullback stood out sharply when compared to enforcement trends in other industries, where only a small fraction of cases were dropped. During the same period, regulators continued to pursue non-crypto cases as usual, making the crypto sector an exception rather than the norm.

The report described this shift as unusual, noting that the Securities and Exchange Commission has historically avoided backing away from large clusters of cases within a single industry.

According to the NYT, several of the eased or dismissed cases involved companies or individuals who later developed political or business connections with Trump or his family. The report alleges that some legal outcomes coincided with donations or ties to the Trump family’s expanding crypto-related ventures.

One example cited was a crypto company founded by the Winklevoss twins. The firm reportedly faced a federal lawsuit that stalled after the administration changed. Around the same time, the SEC also dropped its case against Binance entirely. Another high-profile shift involved Ripple Labs, where the SEC later sought to reduce a court-ordered penalty following Trump’s return to office.

The report claims that crypto cases were dismissed at a much higher rate than cases involving other industries. Of the 23 crypto cases inherited from the previous administration, the SEC reportedly pulled back from 14. Eight of those involved defendants who later formed financial or political links tied to Trump or his family. In contrast, only around 4% of non-crypto cases inherited during the same period were dismissed, highlighting what the NYT described as a clear imbalance.

Not everyone agrees with the report’s conclusions. Crypto analyst Alex Thorn strongly criticized the NYT’s framing, arguing that it ignores the context of the prior administration’s crypto stance. He says the earlier crackdown on crypto was far from normal and had been openly criticized for years by bipartisan lawmakers and even federal courts.

Thorn points to past moments when Congress, including Democrats, moved to overturn aggressive SEC policies tied to crypto, showing that resistance to that approach was widespread. In his view, the recent easing of enforcement reflects a correction of an extreme regulatory phase rather than favoritism or personal gain.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The report claims possible links between eased cases and Trump-related ties, but no court has proven direct personal financial benefit so far.

Over 60% of inherited crypto cases were paused or dropped, which critics call unusual, while supporters say it corrected overly aggressive regulation.

Cases involving Binance, Ripple Labs, and a Winklevoss-backed firm saw pauses, dismissals, or reduced penalties after the administration change.

![XRP News [LIVE] Update](https://image.coinpedia.org/wp-content/uploads/2025/12/01124853/How-High-or-Low-Can-XRP-Price-Go-After-Fifth-ETF-Launch-Today-1024x536.webp)

The post XRP’s Multi-Chain Expansion Prompts Discussion Around Yield Platforms Like SolStaking appeared first on Coinpedia Fintech News

“As wXRP expands across Solana and Ethereum, some investors are exploring platforms such as SolStaking as part of broader income-oriented strategies.”

The XRP ecosystem has entered a new phase.

With the introduction of Wrapped XRP (wXRP) on Solana and Ethereum, XRP now extends its reach beyond the XRP Ledger, unlocking new utility in DeFi, cross-chain swaps, and multi-chain liquidity environments.

At the same time, investor behaviour is evolving.

Instead of relying solely on long-term price appreciation, more XRP holders are adopting a dual-income strategy:

Hold XRP for long-term upside

Hold XRP for long-term upside Earn stable daily returns through SolStaking’s structured yield cycles

Earn stable daily returns through SolStaking’s structured yield cycles

For many, this approach results in 800–900+ XRP per day in equivalent value—without depending on market conditions.

wXRP, issued by regulated custodian Hex Trust using LayerZero’s OFT standard, is a 1:1 representation of native XRP.

It allows XRP to participate in:

wXRP first launched on Solana, with Ethereum, Optimism, and HyperEVM next in line.

Crypto analyst Mr. Cauliman emphasized that:

He also notes that wrapped assets introduce additional risks (bridges, custody, counterparties), while native XRP avoids these entirely.

Even so, demand for XRP in DeFi continues to grow—highlighting a broader shift in how investors use the asset.

Although XRP is expanding its reach, major technical upgrades—programmability improvements, validator incentives, broader ecosystem growth—take time.

This creates a familiar problem:

XRP may be valuable long-term, but it doesn’t generate income today.

To fill that gap, investors are adding SolStaking into their strategy.

The platform provides structured earning cycles that deliver predictable returns with:

This allows XRP holders to remain positioned for future growth while earning steady daily income right now.

SolStaking focuses on simplicity and reliability.

Users do not need to:

Once an earning cycle is activated, payouts are sent automatically every 24 hours.

Returns do not change with market volatility.

Each plan includes a clear duration and payout amount.

SolStaking is designed to be hands-off—ideal for users seeking consistent cash flow.

Supported assets include:

XRP, USDT, BTC, ETH, SOL, TRX, DOGE, USDC, and more.

This enables investors to diversify their income streams while maintaining long-term holdings.

SolStaking operates under a regulated and secure infrastructure:

This structure gives users confidence even during periods of market stress.

| Plan Type | Minimum | Cycle | Payout at Maturity |

| Trial Plan | $100 | 2 days | $108 |

| TRX Staking | $3,000 | 15 days | $3,585 |

| USDT Staking | $5,000 | 20 days | $6,350 |

| XRP Flagship Plan | $30,000 | 35 days | $46,800 |

| SOL Staking | $100,000 | 45 days | $183,250 |

(Latest rates available on the official site)

1 — Visit the official site : https://solstaking.com

2 — Create an account : Simple signup, quick verification.

3 — Deposit supported assets : Choose XRP, USDT, BTC, SOL, ETH, TRX, DOGE, and more.

4 — Select and activate a cycle

Daily payouts begin automatically.

No trading. No monitoring. No complex setup.

With wXRP expanding XRP’s utility across multiple blockchains and SolStaking offering stable daily income, many investors are adopting a forward-looking model:

Hold XRP for long-term appreciation

Hold XRP for long-term appreciation Earn predictable income through SolStaking

Earn predictable income through SolStaking

In a market where volatility and uncertainty dominate, this dual strategy provides both growth potential and consistent returns—a combination increasingly valued by investors worldwide.

Official Website : https://solstaking.com

Business & Cooperation : info@solstaking.com

The post US SEC Seeks Public Feedback on Nasdaq’s Plan to Launch Tokenized Stock Trading appeared first on Coinpedia Fintech News

The US Securities and Exchange Commission is seeking public Feedback to decide whether Nasdaq can list and trade tokenized stocks. The move comes as regulators closely examine how blockchain-based assets could fit into existing market rules.

If approved, blockchain-based shares could trade like regular stocks, offering faster and cheaper settlements.

According to the SEC filing on Nasdaq’s rule change, the SEC has asked for public Feedback to decide whether Nasdaq should be allowed to list and trade securities in tokenized form.

This marks the start of a deeper review process covering legal, technical, and policy issues.

Under Nasdaq’s plan, tokenized stocks and exchange-traded products would trade alongside traditional shares. Both would use the same order book, offer the same investor rights, and settle through the DTCC, while blockchain technology improves efficiency.

A key example of this shift is Galaxy Digital, which recently became the first Nasdaq-listed company to tokenize its stock on Solana, showing how traditional finance and blockchain are merging.

Market participants have shown mixed responses to the proposal. Groups like the Securities Industry and Financial Markets Association support the plan, saying tokenization can improve how markets work.

At the same time, the US Commodity Futures Trading Commission has approved a test program that allows tokenized assets to be used as collateral, showing growing acceptance.

However, firms like Ondo Finance and Cboe Global Markets have opposed the idea. They want the SEC to wait until DTCC clearly explains how tokenized trades will be settled, since all such trades would still depend on DTCC systems.

In a related development, the SEC recently issued a no-action letter to the Depository Trust Company, part of DTCC, allowing it to tokenize certain custody assets. This decision is seen as a critical building block, as any tokenized trades on Nasdaq would still need to clear and settle through DTCC systems.

Meanwhile, the CFTC now allows tokenized bitcoin, ether, and USDC as derivatives collateral.

Banks like JPMorgan and BMW are testing on-chain transactions, showing tokenization can make trading faster, cheaper, and available 24/7 despite some challenges.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Tokenized stocks are blockchain versions of traditional shares, offering faster settlement and lower costs while maintaining the same rights and regulations as regular stocks.

Not exactly. Nasdaq seeks SEC approval to list tokenized stocks—traditional securities on a blockchain—which would trade alongside regular stocks using the same systems and rules.

Under Nasdaq’s plan, tokenized stocks would still settle through the DTCC, using blockchain to streamline the process while relying on established, regulated financial infrastructure.

If approved, they’d operate under the same investor protections, regulations, and clearing systems as traditional stocks, with added blockchain efficiency. Regulatory scrutiny aims to ensure safety.

The post Ethereum Founder Vitalik Buterin Wants Algorithm Transparency on X appeared first on Coinpedia Fintech News

Ethereum co-founder Vitalik Buterin has called for major social media platforms to be more transparent about their content algorithms, saying users deserve to know how posts are filtered and ranked.

His comments come as concerns grow over how large tech platforms control online conversations. He believes these steps can help protect free speech and rebuild trust in platforms like X.

In a recent tweet post, Ethereum Foundation AI lead Davide Crapis said that platforms claiming to support free speech should clearly explain how their algorithms work.

He argued that users deserve to know what these systems are designed to promote and that such settings should be easy to understand and adjustable.

if you want to claim X is the platform for free speech, you should disclose your algorithm optimization targets

— Davide Crapis (@DavideCrapis) December 15, 2025

it should be legible to the users, and tweakable

Vitalik Buterin responded by pushing the idea much further. He suggested that every major algorithmic decision should be verified using zero-knowledge proofs. This would allow platforms to prove their systems are acting fairly without exposing private user data.

He also proposed recording content and engagement timestamps on-chain, making it impossible for platforms to quietly censor posts or manipulate timelines.

To improve accountability, Vitalik proposed that social media companies publish their full algorithm code after a delay of 1 to 2 years.

This approach, he said, would balance transparency with security, allowing the public to review how decisions were made while protecting platforms from immediate exploitation.

With platforms like X handling hundreds of millions of posts daily, Vitalik believes delayed transparency could help users and researchers better understand how content decisions were made over time.

Vitalik also shared concerns about the direction of free speech on large social media platforms. Quoting Elon Musk’s vision of X as a global free speech space, he warned that turning platforms into tools for organized harassment could have serious consequences.

@elonmusk I think you should consider that making X a global totem pole for Free Speech, and then turning it into a death star laser for coordinated hate sessions, is actually harmful for the cause of free speech. I'm seriously worried that huge backlashes against values I hold…

— vitalik.eth (@VitalikButerin) December 9, 2025

He said such behavior may lead to strong public backlash in the future and could end up harming the very idea of free speech itself.

Beyond algorithms, Vitalik also spoke about growing online hate, especially targeting Europe. He said some discussions have moved from fair criticism to extreme and hostile attacks that do not match his personal experience.

While he agreed Europe has real problems, he warned that exaggerated stories are being used to attack entire regions.

According to Vitalik, the broader crypto and blockchain community believes that transparency, clear rules, and verifiable systems are essential to rebuilding trust in online platforms and protecting open conversation.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Greater transparency could help users understand why certain posts appear in their feeds while others don’t, reducing perceptions of hidden bias. Over time, this may encourage platforms to design ranking systems that are easier to audit and less prone to arbitrary changes.

Regulators may see these proposals as a framework for future rules around algorithm accountability without demanding full disclosure of trade secrets. It could influence upcoming digital governance discussions in the US, EU, and other regions focused on platform power and speech moderation.

Content creators, journalists, and activists would likely benefit from clearer insight into reach and visibility decisions. At the same time, platforms and advertisers would need to adapt to a more transparent environment that limits opaque optimization strategies.

The post Upbit to List Solana-Based HumidiFi (WET) on Dec. 15 appeared first on Coinpedia Fintech News

South Korea’s largest crypto exchange, Upbit, is listing HumidiFi’s WET token today, December 15, with KRW, BTC, and USDT trading pairs starting at 18:30 KST. HumidiFi, a Solana-based protocol, handles over 35% of daily DEX volume through its proprietary AMM technology, offering dark pool-like execution, sub-0.1% slippage on large trades, and MEV protection. WET holders can earn fee rebates and participate in staking. After doubling post-launch via Jupiter DTF, the token now aims to boost liquidity through Upbit’s active KRW markets.

The post “Quantum Threat to Bitcoin Is Decades Away”, Says Adam Back appeared first on Coinpedia Fintech News

Talk of quantum computers destroying Bitcoin is making the rounds again, but leading voices in crypto say the panic is getting far ahead of reality. While dramatic claims suggest Bitcoin could be wiped out overnight, experts argue these fears ignore how the network actually works and how far quantum technology still has to go.

At the same time, the Bitcoin price has shown mild weakness. On December 15, BTC traded around $89,608, down 0.62% in 24 hours. The drop briefly pushed Bitcoin as low as $87,996 before it bounced back near $89,900. The broader crypto market followed suit, losing more than $130 billion in value and bringing total market capitalization down to $2.98 trillion.

The renewed concern began after writer Josh Otten claimed future quantum computers could unlock Bitcoin’s earliest wallets. According to him, advanced machines could break the keys protecting Satoshi Nakamoto’s coins, shake investor confidence, and send Bitcoin’s price crashing. While the idea sounds serious, many experts say it skips over crucial details and exaggerates what quantum computers can actually do today.

Blockstream CEO Adam Back stepped in to correct what he calls a basic misunderstanding. Bitcoin does not protect coins by locking data behind traditional encryption. Instead, it uses digital signatures to prove ownership.