Bitcoin Magazine

Human Rights Foundation Grants 1 Billion Satoshis to 20 Freedom Tech Projects Worldwide

The Human Rights Foundation (HRF) has announced a new wave of funding through its Bitcoin Development Fund (BDF), distributing 1 billion satoshis to 20 projects around the world.

The grants, awarded to developers, educators, and activists spanning Asia, Africa, Latin America, and Europe, aim to strengthen Bitcoin’s role as a tool for human freedom and resistance to financial repression.

HRF has a mission to empower the more than 5.9 million people living under authoritarian regimes through open-source technologies that enable private communication, censorship-resistant finance, and decentralized coordination.

Since launching the Bitcoin Development Fund in 2020, HRF has provided more than $9.6 million in Bitcoin to 319 projects across 62 countries.

The foundation’s approach merges human rights advocacy with technical development, supporting builders who are creating practical tools for dissidents, journalists, and ordinary citizens in repressive environments.

“Bitcoin is more than just a monetary innovation,” HRF said in a statement. “It’s a survival mechanism for billions of people living without political or economic freedom.”

This round of grants supports projects advancing everything from core Bitcoin development and mining decentralization to regional education and financial autonomy programs. Each reflects a piece of a larger puzzle: a global freedom technology ecosystem built on Bitcoin’s permissionless infrastructure.

Human Rights Foundation Grant Recipients

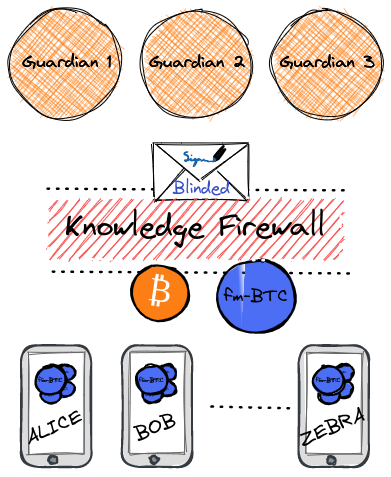

Nymius: Bitcoin’s transparent ledger is essential to its design, but it also exposes dissidents to surveillance from authoritarian states seeking to monitor transactions and networks. Silent Payments enables individuals to receive Bitcoin through unique, one-time addresses derived from a static public key, but its effectiveness depends on wallet adoption. Nymius, a Bitcoin Dev Kit (BDK) contributor, will integrate Silent Payments into the BDK. With this grant, dozens of wallets and applications built with the BDK will be able to offer users greater financial privacy.

Daniela Brozzoni: Bitcoin nodes (computers running the Bitcoin software) reveal user metadata when connecting with one another. This opens the door for regimes or hackers to track or isolate activists and dissidents running Bitcoin nodes. Daniela Brozzoni is a Bitcoin Core developer who has been researching this vulnerability and publishing mitigation proposals to counter the tactics. With this grant, she will gather community feedback and implement fixes to make the network safer.

Build on Bitcoin (BOB) Buidlers Residency: Every day, users often find freedom technologies difficult to use, which limits their accessibility and impact. BOB Buidlers Residency in Bangkok has supported three cohorts of free and open-source developers to advance Bitcoin’s privacy, decentralization, and mining. With HRF’s funding, a fourth cohort of four developers will improve usability across Bitcoin, Lightning, nostr, and ecash, making freedom tech more accessible to those who need it most.

2140 Foundation: Bitcoin developers, especially those in autocratic countries, often struggle with burnout, isolation, and a lack of incentives to complete long-term projects. The 2140 Foundation, founded by open-source developers Josie Baker and Ruben Somsen, is a co-working space in Amsterdam that provides mentorship, collaboration, and employment to global contributors advancing Bitcoin’s long-term security, resilience, and scalability. With HRF funding, the foundation will support the work of developers from authoritarian states to strengthen Bitcoin as a human rights tool.

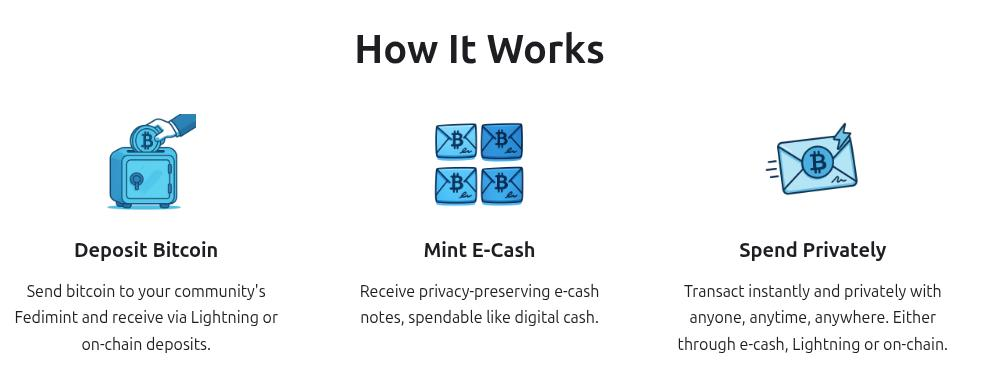

Cashu for Community Sovereignty: In many parts of Latin America, governments restrict financial flows by blocking payments, freezing accounts, and, at times, disrupting internet access. Cashu for Community Sovereignty, founded by Forte11, addresses this with ecash, which enables quick and private payments that even work offline. The initiative will train 10 communities in authoritarian environments to deploy Cashu mints and Lightning Network nodes. With this funding, communities facing repression will develop a stronger infrastructure for financial freedom.

Bhartiya Bitcoin: As India advances a central bank digital currency (CBDC) and financially represses political opposition, Bitcoin offers a path to financial freedom. However, education is often inaccessible to non-English speakers. Bhartiya Bitcoin produces free, culturally relevant Bitcoin content in Hindi, Marwari, Sindhi, and Assamese. With HRF support, Bhartiya Bitcoin will expand into Marathi, Bengali, Gujarati, Kannada, and Malayalam to make Bitcoin more accessible to the more than 1.4 billion people living under increasingly autocratic rule in India.

Bitcoin Education for Lebanon’s Liberty & Empowerment (BELLE): In Lebanon, a collapsing currency, banking restrictions, and asset confiscations have stripped people of financial stability. The Lebanese Institute for Market Studies is launching BELLE, a project to teach political activists and youth to use Bitcoin to preserve their purchasing power. With HRF support, BELLE will provide Arabic-language workshops, educational videos, and media outreach to strengthen individuals’ ability to resist financial repression and secure their financial futures.

Bitcoin Arusha: Tanzania’s government restricts the use of foreign currency and limits dissidents’ banking access, while the local currency depreciates, leaving many citizens trapped in a cycle of poverty. To alleviate this, Bitcoin Arusha provides culturally rooted, Swahili-language Bitcoin education in northern Tanzania through music, dance, and events. HRF support will strengthen Bitcoin Arusha’s resilience and empower communities through economic opportunities.

Bitcoin for Fairness: Human rights defenders and non-governmental organizations (NGOs) often lack the knowledge to use Bitcoin to bypass repressive financial restrictions. Bitcoin for Fairness (BFF) is an educational initiative that disseminates Bitcoin knowledge to the global majority. In 2026, BFF will focus its initiatives in Zimbabwe, Mozambique, and Zambia – countries scarred by currency crises and periods of one-party rule – and deliver workshops, micro-seed funding, mentorship, and educator training. With HRF funding, BFF will empower activists and civic organizations in Southern Africa with censorship-resistant, permissionless financial tools.

Exile Hub: Burma’s military junta uses financial repression, exile, and imprisonment to crush peaceful resistance. Exile Hub’s Bitcoin for Exiles initiative will pilot a Bitcoin-based financial autonomy program designed to meet the needs of Burma’s democratic movement. With HRF support, the program will offer training, privacy-focused toolkits, and workshops to equip dissidents within Burma and in exile with the tools to survive, organize, and resist the junta’s financial repression.

Pluto Mining: Today, most Bitcoin mining hardware relies on closed-source software that can expose user data and create dependence on third parties. Pluto Mining is the first open-source mining fleet management platform that gives miners control over their operations without third-party dependence. With HRF support, Pluto will empower individuals in repressive environments to mine Bitcoin privately, independently, and securely, further decentralizing the Bitcoin network.

WantClue: Bitcoin mining is dominated by industrial operations that use proprietary hardware and software. Over time, this could put Bitcoin’s decentralization and accessibility at risk. Bitaxe counters this trend by providing an affordable and open-source miner for individuals. WantClue maintains the Bitaxe firmware and produces educational content that makes mining more accessible to dissidents and individuals in closed societies. With HRF support, WantClue will strengthen mining decentralization and expand access to self-sovereign financial infrastructure for those under repression.

Peter Tyonum: Developers in adverse political and economic environments need accessible and secure wallet software infrastructure to build freedom tools. Developer Peter Tyonum contributes to the BDK, which abstracts wallet software into usable plug-and-play components and makes it easier for developers to create censorship-resistant tools. With this grant, Tyonum will continue to help developers worldwide create accessible, permissionless Bitcoin applications.

BitScript: An inclusive developer base is essential to Bitcoin’s long-term decentralization. BitScript, a free, open-source Bitcoin developer education program, trains developers in authoritarian and inflationary environments across Latin America and Africa to build protocol-level freedom technologies. Global development helps ensure that Bitcoin serves as a lifeline for people facing repression. HRF’s grant will help BitScript democratize protocol knowledge to ensure the network reflects global needs.

Code Orange Dev School: Many regions lack the technical education to build, maintain, and use Bitcoin. To address this, the Code Orange Dev School in Indonesia teaches developers and individuals across Asia to contribute to open-source Bitcoin projects, run nodes, and use privacy-enhancing tools like ecash, fedimint, and nostr. HRF’s support will help equip communities with tools to resist authoritarianism.

Demo Lab: As authoritarian governments in Latin America tighten their grip on financial and political power, there is an urgent need for civic and financial education. Demo Lab’s Freedom Academy introduces Bitcoin as a tool for financial independence and teaches practical skills for saving and transacting securely. Through this grant, the Freedom Academy will prepare the next generation of Latin Americans to defend democracy and achieve economic sovereignty.

Nostr under Autocracy: In Venezuela, Nicolás Maduro’s brutal dictatorship restricts traditional communication channels, prevents journalists from exposing the regime’s brutality, and financially suppresses civil society. Nostr under Autocracy, led by democracy activist Jesús González, will train Venezuelan activists and human rights defenders to use the open-source nostr protocol for private, censorship-resistant communication and payments. With HRF support, this project will help Venezuelan dissidents speak freely online and build movements to resist Maduro’s digital and financial repression.

KernelKind: Dictators restrict communication, manipulate online content, and restrict dissidents’ financial access to silence dissent. Notedeck is a Nostr browser created by Damus that makes it easier to build censorship-resistant apps with integrated Bitcoin payments. Its first app, Columns, introduces modular feeds and a marketplace for user-controlled algorithms, while Dmail will enable private, decentralized messaging with email interoperability. With this grant, Notedeck will continue to merge censorship-resistant communication with financial freedom and foster an ecosystem of apps for dissident communications and transactions.

Eric Holguin: Many people living under authoritarian regimes face censorship, Internet shutdowns, and frozen bank accounts that cut them off from communication and commerce. Nostr developer Eric Holguin is working to build censorship-resistant apps with integrated Bitcoin payments by contributing to Damus and Nostr projects that empower individuals to communicate and transact without centralized control. With this grant, he will continue expanding free speech and financial freedom tools for people resisting repression worldwide.

Craig Warmke and Troy Cross: As authoritarian regimes expand financial surveillance and roll out central bank digital currencies (CBDCs), many people remain dangerously unaware of their risks to individual liberties. Transactional Freedom, a forthcoming book co-written by philosophers Craig Warmke and Troy Cross, makes the moral and legal case for recognizing a universal and constitutional right to transact. With HRF support, Warmke and Cross will examine financial repression in authoritarian regimes and its impact on human rights, activism, and financial freedom.

Together, these 20 grantees form a diverse coalition of builders, thinkers, and educators working to fortify Bitcoin’s role as a global freedom network. While their methods vary — from protocol research to street-level education — their shared mission is clear: to ensure that financial and informational freedom remain accessible to everyone, everywhere.

This post Human Rights Foundation Grants 1 Billion Satoshis to 20 Freedom Tech Projects Worldwide first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Federal Reserve announces it will stop shrinking it's balance sheet on December 1

pic.twitter.com/1SYilnW1cA

Germany’s second-largest party, AfD, introduced a motion to build a

Germany’s second-largest party, AfD, introduced a motion to build a

French politician Éric Ciotti introduced a bill to adapt “the new monetary order by embracing Bitcoin and crypto.”

French politician Éric Ciotti introduced a bill to adapt “the new monetary order by embracing Bitcoin and crypto.”