Here’s What Happens To The Dogecoin Price After The Consolidation Phase Ends

Dogecoin has spent the past several days locked in a tight decline that has seen it push lower. The meme coin has struggled to break above $0.19, slipping between $0.17 and $0.18 in what could be described as another consolidation phase.

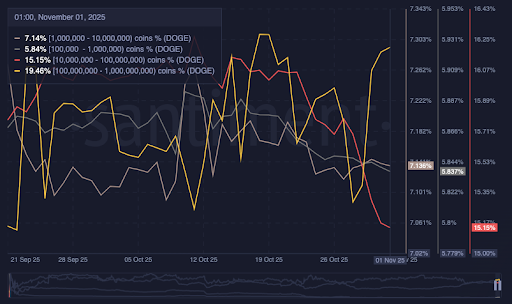

This movement follows a series of attempts to recover losses in October, which failed with a rejection at $0.205. The current chart setup has attracted interest among traders who believe a major rally move is close. A technical analysis posted on the social media platform X highlights what could happen once this slow decline period comes to an end.

Dogecoin Holds Its Ground In A Tight Range

Technical analysis shows that Dogecoin’s price action has been fluctuating within a narrow corridor for weeks, forming a horizontal support zone between $0.17 and $0.19. Each time the price tested the lower boundary, buyers have managed to absorb the selling pressure to prevent a deeper correction. This price action shows accumulation behavior where investors quietly build positions when there’s a lack of bullish momentum. The same pattern appeared in late September and early October when Dogecoin consolidated before briefly spiking to $0.26.

The chart below shows that Dogecoin has been consolidating since October 10, with several attempted short-lived recoveries during this period, but each one stalled below the resistance range. The last week of October was characterized by a further Dogeocin price breakdown that ended at $0.17 before picking up a little steam to $0.18.

Analysts always interpret these movements as signs that buyers are gradually regaining control. The repeated defense of the $0.17 area has become a psychological level that traders are closely watching. If the support continues to hold, it means that Dogecoin is getting ready for another bounce at this level. Some buyers are already positioning early for that outcome. As noted by crypto analyst BitGuru on X, “buyers are showing signs of stepping in again.”

Possible Upside Short-Term Targets Above $0.22

If Dogecoin manages to exit this consolidation zone, the analysis projects a potential rally above $0.20 and into the mid-$0.20s range. This projection, although short-term, aligns with the rally witnessed by Dogecoin in early October.

The scenario is for Dogecoin to break above $0.2 in a swift move and return to its early October level. The price target in this case is around $0.27, and Dogecoin could break out further from here to test psychological resistance at $0.3.

The most important factors for such a move would be a bullish bounce around $0.17 and a confirmed daily close above $0.20, accompanied by rising trading volume. At the time of writing, Dogecoin is trading at $0.1735 and is looking like it is about to retest the $0.17 support.