Bitcoin Remains ‘Fully Bearish’ Until This Price Level Is Reclaimed: Veteran Analyst

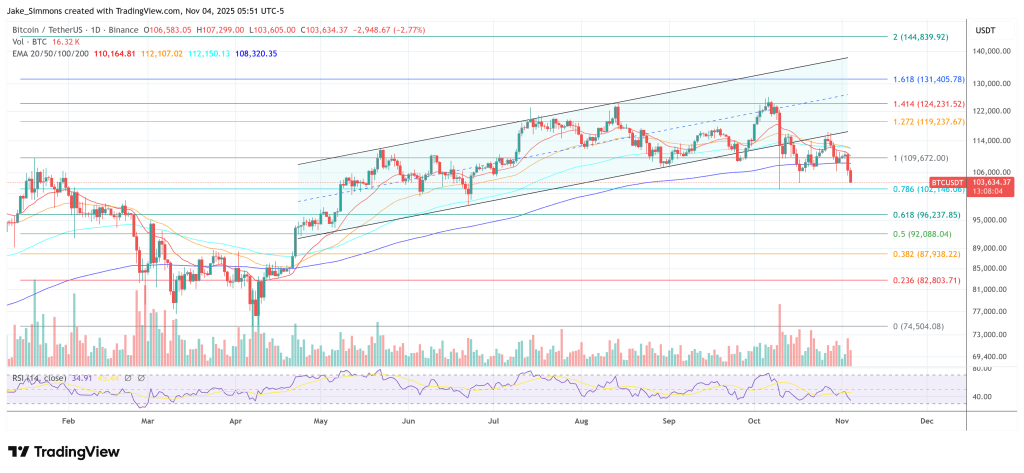

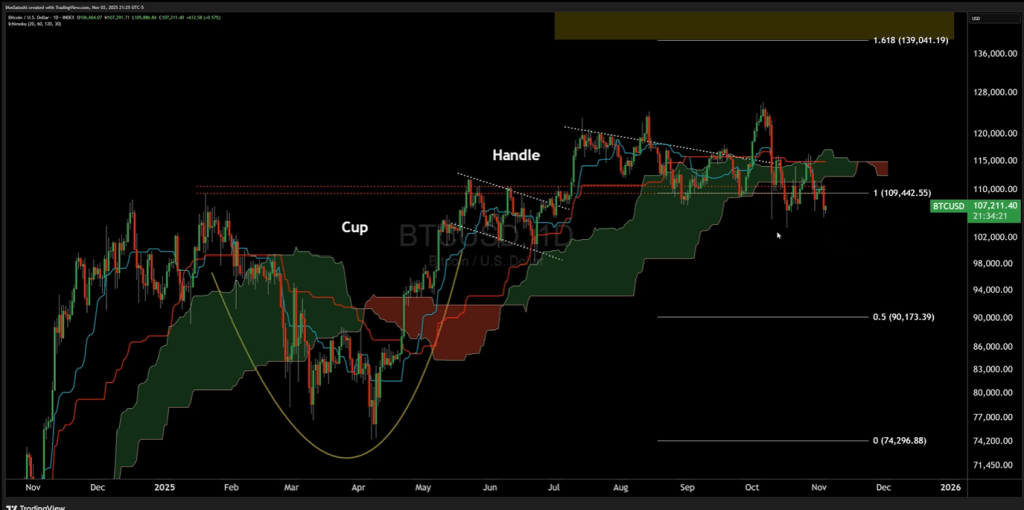

Bitcoin’s technical structure remains decisively negative and will stay that way “until” a key resistance level is reclaimed, according to veteran analyst Josh Olszewicz in his latest video published today. Pointing to the Ichimoku Cloud and a stack of trend signals, Olszewicz said, “Below the cloud we’re bearish, above we’re bullish. We are currently below… [and] fully bearish on price and the expectation is lower lows.”

The fulcrum, in his view, is a reclaim of roughly $115,000. “I don’t really have anything bullish to say here at all until we’re back above $115,000 on BTC and $4,200 on ETH,” he said, adding that Ethereum’s setup is comparatively less negative—trading “in the cloud,” with what he still characterizes as “certainly not a long entry signal.”

For Bitcoin, he flagged a confluence of bearish cues: a bearish Chikou span on the weekly, moving-average crosses to the downside, and head-and-shoulders patterns both at larger and smaller scales. While he acknowledged a possible “falling channel” and even a broader “megaphone” that could complicate pattern reads, Olszewicz underscored directional risk in the near term: “If I were to randomly wake up and see price at $103k, $102k, that would not surprise me here,” even warning that “it’s possible we flirt with… below $100,000.”

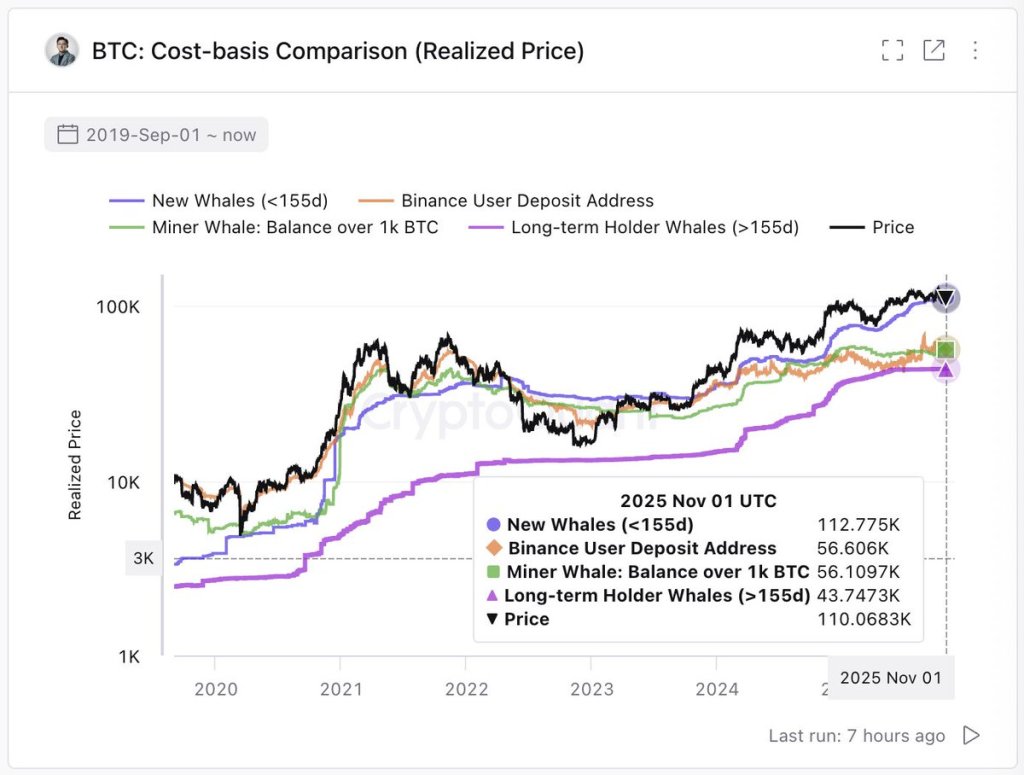

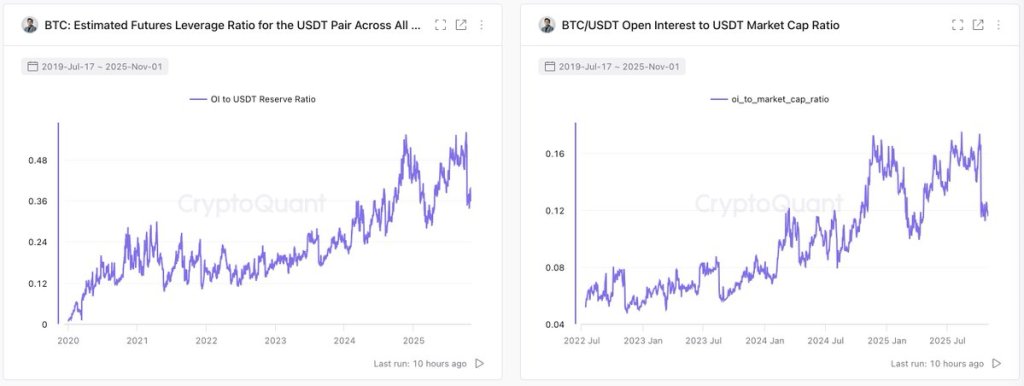

The deterioration in derivatives premia underscores that message, he argued. “If you look at the basis on CME we are making multi-month lows here… you go to ETH [and it’s] also making significant lows. So there’s certainly no froth in this market based on premiums.” Spot flow doesn’t help either: “On BTC we’ve still got people sending hundreds of millions to exchanges seemingly every day… my guess is they are [selling] because you don’t send coins to an exchange for fun.”

Macro Headwinds For Bitcoin

Beyond crypto-native signals, Olszewicz tied the setup to a macro regime shift that has turned unhelpful at the margins. He highlighted a still-ongoing US government shutdown as a potential kink in liquidity transmission—“maybe when the government comes back… the pipes start moving again”—and warned of rising near-term volatility around a data drought: “We do have ADP employment on Wednesday… very, very closely paid attention to because there is a data drought on employment numbers.”

Since last week’s FOMC, he noted, rate-cut odds tightened materially “after Powell mentioned a comment about the fog. Got to slow down on the fog, he says,” with risk assets reacting poorly: “Equities didn’t like that… crypto certainly didn’t like that.”

He also flagged the inflation now-casting mix as a swing factor. “Trueflation [is] ticking higher consistently… you don’t want to be in this position where we are cutting into rising inflation,” he cautioned, while contrasting that with the Fed’s nowcast, which “doesn’t look as dire.”

A CPI headline beginning with a ‘3’ would be problematic in his view: “I suspect if we do get a three handle on headline CPI, markets aren’t going to like that.” Under the hood, he pointed to falling gasoline and used-car prints and easing rents as disinflationary, but called out sticky components like insurance.

Liquidity optics remain mixed: the reverse repo facility has seen periodic end-month spikes yet is “running on fumes,” and, crucially, the long-observed link between global liquidity gauges and BTC “has not reconnected in any regard since May, June, July.”

Dollar strength is an additional pressure point. “The dollar continues to look good, continues to push higher… and this chart looks phenomenal… a real problem” for Bitcoin if that uptrend persists, he said. In classic cross-asset contrast, he described the 60/40 US bonds/equity mix as technically constructive—“above the cloud, bullish TK cross, bullish cloud”—and noted that risk proxies like high-yield credit are diverging from the S&P 500, which he reads as consistent with crypto’s underperformance: “With BTC struggling, you see riskier parts of the market also pulling back to a greater degree than equities.”

Equities Need To Remain Strong

In equities, he argued there is “nothing to short” on the major indices right now—“SPY… looks great,” with the Nasdaq and semis echoing the same message—creating an awkward asymmetry for BTC: “If Bitcoin can’t find its way when the SPY and the Q’s look like this, we’re certainly in trouble because if this does reverse, that’s going to take BTC with it almost certainly.”

On crypto-equity linkages, Olszewicz observed that miners have outperformed for reasons outside of Bitcoin’s fundamentals: “If you look at the Bitcoin miners, those have been bullish. Why? Because of AI and not because of Bitcoin… anybody following that story has done very well this year.” He extended the caution to other high-beta tech themes—quantum names “look very tired… more and more like a head and shoulders”—while acknowledging individual standouts like Palantir, which he said is “breaking out of its own cup and handle,” even if near-term price action was choppy after hours.

The broader market psychology, in his view, is shaped by cycle age and wealth preservation. “A thousand days from the bottom, more and more people are just saying, okay, this is enough… if they’re rich, they want to stay that way… it makes some sense to take a little bit off the table.” Until the technicals change, he sees no reason to force trades: “Honestly, not much, probably just sit around and collect some cash. Wait for those A-plus setups to emerge.”

The trigger for a regime shift is unambiguous in his framework. As he put it at the outset, “Below the cloud we’re bearish… not a bullish expectation.” The condition for flipping that view is equally clear: “Back above $115,000 on BTC and 4,200 on ETH,” or, in this headline terms, reclaim the level—or remain “fully bearish.”

At press time, BTC traded at $103,634.