Gemini cuts workforce, closes international operations

Strategy executives Phong Le and Andrew Kang say the company is on a strong financial footing despite it now being down 17.5% on its Bitcoin holdings.

Bitcoin fell below 63,000 as investors reacted to dismal US economic data, a weakening stock market and fears of an AI industry bubble. Does data forecast a return to $90,000 by March?

European tokenization companies urged EU lawmakers to quickly amend the DLT Pilot Regime, warning that current limits risk pushing onchain markets to the US.

Gemini, a US-based cryptocurrency exchange founded in 2015, will focus on growth in the United States due to its deep capital markets.

Bitcoin touched new lows under $64,000 as market selling reached a historic level, and analysts warn that the bottom is not in. Does data support analysts’ sub-$60,000 prediction?

The investment extends an existing partnership with Anchorage and comes as the federally regulated crypto bank explores a major capital raise ahead of a potential IPO.

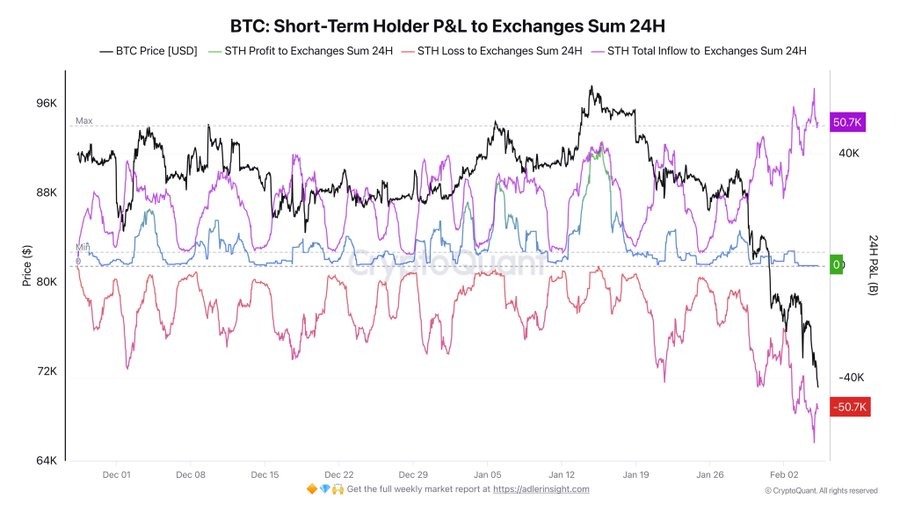

Panic selling by short-term holders, extreme fear, and oversold RSI suggested that BTC could be nearing the final phase of capitulation.

Aster rebranded to become a crypto perpetual futures decentralized exchange in 2025, as perp DEX trading volume surged by trillions of dollars.

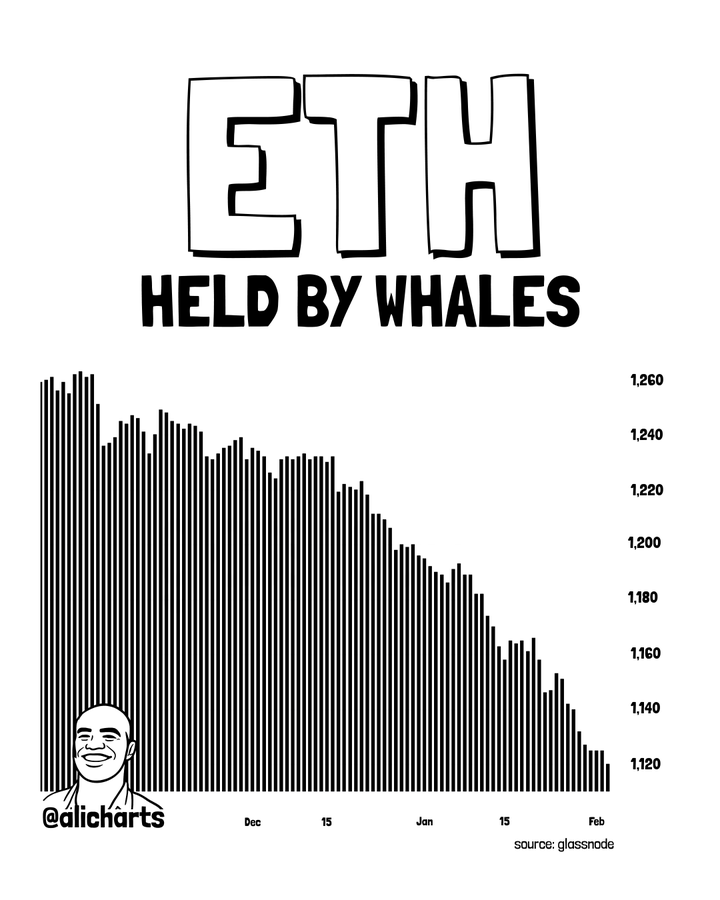

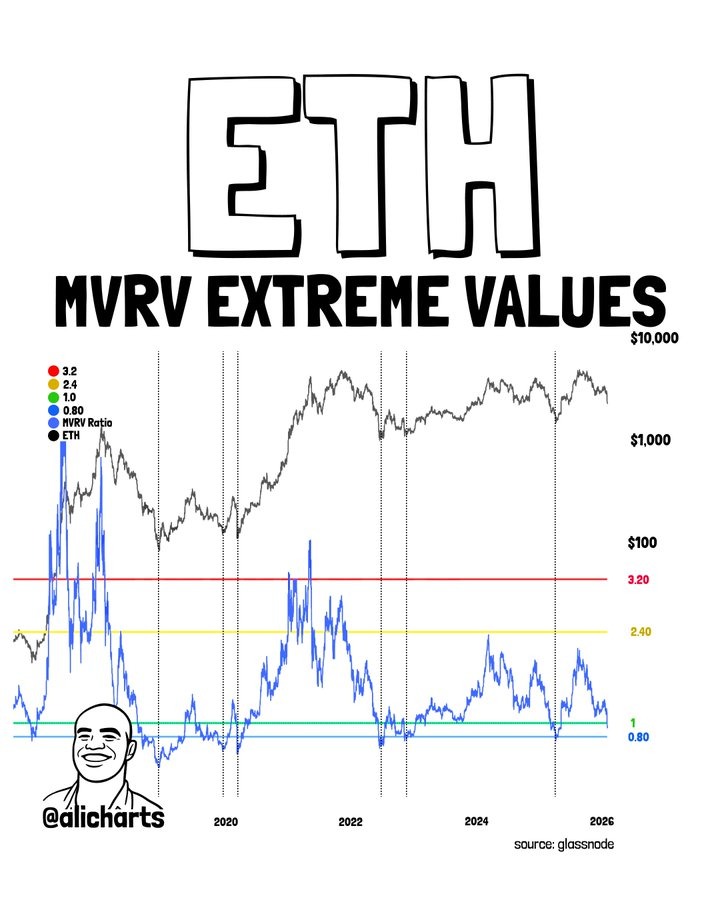

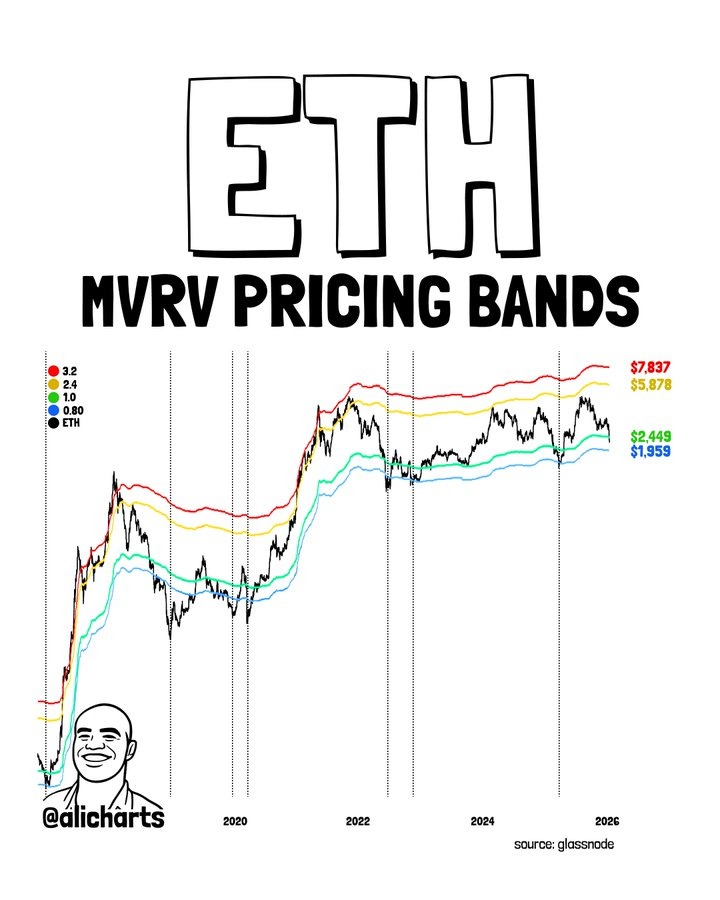

Ether is testing holder conviction with its price dip, with data showing continued selling by smaller holders and steady accumulation by larger investors.

Polymarket will migrate from bridged USDC on Polygon to Circle-issued native USDC, reducing reliance on cross-chain bridges as prediction markets expand.

The post Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises appeared first on Coinpedia Fintech News

Recently, the shift toward a “risk-off” sentiment is largely driven by a more hawkish U.S. Federal Reserve, with the potential for higher-for-longer interest rates strengthening the U.S. Dollar. As a result, the dollar gains strength from $95.56 to $97.80 when writing. Since DXY rose, capital has typically exited speculative assets like Bitcoin and Ethereum and that’s why liquidations has increased in February, as at times like these markets favor safer, yield-bearing government bonds. That’s why TOTAL, which represents the entire crypto market cap, took a deeper hit this time, falling to $2.28 trillion.

Whereas TOTAL is at risk if DXY continues to pump around 10%-11%, which could push it to $110 by July 2026, it could harm TOTAL badly, pushing it down 33% to around $1.5 trillion. This event is at higher odds because DXY is supported by the most reliable support, a 200-month EMA, and a decline in the crypto market seems to be intensifying.

In February, the decline intensified as global liquidity tightened significantly amid disappointing economic data from major markets, leading to a broader sell-off in the technology sector. Since cryptocurrencies remain highly correlated with tech stocks, the Nasdaq’s February decline triggered a massive wave of liquidations across the crypto market, a trend that could worsen over time.

Geopolitical tensions and regulatory uncertainty have further spooked institutional investors, causing a sharp reversal in Spot ETF inflows. This lack of institutional support, combined with a breach of key technical support levels, has created a “perfect storm” that forced the entire sector into a deep correction.

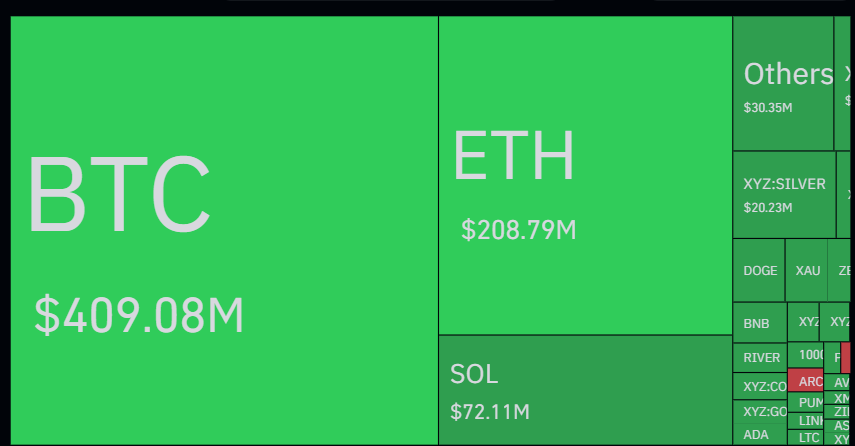

According to CoinGlass data, over the past 24 hours, 302,435 traders were liquidated, totaling $1.43 billion in liquidations. Across 7 exchanges, data shows over $100 million in liquidations; Bybit saw the most, at $338.54 million, and Hyperliquid was second, at $335.78 million.

The latest liquidations data show that top blue-chip coins were hit the hardest.

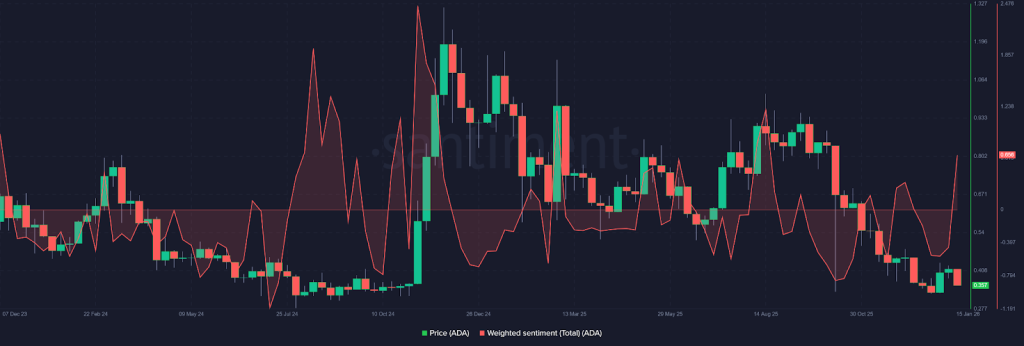

The top 3 cryptocurrencies with the most liquidations were BTC ($736 million), ETH ($337 million), and SOL ($77 million). And the weighted sentiment for this trio has fallen sharply, and most people are talking negatively about these assets.

The post XRP Price Prediction For February 6 appeared first on Coinpedia Fintech News

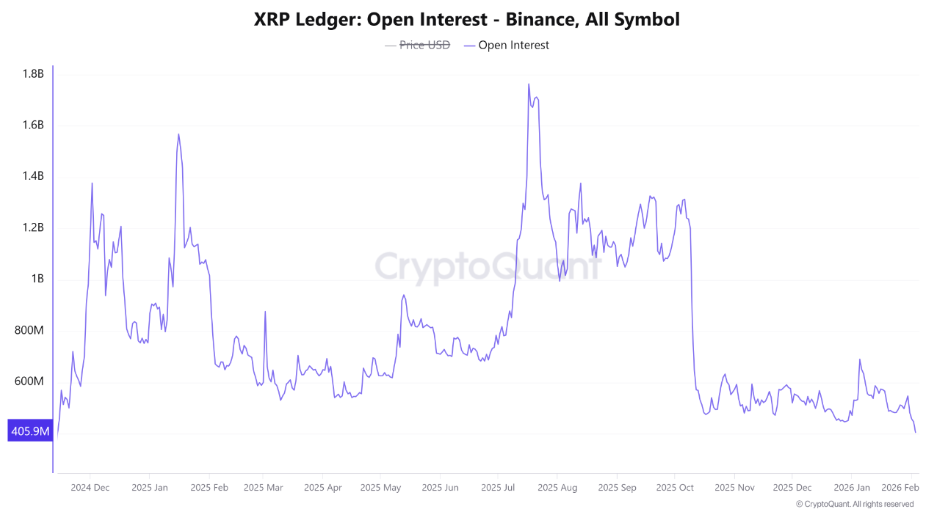

The price of XRP continued to move lower this week, extending its corrective phase after breaking below a consolidation pattern and reflecting broader weakness across the cryptocurrency market.

XRP has fallen about 12% in a short period, with chart-based projections placing the next important price region between $1.36 and $1.21, where the decline could begin to slow if buying demand strengthens.

The latest downward move accelerated after XRP dropped below a triangular consolidation pattern that had held prices steady for several sessions. Once the lower boundary of that range was breached, selling intensified and prices moved rapidly toward lower technical projections.

Analysts describe the current move as part of a broader corrective cycle within the longer-term trend, in which a rapid final phase of selling typically follows the completion of earlier consolidation waves.

Technical projections based on earlier price swings place potential stabilization zones near $1.36, $1.29, and $1.21. The $1.21 area corresponds roughly to a 50% retracement of the previous upward rally, a region where declines often begin to slow as longer-term investors re-enter the market.

If prices fall below that band, the correction could extend toward lower historical trading ranges, with some analysts pointing to significantly lower retracement zones as alternative scenarios depending on overall crypto market sentiment.

For a sustained recovery to develop, XRP would need to move back above approximately $1.64, which marked the upper boundary of the earlier consolidation zone. A move above that level would indicate that downward momentum is easing and that a more stable price base is forming.

The current XRP decline has taken place alongside a wider digital-asset downturn, in which Bitcoin, Ethereum and other major cryptocurrencies have also experienced steep losses.

Analysts say XRP’s direction in the near term is likely to remain closely linked to the broader crypto market environment, including institutional flows, leverage reductions and overall investor sentiment.

Until a clear reversal develops, XRP is expected to remain within a corrective phase characterized by sharp short-term fluctuations and gradual attempts to stabilize near major retracement regions.

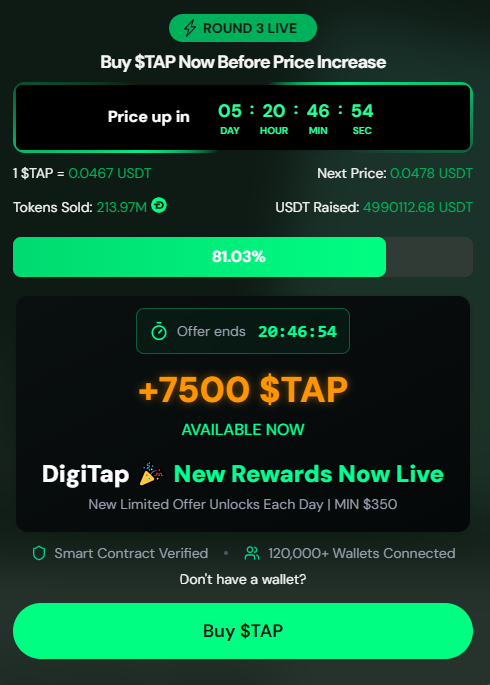

The post Uniswap Struggles at $3.93: Why Digitap ($TAP) is the Best Crypto to Buy in a Crash appeared first on Coinpedia Fintech News

Uniswap (UNI), one of the top blockchain projects in the decentralized exchange sector, has lost all momentum over the past few months. UNI briefly challenged the $6.5 level in late 2025, but it has since collapsed to $3.9 and is struggling to find support around that level.

Large-cap tokens have failed to regain momentum in this bearish cycle, while emerging utility tokens with superior economic moats are gaining massive traction as the next winners.

On the cross-border banking front, Digitap ($TAP) has emerged as a leader by introducing the world’s first omnibank platform that connects currency and crypto in a single app. Because of its first-mover advantage and a massive total addressable market of billions of users, Digitap is now ranked as the best crypto to buy in a crash.

During the recent market crash, Uniswap struggled to break below the multi-year support level of $4.5-$5. This support zone was significant, as it protected the downside in many cycles. Amid bearish market conditions, the breakdown of this support level has opened the door to further downside, removing Uniswap from the list of the best cryptos to buy in a crash.

This bearish outlook has been further reinforced by derivative traders, who are increasing bets on short leveraged positions.

As of press time, Uniswap was trading at around $3.90, down about 18% over the past seven days. Historical price action data show that if UNI fails to reclaim and sustain above the $4.5 support, the current decline could extend by $3, representing another 22% loss from current levels.

Persistent underperformance in Uniswap’s price has prompted investors to seek top altcoins to buy to recoup losses during short-term upswings.

Digitap has attracted attention despite weak market conditions because it’s the world’s first omnibank platform with the potential to disrupt the crypto banking sector. It operates on multi-rail infrastructure and already has a working product. While many projects are still building promises, Digitap delivers tools people can use today, positioning it as the best crypto to buy in a crash.

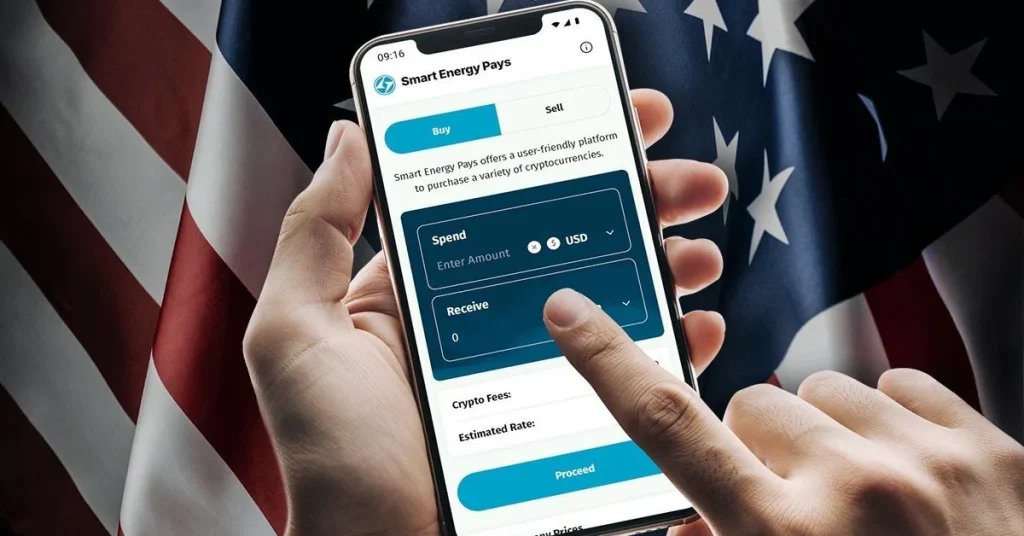

The Digitap app is live on both iOS and Android. It allows users to manage traditional money and digital assets in one place. From everyday banking to saving, investing, and spending, users can handle multiple fiat currencies alongside more than 100 cryptocurrencies without switching platforms.

By blending crypto speed with traditional banking access, Digitap enables cross-border money transfers at fees below 1%. This approach opens the door to the global remittance market, a trillion-dollar industry that still relies on slow and expensive systems. Being early in this space gives Digitap a strong advantage as demand for cheaper international transfers continues to rise.

The platform recently expanded its capabilities by enabling Solana deposits directly inside the app. Users can now add SOL and USDT via the Solana network, enabling faster transactions and lower fees. This update directly addressed community requests for speed, highlighting Digitap’s focus on practical improvements.

While Uniswap continues to move sideways around $3.93, crypto presales like Digitap are gaining investors’ attention. When popular projects lose momentum, capital often shifts toward newer ideas with clearer growth potential.

USE THE CODE “BIGWALLET35” FOR 35% OFF $TAP TOKENS. LIMITED OFFER

For investors scanning the market for the best crypto buy in this crash, Digitap stands out among presale projects. Early entries often carry a higher risk but also offer the greatest upside. With $TAP priced at $0.0467, it offers a ground-floor entry into a project that could easily reach $1 if adoption accelerates.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

![[Live] Crypto Market News Today: Latest Updates on December 9, 2025](https://image.coinpedia.org/wp-content/uploads/2025/12/09165111/Live-Crypto-Market-News-Today-Latest-Updates-on-December-9-2025-1024x536.webp)

The post Bitcoin And Altcoins Recovery Coming Soon, Says Bitwise CIO appeared first on Coinpedia Fintech News

Despite the recent volatility in digital asset markets, Matt Hougan, chief investment officer at Bitwise Asset Management, says the broader crypto sector may already be emerging from a bear-market phase, with institutional demand and improving fundamentals likely to drive the next cycle.

Hougan argued that much of the crypto market experienced a significant downturn earlier, even if major assets appeared relatively resilient.

“We had a full-blown bear market last year. We didn’t experience it because Bitcoin, ETH, and XRP did okay — they had institutional flows from ETFs and corporations,” he said.

Assets without institutional backing, he noted, fell sharply, with some large cryptocurrencies declining 50%–60%, resembling conditions seen during previous bear cycles such as 2018 and 2022.

According to Hougan, the market may already be moving into a recovery phase.

“We ran the four-year cycle last year. We’re already at the bottom. I think we’re coming back up.”

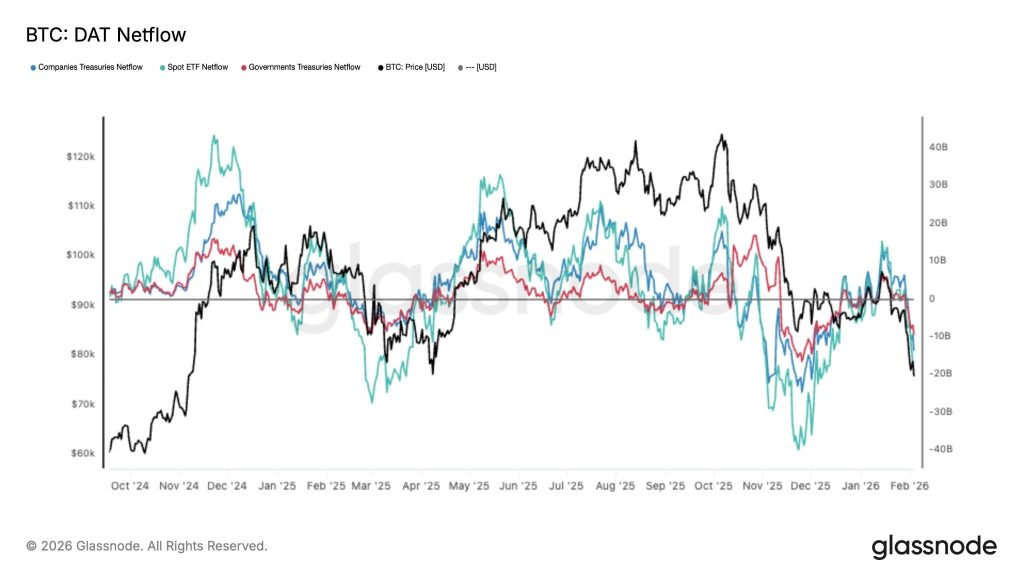

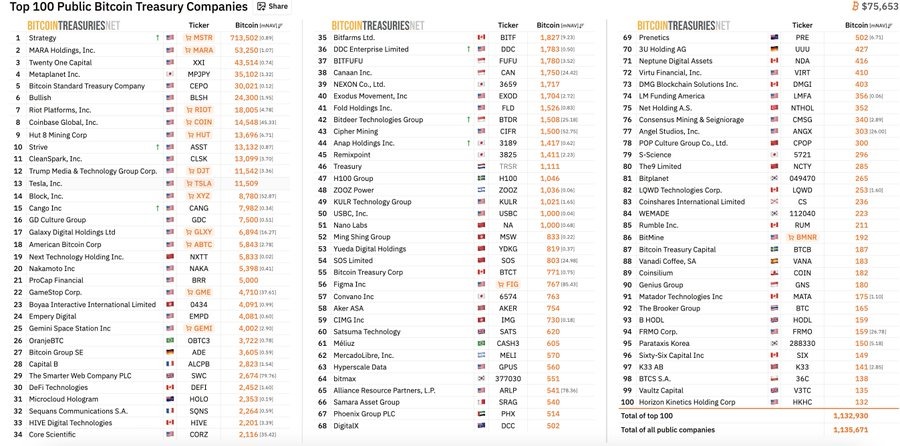

Hougan said the introduction of Bitcoin exchange-traded funds in early 2024 created a structural shift in demand. ETF purchases, corporate accumulation and other institutional buying have, at times, exceeded the amount of new Bitcoin entering circulation.

“If you look at ETF purchases or corporate purchases, it’s vastly more than the amount of new Bitcoin being produced,” he said.

He compared the situation to the gold market, where sustained central-bank buying initially stabilized prices before eventually driving a stronger rally once selling pressure from existing holders declined.

“Just like gold eventually entered a parabolic move, Bitcoin will follow suit. We’re just earlier in that process.”

Hougan said the next phase of the crypto market is unlikely to resemble past “everything rallies” altcoin cycles. Instead, investors are becoming more selective, rewarding projects with real adoption and strong fundamentals.

“We’re not going to have a classic alt season where every zombie coin rises,” he said. “People are going to distinguish between high-quality projects and low-quality projects.”

He pointed to networks with strong activity in areas such as stablecoins, tokenization and decentralized infrastructure as potential leaders in the next cycle, while weaker projects could struggle to attract capital.

Hougan also highlighted a broader shift occurring within the market: early investors and long-term holders are gradually selling portions of their holdings, while institutional investors increasingly replace them as the dominant buyers.

This transition, he said, is typical of maturing asset classes and does not necessarily signal weakening demand.

“We’re working through that sale wall… but we’re going to get through it,” he said, adding that the long-term trend of increasing institutional participation remains intact.

While timing remains uncertain, Hougan said the combination of structural demand, improving infrastructure and investor selectivity could support the next stage of growth in digital assets, with stronger projects leading the recovery rather than the entire market moving in unison.

The post Top Crypto Investment Opportunity for $1,000 in 2026: Analysts Weigh In appeared first on Coinpedia Fintech News

By 2026, the focus of the market is shifting away from the slow-moving leaders of the past decade. As investors look for the next big crypto breakout, attention is increasingly turning to newer protocols rather than only established coins. A quiet change is taking place as projects that address real challenges in crypto lending begin to stand out.

Many analysts believe that the strongest upside in this cycle may come from assets that are still early in their growth and adoption. While much of the attention remains on older tokens, new crypto infrastructure is being developed that could reshape how digital finance works.

Mutuum Finance (MUTM) is a decentralized protocol focused on crypto lending and borrowing. The project is developing a non-custodial system that allows users to access liquidity while maintaining ownership of their digital assets, with all activity designed to run through smart contracts rather than intermediaries.

The protocol has already reached notable funding milestones, raising over $20.4 million from a global community of more than 19,000 token holders, reflecting growing interest as development continues.

Participation is currently managed through a structured presale that is moving through its final stages. The project is currently in Phase 7, where the price of the MUTM token is set at $0.04. This follows a growth path that started at just $0.01 in early 2025, representing a 300% surge so far.

With the official launch price confirmed at $0.06, investors entering at the current rate are securing a 50% increase in value before the token even hits public exchanges. The total supply is fixed at 4 billion tokens, with 45.5% (1.82 billion) specifically allocated for the community during these presale stages.

The biggest catalyst for the recent growth is the official activation of the V1 protocol on the Sepolia testnet. This move has proved that the code is functional. Users can now test core features such as liquidity pools and automated borrowing flows. A key component of this system is the mtToken.

When you supply assets like ETH or USDT to the protocol, you receive mtTokens that act as interest-bearing receipts. These tokens automatically grow in value as borrowers pay interest back into the system. This allows lenders to earn a passive yield without having to manage their positions actively.

To support the long-term price of the token, the protocol’s whitepaper uses a buy-and-distribute model. A portion of the fees generated from lending activity is used to purchase MUTM tokens on the open market. These tokens are then distributed to participants who stake their mtTokens in the safety module.

This creates consistent buying pressure and aligns the token’s value with the actual usage of the platform. Because of these strong utility mechanics, many analysts are highly optimistic. Current predictions suggest that the token could see a 600% to 1,000% increase within the first few months of its mainnet release, with some experts eyeing a move toward the $0.30 to $0.45 range.

In the world of DeFi, security is the most important factor for success. Mutuum Finance has prioritized safety by completing a full independent audit with Halborn Security. This firm is known for testing some of the most complex architectures in the blockchain world.

Additionally, the project holds a high 90/100 score from CertiK, verifying that its smart contracts are built to institutional standards. The team also maintains a $50,000 bug bounty to reward security researchers for finding and reporting any potential vulnerabilities.

To keep the community engaged during these final stages, the project features a 24-hour leaderboard. Every day, the top daily contributor is rewarded with a $500 bonus in MUTM tokens. This transparent system ensures that the most active supporters are rewarded while the project maintains its steady momentum.

With over 840 million tokens already sold and the V1 testnet live, the window to access Phase 7 prices is closing quickly. As the project prepares for its full public debut, the combination of technical milestones and community backing has positioned MUTM as a top crypto opportunity for the 2026 cycle.

For more information about Mutuum Finance (MUTM) visit the links below:

Website:https://www.mutuum.com

Linktree:https://linktr.ee/mutuumfinance

The post Bitcoin Price Survival Test: Is a $53K Revisit Inevitable? appeared first on Coinpedia Fintech News

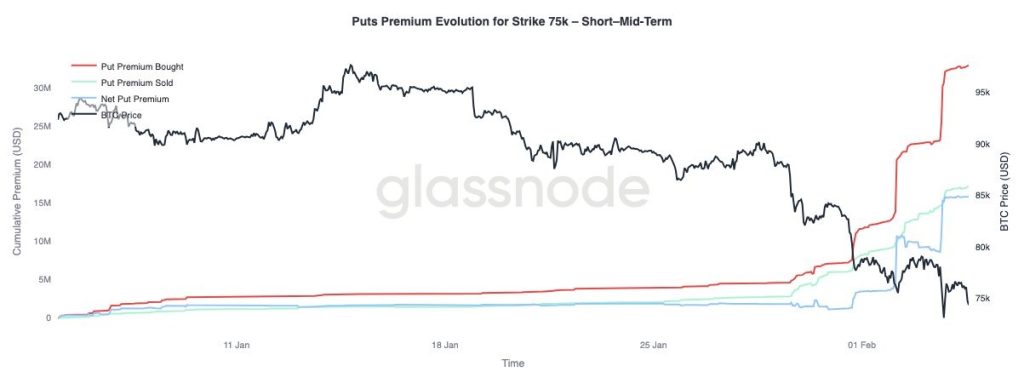

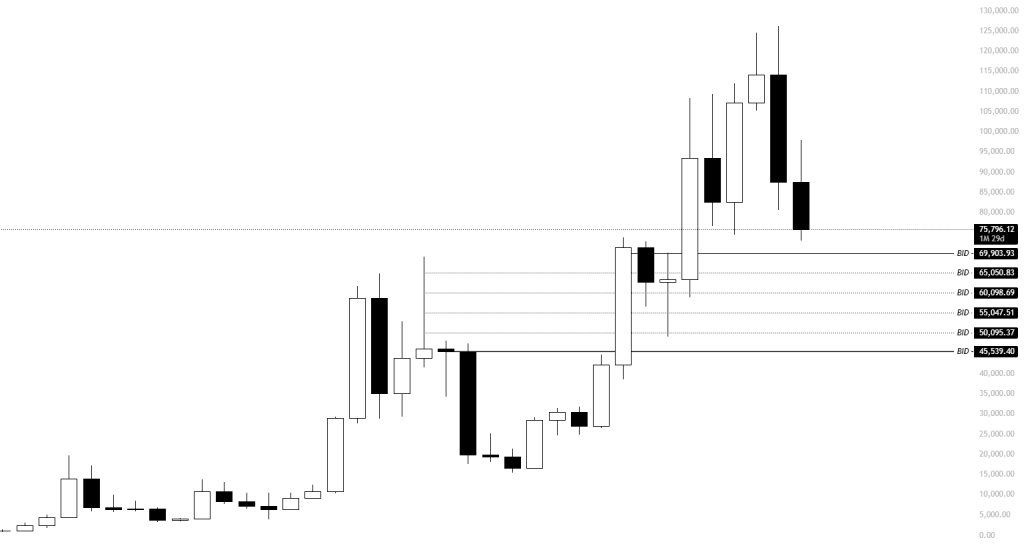

The breakdown of the ascending wedge in Bitcoin price chart and the dip below the psychological $70,000 level have shifted the immediate market bias to bearish. With spot BTC ETFs experiencing massive net outflows in recent weeks the institutional “shield” that protected higher price levels is currently under pressure.

Currently, Bitcoin crypto’s adjusted Net Unrealized Profit/Loss (NUPL) stands at approximately 26–29%, down from its January highs. This is not yet in the “capitulation” zone seen in 2022, but it is trending toward the neutral territory last seen during the September 2023 reset.

Now, BTC is inching towards $65K support now a failure to reclaim the $65,000 support level would likely trigger further liquidations toward the $53,000 to $56,000 range, which aligns with the realized price (average cost basis) of the network. While the $41,000 level remains a theoretical target on the macro chart, the presence of institutional demand at lower levels and a recent shift in whale behavior suggest a “hard floor” may form much higher.

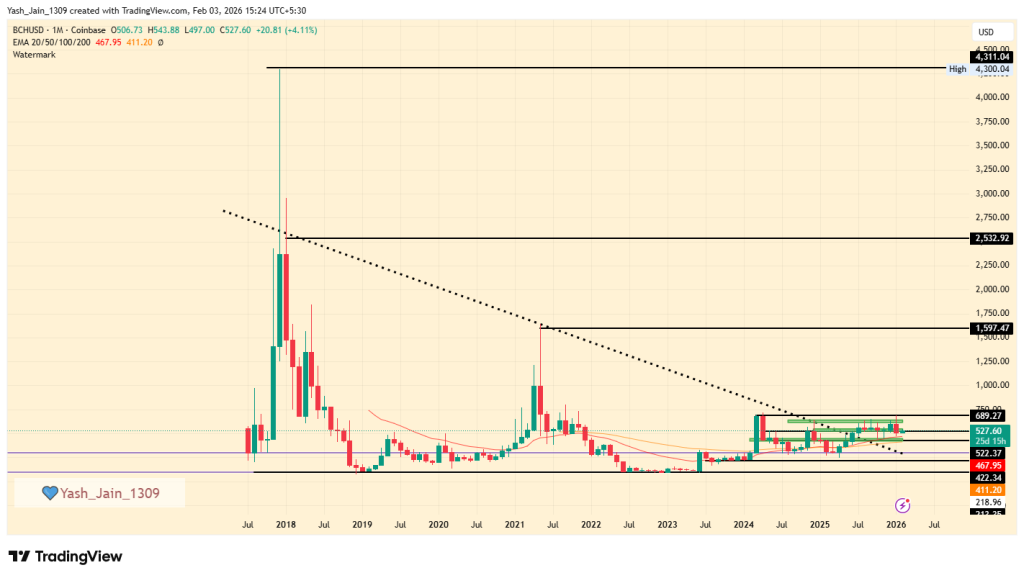

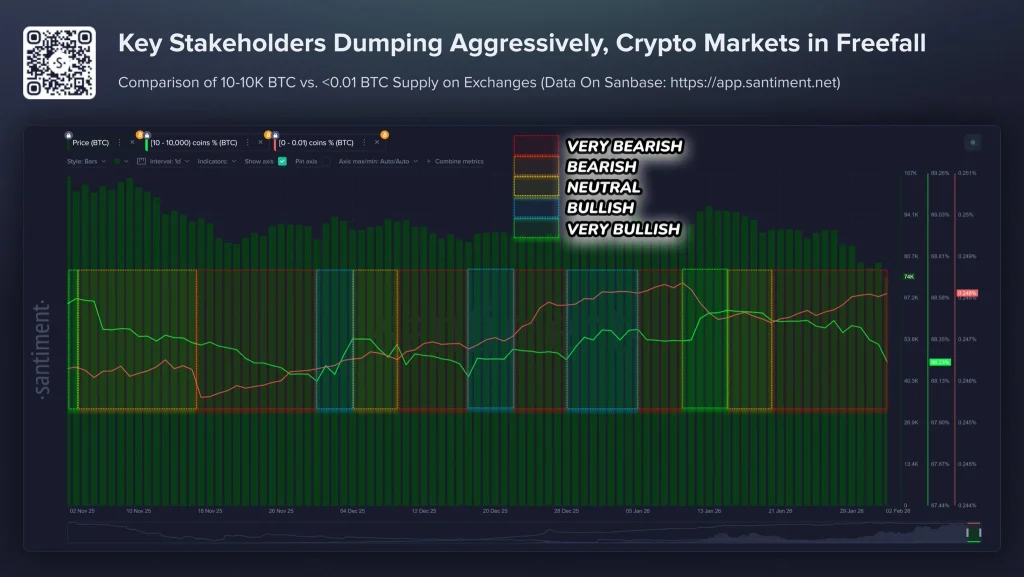

The supply distribution data reveals a fascinating “changing of the guard” among Bitcoin’s largest holders over the last 48 hours:

Addresses holding 10,000 to 100,000 BTC have been significant sellers, contributing to the recent break below $70,000.

Conversely, the 1,000 to 10,000 BTC cohort, which had been in a decline, has begun aggressive accumulation in the last 48 hours. This suggests that while some “mega-whales” are taking profits, institutional-sized “smart money” is actively buying the dip.

Despite the headline-grabbing outflows, the total net assets in U.S. spot Bitcoin ETFs remain substantial at over $93.5 billion, indicating that many long-term institutional holders are not panicking.

Bitcoin price analysis highlights the importance of a critical support zone. This suggests that If Bitcoin price fails to hold the $65,000 mark, the next major demand floor sits at $53,000–$56,000, which represents the network’s current realized price.

Whale Sentiment Divergence: Mega-whales are offloading supply, but mid-tier institutional whales (1k–10k BTC) are aggressively accumulating, creating a potential bottoming structure.

Volatility Warning: With record-high leverage usage and declining open interest, the market is primed for violent price swings; a return to $78,000 is required to invalidate the current bearish trend.

Bitcoin risks a deeper slide as miners and US spot ETFs cut BTC exposure, adding supply pressure during a fragile downtrend.

The new facility allows institutions to redeem tokenized real-world assets into stablecoins instantly, addressing a key liquidity bottleneck in onchain markets.

A $1 million Lightning transfer between SDM and Kraken was used to test whether Bitcoin’s main scaling layer could handle seven‑figure, institutional‑grade payments.

House Democrats probe $500 million UAE investment in Trump-linked WLFI, highlighting questions over dealings with the country's national security adviser.

The post Why are Bitcoin, Ethereum and XRP Prices Crashing Hard Today? appeared first on Coinpedia Fintech News

Cryptocurrency markets extended their sharp decline on Thursday, with Bitcoin, Ethereum and XRP dropping to multi-month lows as institutional selling, heavy liquidations and weak market sentiment combined to push prices lower.

Bitcoin fell below $69,000, slipping under its previous 2021 all-time high, while Ethereum dropped below $2,000 for the first time since May 2025. XRP also recorded steep weekly losses as selling spread across major altcoins.

The total crypto market capitalization declined to roughly $2.3 trillion, down more than 7% in 24 hours.

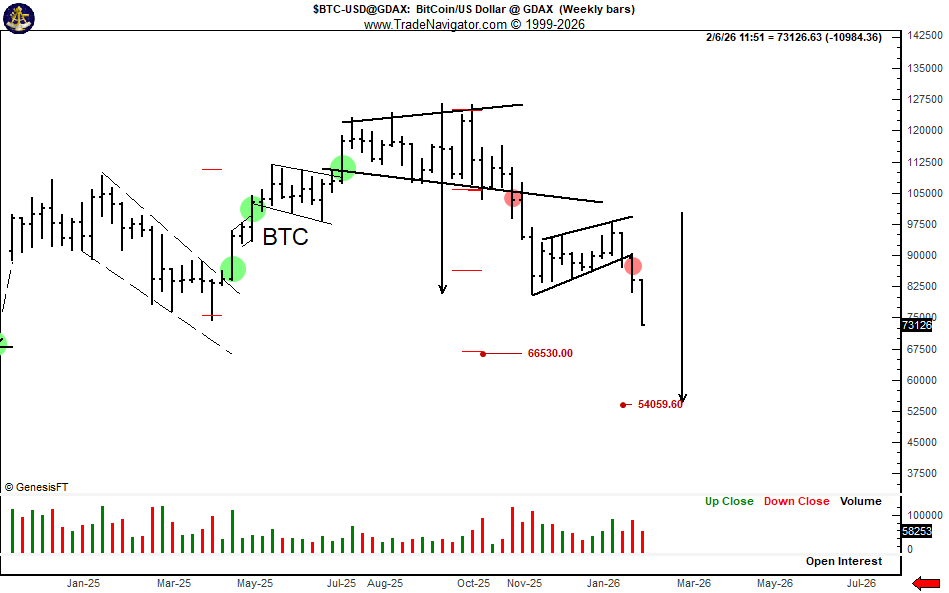

Bitcoin has now fallen roughly 45% from its recent peak near $126,000, marking one of the fastest multi-month corrections of the current cycle. Over the past 120 days, the cryptocurrency has dropped by more than $56,000, averaging a decline of roughly $14,000 per month.

— Bull Theory (@BullTheoryio) February 5, 2026

BREAKING: Bitcoin just dropped below its 2021 all time high of $69,000

while ETH fell below $2,000 for the first time since May 2025.

Crypto market is in free fall. pic.twitter.com/E7KPMUUKkw

Market analysts say the fall below the $69,000 level is psychologically significant because it represents a loss of a major long-term support zone that had held since the previous bull cycle.

The sell-off has been driven largely by institutional flows rather than retail activity. Analysts pointed to large deposits of Bitcoin onto major exchanges and continued outflows from U.S. spot Bitcoin exchange-traded funds, which together increased available supply in the market.

Some blockchain tracking services reported that several large trading firms and exchanges collectively moved billions of dollars worth of Bitcoin during low-liquidity trading hours, accelerating the downward move.

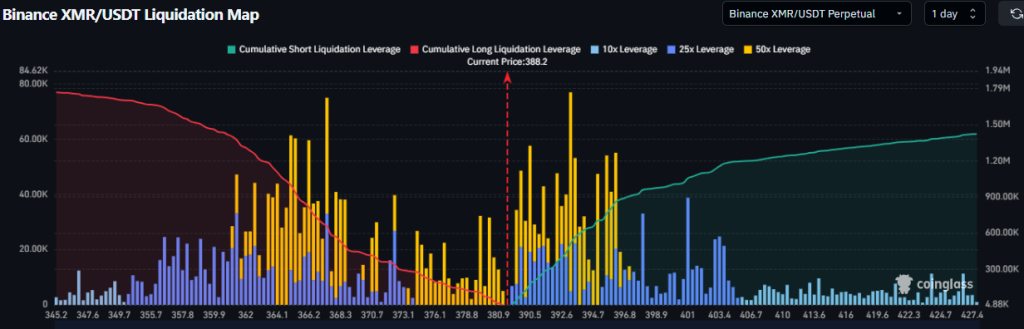

The decline triggered a wave of forced liquidations across leveraged trading positions. More than $1.3 billion in crypto positions were liquidated in 24 hours, including hundreds of millions of dollars in Bitcoin long positions.

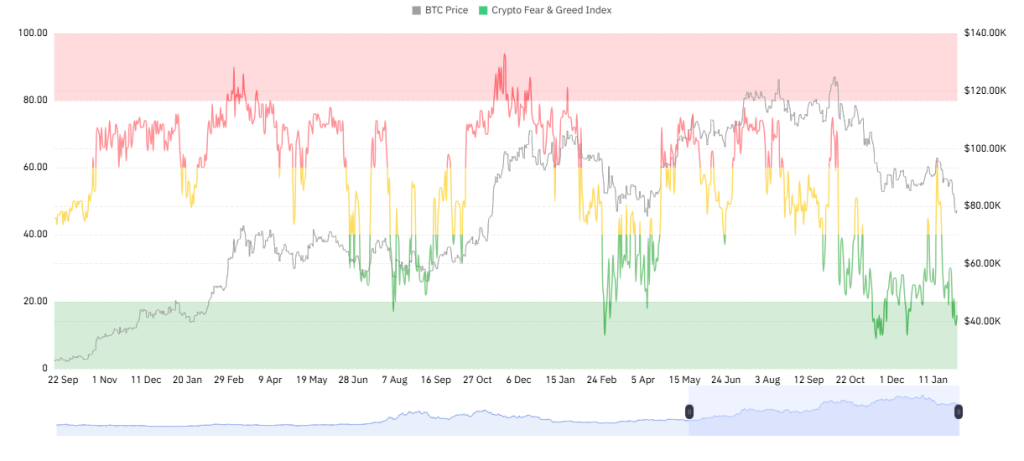

Market sentiment indicators reflected the stress, with the Fear and Greed Index dropping to “extreme fear” territory while momentum indicators signaled heavily oversold conditions.

Ethereum fell sharply during the week, losing more than 25%, while XRP also posted double-digit declines as traders reduced exposure to higher-risk altcoins during the downturn.

Historically, altcoins tend to fall faster than Bitcoin during risk-off phases because of thinner liquidity and higher speculative positioning.

There is also rising correlation between crypto markets and traditional financial assets, including equities and gold, suggesting the sell-off may be partly driven by broader macro positioning rather than crypto-specific news.

The lack of a single major negative headline has led some analysts to describe the downturn as a liquidity-driven reset, where institutional positioning, leverage unwinding and weak sentiment collectively pushed prices lower.

Technical analysts say the near-term outlook depends on whether Bitcoin can hold the $66,000 support zone. Holding above this level could trigger a short-term relief rally as oversold conditions attract buyers, while a decisive break lower could open the path toward the $62,000–$60,000 range.

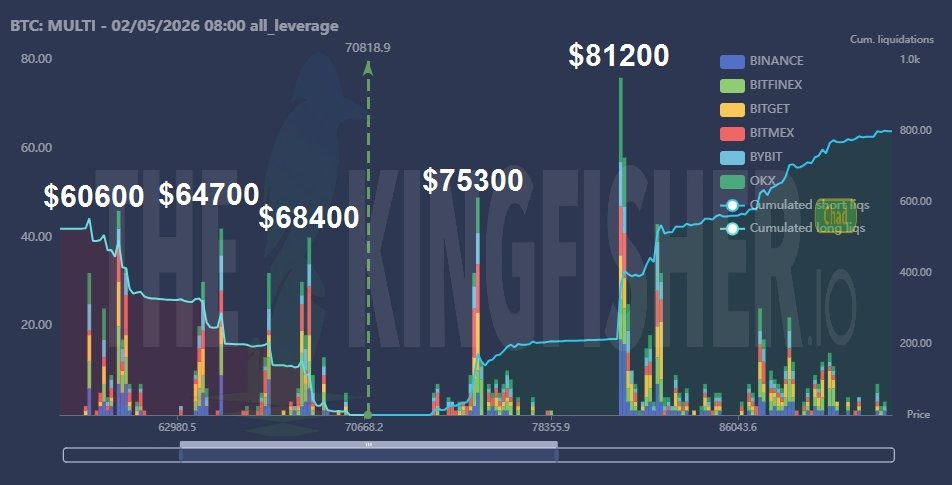

The post Bitcoin Price Prediction: After Losing $81K and $75.3K, is BTC Plunging Below $60,000? appeared first on Coinpedia Fintech News

Bitcoin price has officially erased all the gains incurred in the past couple of years, specifically after Donald Trump was elected as the president of the US. The current trade dynamics and the market structure suggest Bitcoin bears may still be in control, highlighting the possibility of a deeper correction in the coming days.

The BTC price has come under pressure after losing key support zones between $75,000 and $81,000, shifting the short-term market structure in favour of the bears. With the momentum fading and volatility picking up, the attention has now shifted to the next major support and resistance zones.

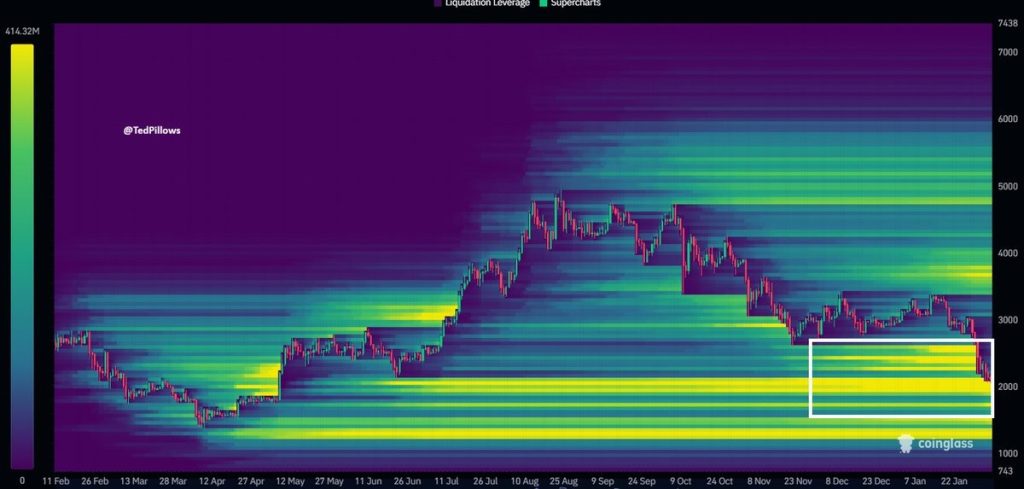

Bitcoin’s recent price action looks less like a clean trend and more like a liquidity-driven move. On the all-leverage liquidation map, the largest clusters of open positions sit below the current price, which makes downside moves easier to trigger.

The biggest liquidity pools are stacked around $81,200, $75,300, $68,400, $64,700, and $60,600. Each time BTC loses a support level, the price drifts toward the next pocket where leveraged long positions are concentrated. Those levels act like magnets, as forced liquidations add momentum to the downside.

This also explains why the rebounds have struggled to hold. Without steady spot buying to absorb sell pressure, prices continue to sweep lower liquidity zones. Until that changes, volatility is likely to stay high, and risk remains tilted toward further downside moves.

In the long-term, the Bitcoin price broke down from the rising wedge in mid-Q4 2024. This was believed to be a correction that could rebound as the price was accumulating within an ascending trend. However, a rejection of $90,000 has pushed the BTC price into a strong bearish trap. Currently, the support at $74,500 is also broken, which suggests the BTC bears are still in control.

On the price side, Bitcoin has clearly been rejected from the upper supply zone near the $100K–$120K region, confirming strong selling pressure at higher levels. The sell-off has now pushed BTC into a well-defined weekly demand zone around $60K–$65K, an area where buyers have historically stepped in.

RSI adds an important layer here. The weekly RSI has dropped toward the lower end of its range, nearing oversold territory compared to prior cycles. This suggests that while momentum is still weak, selling pressure is starting to look stretched. In past instances, similar RSI conditions inside major demand zones have often preceded either a relief bounce or a period of consolidation rather than an immediate continuation lower.

Put together, the indicators suggest Bitcoin is at a critical turning point: holding this demand zone with stabilizing RSI could trigger a short-term rebound or sideways base, while a breakdown, especially with RSI slipping further, would point to deeper downside risk in the weeks ahead.

Bitcoin has now entered a demand zone just below $70,000, where the buyers have previously stepped in. The weekly RSI has dropped to the lower threshold below the lower threshold for the first time since November 2022, followed by a strong rebound backed by volume. But the volume has drained now, indicating a massive drop in the trader’s participation. In such a scenario, the BTC price is feared to drop below $60,000 before the end of the week.

The post Worst-Case Bitcoin Price Could Be $35,000, Warns Veteran Analyst appeared first on Coinpedia Fintech News

Veteran market analyst Gareth Soloway has outlined several possible paths for Bitcoin’s price, including a worst-case scenario that could see the cryptocurrency fall sharply if global financial markets face a major downturn.

In a recent market update, Soloway said Bitcoin is currently holding an important price area and has shown more resilience than U.S. stock markets, which he expects to remain under pressure in the months ahead.

He added that while equities may continue to struggle, some capital could rotate into Bitcoin, helping limit further downside in the near term.

Soloway said that Bitcoin recently moved lower but managed to close back above important chart levels. This behavior, he said, suggests buyers are still active at current prices.

The area around $73,000–$74,000 has acted as a strong zone of interest, as it previously marked a major breakout point. Bitcoin also reacted sharply near $73,000, bouncing almost precisely from that level.

Because of this, Soloway says Bitcoin could see a short-term bounce, even if broader market risks remain.

If Bitcoin rebounds, Soloway expects selling pressure to emerge around the $85,000 to $86,000 range. This zone previously acted as support before breaking down and is now likely to limit upside in the short run.

He stressed that any rebound into this area would not necessarily signal the start of a new bull market and could be followed by renewed weakness.

Looking further ahead, Soloway outlined his base scenario, which assumes a typical market correction rather than a severe financial crisis.

Drawing on past Bitcoin cycles, he noted that during previous downturns Bitcoin often fell roughly 20% below the prior cycle’s all-time high. Applying that pattern to the 2021 peak near $69,000 suggests a possible move toward the $55,000 region.

He said this area aligns with historical trading activity and could act as a longer-term floor if market conditions remain relatively orderly.

Soloway added that he would look to accumulate Bitcoin gradually if prices move into the $55,000–$65,000 range.

Soloway said a much deeper drop would likely require a sharp collapse in global equity markets, potentially involving losses of 30% to 50%.

In such a case, Bitcoin’s chart has formed a large head-and-shoulders pattern, a bearish structure that can signal deeper declines. If fully played out, this pattern points to a potential fall toward $34,000 to $35,000.

He warned that this scenario is not his central expectation and would only occur under extreme market stress.

The post Brazil Moves to Ban Unbacked Stablecoins appeared first on Coinpedia Fintech News

Brazil’s congressional committee has approved Bill 4,308/2024 to strengthen stablecoin oversight. The law requires all stablecoins to be fully backed by reserves, banning unbacked tokens like Ethena’s USDe and Frax. Issuers of unbacked coins could face up to eight years in prison, and exchanges handling foreign stablecoins such as USDT and USDC must follow strict compliance and risk rules. This move is set to reshape Brazil’s crypto market.

The post Former CFTC Chair Says XRP Became the Poster Child of the Warren–Gensler Crackdown on Crypto appeared first on Coinpedia Fintech News

Former U.S. Commodity Futures Trading Commission chair Chris Giancarlo said XRP became the “poster child” of Washington’s tough stance on cryptocurrency, but noted that the project has survived and is now moving forward.

Speaking in a recent discussion on crypto regulation and innovation, Giancarlo said regulatory clarity is critical for the future of digital finance in the United States. Without clear rules, he warned, American banks could fall behind their global peers.

Giancarlo pointed to Ripple as an example of how clear rules can unlock innovation. Ripple has recently secured regulatory approvals in Europe, allowing its stablecoin and XRP to be used more widely within the region’s financial infrastructure.

Under Europe’s MiCA framework, banks across the region can now hold and use these digital assets in a regulated manner. Giancarlo said this gives European banks a major advantage, while U.S. banks remain cautious due to regulatory uncertainty.

“Something clear is better than nothing,” he said, adding that while Europe’s rules may not be perfect, they at least allow institutions to move forward.

Giancarlo also touched on XRP’s long-running legal battle with the U.S. Securities and Exchange Commission, calling it a defining moment for the crypto industry.

He said XRP became a key target during what he described as the crackdown led by regulators under former SEC leadership. Despite years of legal pressure, he noted that XRP “stood up to it, withstood it, and is still standing.”

The legal fight between Ripple and the SEC, which centered on whether XRP should be classified as a security, has been closely watched across the crypto market and is seen as a test case for how digital assets are regulated in the U.S.

Giancarlo argued that U.S. banks tend to innovate only when regulation leaves them no choice. Once clear crypto rules are in place, he said banks will no longer be able to use regulatory risk as an excuse and will be pushed to adopt digital network technologies.

He added that the future of digital finance will not be dominated by a single blockchain. Instead, multiple networks will likely coexist, much like Visa, Mastercard, and American Express operate side by side today.

“The digital future will be just as complex as the financial system we already have,” Giancarlo said.

The post Why Crypto Crashed Today: $184 Billion Wiped Out in One Day appeared first on Coinpedia Fintech News

Global financial markets saw heavy losses over the past 24 hours, with cryptocurrencies leading a sharp sell-off that wiped out trillions of dollars in market value across asset classes.

The total crypto market fell about 7%, erasing roughly $184 billion in value in a single day, as selling pressure accelerated and investor confidence weakened.

Bitcoin dropped nearly 8%, losing around $120 billion in market value, while Ethereum slid more than 30% from recent highs. Over the past eight days, Bitcoin has fallen roughly $20,000, while Ethereum has lost close to $1,000. Bitcoin has also slipped below $70,000 at the time of writing.

Forced liquidations intensified the move. More than $830 million in positions were liquidated in the last 24 hours alone, while total liquidations over the past week exceeded $6.7 billion, according to market data.

Analysts said the decline reflects aggressive deleveraging as traders unwind risky positions.

The sell-off was not limited to digital assets. Traditional markets also recorded losses:

In total, close to $5 trillion was erased across global markets in a short period, despite the absence of any single major negative headline.

Investor demand showed further signs of strain. Bitcoin exchange-traded funds recorded significant outflows in January, reinforcing signs of sustained institutional selling.

Meanwhile, indicators tracking U.S. investor demand showed persistent weakness, showing limited buying support during the downturn.

Market sentiment has deteriorated sharply. The crypto Fear and Greed Index has logged one of its longest stretches of “extreme fear” in recent months, a level often seen during late-stage market drawdowns.

Data from on-chain analytics firms also showed momentum indicators falling to their weakest levels, signaling little near-term bullish conviction.

Some analysts said Bitcoin is approaching price zones where buyers may begin searching for a bottom, but warned that past cycles show such phases can last months rather than days.

“This is no longer a routine pullback,” one analyst said. “It’s a broad reset driven by forced selling, broken confidence and declining risk appetite.”

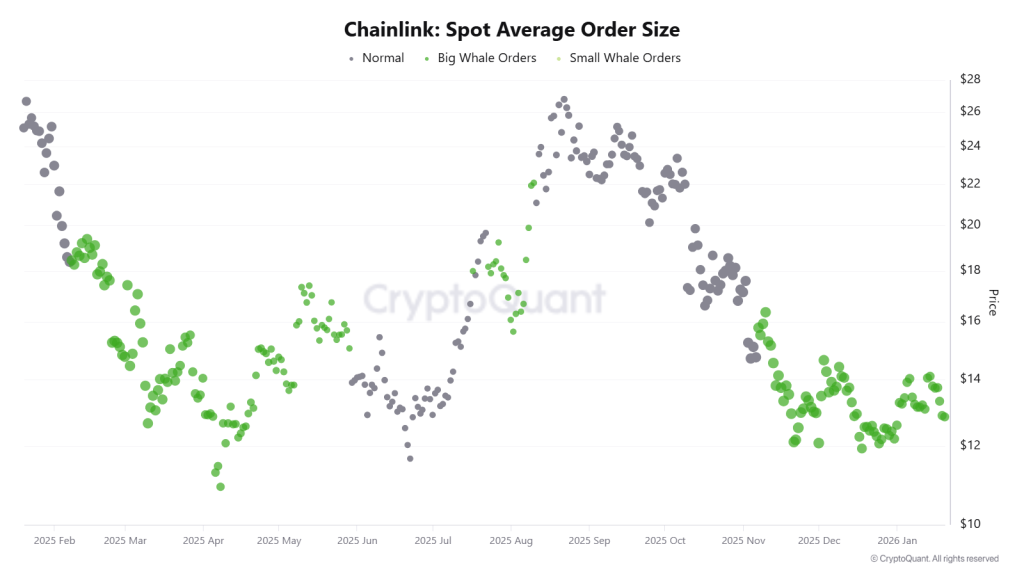

The post Chainlink Price Breaks Down—Is LINK Heading Back Into Its 2022–23 Accumulation Range? appeared first on Coinpedia Fintech News

The broader crypto market has slipped into a bearish phase, with Bitcoin dropping below $70,000 and giving up more than 50% from its cycle highs. As downside pressure builds across majors, Chainlink has also erased most of its 2024–25 gains, raising concerns that Chainlink’s price could drift back into the long consolidation range seen during 2022–23.

With price now losing key support levels, traders are watching closely to see whether LINK price enters another extended accumulation phase or if the current weakness marks a short-term corrective pullback that could eventually set the stage for a stronger rebound.

Chainlink is starting to look vulnerable as the broader crypto market remains under pressure. After failing to hold the $11–$12 support zone, LINK has slipped lower and is now trading in a price area that previously defined its long consolidation phase in 2022–23. With momentum fading and buyers stepping back, traders are questioning whether this move marks the beginning of another extended accumulation period or just a temporary pullback before a rebound.

On the weekly chart, LINK has clearly lost a key support level that had held through much of 2024 and early 2025. Once the price broke below this zone, it quickly struggled to recover, turning former support into resistance, which is a classic sign of weakening structure.

The highlighted box on the chart marks LINK’s previous accumulation range, where the price spent months moving sideways between roughly $6 and $9. With LINK now trading near $8.8, the price is already testing the upper end of that old range. If buyers fail to step in here, the risk shifts toward range acceptance rather than a quick bounce.

Momentum indicators add to the cautious picture. The RSI has drifted lower, showing fading strength without signaling a full oversold reset, while CMF turning negative suggests capital is slowly flowing out rather than back in.

For now, LINK needs to reclaim the $11–$12 area to shift sentiment back in favor of the bulls. Until that happens, the chart points to continued consolidation or further downside, with the 2022–23 range acting as the key zone to watch.

Chainlink price is still under pressure after losing the $11–$12 zone, and for now, the downside risks haven’t eased. In the near term, $8.5–$8.8 is the level to watch this week. If that fails, the price could slide toward $7.5. Looking further into the month, holding below $9 keeps the LINK price exposed to a move back into the $6.5–$7.0 range. Bulls only regain some control if the price manages to reclaim $11, which could allow for a short-term bounce.

The post Trump’s New Fed Chair Kevin Warsh Could Cut Rates “Aggressively”, Says Analyst appeared first on Coinpedia Fintech News

Bitcoin fell to $75,000 over the weekend, down over 40% from its all-time high of roughly $126,000 reached in early October. The sell-off came amid renewed uncertainty around Fed policy and risk sentiment across crypto markets.

In a recent Schwab Network segment, analyst Adam Lynch and host Jenny Horne discussed what’s driving Bitcoin’s decline and why Trump’s nomination of Kevin Warsh as the next Fed Chair could shift the outlook for crypto investors.

President Trump nominated Warsh, a former Fed Board of Governors member who served under Ben Bernanke from 2006 to 2011, to replace Jerome Powell after his term ends in May. The pick came as a surprise, as BlackRock’s Rick Rieder had been the early favorite.

Warsh has historically been seen as a hawk, but his recent stance has leaned more dovish. Robin Brooks at the Brookings Institution expects Warsh to cut rates aggressively, projecting around 100 basis points in cuts over his first four meetings.

“He can’t be and he won’t be [hawkish] because his worst nightmare is probably to have Trump on him the way he was on Powell,” Brooks noted, as cited by Lynch.

His confirmation does face one hurdle. Senator Tom Tillis (R) has said he will oppose any nomination until the Fed’s investigation into Jerome Powell is resolved, though most expect this to be cleared by May.

Bitcoin started 2026 at around $88,000, briefly hit $95,000, then began its most recent decline in mid-January. It now trades well below its 50-day and 100-day moving averages.

Lynch put the drawdown in perspective. Bitcoin’s volatility runs 3-4x that of equities.

“If you can reasonably expect a 10 to 15% equity market correction in any given year, and you can, a 40% drop in Bitcoin is just as reasonable,” he said.

Strategy disclosed it purchased 855 Bitcoin last week at roughly $88,000, bringing its total holdings to around 713,000 BTC at an average cost of $76,000. With Bitcoin below $75,000, the position is currently in the red.

Canaccord analyst Joseph Vafi cut his price target 61%, from $475 to $185, but maintained a buy rating. He described Bitcoin as being “amid an identity crisis. Still somewhat fitting the profile of a long-term store of value, but increasingly trading like a risk asset in the short term.”

The post Crypto Markets Are Weak — Here’s How Some Investors Are Still Earning with SolStaking appeared first on Coinpedia Fintech News

Bitcoin (BTC) has recently slipped below the $80,000 psychological level, as thin liquidity and futures-related liquidations amplified market volatility. With macro uncertainty rising and risk appetite weakening, short-term price stability has once again become a concern across the crypto market. In this environment, strategies that rely solely on predicting price direction are facing growing uncertainty.

As volatility intensifies, many participants are realizing that risk does not only come from “being wrong on direction,” but from overexposure to price movements themselves. During choppy market cycles, strategies based on short-term trading or leverage are easily disrupted by sudden shifts in liquidity and market sentiment. As a result, some investors are beginning to explore participation models with clearer rules, fixed cycles, and automated settlement—seeking ways to stay engaged in the market without being fully dependent on price trends.

SolStaking is a platform that provides multi-asset staking and cloud mining services. Rather than focusing on market timing or price prediction, SolStaking is designed around contract-based participation models that aim to operate consistently across different market conditions.

At the infrastructure level,SolStaking places strong emphasis on compliance and security for long-term operation:

This framework is not built for short-term speculation, but for sustained operation in volatile market environments.

Unlike models that are fully exposed to on-chain price fluctuations, SolStaking incorporates Real-World Assets (RWA) as part of its underlying support. These assets include, but are not limited to:Large-scale AI data center operations, sovereign and investment-grade bonds, physical gold and commodities, industrial metal inventories, logistics and cold-chain infrastructure, as well as agricultural and clean energy projects.These real-world assets operate off-chain and generate relatively stable revenue streams. After verification and accounting, relevant data is mapped on-chain, where smart contracts execute settlement automatically based on predefined rules—without manual intervention. This approach helps reduce reliance on single-market price movements.

SolStaking offers a range of staking and cloud mining contracts designed to accommodate different capital sizes and participation periods, including:

| Contract Type | Starting Amount | Duration | Estimated Settlement |

| Trial Plan | $100 | 2 days | approx. $108 |

| TRX Income Plan | $3,000 | 15 days | approx. $3,585 |

| XRP Flagship Plan | $30,000 | 30 days | approx. $44,400 |

| BTC Flagship Plan | $300,000 | 50 days | approx. $630,000 |

The above figures are model illustrations. Actual results depend on contract terms and system performance.

Under certain capital allocations and contract configurations, the system model can generate results equivalent to approximately 3,000+ XRP per day, driven by operational design and execution efficiency rather than market price movements.

Participation follows a straightforward process:

Step 1: Register an Account

Visit https://solstaking.com and complete account registration.

Step 2: Choose a Contract

Deposit XRP, BTC, ETH, or SOL, and select a staking or cloud mining contract aligned with your capital size.

Step 3: Contract Execution & Settlement

Once activated, the system runs automatically. Returns are settled according to contract rules and credited to your account, with asset and earnings status available for review and withdrawal.

The platform supports deposits and withdrawals in multiple cryptocurrencies, including USDT, BTC, ETH, XRP, USDC, SOL, LTC, and DOGE.

As Bitcoin breaks key support levels and market volatility becomes a constant rather than an exception, more participants are reassessing how they engage with crypto markets.

The challenge may no longer be improving price forecasts—but upgrading participation models.

SolStaking represents one approach designed to remain operational and consistent in environments defined by uncertainty rather than momentum.

Official Website: https://solstaking.com

The post Bonk (BONK) Price Prediction 2026, 2027 – 2030: Will BONK Price Reach $0.00013 by 2030? appeared first on Coinpedia Fintech News

Bonk (BONK) has entered a phase where price action matters more than narrative. After witnessing sharp upside volatility followed by an extended cooldown, the Solana-based meme token is now trading within a clearly defined structure, signaling that speculative froth has largely settled.

Unlike its early cycles driven by hype alone, BONK’s current movement reflects broader market positioning, liquidity shifts, and technically respected demand zones. As the market turns its attention toward 2026, BONK’s chart suggests it may be approaching a pivotal phase where consolidation gives way to directional expansion provided key resistance levels are reclaimed.

| Cryptocurrency | Bonk |

| Token | BONK |

| Price | $0.0000

|

| Market Cap | $ 547,959,325.76 |

| 24h Volume | $ 131,161,328.2097 |

| Circulating Supply | 87,995,158,654,161.20 |

| Total Supply | 87,995,158,654,161.20 |

| All-Time High | $ 0.0001 on 20 November 2024 |

| All-Time Low | $ 0.0000 on 30 December 2022 |

As February unfolds, BONK continues to trade above a critical demand band near $0.000015–$0.000017, a zone that has repeatedly absorbed selling pressure in recent months. This area has now become a structural base, indicating that downside momentum is weakening. On the upside, BONK faces immediate resistance around $0.000022, followed by a more decisive barrier near $0.000026. A sustained hold above these levels would signal growing bullish participation, while failure to break higher could result in continued range-bound movement through the month. From a technical standpoint, February’s price behavior is likely to act as a tone-setter, either confirming accumulation or extending the consolidation phase into the second quarter.

The broader 2026 outlook for BONK hinges on how price reacts to its long-term compression structure. On higher timeframes, BONK is trading within a narrowing range formed by descending resistance and a stable horizontal base, a setup often associated with volatility expansion once resolved.

In the early part of 2026, BONK may continue oscillating between $0.000016 and $0.000024, allowing liquidity to build. However, a confirmed breakout above the upper boundary of this range could trigger a shift in market structure, opening the path toward higher price discovery zones.

If bullish momentum strengthens alongside broader market recovery, BONK could advance toward $0.000028, with an extended upside scenario placing the token near $0.000033 by the latter half of 2026. Importantly, pullbacks during this phase are expected to remain corrective as long as price holds above its established base.

| Year | Potential Low ($) | Potential Average ($ | Potential High ($) |

| 2026 | 0.0000160 | 0.0000245 | 0.0000330 |

| 2027 | 0.0000280 | 0.0000410 | 0.0000560 |

| 2028 | 0.0000450 | 0.0000670 | 0.0000850 |

| 2029 | 0.0000720 | 0.0000980 | 0.0001150 |

| 2030 | 0.0000950 | 0.0001120 | 0.0001300 |

In 2026, Bonk price could project a low price of $0.0000160, an average price of $0.0000245, and a high of $0.0000330.

As per the Bonk Price Prediction 2027, BONK may see a potential low price of $0.0000280. Meanwhile, the average price is predicted to be around $0.0000410. The potential high for BONK price in 2027 is estimated to reach $0.0000560.

In 2028, Bonk price is forecasted to potentially reach a low price of $0.0000450 and a high price of $0.0000850.

Thereafter, the Bonk (BONK) price for the year 2029 could range between $0.0000720 and $0.0001150.

Finally, in 2030, the price of Bonk is predicted to remain steadily positive. It may trade between $0.0000950 and $0.0001300.

The long-term projection assumes Bonk sustains relevance in enterprise blockchain use cases, with growth moderating over time as the asset matures.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | 0.0001100 | 0.0001450 | 0.0001750 |

| 2032 | 0.0001400 | 0.0001900 | 0.0002400 |

| 2033 | 0.0001800 | 0.0002400 | 0.0003200 |

| 2040 | 0.0004200 | 0.0006800 | 0.0009500 |

| 2050 | 0.0008500 | 0.001300 | 0.001900 |

| Year | 2026 | 2027 | 2030 |

| Changelly | $0.0000350 | $0.0000500 | $0.0001350 |

| CoinCodex | $0.0000300 | $0.0000590 | $0.0001120 |

| WalletInvestor | $0.0000280 | $0.0000510 | $0.0001200 |

Coinpedia’s price prediction suggests that BONK could trade between $0.000016 and $0.000033 in 2026, provided the asset sustains its demand zone and confirms a higher-timeframe breakout. Looking ahead, if BONK maintains relevance within high-beta market phases, the token may extend toward $0.000130 by 2030, though price volatility is expected to remain elevated across cycles.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 0.0000160 | 0.0000245 | 0.0000330 |

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

In 2026, BONK could range between $0.000016 and $0.000033, depending on breakout confirmation above key resistance levels.

Yes, if bullish momentum continues, BONK may reach up to $0.000130 by 2030 while maintaining a stable long-term base.

BONK’s price moves are shaped by market positioning, liquidity zones, resistance levels, and broader crypto market trends.

If BONK sustains demand zones and market relevance, it shows potential for long-term growth, though volatility remains high.

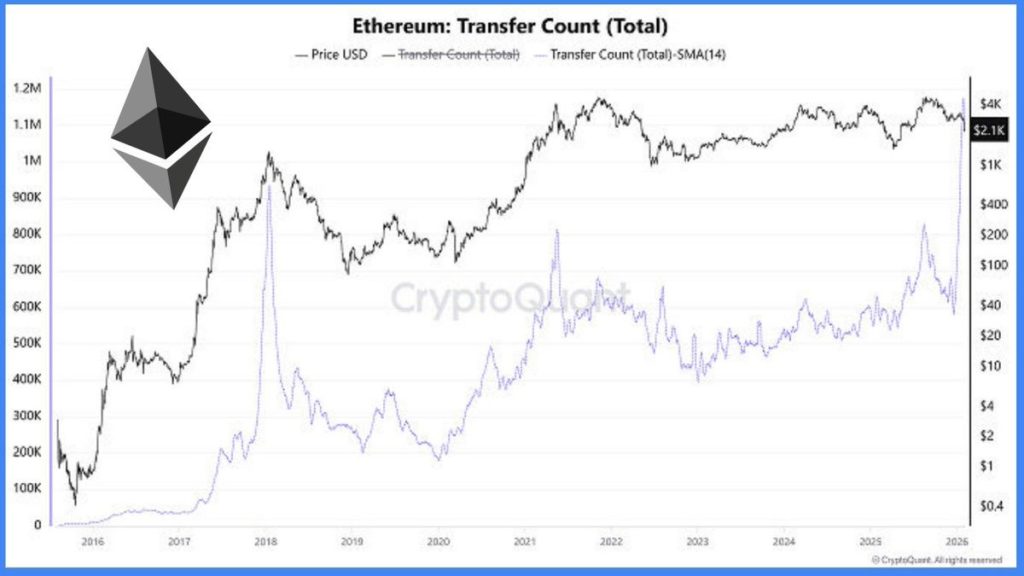

The post Is Ethereum Entering a Distribution Phase? Key On-Chain and Price Signals to Watch appeared first on Coinpedia Fintech News

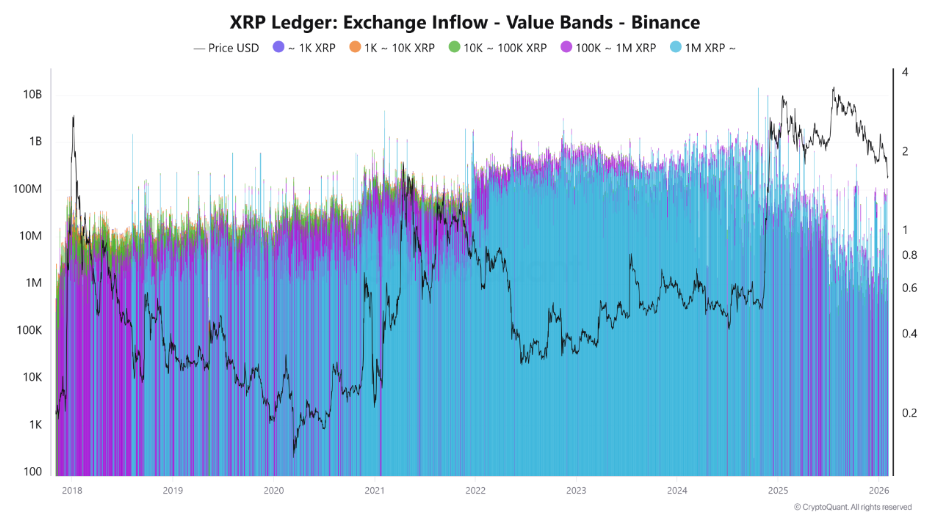

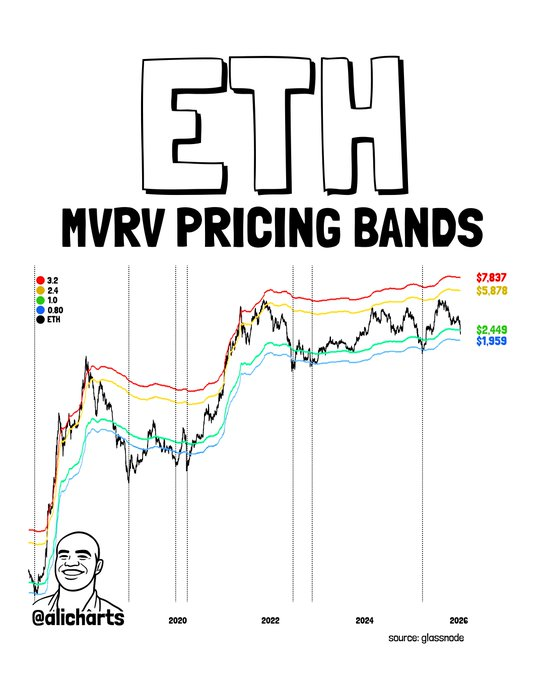

The crypto market bears have strengthened since the start of the month as the top tokens, Bitcoin and Ethereum, have attracted significant selling pressure. While BTC price is feared to drop below $60,000, ETH is showing mixed but increasingly cautionary signals. Now that the Ethereum price is about to test one of the crucial support levels at $2000, the question arises whether the distribution phase is about to begin.

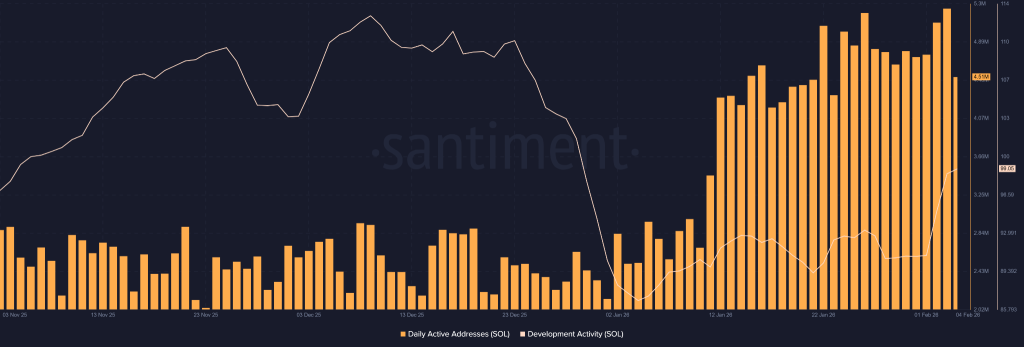

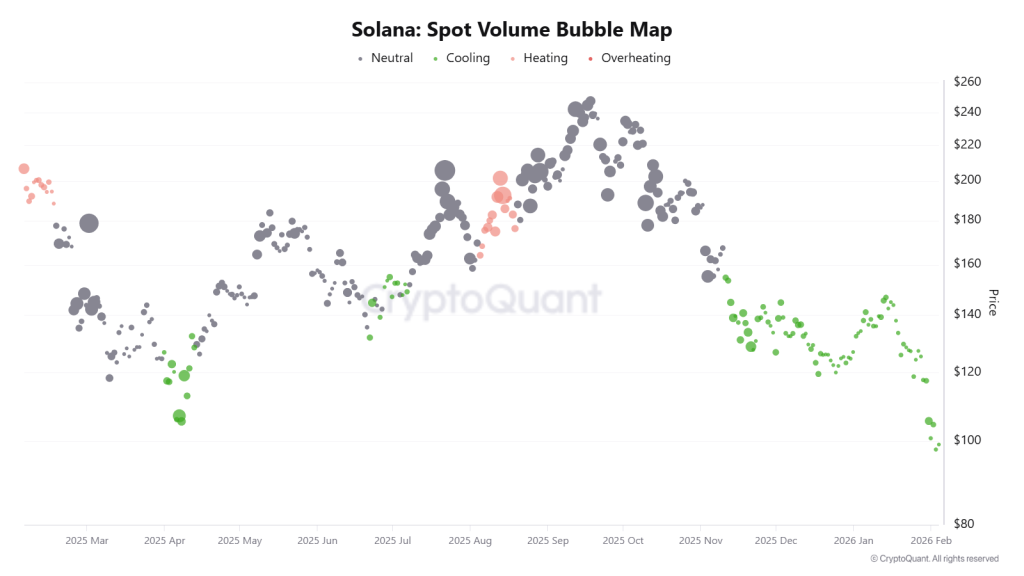

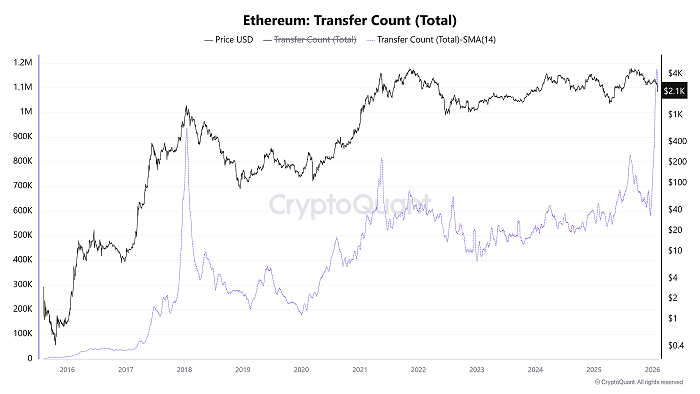

On-chain data shows Ethereum transfer count has surged to 1.17 million, a level historically associated with late-cycle market behavior. Similar spikes were last seen near market tops in 2018 and 2021, periods that preceded sharp volatility and prolonged consolidations.

While high network activity is often interpreted as bullish, history shows that activity peaks without sustained price expansion can signal distribution. In such phases, large holders continue transacting, but price struggles to trend higher as supply gradually outweighs demand.

Notably, Ethereum’s price has failed to establish a strong upside continuation despite rising transfers, reinforcing the view that network usage is no longer translating into directional price strength.

At the same time, derivatives data highlights a dense liquidity cluster between $1,800 and $2,000, where a large concentration of leveraged positions sits. Liquidation heatmaps show this zone acting as a magnet for price, particularly during periods of weakening momentum.

As ETH moves closer to this range, downside liquidity becomes increasingly attractive from a market-structure perspective. In distribution environments, price often drifts toward areas with maximum liquidation potential, rather than breaking higher resistance levels. This setup suggests that short-term price action may remain reactive and volatility-driven, with sharp moves possible as leverage is flushed out.

Both charts combined indicate active participation with potential supply rotation with the probability of downside tests. The second-largest token now appears to be more vulnerable to liquidity-driven moves due to a lack of strong upside follow-through. These points hint towards a distribution phase where markets transition from momentum-driven to balance-seeking behaviour.

Overall, the Ethereum (ETH) price is not showing signs of panic or breakdown, but the data suggests the risk remains skewed to the downside in the near term.

The post XRP Community Day 2026: Grayscale, Solana, Gemini Join Ripple’s Global Event appeared first on Coinpedia Fintech News

SBI Holdings CEO Yoshitaka Kitao shared Ripple’s XRP Community Day 2026 announcement on X today, drawing attention to what’s shaping up to be a major event for the XRP ecosystem.

The global virtual event is scheduled for February 11-12 and will feature Ripple CEO Brad Garlinghouse, President Monica Long, and a lineup of speakers from some of the biggest names in crypto and traditional finance.

According to Ripple’s blog, the event will bring together “XRP holders, builders, institutions, and Ripple leaders” to discuss the growing utility and adoption of XRP and the broader XRPL ecosystem.

The names on this roster are worth paying attention to.

Grayscale’s Head of Product & Research, Rayhaneh Sharif-Askary, will speak on regulated XRP investment products and the growth of crypto ETFs and ETPs globally. Brad Vopni, Head of Institutional at Gemini, and Bitnomial President Michael Dunn are also part of the event.

Ripple also teased a “surprise guest” for a fireside chat on tokenized finance with Markus Infanger, SVP of RippleX. No details yet on who that might be.

One session that stands out covers wrapped XRP expanding to other blockchains, starting with Solana. Solana Foundation’s Interim CMO Vibhu Norby and Hex Trust’s CPO Giorgia Pellizzari will discuss what this means for liquidity, access, and real-world use across chains.

Monica Long will lay out Ripple’s key priorities for 2026, with XRP at the center of the company’s strategy. Other sessions will cover stablecoins, DeFi on XRPL, ecosystem funding, and the introduction of a new XRPL Foundation Executive Director.

David Schwartz, co-creator of the XRPL, will close out the APAC session with a live community Q&A.

XRP Community Day kicks off next week!@JoelKatz returns with @sentosumosaba to take some of YOUR questions and share his perspective on how XRP use cases have evolved, what matters most for adoption, and where real progress is happening.

— Ripple (@Ripple) February 4, 2026

Set a reminder and tune in:… pic.twitter.com/UALBmaNwgS

The event runs across three live X Spaces on Ripple covering EMEA and Americas on February 11, and APAC on February 12.

Attendees can RSVP through Luma for reminders, and recordings will be posted on Ripple’s official channels after the event.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The global virtual event is scheduled for February 11-12, 2026, featuring live X Spaces sessions for different time zones. Recordings will be available on Ripple’s official channels afterward.

Key speakers include Ripple CEO Brad Garlinghouse, President Monica Long, XRPL co-creator David Schwartz, and executives from Gemini, Grayscale, and the Solana Foundation, discussing adoption and strategy.

Join via live X Spaces on Ripple’s X account. You can RSVP on Luma for session reminders. It’s a free, global virtual event open to all.

The post Bitcoin Price Crash Slips Below $70K After 15 Months appeared first on Coinpedia Fintech News

Bitcoin briefly dropped below the $70,000 mark for the first time since November 2024 and is now trading at $70,131, down 5.34% in the past 24 hours. Ethereum also faced heavy selling pressure, sliding to $2,095 after a sharp 6.96% daily decline. Market volatility triggered massive liquidations, with CoinGlass data showing $951 million wiped out in the last 24 hours. Long traders were hit the hardest, accounting for $790 million of the total liquidations, as the sudden sell-off caught bullish bets off guard.

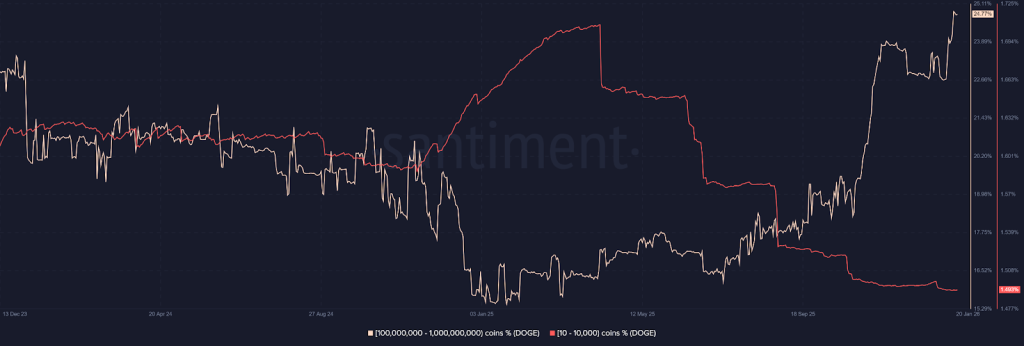

The post Dogecoin Price Slips Below $0.10 as Selling Pressure Intensifies, Despite Musk Hints appeared first on Coinpedia Fintech News

Dogecoin price slid sharply nearly 7% intraday and dipped below the key $0.10 support zone amid broader market weakness. The decline comes despite renewed “moon mission” chatter linked to Elon Musk’s recent social media interaction, showing that the meme coin’s traditional narrative drivers may be losing momentum in the current macro environment. While DOGE did briefly react to Musk-related posts earlier in the week, the response has so far failed to sustain a bullish trend, leaving price vulnerable as sellers remain in control.

Elon Musk’s recent reply on X, hinting that SpaceX “maybe next year” could support the long-delayed DOGE-1 lunar mission sparked modest interest in Dogecoin, with markets initially posting gains. However, the hype was short-lived. Unlike past cycles where similar comments triggered extended rallies, DOGE’s bounce lacked follow-through and quickly gave way to renewed selling.

BREAKING: Elon Musk says SpaceX will likely put Dogecoin on the moon next year, calling a Dogecoin to the moon moment inevitable. pic.twitter.com/ZulhZXDelV

— DogeDesigner (@cb_doge) February 3, 2026

This suggests that narrative catalysts alone are not carrying the same market influence they once did, especially when broader crypto sentiment is under pressure.

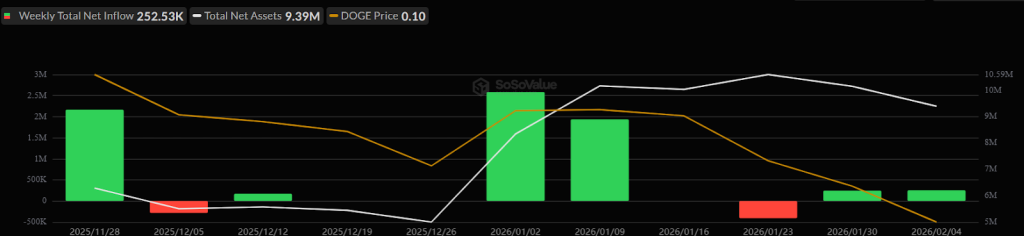

Dogecoin spot ETF data paints a mixed picture rather than a bullish one. During early January, DOGE ETFs recorded a weekly net inflow of roughly $252K, followed by additional single-day inflows near $1.9M–$2.6M in subsequent sessions. These spikes briefly lifted cumulative inflows to around $6.7M, while total net assets hovered near $9.3M.

However, these inflows failed to persist. Several sessions quickly flipped back into net outflows, highlighting a lack of sustained institutional conviction. Trading volumes also remained uneven, suggesting that most activity was reactive rather than trend-driven. In short, ETF participation exists but it is tactical, not directional. Without consistent inflows, DOGE has struggled to find a structural bid.

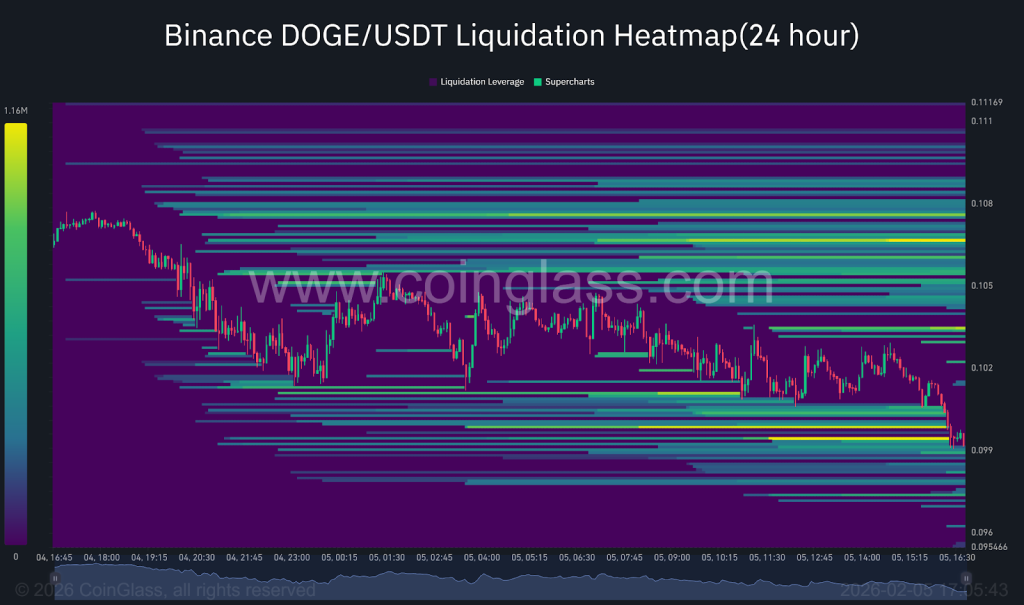

Dogecoin price has been trading inside a well-defined descending channel, but the latest move is critical, as DOGE price has fallen toward the support trendline that had held since the previous consolidation phase. This drop shifts near-term control firmly toward sellers. Recent rallies are getting cut short earlier, while drops are stretching deeper than before. Each recovery attempt loses momentum near the same zone, while downside moves travel further. At press time, DOGE price trades at $0.098, below the short-term moving averages, underlying weakness.

On the downside, the $0.098–$0.095 zone now stands out as the first major support. A daily close below $0.095 would expose DOGE to a deeper pullback toward the $0.088–$0.090 range, which represents the channel base and a historically reactive level. On the upside, immediate resistance sits near $0.105–$0.108, where price was repeatedly rejected after the breakdown. Above that, the more decisive level remains $0.118–$0.120, coinciding with the descending channel’s midline. Until DOGE reclaims this zone with volume expansion, rebounds are likely to remain corrective rather than trend-reversing.

Liquidation data shows that Dogecoin has already swept most downside liquidity following the recent sell-off, reducing the immediate incentive for price to push sharply lower from current levels. As DOGE dipped below the $0.10 zone, clusters of long liquidations were largely cleared, easing near-term downside pressure. Now, attention is shifting to overhead liquidity, where dense clusters are building between $0.129 and $0.132. These levels mark areas where a large concentration of short positions remains exposed. If price begins to grind higher and approaches this zone, it could trigger forced short covering, potentially accelerating upside momentum.

Notably, this setup reflects a market driven more by liquidity positioning than organic spot demand. Traders are watching whether DOGE can attract enough buying pressure to move into these liquidity pockets. Without follow-through, price risks remaining range-bound. However, a decisive push toward these levels could quickly change market dynamics, turning a slow recovery into a sharper liquidity-driven move.

While Musk’s hint about the DOGE-1 mission sparked initial gains, the rally was short-lived, suggesting such narrative catalysts now have less influence amid overall negative market sentiment.

Dogecoin faces immediate resistance near $0.105-$0.108. A daily close below key support at $0.095 could see a pullback toward $0.088, while reclaiming $0.120 is needed for a potential trend reversal.

DOGE ETF flows have been inconsistent, flipping between inflows and outflows, indicating a lack of sustained institutional conviction and making them a tactical, rather than directional, investment currently.

Liquidation data shows heavy short positions clustered overhead near $0.129-$0.132. A price move toward that zone could trigger a short squeeze, but it requires stronger buying pressure than currently exists.

The post Bitcoin Recovery Timeline: When BTC Price May Start Rising Again appeared first on Coinpedia Fintech News

Bitcoin price continued to face heavy selling pressure this week, trading near the $71,000 level and showing signs of further downside as broader market uncertainty builds. Market observers warn that a break below the $70,000 psychological support could open the door to a deeper correction into the $60,000 range or lower.

Past Bitcoin bear markets show a clear trend of becoming shorter with each cycle. The first major downturn lasted about 410 days. The second cycle lasted around 365 days. The most recent completed bear market lasted roughly 330 days. This shows that Bitcoin’s price declines have taken less time over the years.

Despite this pattern, some analysts still use an average duration of about 370 days to estimate market bottoms. This approach ignores the steady shortening of market cycles.

When historical data is analyzed using trend-based models, the current bear market is projected to last closer to 288 days. Measured from Bitcoin’s all-time high on October 6, this points to a possible market bottom around July 21, 2026.

More signs of a possible Bitcoin price bottom come from a long-used market indicator that compares how much Bitcoin is currently in profit versus how much is in loss.

In previous market declines, Bitcoin has often reached its lowest point when these two amounts moved close to each other.

Right now, about 11 million Bitcoins are still in profit, while roughly 9 million are sitting at a loss. If these figures continue to narrow at current price levels, it would point to a Bitcoin price near $60,000, which closely matches where past market bottoms have formed.

Based on the historical view, Bitcoin’s price could hit a low as early as May 14, well ahead of the July estimate suggested by longer-term trend models. Even though the timelines differ, both point toward the same price area, making $60,000 an important level to watch.

While market conditions can change quickly and no single method can predict prices with certainty, the way past trends, price behavior, and supply data line up this cycle suggests the downturn may be shorter than in previous years.

The economic conditions and unexpected events could still affect the outcome, but the repeating patterns seen across multiple Bitcoin cycles offer useful context for those watching Bitcoin’s long-term price direction.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Bitcoin is under pressure due to market uncertainty, profit-taking, and weakening sentiment, with traders watching the $70,000 support closely.

Market data suggests Bitcoin is in a corrective phase, with price behavior and cycle trends aligning with past bear market conditions.

Yes, historical cycles show each Bitcoin bear market has lasted fewer days, suggesting faster corrections as the market matures.

Based on trend models and historical patterns, Bitcoin could form a price bottom between mid-2025 and mid-2026, depending on market conditions.

The post Will Bitcoin Break a 15 Year Pattern for the First Time Ever? appeared first on Coinpedia Fintech News

The global market crash has hit the crypto market hard, wiping out $184 billion in value and pushing the total market cap down to $2.43 trillion. Bitcoin is now trading around $71,470, just $2,000 above its key 2021 all-time high of $69,000.

Meanwhile, traders fear that if Bitcoin breaks its 15-year pattern, the market could face further downside.

One of the reasons behind this bitcoin price drop is selling from wallets linked to Bhutan’s Royal Government. During this market dip, Bhutan sold more than $22 million worth of Bitcoin, transferring over 284 BTC to institutional market maker QCP Capital.

Bhutan is selling Bitcoin. pic.twitter.com/WDuUQmBZsU

— Arkham (@arkham) February 4, 2026

Data shows that Bhutan has been selling Bitcoin in batches of nearly $50 million over the past few months.

Meanwhile, experts believe this selling is mainly due to rising mining costs after the latest Bitcoin halving, which has reduced profits for sovereign and state-linked miners.

Another key signal comes from the Coinbase Premium Gap. This metric compares Bitcoin prices on Coinbase versus Binance. It has now turned deeply negative, the lowest level this year, indicating strong selling from institutional traders

This institutional selling has been clearly visible in Bitcoin ETFs for the past three weeks.

On February 4, 2026, alone, U.S. spot Bitcoin ETFs saw about $545 million in net outflows, with BlackRock’s IBIT losing roughly $373 million.

CryptoQuant data shows that short-term holders (STH) are panicking as Bitcoin continues to fall. In the last 24 hours, these holders have sent nearly 60,000 BTC to exchanges, marking the highest single-day inflow seen this year.

Most of these coins were moved at a loss, meaning recent buyers are exiting under pressure.

At the same time, long-term holders are mostly inactive, with very little profit-taking from older wallets. This pattern usually appears during strong and heavy market corrections.

As of now, Bitcoin is testing a very important historical price level. It is now just $2K away from hitting the previous ATH of $69,000 from the last cycle in 2021.

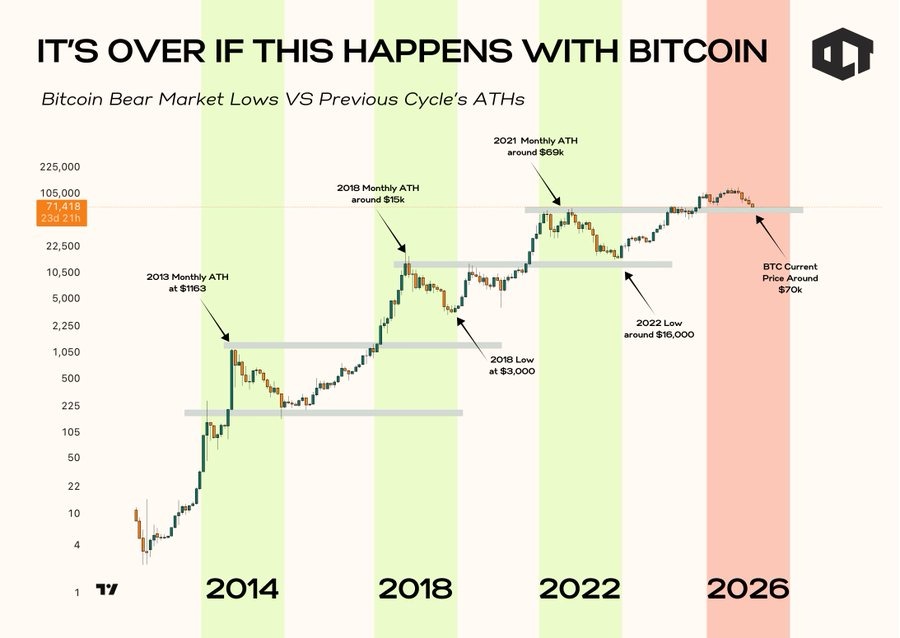

For 15 years, Bitcoin has followed one strong pattern, it has never stayed below the previous cycle’s all-time high. In every cycle, old highs turned into long-term support. This rule held in 2014, 2018, and even during the 2022 crash.

Now the market is testing that rule again. If Bitcoin drops and stays below $69,000, it would be the first time this historic pattern breaks. That could signal a major change in market structure and open the door for a deeper fall toward the $62,442 level.

But if Bitcoin holds above $70,000, the long-term bullish trend remains intact. This level is now the key line between strength and fear.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Prolonged volatility often leads institutions to reduce exposure or hedge positions. This can lower short-term liquidity and slow recovery momentum even if prices stabilize.

Recent buyers and leveraged traders face the highest risk, as price swings can force liquidations. Long-term holders are typically less impacted unless support breaks decisively.

Traders will closely track ETF fund flows, exchange inflows, and whether Bitcoin reclaims key levels. These signals often shape sentiment before price trends reverse.

Recent volatility reviews, new surveillance systems and a landmark court ruling show how South Korea is enforcing stricter oversight of crypto markets.

Vitalik Buterin sold almost 3,000 ETH worth $6.6 million through a series of swaps days after saying withdrawals from his holdings were coming.

Bitcoin ETFs saw $545 million in daily outflows as BTC neared $70,000, though analysts said most investors were holding positions despite market weakness.

A Nevada judge declined to grant regulators’ bid to halt Coinbase’s event contract markets, as the exchange presses a CFTC preemption argument in federal court.

USDt added $12.4 billion in Q4 to reach a $187.3 billion market cap, increasing users and onchain activity even as rival stablecoins declined after October’s liquidation event.

Bitcoin selling pressure sparked a retreat below the 2021 bull market high, with lower BTC price targets still expected to be hit.

The post Aperture Finance Hit by $3.67M Smart Contract Exploit, Funds Laundered via Tornado Cash appeared first on Coinpedia Fintech News

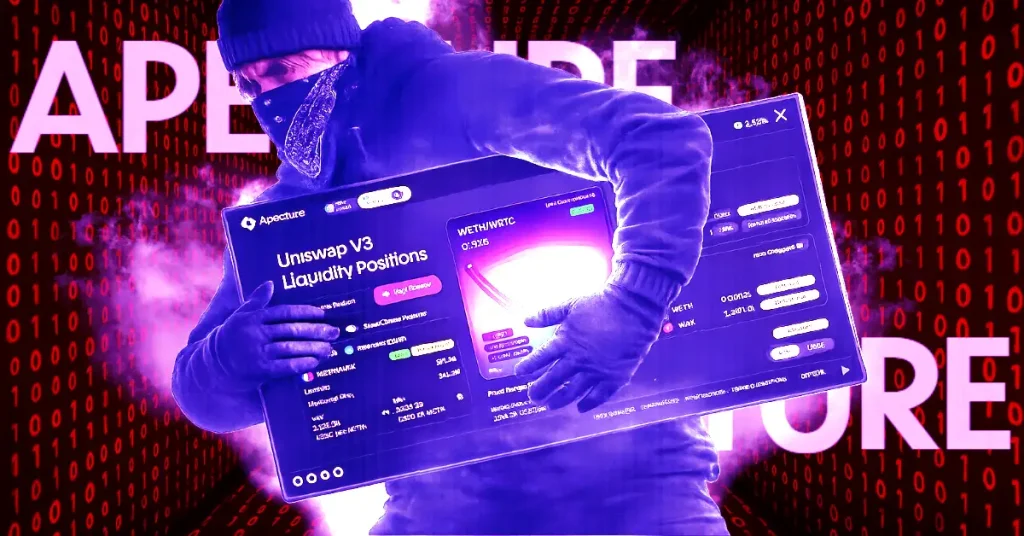

DeFi platform Aperture Finance has suffered a major security breach, losing about $3.67 million in a smart contract exploit. Blockchain security firm PeckShieldAlert shows the hacker is actively moving stolen funds through Tornado Cash, a privacy-mixing service.

The activity has raised new concerns about fund recovery and how the actual hack happened.

According to PeckShieldAlert, the Aperture Finance hack happened on January 25, 2026, due to a weakness in its V3 and V4 smart contracts, combined with existing user token approvals.

In DeFi platforms, users often permit contracts to move their ERC-20 tokens or liquidity position NFTs so trades and strategies can run automatically. But in this case, the exploiter found a flaw in how the contract handled those permissions and function calls.

Instead of breaking wallets or stealing private keys, the attacker used the contract’s own logic to trigger unauthorized asset transfers.

Because many users had already granted approvals, the attacker could move funds without needing new signatures. This allowed them to drain assets tied to approved tokens and liquidity positions.

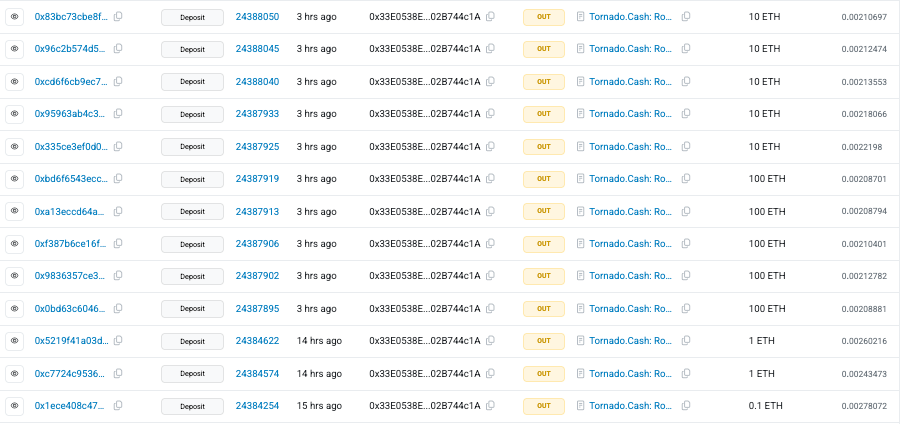

And all this led to the extraction of $3.67 million in value, the attacker converted a large share into ETH, and sent about 1,242 ETH to Tornado Cash to hide the trail.

Attackers often use mixing services like Tornado Cash to hide the origin of stolen crypto and make tracking more difficult. The funds were sent in multiple small transactions, including batches of 10 ETH and 100 ETH, a common method used to avoid attention.

Following the exploit, the Aperture Finance team released an emergency notice and shared a list of affected contract addresses. And also warned users to urgently revoke both ERC-20 token approvals and ERC-721 liquidity position approvals tied to the risky addresses.

Affected Contract List

— Aperture Finance (@ApertureFinance) January 27, 2026

Please cross-reference your ERC-20 and liquidity position (ERC-721) approvals against the addresses listed in the image below. All such approvals to these addresses should be revoked. pic.twitter.com/Sn1BJ8fh92

Wallet approvals allow smart contracts to move user funds, and if left active, they can be abused after a contract is compromised.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Hackers exploited a weakness in the platform’s smart contracts, using existing user token approvals to move assets without stealing private keys.

Users should immediately revoke all token and liquidity position approvals linked to the affected contract addresses to prevent further losses.

Services like Tornado Cash obscure transaction trails, making it difficult to track and recover stolen cryptocurrency after a hack.

No. The exploit abused smart contract permissions; your private keys remain secure, but your approved funds were at risk.

The post Vitalik Buterin Warns Ethereum L2 Projects: Stop Copying, Start Innovating appeared first on Coinpedia Fintech News

Ethereum co-founder Vitalik Buterin has taken aim at the current state of Layer 2 projects in a follow-up post that has the crypto community talking. According to Buterin, most L2s are recycling the same tired formula and adding nothing new to Ethereum.

He compared the standard L2 approach to “forking Compound,” calling it “something we’ve done far too much for far too long, because we got comfortable, and which has sapped our imagination and put us in a dead end.”

“We don’t friggin need more copypasta EVM chains, and we definitely don’t need even more L1s,” he added.

Buterin’s frustration didn’t come out of nowhere. In an earlier post, he pointed to two key problems: L2 progress toward Stage 2 security has been much slower than expected, and Ethereum L1 is now scaling on its own, with gas limit increases planned for 2026.

“The original vision of L2s and their role in Ethereum no longer makes sense, and we need a new path,” he said.

With L1 set to handle a lot more blockspace directly, the main reason most L2s exist, scaling, is losing relevance.

Instead of more generic EVM chains, Buterin wants L2s building around privacy, app-specific efficiency, ultra-low latency, and emerging sectors like AI, social platforms, and digital identity. These are areas where even a scaled L1 won’t be enough.

From Ethereum’s side, he also pushed for a native rollup precompile, a protocol-level tool that would verify ZK-EVM proofs and give real L2s secure, trustless connections to Ethereum without relying on security councils.

Buterin also had a clear message on L2 branding. If your project barely depends on Ethereum for security, stop calling yourself an Ethereum L2.

“The degree of connection to Ethereum in your public image should reflect the degree of connection to Ethereum that your thing has in reality,” he said.

With Ethereum L1 scaling fast and Buterin publicly reshaping what counts as a legitimate L2, projects still running the 2021 playbook could find themselves without a purpose.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The post Hyperliquid and MYX Finance Prices Recover Amid Market Correction—Is Bullish Momentum Building? appeared first on Coinpedia Fintech News

Bitcoin remains under pressure, trading close to $72,000, despite a recovery from $70,034, while Ethereum hovers around $2,100, struggling to reclaim key short-term resistance. Broader market sentiment stays cautious as derivative positioning turns defensive and spot demand remains muted, keeping upside moves across majors limited.

Despite this risk-off backdrop, select altcoins are beginning to diverge from Bitcoin’s weakness. Prices of Hyperliquid and MYX Finance have staged short-term recoveries, attracting fresh speculative interest. The rebound suggests early positioning rather than trend confirmation, but it highlights how capital is selectively flowing into altcoins even as BTC and ETH remain range-bound under selling pressure.

The MYX Finance price has been rising in a bullish pattern since the November rebound, which has kept the bullish possibility alive. After the rebound from the support of the rising parallel channel, the price is consolidating within a tight range, suggesting a strong compression. As the price continues to consolidate within the upper bands of the Bollinger, a breakout appears to be on the horizon.

Although the markets are experiencing significant selling pressure, the MYX price is gearing up for a breakout. The MACD is heading for a bullish crossover as the buying volume is rising effectively. Therefore, the price is expected to enter the immediate resistance zone between $7.05 and $7.38 and may further test the resistance of the channel at $8.5. Considering the current market conditions, a breakout seems to be unlikely, but the crypto may continue to maintain an ascending trend consolidation until it rises above $10.

The Hyperliquid price has been maintaining a strong upswing since late January 2026, attracting more than 75% gains. In times when the price is heading towards its ATH, the pullback can be considered as an interim correction. The technicals remain bullish, hinting towards continued price action towards the final resistance zone.