Over 23% of traders now expect interest rate cut at next FOMC meeting

The number of traders expecting a rate cut at the March Federal Open Market Committee meeting rose following fears of a hawkish Fed nominee.

The number of traders expecting a rate cut at the March Federal Open Market Committee meeting rose following fears of a hawkish Fed nominee.

The Commodity Futures Trading Commission (CFTC) revised a previous staff letter to reflect the regulations in the GENIUS stablecoin framework.

The Bitcoin network's mining difficulty dropped by as much as 27% within a single adjustment period during China's 2021 crypto mining ban.

The post Curve DAO Token (CRV) Price Prediction 2026, 2027-2030: Can CRV Break Its Long-Term Range? appeared first on Coinpedia Fintech News

Curve DAO (CRV) is entering a technically sensitive phase where its role as a core DeFi liquidity protocol contrasts sharply with a price structure that has spent months compressing near long-term support. With 2026 already underway, CRV’s price behavior is no longer defined by aggressive downside extensions but by controlled ranges, contracting volatility, and repeated defenses of demand conditions that often precede a broader trend transition.

Fundamentally, Curve continues to sit at the center of decentralized liquidity infrastructure, particularly across stablecoin and low-slippage markets. While price action has lagged this relevance, the technical structure is beginning to reflect stabilization rather than decay. As the first quarter of 2026 unfolds, the market is closely watching whether this prolonged consolidation evolves into a sustained recovery phase or remains range-bound for longer.

| Cryptocurrency | Curve DAO Token |

| Token | CRV |

| Price | $0.2573

|

| Market Cap | $ 376,409,206.76 |

| 24h Volume | $ 76,267,678.6033 |

| Circulating Supply | 1,462,695,186.9619 |

| Total Supply | 2,350,432,173.8907 |

| All-Time High | $ 60.4988 on 14 August 2020 |

| All-Time Low | $ 0.1811 on 05 August 2024 |

Through February, CRV has continued to trade above its $0.22–$0.25 demand zone, a region that has repeatedly absorbed selling pressure since late 2025. Price remains compressed beneath overhead resistance near $0.35–$0.40, forming a tightening wedge on the daily timeframe.

This behavior suggests that bearish momentum is fading, even though bullish follow-through remains gradual. As long as CRV holds above its rising support trendline, downside risk appears limited. A decisive daily close above the $0.40 region would be a technical signal that accumulation is giving way to early expansion, while failure to break higher would likely extend consolidation without invalidating the broader setup.

As 2026 progresses, the focus shifts from whether CRV can hold its base to whether it can begin reclaiming higher structural levels. On higher timeframes, CRV appears to be forming a rounded accumulation zone following a multi-year downtrend, an environment typically associated with longer-term reversals rather than short-lived relief rallies.

If momentum gradually builds, CRV could start challenging intermediate resistance near $0.85, followed by the psychologically important $1.60 zone. These levels align with prior consolidation ranges and would likely attract profit-taking along the way. However, sustained acceptance above these areas could open a path toward the $2.40–$3.00 region before the end of 2026. Pullbacks toward $0.50–$0.65 would remain constructive as long as higher lows continue to form. A breakdown below long-term demand would delay the bullish outlook but would not automatically negate the broader recovery thesis unless followed by sustained weakness.

| Year | Potential Low ($) | Potential Average ($ | Potential High ($) |

| 2026 | 0.45 | 1.75 | 3.00 |

| 2027 | 1.50 | 2.00 | 4.50 |

| 2028 | 2.10 | 4.10 | 6.00 |

| 2029 | 3.40 | 6.00 | 7.20 |

| 2030 | 4.80 | 6.50 | 8.00 |

In 2026, Curve Dao price could project a low price of $0.45, an average price of $1.75, and a high of $3.00.

As per the Curve Dao Price Prediction 2027, Curve Dao may see a potential low price of $1.50 . Meanwhile, the average price is predicted to be around $2.00. The potential high for Curve Dao price in 2027 is estimated to reach $4.50.

In 2028, Curve Dao price is forecasted to potentially reach a low price of $2.10 and a high price of $6.00.

Thereafter, the Curve Dao (Curve Dao) price for the year 2029 could range between $3.40 and $7.20.

Finally, in 2030, the price of Curve Dao is predicted to maintain a steady positive. It may trade between $4.80 and $8.00.

The long-term projection assumes Curve Dao sustains relevance in enterprise blockchain use cases, with growth moderating over time as the asset matures.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | 5.20 | 7.40 | 9.00 |

| 2032 | 6.00 | 8.60 | 10.80 |

| 2033 | 7.00 | 11.50 | 13.50 |

| 2040 | 19.00 | 25.00 | 32.00 |

| 2050 | 35.00 | 48.00 | 70.00 |

| Year | 2026 | 2027 | 2030 |

| Changelly | $2.40 | $3.80 | $6.50 |

| CoinCodex | $1.90 | $3.50 | $7.00 |

| WalletInvestor | $2.00 | $3.60 | $6.40 |

Coinpedia’s price prediction for Curve DAO’s in 2026 and beyond hinges on whether its extended base structure transitions into sustained upside momentum. While CRV may not deliver rapid price acceleration, the current technical setup favors gradual recovery over continued decline. If broader DeFi sentiment improves and CRV maintains its higher-timeframe support zones, the token could steadily work toward multi-dollar valuations over the coming years. Failure to reclaim key resistance levels, however, would keep price action range-bound and delay the recovery cycle.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | 0.45 | 1.75 | 3.00 |

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Curve DAO Token (CRV) is used for governance, staking, and boosting rewards on Curve Finance, a leading DeFi protocol for low-slippage stablecoin trading.

Curve DAO price prediction for 2026 suggests CRV may trade between $0.45 and $3.00 if long-term support holds and DeFi demand improves.

CRV price prediction for 2030 estimates a range between $4.80 and $8.00 if Curve continues serving as key liquidity infrastructure in DeFi.

CRV’s long-term price depends on DeFi adoption, stablecoin growth, protocol revenue, governance activity, and broader crypto market cycles.

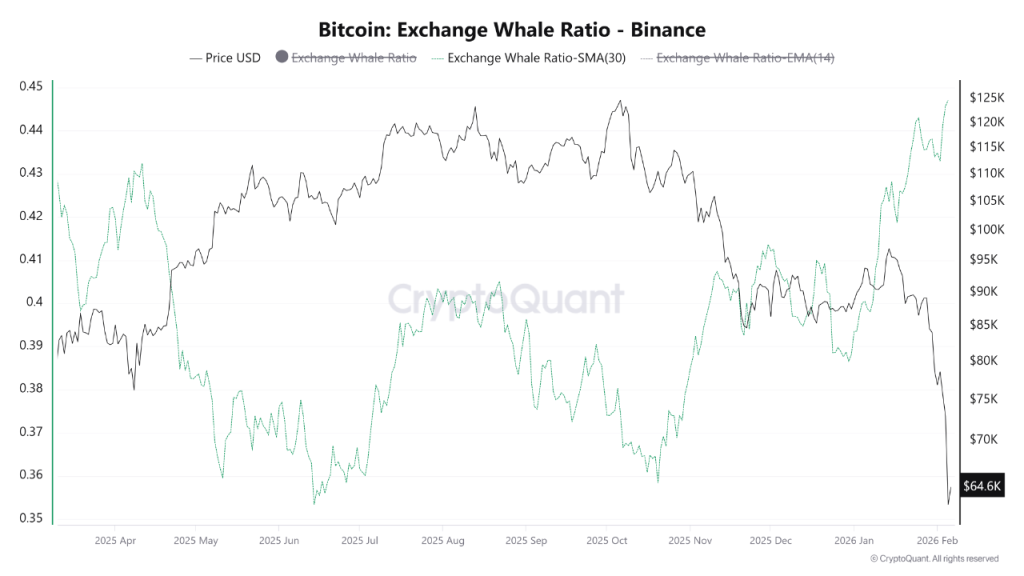

Hong Kong hedge funds’ leveraged BTC price bets are emerging as the main trigger behind Bitcoin’s sharp month-long sell-off.

Tether claims it has helped law enforcement in over 1,800 cases across 62 countries, freezing $3.4 billion in USDT tied to suspected illicit activity.

The post 20% Bounce and an ETF Filing: Why ONDO Price is Separating from the Crypto Pack. appeared first on Coinpedia Fintech News

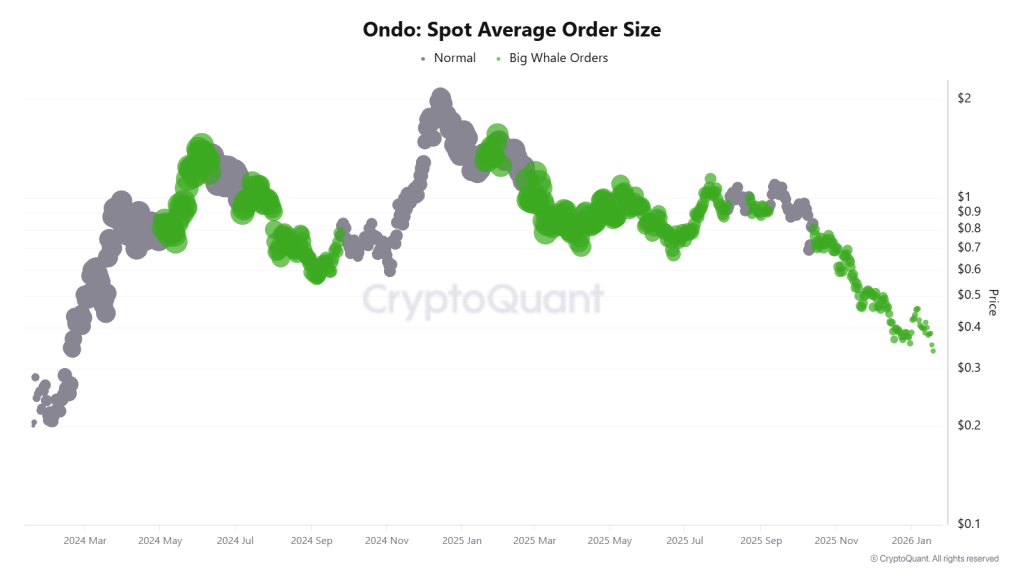

ONDO price is hovering around $0.2539, up roughly 20% from its recent $0.2017 low, and the timing isn’t random. While broader markets remain choppy, Ondo Global Markets has already crossed $10 billion in cumulative volume since launch, a detail that cuts through the noise faster than most price charts do.

And yes, that matters. This isn’t about vibes or speculative excitement. It’s about usage. Tokenized RWAs are still the fastest-growing corner of crypto, mostly because they do something radical: they work. Global access, smoother settlement, fewer intermediaries, these are the unglamorous stuff that institutions actually care about.

Since launch, Ondo Global Markets has pushed past $10 billion in total volume. That number doesn’t come from retail gambling on memes. It comes from tokenized stocks and structured products steadily finding demand.

Tokenized stocks keep growing.

— Ondo Finance (@OndoFinance) February 5, 2026

Since launch, Ondo Global Markets has surpassed $10 billion in total volume.

Tokenized RWAs continue to be the industry's fastest growing sector, unlocking global access to the world's largest markets. pic.twitter.com/PxzB8fqCto

Well, here’s the kicker: tokenization isn’t just a crypto buzzword anymore. It’s becoming financial plumbing. Industry commentary continues to frame tokenization as a way to make markets faster and more efficient, cutting down friction that traditional systems still haven’t solved.

So when volume keeps stacking up, it signals something simple and that is Ondo isn’t being “tested” anymore. It’s being used.

Meanwhile, tokenized US stocks and ETFs are now live inside MetaMask with ONDO infrastructure doing the heavy lifting. That’s not cosmetic. It drops tokenized assets directly into one of the largest self-custody wallets in the market.

But let’s be real. Accessibility is only half the story. Trust is the other half. And this is where institutional behavior quietly enters the frame.

An asset manager has taken another formal step toward launching an exchange-traded product tied to Ondo by submitting an amended S-1 filing. No approvals yet. No victory laps either. Still, the filing keeps the process alive and confirms that tokenization-focused products are staying on regulatory radars.

Goldman Sachs on tokenization:

“Tokenization has the potential to really improve operational efficiencies.”

Now for the part traders keep staring at. The ONDO price chart shows price compressing near the lower boundary of a falling wedge, a structure aligning closely with the February 2024 base. Technically, it’s a pressure zone.

Momentum indicators are trying to turn. CMF is climbing. MACD and AO are improving. RSI is crawling out of oversold territory. None of this guarantees upside, but it does suggest selling pressure isn’t accelerating anymore.

If demand actually shows up, the ONDO/USD structure opens space toward the $0.60 region. Beyond that, higher levels come into view only if participation expands meaningfully. That’s where any ONDO price prediction becomes conditional, not confident.

And for now, ONDO price remains stuck between solid fundamentals and a market that still isn’t ready to reward them.

The post CFTC Confirms National Trust Bank Stablecoins as Approved Payment Tokens appeared first on Coinpedia Fintech News

The U.S. Commodity Futures Trading Commission has taken another step toward formalizing stablecoins within the regulated financial system. By revising its guidance, the agency has clarified that stablecoins issued by national trust banks can now qualify as approved payment stablecoins under its existing framework. The move signals growing regulatory comfort with stablecoins as they become more embedded in mainstream financial markets.

The update comes through a reissued version of CFTC Staff Letter 25-40, which outlines how certain digital assets can be used as margin collateral in derivatives markets. When the original letter was released in December 2025, it allowed futures commission merchants to accept qualifying non-securities digital assets, including payment stablecoins, under strict conditions.

However, regulators later acknowledged that the original wording unintentionally left out stablecoins issued by national trust banks, even when those tokens met all the required standards. The revised guidance fixes that gap by explicitly recognizing national trust banks as permitted stablecoin issuers within the no-action framework.

National trust banks have played a growing role in the stablecoin ecosystem, particularly after earlier regulatory approvals allowed them to custody and issue payment-related digital assets. These institutions operate under federal charters and are subject to strict oversight, which makes their stablecoins attractive for use in regulated markets.

By including these banks in the definition of payment stablecoins, the CFTC is aligning its guidance with existing banking structures rather than creating a parallel system for digital assets. This also reinforces the idea that stablecoins are no longer operating at the fringes of finance but are increasingly part of regulated infrastructure.

For futures commission merchants, the revised guidance brings much-needed clarity. Firms can now more confidently accept eligible stablecoins issued by national trust banks as customer margin collateral, provided all existing safeguards are met. These safeguards include segregation requirements designed to protect customer funds and limit risk.

Importantly, the update does not loosen compliance standards or change the conditions under which stablecoins can be used. Instead, it removes ambiguity and ensures consistent treatment of qualifying stablecoins across regulated derivatives markets.

CFTC Chairman Michael Selig framed the move as part of a broader push to position the U.S. as a leader in stablecoin innovation, especially following the passage of the GENIUS Act. Taken together, these developments suggest regulators are shifting from cautious observation to structured integration of stablecoins into the financial system.

For the crypto industry, this marks another sign that payment-focused stablecoins are becoming an accepted tool rather than an experimental one, especially when issued by regulated and federally chartered institutions.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The CFTC updated its rules to include stablecoins issued by federally-regulated national trust banks as approved collateral for derivatives trading, integrating them into the regulated financial system.

Yes, futures merchants can accept qualifying payment stablecoins—including those from national trust banks—as customer margin collateral, provided all existing customer protection safeguards are met.

The revised guidance explicitly approves stablecoins issued by federally-chartered national trust banks, which operate under strict oversight, aligning them with existing banking structures.

The post The Sharpe Ratio Warning: Why This BTC Price Bounce Could Be a Trap Heading for $48K appeared first on Coinpedia Fintech News

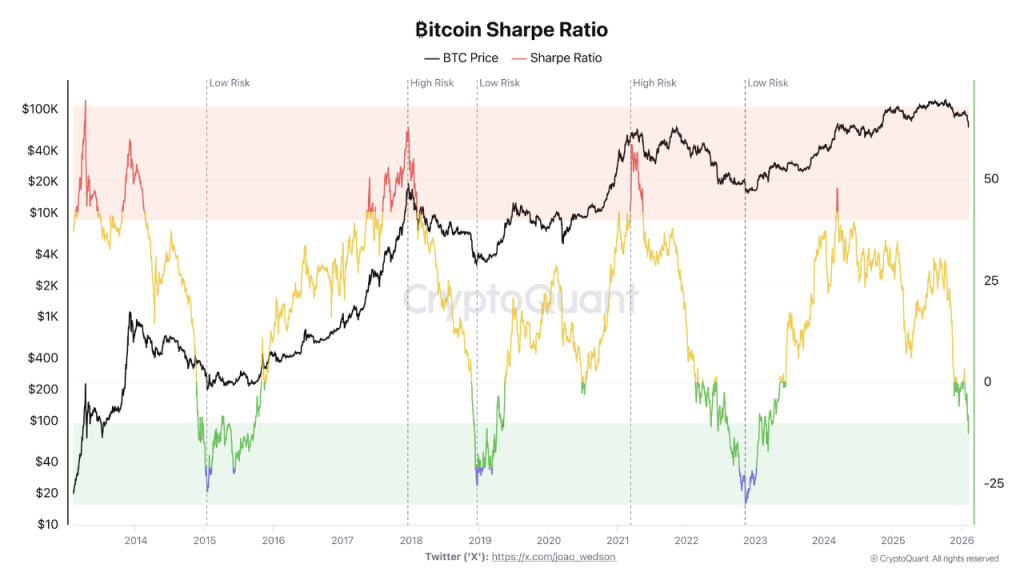

The BTC price is hovering near $68,890 today after a brief recovery from $60K. But, the key risk metric, the Sharpe Ratio, shows intact caution. It shows that BTC’s sharpe ratio has slipped into a historical bear-market zone. Rather than signaling an immediate bottom, this shift highlights rising risk relative to returns, a dynamic that has often appeared near long, complex market turning phases.

The Sharpe Ratio, which measures risk-adjusted returns, has now entered a zone historically associated with the later stages of Bitcoin bear markets. In practical terms, this means investors are currently taking on elevated risk for relatively weak performance.

Meanwhile, the ratio continues to deteriorate, underscoring that recent BTC returns remain insufficient to justify volatility. At the same time, this type of compression has often emerged before broader trend stabilization, not during periods of optimism.

Importantly, the Sharpe Ratio should not be interpreted as a timing tool. Rather, it reflects the consequences of price behavior already in motion. As BTC crypto performance weakens on a risk-adjusted basis, more participants find themselves underwater, increasing stress across shorter time horizons.

Still, market history shows that extreme Sharpe Ratio readings often align with contrarian opportunity zones. That does not imply an imminent reversal. Instead, it suggests the market may be entering a phase where long-term positioning slowly becomes more defensible.

From a behavioral perspective, prolonged underperformance tends to reduce speculative excess, gradually shifting ownership toward participants with longer holding periods.

That said, patience remains critical. This phase can persist for months, and the BTC price today may continue adjusting lower before risk metrics begin to improve meaningfully.

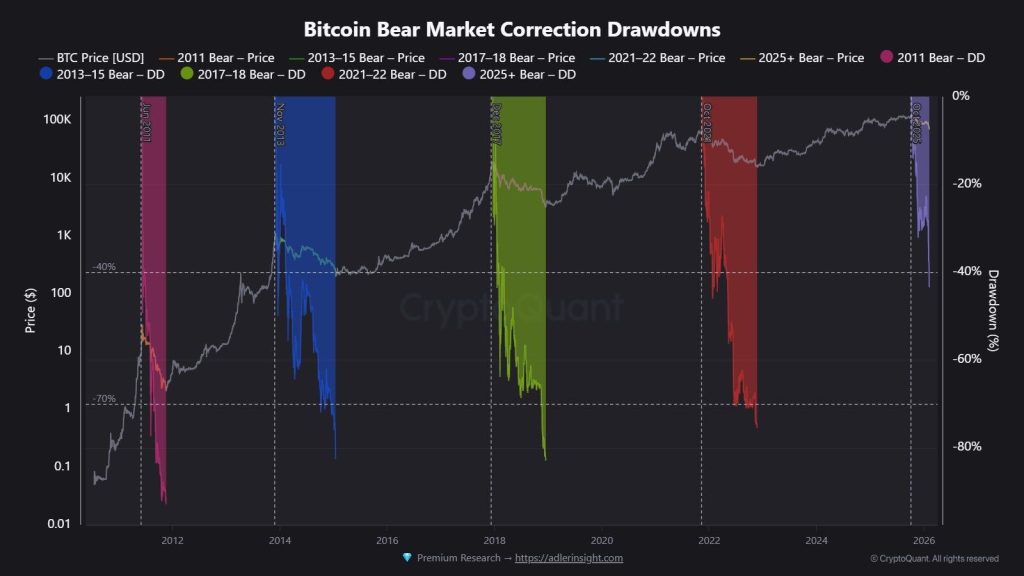

From a technical perspective, the experts presents his theory that BTC price chart reinforces cautious outlook and shows historical dip odds. Following a peak near $126,000, Bitcoin respected the 0.382 Fibonacci retracement around $78,000, an area that acted as a structural drift zone. Once that level was lost, technical focus shifted lower.

The next major retracement level sits near the 0.618 zone around $48,000, a level that may act as a longer-term magnet should corrective pressure persist.

As a result, investors are increasingly weighing two broad approaches. One involves gradually building exposure as risk metrics approach historically lower-risk zones. The other prioritizes confirmation, waiting for the Sharpe Ratio to clearly improve before increasing allocation. Neither path implies urgency.

Still, the current setup emphasizes discipline. The BTC price USD remains sensitive to liquidity conditions, and the developing structure suggests that time, rather than speed, is the primary variable. In this environment, BTC price behavior reflects positioning stress more than directional conviction, a dynamic that continues to shape the evolving BTC price forecast.

The post Shiba Inu Price Holds Ground, Yet Data Shows the Market Isn’t Ready To Chase appeared first on Coinpedia Fintech News

Shiba Inu price regains ground with the broader market recovery, stabilizes near the $0.000006200 mark. Following a rebound from the channel lows, SHIB price eyes further rebound ahead. The broader market recovery has helped stabilize price, yet SHIB’s own momentum remains selective rather than impulsive. Beneath the surface, on-chain positioning and derivatives activity hint at a market that is no longer panicking, but not fully convinced either. The rebound has removed immediate downside pressure, but whether it evolves into a trend or fades into another range depends on how holders, leverage and liquidity align next.

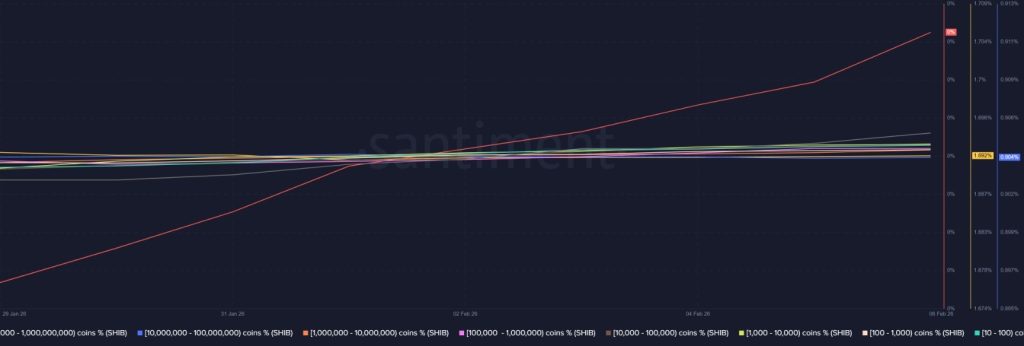

Shiba Inu’s on-chain holding data suggests the recent rebound has brought stability, but not a surge in conviction buying. Wallet distribution shows that large holders, particularly addresses holding between 100 billion – 1 trillion SHIB have largely maintained their positions rather than expanding exposure. This points to confidence in current price levels, but not urgency to accumulate at resistance. Mid-sized holders, typically more reactive to short-term moves, have also slowed activity. Transfers from this cohort have flattened after the rebound, indicating that profit-taking pressure has eased, yet fresh inflows remain limited. In practical terms, selling has cooled, but demand has not accelerated.

Smaller retail wallets continue to show minor net additions, though the scale remains modest. This behavior aligns with a market attempting to form a base rather than initiate a breakout. When holding data stabilizes without sharp distribution or accumulation, it often reflects a pause phase, a period where price absorbs prior moves before choosing direction. For SHIB, this balance explains why downside momentum has stalled, but upside progress remains capped. Holders are patient, not aggressive, and that restraint is shaping the current range-bound structure.

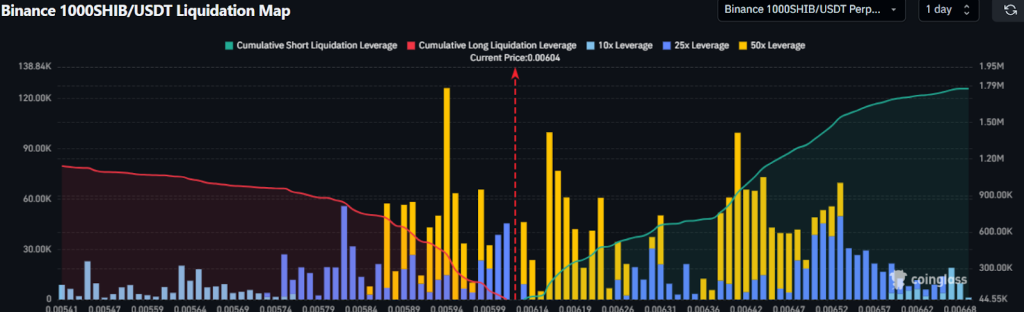

The liquidation map shows that SHIB’s current price zone is sitting between two well-defined leverage clusters, explaining why recent moves have slowed despite yesterday’s rebound. On the upside, a dense concentration of short liquidations is stacked near the $0.00000610–$0.00000625 range. This zone has repeatedly capped price, as short positions remain active and unchallenged. Without a decisive push through this band, forced short covering is unlikely to materialize.

On the downside, long liquidation clusters thin out significantly above $0.00000570, indicating that downside leverage has already been reduced during the prior sell-off. The next meaningful pool of long liquidations sits closer to $0.00000540, suggesting that sellers would need renewed momentum to trigger another cascade lower. This positioning tells a clear story: leverage has been partially flushed, but not reset enough to fuel volatility.

In these conditions, SHIB is more likely to remain sideways unless one side is decisively forced out. A clean break above $0.000006250 would expose a thin liquidation zone higher up, increasing the odds of a fast extension. Conversely, a drop below $0.00000570 would test whether remaining longs are willing to defend or capitulate.

SHIB’s price action remains constructive but constrained, with the chart showing a recovery from the lower end of its recent trading channel rather than a full trend reversal. After stabilizing from the channel lows, SHIB has pushed higher into a well-defined resistance zone near $0.000006100, a level that has repeatedly capped upside attempts over the past sessions. Shiba Inu price is still respecting a descending-to-sideways range, where lower highs remain intact despite the bounce.

The recent recovery has been supported by declining sell pressure rather than aggressive new buying, suggesting consolidation rather than breakout momentum. As long as SHIB holds above the $0.00000580–$0.00000570 support band, downside risks remain contained in the near term. A decisive close above $0.000006200 would shift the short-term bias higher, opening room toward the next resistance near $0.00000645–$0.00000660, where prior supply and liquidation pressure cluster. Failure to clear this zone, however, could keep SHIB locked in a range, with price drifting back toward mid-channel support.

The post Altcoin to Watch in February: Hyperliquid (HYPE) Primed for a 50% Upswing appeared first on Coinpedia Fintech News

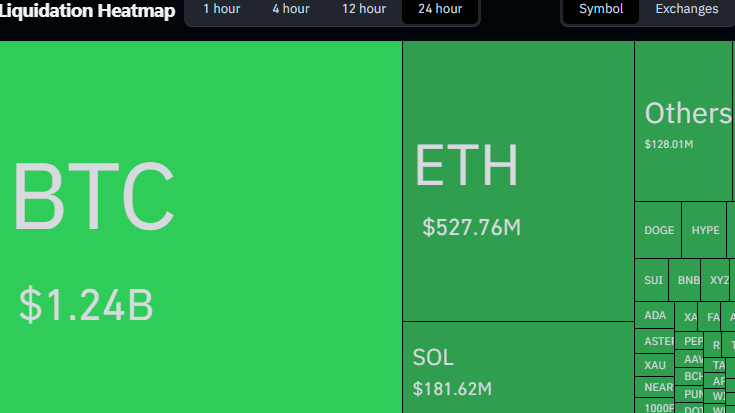

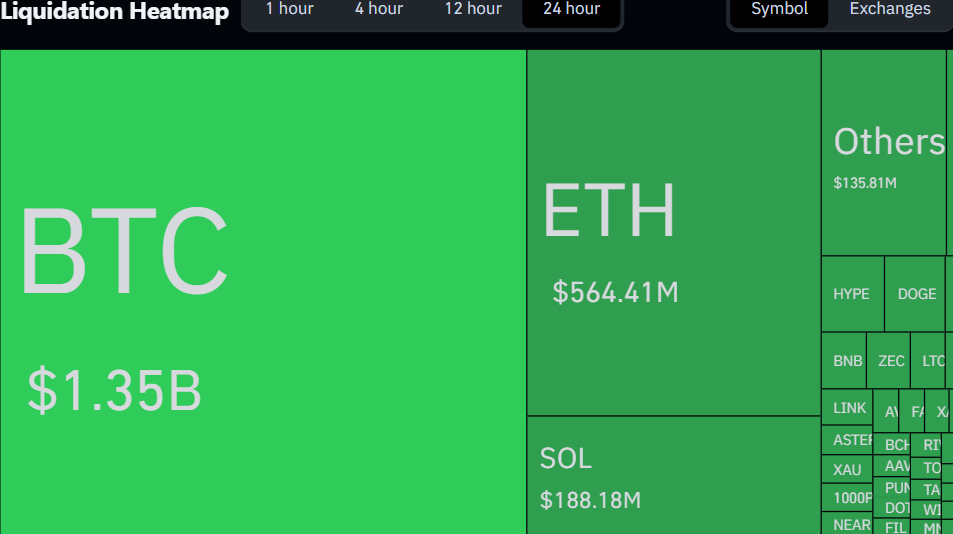

Crypto market volatility has intensified since the start of the month, with Bitcoin recording one of its sharpest single-day declines, dropping over $10,000. The sell-off triggered multiple liquidation cascades exceeding $2 billion, forcing leveraged positions out and creating conditions for buyers to step in near local lows.

As broader markets begin to stabilize, trader focus is shifting toward select altcoins showing relative strength and rising participation. While many tokens have bounced from oversold levels, only a few are displaying sustained momentum rather than short-term relief moves. Hyperliquid (HYPE) has emerged as a standout, with the price consolidating above a recently broken resistance level.

Although buying pressure has cooled in the short term, the HYPE price continues to show strength on higher timeframes, positioning the token for a potential volatility expansion if broader market conditions remain supportive.

Looking at the daily chart, Hyperliquid (HYPE) price is currently trading in a tight zone where supply and demand are stacked closely together. This overlap explains why price has struggled to push higher, with repeated rejections keeping the move capped below the $35 level. Buyers are clearly stepping in on dips, but sellers continue to defend this area, resulting in sideways consolidation rather than a breakout.

That said, the Chaikin Money Flow (CMF) tells a more constructive story. The indicator shows a bullish divergence and is holding near the zero line, suggesting capital is still flowing into the asset despite muted price action. This points to accumulation rather than distribution.

From here, HYPE needs a clean daily and weekly close above $35 to shift momentum decisively. A successful breakout above $40 would significantly improve the odds of a move toward the $50 zone, where the chart shows relatively limited resistance.

The post Eigen LabsResearcher Says DAOs Will 100x as AI Crushes Software Costs appeared first on Coinpedia Fintech News

Building a software product used to cost around $215,000. Today, with AI tools, that number has dropped to under $450. That gap is exactly why one expert believes DAOs are about to take off.

Kydo, a researcher at Eigen Labs, shared a detailed breakdown on X explaining why DAOs are no longer just a governance experiment. His argument is straightforward: AI has made building software so cheap that the cost of setting up a company now matters more than the cost of building the product itself.

In a traditional setup, hiring one software engineer for 12 months costs roughly $200,000. Add $15,000 for legal and LLC formation, and you’re looking at about $215,000 to get an MVP off the ground.

With AI tools like Claude Code and Opus, a single builder can now ship a working product for around $200. Setting up a DAO costs $50 to $250. Total: under $450.

“That’s not a marginal improvement. That’s a structural inversion,” Kydo wrote.

When building was expensive, nobody cared that an LLC cost $15,000. It was a rounding error. Now that AI has pushed production costs near zero, that $15,000 is the biggest expense on the table. DAOs, at a fraction of that cost, suddenly have a real advantage.

DAOs were always sold on ideology: decentralization, community ownership, censorship resistance. Kydo argues those ideas alone were never enough to justify the friction of working without a traditional company.

The new case for DAOs is purely economic. And economic arguments, as he put it, “scale.”

He backed this up with real examples. Nouns DAO hit a treasury worth over $50 million without any corporate entity behind it. Botto, an AI-generated art collective, used a DAO to let community members direct an autonomous artist and share in the earnings.

Kydo highlighted a problem many builders already know too well. Building is now cheap. Getting distribution and funding is not.

A working app built for $200 without a community behind it is just a side project. Add a DAO with a token and aligned contributors, and it becomes what Kydo calls “an economic organism.”

He also confirmed that Eigen Labs is working on solutions to make tokens “actually own and mean something, not this speculative fluffy thing that we have currently.”

Crypto lawyer Gabriel Shapiro responded, arguing that regulation, not costs, is the real reason DAOs haven’t taken off as fundraising vehicles.

Kydo pushed back: “crypto never had much reg clarity but it didn’t stop tokens and companies making 100s of billions here.”

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

A DAO is a blockchain-based organization run by smart contracts where members vote on decisions using tokens instead of relying on a traditional company structure.

AI has slashed software-building costs, making company setup the biggest expense. DAOs are cheaper than forming an LLC, creating a major economic advantage.

A DAO can be launched for $50–$250, while forming an LLC and hiring staff can exceed $200,000, even before product development.

Solo builders can now launch real products cheaply and use DAOs to attract funding, contributors, and users—turning side projects into viable ecosystems.

The post Next Crypto to Reach $1? Analysts Highlight This New Protocol appeared first on Coinpedia Fintech News

While large, well-known cryptocurrencies continue to move at a slower pace, innovation across the crypto market has not stopped. Historically, some of the strongest gains have come from projects that focus on solving real problems before they reach wide adoption. As 2026 approaches, analysts are observing a clear shift in capital away from hype-driven tokens and toward new crypto protocols.

This transition often begins when a project moves beyond planning and delivers working technology. In the current market, one emerging protocol is drawing attention as it enters this critical stage. Its recent progress suggests it may be positioning itself for increased visibility as investors search for the next crypto phase of growth.

The growth of this project is being fueled by a very successful presale that has caught the attention of the global market. Mutuum Finance has already raised over $20.4 million from early participants. This is not just a small group of traders; more than 19,000 individuals have already joined the ecosystem as holders. The project is currently in Phase 7 of its structured distribution, and the MUTM token is priced at $0.04.

This price is a significant climb from the early starting point of $0.01, which represents a 300% surge during the development stage. However, there is still more room for the price to move. The team has confirmed that the official launch price will be $0.06.

This means that anyone joining today is securing their MUTM at a lower rate than what the general public will pay when the mainnet goes live. With a total supply of 4 billion tokens, exactly 45.5% (1.82 billion tokens) were allocated for this presale phase to ensure a fair and broad distribution. To date over 840M MUTM is already sold out.

Mutuum Finance is being developed as a decentralized lending hub focused on simplicity and safety. The protocol aims to let users lend digital assets to earn yield or borrow against them without relying on a traditional middleman. All interactions are designed to be non-custodial, so users remain in control of their funds.

On the lending side, users are expected to earn APY based on borrowing demand. For example, supplying 1,000 USDT to a pool offering 6% APY could generate about 60 USDT over a year if rates remain stable. Borrowing is planned to follow loan-to-value (LTV) limits to manage risk. With a 70% LTV, depositing $10,000 worth of crypto would allow borrowing up to $7,000 while keeping ownership of the collateral.

According to the project’s whitepaper, Mutuum Finance also plans to introduce a buy-and-distribute model in later stages. Under this mechanism, a portion of protocol fees is intended to be used to acquire MUTM tokens and distribute them to participants who help support the ecosystem.

Security remains a major priority. The protocol has completed a comprehensive audit with Halborn, maintains a strong safety score from CertiK, and operates an active $50,000 bug bounty to encourage ongoing testing and transparency as development continues.

Looking ahead, analysts are highlighting several roadmap catalysts that could drive the price of MUTM much higher. One major plan is the launch of a native, over-collateralized stablecoin. This will allow borrowers to access a stable unit of value without ever leaving the protocol.

To ensure everything runs smoothly, the project is integrating decentralized oracles like Chainlink. These oracles provide real-time price data so that collateral values are always accurate and liquidations remain fair.

Because of these professional features, many market experts believe the token is on a path to a major milestone. Some analysts suggest that if the platform captures a slice of the global lending market, the price could reach $1.00 by late 2026 or 2027.

From the current price of $0.04, this would represent a massive 2,400% increase. This prediction is based on the protocol’s developing ability to generate revenue and the planned expansion to Layer-2 networks, which is expected to make transactions faster and much cheaper for every user.

The project recently reached its biggest technical milestone yet. The V1 protocol is now live on the Sepolia testnet, which means the technology is no longer just a promise on a website. Users are currently testing the core lending and borrowing flows in a live environment. This successful launch has triggered a surge in demand, causing Phase 7 to sell out at a record pace.

This technical progress has also brought in whale allocations, with large investors moving significant capital into the project. When “whales” enter a project at this stage, it often signals strong confidence in the upcoming mainnet launch.

These large holders are looking for “day one utility,” and Mutuum Finance is aiming exactly that. With the security verified and the testnet running, the final window to join before the $0.06 launch is closing fast.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Bitcoin market participants diverged on the short-term BTC price outlook, with warnings of new macro lows contrasting with $84,000 targets.

Vietnam’s Finance Ministry proposes a 0.1% tax on crypto transfers, 20% corporate tax on profits and tough licensing standards for digital asset exchanges.

The post Vietnam Proposes 0.1% Tax on Crypto Transactions Under New Regulatory Framework appeared first on Coinpedia Fintech News

Vietnam is moving closer to formally regulating cryptocurrency trading, with a new draft policy that treats digital assets similarly to traditional securities. The proposal, circulated by the Ministry of Finance for public feedback, introduces a transaction-based tax system while tightening oversight of crypto exchanges.

Under the proposed framework, individuals trading or transferring cryptocurrencies through licensed service providers would be charged a 0.1% personal income tax on the value of each transaction. This mirrors the tax structure currently applied to stock trading in Vietnam. The levy would apply to all investors, regardless of residency, whenever a crypto transfer is executed within the regulated system.

At the same time, the draft clarifies that crypto transfers and trading would be exempt from value-added tax, signaling that the government views digital assets more as financial instruments than consumer goods.

Companies and institutional investors would be taxed differently. Profits generated from crypto trading would fall under the standard 20% corporate income tax regime. This tax would be calculated after deducting acquisition costs and related expenses, aligning crypto-related earnings with other business income.

The proposal also formally defines crypto assets as digital assets that rely on cryptographic or similar technologies for issuance, storage, and transaction verification. Alongside this definition, the draft sets strict requirements for exchange operators. Firms seeking to run digital asset trading platforms would need at least 10 trillion Vietnamese dong, or about $408 million, in charter capital. Foreign ownership would be allowed but limited to 49%.

These rules come as Vietnam continues its five-year pilot program for a regulated crypto market, launched in September 2025. Despite the country ranking among the top globally for crypto adoption, no firms initially applied, largely due to high capital and compliance hurdles.

To push the framework forward, Vietnam began accepting license applications for crypto exchanges in January 2026, marking a concrete step toward bringing the fast-growing sector under full regulatory oversight.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Vietnam is implementing a formal regulatory pilot program for crypto trading, treating digital assets similarly to securities, with licensing for exchanges now open.

Individuals pay a 0.1% transaction tax per crypto transfer. Companies are taxed 20% on trading profits, aligning with standard corporate income tax rules.

Yes, but foreign ownership in licensed Vietnamese crypto exchanges is capped at 49%, with high capital requirements of approximately $408 million.

Yes. Individuals pay via the 0.1% transaction levy. Corporate investors pay a 20% tax on net profits from crypto trading, after deducting costs.

The post Bitcoin Searches Reach 12-Month High appeared first on Coinpedia Fintech News

Global Google searches for “Bitcoin” soared to a one-year high during the week of February 1 as the price plunged toward $60,000 before rebounding near $70,000, erasing post-election gains. On X, opinions are divided: some see rising retail interest as a bullish signal, while others call it FOMO. Volatility was fueled by deleveraging, Fed signals, and Epstein-related FUD. On-chain data showed record losses, suggesting either capitulation or a fresh buying opportunity for investors.

The post Crypto.com CEO Buys AI.com for $70M appeared first on Coinpedia Fintech News

Cryptocom co-founder and CEO Kris Marszalek has purchased the domain AIcom for approximately $70 million, marking the largest publicly disclosed domain name sale. He plans to use it to launch a consumer-focused AI platform, promoted with a Super Bowl ad, featuring an AI agent that can message, use apps, and trade stocks. The entire purchase was made in cryptocurrency, signaling Marszalek’s long-term confidence in AI as a major technological wave shaping the future.

The post Bitcoin Rebounds Into the Weekend, Ethereum Outperforms: ETH vs BTC, Who Leads Next Week? appeared first on Coinpedia Fintech News

Crypto markets head into the weekend after a sharp relief bounce across majors, but price behavior shows a clear divergence. Bitcoin price is stabilizing after a deep sell-off, while Ethereum price is attempting to reclaim structure after a more aggressive breakdown. The key question for traders is whether this move marks an early rotation into ETH or if BTC continues to control market direction next week.

The short-term price action of Bitcoin shows the price stuck within a falling wedge after it broke down from the horizontal consolidation. Despite the rebound, the price has failed to break the resistance, keeping the lower targets active. With the BTC price entering the weekend trade, the volatility is expected to rise, which may have a huge impact in the coming week.

Bitcoin is trading near $68,200 on the 4H chart after rebounding from the $62,200–$63,000 demand zone. Price remains near the mid Bollinger Band (~$69,700), keeping the broader structure bearish. RSI has recovered to around 40, easing from oversold conditions but still below neutral, suggesting stabilization rather than trend reversal. For Bitcoin to regain control, bulls need a clean reclaim above $70,000–$72,000; failure to hold $68,000 risks another test of lower demand.

Similar to Bitcoin, the Ethereum price has also rebounded from the lows below $1800, but despite a rebound, it failed to surpass $2,157. This is one of the important resistances, and hence a rise beyond this range may strengthen the bullish momentum. The buying pressure has dropped in the short term, raising the possibility of a pullback into the demand zone.

Ethereum shows stronger relative momentum. ETH bounced sharply from $1,820, reclaiming $2,000, though it remains capped below the former support zone at $2,150–$2,170. Unlike BTC, ETH printed a deeper breakdown followed by a faster recovery. The MACD is curling upward, and the CMF has turned slightly positive, hinting at improving short-term participation. However, ETH still trades well below its prior range, making this a recovery attempt, not confirmation.

Despite ETH’s stronger rebound, directional control still sits with Bitcoin. BTC is stabilizing above key demand after a violent sell-off, and as long as it holds the $68K area, it will continue to dictate risk appetite across the market. Ethereum’s bounce, while faster, is still a recovery from a deeper structural breakdown, with price capped below former support near $2,150–$2,170.

For traders, the setup is clear: ETH can outperform only if Bitcoin holds its range and reclaims resistance. Any weakness or rejection in BTC is likely to hit ETH harder. Until Bitcoin regains trend structure, ETH’s strength remains beta-driven, not leadership-driven.

The market is showing early recovery signs, with prices bouncing from key demand zones, but confirmation needs sustained strength above resistance.

Right now, it looks like a relief bounce. Sustainability depends on Bitcoin holding support and reclaiming higher resistance levels.

Bitcoin sets market confidence. If BTC holds support and stabilizes, it allows altcoins like ETH to recover more sustainably.

Usually no. Ethereum’s recovery is closely tied to Bitcoin’s stability, and BTC weakness often leads to sharper ETH pullbacks.

The post Solana Price Reclaims $85, but On-Chain Data Tells a More Cautious Story appeared first on Coinpedia Fintech News

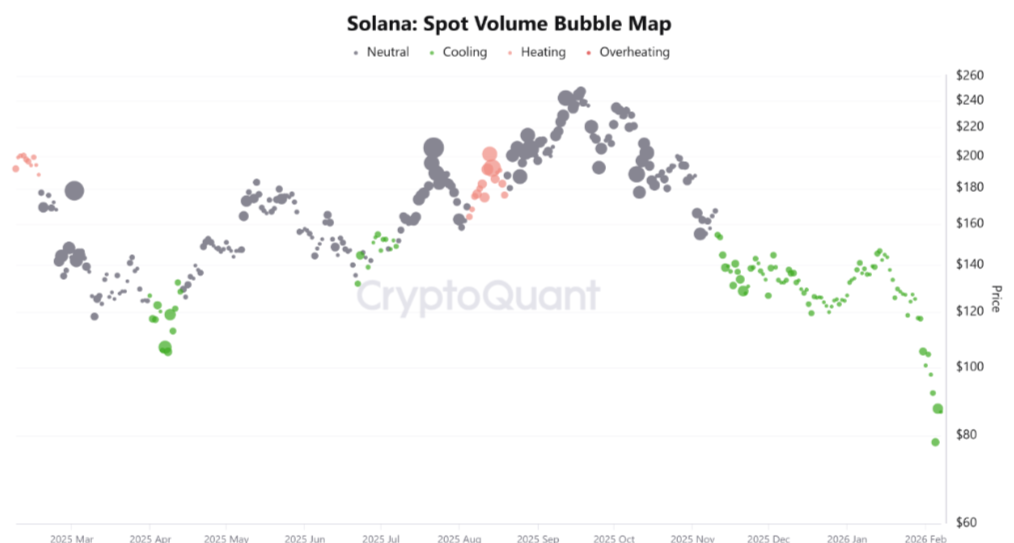

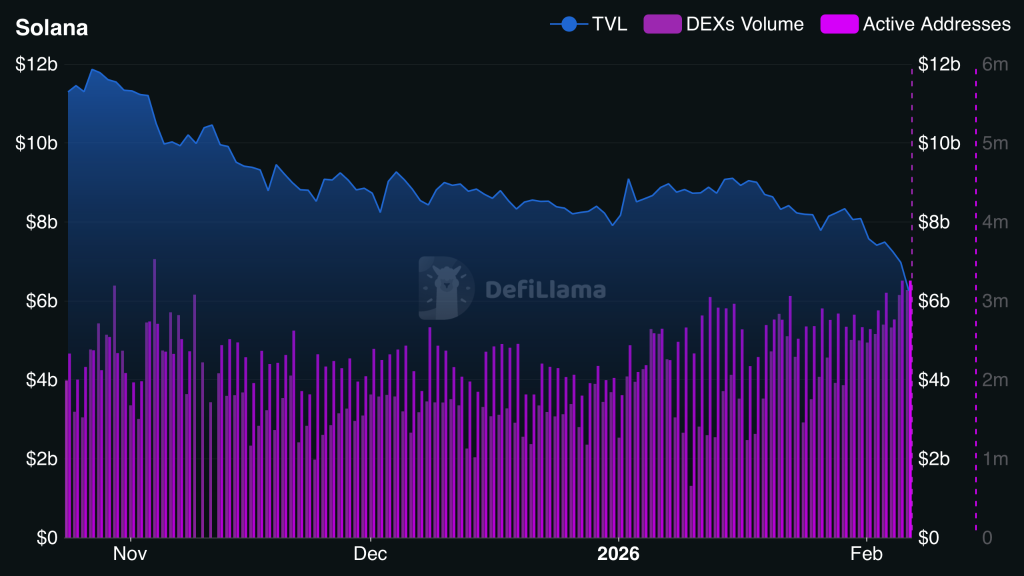

Crypto markets witnessed a mild recovery today after last week’s sharp sell-off, with Bitcoin stabilizing and altcoins attempting to form short-term bases. Solana joined the rebound, climbing over 5% to reclaim the $85 level after briefly dipping into the low-$70s. The move has eased immediate downside pressure, but on-chain data suggests the market is still recalibrating rather than transitioning into a fresh uptrend. While SOL price has bounced, the deeper market signals point to balance returning, not conviction. The question now centers on whether Solana (SOL) is building a foundation or merely reacting to exhausted selling.

Solana’s on-chain data reflects a textbook post-liquidation environment. CryptoQuant’s Spot Volume Bubble Map places current activity firmly in a “cooling” region, a phase typically observed after extended declines. Historically, this zone indicates that sellers have largely exited, but buyers have not yet re-engaged with force. Crucially, spot volume remains subdued relative to prior recovery attempts. This matters because sustainable bottoms are usually accompanied by rising spot participation, not just price stabilization. The absence of strong spot inflows suggests that large holders are waiting for confirmation rather than front-running a reversal.

Derivatives data reinforces this view. Futures volume bubble maps show a sharp transition from “overheating” to “cooling,” confirming that speculative leverage has been flushed. Open interest has contracted meaningfully, reducing liquidation risk but also signaling reduced directional conviction. In simple terms, traders have stepped back rather than stepped in.

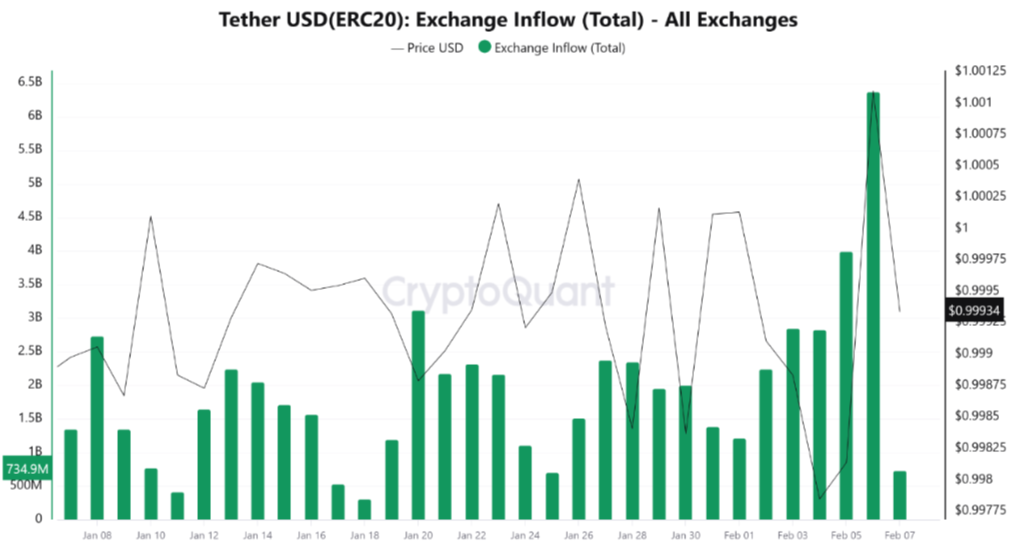

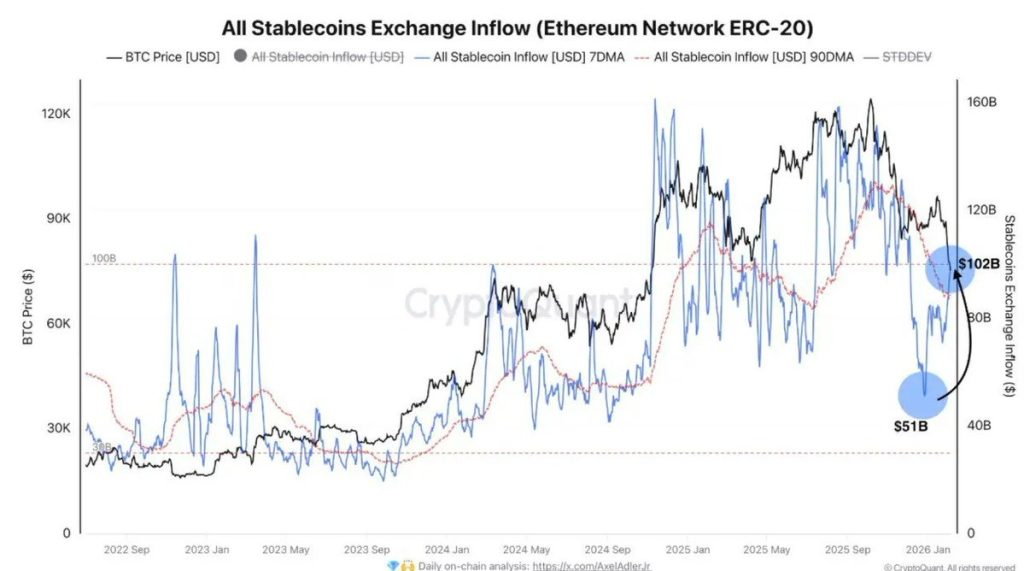

Stablecoin flow data adds an important layer to the narrative. Exchange inflows of USDT recently spiked to multi-week highs, reflecting fresh liquidity entering the system. However, this liquidity has not translated into aggressive Solana accumulation.

Historically, strong bottoms form when rising stablecoin balances coincide with expanding spot volume and declining exchange reserves for the asset itself. At present, Solana’s on-chain footprint shows liquidity availability without decisive allocation. This asymmetry suggests capital is positioning defensively, waiting for clearer signals before committing. In institutional terms, the market is liquid but cautious.

Solana’s price rebound toward the $85 mark marks a clear short-term recovery from recent panic lows, but the broader chart structure suggests the move is still corrective rather than trend-changing. On the daily timeframe, SOL remains confined within a descending channel that has guided price action since the January breakdown, indicating that sellers continue to control the dominant trend. The recent bounce originated from a well-defined demand zone in the $70–$75 region, where historical buying interest previously absorbed heavy sell pressure. That zone acted as a liquidity flush, triggering short covering and a technical rebound. However, the rally has so far stalled near the mid-range of the descending channel, an area that has repeatedly capped upside attempts over the past several weeks.

The $88–$92 resistance band now stands out as the first major supply zone. This region aligns with prior breakdown levels, short-term moving averages, and the upper boundary of the declining structure. A clean daily close above this zone would be required to shift market structure and open the door toward $100. Until then, upside moves risk being sold into. On the downside, immediate support now rests near $80, followed by the broader demand block around $72. As long as SOL holds above $80, the rebound structure remains intact. A failure back below that level would signal that the current move is losing momentum and could drag price back toward the lower demand area. Overall, Solana’s price action reflects stabilization after a sharp sell-off, but confirmation of a trend reversal remains absent.

Solana’s price recovery toward $85 reflects short-term relief driven by oversold conditions and cooling on-chain metrics, including declining futures leverage and stabilizing spot volume. That said, exchange inflows and muted follow-through buying suggest conviction is still building. A sustained push above the $90–$95 resistance zone, backed by rising spot demand and reduced sell pressure, is needed to confirm a durable trend shift rather than a temporary rebound.

Solana is rebounding as selling pressure eased and leverage was flushed, leading to stabilization rather than strong new buying.

Sustainability depends on rising spot volume and continued demand. Without that, the move remains a technical rebound.

Short term, SOL may consolidate as the market recalibrates. A trend reversal needs stronger buying and a close above $90.

The post How Hard Has the Crypto Market Crash Hit Donald Trump’s Holdings? appeared first on Coinpedia Fintech News

The crypto market just had one of its worst days in months, and Trump might have felt the heat too.

In a recent video breakdown by The Bulwark, hosts Tim Miller and Catherine Rampell unpacked the crash, what caused it, and why the Trump family’s deep crypto exposure makes this sell-off different from the rest.

Bitcoin fell toward $60,000, with realized losses reaching about $3.2 billion in just one day – the highest daily total ever recorded. It now sits 46% below its all-time high, back to where it was in 2021. Ethereum lost 50% over six months. Dogecoin dropped 66% in a year.

The $TRUMP meme coin took the hardest hit. It currently trades at $3.33, down 95.58% from it’s all-time high just a year ago.

Treasury Secretary Scott Bessent made one thing very clear: the government is not coming to save crypto. That statement sent markets deeper into panic, triggering forced liquidations and stop-loss cascades that made the drop worse.

The bigger issue is the rising long-term interest rates.

Rampell explained it simply: “You want money to be really cheap… when you have long-term rates going up, that tends to be bad for asset bubbles.”

Cheap money fuels speculation. When borrowing gets expensive, assets like meme coins are the first to break.

The Wall Street Journal reported that the Trump family’s crypto exchange sold a 49% stake to an Abu Dhabi royal who serves as the country’s national security chief. No one knew about the deal until journalists broke the story.

Rampell raised the concern directly: “We don’t have a lot of visibility into those transactions and whether Trump and his family may be doing lots of shady deals or selling off at various points to enrich themselves.”

While crypto crashed, gold kept climbing.

According to Rampell, that gap challenges the idea that Bitcoin works as a hedge against inflation. She argued that gold has thousands of years of history behind it, while crypto still behaves more like a speculative risk asset tied to cheap money conditions.

Rampell was blunt about who loses the most here: “There are a lot of people who maybe lost their shirts who can’t afford it.”

With this level of political involvement in crypto markets, the questions around transparency and investor protection are only going to get louder.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

A combination of high investor losses, a government statement ruling out a crypto bailout, and rising long-term interest rates that reduced cheap money for speculation triggered the sell-off.

Recent trends challenge that idea. While gold rose, Bitcoin crashed, behaving more like a speculative risk asset dependent on low interest rates rather than a stable store of value.

Retail investors often bear the biggest losses, as they may invest money they cannot afford to lose in these highly volatile and speculative digital asset markets.

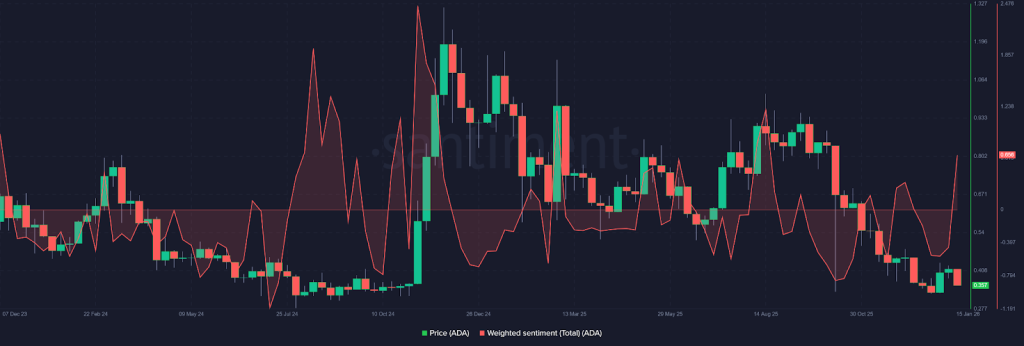

The post Cardano (ADA) Price Surges 10% as Whales Accumulate and CME Futures Near Launch appeared first on Coinpedia Fintech News

Cardano’s native token ADA has made a strong comeback, rising nearly 10% today to trade around $0.27 after falling close to $0.22 earlier this week. The sharp recovery has renewed optimism among investors and raised fresh questions about whether ADA is preparing for a bigger rally ahead.

One major reason behind the rebound is renewed institutional interest. Grayscale, a leading crypto investment firm managing over $35 billion in assets, recently increased its ADA holdings.

BREAKING NEWS

— Mintern (@MinswapIntern) February 6, 2026

GRAYSCALE SIGNALS STRONG CONFIDENCE IN CARDANO

Grayscale has increased its $ADA allocation in the Smart Contract Fund from 18.55% to 19.50%, reaffirming strong conviction in Cardano.

As of 05-02-2026, $ADA remains the third-largest holding in the fund pic.twitter.com/LMQI60di8u

The firm raised Cardano’s weight in its Smart Contract Fund from 18.55% to 19.50%, showing stronger confidence in the project.

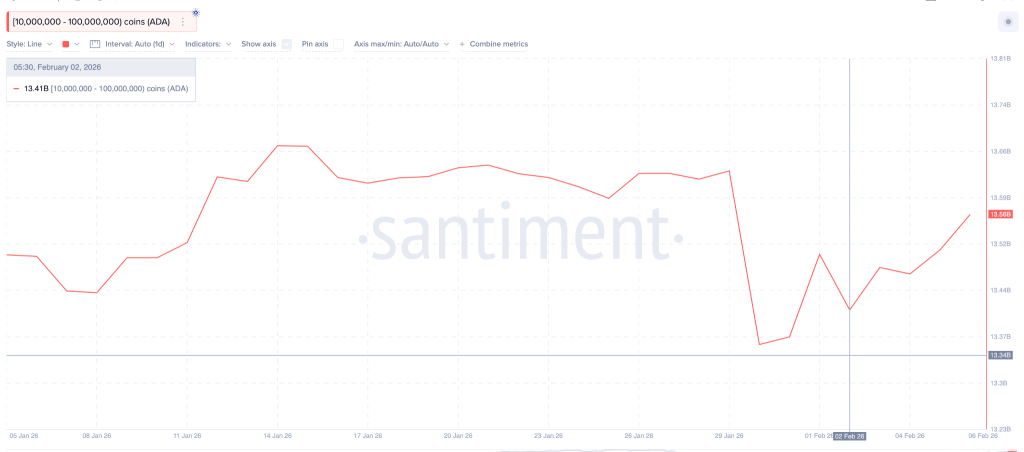

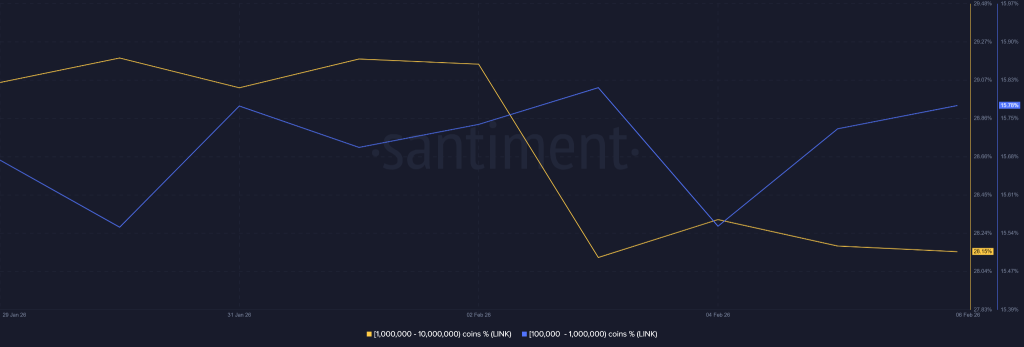

Data from santiment shows that large ADA holders took advantage of the recent price drop. Wallets holding between 10 million and 100 million ADA increased their combined balances from about 13.41 billion to 13.56 billion ADA since early February. This represents an accumulation of roughly $40 million worth of tokens.

More importantly, these mid-sized whales did not sell during the crash. Their holdings remained stable even when prices briefly fell to $0.22.

Adding to the positive momentum, Cardano futures are set to launch on the CME exchange on February 9. The new contracts will give institutional investors regulated access to ADA trading. CME will introduce both standard contracts of 100,000 ADA and smaller micro contracts of 10,000 ADA.

This upcoming launch could increase liquidity and bring more professional participation into the Cardano market.

On the weekly chart, ADA has been moving sideways for a long time after its last major peak. The price is forming higher lows near the $0.26 support zone, showing steady buying interest. ADA is also testing a long-term resistance line that has blocked earlier rallies.

A weekly close below $0.20 would weaken the bullish structure and invalidate the current setup. That level acts as the main line of defense for bulls.

However, if momentum improves, analysts see potential for a mid-cycle move toward the $2 to $3 range.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Cardano (ADA) price is rising due to strong whale accumulation, increased Grayscale exposure, and optimism ahead of CME ADA futures.

Yes, wallets holding 10M–100M ADA added nearly $40M worth of tokens, signaling confidence and long-term accumulation.

ADA holds strong support near $0.26, while a weekly close below $0.20 would weaken bullish momentum.

Analysts expect ADA to trade between $0.90 and $1.50 by February 2026 if adoption grows and bullish momentum holds.

The post China’s New Crypto Ban Explained: Stablecoins, RWA, and the Digital Yuan appeared first on Coinpedia Fintech News

China is tightening the screws on crypto again.

The People’s Bank of China and seven other government agencies released a revised joint notice on Friday, banning unauthorized offshore issuance of yuan-pegged stablecoins. The notice also brings RWA tokenization under regulatory control for the first time.

The agencies stated that stablecoins pegged to fiat currencies “perform some of the functions of fiat currencies,” and warned that their unregulated circulation could threaten the yuan’s stability.

The rules apply to both domestic and foreign entities, including overseas branches of Chinese firms.

The notice reaffirms that crypto has no legal tender status in China. All crypto-related business activities remain classified as “illegal financial activities.”

Financial institutions are warned against offering banking or clearing services to crypto businesses. Mining operations continue to face enforcement. And businesses can no longer include words like “stablecoin,” “RWA,” or “cryptocurrency” in their registered names or business scope.

Here is where it gets interesting. Despite the ban language, the notice does seem to create a regulated path for RWA tokenization, something that previously sat in a grey area.

Louis Wan, CEO of Unified Labs, said, “The biggest breakthrough is a clear separation between virtual currencies and RWA. Virtual currencies will still be outlawed, but RWA is being included in the regulatory system. For China’s RWA business, this is a milestone.”

Alex Zuo, senior vice president at Cobo, added, “To some extent, this means China is allowing the issuance of offshore tokens based on onshore assets.”

Winston Ma, adjunct professor at NYU School of Law, said China’s central bank is essentially highlighting that only its own digital yuan is legitimate.

China recently allowed commercial banks to pay interest on digital yuan wallets starting January 1, 2026, a clear push to drive e-CNY adoption while shutting out private alternatives.

Crypto Twitter has been exploding with reactions. Benjamin Cowen, CEO of Into The Cryptoverse, summed it up on X: “It wouldn’t be a bear market if China wasn’t banning crypto.”

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

No, all cryptocurrency-related business activities are officially classified as illegal financial activities in China, and crypto has no legal tender status.

China maintains a comprehensive ban on all cryptocurrency trading and business activities, classifying them as illegal financial operations to protect its financial sovereignty and the yuan.

While cryptocurrencies are banned, China is creating a regulated path for Real World Asset (RWA) tokenization and actively promoting its own central bank digital currency, the digital yuan (e-CNY).

Crypto mining remains prohibited, and businesses cannot use terms like “cryptocurrency” in registrations. Financial institutions are barred from servicing crypto firms, with continuous enforcement.

The post Vitalik Buterin Backs Zcash Upgrade, Signaling Crypto’s Privacy Future appeared first on Coinpedia Fintech News

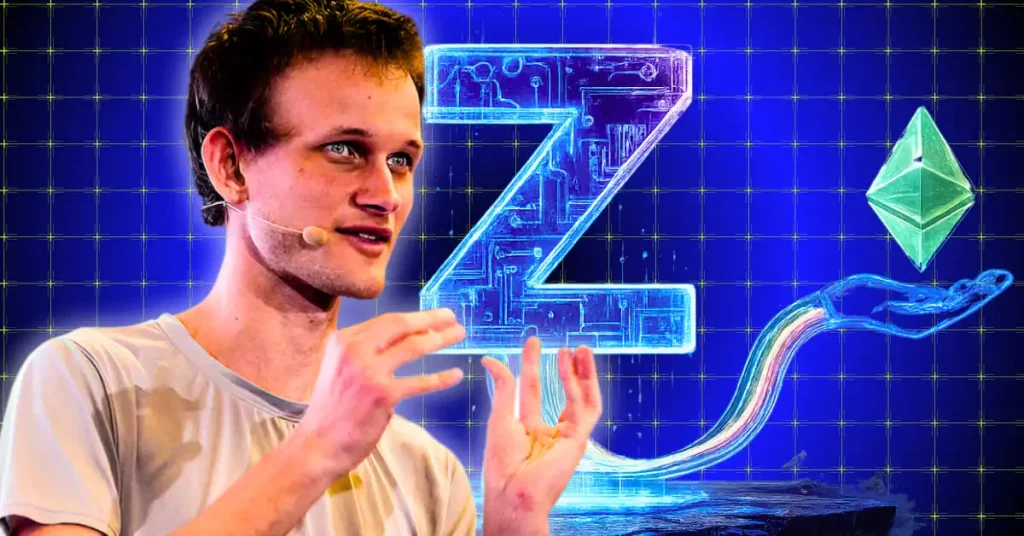

Ethereum co-founder Vitalik Buterin has quietly made a strong statement about where he thinks crypto should be heading. He recently donated to Shielded Labs, a research group working on a major upgrade for Zcash, signaling his growing focus on privacy and long-term security rather than hype or short-term growth.

The donation supports the development of Crosslink, a proposed upgrade aimed at making Zcash transactions settle faster and more securely. More than the money itself, the move reflects Buterin’s belief that privacy should be treated as core infrastructure, not a bonus feature.

At a simple level, Crosslink adds an extra layer of confirmation on top of Zcash’s existing proof-of-work system. This second layer is designed to lock in transactions more quickly and with stronger certainty. That matters because it reduces the risk of chain reorganizations and double-spend attacks, issues that can be especially costly for exchanges and large transfers.

With stronger finality, exchanges would not need to wait as long before crediting deposits, cross-chain bridges could operate with better security guarantees, and developers would have clearer assumptions when building on the network. For Zcash, this means becoming more practical to use without weakening its privacy model.

Shielded Labs is focused entirely on improving Zcash at the protocol level. It is not building apps or chasing user growth. Instead, the team works on deep technical upgrades that improve security, usability, and cryptographic guarantees, especially around shielded transactions.

That approach lines up closely with how Buterin has been speaking lately. He has argued that blockchains should be designed for worst-case scenarios, not ideal conditions. In other words, systems should still protect users even under censorship, attacks, or hostile regulatory pressure.

Buterin has become increasingly vocal about the risks of financial systems that are fully transparent without strong privacy protections. He has warned that this kind of openness can lead to surveillance, coercion, and long-term instability.

From that perspective, Zcash stands out because privacy is built directly into the protocol through shielded transactions, rather than added later as an extra feature. Supporting Shielded Labs is effectively an endorsement of that design philosophy.

Crypto analyst Mert argues that crypto cannot truly succeed without strong, built-in financial privacy, saying that a system without encrypted money misses the entire point of decentralization. He suggests that what the market saw late last year was only a preview, and believes momentum is building for a serious revival of Zcash. According to him, the groundwork is already in place for Zcash to accelerate sharply and potentially re-enter the top tier of cryptocurrencies.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Crosslink adds an extra layer of confirmation to Zcash, speeding up transactions and reducing the risk of double-spends.

Zcash uses shielded transactions, encrypting amounts and addresses, making privacy a built-in feature, not optional.

With Crosslink upgrades and growing privacy demand, Zcash could accelerate adoption and rise among top cryptocurrencies.

The post Scaramucci Explains Why Bitcoin Fell to $60K This Week appeared first on Coinpedia Fintech News

Bitcoin fell sharply to $60,000 this week, shaking investor confidence, even though the market has many positive developments. On CNBC’s Closing Bell Overtime, SkyBridge Capital founder Anthony Scaramucci explained why Bitcoin can still have big swings, despite favorable regulation, the approval of ETFs, and growing interest from large investors.

This week, Bitcoin saw a steep drop followed by a quick rebound, showing that it remains unpredictable. This happened even though many consider recent events as wins: spot Bitcoin ETFs are now available, institutions are investing, and U.S. regulations are becoming clearer. Still, instead of stable prices, Bitcoin fell hard, leaving investors puzzled.

Scaramucci said the recent drop is uncomfortable but not unusual for Bitcoin.

Scaramucci emphasized that Bitcoin is still in its early adoption phase. He doesn’t call it just “digital gold” or a hedge against inflation, but a new type of technology with characteristics of both money and gold. Early-stage assets often have big ups and downs.

He added that most Bitcoin investors are younger. Older, wealthier investors often prefer traditional safe-haven assets like gold and silver. That’s why those assets rose earlier this year while Bitcoin struggled to stay at its highs.

A major factor holding Bitcoin back, according to Scaramucci, is uncertainty around U.S. regulations. He highlighted the importance of the Clarity Act. Even with ETFs, many banks and institutions hesitate to invest fully without clear government guidance.

If such legislation passes, it could bring in a new wave of large investors. Until then, uncertainty is likely to keep Bitcoin prices volatile.

Even with institutional buying and ETFs, Bitcoin still reacts strongly to market conditions. Scaramucci said the recent price drop was actually smaller than past cycles. For example, a fall like this might have pushed Bitcoin down to $38,000 before, but this time it held near its 200-day moving average. This shows some support from ETFs and big buyers.

He also pointed out that fear is very high in the market. The Fear & Greed Index dropped to 5, one of Bitcoin’s lowest levels ever, which usually happens during major sell-offs rather than market peaks.

Despite the chaos, Scaramucci remains confident. He called the recent drop a “normal correction” and revealed he bought more Bitcoin during the dip. For him, volatility is just part of owning an asset that is still early in global adoption.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Yes, Bitcoin is an early-stage asset with big price swings, influenced by adoption trends, ETFs, and ongoing regulatory uncertainty.

Clear regulations could attract institutional investors and reduce volatility, but current uncertainty keeps Bitcoin unpredictable.

Early adoption, a younger investor base, and Fear & Greed-driven sentiment make Bitcoin prone to large swings.

Buying during dips can be an opportunity, but it carries risk; volatility is normal for Bitcoin’s early-stage market.

The post WLFI Price Slumps as Regulatory Concerns Eclipse Crypto Market Recovery appeared first on Coinpedia Fintech News

Crypto markets attempted to stabilize today, with Bitcoin holding above the $67,000 mark and several major altcoins showing short-term relief rallies after aggressive liquidation-driven selloffs. Risk appetite, while fragile, showed early signs of returning across parts of the market. WLFI price has failed to participate in that rebound. Instead, WLFI price extended losses, remaining one of the weakest performers as selling pressure persisted. The divergence highlights a key point: WLFI price action is being driven by project-specific risk rather than broader market conditions.

WLFI price continues to face bearish pressure as political scrutiny surrounding World Liberty Financial remains firmly in focus, keeping traders cautious even as broader crypto markets attempt to stabilize. The project sits under increasing examination after the U.S. Congressman Ro Khanna, a ranking member of the House Select Committee on China, confirmed an investigation into a reported $500 million UAE-linked investment connected to the Trump family’s crypto venture. The inquiry centers on transparency, foreign capital exposure, and potential national-interest implications factors that markets typically price in well before any regulatory outcome materializes.

Breaking: I have launched an investigation as ranking member of the Select Committee on China into a $500 million UAE investment in the Trump family’s cryptocurrency company.

— Ro Khanna (@RoKhanna) February 5, 2026

This is about public trust and transparency. https://t.co/2PfVrOmNni https://t.co/1PjXb64jyH

For WLFI, the issue is not a single headline but the persistence of uncertainty. Once political oversight enters the equation, price discovery often shifts away from short-term technicals toward risk management, with traders reducing exposure until clarity emerges. That dynamic appears evident in WLFI’s continued downside momentum. Adding to the strain, reports of World Liberty Financial reducing its wrapped Bitcoin holdings have deepened concerns around defensive positioning. Whether interpreted as liquidity management or precautionary de-risking, the move has amplified bearish sentiment around WLFI price, reinforcing the perception that the token is trading under an unresolved cloud.

As long as political scrutiny and balance-sheet questions remain active themes, WLFI price is likely to stay sensitive to headlines, with rallies facing immediate selling pressure rather than sustained follow-through.

WLFI price action remains technically weak, with the chart reflecting sustained selling pressure following its breakdown of the symmetrical triangle pattern. After failing to hold its prior consolidation base around $0.1600, price broke down below the trendline support, confirming a bearish thesis. Moreover, the meme-coin has slipped below the short-term moving averages, with EMAs sloping downwards, indicating that sellers are active on rallies.

The recent breakdown has shifted the structure, from higher lows to lower lows which signals that sellers have dominated now. The current structure signals that WLFI price is heading toward the swing low of $0.0750, the key demand zone. Once price approaches the zone, buyers may accumulate the memecoin and a swift recovery could be seen from there. Until WLFI token price remains below $0.1500, the short-term trend remains bearish. In case of bounceback, the $0.1200 would act as an immediate resistance, while near support levels are $0.1000 and $0.0900.

The post Crypto Startup Erebor Becomes First US Bank of Trump’s Term appeared first on Coinpedia Fintech News

Erebor Bank, a crypto‑friendly financial startup backed by tech investors including Palmer Luckey and Joe Lonsdale, has become the first new national bank chartered in the US during President Trump’s second term, the Wall Street Journal reported. The Office of the Comptroller of the Currency (OCC) approved the charter less than eight months after application, allowing Erebor to operate nationwide. The bank aims to serve technology firms in crypto, artificial intelligence, defense, and manufacturing, helping fill funding gaps left after Silicon Valley Bank’s collapse. It has also secured FDIC deposit insurance and plans to offer traditional banking alongside services tailored to emerging industries.

The post Arthur Hayes Links Bitcoin Crash to BlackRock Bitcoin ETF Flows appeared first on Coinpedia Fintech News

Bitcoin and other major cryptocurrencies are showing signs of short-term recovery after a recent sharp drop, with prices bouncing off key support levels. Analysts say this rebound may indicate the worst of the recent sell-off is over, at least for now.

Bitcoin found support at $60,000, which is now acting as a short-term floor. Ethereum, XRP, Solana, and Chainlink have also bounced, suggesting the recovery is affecting the wider crypto market.

The crypto recovery happened at the same time as a small bounce in U.S. stocks. The S&P 500 rose slightly as the week ended, showing that traditional markets and cryptocurrencies often move together. Analysts say this stock market bounce may have helped Bitcoin and other cryptocurrencies start to recover.

While the recent rebound is encouraging, some experts caution that the prior crash was influenced by more than just market sentiment.

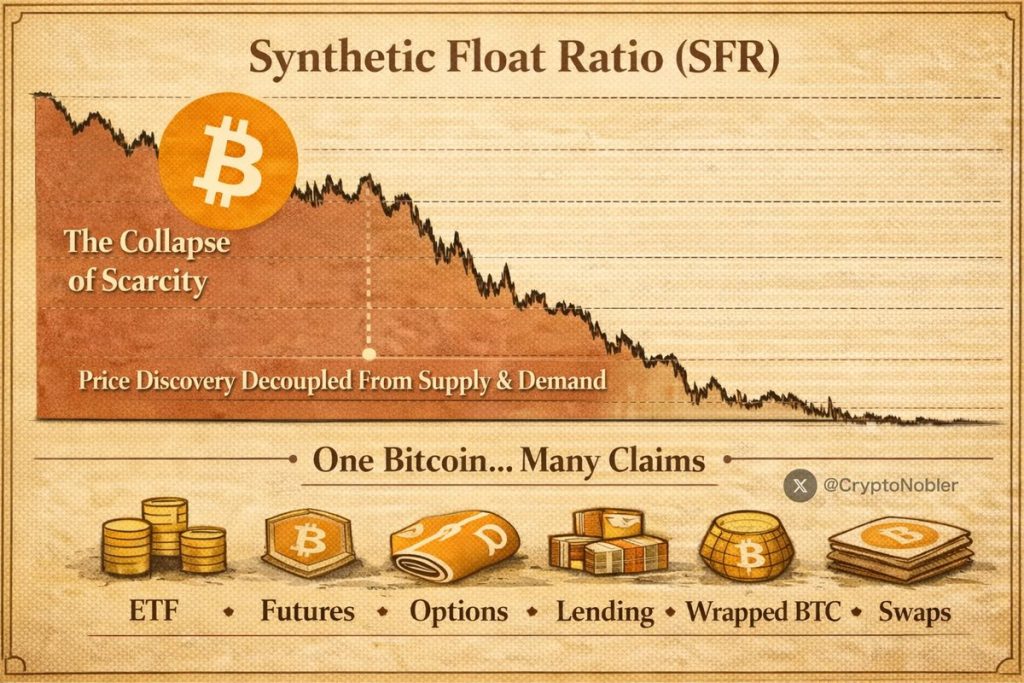

BitMEX co-founder Arthur Hayes offered a structural explanation for the decline. He believes the Bitcoin sell-off is not just panic-driven but also linked to dealer hedging related to structured products tied to BlackRock’s iShares Bitcoin Trust (IBIT). As IBIT shares fell sharply, banks and dealers were forced to rebalance their positions, triggering aggressive selling in Bitcoin and related derivatives.

$BTC dump probably due to dealer hedging off the back of $IBIT structured products. I will be compiling a complete list of all issued notes by the banks to better understand trigger points that could cause rapid price rises and falls. As the game changes, u must as well. pic.twitter.com/9DF8VE9XBL

— Arthur Hayes (@CryptoHayes) February 7, 2026

Hayes noted that such mechanical selling can create sudden and dramatic price swings, especially in fragile markets. He is compiling a detailed list of bank-issued notes to identify key triggers that could cause rapid moves in either direction.

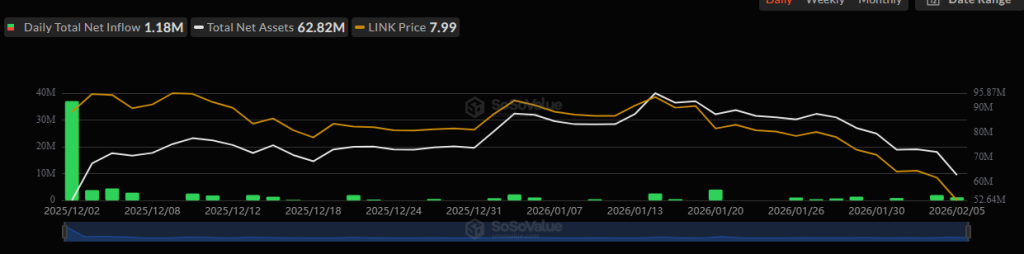

Recent spot Bitcoin ETFs have been net sellers, supporting Hayes’ view. Nearly $1.2 billion has flowed out of spot Bitcoin ETFs over the last three trading days, led by BlackRock’s IBIT. Meanwhile, IBIT recorded a record $10 billion in trading volume as its share price fell 13% in a single session, its second-largest daily drop since launch.

Rather than signaling strong demand, this surge in volume reflects stress, hedging, and forced repositioning. It underscores that structural flows are becoming a dominant factor in Bitcoin’s price movements.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Crypto prices are rising as key coins find support, ETF outflows slow, and investor confidence returns alongside stocks.

The decline was driven by structural factors like ETF-related hedging, forced bank selling, and high-volume repositioning.

Yes, large spot Bitcoin ETF flows can trigger mechanical selling and sudden moves, making structural pressures key in crypto volatility.

The post XRP News Today : Ripple Pushes XRP Beyond Trading Into Core Settlement and Liquidity Role appeared first on Coinpedia Fintech News

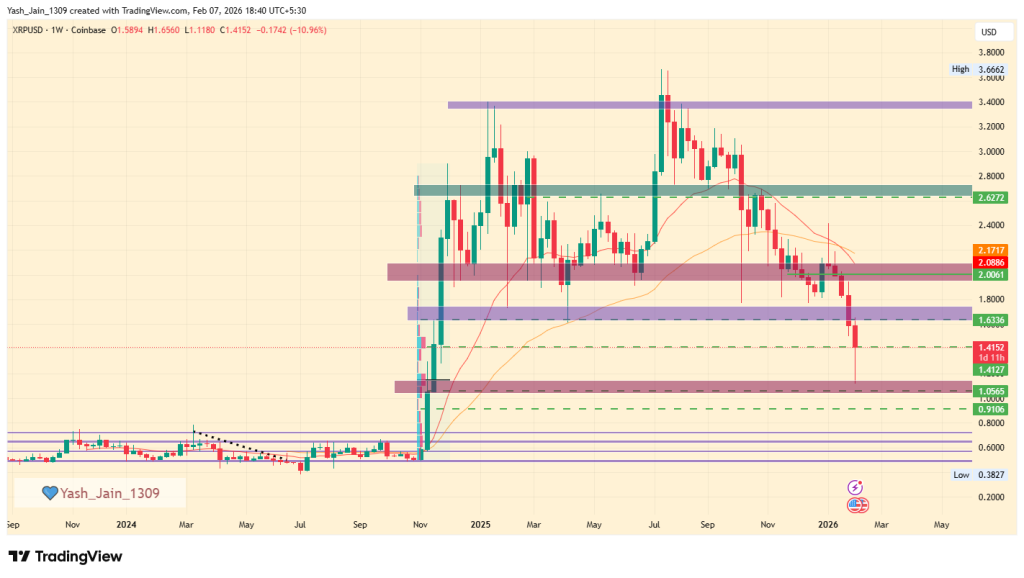

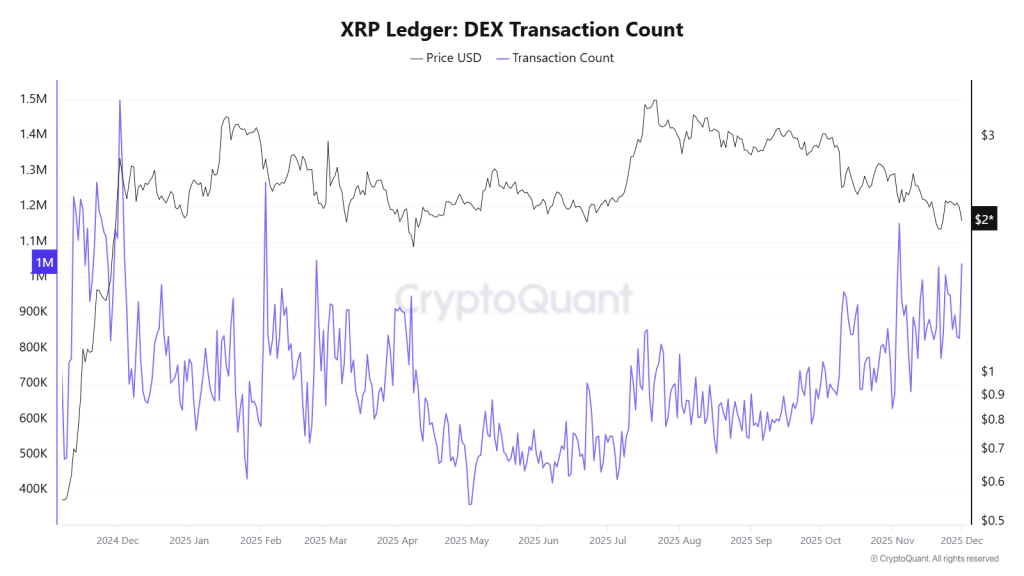

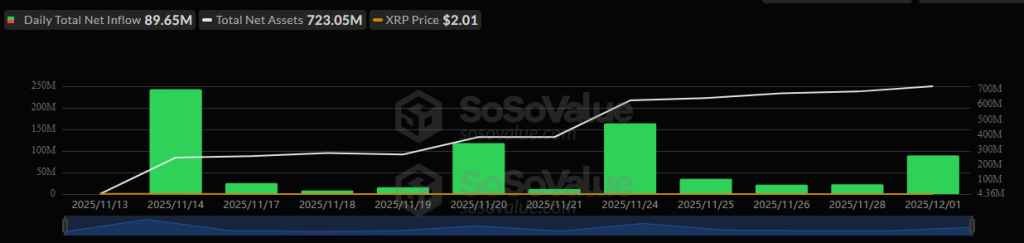

Ripple’s native token XRP is shifting from a trading-focused crypto asset into a key settlement layer for institutional finance. A new strategic update around XRP Ledger (XRPL) shows a strong push toward regulated decentralized finance, positioning XRP at the core of payments, liquidity transfers, and on-chain credit activity.

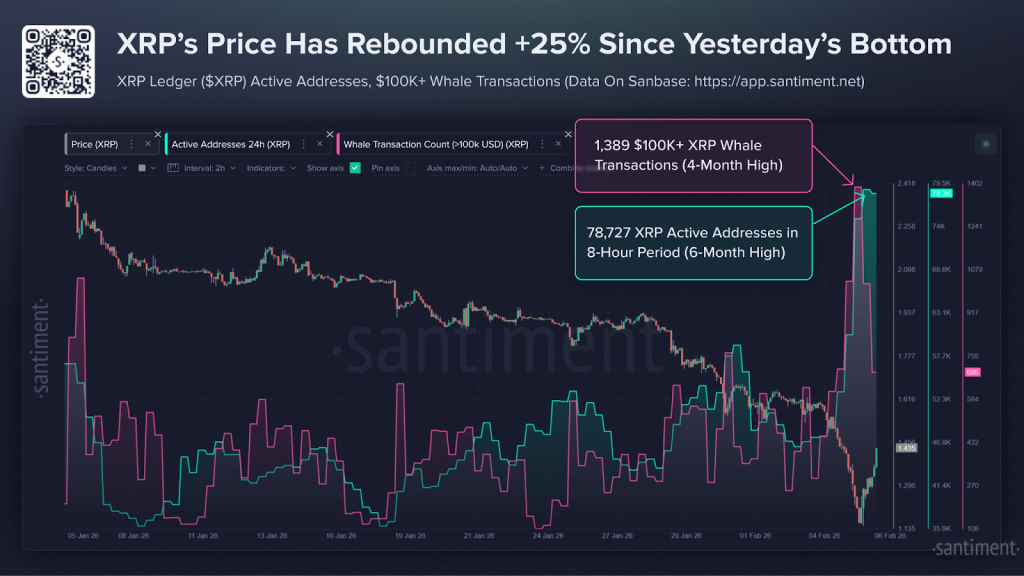

Meanwhile, XRP is trading near $1.46, gaining almost 12% in today’s market rally.

According to Ripple’s latest roadmap insight, XRPL is evolving beyond basic transfers and is now designed to handle real-time settlement and tokenized finance operations at scale.

The network already supports tools that institutions typically require, such as multi-purpose tokens, permissioned environments, credential layers, escrow controls, and batch transaction processing.

These functions allow financial players to manage foreign exchange settlements, issue tokens, and complete delivery-versus-payment transactions directly on the ledger.

Instead of operating as a separate trading asset, XRP is used directly inside these flows to cover transaction fees, reserve requirements, and automatic asset bridging between tokens.

Ripple’s framework positions XRP as a functional protocol token rather than only a medium of exchange. The asset supports multiple ledger-level operations that connect payments, collateral movement, and liquidity routing.

This design allows different financial components to work together as a single system. Payments, token settlement, and liquidity conversion are linked through XRP at the base layer, giving it a structural role in how transactions are completed.

Recently, Ripple also pointed to 2 upcoming upgrades expected to deepen XRP’s role:

These additions would allow credit markets to function directly on XRPL while keeping XRP central to settlement and liquidity movement.

At the same time, exchange-side support for the XRP ecosystem is also expanding. Crypto trading platform Bitrue announced stronger XRP ecosystem support and launched 10 new RLUSD spot trading pairs linked to major crypto assets.

#Bitrue was the world's first crypto exchange to offer #XRP base pairs and we continue to show our support and dedication to the #XRP ecosystem with the introduction of $RLUSD trading pairs this week!

— Bitrue (@BitrueOfficial) February 5, 2026@ripple

Here's 10 $RLUSD Spot trading pairs we will be offering:… pic.twitter.com/zzS5OZzGFC

The platform says its XRP-focused product line now includes trading, staking, loans, and futures tools.

The rollout is designed to improve liquidity access and portfolio flexibility for traders positioning for the next market cycle.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

XRP is shifting into a settlement and liquidity layer for institutions, supporting payments, tokenized finance, and on-ledger credit operations.

XRP handles fees, reserves, and asset bridging, enabling real-time settlements and smooth liquidity flow for institutions.

XRP’s value is increasingly tied to its utility in institutional finance for settlements and liquidity, not just speculation. It recently traded near $1.46, gaining 12% in a market rally.

Yes, an upcoming XRPL upgrade (XLS-66 Lending Protocol) will allow native on-ledger borrowing and lending, deepening XRP’s role in credit markets and asset management.

The post White House to Hold Feb. 10 Meeting on Stablecoin Yield Rules With Banks and Crypto Firms appeared first on Coinpedia Fintech News

The White House is preparing for another important meeting on February 10 to discuss stablecoin rules with banks and crypto companies. The talks are part of ongoing efforts to shape clear regulations for the U.S. crypto market.

The main issue remains whether stablecoin issuers should be allowed to offer yield or interest to users.

Independent journalist Eleanor Terrett highlighted that a new round of White House discussions is about the happen next Tuesday.

This follows an earlier closed-door session earlier in the week where staff-level participants from both sectors met but failed to fully resolve major policy gaps. Even though attendees described the tone as productive, no final consensus was reached.

However, the main goal of this discussion is about clarisfication over the Stablecoin Yield talks.

Traditional banks are strongly worried about yield-bearing stablecoins. They believe that if crypto firms are allowed to offer interest on stablecoins, customers may move their money away from bank deposits. This could weaken the banking system and reduce financial stability.

Therefore, banking groups and Treasury officials have pushed for strict limits on stablecoin rewards. They argue that only regulated banks should be allowed to offer interest-based products to protect consumers and the economy.

Crypto firms strongly disagree. They say user rewards are a standard growth tool in digital finance, and banning them would hurt competition and give traditional banks an unfair advantage in the market.

Several industry participants have suggested targeted edits to the draft framework to make the bill more balanced and practical. Perhaps, banking representatives have not yet signaled acceptance of those changes.

The upcoming discussion will include staff-level officials, bank representatives, and crypto trade groups. This is an important change from earlier meetings, which mainly involved government officials and policy experts.

With the crypto market facing recent volatility, regulatory clarity is widely seen as a potential confidence booster for investors and institutions

If both sides reach a compromise, it may help speed up long-delayed crypto legislation.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Regulators and banks fear yield-bearing stablecoins could lure deposits away from traditional banks, potentially weakening the financial system’s stability and consumer protections.

Banks argue that only regulated institutions should offer interest products to safeguard customers and maintain economic stability, viewing crypto yields as a competitive threat to deposits.

The February 10 meeting aims to bridge policy gaps between banks and crypto firms, seeking clarity on yield rules to advance clearer U.S. crypto regulations.

The post Arthur Hayes Blames IBIT Hedging for Recent Bitcoin Selloff appeared first on Coinpedia Fintech News

BitMEX co-founder Arthur Hayes said the recent Bitcoin selloff was likely driven by dealer hedging linked to iShares Bitcoin Trust (IBIT) structured products. These hedging activities, where market participants adjust positions based on price movements, can amplify volatility. Hayes is also compiling a detailed list of bank-issued notes and related products to identify potential trigger points that could cause sharp Bitcoin swings. He stressed that as market conditions evolve, traders and institutions must adapt quickly to navigate sudden price changes.

The post Crypto Markets Rebound—Here’s Why Bitcoin, Ethereum, XRP Prices are Rising Today appeared first on Coinpedia Fintech News

The crypto markets experienced some relief as the selling pressure eased over the major cryptos. The market capitalisation recovered above $2.4 trillion, while the volume dropped close to $200 billion from the highs around $306 billion during the sell-off. The crypto ETF also turned positive after 2 to 3 days of continuous outflow. The market dynamics suggest a shift in favour of the bulls, but the sentiments remain under extreme fear, indicating that the traders and the investors remain in disbelief.

Bitcoin is rising after a sharp rebound from intraday lows, driven by exhausted selling and forced short covering rather than fresh bullish news. BTC price is trading near $69,942, up 7.68% on the day, after bouncing from a low of $64,459 to an intraday high of $71,681. The recovery followed an extreme momentum reset, with RSI climbing to 32.2 from 15.82, a level that often signals panic selling has peaked.

Derivatives data show the move was mechanically fueled. Open interest rose to $58.6 billion, pointing to new positions entering after the flush. Liquidations also skewed toward the downside, with short liquidations at roughly $384 million, compared to $299 million in long liquidations, forcing late sellers to buy back into the move.

ETH price is trading around $2,072, up 7.75%, after rebounding from a $1,865 low to a $2,115 intraday high. The move followed extreme downside pressure, with RSI recovering from 18.66 to near 30, a level that often marks seller exhaustion. Derivatives positioning picked up alongside the bounce, as open interest rose from $22.89 billion to $25.16 billion, suggesting fresh participation after the flush rather than long-term accumulation.

XRP price trades near $1.45, up 10.74%, after climbing from $1.29 to $1.54. RSI jumped from 17.05 to the mid-30s, while open interest increased from $2.4 billion to $2.63 billion, pointing to speculative flows rather than confirmed trend strength. XRP is also among the top performers among the top 10 cryptos, with over a 30% rise from the lows close to $1.12.