Ethereum’s Fusaka Upgrade Completes Final Hoodi Test Ahead of Mainnet Launch

This article was first published on The Bit Journal.

BitMine Immersion Technologies has jumped into the top tier of institutional crypto treasuries with total crypto, cash and “moonshot” investments of $14.2 billion, anchored by a whopping 3,313,069 ETH position; seemingly the largest Ethereum treasury in the world.

Chairman Tom Lee has described the strategy as pursuing what the firm calls its “alchemy of 5%” of Ethereum’s total supply.

For BitMine Ethereum holdings, this means $ETH is no longer just a speculative token, but a corporate reserve asset.

BitMine’s recent announcement divulged that they now hold 3.31 million ETH tokens, or roughly 2.8% of Ethereum’s total supply.

The breakdown includes 192 BTC, $305 million in unencumbered cash, plus their “moonshot” investments, all totaling $14.2 billion.

Earlier in August, they reported 1.71 million ETH and crypto + cash assets of $8.8 billion.

BitMine’s ETH strategy started with a $250 million private placement announced on June 30 2025, specifically for ETH accumulation.

From there; they scaled fast and by July; they had over 300,000 ETH worth over $1 billion.

By early August, they had 833,137 ETH ($2.9 billion). By August 24th; they had 1.71 million ETH with $8.8 billion in assets.

BitMine’s move resonates with a trend in corporate treasuries where instead of just Bitcoin, Ethereum is becoming a reserve asset. By holding ETH as a core treasury holding, BitMine is signaling that they believe in ETH’s role in decentralized finance, staking, smart-contracts and tokenization.

Tom Lee drew a historical parallel, calling the ongoing evolution: “[The] end of Bretton Woods … as transformational to financial services in 2025 as ending Bretton Woods was 54 years ago.”

BitMine’s ETH accumulation has had effects. Their stock (BMNR) has gone up big time and is now one of the most traded stocks in the US with daily volumes in the billions.

Big investors like ARK Invest, Bill Miller III, Founders Fund (via Peter Thiel) and others are also reportedly behind the strategy.

For ETH markets, big public-treasury holders like BitMine set a new precedent: corporate accumulation, staking and ecosystem integration are part of how ETH is valued.

Going forward, market observers could monitor include how BitMine manages and deploys its ETH; whether it stakes, uses it for DeFi yield or holds it passively. The firm’s target of 5% of ETH supply is ambitious.

Also; how other companies respond; will more firms add ETH to their reserves? The whole ecosystem may change if BitMine Ethereum holdings becomes the corporate crypto strategy.

Finally; how this accumulation impacts ETH tokenomics, staking; supply concentration and market perceptions will make headlines.

Ethereum (ETH): a crypto-asset used for the Ethereum blockchain; for smart contracts; staking and DeFi.

Treasury holdings: assets held long-term by a company for reserve or strategic purposes; not for short-term speculation.

Staking: locking cryptocurrency to support blockchain operations; and earn rewards.

Tokenization: converting real-world assets or rights into digital tokens on a blockchain.

Circulating supply: total number of tokens available in the market; for a given cryptocurrency.

Private placement: issuing securities directly to a limited number of investors; often used to raise capital for strategic initiatives.

As of October 27, 2025; BitMine holds approximately 3,313,069 ETH.

$14.2 billion in crypto, cash and “moonshots.”

BitMine says its holdings are about 2.8% of the total ETH supply.

ARK Invest, Founders Fund (via Peter Thiel), Bill Miller III, Pantera Capital and Galaxy Digital.

The company’s internal target is 5% of the total ETH supply, its “5% alchemy” goal.

Read More: BitMine Becomes Ethereum’s Biggest Corporate Holder With 3.3 Million ETH in Reserves">BitMine Becomes Ethereum’s Biggest Corporate Holder With 3.3 Million ETH in Reserves

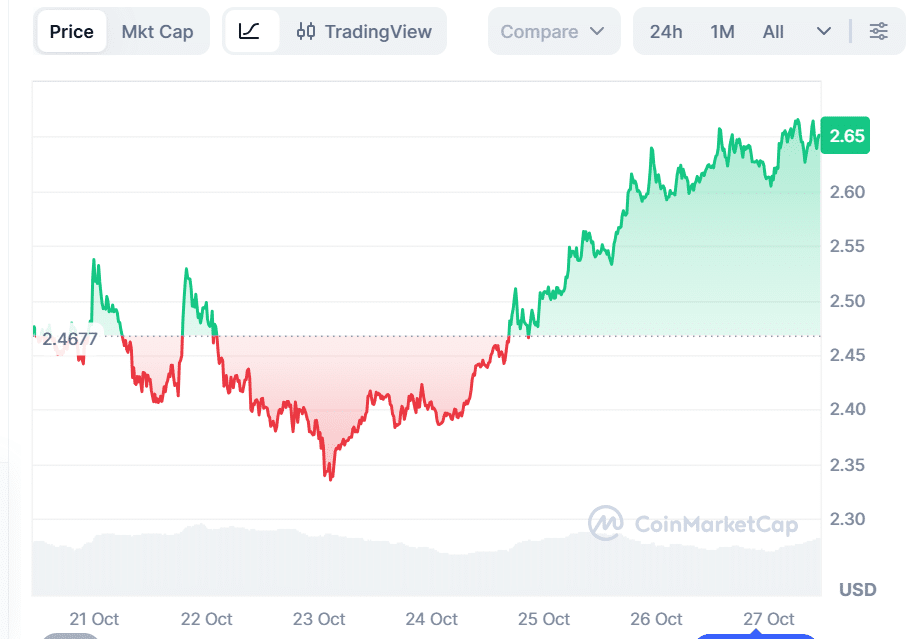

Cantonese Cat used his October 28 video to zero in on the Dogecoin market structure, arguing that the meme-coin is nearing the end of a multi-year accumulation phase—and that the recent washout was a feature, not a bug, of that process. While he declined to publish numeric price targets in the video, he made the case that DOGE’s setup is maturing in lockstep with broader “risk-on” signals, with a familiar lag to Ethereum that historically precedes Dogecoin’s larger moves.

On structure, he was explicit. “Just looking at Doge here, you can see how […] Doge has been forming a cup over here for close to four and a half, five years now […] it’s just been building a big giant base.” In his read, the rounded bottom is the defining pattern of this cycle for DOGE, and it remains intact despite recent volatility.

He framed the sharp drawdown two weeks ago as necessary positioning rather than a break in trend: “You just had a great deleveraging event […] I’m not going to look at a lower low and think the trend is broken […] These are very healthy deleveraging before the next move up as far as I’m concerned.” He highlighted “a big giant wick” and “a lot of demand down below,” pointing to what he sees as resilient spot support through the base.

Timing, not targets, was the centerpiece. He reiterated that Dogecoin typically follows Ethereum with a delay once ETH clears its own major resistance bands. “Whenever we get closer to the end of the rounded bottom […] that’s when Ethereum breaks out above the resistance zone and goes up a lot higher. Thus, Doge runs together with Ethereum,” he said, adding: “There is a lag. I would say the lag is probably maybe a couple months between Ethereum breaking up and Doge finally breaking above this rounded bottom here and going up.”

He made a similar observation using risk proxies, noting that DOGE moves have historically trailed small-cap-led risk cycles by several months, though he cautioned that the exact interval can vary. Via X, he added “DOGE lags behind IWM [iShares Russell 2000 ETF] all-time-high breakout by about 2 to 4 months before it takes off.”

Cantonese Cat also pushed back on the view that a sequence of lower lows automatically invalidates the DOGE setup, arguing that this occurred in prior cycles just before outsized rallies. “A lot of people look at this, ‘that’s a lower low […] the cycle is over.’ Well, it doesn’t work that way. That’s a lower low right there. Next thing you know, it just went a lot higher,” he said, tying the observation to the current “healthy deleveraging” and the persistence of the rounded-bottom structure.

If the video offered the structural blueprint, his same-day post on X clarified his stance on headline targets. “I realize that it’s stupid to call for DOGE to $2 or $4 when price is at 20 cents. If I was smart like others, I should just call for DOGE to $2 or $4 when it’s $2 or $4.” The comment is consistent with his prior price predictions.

Inside the video update, the analyst instead emphasized the sequence he expects to matter—ETH strength first, DOGE follow-through second, with the magnitude determined by how far the broader risk cycle runs once momentum rotates.

At press time, DOGE traded at $0.20.

Institutional interest in Ethereum signals a shift towards integrating traditional finance with decentralized technologies, enhancing web3 adoption.

The post BlackRock Ethereum ETF purchases $72.5M in ETH appeared first on Crypto Briefing.

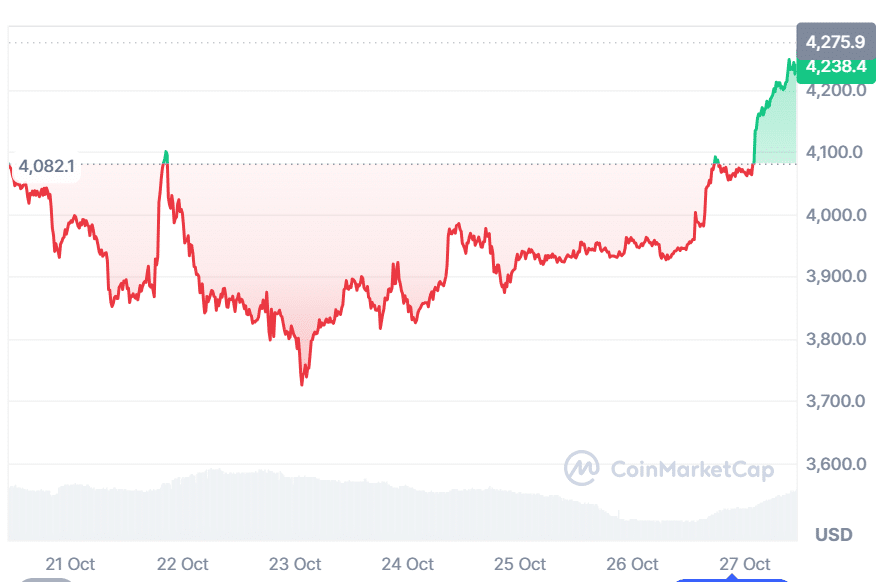

Ethereum price started a decent increase above $4,000. ETH is consolidating gains and could aim for more gains above the $4,220 resistance.

Ethereum price started a steady upward move above the $3,880 zone, like Bitcoin. ETH price surpassed the $4,000 and $4,120 levels to enter a short-term positive zone.

The price even spiked above $4,200. A high was formed at $4,252 and the price is now consolidating gains. There was a minor decline below the 23.6% Fib retracement level of the recent wave from the $3,708 swing low to the $4,252 high.

Ethereum price is now trading above $4,080 and the 100-hourly Simple Moving Average. Besides, there is a bullish trend line forming with support at $4,055 on the hourly chart of ETH/USD.

On the upside, the price could face resistance near the $4,180 level. The next key resistance is near the $4,200 level. The first major resistance is near the $4,250 level. A clear move above the $4,250 resistance might send the price toward the $4,320 resistance. An upside break above the $4,320 region might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $4,480 resistance zone or even $4,500 in the near term.

If Ethereum fails to clear the $4,200 resistance, it could start a fresh decline. Initial support on the downside is near the $4,080 level. The first major support sits near the $4,050 zone and the trend line.

A clear move below the $4,050 support might push the price toward the $3,980 support or the 50% Fib retracement level of the recent wave from the $3,708 swing low to the $4,252 high. Any more losses might send the price toward the $3,840 region in the near term. The next key support sits at $3,780.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $4,050

Major Resistance Level – $4,200

Ethereum’s bullish momentum has intensified throughout the weekend, with the price climbing above $4,100. This steady recovery follows a strong rebound from the $3,500 region after a crash earlier in the month.

Investor sentiment, as shown by trading volume and flows on exchanges, has turned optimistic amidst the recovery. Now that Ethereum’s price action is starting to turn bullish again, a new technical analysis shared by crypto analyst Freedomby40 on the social media platform X suggests that the current rally could be far from over, projecting a possible long-term climb to $16,000.

Freedomby40’s analysis, which is based on the Elliott Wave structure, presents Ethereum as currently positioned in an extended bullish sequence that began forming in late 2022. Posting the technical analysis on X, the analyst noted that Ethereum’s price action looks great for a continuation.

His chart shows that the asset has just completed a corrective phase and is entering a renewed impulse wave, with support established between $3,225 and $3,563 at the 0.5 and 0.382 Fibonacci retracement zones, respectively. The analyst labels this zone as the ideal accumulation area for the next leg up, consistent with previous cycle structures seen in 2017 and 2021.

The Elliott Wave projection in his analysis presents a multi-layered confluence of impulse waves extending to the third degree. It illustrates that Ethereum is currently unfolding its fifth major impulse wave in a structure that traces back to mid-2022.

The internal structure of this wave sequence also reveals a C wave in motion, which itself contains smaller sub-impulse waves. Within that C wave, Ethereum appears to be entering its own fifth sub-wave, which is known to be a decisively bullish wave.

Based on this setup, the analyst outlined two potential target zones on the chart: a green box representing the realistic price range for this wave cycle and a red box depicting the higher, more extended scenario that could push Ethereum’s market cap into the trillion-dollar level.

Freedomby40’s analysis identifies multiple price levels based on Fibonacci extensions from the current price action. The first price target is at $6,303, which is based on the 1.0 Fibonacci extension. This initial price target will see the Ethereum price break above its current all-time high, but this is the first of many.

The next target, the 1.236 extension, is positioned around $9,013. These two price targets ($6,303 and $9,013) were described by the analyst as very realistic. Possible extensions are at the 1.382 and 1.618 Fibonacci extension levels, corresponding to $11,210 and $16,077, respectively.

At the time of writing, Ethereum is trading at $4,160, up by 5.2% in the past 24 hours. Freedomby40’s outlook joins a growing list of ultra-bullish Ethereum price forecasts from institutional research desks and top analysts. Standard Chartered Bank recently raised its 2025 price target for Ethereum to $7,500, while projecting a potential long-term path to $25,000 by 2028.

BitMine's strategic Ethereum accumulation may indicate rising institutional confidence, potentially leading to a supply shock and broader blockchain adoption.

The post BitMine’s Ethereum holdings increase by 77,055 tokens in one week appeared first on Crypto Briefing.

The Robert Kiyosaki Ethereum prediction says that Ethereum, which is trading around $4,170, could be at the start of a big rise. Robert Kiyosaki believes this price level may give patient investors a strong chance to grow their wealth.

Robert Kiyosaki, the writer of Rich Dad Poor Dad, shared his opinion that Ethereum today reminds him of Bitcoin in the early days. He stated that people buying Ethereum will one day experience the same gains as those who bought Bitcoin when it was also valued at around $4,000.

Famous author and investor Robert Kiyosaki, the author of Rich Dad Poor Dad, often expresses his belief in the value of owning real assets, not just depending on paper money.

Recently, he has taken a strong liking to Ethereum and its future value. Robert Kiyosaki’s Ethereum prediction reflects his belief that Ethereum could have a run like Bitcoin.

Robert Kiyosaki is excited about Ethereum because he believes that fiat currencies are in decline, and he believes that investors will need real digital assets for security throughout the rest of their lives.

Robert Kiyosaki is known for leading the use of gold, silver and Bitcoin, and now he has classified Ethereum with them. The Robert Kiyosaki Ethereum prediction focuses on the fact that ETH is real money due to its utility and scarcity driving its value.

In his recent talk, Robert Kiyosaki said Ethereum has many real uses, such as in finance and smart contracts. He explained that these uses make it much more than just a coin to trade.

The Robert Kiyosaki Ethereum prediction says that real and practical uses could help Ethereum rise over time. He thinks that these uses will keep attracting more people and businesses to the network.

Kiyosaki’s comparison between Ethereum at $4,000 and Bitcoin when it was at the same price has drawn strong attention. He believes both reached a point where more people could begin to use them widely.

The Robert Kiyosaki Ethereum prediction presents ETH as the next version of Bitcoin with similar potential for major growth. Kiyosaki thinks Ethereum could follow a path like Bitcoin’s as blockchain technology continues to develop.

Analysts say Robert Kiyosaki’s opinions often shape how investors think because of his long experience in finance. Some experts share Kiyosaki’s positive outlook and note that Ethereum has a solid network with updates that could make it quicker and easier to use. They believe these changes may help its value grow over time.

Other analysts point out that Bitcoin has a fixed supply, while Ethereum’s supply can change depending on network activity. Because of this, they say the prices of the two coins may not always move in the same direction.

Even so, the faith expressed in the Robert Kiyosaki Ethereum prediction keeps people in the market talking. Many investors are watching closely to see how Ethereum’s value will change in the future.

Kiyosaki often talks about the idea of saving what he calls real money, such as gold, silver, Bitcoin, and now Ethereum. This shows that he does not fully trust traditional paper currencies.

He said that people who buy Ethereum at $4,000 could be like those who bought Bitcoin when it was at the same price. Through the Robert Kiyosaki Ethereum prediction, he points to Ethereum as both a way to protect wealth and a chance for future growth.

Ethereum’s staking system, support for NFTs, and growing interest from large investors make it different from many other digital assets. Kiyosaki pointed to these features as key reasons Ethereum could perform well over time.

He believes these strengths prove that Ethereum holds true and lasting worth in the market. The Robert Kiyosaki Ethereum prediction links these strong points to a chance for a big increase in value.

Kiyosaki thinks Ethereum could grow the same way Bitcoin did when it first started rising. He believes it has the power to play a big part in the future of online investing.

When a well known investor like Robert Kiyosaki shares his thoughts, many people in the market pay attention. His view on Ethereum strengthens the idea that blockchain assets are becoming an important part of today’s investments.

The Robert Kiyosaki Ethereum prediction invites people to see crypto as more than just a gamble. It suggests that digital assets can be real tools for building wealth as technology continues to evolve.

The Robert Kiyosaki Ethereum prediction presents Ethereum at $4,000 as the starting point for a new era of digital growth. Although no prediction can be guaranteed, Kiyosaki’s belief matches the wider view that blockchain technology is shaping the future of finance.

If his idea turns out to be right, those investing in Ethereum today could see success similar to early Bitcoin holders. This makes his prediction one of the most closely followed in the cryptocurrency world.

Generational Wealth: Wealth saved to help future family members.

Passive Income: Money that keeps coming in without daily work, like staking rewards.

Staking: Keeping crypto locked to help its system and earn more coins.

Blockchain: A secure digital book that records every crypto transaction.

Robert Kiyosaki: A famous author who teaches people smart ways to handle money.

He said buying Ethereum at arround $4,000 could be a big chance, like buying Bitcoin early.

He thinks Ethereum has strong use in DeFi, gaming, and AI, and could build wealth over time.

Yes, he thinks Ethereum could become as big as Bitcoin one day.

He means assets like gold, silver, Bitcoin, and Ethereum that hold value over time.

Yes, through staking, users can earn rewards for helping run the Ethereum network.

Read More: Robert Kiyosaki Predicts Ethereum Could Mirror Bitcoin’s Early Boom">Robert Kiyosaki Predicts Ethereum Could Mirror Bitcoin’s Early Boom

Ethereum enters the week with a sturdier floor. The tenor feels different, not loud, just confident. The latest on-chain reads show a market that prefers patience over drama, with long holders adding and fewer coins sitting on trading venues. That mix supports a measured push toward a decisive move above the recent pivot.

The case starts with concrete data. Whale addresses holding 10,000 to 100,000 ETH expanded their stacks to roughly 31 million ETH, a band that grew during prior bull phases. Alongside that, total staked supply climbed to about 36.15 million ETH, while exchange reserves hovered near 15.9 million.

Together, the trio points to firmer hands and thinner near-term sell pressure, which often precedes breakouts when macro is not a headwind. These figures were highlighted in a Monday roundup that also noted ETH trading near 4,225 after a swift 7 percent rebound, published on October 27, 2025.

Ethereum staking is pulling coins out of the active float, which tightens supply during risk-on stretches and cushions drawdowns when volatility flickers. The mechanical effect is simple. Fewer liquid tokens on exchanges can amplify price sensitivity to fresh demand. The behavioral effect matters too. Participants willing to lock capital for yield tend to ignore noise and trade less often, which steadies the tape.

Policy and positioning sit in the background like stage lighting. The fund market premium tied to ETH has held in positive territory in recent snapshots, a sign that institutional appetite remains constructive when futures trade above spot. When that premium stays above zero, subsequent weeks have often leaned higher, according to prior analyses.

Public voices are adding color. Vitalik Buterin recently defended the design choice that exiting validators face some friction, stating that

“friction in quitting is part of the deal. An army cannot hold together if any percent of it can suddenly leave at any time.”

The framing underscores why a multi-week exit path exists and why the process lowers reflexive churn during stress events.

Regulatory temperature also enters the frame. Brian Armstrong has pressed for uniform access to services, writing that “more dominoes [are] falling” and that states blocking staking harm residents by limiting participation. The comment came alongside progress on staking availability in key jurisdictions, reinforcing the view that participation can broaden as rules settle.

From a trading perspective, Ethereum staking changes how pullbacks behave. When whales accumulate and a larger slice is locked, dips tend to meet bids faster, especially near well-watched supports. If buyers defend the 4,200 to 4,300 zone and the broader market avoids a macro shock, traders will likely lean into a retest of the next shelf overhead. The cleaner the order book, the faster momentum accounts re-enter.

The medium view improves if fund flows and derivatives stay balanced. A steady premium, coupled with calm liquidations, removes fuel for disorderly swings. That is the kind of backdrop where narratives breathe and relative strength rotates toward assets showing inflows. In that scenario, Ethereum staking can play the quiet role of ballast, letting incremental demand translate into a trend rather than chop.

Price prediction is never a promise, but the map is readable. If ETH holds above the pivot and clears 4,500 with volume, the path opens toward a measured climb into the mid-4,000s, with an eventual attempt at the prior all-time high if macro winds cooperate.

If the pivot fails, a revisit of lower support would not break the thesis unless exchange reserves rise and long holders start distributing. The presence of large locked supply through Ethereum staking would still argue for a patient, stair-step structure rather than a slide.

Momentum grows when supply tightens and confidence improves. With whales adding, reserves thin, and the fund premium supportive, the setup leans constructive. A clean push through the pivot would validate the view that Ethereum staking is acting like a new version of strong hands, turning calm conviction into staying power.

What is Ethereum staking and how does it affect price action?

Ethereum staking is the process of locking ETH to secure the network and earn yield. Reducing the liquid supply on exchanges can make prices more sensitive to fresh demand, which may support trend formation when sentiment is improving.

Why does the fund market premium matter for ETH?

A positive premium indicates that futures trade above spot, a sign of constructive positioning from larger investors. Persistent positive readings have historically aligned with upward drift in the following weeks.

Do validator exit queues weaken participation?

Design friction exists to protect network security. As Vitalik Buterin put it, “friction in quitting is part of the deal,” which reduces herd exits during stress.

Fund Market Premium

A metric comparing futures pricing to spot that helps gauge institutional sentiment. Positive values often signal supportive demand from professional money.

Exchange Reserves

The aggregate ETH held on trading venues. Lower reserves suggest fewer coins available for immediate sale and can point to reduced sell pressure.

Realized Price

An on-chain estimate of the average cost basis for all coins. Price action above realized price indicates aggregate profit, while deep moves below have aligned with capitulation zones in past cycles.

Whale Accumulation Band

A supply band tracking holdings of large addresses. Rising balances in the 10,000 to 100,000 cohort have preceded strong cycles in earlier years.

Read More: Ethereum Staking turns into staying power as ETH eyes a 4,500">Ethereum Staking turns into staying power as ETH eyes a 4,500

The market opens with a calmer stride. Crypto prices reflect a modest bid across majors as funding normalizes and forced selling cools. Traders are watching policy signals and liquidity conditions, with attention on whether easing talk translates into sustained flows. Positioning looks cleaner than it did late last week, which tends to reduce whipsaws and gives price action a chance to breathe.

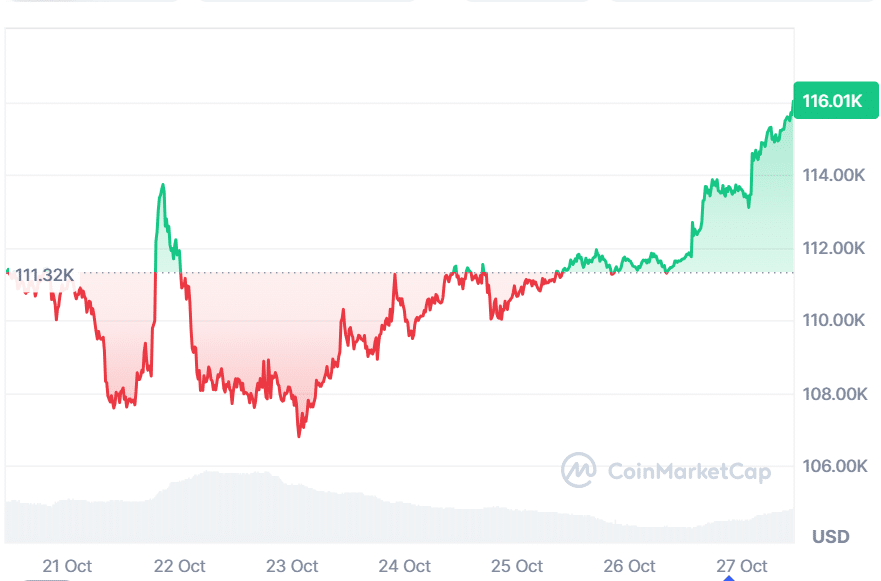

Bitcoin trades in a tightened range, and that alone feels constructive after a choppy weekend. The first task for bulls is to defend recent higher lows while pressing toward the upper band of resistance seen in overnight trade.

Derivatives data shows a softer pace of liquidations than earlier in the week. When volatility cools without a sharp drop in open interest, it often signals that participants are rebuilding positions with more caution. If macro headlines lean supportive, crypto prices can grind higher as systematic buyers follow momentum signals.

Ethereum continues a measured catch-up. The market likes the improving depth on major pairs and the narrative around network activity stabilizing after the last burst of upgrades. Traders are focusing on the 4,200 to 4,300 zone as a pivot that can flip sentiment from cautious to constructive.

If spot demand holds into the close, the door opens for a test of the next shelf above. In that scenario, crypto prices for ETH tend to pull alt liquidity with them, especially in high quality large caps.

XRP is steady after recent swings. The coin’s behavior has been textbook range trading, with quick fades at resistance and fast rebounds near support. That rhythm suggests market makers are active and retail is respecting levels. A clean close above the mid-range would encourage momentum accounts to re-engage. If the tape stays quiet, crypto prices for XRP likely chop within the band until a higher time frame catalyst arrives.

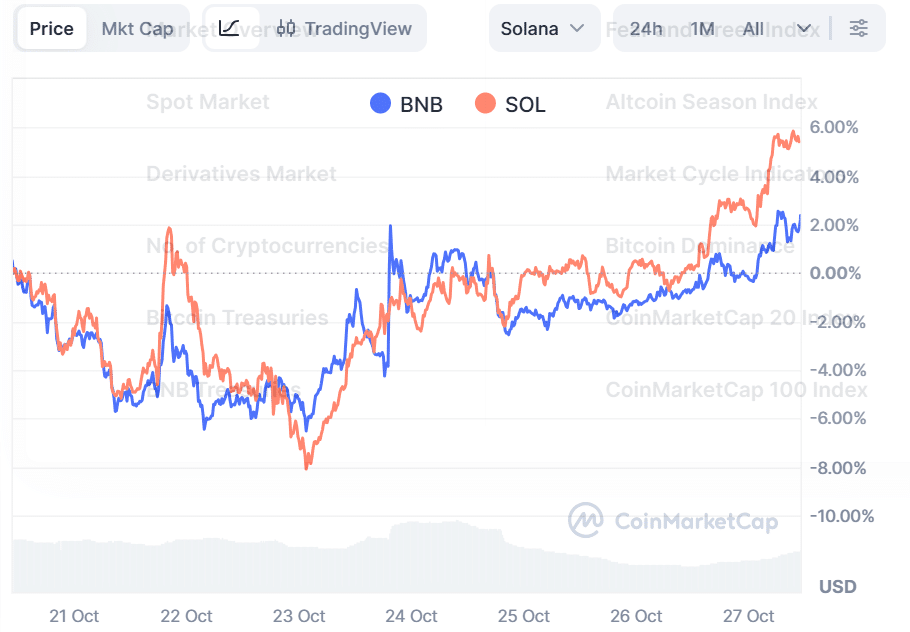

BNB holds its footing above the prior breakdown area, which is a small but notable positive. The spot book shows buyers willing to defend incremental dips, and that has reduced the frequency of sharp wicks. The pair’s next step is to stabilize volume on up days rather than clustering activity during selloffs. If that shift continues, crypto prices for BNB can lean into a slow stair-step higher rather than relying on one-off squeezes.

Solana carries a confident tone when broader risk appetite improves. Recent sessions show buyers returning on shallow pullbacks, which is usually a sign that intraday participants expect follow-through. A

s long as the market respects the nearest support shelf, the path of least resistance remains to the upside. Should liquidity thin out, the pair can still experience quick air pockets, but the medium view improves if higher lows keep printing. That backdrop often helps crypto prices across adjacent high beta names.

Macro expectations sit front and center. A friendlier path for policy usually eases financial conditions, lowers discount rates, and supports risk assets. On the micro side, the liquidation profile has cooled and sentiment sits close to neutral. Neither euphoria nor panic is in control, which is often the recipe for a grind rather than a spike.

If exchange flows and spot demand improve together, crypto prices tend to hold gains more easily, and leadership broadens beyond a single coin.

This is a healthier tape than a few days ago. Bitcoin is calm, Ethereum is building, and the rest of the board is following in a sensible way. It is not a victory lap, but it is constructive. If macro signals remain supportive and the derivatives picture stays balanced, crypto prices can continue to firm into the week. If the tone sours, expect a quick check of nearby support, followed by another attempt to reset and climb.

Where can readers see live crypto prices for top coins like BTC and ETH?

Live quotes are available on major price dashboards and institutional terminals. The figures in this article come from real-time market feeds.

Why do policy odds affect crypto prices?

Rate expectations change the price of liquidity. Easier policy often supports risk assets by lowering discount rates and easing financial conditions.

Do liquidations always push markets higher afterward?

No. Large short liquidations can fuel a bounce, but if demand is weak, the effect fades quickly. Context matters.

Open interest

The total number of outstanding futures or options contracts. Rising open interest with rising crypto prices can signal trend confirmation.

Market capitalization

The combined value of all circulating crypto assets. It helps frame market size and dominance when comparing segments.

Policy rate probabilities

Implied odds from futures that estimate the chance of an interest rate move at an upcoming meeting. Traders watch these odds because shifts can move crypto prices.

Liquidations

Forced closures of leveraged positions when margin is insufficient. Heavy short liquidations can reduce immediate selling pressure and sometimes lift crypto prices.

Read More: Crypto prices today: Market up 3.5% as BTC, ETH, XRP, BNB rebound">Crypto prices today: Market up 3.5% as BTC, ETH, XRP, BNB rebound

Ethereum price started a recovery wave above $4,000. ETH is moving higher but faces a couple of key hurdles near $4,220 and $4,250.

Ethereum price started a minor recovery wave above the $3,880 zone, like Bitcoin. ETH price surpassed the $4,000 and $4,050 levels to enter a short-term positive zone.

The price even spiked above $4,220. A high was formed at $4,225 and the price is now consolidating gains. The price is stable above the 23.6% Fib retracement level of the recent increase from the $3,708 swing low to the $4,225 high.

Ethereum price is now trading above $4,150 and the 100-hourly Simple Moving Average. Besides, there is a bullish trend line forming with support at $4,050 on the hourly chart of ETH/USD.

On the upside, the price could face resistance near the $4,220 level. The next key resistance is near the $4,250 level. The first major resistance is near the $4,320 level. A clear move above the $4,320 resistance might send the price toward the $4,450 resistance. An upside break above the $4,450 region might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $4,500 resistance zone or even $4,550 in the near term.

If Ethereum fails to clear the $4,220 resistance, it could start a fresh decline. Initial support on the downside is near the $4,150 level. The first major support sits near the $4,120 zone.

A clear move below the $4,120 support might push the price toward the $4,050 support. Any more losses might send the price toward the $4,000 region in the near term. The next key support sits at $3,880.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $4,120

Major Resistance Level – $4,220

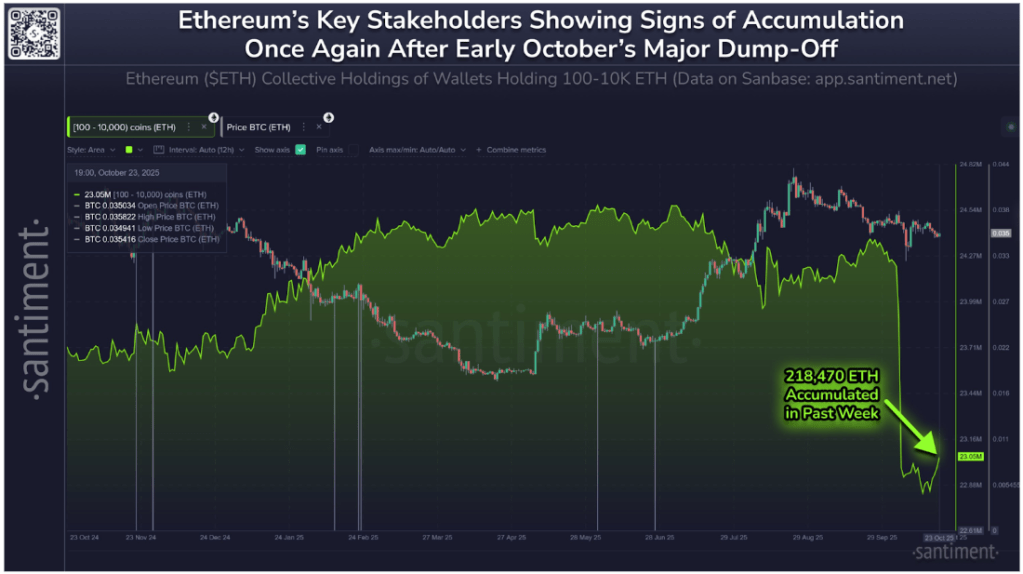

Ethereum’s largest non-exchange holders are tiptoeing back into accumulation. On-chain analytics platform Santiment reported that wallets holding between 100 and 10,000 ETH, also known as whales and sharks, have begun to rebuild positions after unloading roughly 1.36 million ETH between October 5 and 16.

Notably, the Ethereum collective holdings chart shows that nearly one-sixth of those coins have already been clawed back, as some confidence starts to return to the second-largest crypto asset.

The first half of October was highlighted by one of Ethereum’s most pronounced periods of capitulation this year. Macroeconomic fears due to US tariffs saw the Bitcoin price undergo a flash crash that dragged many altcoins to the downside. During this move, Ethereum’s price also fell very quickly, dropping from highs around $4,740 on October 7 to as low as $3,680 on October 11.

Interestingly, on-chain data shows that the selling pressure from large holders amplified this move, as the chart from Santiment shows a steep decline in their cumulative holdings from about 24.5 million ETH to roughly 22.6 million ETH. This 1.9 million ETH drop reflected clear risk-off behavior among whales and sharks, who had been net buyers since August.

However, once selling momentum began to fade, accumulation started to return. Institutional inflows started to return into Spot Ethereum ETFs, and whale/shark trades started accumulating Ethereum. Since October 16, the same cohort that contributed to the liquidation has begun adding back to their positions. Santiment noted that these holders are finally showing some signs of confidence, demonstrating an incoming extended recovery phase following the shakeout.

According to Santiment’s data, the collective holdings of addresses with 100 to 10,000 ETH have rebounded to approximately 23.05 million ETH after bottoming out in mid-October. A highlighted annotation on the chart shows that 218,470 ETH were accumulated in just the past week, signaling a tangible shift in on-chain behavior.

Ethereum collective holdings of wallets holding 100-10,000 ETH. Source: Santiment

This increase represents roughly one-sixth of the coins previously dumped, a sign that major investors are gradually re-entering the market after what appeared to be an exhaustion phase. Similar accumulation trends have often preceded a broader recovery in Ethereum’s price, especially when accompanied by stabilization in the ETH/BTC trading pair.

As it stands, the Ethereum price appears to be building a firmer base for the next phase of its recovery heading into November. When whale wallets accumulate, it reduces the circulating supply available on exchanges and reduces selling pressure.

At the time of writing, Ethereum is trading at $3,940 and is on track to break and close above $4,000 again. Both Ethereum and Bitcoin have risen a bit in recent days after inflation report showed US inflation cooling to 3% in September, below the 3.1% forecasted by economists.

Featured image from Unsplash, chart from TradingView

Updated on 24th October, 2025

This article was first published in The Bit Journal.

What could be the driving force behind the sharp outflow, despite Bitcoin and Ethereum ETFs experiencing a $619 million inflow only a few days ago?

Analysts are concerned about a fading momentum in both Bitcoin and Ethereum ETFs, which has led to mass investor outflows. After a combined inflow of at least $619 million last Tuesday, signaling investor confidence, the energy faded the following day, with Bitcoin and Ethereum ETFs recording significant outflows.

According to data from Fairside, BlackRock’s IBIT led the outflow from Bitcoin and Ethereum ETFs, with over $100 million exiting the market. This was followed by other ETFs, including Fidelity, Grayscale, Bitwise, VanEck, and Invesco, that recorded smaller inflows that may have helped soften the overall decline. It’s worth noting that the outflows from the Bitcoin and Ethereum ETFs occurred when BTC briefly surged past $111K before retreating to around $108K early Tuesday.

Ethereum ETFs, on the other hand, were also under pressure, recording $145.7M in outflows, extending a three-day streak of withdrawals. According to most analysts, the trend indicates that investors were treading cautiously, balancing short-term price swings and were concerned about broader market volatility.

The optimism experienced earlier in the week proved short-lived, as both Bitcoin and Ethereum ETFs saw outflows. Total withdrawals peaked at $120 million, with Bitcoin funds losing $101.29 million and Ethereum ETFs shedding $18.77 million. Currently, the broader cryptocurrency market sentiment remains cautious, with the Crypto Fear & Greed Index at 27, indicating that fear prevails.

The cautious mood is reflected in the continued outflow from Bitcoin and Ethereum ETFs despite prices inching higher. For some reason, investors are hesitant to make any firm commitments due to uncertainty about the market’s short-term direction.

While the general market trend shows active investor interest in spot Bitcoin and Ethereum ETFs, the sentiment keeps fluctuating. The strong rebound on Tuesday shows how quickly capital can flow when investors are confident, while the pullback on Wednesday shows that traders remain cautious.

The latest activity in Bitcoin and Ethereum ETFs comes hot on the heels of mixed performance in the broader cryptocurrency market. Historically, when spot prices rebound, investor confidence flows suggest that institutional traders may still be wary of potential price corrections.

Unlike the spot market, Bitcoin and Ethereum ETFs may react more slowly due to associated fund mechanics, investor reporting schedules, and capital reallocation strategies. The ongoing pullback in Bitcoin and Ethereum ETFs suggests that crypto investment products may behave differently from their underlying tokens.

ETFs: Cryptocurrency exchange-traded funds (ETFs) track the price performance of cryptocurrencies by investing in a portfolio linked to their instruments, which can be traded on regular stock exchanges, and investors can hold them in their standard brokerage accounts.

ETF Inflows: Fund flow measures the cash moving into and out of financial assets over specific time periods, often used to understand investor sentiment. Net inflow can signal investor optimism or caution in the market.

ETF Outflows: When ETF shares are converted into the component securities, this is referred to as ETF outflow. ETFs depend on the effectiveness of the arbitrage mechanism for their share prices to track net asset value.

Market rebound: In the world of stocks, a rebound is a period in which prices rise after a prior decline or bearish phase.

Bitcoin and Ether ETFs experienced severe outflows they losing $101 million and $19 million, respectively.

The most significant casualties of the outflows were Grayscale’s GBTC, Fidelity’s FBTC, and Ark’s ARKB, which reversed Tuesday’s gains.

According to available data, BlackRock’s IBIT and ETHA continued to attract strong investor interest despite the ongoing outflows.

The midweek pullback in crypto ETFs signals that investors were treading cautiously amid ongoing market volatility.

Read More: After $619M Inflow, Bitcoin and Ethereum ETFs Face Sudden $120M Pullback">After $619M Inflow, Bitcoin and Ethereum ETFs Face Sudden $120M Pullback