Western Union lays USDPT stablecoin rails on Solana

The post Gemini for Education: Google’s AI Dominates Higher Ed appeared first on StartupHub.ai.

Google's Gemini for Education is rapidly integrating into higher education, offering no-cost AI tools to over 1000 institutions and 10 million students.

The post Gemini for Education: Google’s AI Dominates Higher Ed appeared first on StartupHub.ai.

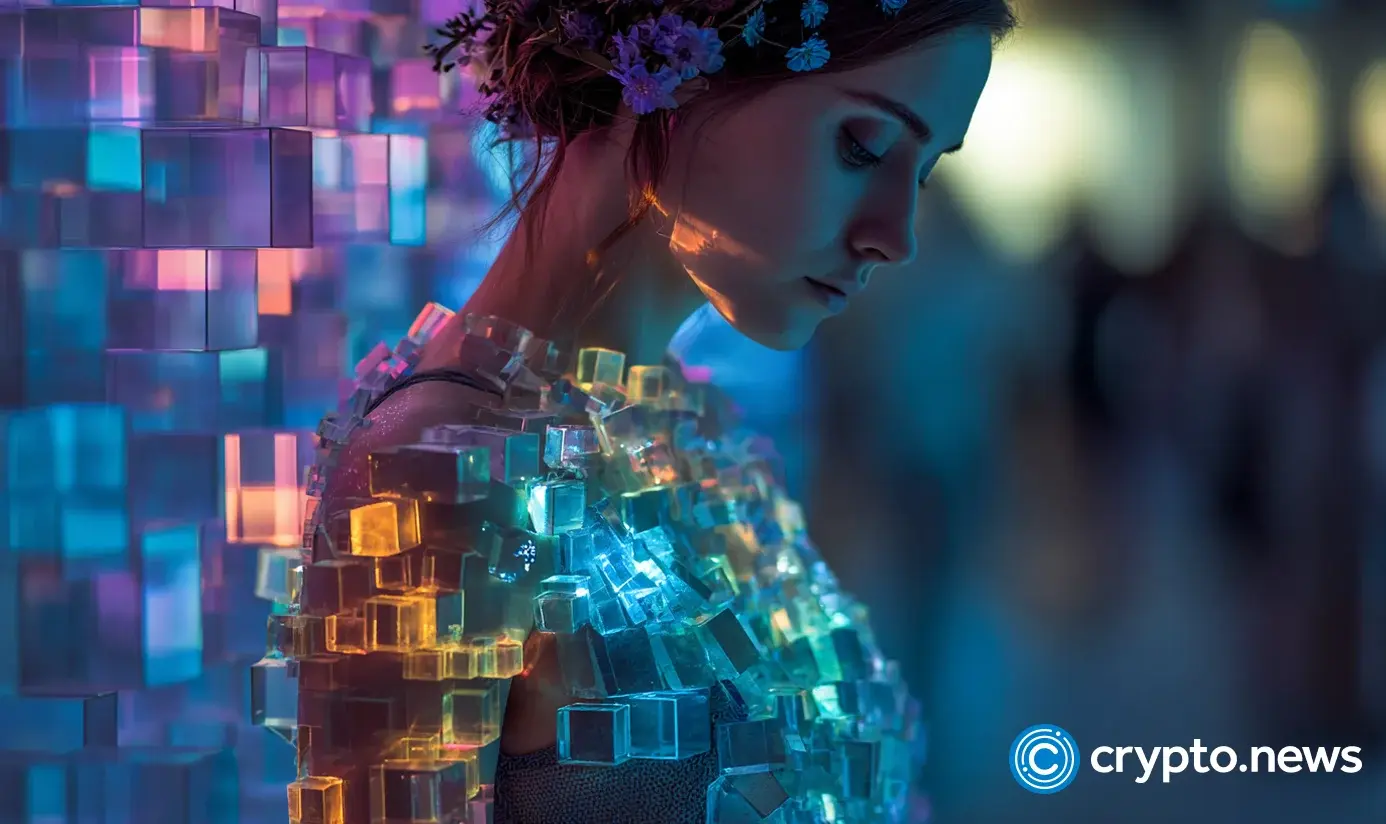

The next Federal Open Market Committee (FOMC) meeting is fast approaching, and the bets are already pouring in as to what it would mean for the Bitcoin and crypto industry. The last FOMC meeting took place in September, when the Federal Reserve ended up cutting rates down to 4-4.25% after months of no rate cuts. With this setting the tone, the expectations that another rate cut could be on the way are getting louder, with the FedWatch Tool showing a high percentage.

The next FOMC meeting is scheduled for Wednesday, October 29, 2025, and there is already a major clamor around what the Fed is planning on doing. The current market headwinds point to a favorable outcome for risk assets such as Bitcoin and other cryptocurrencies, with expected rate cuts.

Currently, the CME FedWatch Tool is showing that the probability of a rate cut has risen to 98.3% as of the time of this writing. This leaves only a 1.7% chance that the Federal Reserve will actually leave rates at their current levels, and there is zero chance that there will be a rate hike.

A reduction in the rate cuts is good for businesses all around, as lower interest rates mean better loan terms and increased spending and borrowing. Thus, it will increase the participation in the markets, from consumer goods to the stock market, and then make its way into newer markets such as Bitcoin and crypto.

A rate cut by the Federal Reserve aligns with the more pro-crypto stance that the United States has been moving in since President Donald Trump was elected. Last week, the president pardoned the Founder and former CEO of the Binance crypto exchange, Changpeng Zhao, after he previously pled guilty to money laundering violations back in 2024. Zhao has since served a 4-month stint before the pardon from Trump came.

With the US embracing Bitcoin and crypto again, a rate cut will only further the ascent, allowing more investors to get into the market as liquidity frees up. The initial announcement has been known to trigger a rapid increase in the market. But as the news settles, the crypto market is expected to continue to rise in response.

However, nothing is certain until the FOMC meeting is complete and the announcement is made. For the Bitcoin and crypto market to remain bullish, inflation will also have to be reduced, as an increase could trigger more conservative stances from investors.

Cybersecurity in 2025 is not just the ability to ensure that hackers stay away. It is about securing massive networks, confidential data and millions of online interactions daily that make businesses alive. The world has never been more connected through global enterprise systems and that translates to more entry points to intruders. The 2025 Cost of a Data Breach Report by IBM states that the average breach now costs an organization and its visitors an average of 5.6 million dollars or approximately 15 percent more than it was only two years ago in 2023. That is a definite sign of one thing, that is, traditional methodologies are no longer enough.

This is where the blockchain-based cybersecurity protocols are starting gaining attention. Originally serving as the basis of cryptocurrencies, blockchain is becoming one of the most powerful barriers to enterprise systems. Blockchain is equally powerful in the cybersecurity domain because of the same characteristics that render it the optimal choice in the digital currency industry, transparency, decentralization, and immutability of data.

In this article, we shall endeavor to articulate clearly how blockchain will play its role in security to the large organizations. We are going to cover some of the definitions in the field of cybersecurity that will relate to blockchain, why cybersecurity is becoming such a large portion of 2025, and how it will be used by organizations to mitigate cybersecurity threats.

Blockchain can sound like a complicated word. But in simple terms, it means a digital record book that no one can secretly change. All transactions or actions recorded are checked and stored by many different computers at the same time. Even though one computer may be compromised, the “truth” is still safe among the other stored copies.

This is great for organizations. Large organizations run massive IT systems that have thousands of users, partners, and vendors accessing data. They hold financial records, customer data, supply chain documents, etc. If a hacker gets access to a centralized database, they can change or steal the information very easily. But with a blockchain, the control is distributed across the network, making it much harder for a hacker, especially in large organizations.

In a blockchain cybersecurity model, data can be broken into blocks and shared across the network of nodes (virtual), where the nodes will verify the data before being added to the blockchain. Once added, it is not possible to delete or modify it in secret. This makes it perfect for applications that require audit trails, integrity and identity management.

While blockchain is not an alternative to firewalls or antivirus software, it offers additional security similar to the solid base of a trusted solution that assures the data cannot be modified in secret. For example, a company could use blockchain to record every employee login and file access. If a hacker tries to fake an entry, the other nodes will notice the mismatch immediately.

In 2025, there have already been digital attacks that have never been witnessed. In another instance, Microsoft declared in April 2025 that over 160,000 ransomware assaults took place every day, a rise of 40 percent compared to 2024. In the meantime, Gartner predicts that almost 68 percent of large enterprises will include blockchain as part of its security architecture by 2026.

Businesses are seeking blockchain since it eliminates a significant amount of historic burdens of possessing a digital security feature. The conventional cybersecurity functionality is based on a central database and central administrator. This implies that; in case the central administrator is compromised, the whole system may be compromised. Blockchain is not operated in this manner. No single central administrator can change or manipulate records in secrecy.

Here is a simple comparison that shows why many enterprises are shifting to blockchain-based protocols:

| Feature | Traditional Cybersecurity | Blockchain-Based Cybersecurity |

| Data integrity | Centralized logs that can be changed | Distributed ledger, tamper-proof |

| Single point of failure | High risk if central server is hacked | Very low, multiple verifying nodes |

| Audit trail | Often incomplete | Transparent, immutable record |

| Deployment complexity | Easier setup but limited trust | Needs expertise but stronger trust |

| Cost trend (2025) | Rising due to more threats | Falling with automation and shared ledgers |

As global regulations get tighter, enterprises also need systems that can prove they followed rules correctly. For instance, the European Union’s Digital Resilience Act of 2025 now requires financial firms to keep verifiable digital audit trails. Blockchain helps meet such requirements automatically because every transaction is recorded forever.

Another major reason is insider threats. In a 2025 Verizon Data Breach Report, 27 percent of all corporate breaches came from inside the company. Blockchain helps fix this problem by giving everyone a transparent log of who did what and when.

There are two main types of blockchains – permissionless and permissioned. A permissionless blockchain provides access to anyone publicly, for example, Bitcoin or Ethereum. A permissioned blockchain is typically used internally to an organization that only provides access to users with permission. Many enterprises tend to favor permissioned chains because of the security, compliance, and data control.

Let’s take a look at some of the form classes of blockchain technologies that are being used in enterprise cybersecurity today.

Smart contracts are programs that automatically run on the blockchain. A smart contract can execute the rules that are coded in the contract without an administrator needing to take action. For example, the smart contract would not permit an unauthorized user to access the information until an authorized digital key is used. The benefit of smart contracts is that they remove the human from the access granting process as a result limiting human error.

Traditional identity systems use central databases, which can be hacked or misused. Blockchain makes identity management decentralized. Each employee or partner gets a cryptographic identity stored on the blockchain. Access permissions can be verified instantly without sending personal data across multiple systems.

Many enterprises face the same types of threats, but they rarely share that information in real time. Blockchain allows companies to share verified threat data securely without exposing sensitive details. IBM’s 2025 Enterprise Security Survey found that blockchain-based information sharing cut response time to new cyber attacks by 32 percent across participating companies.

| Protocol / Technology | Use Case in Enterprise Security | Main Benefit |

| Permissioned Blockchain | Secure internal records and data sharing | Controlled access with strong audit trail |

| Smart Contracts | Automated compliance and access control | No manual errors or delays |

| Blockchain-IoT Networks | Secure connected devices in factories | Device trust and tamper detection |

| Decentralized IAM Systems | Employee verification and login | Reduces credential theft |

| Threat Intelligence Ledger | Global cyber threat data sharing | Real-time awareness and faster defense |

Designing a blockchain-based security system takes planning. Enterprises must figure out where blockchain fits best in their cybersecurity setup. It should not replace every system, but rather add strength to the areas that need higher trust, like logs, identity, and access.

A good plan usually moves in stages.

Enterprises first need to check their current cybersecurity setup. Some already have strong monitoring systems and access control, others still depend on older tools. Blockchain works best when the company already understands where its weak spots are.

Blockchain does not manage itself. There must be rules about who can join the chain, who can approve updates, and how audits are done. Governance is very important here. If governance is weak, even a strong blockchain system can become unreliable.

Enterprises use many other systems like cloud services, databases, and IoT devices. The blockchain layer must work with all of them. This is where APIs and middleware tools come in. They connect the blockchain with normal IT tools.

Once deployed, the new blockchain protocol should be tested under real conditions. Security teams need to simulate attacks and watch how the system reacts. Regular audits should be done to check smart contracts and node performance.

Here is a table that explains the general process:

| Phase | Key Tasks | Important Considerations |

| Phase 1: Planning | Identify data and assets that need blockchain protection | Check data sensitivity and regulations |

| Phase 2: Design | Choose blockchain type and create smart contracts | Think about scalability and vendor risk |

| Phase 3: Deployment | Install nodes and connect to IT systems | Staff training and system testing |

| Phase 4: Monitoring | Watch logs and performance on the chain | Make sure data is synced and secure |

The companies that succeed in deploying blockchain for cybersecurity often start small. They begin with one department, like finance or HR, and then expand after proving the results. This gradual rollout helps avoid big technical shocks.

By 2025, many global companies already started to use blockchain to protect data. For example, Walmart uses blockchain to secure its supply chain data and verify product origins. Siemens Energy uses blockchain to protect industrial control systems and detect fake device signals. Mastercard has been developing a blockchain framework to manage digital identities and reduce fraud in payment systems.

These real-world examples show how blockchain protocols are not just theory anymore. They are working tools.

| Use Case | Industry | Benefits of Blockchain Security |

| Digital Identity Verification | Finance / Insurance | Lower identity theft and fraud |

| Supply Chain Data Integrity | Retail / Manufacturing | Prevents tampered records and improves traceability |

| IIoT Device Authentication | Industrial / Utilities | Protects machine-to-machine communication |

| Secure Document Exchange | Legal / Healthcare | Reduces leaks of private data |

| Inter-Company Audits | Banking / IT | Enables transparent, shared audit logs |

Each of these use cases solves a specific pain point that traditional security tools struggled with for years. For instance, in industrial IoT networks, devices often communicate without human supervision. Hackers can easily fake a signal and trick systems. Blockchain creates a shared log of all signals and commands. That means even if one device sends false data, others will immediately see the mismatch and stop it from spreading.

In the financial sector, blockchain-based identity systems are helping banks reduce fraudulent applications. A shared digital identity ledger means once a person’s ID is verified by one institution, others can trust it without redoing all checks. This saves both time and cost while improving customer security.

Even though blockchain adds strong layers of protection, it also comes with some new problems. Enterprises must be careful during deployment. Many companies in 2025 found that using blockchain for cybersecurity is not as simple as turning on a switch. It needs planning, training, and coordination.

One of the biggest challenges is integration with older systems. Many large organizations still run software from ten or even fifteen years ago. These systems were never built to connect with distributed ledgers. So when blockchain is added on top, it can create technical issues or data delays.

Another major issue is governance. A blockchain network has many participants. If there is no clear structure on who approves transactions or who maintains the nodes, it can quickly become messy. Without good governance, even the most secure network can fail.

Smart contracts also come with code vulnerabilities. In 2024, over $2.1 billion was lost globally due to faulty or hacked smart contracts (Chainalysis 2025 report). A single programming error can create an entry point for attackers.

Then there is regulation. Legislations regarding blockchain are in their infancy. To illustrate, the National Data Security Framework 2025, which was launched in the U.S., has new reporting requirements of decentralized systems. Now enterprises have to demonstrate the flow of data in their blockchain networks.

Lastly, another threat is quantum computing. The cryptographic systems in the present could soon be broken by quantum algorithms. Although big-scale quantum attack is not occurring as yet, cybersecurity professionals already advise the implementation of post-quantum cryptography within blockchain applications.

Blockchain-based cybersecurity will transform the process of enterprise defense in the digital environment. In a blockchain, trust is encouraged by all members in the network where an organization usually depends on one system or administrator (or both) to keep the trust intact. It might not be short-term and might not be cost effective but it will be long term. In 2025, blockchain will be an enterprise security bargain, providing audit trails that are immutable, decentralized control, secure identities and more rapid breach detection.

Forward-looking organizations will have carbon floor plans, but they will also balance blockchain with Ai and quantum-resistant encryption techniques with conventional security layers. Our focus is not on replacing cybersecurity systems, but on strengthening cybersecurity systems with trustless verification outside of striking distance. In 2025, that is essential as hackers will make attacks and espionage more complex than ever, while blockchain offers something reliable and powerful, transparency that cannot be faked.

Blockchain keeps records in a shared digital ledger that no one can secretly change. It verifies every action through many computers, which makes data harder to tamper with.

At first, they can be costly because they require integration and new software. But over time, costs drop since there are fewer breaches and less manual auditing.

Blockchain prevents tampering and records all activity. If an attacker tries to change a file, the blockchain record shows the exact time and user. It also helps restore clean versions faster.

Yes, but large enterprises benefit the most because they manage complex supply chains and sensitive data. Smaller firms can use simpler blockchain tools for data logging or document verification.

Financial services, manufacturing, healthcare, and logistics are leading in 2025. These industries need strong auditability and traceable data protection.

Blockchain: A decentralized record-keeping system that stores data in blocks linked chronologically.

Smart Contract: Code on a blockchain that runs automatically when certain rules are met.

Node: A computer that helps verify transactions in a blockchain network.

Permissioned Blockchain: A private blockchain where only approved members can join.

Decentralization: Distribution of control among many nodes instead of one central authority.

Immutable Ledger: A record that cannot be changed once added to the blockchain.

Quantum-Resistant Cryptography: Encryption designed to withstand attacks from quantum computers.

Threat Intelligence Ledger: A blockchain system for sharing verified cyber threat data across organizations.

By 2025, blockchain has become a serious tool for cybersecurity in enterprises. From supply chain tracking to digital identity management, it helps companies create trust that cannot be faked. It records every change in a transparent and permanent way, reducing insider risk and external manipulation.

However, blockchain should not replace existing cybersecurity layers. It should work alongside traditional systems, adding trust where it was missing before. As businesses prepare for more advanced digital threats, blockchain stands out as one of the best answers, a shared truth system that protects data even when everything else fails.

Read More: Blockchain-Based Cybersecurity Protocols for Enterprises: A Complete 2025 Guide">Blockchain-Based Cybersecurity Protocols for Enterprises: A Complete 2025 Guide

Anthropic's India expansion marks a shift from global scale to sovereign-aware AI, building trust, data residency, and deeper enterprise integration.

The post Data residency in AI: Geopolitical, regulatory, enterprise risk appeared first on CoinGeek.

Over the years, a number of indicators have emerged that have often helped to pinpoint the Bitcoin bull market peak. These indicators have been triggered in previous cycles, and their triggers have often been a signal that it was time to get out of the market, as a new bear market is underway. However, this time around, even with the Bitcoin price hitting multiple new all-time highs, none of these cycle peak indicators have been triggered, suggesting that the market top has yet to be reached.

The Bull Market Peak Indicator tracker on the Coinglass website follows a total of 30 indicators that follow 30 indicators that show the progress of the Bitcoin bull market toward reaching a top. Some major ones include the Bitcoin Bubble Index, the Puell Multiple, the Bitcoin Rainbow Chart, and the Altcoin Season Index, among others.

Usually, these indicators are tracked on a scale of 0-100%, with 0% meaning that it is far from being triggered and 100% showing that an indicator has been triggered. If only a few of these get to the 100% mark and are triggered, it usually doesn’t mean that the Bitcoin peak has been reached.

However, even now, not one of these indicators has been triggered. Most continue to remain quite low, while the likes of the Bitcoin dominance are high, but still have not been triggered. For there to be a definite progress toward the Bitcoin market peak, at least half of these would have to be triggered.

Since none of the bull market peak indicators have been triggered, it means that the Bitcoin price might actually be far away from its all-time high. With the score still being 0 out of 30, it points to this being a time to hold, despite the declines that the market has suffered recently.

According to a previous report from Bitcoinist, this was the case a few months ago, and now two months later, the tracker remains the same. Thus, it could be that $126,000 is not the all-time high for Bitcoin, and that the market could end up getting an altcoin season after all.

In the case that more than half of the bull market peak indicators do get triggered, then it means that the top of the market is getting close. Once it gets to 30/30, then it signals the start of the next bear market, and this is when selling is at its highest in the market, leading to rapid price declines across the board.

The post Healthcare’s AI Surge: The $1.4B Transformation appeared first on StartupHub.ai.

Healthcare, once a digital laggard, has become an AI powerhouse, deploying solutions at 2.2 times the rate of other industries and tripling spending to $1.4 billion this year.

The post Healthcare’s AI Surge: The $1.4B Transformation appeared first on StartupHub.ai.

The internet is changing fast. What started as simple web pages has now become a world full of digital ownership, smart contracts, and crypto payments. This is the third generation of the internet, which is referred to as Web3. But there is one big problem. It is not easy to use.

There is a large number of individuals who wish to use blockchain applications, to them halted due to their lack of knowledge regarding how wallets, gas charges, and private keys function. It is even frightening to connect a wallet or authorize a purchase. That is why user experience, or UX, is so significant in Web3.

To put it in simple terms, UX refers to the ease or the difficulty of using a product. Poor UX causes users to abandon them, and good UX causes users to come back. Web3 UX is in the infancy stage, and everything is a bit complex. It must be simplified to access more users, like regular applications like Google Pay or Instagram.

In order to become something that people can bring into daily life, blockchain should become invisible. The user is not supposed to be aware that he or she is using it. The system should work smoothly in the background, and that is where the future of Web3 UX is heading.

Even though Web3 is full of new ideas, it has one major weakness. It is still made for tech people, not for everyone. Many users find it too complex to even start.

There are three big reasons that make Web3 hard for most people today.

A crypto wallet is needed for almost every Web3 app. But for new users, setting it up can be confusing. There are seed phrases, passwords, private keys, and backup rules. One small mistake can make someone lose all their funds forever. In regular apps, people can reset their passwords easily. But in blockchain, once it’s gone, it’s gone.

This fear makes many people stop before even starting. A better UX will have to remove this fear by offering safe, easy recovery and clear steps.

Every blockchain transaction needs gas fees. These are small payments made to confirm the transaction. But users don’t always understand what gas is or why the price keeps changing. On busy days, the fees can go up suddenly, and that makes people angry or confused.

Future Web3 UX will need to make this automatic. The system should pick the right gas fee and show a simple message like “Your transaction will complete in 10 seconds.” That is how easy it should feel.

Most Web3 sites are still built for developers. They often use tech words like “bridge,” “staking,” or “hash” that make no sense to regular users. Simple design, clear buttons, and easy words are what the next phase of Web3 UX needs.

Blockchain will not go mainstream unless it becomes easy enough for anyone to use. Most people don’t want to think about how something works inside. They just want to use it and get results.

Simplifying Web3 UX means hiding the complicated parts and showing only what’s needed. When people can open an app, buy something, and sign a transaction without fear or confusion, that is when blockchain will really grow.

Better UX also means trust. When users feel safe and confident, they spend more time in the ecosystem. They explore NFTs, DeFi, and games. They bring friends too. That is how mass adoption starts. Here is an example of what before and after UX improvement can look like:

| Action | Before UX | After Simplified UX |

| Send crypto | Enter address manually | Choose contact name |

| Pay gas fees | Set manually | Auto-calculated in app |

| Sign transactions | Use long wallet popups | One-tap confirmation |

| View balance | Check explorer | Visible inside the app |

| Manage keys | Manual backups | Cloud + social recovery |

This table shows how simplification can make blockchain act more like normal apps. Small improvements like these can change everything for new users.

Once blockchain tools become simpler, more people will join. It is the same story as the early internet. At first, only developers used it. Then came browsers and search engines. The same will happen with Web3. When the UX becomes smooth, adoption will follow.

Some projects already understand how big UX is for the future. They are trying to fix problems and make blockchain easier to use for everyone.

MetaMask used to feel complex for many new users, but over time, it improved. It added features like one-click token swaps, easy network switching, and now even mobile login. The app also shows warnings for risky websites, which helps protect beginners.

Coinbase is known for making crypto easier for normal users. It hides complex actions behind simple buttons like “Buy,” “Send,” or “Receive.” The app also connects directly to Web3 dApps through its wallet extension, which removes many confusing steps.

Another big improvement comes from networks like Arbitrum and Polygon. They help cut gas fees and make transactions faster. For users, this means cheaper actions and fewer failed transactions. That alone improves the overall experience.

Here’s a small table comparing some popular Web3 wallets and their UX features.

| Wallet Name | Speed | Design Simplicity | Recovery Option | Cross-Chain Support |

| MetaMask | Medium | Good | Seed phrase only | Yes |

| Coinbase Wallet | Fast | Very Easy | Cloud backup | Yes |

| Trust Wallet | Fast | Simple | Recovery phrase | Yes |

| Rainbow Wallet | Medium | Modern UI | Social login | Partial |

| Phantom (Solana) | Very Fast | Excellent | Recovery via seed | No |

This comparison shows that wallets are slowly moving toward simplicity. Future ones will likely combine the best of all: one-click recovery, low fees, and clean designs.

Artificial intelligence is starting to play a big role in Web3 design. It helps remove small confusions and guide users better. AI can make blockchain easier in many ways, like automating gas fee selection, predicting user intent, and helping with lost keys.

Some wallets now use chatbots that talk with the user. Instead of clicking through complex menus, users can just type what they want. For example, “Send 10 USDC to Alex,” and the AI assistant prepares the transaction.

AI can also predict network congestion and suggest the best time to make a transaction. It can calculate the best fee for the fastest confirmation. This not only saves money but also makes blockchain use feel smooth and intelligent.

| AI Feature | Benefit to Users | Example in Web3 |

| Auto gas calculation | No manual setup | MetaMask AI plugin |

| Transaction prediction | Faster approvals | Arbitrum AI integration |

| Voice or chat commands | Easier to interact | AI wallet assistants |

| Fraud detection | Safer experience | Coinbase security AI |

AI takes away guesswork. It turns a complex blockchain task into something anyone can do without fear. This mix of AI and UX is the next big step for Web3 apps.

One of the biggest issues in Web3 is how many blockchains exist. Ethereum, Solana, BNB Chain, Avalanche, and so many more. Each one works differently and uses its own tokens. For normal people, this can be confusing. They don’t understand why they can’t move coins easily from one to another.

Cross-chain UX is trying to fix this. It means building apps that work across different blockchains in a single interface. When users can do everything from one place, blockchain starts to feel like one connected internet, not a group of small islands.

A big trend now is multi-chain wallets. These wallets let users send or receive tokens on many blockchains without leaving the app. For example, Trust Wallet and OKX Wallet support dozens of networks on one screen. Users can switch between chains like Ethereum or BSC without even knowing what’s happening under the hood.

This kind of experience hides the complexity and makes blockchain feel like a normal digital app.

Cross-chain UX makes things smoother for developers and users both. It means people can buy an NFT on Polygon and then use it in a game built on Arbitrum. No need to worry about bridges or manual transfers. That’s what future apps will look like: simple, connected, and user-friendly.

| UX Feature | Old Way | New Cross-Chain UX |

| Token transfers | Bridge manually between chains | Done inside wallet |

| App access | One app per blockchain | One app for all chains |

| Fees | Pay in each network token | Unified gas token system |

| NFT use | Locked to one chain | Shared between multiple chains |

Cross-chain UX is what will make blockchain feel complete. It removes the feeling of walls between chains and helps new users see Web3 as one whole ecosystem.

UX design in blockchain is not just about color or buttons. It’s about making something hard feel natural. The way users interact with wallets, tokens, and dApps is changing fast. Some design trends are now leading the next wave of Web3 UX.

Some platforms now pay the gas fee for users or let them pay it in stablecoins. This removes a big confusion. Users don’t need to know about ETH or MATIC tokens to make transactions. It feels more like using an app that just works.

Instead of long wallet addresses, some projects now let users use simple names like “john.eth” or “sara.crypto.” These are called ENS (Ethereum Name Service) domains. It makes sending tokens easier and safer because no one has to copy long codes.

Losing a seed phrase used to mean losing everything. Now, wallets are adding social recovery. It means friends or trusted contacts can help restore access if someone forgets their password. This feels more like normal internet apps.

| Trend | What It Fixes | How It Helps Users |

| Gasless payments | Removes gas confusion | Makes sending faster |

| Simple wallet names | Long codes are hard | Easier to share |

| Social recovery | Seed phrase loss | Safer access |

| Mobile-first design | Desktop-only use | Brings blockchain to phones |

These design trends show that Web3 is learning from Web2. The goal is to make blockchain tools work for everyone, not just developers.

Although UX is improving, developers continue to struggle a lot in their attempt to make Web3 easy. Blockchain is not just a normal database, and that complicates things.

One of them is the challenge of simplicity and decentralization. Developers would like to simplify things, but they also wish to have the users in control. One such example is to make apps centralized by adding password recovery. Then they have to strike a compromise.

Slow onboarding is another issue. Upon registration, new users must create wallets, keys, network connectivity, and even purchase crypto first. That’s a lot for a beginner. Making this process easier without violating the blockchain regulations is time and testing.

Some apps become slow when the network is busy. That also hurts UX. Developers must design systems that stay fast even with millions of users.

| Developer Problem | Why It’s Hard | Example |

| Balancing control | Easy UX vs user ownership | Custodial vs non-custodial wallets |

| Complex onboarding | Too many steps for new users | Wallet setup confusion |

| Network limits | High gas and lag | Ethereum congestion |

| Security trade-offs | Simpler UX can mean risk | Auto-sign features |

These problems show why Web3 UX is not easy to fix overnight. But step by step, it’s getting better with new ideas and community testing.

The future of Web3 depends on how easy it becomes to use. If people can use blockchain without stress or fear, it will spread faster than ever. Simplicity is not just about good design; it’s about trust. When apps are clear, users trust them more.

Blockchain started as a tech project, but it will become part of normal internet life through better UX. AI, automation, and multi-chain support are already showing that direction. One day, people won’t even say they are using blockchain; they will just use it. That’s when Web3 truly becomes mainstream.

The abbreviation of user experience is UX. In Web3, it refers to the ease or the complexity of using a blockchain application. With a decent UX, users should be able to buy, send, or trade crypto without worrying or having to understand technical aspects.

Web3 applications are more difficult as they require distinguishing such aspects as keys, wallets, and gases payments that are not regularly encountered by ordinary users. All these are concealed behind some casually placed buttons in normal apps, but Web3 still displays too much technical data in the first place.

Once Web3 apps are easy and approachable, they will be used more by people. The UX should be smooth as this creates a feeling of trust and confidence so that users can navigate crypto without fear. It transforms blockchain into one of the baffling technologies into something that anybody can use in everyday life.

Coinbase Wallet, Trust Wallet, and Rainbow Wallet are some of the already-improving wallets. They are designed with intuitive designs, quick logins, and simple recoveries. Such minor additions allow amateurs to get into Web3 without being confused and intimidated.

Yes, AI can make blockchain apps much simpler. It can explain what transactions mean, help pick gas fees, warn about risky websites, and even recover lost accounts. With AI guidance, Web3 apps will feel smarter and more user-friendly for everyone.

The next generation of the internet that runs on blockchain technology. It allows users to own their data, use crypto, and interact directly with decentralized apps instead of big companies controlling everything.

How a person feels when using a product or app. In Web3, it means how easy or hard it is to use wallets, trade crypto, or understand smart contracts.

A digital system that records information in a secure and transparent way. It stores data across many computers so no one person or company can control it.

A digital tool used to store and send cryptocurrencies. It can be a mobile app, browser extension, or hardware device that helps people manage their blockchain assets.

A small payment made to blockchain validators who confirm and record transactions. It is like a service charge for using the blockchain network.

The future of Web3 depends on how simple it becomes to use. Right now, many people stay away from blockchain because it feels too technical. Complicated wallet setups, seed phrases, and gas fees confuse users who just want easy tools.

But the new wave of UX improvements is changing this. Developers and designers are focusing on clean interfaces, automatic gas settings, human-readable wallet names, and better onboarding experiences. AI is also stepping in to help people understand what they are doing without getting lost in blockchain terms.

Cross-chain tools are making it possible to move tokens between networks easily, so users no longer feel stuck in one place. This new direction is what will make blockchain as normal as using social media or online banking.

A future Web3 app might let someone buy, trade, or store digital assets without even realizing they are using blockchain. That’s the goal, to make Web3 so smooth and natural that it just works. When that happens, blockchain will finally reach the mainstream world and become a part of daily life.

Read More: The Future of Web3 UX: How Simplifying Blockchain Can Bring Mass Adoption">The Future of Web3 UX: How Simplifying Blockchain Can Bring Mass Adoption