Trump’s Bitcoin bet? Cramer hints at $60k strategic reserve

The banking acquisition follows a trademark filing for “MrBeast Financial” in October, which specifically mentioned “cryptocurrency exchange services.”

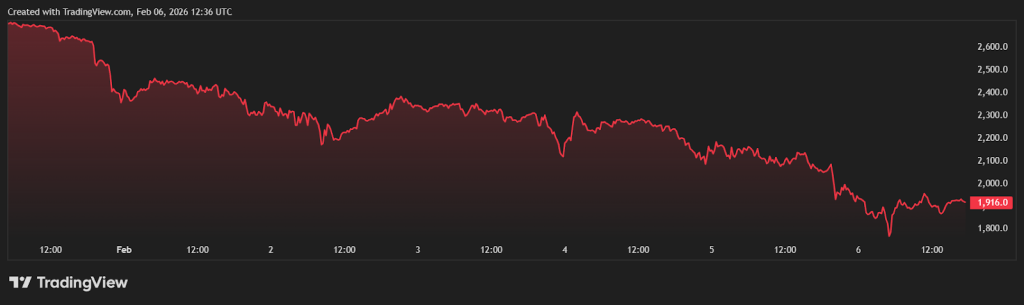

ETH price moved above $2,150 as Bitcoin and US stock markets rallied, but does data show whether derivatives traders have turned bullish yet?

Long-term Bitcoin holders sold 245,000 BTC as the price fell under $60,000 last week, but a fresh set of US macroeconomic cues and an uptick in BTC dip-buyers may signal that the market has bottomed.

Polymarket is challenging Massachusetts in federal court, arguing that states lack the authority to regulate CFTC-approved prediction markets.

Reform of Israel's digital asset regulations may add 70,000 jobs and $38 billion to the country's GDP, according to KPMG.

The post Crypto Rout Rises as Vitalik Buterin Advocates For Privacy in DeFi appeared first on Coinpedia Fintech News

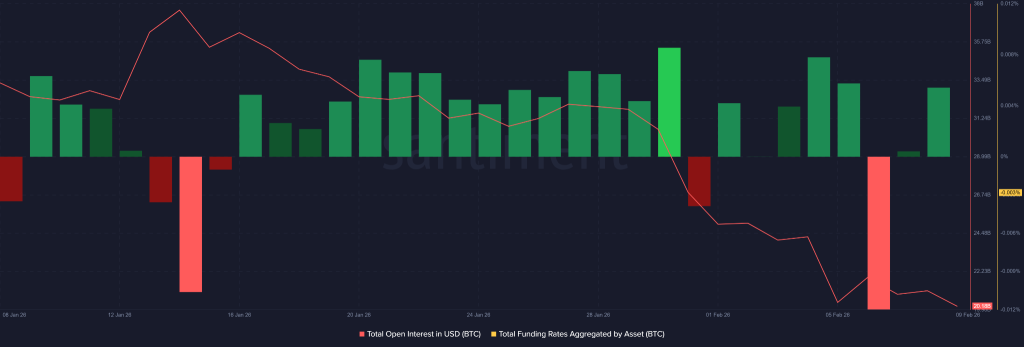

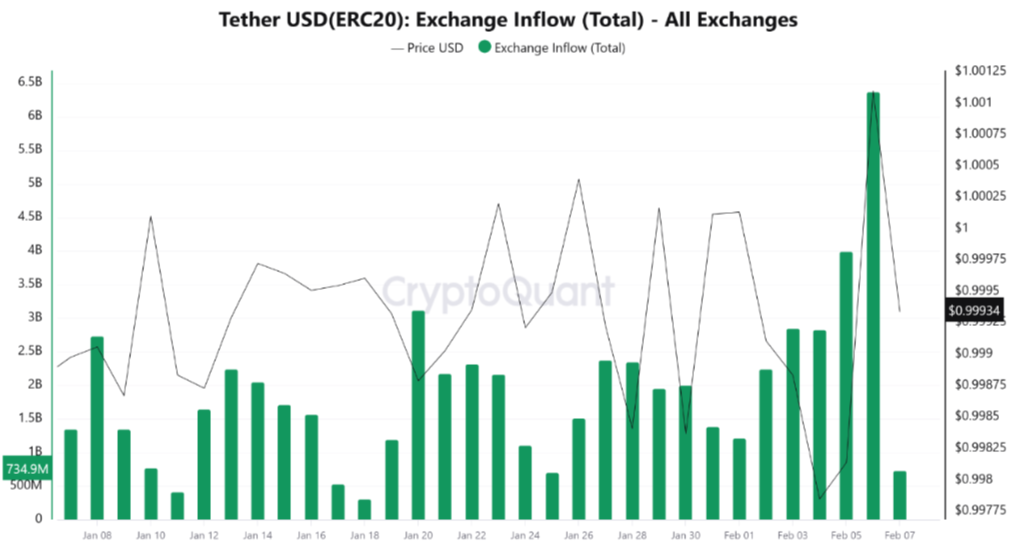

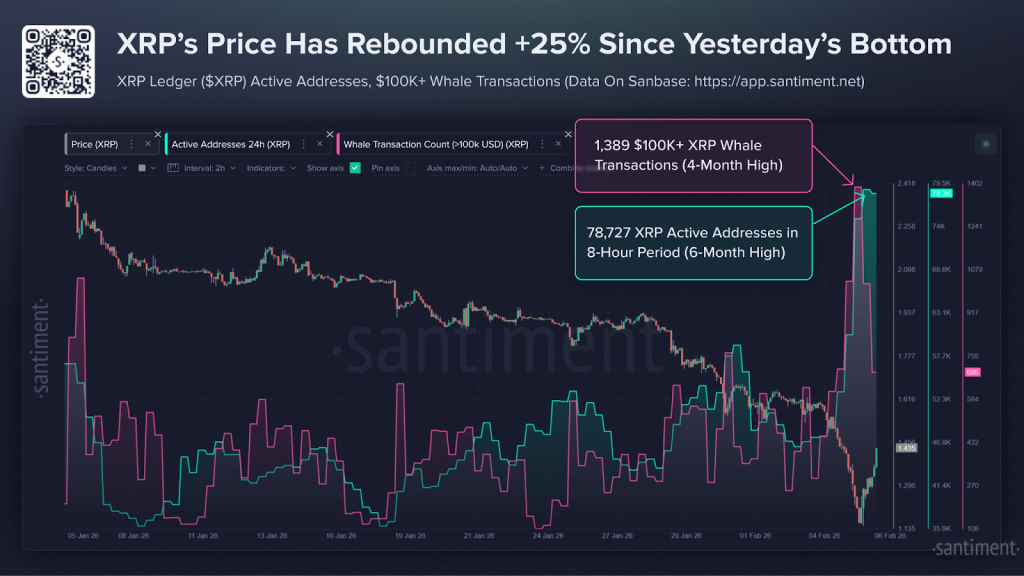

The crypto market rout has intensified with heavy liquidation amid low liquidity. Although the Bitcoin (BTC) price has rebounded above $70,000 on Monday, February 9, the derivatives market has signaled further weakness due to the falling Open Interest (OI) in the recent past amid a negative funding rate.

According to Federal Reserve governor Christopher Waller, the stalled Clarity Act has led to low traction in crypto adoption in the United States and, by extension, globally. Waller stated that his plan for Fed Skinny accounts has not prevented lawsuits tied to the crypto industry.

As such, Waller concluded that the initial enthusiasm tied to President Donald Trump is fading fast.

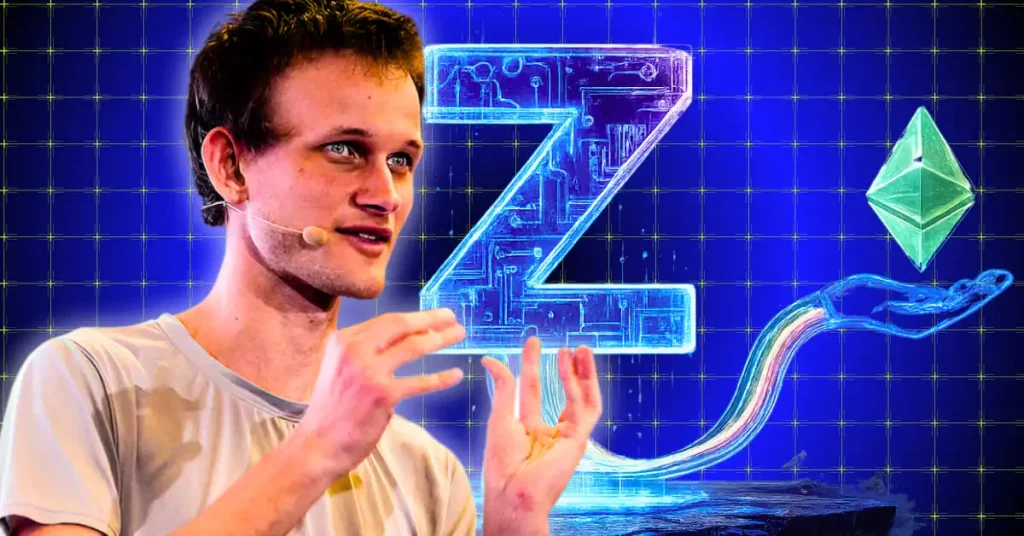

Amid the low crypto liquidity and heavy liquidation in the recent past, Ethereum cofounder Vitalik Buterin has urged the use of privacy-centric DeFi projects to catalyze the mainstream adoption of digital assets and web3 protocols. Furthermore, Buterin believes that self-sovereignty is the holy grail to catalyze organic adoption of digital assets and web3 protocols.

Already, institutional investors and regulators have turned to the use of privacy-centric technologies led by Zero Knowledge (ZK). Moreover, institutional investors seeking to tokenize real-world assets (RWA) have been increasingly adopting privacy-centric DeFi protocols and chains.

Circle Internet Group Inc. (NYSE: CRCL) has led many web3 companies in doubling down on privacy-centric solutions. For instance, XION (XION), a small-cap layer one blockchain backed by Circle, has over 150 brands led by Uber, Amazon, and BMW, thus engaging more than 4 million global organic users. Earlier on Monday, XION announced the launch of its ZK and DKIM modules to pioneer privacy in email messaging.

The post XRP SOPR Turns Negative as Holders Realise Losses—Is the Price at Risk of Slipping Below the $1? appeared first on Coinpedia Fintech News

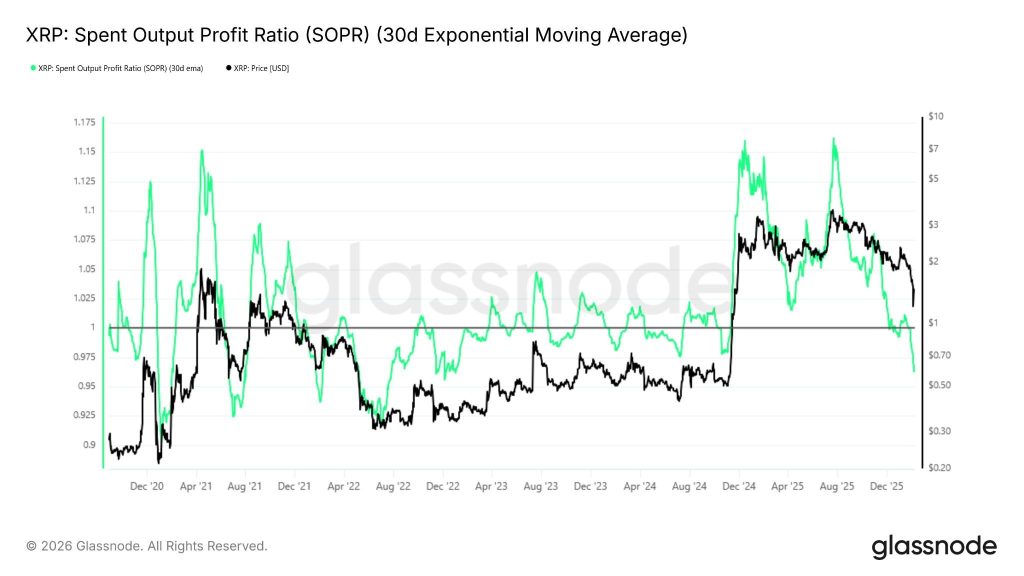

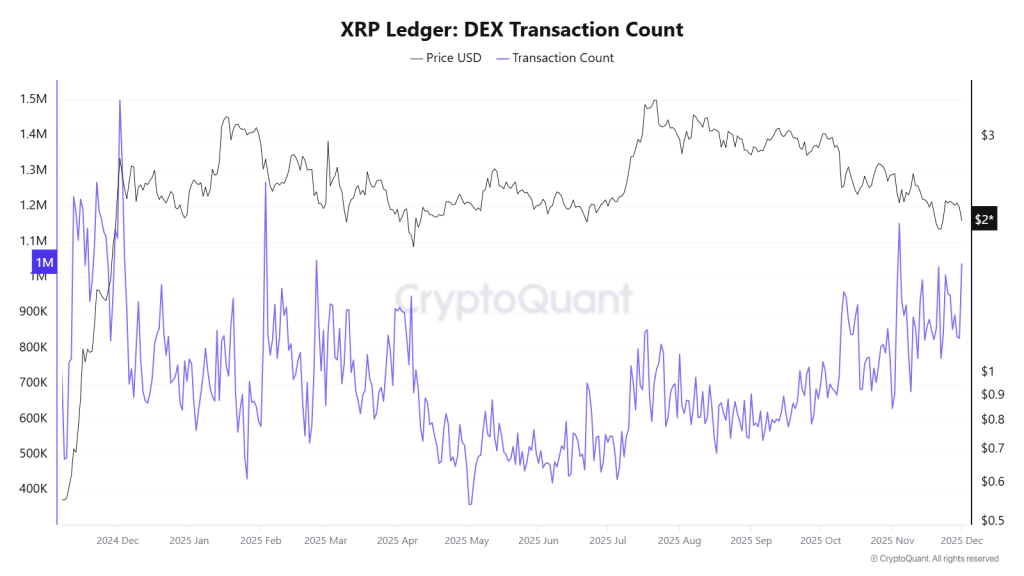

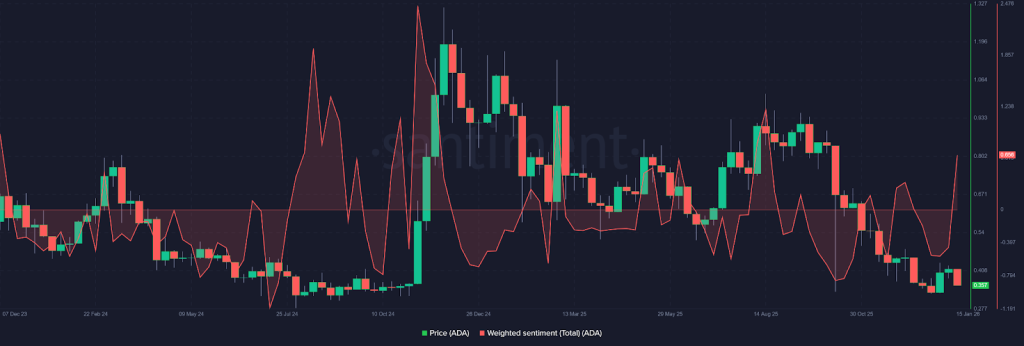

XRP has returned to focus as recent price weakness coincides with a noticeable shift in on-chain behavior. The token is currently trading in a very tight range, with both volume and volatility compressing significantly. At the same time, on-chain data indicates that a growing number of market participants are selling XRP at a loss. This combination of muted price action and rising holder stress has raised concerns about the near-term outlook, keeping the $1 level in focus as traders assess the risk of further downside.

The on-chain data from Glassnode shows clear signs of stress among XRP holders. The Spent Output Profit Ratio (SOPR) has dropped below the key 1.0 level, which means that, on average, XRP is now being sold at prices lower than where it was bought. The 7-day average SOPR has dropped from around 1.16 in mid-2025 to about 0.96, highlighting a steady increase in loss-driven selling.

Historically, this kind of setup has appeared during periods of heavy pressure rather than during strong trends. A similar pattern played out between September 2021 and May 2022, when XRP spent months consolidating after holders absorbed losses. While a negative SOPR does not guarantee an immediate recovery, it often suggests that much of the emotional selling is already underway, a phase that can eventually lead to stabilization once selling pressure begins to fade.

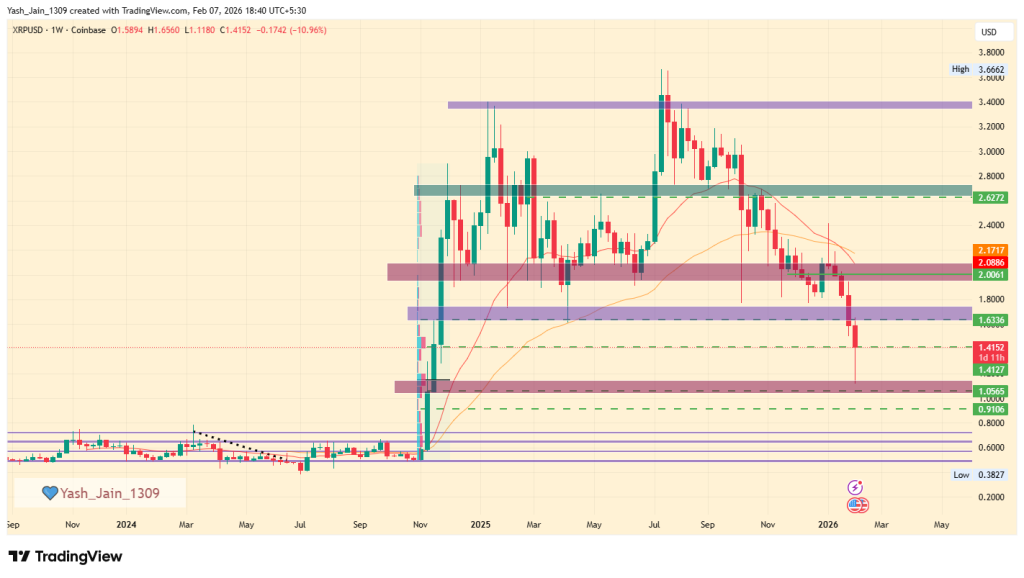

XRP price has struggled to deliver any meaningful upside since July 2025, when the price was rejected from its all-time high. Since then, the weekly structure has remained weak, marked by a steady sequence of lower highs and lower lows, reflecting sustained bearish control. More recently, however, price action has slowed considerably, with both buyers and sellers showing little urgency. This pause suggests XRP may either be entering a prolonged consolidation phase or quietly building toward a larger move.

From a broader perspective, the weekly structure shows limited demand until the $0.50 region, a zone where buyers previously stepped in aggressively. Adding to this, open interest has been declining alongside price, indicating traders are closing positions rather than aggressively shorting. This behavior often appears in the later stages of a bearish trend, when selling pressure begins to fade. With positioning thinning out, XRP is more likely to drift sideways or grind slowly rather than see a sharp continuation lower in the near term.

XRP price remains in a wait-and-watch phase as long as the price holds above the $1.00 psychological zone. A sustained breakdown below this level could open the door for a deeper move toward $0.75, with $0.50 standing out as the next major demand area where buyers previously stepped in aggressively. On the upside, bulls would need a clear weekly reclaim above $1.25–$1.30 to signal improving structure and shift momentum toward $1.50. Until then, thinning open interest and muted volatility suggest consolidation or a slow grind is more likely than a sharp trend move.

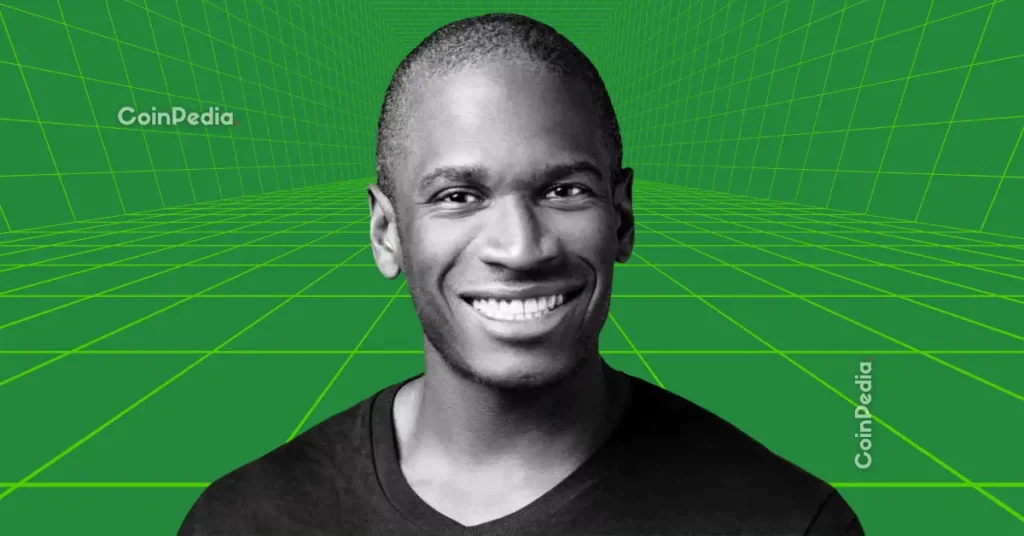

The post Ripple CEO Says XRP Community Remains ‘Top of Mind’ Amid Price Struggles appeared first on Coinpedia Fintech News

The chief executive of Ripple has reaffirmed the company’s commitment to the XRP ecosystem, saying the “XRP family has and always will be top of mind for Ripple,” a message that comes as the token struggles to regain upward momentum following recent market volatility.

Glad to see the message is (finally, even more) clear!

— Brad Garlinghouse (@bgarlinghouse) February 9, 2026

XRP family has and always will be top of mind for Ripple. https://t.co/Pu2aMx6ja0

The reassurance followed renewed discussion around XRP’s role as a bridge asset for cross-border payments after Ripple outlined plans for compliance-focused decentralized finance infrastructure on the XRP Ledger. Supporters welcomed the statement, noting that it reinforces the company’s long-standing strategy of keeping XRP central to its payments vision.

The comments come at a time when XRP is trading near $1.44, with the broader cryptocurrency market still recovering from a sharp sell-off that pushed many major digital assets lower. Although XRP recently attempted a rebound along with the wider market, the rally did not hold, and the token has since moved into a consolidation phase.

In the short term, XRP’s price action remains uncertain. Market data shows the token has been moving mostly sideways after a recent swing high, with no clear breakout pattern yet visible.

Support levels around $1.36 and $1.31 are being closely watched, with a deeper key support near $1.19 seen as critical. A drop below these levels could open the door to further downside pressure, while holding above them may help maintain the possibility that a broader market bottom has already formed.

On the upside, traders say XRP would need to break above nearby resistance levels around $1.55 and then $1.63–$1.64 to signal stronger recovery momentum.

Analysts say the token has not yet formed a strong bullish breakout pattern, and the short-term trend remains uncertain.

The new integrations enable banks and custodians to deploy custody and staking services without operating their own validator or key-management infrastructure.

Bitcoin and several major altcoins are not out of the woods yet, especially since they face significant selling near their range highs. Do charts show BTC and altcoins forming a bottom?

Wall Street–style liquidity is reportedly moving into prediction markets, signaling a shift toward deeper markets, higher volumes and greater institutional participation.

A CTDG Dev Hub participant introduces an adapter layer for RGB to facilitate seamless integration with wallet SDKs.

Bitcoin price more than doubled the last time Tether's crypto market dominance topped out, a signal that is flashing again in 2026.

The research analysts pointed to tight liquidity and macro pressure as drivers of the decline, while noting that spot Bitcoin ETFs have seen relatively modest outflows.

Tom Lee–backed BitMine added over 40,000 ETH during last week’s market sell-off, doubling down on its Ether treasury strategy despite multibillion-dollar unrealized losses.

Bitcoin saw the first brief period of positive Coinbase Premium since mid-January as BTC price action stabilized near $70,000.

The post XRP News: Ripple Brings Institutional ETH and Solana Staking to Custody Clients appeared first on Coinpedia Fintech News

Blockchain payments company Ripple is expanding its institutional digital asset custody services through new partnerships designed to strengthen security infrastructure and broaden staking capabilities for large financial clients.

The company announced collaborations with cybersecurity provider Securosys and staking infrastructure firm Figment, moves aimed at helping banks, asset managers, and regulated institutions deploy digital asset custody solutions more quickly while meeting compliance and security requirements.

Enhanced Security for Institutional Custody

Under the partnership with Securosys, Ripple will integrate high-security hardware security module (HSM) technology into its custody platform. These systems allow institutions to manage cryptographic keys directly while maintaining strong security protections across both cloud-based and on-premises environments. Industry analysts say such infrastructure is increasingly important as financial institutions seek enterprise-grade storage solutions for digital assets.

Institutional Staking Added to Custody Services

Ripple’s collaboration with Figment will enable institutional clients using its custody platform to access staking services for proof-of-stake blockchain networks, including Ethereum and Solana. By offering staking as part of custody workflows, financial institutions can participate in blockchain network validation and earn staking rewards without building their own validator infrastructure.

Part of Broader Institutional Expansion Strategy

The new partnerships follow a series of recent developments in Ripple’s institutional services, including expanded compliance integrations and infrastructure upgrades intended to support regulated financial institutions entering the digital asset market. Analysts note that as institutional participation in cryptocurrencies grows, demand for integrated custody, compliance, and staking solutions has increased significantly.

Growing Institutional Focus in the Digital Asset Sector

Ripple’s latest moves reflect a broader industry trend in which financial technology firms are building infrastructure tailored to banks, custodians, and large enterprises seeking exposure to digital assets. As regulatory clarity gradually improves in several jurisdictions, market participants expect institutional-grade custody and asset management platforms to play a larger role in the next phase of digital asset adoption.

The post Solana (SOL) Price Breaks Key Support—Is $50 the Next Level to Watch? appeared first on Coinpedia Fintech News

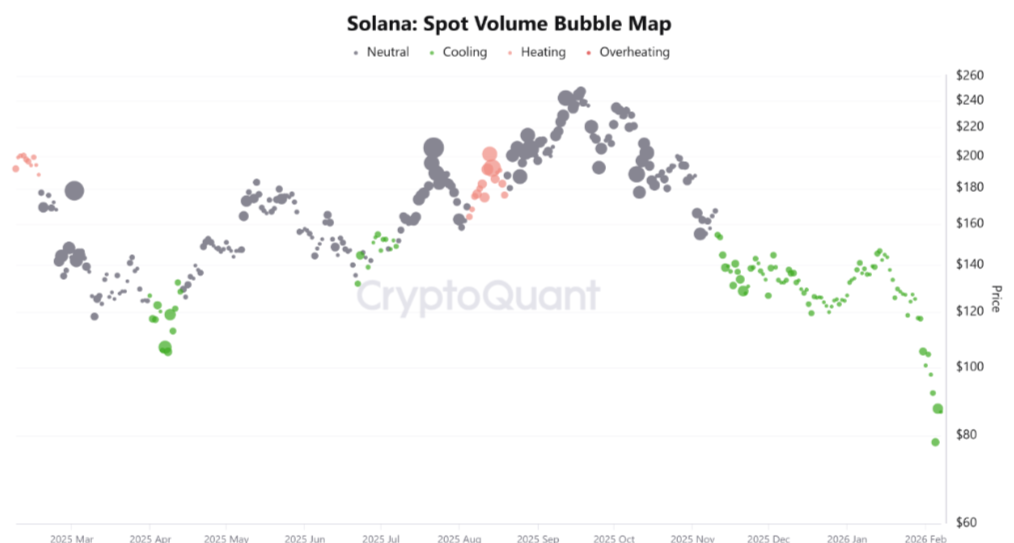

Solana price saw a sharp pullback at the start of the month, with the price sliding to a low near $67.48. Since then, the recovery has looked fragile. After losing an important support zone, SOL has moved into a weaker position, allowing sellers to regain control. Buyers tried to steady the price during the consolidation phase, but the lack of strong follow-through has kept downside risks alive, shifting focus toward the $50 area as the next key support.

The move has closely followed Bitcoin’s recent breakdown below a major psychological level. While Ethereum and XRP managed to defend their supports, Solana struggled to build momentum after its bounce, raising concerns that the current setup could still open the door to a deeper pullback.

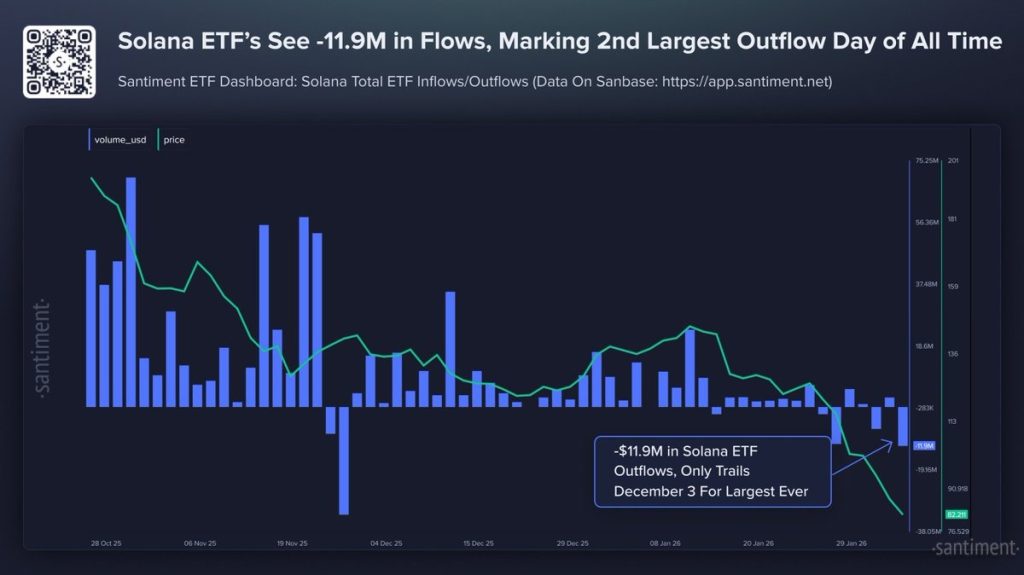

Since their launch, Solana ETFs have largely recorded consistent net inflows, with outflows remaining limited and short-lived. However, the chart above highlights a clear shift in that trend. There have been a few instances where outflows briefly overtook inflows, signalling cooling institutional interest, and the latest data points to one of the most notable moves so far.

According to Santiment, Solana ETFs recently saw nearly $11.9 million in net outflows, marking the second-largest outflow day on record, trailing only December 2025. This comes at a time when SOL has already shed over 62% of its market capitalization in the past four months, reinforcing the view that institutional sentiment has weakened alongside price.

Historically, sharp ETF outflows during extended downtrends have often coincided with late-stage selling or capitulation, rather than the start of fresh declines. While this does not confirm a bottom, the scale of the outflow suggests traders are becoming increasingly cautious, a dynamic that has, in past cycles, preceded periods of stabilization once selling pressure begins to exhaust.

Selling pressure has picked up again on Solana’s weekly chart, even after a brief rebound attempt. As the chart shows, buyers failed to deliver sustained follow-through, keeping SOL capped below key resistance zones. Last week’s sharp spike in trading volume triggered heightened volatility, but with volume now cooling and price stuck in a tight range, momentum has clearly weakened.

More importantly, the weekly Gaussian Channel has flipped bearish, signaling that SOL may have entered a broader downtrend phase rather than a short-lived correction. This shift aligns with the confirmed breakdown of a head-and-shoulders pattern on the weekly timeframe, a structure that often precedes extended downside if price fails to reclaim lost levels.

On a slightly constructive note, the weekly RSI appears to have bottomed and is attempting a rebound, suggesting selling pressure may be slowing. However, until momentum improves and price reclaims key resistance levels, the broader setup continues to favor caution, keeping the risk of further downside open as the month progresses.

Solana remains in a fragile position as long as the price stays below the $105–$110 resistance zone. Failure to reclaim this range could keep downside pressure intact, opening the door for a move toward $77–$75, where short-term demand may attempt to slow the decline. A deeper breakdown would bring the $50–$55 region into focus, aligning with historical support.

On the upside, bulls need a strong weekly close back above $115 to invalidate the bearish setup and shift momentum toward $135–$150. Until then, risk remains skewed to the downside.

The post Why is Bitcoin Price Struggling Near $70K? Will It Continue Falling? appeared first on Coinpedia Fintech News

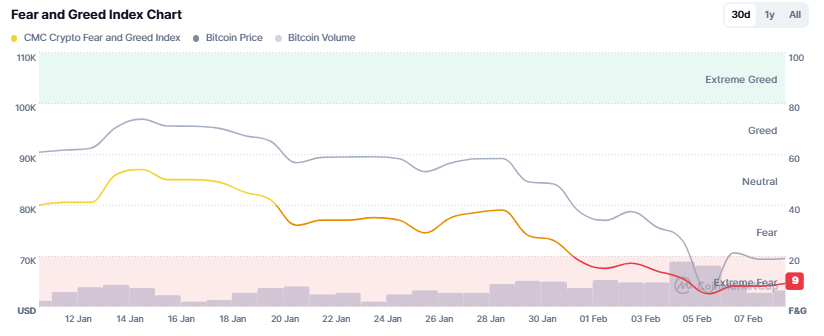

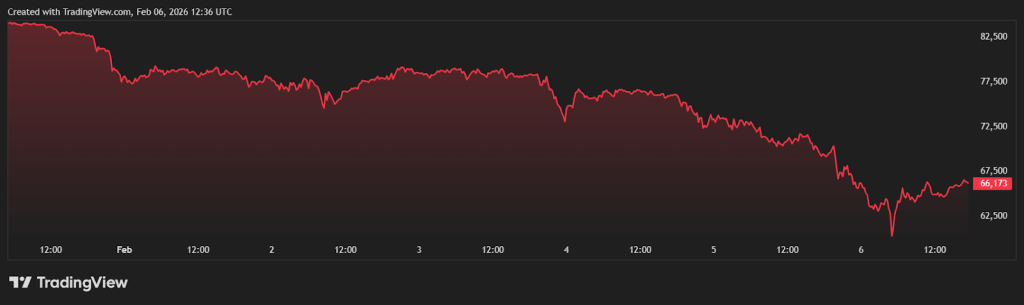

Bitcoin price is hovering near the $70,000 mark in early February 2026, a strong drawdown from the late-January highs near $90K. The selloff was sharp, confidence faded quickly, and now the market is stuck watching one range obsessively and that is $60K to $65K. Lose that, and things could get messy fast in shortterm.

The damage along the way is already clear. Multiple support levels failed during the drop, forcing traders into a wait-and-see mode. Big bets are on pause. Everyone wants proof that a short-term bottom actually exists before stepping back in.

Now is a time when every investor and trader wants a clear view, not a sugarcoating. To them sentiment has turned really ugly and a position without knowing the risk could create serious consequences.

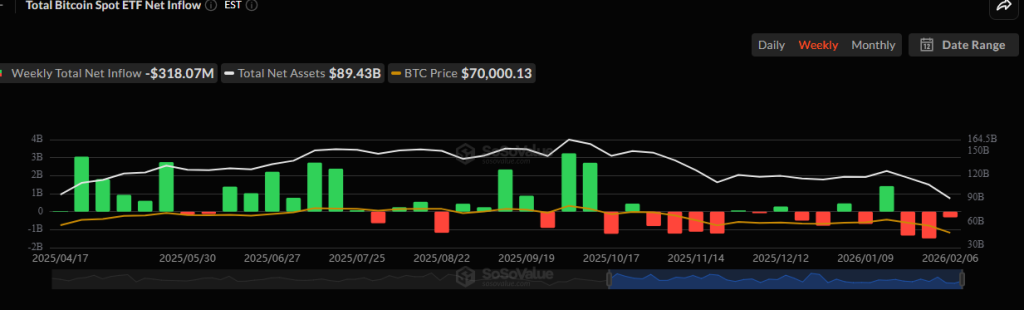

Because, the Crypto Fear and Greed Index still remains deep in Extreme Fear territory. At the same time, spot Bitcoin ETFs continue to bleed capital, with weekly flow data showing persistent outflows stretching back from September 2025 and extending into early February. That’s not the backdrop of a confident market.

Zoom out on the Bitcoin price chart and the technical picture lines up with the mood. The 50-day EMA is still below the 200-day EMA, keeping the death cross active since mid-November. Adding to the pressure, a short-term death cross between the 20-day and 50-day EMAs printed in late January, confirming near-term weakness.

As a result, traders now treat the $60,000–$65,000 zone as the last meaningful cushion. A clean break there could invite forced selling rather than measured exits.

That said, not everything is screaming collapse, at least not on the daily timeframe.

RSI on the daily chart is recovering from deeply oversold levels and currently sits near 32.5, suggesting selling pressure may be losing some intensity on daily timeframe chart. Meanwhile, MACD remains in a bearish cross, but the gap between signal lines is narrowing. In plain terms, downside momentum is slowing with recent bullish move in past few days.

CMF, however, is still negative at around –0.05. Until it flips above the zero line, money flow doesn’t support a sustained bounce. This keeps any Bitcoin price prediction in the “short-term relief only” category rather than any kind of trend reversal not even in the shortterm view.

Derivatives data adds another layer of concern. As per Santiment data, the Open Interest has been falling seamleslly from 30 days high of 38 million OI to only 20 billion OI positions, while BTC price struggles, a sign that traders are exiting positions rather than committing fresh capital.

The brief funding spike on February 6 looked dramatic, but it functioned more like a short squeeze than genuine demand. Once funding flipped back to positive, the market became crowded with over-leveraged longs.

That’s the trap. Positive funding without rising participation leaves buyers exposed. Without new money entering, even a modest dip could trigger liquidations, dragging Bitcoin/USD back toward lower support.

For now or this month, Bitcoin price may attempt a bounce toward $74,750 or even $84,900 if buyers show up decisively. But until the 200-day EMA near $95,700 is reclaimed, the broader structure stays tilted firmly toward the bears.

The post Macro Researcher Says XRP Price Could Surge to $5–$7, But Only After This Happens appeared first on Coinpedia Fintech News

XRP is approaching what some analysts describe as a critical technical range that could determine its next major price move. Macro researcher Jim Willie said XRP’s first big breakout could begin if the token decisively moves above the $2.70–$3.00 zone, a level he believes could trigger rapid upward momentum.

“If it goes above about $2.70 to $3, it could quickly move to $5 and then possibly $7,” he said, hinting that once important resistance levels are cleared, technical buying and investor interest could accelerate the rally.

At the time of writing, XRP is trading at $1.44.

Adoption, Not Trading, Seen as the Real Catalyst

While short-term price movements often depend on market trading activity, Willie said that the long-term direction of XRP will depend more on real-world adoption than on technical factors.

“It’s not just a trading phenomenon, it’s a usage phenomenon,” he said, arguing that large-scale institutional or national adoption of XRP-based payment systems could dramatically expand transaction volumes and market demand.

XRP’s core value proposition lies in its role as a bridge asset for cross-border settlements, where faster settlement speeds and lower transaction costs are key advantages compared with traditional payment systems.

Potential Impact of Institutional or Government Adoption

According to Willie, major adoption announcements, such as governments or large corporations integrating XRP for international trade payments, could change the asset’s valuation outlook. Increased transaction flows tied to trade settlement or financial infrastructure could create sustained demand, potentially pushing prices to higher long-term targets if adoption accelerates.

Market Outlook Remains Linked to Utility Growth

XRP’s next major rally may depend on a combination of technical breakout levels and measurable growth in payment usage across financial institutions and global payment networks. A decisive move above the $3 range could signal renewed bullish momentum, but sustained long-term gains are likely to depend on continued expansion of real-world applications rather than short-term speculative trading alone

The post Mark Yusko Reveals How Low Bitcoin Price Could Go in 2026 appeared first on Coinpedia Fintech News

Investor Mark Yusko says the cryptocurrency market is still moving through a classic cycle, even as institutional participation has grown dramatically. “We’re in crypto winter,” he said, adding that many investors assumed the traditional four-year cycle had ended once large institutions and ETFs began accumulating Bitcoin. Yet, according to Yusko, price behavior hints the historical cycle structure is still influencing markets.

He pointed out that institutional investors last year “bought four times more than the amount of Bitcoin that was mined,” yet prices still declined. The reason, he explained, is that long-term holders who accumulated coins years earlier also sold into rallies, adding supply that offset institutional buying.

Futures Markets Now Drive Price Movements

Yusko said that Bitcoin’s price is no longer determined mainly by spot transactions. “The price of Bitcoin isn’t necessarily set only by spot,” he said, explaining that derivatives markets, particularly futures, now dominate trading activity. Because large leveraged positions can push prices higher or lower quickly, futures markets can sometimes suppress price gains even when underlying demand appears strong.

Where Could Bitcoin Bottom?

Using historical cycle patterns, Yusko suggested that previous bear markets often pushed Bitcoin down toward long-term trend indicators such as the 200-week moving average. Based on current conditions, he said potential downside levels could fall into the range around the high-$50,000s to low-$60,000s before a durable bottom forms.

He also noted that the latest cycle peak was not as far above estimated “fair value” as in previous cycles, meaning the current correction may not need to fall as deeply as earlier downturns.

Human Behavior Still Shapes Crypto Markets

Despite the growing role of algorithms and institutional trading, Yusko said investor psychology remains a dominant force behind crypto market cycles. “Humans are going to human,” he said, explaining that investors often buy when prices are rising and sell when liquidity is needed, reinforcing repeating boom-and-bust patterns across the market.

Recovery Likely Requires a Breakout Catalyst

According to Yusko, the next sustained rally may begin only when strong buying pressure breaks through the current ceiling created by derivatives positioning, potentially triggering a large short squeeze. Until that happens, he expects the market to trade in a volatile range, with gradual stabilization rather than an immediate return to record highs.

The post Mega Whales Turned Bearish: Is $1.00 the Real Risk Level for XRP price? appeared first on Coinpedia Fintech News

XRP price is hovering around $1.43, barely holding above the $1.41 support, and the market tone isn’t exactly comforting. Just days ago on the weekly chart, XRP briefly slid to $1.10 which was its lowest level in several months, it barely stopped just above the psychologically loaded $1.00 mark.

That bounce looked encouraging on the surface. Underneath, not so much. Because while price recovered, confidence didn’t.

Longer-term holders still remain shaky, and the structure around the XRP price chart suggests the rebound may have been more mechanical than conviction-driven. This isn’t panic yet, but it’s fragile on the inside.

One thing investors and traders must know to be clear. That a dip to $1.10 and a spike back isn’t meaningless, at least for now. Because it means that buyers did step in, and the $1.00-$1.10 zone still commands respect from bulls. But here’s the problem, in the short-term it looks like a spike but on the long-term chart the recovery didn’t flinch XRP price meaningfully towards the broader trend.

From a technical standpoint, XRP/USD is still skating dangerously close to failure. If $1.41 gives way, price action opens a clean path back toward $1.10. And if that level fails to hold on a retest, the downside narrative intensifies fast.

So yes, support exists. But it’s being tested by hesitation, not confidence. And, if it returns back the $1.00 consolidation could start.

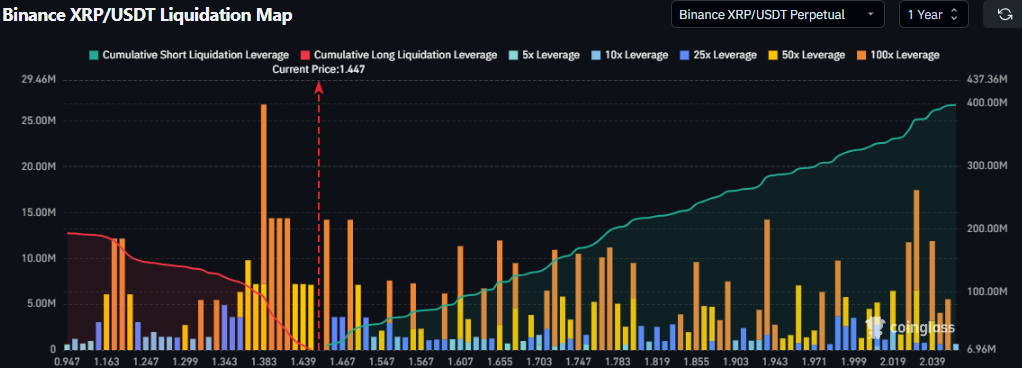

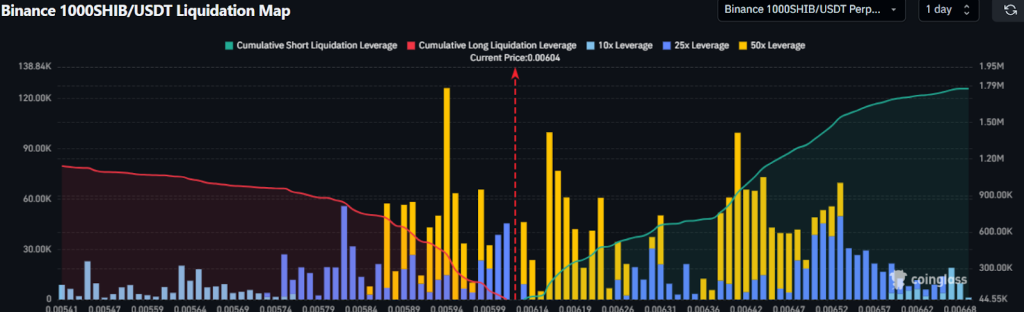

Now for the uncomfortable part. Derivatives positioning also doesn’t agree with the idea of a stable base forming.

Liquidation data shows roughly $390 million stacked on the short side compared with just over $190 million in long exposure. That imbalance matters. It suggests traders are leaning into weakness, not preparing for a sustained rebound.

In other words, the futures market isn’t buying the bounce. It’s betting against it.

And if XRP price drifts lower again, that heavy short positioning could amplify volatility rather than cushion it. This is why any XRP price prediction right now carries asymmetric risk.

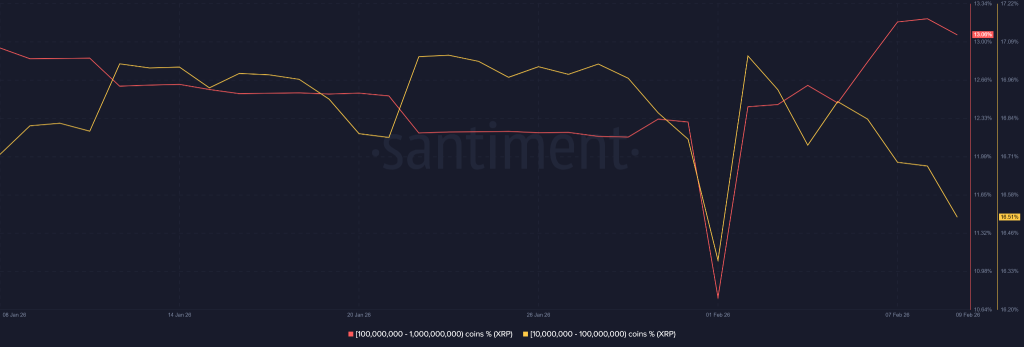

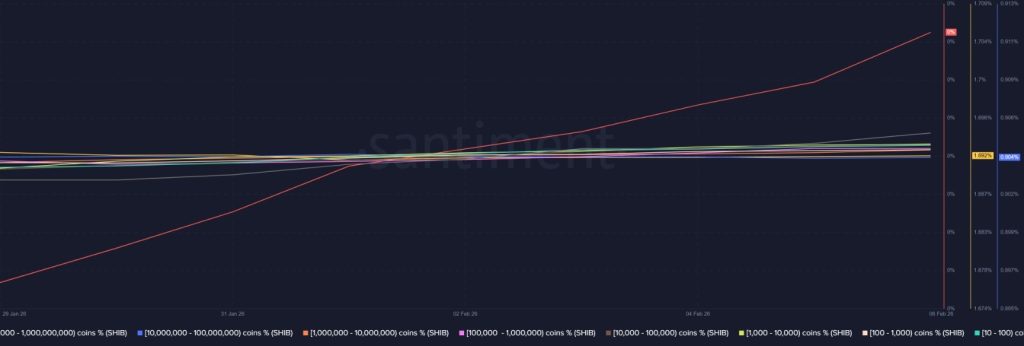

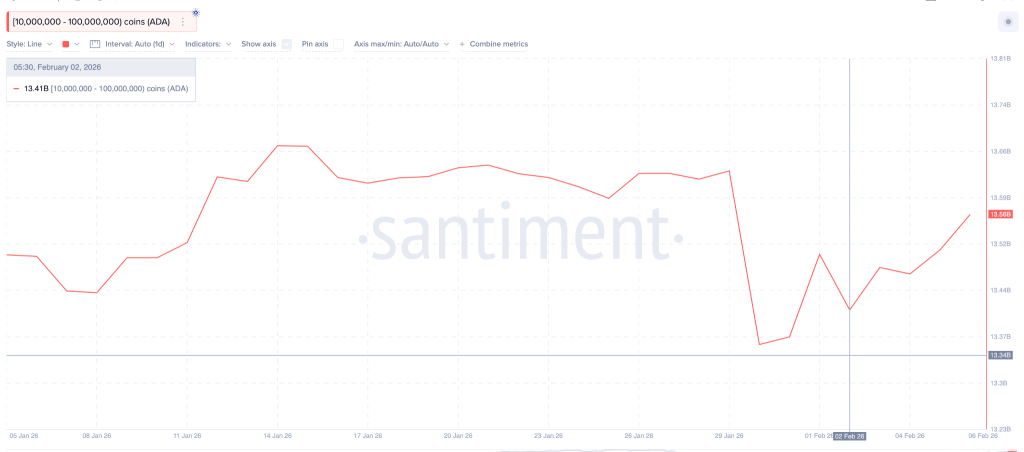

Meanwhile, on-chain behavior isn’t offering much comfort either. Per Santiment data, the metric Supply distribution by balance tells a clear story. Addresses holding between 10 million and 100 million XRP have been steadily selling since early February, which is responsible for the crash in XRP. More concerning, now wallets in the 100 million to 1 billion XRP range have turned bearish in the last 24 hours with metric showing a downside u-curve.

That shift matters. Larger holders don’t usually rush. When they start leaning toward distribution, it often precedes deeper price tests.

If selling pressure continues and XRP revisits $1.00, the risk isn’t just a clean breakdown. Cascading liquidations could follow, reinforcing bearish momentum across both spot and derivatives markets.

For now, XRP price remains above support. But the longer it lingers without demand stepping in, the thinner that safety net becomes.

The post Former House Financial Services Chairman Says CLARITY Act Could Be Signed Before Memorial Day appeared first on Coinpedia Fintech News

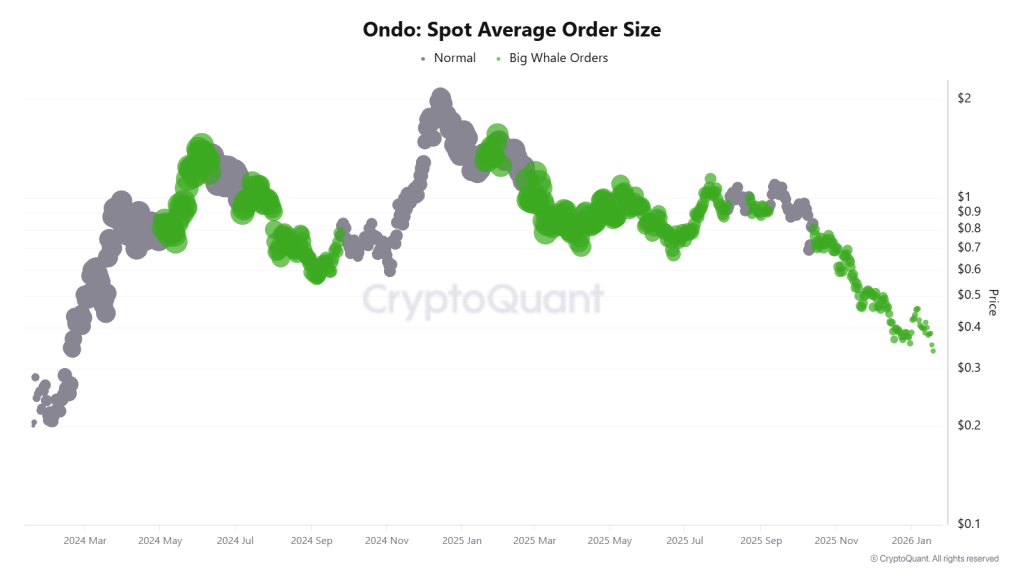

Patrick McHenry, vice chairman of Ondo Finance and former chairman of the House Financial Services Committee, said he expects the long-awaited U.S. crypto market structure legislation, widely known as the CLARITY Act, to advance in the coming months, potentially reaching the president’s desk before Memorial Day.

Speaking at a recent event, McHenry said negotiations around the bill are progressing despite ongoing disagreements, particularly over rules governing stablecoin yield payments. He said that discussions led by White House officials have brought crypto companies and banking representatives together to seek a compromise that would allow the broader legislation to move forward.

Stablecoin Yield Debate Remains the Key Obstacle

According to McHenry, cryptocurrency firms have shown willingness to negotiate on how yield-bearing stablecoins should operate, while banks remain cautious due to concerns that higher-yield digital dollar products could attract deposits away from traditional financial institutions. He said the issue is likely to be resolved because market structure legislation cannot advance without a final agreement on this point.

Lawmakers and industry participants view the stablecoin yield debate as the primary hurdle preventing full regulatory clarity for the digital asset sector.

DeFi Framework Seen as Essential to Final Legislation

McHenry also said that decentralized finance (DeFi) must be addressed in the legislation for it to succeed. He said the benefits of blockchain-based financial systems—such as faster transactions, continuous trading, and lower lending costs—are closely tied to DeFi innovation, making it an important component of any comprehensive regulatory framework.

Regulatory Coordination and Policy Clarity

Another focus of the proposed legislation is improving coordination between U.S. regulators overseeing securities, commodities, and stablecoins, a move McHenry said would simplify compliance and provide clearer rules for investors and companies. Harmonizing these regulatory frameworks is expected to reduce confusion for market participants and support broader adoption of tokenized financial products.

Outlook for Passage

Despite political disagreements and ongoing negotiations, McHenry expressed confidence that lawmakers will reach common ground. He said Senate action could occur in the coming months, followed by final legislative approval, allowing the administration to sign the market structure bill into law later this year if current momentum continues.

The post Bitcoin Crash 2026: Token Bay Capital Says Whales Are Already Buying Back In appeared first on Coinpedia Fintech News

Bitcoin had dropped over 50% from its all-time highs, with roughly 40% of that fall happening in the last six months alone. But one fund manager thinks the bottom could already be forming.

In a recent CNBC International interview, Lucy Gazmararian, founder and managing partner of Token Bay Capital, explained that crypto’s recent sell-off was not isolated. It followed a broader macro risk asset correction into early 2026, with another 20-30% drop across the board.

Gazmararian pointed to OG Bitcoin whales who sold down their holdings around the $100K psychological level at the end of 2025. According to her, this follows the same four-year cycle pattern that has played out repeatedly in crypto markets.

“Until it’s proven otherwise, these four-year cycles are going to persist,” she said.

She added that if Bitcoin drops back to the $50K level, whales are expected to accumulate heavily. Some may already be “beginning to nibble back into the market.”

Also Read: Is Bitcoin’s 4-Year Cycle Breaking Down? Ran Neuner Points to Liquidity Shift

Gazmararian noted that while the pattern of roughly three years up, a blow-off top, and a sharp decline still holds, the drawdowns are getting “smaller and smaller” each cycle. This suggests the crypto market is gradually maturing.

For those watching for a re-entry point, her message was direct.

“If you’re looking to accumulate, it is not a crazy thing to be accumulating at this price,” she said.

While nearly every crypto asset saw outflows last week, XRP was the only cryptocurrency with record positive ETF flows, bucking the broader sell-off trend entirely.

Gazmararian also drew a clear line between tokens with real utility and those without. She described memecoins and cultural tokens as “backed by absolutely nothing,” adding that they trade purely on “social media momentum and tokens going viral for really obscure reasons.”

On the other hand, tokens tied to blockchain infrastructure like Ethereum serve as consensus mechanisms for decentralized transactions. Bitcoin’s value, she said, is anchored in its function as a global instant payment system and the energy cost behind mining.

SOL’s price has validated a classic head-and-shoulders pattern on multiple time frames, with a price target of about $50.

The sale shows how Bitcoin miners are reshaping strategies as mining economics continue to deteriorate.

Michael Saylor’s Strategy missed Bitcoin’s brief drop to $60,000 last week, purchasing $90 million worth of BTC at an average price near $78,800.

Digital Asset cofounder and CEO Yuval Rooz said the latest crypto sell‑off is repricing “empty shell” token models and pushing institutions to chains with value, privacy and predictability.

Binance bought $300 million in Bitcoin for its SAFU reserve, pushing the fund past $720 million as the exchange shifts its emergency buffer to BTC.

The post Why are Bitcoin, Ethereum and XRP Prices Going Down Today? appeared first on Coinpedia Fintech News

Bitcoin, Ethereum and XRP declined again as the broader cryptocurrency market remained under pressure, with Bitcoin falling back below the $70,000 level after a brief recovery attempt. Analysts say the latest pullback has weakened short-term market confidence, especially after Bitcoin failed to hold above recent resistance levels near $74,500.

Bitcoin’s weekly chart now shows a break in the longer-term upward trend that had been supported by a series of higher highs and higher lows over the past several months. The earlier rebound attempts provided temporary support, but the recent drop below key technical levels has increased uncertainty about the near-term direction.

Short-term price movements have been especially volatile. On shorter time frames, Bitcoin briefly found support before falling sharply to around $60,000, its lowest level in more than a year. The market is now in a transitional phase, with the overall trend still uncertain until stronger buying momentum returns.

Global Market Pressure Weighs on Crypto

One of the main reasons behind the decline is a broader sell-off across risk assets, including equities. Analysts say that cryptocurrencies have recently shown strong correlation with stock markets, meaning when equities fall, digital assets often follow as investors reduce exposure to riskier investments.

Institutional Outflows Add Selling Pressure

Additional downward pressure has come from recent outflows from spot Bitcoin exchange-traded funds, which have reduced institutional demand in the short term. When ETF investors withdraw funds, it can lead to increased selling in the underlying market, contributing to price weakness across major cryptocurrencies.

Market Uncertainty and Policy Developments

Uncertainty surrounding upcoming regulatory discussions in the United States has also contributed to the bearish sentiment. Policymakers are currently working to resolve disagreements over crypto market structure legislation, and investors are waiting for clearer regulatory direction before taking large positions.

Short-Term Outlook Remains Uncertain

Market analysts say the next few days could be critical. If the overall crypto market holds above key support levels, prices may stabilize and attempt a recovery. However, continued weakness in global markets or further institutional outflows could lead to additional short-term declines in major assets such as Bitcoin, Ethereum and XRP.

The post Bitcoin Miner Cango Sells 4,451 BTC Worth $305M to Fund AI Pivot appeared first on Coinpedia Fintech News

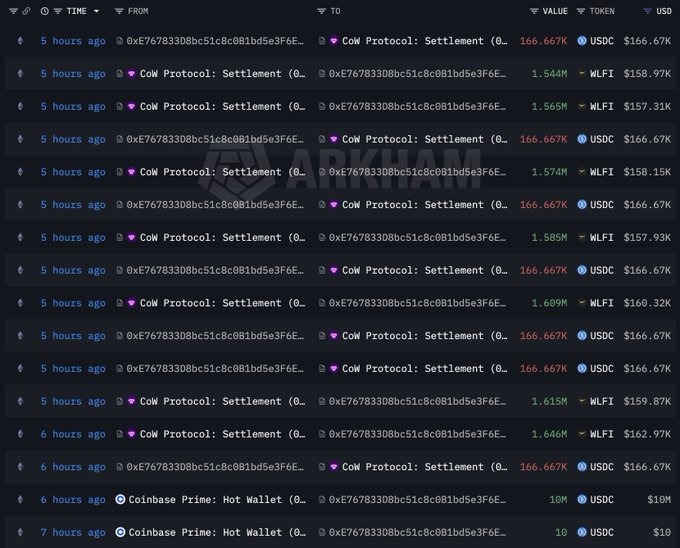

Bitcoin miner Cango Inc. (NYSE: CANG) sold 4,451 BTC on the open market for approximately $305 million in USDT. The company’s market cap sits at around $333 million, making this sale nearly as large as the entire firm itself.

Cango confirmed Monday that all proceeds were used to partially repay a Bitcoin-collateralized loan. The company is dealing with $407 million in debt, a current ratio of 1.2, and negative free cash flow of $252 million. Its stock is trading near a 52-week low of $0.93.

“The partial divestment of the Company’s Bitcoin holding underscores the strategic importance of strengthening the balance sheet to fund new growth initiatives,” Cango stated in a press release.

Cango is transitioning its mining infrastructure toward AI computing. The company plans to deploy modular, containerized GPU compute nodes across its existing sites to provide inference capacity, targeting small and medium enterprises first.

To lead this shift, Cango brought in Jack Jin as CTO of its AI business line. Jin previously worked at Zoom Communications, where he managed GPU cluster deployments supporting large language model operations.

Cango’s January 2026 production fell to 496.35 BTC, down from 569 in December 2025. Average daily output also dropped from 18.35 to 16.01 BTC, with the hashrate declining as well.

The company only entered crypto mining in November 2024 and currently operates across 40+ sites in North America, the Middle East, South America, and East Africa.

Cango said it remains committed to mining while seeking “an optimal balance between hashrate scale and operational efficiency.”

Despite the financial pressure, Cango recently secured $10.5 million from Enduring Wealth Capital Limited, which purchased 7 million Class B shares at $1.50 each. The investment raised EWCL’s stake from 2.81% to 4.69%.

Analysts expect 5.23% revenue growth this fiscal year, though profitability is not on the cards yet.

Read More: Is Bitcoin Safe From Quantum Computing? CoinShares Data Says Yes For Now

The post Ethereum Struggles at Pivotal Resistance—Can Price Move Toward $2,200 or Slip to $1,800? appeared first on Coinpedia Fintech News

After a highly volatile week, Ethereum’s price appears to be taking a pause, trading within a more stable range. Buyers stepped in to stop a deeper sell-off, but the rebound has struggled to gain real momentum. As the ETH price moves closer to resistance near $2,157, buying pressure is starting to fade. This leaves traders watching closely to see whether the recent low around $1,754 marked a short-term bottom or if the market is preparing for another leg lower.

A crypto proponent, anonymously known as Wise Advice, shared data that suggests the Ethereum price is no longer under serious selling pressure.

Ethereum’s daily chart shows a market that has already taken a lot of damage and is now testing whether buyers are ready to step back in. After failing multiple times near the $3,200–$3,400 zone, ETH broke down sharply, slicing through a key demand area and triggering a fast sell-off toward long-term support. The structure clearly reflects distribution at the highs, followed by panic-style selling, which often marks the late stages of a corrective move rather than the start of one.

From a price-structure perspective, ETH lost the $2,800–$2,900 support, which flipped cleanly into resistance and accelerated downside momentum. The current bounce is happening near the rising long-term trendline around $1,800–$1,850, a level traders will watch closely for stabilization. RSI hovering near the low-30s signals oversold conditions, while MACD remains bearish but deeply extended, hinting selling pressure may be tiring. A sustained hold above $1,820 can open a relief move toward $2,150–$2,300, while losing this support risks a deeper flush before any meaningful recovery.

Ethereum is reacting from the $1,800–$1,850 long-term trendline, which is the last meaningful support before a deeper drawdown. As long as the ETH price holds this zone, a short-term relief bounce toward $2,150–$2,300 remains realistic, but this would still be a counter-trend move unless ETH reclaims $2,800 on strong volume. If $1,800 breaks decisively, the downside opens toward the $1,600–$1,650 area where buyers previously stepped in. Until structure flips bullish, rallies are better treated as sells, not trend reversals.

The post Strategy Buys 1,142 BTC, Now Holds Over 714K Coins appeared first on Coinpedia Fintech News

Strategy has announced the purchase of 1,142 Bitcoin for roughly $90 million, at an average price of about $78,815 per BTC. This latest acquisition brings the company’s total Bitcoin holdings to 714,644 BTC, bought for around $54.35 billion at an average cost of $76,056 each. The move reinforces Strategy’s long-term commitment to accumulating Bitcoin, even as prices fluctuate, highlighting its continued confidence in the world’s largest cryptocurrency as a store of value.

The post Top 3 Crypto Picks for 2026 as Investors Reposition for the Next Crypto Cycle appeared first on Coinpedia Fintech News

The crypto market is entering a new crypto phase as early 2026 begins. Investor behaviour is changing, and the focus is moving away from short-term momentum toward utility-driven crypto projects with long-term potential. Instead of chasing quick price moves, many participants are now prioritizing real use cases, sustainable growth, and strong fundamentals.

This shift is driving a quiet capital rotation away from saturated assets and into newer crypto ecosystems that are still in early development stages. Analysts note that these transition periods often set the foundation for the next crypto market cycle. For long-term investors, this moment is increasingly viewed as a key entry window that could shape portfolio performance in the years ahead.

Bitcoin remains the undisputed leader of the market, but it is currently facing a period of heavy pressure. The price is trading around $66,500, with a market capitalization of approximately $1.4 trillion. While Bitcoin is the most secure network in the world, it is feeling the weight of a broader market sell off. The early rallies of the past year have cooled, leaving the asset in a zone of high volatility where it must prove its resilience once again.

The technical outlook for Bitcoin shows strong resistance at the $67,200 and $70,500 levels. Until it can reclaim these zones with high volume, the path upward is blocked. Analysts have issued some cautious price predictions, suggesting that if the $58,000 support fails, Bitcoin could drop back toward $40,000.

Ethereum continues to be the foundation for most decentralized applications, but its price action has been sluggish. It is currently trading at approximately $1,950, with a market capitalization of around $250 billion. Despite its dominance in smart contracts and NFTs, Ethereum has struggled to keep pace with some of its faster competitors. The network is undergoing constant upgrades to improve speed and lower costs, but the market has yet to fully price in these technical improvements.

From a technical perspective, Ethereum faces major resistance at $2,200 and $2,350. These levels have repeatedly rejected recovery attempts, showing that sellers are still in control of the short term trend. Some bad price predictions suggest that Ethereum could slip further toward $1,360 if the current support zones are broken.

Mutuum Finance (MUTM) is gaining attention as a project to watch heading into 2026, largely because it focuses on practical needs within crypto finance. The protocol is being developed as a lending and borrowing hub designed to let users access liquidity without selling their digital assets.

Instead of exiting long-term positions, users are intended to be able to use their crypto as collateral while retaining ownership. The system is built to be non-custodial, meaning users keep control of their private keys as they interact with the platform. This approach aims to support capital efficiency while allowing assets to continue working within a decentralized framework.

The protocol reached an important milestone with the V1 protocol launch on the Sepolia testnet, moving from roadmap to real execution. Users can now test core features such as supplying assets to liquidity pools, minting mtTokens, tracking debt positions, and observing basic risk controls like health factors in a safe, test environment.

The project is currently in Phase 7 of its distribution, with the token priced at $0.04. It has already raised over $20.4 million and attracted more than 19,000 holders. With a confirmed launch price of $0.06, the project is offering a structured entry point that is attracting massive attention from both retail and institutional participants.

The growth of the MUTM ecosystem is built around core mechanics such as mtTokens and a planned buy-and-distribute model. When users supply assets to the protocol, they receive mtTokens that represent their position. These tokens are designed to increase in value over time as interest from borrowing activity is generated. mtTokens can already be tested through the current V1 protocol on the testnet.

According to the project’s official whitepaper, Mutuum Finance also plans to introduce a buy-and-distribute mechanism in later stages. Under this model, a portion of protocol fees is intended to be used to acquire MUTM tokens and distribute them to stakers.

To ensure the system is accurate and secure, Mutuum Finance uses decentralized oracles to track market prices in real time. This professional setup is why analysts are projecting a target price of $0.18 to $0.25 shortly after the mainnet release. This prediction is based on the actual usage of the protocol rather than just market hype.

The future of Mutuum Finance includes the launch of a native over-collateralized stablecoin and expansion to Layer-2 networks. These plans are crucial because they make the protocol accessible to everyone. By using Layer-2 technology, the platform can offer faster transactions and much lower gas fees. This allows retail users to take out small loans without losing their profits to network costs.

The native stablecoin would also provide a safe haven for users who want to borrow without worrying about market volatility. This combination of speed, safety, and low cost is what top crypto investors are looking for in 2026. As the supply in Phase 7 disappears, the urgency to participate is reaching a peak. With verified security from Halborn and a working testnet, Mutuum Finance is ready to lead the next crypto cycle.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

The post Signs Of a Cryptocurrency Bear Market Have Emerged – Savvy Investors Have Begun Protecting Their Funds appeared first on Coinpedia Fintech News

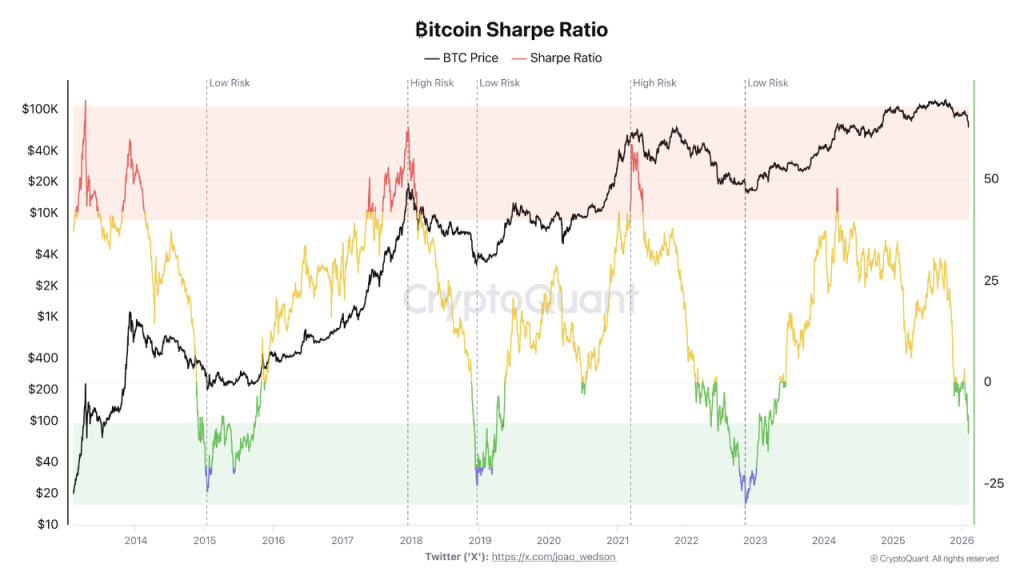

After falling nearly 45% from its all-time high of $126,080, Bitcoin broke below its 365-day simple moving average late last year. Historically, this level has acted as a long-term trend filter — and when it’s lost, it often signals the start of a broader bear market.

According to CryptoQuant research lead Julio Moreno, Bitcoin is currently trading about 30% below its 365-day average, a level comparable to early stages of past bear markets. While the asset has matured significantly over the years, one thing hasn’t changed: volatility still hits hard when sentiment turns.

At the time of writing, Bitcoin is hovering around $70,000, up modestly over the past 24 hours. But for experienced investors, the question is no longer just “When will it bounce?”

It’s something more practical:

How do you protect capital while the market figures itself out?

In bull markets, aggressive positioning is often rewarded. In bear markets, it’s usually punished.

That’s why smart money tends to move early — not necessarily out of crypto, but away from strategies that rely purely on price appreciation. When volatility increases and trends weaken, preserving capital becomes just as important as growing it.

This shift is already happening.

Instead of constantly timing entries and exits, more investors are looking for structured, automated ways to keep assets productive while waiting for clearer market direction.

Bear markets expose weak structures fast.

When prices fall and liquidity tightens, investors pay closer attention to:

This is where platforms designed around compliance, asset segregation, and operational transparency tend to stand out.

SolStaking is one example of this shift in mindset.

Rather than positioning itself as a short-term yield play, SolStaking focuses on building a long-run participation framework, emphasizing:

In volatile markets, structure isn’t a bonus — it’s the baseline.

One of the biggest challenges during crypto bear markets is over-reliance on on-chain price movement.

SolStaking addresses this by integrating Real World Assets (RWAs) into its broader operating model. These include areas such as:

These assets generate returns outside of pure crypto price cycles. Performance data is accounted for off-chain, then transparently reflected on-chain through automated settlement mechanisms.

The result is a system that’s less sensitive to short-term Bitcoin price swings, especially during periods of sustained volatility.

During uncertain market conditions, simplicity matters.

Cloud staking models are gaining attention because they:

For many Bitcoin holders, this approach offers a way to stay engaged without overexposing themselves to market noise.

Instead of reacting to every price move, capital stays deployed — but in a more controlled environment.

When Bitcoin drops below long-term trend indicators, history shows that markets can remain unstable longer than most expect.

Smart money understands this.

Rather than chasing rebounds or sitting completely idle, experienced investors focus on protecting capital first, while positioning themselves for the next cycle.

By combining compliant infrastructure, real-world asset exposure, and automated on-chain execution, platforms like SolStaking reflect a broader shift in how crypto participants are navigating today’s bear market.

Because in times like these, survival isn’t passive — it’s strategic.

Official website: https://solstaking.com

Cooperation email: info@solstaking.com

The post Monero Price Prediction 2026, 2027 – 2030: Privacy Coin Growth Ahead appeared first on Coinpedia Fintech News

Envision the capability to conduct online payments without a digital footprint; that’s payment privacy. Numerous cryptocurrency assets possess a distinct selling proposition (USP) some safeguard transaction details concerning the parties or institutions involved but some does not.

but, this transparency enables larger investors and institutional capital to be easily traced. While unshielded transactions are valued by researchers for the accessible information they provide regarding investments, individuals whose data is subject to scrutiny often experience frustration, as they perceive a loss of privacy over their own financial assets.

This is where Monero (XMR) comes in. Since its inception in 2014, Monero has offered robust privacy features. It has become the top choice for users seeking to maintain a high standard of anonymity in blockchain transactions. The impact of Monero’s privacy capabilities was particularly evident in the fourth quarter of 2025.

Despite the government’s tightening of the rules around digital assets, Monero has ranked 21st globally. Driven by rising interest, XMR stands out as a privacy-focused coin. So, what’s coming next for Monero in 2026 and the years to come? In this Monero price prediction 2026-2030 article, we look at the potential price targets.

| Cryptocurrency | Monero |

| Token | XMR |

| Price | $319.3480

|

| Market Cap | $ 5,890,930,009.30 |

| 24h Volume | $ 100,162,639.3939 |

| Circulating Supply | 18,446,744.0737 |

| Total Supply | 18,446,744.0737 |

| All-Time High | $ 798.9149 on 14 January 2026 |

| All-Time Low | $ 0.2130 on 14 January 2015 |

Monero (XMR) surged to $800 in early 2026 but fell back into its ascending parallel channel, dropping over 40% by late January. It now trades above $425, and a close below this level could trigger further declines.

The price action of Monero (XMR) showed remarkable bullish momentum, particularly in Q4 2025, driven by a broader trend in privacy coins, which resulted in a significant price surge during that period.

In 2026, Monero followed the same privacy narrative, continuing the rally and pushing the price to new all-time highs (ATH) of $800. However, this increase was short-lived, as the price dropped to around $285 in February, losing more than 60% from its peak. Additionally, the mid-trendline of an ascending channel was breached, confirming a bearish dominance in the market.

The remaining days of Q1 2026 may see consolidation or further declines if the overall sentiment remains bearish. However, if demand for XMR increases, it could potentially revisit the $422 mark. It’s important to note that a recovery to this level might not inspire much excitement, as it could form a significant trap for investors. To regain a bullish setup, a weekly close above $422 would be crucial for attracting investor interest. Conversely, if the price fails to break through $422, the first half of 2026 could see a drop to the 200-day weekly EMA or even lower, reaching the lower end of the pattern.

Furthermore, it’s essential to recognize that the price has reached the upper boundary of its ascending parallel channel. As with previous patterns, a correction appears to be imminent. When it pierced the upper boundary, it had two choices: break away from the earlier pattern and establish new price action, but it briefly exceeded the channel before falling back within it, echoing historical trends. Ultimately, it returned to the pattern, continuing its legacy from the past.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2027 | $910.00 | $1000.00 | $1200.00 |

| 2028 | $863.46 | $1,726.90 | $2,590.35 |

| 2029 | $1,295.19 | $2,590.35 | $3,885.53 |

| 2030 | $1,942.76 | $3,885.53 | $5,828.30 |

Looking forward to 2027, XMR’s price is expected to reach a low of $910, with a high of $1,200 and an average forecast price of $1,000.

In 2028, the price of a single Monero is anticipated to reach a minimum of $863.46, with a maximum of $2,590.35 and an average price of $1,726.90.

By 2029, XMR’s price is predicted to reach a minimum of $1,295.19, with the potential to hit a maximum of $3,885.53 and an average of $2,590.35.

In 2030, Monero is predicted to touch its lowest price at $1,942.76, hitting a high of $5,828.30 and an average price of $3,885.53.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Monero is a privacy-focused cryptocurrency that hides sender, receiver, and transaction amounts using advanced cryptography.

Monero price in 2026 could see strong upside if privacy demand rises, with forecasts pointing to continued price discovery above prior highs.

XMR price prediction for 2027 suggests steady growth as Monero adoption expands among users seeking private, censorship-resistant payments.

In 2028, XMR may benefit from long-term privacy adoption, with price forecasts reflecting gradual appreciation during broader crypto growth cycles.

XMR price prediction for 2030 indicates potential for major gains if Monero remains the leading privacy coin amid tightening financial surveillance.

The post Ethena Price Prediction 2026, 2027 – 2030: Will ENA Price Cross $2? appeared first on Coinpedia Fintech News

With high anticipation of an intensified bull run in 2026, top tokens are preparing for an altcoin season. Amidst the hype, the token like Ethena is on people’s watch list. Based on historical price action, ENA price predictions project a high likelihood of an uptrend in 2026.

Now, investors are intrigued to find out: Will the ENA token price manage to fuel the bullish recovery? Additionally, what does Ethena’s future hold over the next four years? Let’s explore the anticipated ENA price predictions for 2026 to 2030.

| Cryptocurrency | Ethena |

| Token | ENA |

| Price | $0.1173

|

| Market Cap | $ 964,879,043.92 |

| 24h Volume | $ 97,588,318.1140 |

| Circulating Supply | 8,225,000,000.00 |

| Total Supply | 15,000,000,000.00 |

| All-Time High | $ 1.5170 on 11 April 2024 |

| All-Time Low | $ 0.1028 on 06 February 2026 |

January 2026 saw a drop that continued into February, bringing ATL to $0.100, but it later recovered to $0.103, possibly signaling a reversal. But things would flip completely. If this level fails, too, then bears may target $0.014. But in case demand returns from $0.103, followed by a possible recovery to $0.200 and $0.250, could lead to a much-awaited rally towards $0.466, aiming for $0.753 by mid-2026.

The 2026 January continued H2 2025’s bearish momentum, making a new low this year at $0.100. The bearish momentum seems strong, but a very small support seems to be forming in February around the $0.103 area, and if this demand multiplies, it could signal a reversal. For now $0.103 is a key demand level, but if that also collapses, then $0.014 could be the bears’ new low target. Now, what happens here onwards will shape the rest of Q1 2026.

But if it recovers, reclaiming the $0.200 and $0.250 earlier levels will be the first steps toward regaining its lost footing in the market.

Once this threshold is cleared, it may see more demand there, with an accumulation pattern. Once it meets the required demand, a recovery rally could begin and complete H1 2026 by challenging the $0.466 resistance level with a potential target of $0.753.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | $0.014-$0.103 | 0.75 | 1.30 |

| 2027 | 1.19 | 2.68 | 3.97 |

| 2028 | 1.85 | 3.49 | 5.14 |

| 2029 | 2.26 | 4.24 | 6.22 |

| 2030 | 2.94 | 5.16 | 7.39 |

Looking forward to 2027, ENA’s price is expected to reach a low of $1.19, with a high of $3.08 and an average forecast price of $2.12.

In 2028, the price of a single Ethena is anticipated to reach a minimum of $1.85, with a maximum of $3.97 and an average price of $2.68.

By 2029, ENA’s price is predicted to reach a minimum of $2.26, with the potential to hit a maximum of $6.22 and an average of $4.24.

In 2030, Ethena is predicted to touch its lowest price at $2.94, hitting a high of $7.39 and an average price of $5.16.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Ethena is a DeFi-focused crypto token gaining traction due to strong price rebounds, growing adoption, and expectations of an altcoin bull cycle.

Yes, if ENA breaks key resistance near $0.46–$0.54, technical patterns suggest a strong rally that could retest the $1.30 level.

Ethena shows long-term growth potential, with forecasts projecting gradual price increases through 2030 amid broader crypto adoption.

ENA’s price is influenced by market cycles, technical patterns, DeFi demand, investor sentiment, and overall crypto market momentum.

The post Crypto.com CEO Kris Marszalek Spends $70 Million on ai.com in Historic Domain Deal appeared first on Coinpedia Fintech News

Kris Marszalek, the CEO and co-founder of Crypto.com, has made one of the boldest moves yet by a crypto executive stepping into artificial intelligence. In April 2025, Marszalek spent a staggering $70 million to acquire the ai.com domain, paying entirely in cryptocurrency. The deal is now the most expensive publicly disclosed domain purchase in history and signals a serious push beyond crypto into AI.

The timing is no accident. AI has become one of the fastest-growing sectors globally, attracting massive capital and attention from both tech giants and retail users. Marszalek’s move places him right at the center of that momentum.

For those familiar with Marszalek’s past decisions, the ai.com purchase looks less like a gamble and more like a repeat of a proven strategy. In 2018, he paid $12 million for the crypto.com domain, a deal that many questioned at the time. Years later, that domain became one of the most powerful branding assets in the industry.

Today, Crypto.com dominates search rankings for the word “crypto,” pulling in roughly 100 million visits per year, largely through organic Google traffic. Nearly 40% of users click the first search result, a reality that helped Crypto.com scale quickly and cheaply. Supporters argue that Marszalek is now applying the same long-term thinking to AI.

The domain purchase isn’t just about branding. Ai.com has unveiled a consumer platform centered around autonomous AI agents. Unlike basic chatbots, these agents are built to act independently on behalf of users. Tasks range from scheduling and workflow automation to trading and other decision-based activities.

Marszalek has described the vision as a decentralized network of AI agents that improve over time by sharing learnings, echoing principles familiar to the crypto world. The idea is to move beyond conversation-based AI into tools that actually get things done.

Ai.com’s debut came with a Super Bowl commercial, instantly placing the platform in front of millions. The response was overwhelming. Traffic surged so quickly that the website went offline for several hours, a sign of both intense interest and the current hype surrounding AI.

Marszalek later admitted the team expected high demand but underestimated the scale of attention the ad would generate.

On the other hand, crypto analyst Miles Deutscher believes the move is being underestimated. He notes that the project has reportedly been in development since April 2025, suggesting a long-term build rather than a rushed launch. To him, the $70 million domain purchase is a clear signal that something much bigger is coming.

Meanwhile, voices like Abbas Khan argue the acquisition reflects a deep understanding of SEO, traffic, and digital real estate. In their view, ai.com could become for AI what crypto.com became for digital assets, a front door for an entire industry.

Whether that vision plays out remains to be seen, but one thing is clear: this is not a casual side project. Marszalek’s move marks a serious and expensive bet that AI is the next major platform shift.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The purchase is a strategic branding move, mirroring his successful acquisition of Crypto.com, to position the new platform at the forefront of the rapidly growing artificial intelligence industry.

Ai.com is developing a platform of autonomous AI agents that perform tasks independently, like scheduling and trading, moving beyond chatbots to create a decentralized network of actionable tools.

While backed by the same founder, ai.com is a separate venture focused on AI agents. It applies the same long-term digital real estate and SEO strategy that made crypto.com a dominant industry domain.

The Ethereum co-founder outlined alternative stablecoin models that he says better align with DeFi’s original promise of risk decentralization.

Whale and institutional demand for Bitcoin show signs of a comeback, but downside risks remain as analysts expect BTC price to retest $66,000 support.

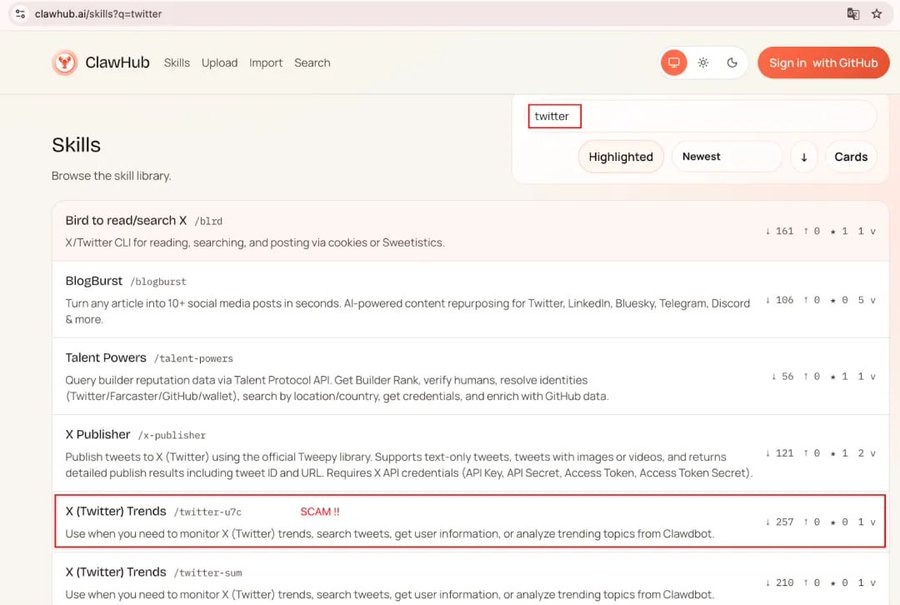

SlowMist flagged 472 AI skills containing malicious code, as plugins and extensions increasingly become a target for hackers seeking access to the devices of cryptocurrency investors.

Six people have been detained after a French magistrate and her mother were abducted in a crypto ransom plot, intensifying concerns over a surge in violent “wrench attacks” in France.

The wallet linked to Infini’s $50 million exploit reactivated after months of silence to buy the Ether dip amid a broader market downturn.

TRM Labs says the $17.9 billion figure reflects gross onchain volume, including internal transfers, not confirmed illicit proceeds.

TON Pay’s new SDK lets Telegram Mini Apps accept Toncoin and stablecoins in a single, low-fee checkout flow, seeking to make TON a payments rail for its 1.1 billion monthly active users.

Crypto ETP outflows slowed to $187 million after weeks of losses, with a record $63 billion in trading volume, suggesting a “potential market nadir,” CoinShares said.

The post Singapore Gulf Bank Launches Virtual Accounts to Reduce Payment Delays appeared first on Coinpedia Fintech News

Singapore Gulf Bank has launched a new Virtual Accounts service for businesses to manage payments more easily. The system helps companies collect money, track payments, and match records in real time.

Meanwhile, this makes payment work faster and reduces delays caused by manual processing.

According to the February 7 announcement, Singapore Gulf Bank introduced its Virtual Accounts framework to help corporate customers manage collections and outgoing payments more efficiently. The service is built for businesses that handle large transaction volumes and need faster visibility over incoming funds.

However, the bank said the new setup is designed to simplify treasury workflows by reducing reconciliation gaps and improving payment identification speed.

The new system combines collect-on-behalf-of and pay-on-behalf-of features within one account structure. Businesses can generate unique identifiers for each payer, invoice, or internal unit. This allows every payment to be automatically tagged and matched without heavy manual checking.

Singapore Gulf Bank (SGB) announced the launch of SGB Virtual Accounts, providing enterprises with automated collections and cash management. The service combines collect-on-behalf-of (COBO) and pay-on-behalf-of (POBO) functions enabling unique structured account identifiers for…

— Wu Blockchain (@WuBlockchain) February 9, 2026

With structured account labels, finance teams can quickly track who paid and why, instead of reviewing mixed transfers line by line. This approach supports cleaner books and faster reporting cycles.

Many companies still depend on manual checks to track incoming payments. As payments grow, this leads to delays and more mistakes.

Singapore Gulf Bank’s Virtual Accounts system is designed for real-time settlement and instant payment tracking. Every payment is clearly tagged, which helps record funds faster and more accurately. This reduces manual work and lowers the chance of human error.

Because the framework runs under a single banking license across its operating markets, companies can use a unified account structure instead of managing separate, fragmented setups.

The service is already being used by Fly Wing Technologies, a subsidiary of Matrixport. In this case, crypto mining clients convert digital assets into fiat and receive funds through the virtual account structure to pay operating costs like electricity bills.

SGB CEO Shawn Chan said, “Our core mission is to solve the structural frictions in the global financial system, and the launch of SGB Virtual Accounts is an important step in that journey.”

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Singapore Gulf Bank’s Virtual Accounts lets businesses create unique identifiers under one main account for instant payment tracking, automated matching, and real-time visibility—perfect for high-volume collections.

Businesses generate custom virtual account numbers for payers, invoices, or departments. Payments arrive tagged automatically, funds settle in real time, and reconciliation happens without manual effort.

They cut manual reconciliation, reduce errors, speed up cash visibility, and streamline treasury workflows—helping companies save time, improve accuracy, and manage payments more efficiently.

High-volume businesses like payment providers, marketplaces, or crypto-related firms (e.g., mining operations) benefit most, especially those needing fast, clear tracking of incoming and outgoing funds.

The post Chainlink Price Moves Lower With the Market, Yet On-Chain Data Stay Measured appeared first on Coinpedia Fintech News

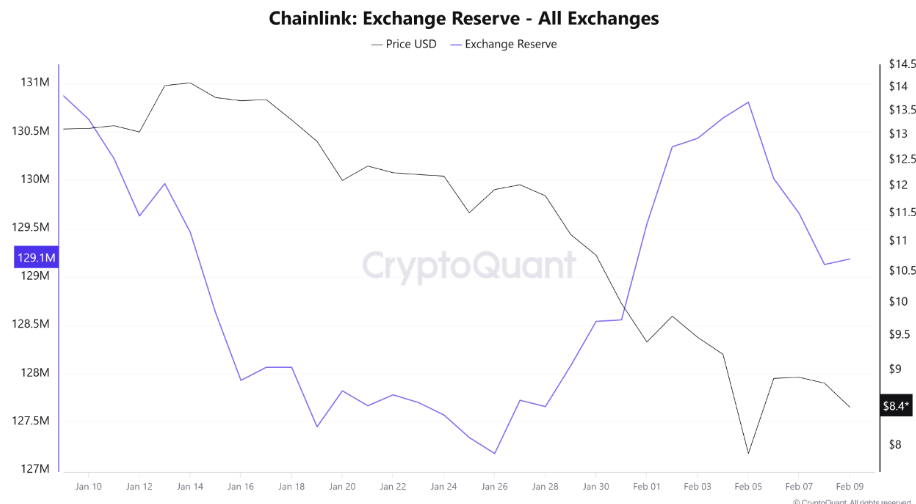

Chainlink price moved lower in the latest session, tracking the broader market’s downturn as Bitcoin and major altcoins faced renewed selling pressure. LINK declined by roughly 3% on the day, extending its short-term pullback as traders reduced exposure amid macro uncertainty. The move lower came without a surge in volume or aggressive downside momentum, indicating that sellers are acting cautiously rather than rushing for exits. While price action remains under pressure, market behavior suggests this decline is part of a broader risk-off rotation rather than a LINK-specific breakdown.

On-chain data from Cryptoquant paints a more balanced picture than price action alone might suggest. Exchange reserve metrics show that LINK balances on centralized exchanges have continued to trend lower, signaling that large holders are not aggressively moving tokens to sell. Historically, sharp drawdowns accompanied by rising exchange reserves often precede extended downside, as supply becomes readily available for distribution.

That pattern is not evident here. Instead, reserves appear stable to declining, implying that long-term holders are maintaining positions despite near-term weakness. This behavior suggests that selling pressure is coming primarily from short-term traders rather than from larger wallets rotating out of LINK exposure. In market structure terms, this aligns more with consolidation than with capitulation.

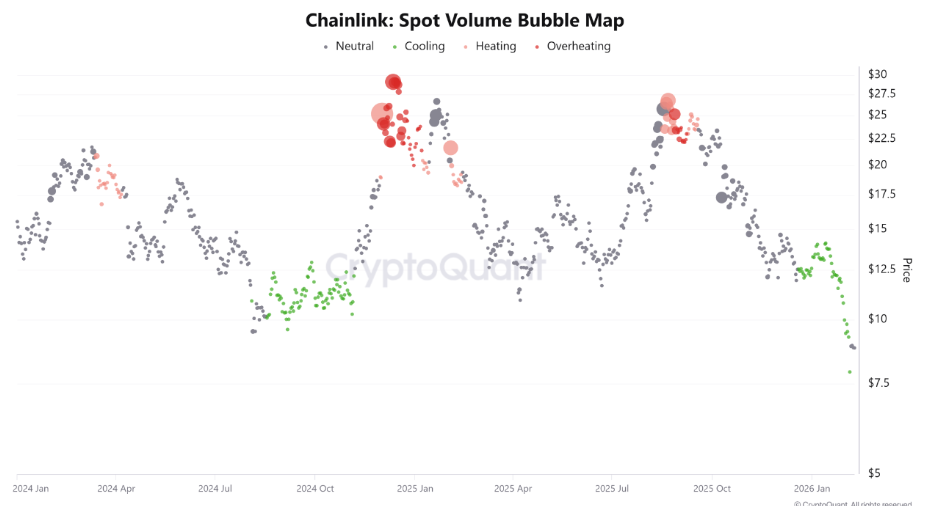

Spot volume bubble data adds further context to LINK’s pullback. Trading activity has cooled across major exchanges, with fewer large-volume buy or sell bursts compared to previous volatile sessions. This reduction in spot aggression typically reflects indecision rather than fear. Buyers are stepping back, but sellers are not accelerating either. Such conditions often emerge when price drifts into demand zones, allowing the market to rebalance positioning before a directional move resumes. Notably, this type of volume contraction tends to precede volatility expansion, though direction depends on how price reacts at key technical levels.

Chainlink price is trading lower with the broader market today, but the decline has brought price back into a well-defined zone rather than into free-fall. The pullback has been orderly, suggesting distribution pressure in present, but not aggressive. Importantly, LINK has not printed a lower low on the higher timeframes, keeping the broader structure intact for now. However, LINK price is compressing near support after rejecting from a recent lower high.

For LINK, the primary support zone of $8 would act as a make or break zone. In case of a break below the zone, a significant downmove toward $7 followed by $6 may be seen ahead. Until the LINK token holds the $8 level, the recovery is imminent. At this stage, LINK is testing its crucial zone, not collapsing. The reaction around support will refine whether the move becomes a reset higher or a continuation lower.

LINK’s recent decline is primarily tracking a broader crypto market downturn, driven by short-term trader risk-off sentiment rather than significant selling from long-term holders, according to on-chain data.

Market data shows exchange reserves are stable or declining, indicating larger holders aren’t aggressively selling. However, with price compressing near support, timing depends on the reaction at the $8 level.

On-chain metrics reveal that LINK exchange reserves are not rising sharply, suggesting this sell-off is driven by short-term traders, not long-term holder distribution—a sign of consolidation, not a major breakdown.

The post Is Bitcoin Safe From Quantum Computing? CoinShares Data Says Yes For Now appeared first on Coinpedia Fintech News

The quantum computing threat to Bitcoin has been a hot topic recently.

A fresh report from CoinShares finally puts real numbers behind the debate, and the actual risk is much smaller than the headlines suggest.

CoinShares confirms that quantum algorithms like Shor’s could, in theory, expose private keys from Bitcoin’s ECDSA signature system. But the computing power needed to pull that off does not exist yet and is not coming anytime soon.

Breaking Bitcoin’s secp256k1 curve within one day would need around 13 million physical qubits. For context, Google’s Willow chip currently operates on just 105.

Ledger CTO Charles Guillemet told CoinShares, “To break current asymmetric cryptography, one would need something in the order of millions of qubits. And as soon as you add one more qubit, it becomes exponentially more difficult to maintain the coherence system.”

Around 1.6 million BTC sits in older P2PK addresses where public keys are visible. But only about 10,200 BTC could realistically cause market disruption if stolen quickly.

The rest is spread across 32,607 separate addresses holding around 50 BTC each. According to CoinShares, cracking those would take millennia, even with the most aggressive quantum progress imaginable.

Modern Bitcoin address formats like P2PKH and P2SH keep public keys hidden behind hashes, which means the vast majority of the supply stays protected.

The report urges caution. Rushing into hard forks or unproven quantum-resistant address formats could introduce bugs, burn developer resources, and chip away at Bitcoin’s core values of immutability and property rights.

Cryptographer Dr. Adam Back offered a calmer take: “Bitcoin can adopt post-quantum signatures. Schnorr signatures paved the way for more upgrades, and Bitcoin can continue evolving defensively.”

CoinShares puts the timeline for cryptographically relevant quantum computers at the 2030s or later. Holders with funds in vulnerable legacy addresses have plenty of time to move them.

The quantum threat is real on paper, but the data says Bitcoin has time on its side.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

In theory yes, but in practice no. Breaking Bitcoin would require millions of stable qubits, far beyond today’s quantum capabilities.

Only about 10,200 BTC could cause market impact if stolen. Most Bitcoin uses modern address types that remain well protected.

Not urgently. Experts agree Bitcoin has time and can upgrade carefully later, avoiding rushed changes that could harm the network.

The post Tether’s Gold Reserves Hit $23 Billion, Among Top Global Holders appeared first on Coinpedia Fintech News

Tether, the company behind the USDT stablecoin, is no longer just a major player in crypto. It has now become one of the largest gold holders in the world. According to a recent report from Wall Street firm Jefferies, Tether’s physical gold reserves have reached about 148 tonnes, worth roughly $23 billion as of late January 2026.

This puts the stablecoin issuer among the top 30 gold holders globally, ahead of several countries. For a privately owned crypto company, this is a major shift and shows how the gap between crypto and traditional finance is getting smaller.

Jefferies estimates that Tether bought around 26 tonnes of gold in the final quarter of 2025 and another 6 tonnes in January alone. During that time, only Brazil and Poland bought more gold, both through their central banks.

At current levels, Tether’s gold holdings are larger than the official reserves of countries such as Australia, South Korea, Greece, Qatar, and the United Arab Emirates. This makes Tether one of the most active non-government buyers in the global gold market.

Since Tether is privately owned, analysts say the reported numbers may not show the full picture. The company could hold even more gold than what is publicly known.

Tether holds gold as part of the assets that support its products. This includes USDT, the world’s largest dollar-pegged stablecoin, and XAUT, a token backed by physical gold.

Tether’s fourth-quarter report showed about $17 billion worth of gold in its reserves, equal to roughly 126 tonnes at year-end prices. At the same time, XAUT has been growing steadily. By the end of January, more than 712,000 XAUT tokens were in circulation, backed by around 6 tonnes of additional gold.

CEO Paolo Ardoino has said that demand for XAUT is especially strong in developing markets, where people often trust gold more during times of currency weakness.

Tether’s buying comes during a strong rise in gold prices. Gold recently moved above $5,000 per ounce, up nearly 50% since September. Increased buying by central banks, higher bond yields, and efforts by some countries to reduce reliance on the U.S. dollar have all supported the price surge.

Looking ahead, Tether does not appear finished with its gold strategy. Ardoino has said the company plans to keep around 10% to 15% of its investment portfolio in physical gold, which means its presence in the gold market could grow further.

Crypto analyst Kyle Chassé noted that the most aggressive gold buyer right now is not a government, but Tether. Holding about $23 billion in gold makes the company look more like a central bank than a typical crypto firm.

As crypto companies begin holding large amounts of real-world assets like gold, the line between traditional finance and digital assets continues to blur, pointing to a new phase where crypto firms operate with strategies once seen only in governments and major financial institutions.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Tether holds approximately 148 tonnes of physical gold, valued around $23 billion, ranking it among the world’s top 30 gold holders.

Tether holds gold as a reserve asset to back its stablecoins, providing stability and trust, particularly for users in markets with volatile local currencies.

Tether plans to keep 10-15% of its portfolio in physical gold, indicating further strategic purchases as its reserves and user demand grow.

The post El Salvador Backs Bukele’s Security Moves, Not His Bitcoin Plan appeared first on Coinpedia Fintech News

El Salvador’s President Nayib Bukele continues to enjoy massive public support, despite his Bitcoin push not gaining the same enthusiasm. A new survey published by La Prensa Gráfica shows Bukele’s approval rating at 91.9%, highlighting just how popular he remains across the country.