Reading view

800% Shiba Inu (SHIB) On-Chain Anomaly Sends Important Signal

Bitcoin (BTC) Price Analysis for December 14

Bitcoin Buyers Face Warning Signal From Bollinger Bands

Analyst Reveals Whether XRP Price Could Ever Fall Back to $1

The post Analyst Reveals Whether XRP Price Could Ever Fall Back to $1 appeared first on Coinpedia Fintech News

XRP price has struggled to move higher even as XRP exchange traded funds continue to see strong interest. This has confused many investors, especially with growing headlines around institutional demand and ETF inflows.

On Paul Barron Podcast, analyst Zach Rector said the lack of price movement is frustrating but not surprising. According to him, the market is going through a “sell-the-news” phase that often follows major ETF launches.

Why ETF Inflows Have Not Boosted XRP Price Yet

Rector explained that ETF demand has not directly pushed XRP’s public market price higher because most ETF purchases are happening over the counter, not on public exchanges.

“In November, about $803 million flowed into XRP ETFs,” Rector said. “At the same time, around $808 million worth of XRP was sold on centralized exchanges.”

Because XRP’s market price is set on public exchanges, selling pressure there has canceled out the ETF demand happening privately.

Exchange Outflows Offset ETF Buying

Rector said nearly $808 million left centralized exchanges in November as investors sold XRP for dollars or stablecoins. This selling pressure kept prices down even as ETF interest increased.

“When ETF inflows move onto exchanges, that’s when things change,” he said. “That’s when buying becomes aggressive.”

Market Cap Data Shows Strong Upside Potential

Rector pointed to past market data to explain why XRP can still move quickly when sentiment turns positive.

In November 2024, XRP’s market cap expanded by nearly $100 billion in one month due to strong inflows. In contrast, November 2025 saw a $41 billion drop in market cap due to exchange outflows.

“This shows how fast XRP can move when buyers step in,” Rector said.

Analyst Says $1 XRP Is Highly Unlikely

When asked directly whether XRP could ever fall back to $1, Rector was clear.

“Not a chance,” he said. “It would take a massive black swan event.”

He added that the market now has deep liquidity, strong passive buying, and many long-term holders waiting to buy on dips.

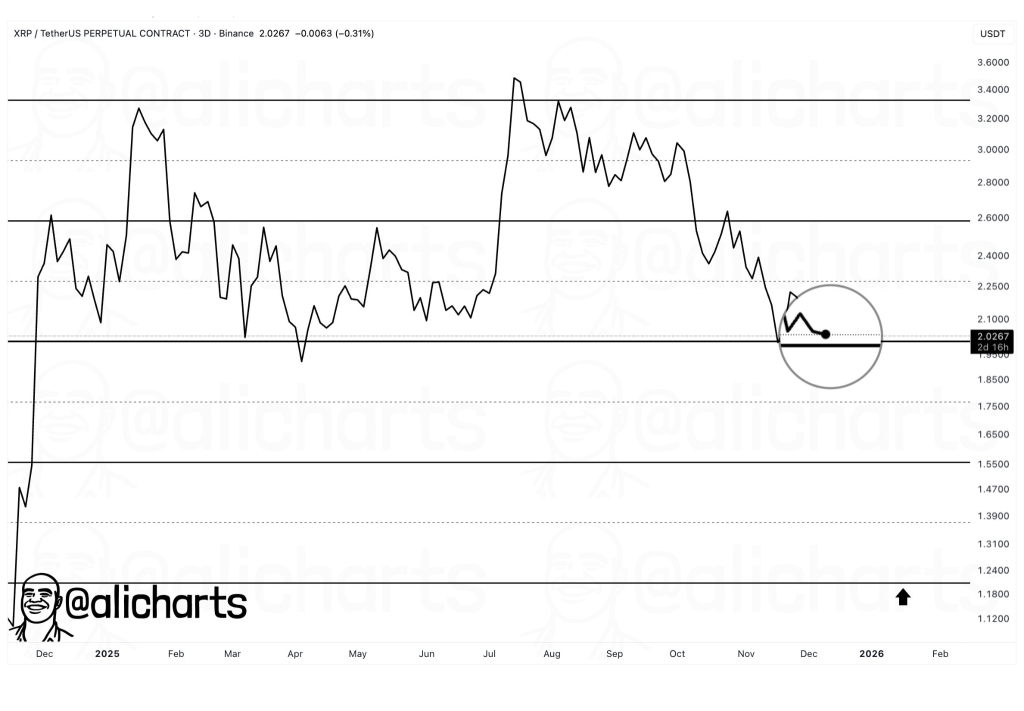

Strong Buying Interest Below $2

Rector said large buy orders are already stacked near current support levels.

“I have a buy order at $1.91,” he said. “If we break $1.90, we could retest $1.80, but below that is very hard.”

He pointed out that XRP has been setting higher lows all year, with key levels around $1.60 in April, $1.77 in October, and $1.81 in November.

XRP price slowly forms a bullish pattern amid good Ripple news

How HashKey plans to become Hong Kong’s first crypto IPO

HashKey’s IPO bid puts Hong Kong’s virtual asset regime on display, testing whether compliance-first crypto platforms can win investors.

Bitcoin’s four-year cycle is intact, but driven by politics and liquidity: Analyst

10x Research’s Markus Thielen says Bitcoin’s four-year cycle still exists but is now driven by politics, liquidity and elections rather than the halving.

Bitcoin will ‘dump below $70K’ thanks to hawkish Japan: Macro analysts

The Bank of Japan is expected to increase its benchmark interest rates on Friday, a historically bearish signal for riskier assets like Bitcoin.

XRP Community Divided on Whether Solana Is Best

Dogecoin Faces Scenario That Can Add Zero to Its Price: Details

XRP Open Interest Surges on Coinbase: American Investors Joining?

Shiba Inu Burns Jump 1,567% in Intriguing SHIB Comeback: What's Next?

The double-edged future: Bringing fintech onchain | Opinion

Bitcoin Price Prediction: Why BTC Could Stay Range-Bound Into January 2026

The post Bitcoin Price Prediction: Why BTC Could Stay Range-Bound Into January 2026 appeared first on Coinpedia Fintech News

Bitcoin price continues to move sideways after a quiet weekend, showing little momentum in either direction. Saturday saw very low activity, and early Sunday trading has not brought any major change.

For now, Bitcoin has slipped below the important $90k level after dropping more than 1% in the last 24 hours.

Support and Resistance Levels

Bitcoin is currently supported between $78,960 and $83,130, a zone that has held during recent pullbacks. On the upside, resistance remains between $92,588 and $101,570, which marks the upper boundary of the current range.

This range is based on the recent swing low formed on Friday, November 21, and the high reached earlier this week. Price action remains trapped between these levels, suggesting consolidation rather than a breakout.

Sideways Movement May Continue Into January

Market conditions hint Bitcoin may remain range-bound through the end of December and possibly into early January. Trading activity often slows during the final days of the year, and the first week of January is usually quiet as well.

While some investors are hoping for a year-end rally, current price action does not yet show the strength needed for a sustained breakout. Any move higher is expected to take time rather than happen suddenly.

Upside Still Possible, But Momentum Is Weak

Bitcoin could still attempt another push toward higher resistance levels between $96,730 and $101,570, but such a move may take one to two weeks to develop.

At the moment, there is no strong momentum signal or sharp buying pressure. The market lacks the kind of decisive move that usually leads to a clear trend change.

Downside Risk Still Exists for Early 2026

If Bitcoin fails to break higher in the coming weeks, a deeper pullback early next year remains possible. Current price declines have been gradual and corrective rather than aggressive, which keeps the market in a holding pattern.

A move below $86,000 would increase the chance that the current consolidation phase has already ended. However, even that would still fall within a broader sideways structure rather than signal panic selling.

Short-Term Levels to Watch Closely

In the near term, Bitcoin continues to respect a trend line that has acted as support multiple times.

On the upside, a clear break above $93,550 would mean that buyers are regaining control and that a fresh move higher may be starting.

Overall, Bitcoin’s current behavior reflects a calm and patient market. Instead of sharp spikes, price action is showing controlled movement within defined levels.

Bitcoin price at risk of a crash to $75 as a major BoJ risk looms

Coinbase sets surprise product launch, solo Bitcoin miner beats 30,000-to-1 odds, Tether eyes Juventus purchase | Weekly Recap

Morning Crypto Report: World's Highest IQ Holder Turns to XRP, Cardano on the Verge of 40% Surge, Shiba Inu (SHIB) Loses $110 Million in Just 24 Hours

Banks Need Bitcoin for Clients, Rochard Says

Twenty One’s first-day slide highlights investor caution toward BTC-backed stocks

Twenty One Capital’s NYSE listing showed how tightly markets now price Bitcoin-heavy firms, with investors refusing to pay much beyond the underlying BTC value.

Why Michael Saylor wants nations to build Bitcoin banks

Michael Saylor explains why governments should consider Bitcoin-backed digital banks. It is time to examine the potential benefits and risks of Bitcoin banks.

Standard Chartered, Coinbase deepen alliance to build institutional crypto infrastructure

Standard Chartered and Coinbase are expanding their partnership to develop trading, custody and financing services aimed at institutional crypto clients.

Cardano Creator Reacts to 'New ADA' $1 Billion Day as XRP Falls Behind

Ripple CTO Pokes Fun at Microsoft Edge

Schiff Jumps on Saylor's McDonald's Pic

Pi network price nosedives amid emerging alarming bearish pattern

Here’s What Could Happen if XRP ETFs Reach $10 Billion

The post Here’s What Could Happen if XRP ETFs Reach $10 Billion appeared first on Coinpedia Fintech News

Interest in XRP exchange traded funds is growing quickly after another product received approval. Cboe has approved a 21Shares XRP ETF under the XR ticker, adding to the list of funds offering exposure to the token.

The pace of inflows has surprised even industry leaders. Ripple CEO Brad Garlinghouse recently celebrated that XRP ETFs crossed $1 billion in assets in about 17 days, a much faster start than many expected.

Market analysts say this trend could accelerate.

$10 Billion Target Within a Year

Crypto analyst Mickle said that if current inflow rates continue, XRP ETFs could hold as much as $10 billion worth of XRP within a year.

He said ETFs are removing friction for investors who previously avoided crypto exchanges. Many investors did not buy XRP earlier simply because access was complicated or outside their compliance rules.

ETFs change that by allowing investors to buy XRP exposure through regular brokerage accounts. Mickle said XRP today is very different from what early investors bought years ago.

“The XRP I bought in 2016 or 2017 is not the same XRP we have today,” he said. “The network keeps getting more powerful. New features are being added, and from an investment point of view, that matters.” He added that many investors overlook Ripple’s original vision for the XRP Ledger.

“If you go back and watch interviews with Chris Larsen from as early as 2013, he was already talking about issuing assets on the ledger and using XRP as liquidity,” Mickle said. “That idea has been there from the start.”

New Liquidity Pipeline for XRP

The analyst described XRP ETFs as a new liquidity pipeline rather than a short term trade. This steady institutional demand could reduce reliance on retail trading cycles and add depth to the XRP market.

Over time, that demand may support price stability and higher trading volumes. As these markets develop, Mickle said the role of the XRP Ledger is likely to expand.

“You’re going to see more infrastructure move onto the XRP Ledger,” he said. “That positions XRP as underlying liquidity across different financial uses, not just money moving back and forth.”

Institutions Drive the Next Phase

Institutions have strong incentives to promote ETF products because they fit within compliance, marketing, and advisory frameworks.

This makes XRP ETFs easier to recommend and distribute than direct crypto holdings. Analysts see this as a major positive catalyst for long term adoption.

Market Cycles Are Changing

Recent price swings following U.S. rate cuts show that crypto still reacts to macro news. However, the analyst argues the market is moving away from strict four year boom and bust cycles.

Instead, performance is becoming more driven by fundamentals such as regulation, infrastructure, and institutional use cases.

XRP has already outperformed many altcoins over the past 18 months, suggesting capital is becoming more selective.

XRP bulls gain ground over bears on social media, ETF inflow streak continues

Spot XRP exchange-traded funds continued a streak of positive flows, with over $20.1 million recorded on Friday, marking 19 consecutive days of net inflows.

Stablecoin usage in Venezuela likely to keep expanding amid economic instability

The crypto ecosystem in Venezuela is a product of ongoing economic collapse and international sanctions pressure, according to the TRM Labs team.

BTC OGs selling covered calls is the main culprit suppressing price: Analyst

Despite traditional ETF investors willing to pay premiums to go long, Bitcoin natives selling covered calls have put a damper on a price rally.

Ripple Executive Explains XRP Vision at Solana Event: Details

The Securities and Exchange Commission publishes crypto custody guide

The guide was a good-faith primer on crypto custody basics and best practices, including different forms of wallet storage and common risks.

Coinbase to Add Prediction Market Ahead of Major Dec. 17 Event

XRP-Solana Bridge Goes Live? Here Is What to Know

656,287,425,149 SHIB in 24 Hours: Can Shiba Inu Still Be Saved?

Which Crypto to Buy Now? Experts Compare $0.035 to Early ADAs Momentum

The post Which Crypto to Buy Now? Experts Compare $0.035 to Early ADAs Momentum appeared first on Coinpedia Fintech News

Investors searching for the next high-upside opportunity are now comparing this $0.035 emerging crypto to the early momentum Cardano (ADA) displayed before its major breakout. Analysts highlight similar fundamentals—strong utility, early-stage pricing, and accelerating community growth—positioning it as one of the most compelling entries in the current market. With demand rising, many experts believe this could be the standout crypto to buy right now. In other words, Mutuum Finance (MUTM) will be the token many investors watch next. The market will shift, and early entry matters. The crypto fear and greed index will push late buyers to chase prices. Smart traders will look for projects with real utility and clear demand. Mutuum Finance (MUTM) will match those needs.

Mutuum Finance (MUTM) Dual Lending Models

The presale is the clearest place to act today. Mutuum Finance (MUTM) now offers tokens at $0.035 during presale phase 6. The project planned a total supply of 4 billion tokens. Across all presale phases, around $19.30 million have been raised so far. Over 18,500 holders have joined across those phases. This phase’s allocation of 170 million tokens are already 97% sold out. Buyers are still able to purchase at $0.035, but the supply will tighten quickly. Mutuum Finance (MUTM) has also streamlined buying. Investors will be able to purchase tokens by card with no purchase limits. This simple on-ramp will accelerate adoption during presale phases.

Mutuum Finance (MUTM) will deliver clear utility through dual lending models. The Peer-to-Contract model will let lenders pool assets such as DAI and ETH into audited smart contracts. Lenders will receive mtTokens at a 1:1 ratio representing deposits and accrued interest. A lender who supplies 15,000 in USDT with a 15% average APY will earn $2,250 in passive income by year end. Interest rates will adjust automatically as pool utilization moves. Higher utilization will push rates up and attract more deposits. Borrowers will choose variable or stable rates to suit their strategy. Stable rates will start higher than variable rates and will rebalance under strict conditions to protect liquidity and fairness.

The Peer-to-Peer offering will isolate riskier tokens from core pools. Tokens like SHIB, and FLOKI will trade in bespoke P2P markets. In that setup, lenders will set interest rates and loan terms directly with borrowers. This will let risk-tolerant lenders chase higher yields without exposing the main liquidity pools. The P2P model will broaden earning paths while protecting the protocol’s stability.

The team will launch V1 of the protocol on Sepolia Testnet in Q4 2025. V1 will include liquidity pools, mtToken and debt token systems, a liquidator bot, and initial support for ETH and USDT. This testnet phase will allow real users to test core flows and confirm the protocol’s soundness.

Security and trust will be central to Mutuum Finance (MUTM). The team has commissioned an independent audit by Halborn Security to vet smart contracts. This audit validates functionality and reduces common risks. A clean security review will bolster investor confidence.

The project also maintains a public dashboard and a Top 50 leaderboard. The leaderboard rewards the largest participants with bonus tokens. A daily bonus gives the top trader $500 in MUTM, provided they transact during that 24-hour window. The leaderboard reset daily at 00:00 UTC. These tools will keep the community engaged and drive on-chain activity.

Factors That Gives MUTM Some Value

Token utility will anchor long-term demand for Mutuum Finance (MUTM). Every protocol function will tie back to MUTM usage. Lending, borrowing, staking, and buybacks will generate sustained circulation. Additionally, the projection includes an over-collateralized stablecoin that users will mint by locking assets like ETH, SOL, or AVAX. Each minting and repayment will add real transactional demand to the ecosystem. As the protocol expands, MUTM will play a central role across lending, borrowing, and staking. This utility-driven approach will support organic demand beyond mere hype.

Risk management will be a core design principle. All loans will require overcollateralization. The protocol will use a Stability Factor to measure collateral health against borrowed amounts. When collateral values drop below thresholds, liquidators will repurchase debt at a discount to restore balance. Proper liquidity and market volume will ensure liquidations close with minimal slippage. Lower-volatility assets like stablecoins and ETH will bear higher LTVs and will typically feature a 97% liquidation threshold. More volatile tokens will carry lower LTVs, preserving the system during sharp price moves.

Interest design will balance predictability and market responsiveness. Stable borrowing rates will lock at borrowing time and will start higher than variable rates. Rebalancing rules will trigger only under explicit conditions, protecting lenders and borrowers against unfair gaps. Not all tokens will qualify for stable borrowing, keeping high-risk assets out of rate-lock mechanisms. This measured design will provide choices for borrowers who prefer rate certainty.

Community Engagement

Community engagement will be a major growth lever for Mutuum Finance (MUTM). The project maintains strong social channels, with over 12,000 followers on Twitter. An ongoing $100K giveaway awards ten winners with $10,000 in MUTM each. The live dashboard lets investors track holdings and estimate returns. These features will accelerate participation and keep momentum through the presale phases. Increased activity will further pressure the presale allocation and amplify price movement.

Analysts compare Mutuum Finance (MUTM) at $0.035 to early ADA momentum because both show demand-driven price action during early stages. Mutuum’s presale metrics, just live utility features, and a planned testnet release form the backbone of bullish forecasts. With the phase nearing sell-out, price elevation will be likely. Early buyers will capture the most attractive entry points.

This is the moment for decisive action. Mutuum Finance (MUTM) presents a rare convergence of utility, security, and community incentives. The presale price will be $0.035 for a short time while phase supply runs low. Demand will rise with every new feature and audit milestone. The next price step will shrink the opportunity to buy at these levels. Investors seeking the best crypto to buy now will find Mutuum Finance (MUTM) a compelling option. Secure your allocation today and position for the next wave of growth.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Tether moves into sports, tables bid for Juventus football club

Solana ETFs record 7-day inflow streak despite price slump

The first SOL ETF was launched in July, followed by Bitwise’s SOL ETF in October, which recorded $57 million in first-day trading volume.

DOGE Price Analysis for December 13

Ripple Labs $300 Million Venture Goes Live in South Korea, Unlocks XRP Opportunities for Investors

Bitcoin (BTC) Price Analysis for December 13

ZCash (ZEC) Best Performer This Week, New Round of Privacy Coins Rally?

Ethereum price stalls at $3K as ETH ETFs record $19.4M in outflows

Solana ETFs Near $700 Million Milestone Amid Steady Inflow Streak

Ripple CTO Shares Hilarious Moment With Chris Larsen at Key Event: Details

Are Weak ETF Inflows Holding LINK Price Back? Is It Gonna Hit $8?

The post Are Weak ETF Inflows Holding LINK Price Back? Is It Gonna Hit $8? appeared first on Coinpedia Fintech News

The LINK price remains capped and under bearish pressure despite there being strong signs of sustained accumulation and a growing narrative that positions Chainlink as foundational infrastructure for on-chain finance. While exchange balances continue to fall and enterprise adoption accelerates, LINK price USD action suggests the market is still struggling with short-term demand constraints, and LINK ETF’s declining inflows kind of proves that.

LINK Crypto’s Infrastructure Narrative Continues to Expand

Fundamentally speaking, Chainlink crypto is a very strong asset and can be viewed as one of the top blue-chip projects in the industry. As it is increasingly viewed as the backbone of on-chain finance, similar to how Microsoft’s operating systems ruled early enterprise computing.

By setting data, interoperability, and security standards, Chainlink is kind of enabling financial institutions to transition from traditional digital systems toward onchain infrastructure.

Chainlink is today’s equivalent of Microsoft in 1990.

— Rory (@rorypiant) December 12, 2025

At that time, personal computers were still primarily the domain of hobbyists and tinkerers rather than the backbone of enterprise operations. The release of Windows 3.0 changed that trajectory. It established the standard… pic.twitter.com/fPzQFjy95y

This project’s efforts demonstrate that global finance is gradually migrating onto the blockchain. If that shift accelerates, Chainlink’s role will be supreme, similar to what Nvidia, Microsoft, and even Apple have, which’s a standardized middleware layer that could become indispensable. This factor alone is reinforcing long-term utility beyond speculative cycles.

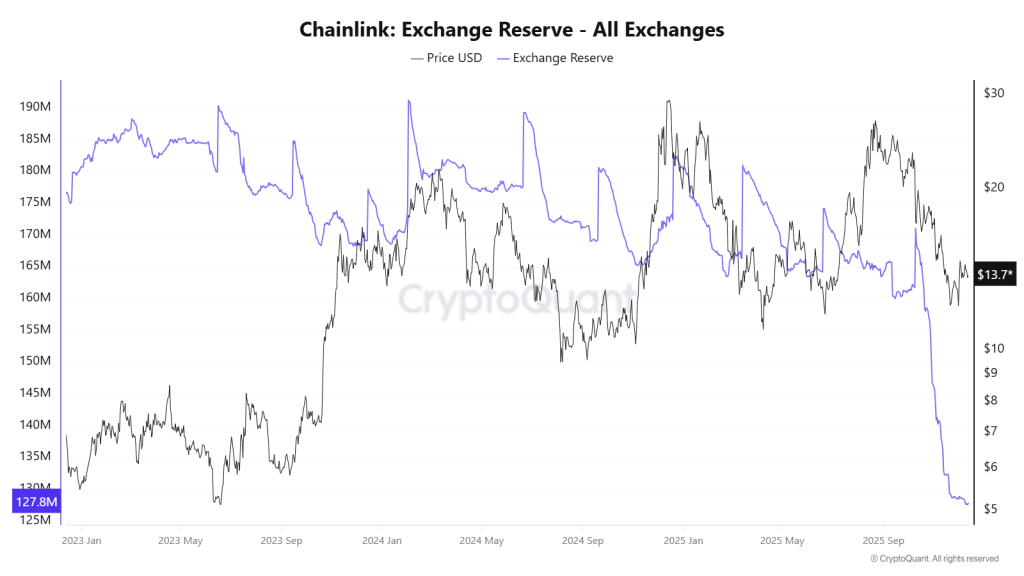

Exchange Balances Signal Silent Accumulation

Not just verbally, it’s growing; even on-chain data shows a notable decline in LINK exchange balances, which suggests that accumulation is happening. On October 13, exchanges held approximately 167 million LINK tokens, a figure that has since dropped like a falling knife to 127.8 million LINK.

Such a sharp reduction is an open book example of how LINK crypto tokens are being bought every day, while retail keeps discarding it due to sector-wide pessimism. The big and wise investors are involved in this game, making long-term investments rather than short-term trades.

However, the LINK price chart has not reflected this accumulation, because if it does rise, the smart money won’t be able to buy at discounts more easily. Instead, they deliberately chose for its price to bleed slowly, so the more the decline, the better their profits will be in the future, which only the wise can understand.

That shows that retail distribution is being absorbed by larger participants. This dynamic explains why selling pressure persists without sharp breakdowns, keeping the LINK price USD suppressed but structurally supported.

ETF Flows Fail to Reinforce Buying Pressure in LINK Price

Despite the introduction of a LINK ETF early December 2025, institutional flows have remained underwhelming. Total cumulative net inflows currently stand near $52.67 million, with recent inflows failing to cross even $10 million during December. While there have been no notable outflows so far, the lack of sustained inflows signals limited conviction from traditional capital.

Without stronger ETF participation, LINK price forecast models remain constrained, as spot accumulation alone has not been sufficient to drive upside momentum. Continued stagnation could risk eventual outflows, which would add further downside pressure.

Technical Structure Shows Rising Risk

From a technical perspective, LINK price is losing alignment with its ascending trendline. This weakening structure increases the probability of further downside if demand does not materialize. If the current trend persists, LINK price prediction scenarios point toward a potential test of the $8 region.

Support is gone for Chainlink $LINK!

— Ali (@alicharts) December 12, 2025

$8 comes into focus. pic.twitter.com/Fro3XHLFf2

At the same time, the divergence between long-term accumulation and short-term technical weakness highlights the broader tension within the market. While Chainlink’s fundamentals continue to strengthen, price action remains dependent on renewed demand and institutional participation.

Strategy survives first Nasdaq 100 shakeup since entering the index

Strategy remains in the Nasdaq 100 as MSCI considers excluding firms whose crypto holdings exceed 50% of total assets.

Spot volumes drop 66% in ‘lulls’ that often precede next cycle leg: Bitfinex

Bitfinex said the recent 66% slide in spot trading volumes echoes lulls seen before next leg in the cycle.

Crypto VC Funding: Real Finance and LI.FI each secure $29m, TenX bags $22m

XRP Could Fall 40% if $2 Support Breaks, Analyst Warns

Bitcoin to $76,000? Crucial Indicator Spells 4 Key BTC Price Levels as Market Dips

Bullish December So Far: Crypto ETFs on Bitcoin, Ether in Green

Strategy Retains Nasdaq-100 Spot, MSCI Delisting Risks Remain

The post Strategy Retains Nasdaq-100 Spot, MSCI Delisting Risks Remain appeared first on Coinpedia Fintech News

Strategy, the company led by Bitcoin advocate Michael Saylor, has successfully held its place in the Nasdaq-100 Index following the index’s annual reconstitution.

While this strengthens its position in major markets, another key decision is still ahead, as MSCI will rule on January 15 whether to remove bitcoin-focused companies like Strategy.

Strategy Retains Nasdaq-100 Position

According to Nasdaq’s official reconstitution announcement made on Friday, the index added six new companies and removed six others, but Strategy remained unchanged.

The update will take effect on December 22 and secures Strategy’s position in the Nasdaq-100 for another 12 months, marking a full year since it first joined the index in December 2024.

— Crypto Rover (@cryptorover) December 13, 2025

BREAKING:

STRATEGY REMAINS IN THE NASDAQ 100 INDEX ACCORDING TO REUTERS. pic.twitter.com/GMRZvSWnCU

Staying in the index means Strategy will continue to be included in major exchange-traded funds such as the Invesco QQQ, which manages tens of billions of dollars in assets.

MSCI Index Exclusion Risks Still Remains

While Nasdaq has confirmed Strategy’s place for now, another major index provider, MSCI, is considering excluding companies with more than 50% of assets in digital assets like bitcoin. A final decision is expected around January 15, 2026.

Analysts warn that if Strategy were removed from MSCI or other key indexes, this could trigger billions in passive fund outflows, possibly forcing large selling of Strategy stock.

However, for now, Strategy’s Nasdaq-100 retention signals growing comfort among mainstream investors with Bitcoin-linked business models

Strategy Bitcoin Holding Continue To Profit

According to recent filings, Strategy holds a huge bitcoin treasury of 660,624 BTC worth around $60 billions, making it one of the largest corporate holders in the world.

While Strategy posts strong profits thanks to crypto gains, including a reported $2.78 billion profit in Q3 2025 some market observers argue its business looks more like a bitcoin investment fund than a traditional tech company.

Therefore, when bitcoin price fall nealy 30% from its highs of $126K, Strategy’s stock slid sharply, reflecting heightened risk perception among investors.

Despite the bullish news, Strategy Inc (MSTR) stock is down by 7% trading around $176.5

XRP Price Holds $2 as Ripple’s OCC Bank Approval Redefines Crypto’s Institutional Path

The post XRP Price Holds $2 as Ripple’s OCC Bank Approval Redefines Crypto’s Institutional Path appeared first on Coinpedia Fintech News

The XRP price is currently in a decisive standoff, as its price is capped despite robust fundamentals, but a wavering market sentiment is preventing it from rising. Ripple’s recent regulatory breakthrough represents a historic shift for the crypto landscape, yet the XRP price has yet to show some response on the chart.

So far, it has been missing significant moves from many positive news stories, similar to other altcoins this quarter, but reflecting negative news immediately on the chart. However, unlike any other altcoin, the resilience in holding $2 is still commendable, and that was only possible for XRP due to its fundamentals, consistent demand, and the trust its investors have in it. Now, people are closely monitoring whether the $2 level will maintain its stability.

Ripple’s OCC Approval Signals a Structural Shift

Ripple recently received conditional approval from the U.S. Office of the Comptroller of the Currency to charter Ripple National Trust Bank. This development places Ripple directly under federal banking oversight, aligning its operations with both OCC and NYDFS standards.

From a structural perspective, this approval elevates Ripple beyond a payments-focused crypto firm into regulated financial infrastructure. The move strengthens the foundation for RLUSD while positioning XRP as a compliant settlement asset connecting fiat rails, stablecoins, and tokenized assets.

HUGE news! @Ripple just received conditional approval from the @USOCC to charter Ripple National Trust Bank. This is a massive step forward – first for $RLUSD, setting the highest standard for stablecoin compliance with both federal (OCC) & state (NYDFS) oversight.

— Brad Garlinghouse (@bgarlinghouse) December 12, 2025

To the…

Importantly, this milestone addresses long-standing criticism that crypto operates outside traditional financial rules. Instead, Ripple now operates within them under direct supervision.

XRP’s Utility Narrative Strengthens Despite Price Silence

Although this announcement did sparked intense discussion across crypto communities, but the XRP price chart seems to have digested this one too, showing little immediate reaction. This disconnect highlights the current environment where macro sentiment outweighs individual project advancements.

Under the new framework, XRP’s role is improving but markets often delay repricing until usage metrics and liquidity flows reflect these changes.

For now, XRP crypto fundamentals appear to be accelerating faster than price .

Market Sentiment Keeps XRP Range-Bound

Despite positive developments, broader market sentiment remains cautious. Risk appetite across crypto has weakened, limiting follow-through even on major news. As a result, XRP price USD continues to trade defensively near the $2 psychological zone.

Technically, XRP is in a consolidation phase in 2025, where buyers consistently defend $2, while upside attempts fail to attract sustained momentum. This behavior suggests distribution rather than accumulation, reinforcing short-term uncertainty.

As long as sentiment remains subdued, XRP price prediction models remain restrained.

From a technical standpoint, the $2 level has become the most important reference point on the XRP price chart. Repeated defenses of this zone indicate longer-term holder confidence, yet each failed recovery adds pressure.

If sentiment does not improve, downside risk remains open. A loss of $2 could expose XRP/USD to deeper retracement levels near $1.20, according to prevailing technical projections.

Meanwhile, as Ripple’s regulatory positioning continues to mature, the divergence between price action and fundamentals leaves XRP price at a pivotal turning point, and what comes next depends purely on improving market sentiment in future weeks or months.

Ripple XRP Price Prediction 2025, 2026-2030: Will XRP Reach $5?

The post Ripple XRP Price Prediction 2025, 2026-2030: Will XRP Reach $5? appeared first on Coinpedia Fintech News

Story Highlights

- The Live Price Of XRP $ 1.99363951

- Predictions suggest XRP could reach $5.05 by the end of 2025.

- Long-term projections show XRP could hit $26.50 by 2030 and $526 by 2050.

XRP price currently stands at $2.99, with a market capitalization of $179.79 billion. Analysts and AI forecasts alike suggest that XRP could reach $5.05 by the end of 2025. Long-term XRP price predictions also place it as high as $26.50 by 2030, with an ultra-bullish target of $526 by 2050.

Ripple (XRP) remains one of the top five crypto assets in the world, gaining traction as institutional adoption ramps up and its prolonged legal battle approaches resolution. Since President Trump’s return to office, XRP has seen a resurgence in on-chain activity, investor sentiment, and speculation around potential ETF approval.

In July 2025, XRP marked a new all-time high of $3.66, coinciding with the ProShares Ultra XRP ETF launch. As more asset managers have filed for the ETF approval race, the crypto community is now asking: How high can XRP go?

XRP Price Today

| Cryptocurrency | XRP |

| Token | XRP |

| Price | $1.9936

|

| Market Cap | $ 120,279,531,898.88 |

| 24h Volume | $ 1,332,736,009.7470 |

| Circulating Supply | 60,331,635,327.00 |

| Total Supply | 99,985,752,852.00 |

| All-Time High | $ 3.8419 on 04 January 2018 |

| All-Time Low | $ 0.0028 on 07 July 2014 |

XRP Price Prediction December 2025

The XRP price has recently established a falling wedge pattern in Q4, indicating a possible price rise if a favorable event prompts a breakout from this structure upward.

Currently, December has begun with a downturn, and the $2.00 support level has been retested, despite the FOMC news being positive regarding the rate cut decision. A rebound was expected, but investor demand remained muted nonetheless.

However, if it dips below this support level, the next target will be $1.80, and beneath this $1.63. If the price rises, it will need to exceed $2.62 to achieve even greater heights.

| Month | Potential Low | Potential Average | Potential High |

| December 2025 | $1.50 | $3.00 | $4.00 |

XRP Price Predictions for December 2025 by AI Platforms

| Platform | Low Price | Average Price | High Price |

| Claude | $3.00 – $3.15 | $3.50 – $4.00 | $7.50 – $8.20 |

| Blackbox | $2.50 | $3.50 | $5.00 |

| Gemini | $3.00 – $4.00 | $4.50 – $6.00 | $6.50 – $8.00+ |

XRP Price Prediction 2025

During the latter half of the year, the XRP/USD pair on Coinbase exhibited significant price fluctuations. A standout moment occurred in July when it surged to an impressive peak of $3.66. However, following this excitement, the price gradually retreated to around $1.80 by November.

As of late November, XRP/USD tested the vital $1.80 support level, showcasing encouraging signs of recovery with a notable 20% increase back above the $2 threshold. But this rise and fall is consistently happening inside a defined channel, which reflects a broader downtrend going on since the July ATH.

December started on a bearish note, retreating from the 20-day EMA band, and it appears to be approaching the $1.80 support level again. The price action for now may be weak, but the fundamentals are strongly aligned, and it’s a matter of time and a catalyst that will provide new price action for XRP/USD.

To avoid a prolonged decline, XRP price analysis 2025 suggests that it must find stability and must bounce above $2.35 to break the upper border of the channel.

Conversely, if XRP price continues to follow the prevailing downtrend, there is a significant risk that it could experience another substantial decline in the final month of the year, potentially testing lower support levels and impacting overall market sentiment. The upcoming weeks will be crucial for investors and analysts alike to monitor the market dynamics surrounding XRP’s performance.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $2.05 | $3.45 | $5.05 |

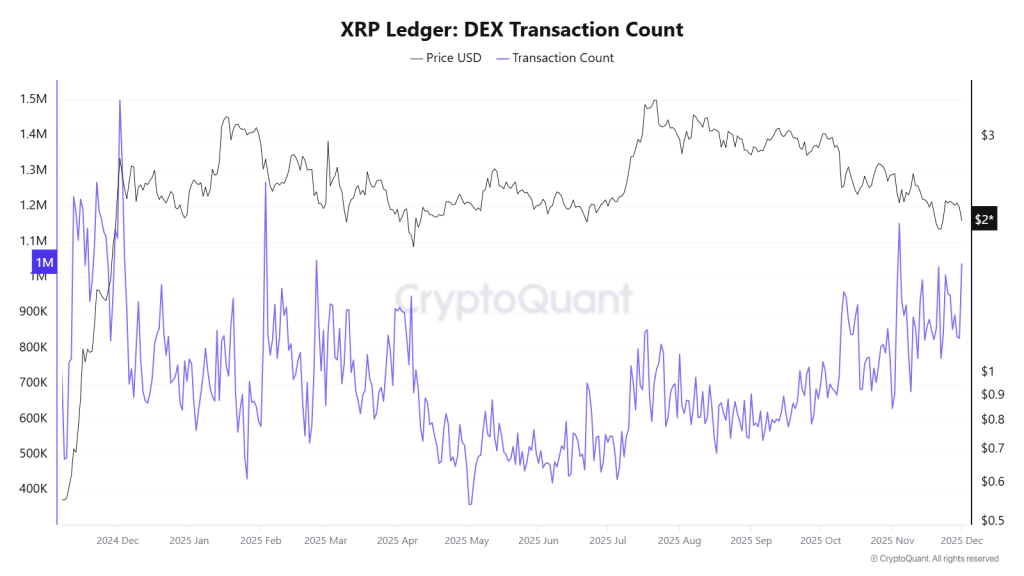

XRP Price Analysis 2025: Onchain Outlook

The XRP Ledger: DEX Transaction Count chart indicates a significant bullish divergence starting from May 2025. While the price is consolidating, the activity in decentralised exchanges (DEX) is increasing sharply.

The high transaction volume, which includes both orders placed and cancelled, shows that experienced traders are actively positioning themselves and adding liquidity in anticipation of a future price movement.

As a result, this on-chain metric suggests that the market is preparing for a powerful and sustainable rally in the XRP price ahead.

Also, the biggest fact right now in December is that altcoin liquidity is drying up. Projects securing new liquidity channels like ETFs have a better chance of long-term survival, and since November 14th, the XRP ETF has been seeing positive inflows consistently, despite what price action is, and so far, Cumulative Total Net Inflow has crossed $756 million, while total net assets are worth $723.05 million, by December 1st.

Ripple XRP Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| XRP Price Prediction 2026 | 5.50 | 6.25 | 8.50 |

| Ripple Price Prediction 2027 | 7.00 | 9.0 | 13.25 |

| XRP Price Prediction 2028 | 11.25 | 13.75 | 16.00 |

| XRP Price Prediction 2029 | 14.25 | 16.50 | 21.50 |

| XRP Price Prediction 2030 | 17.00 | 19.75 | 26.50 |

This table, based on historical movements, shows XRP price prediction 2030 to reach $26.50 based on compounding market cap each year. This table provides a framework for understanding the potential XRP price movements. Yet, the actual price will depend on a combination of market dynamics, investor behavior, and external factors influencing the cryptocurrency landscape.

Ripple (XRP) Price Projection 2031, 2032, 2033, 2040, 2050

Based on historic price sentiments and XRP’s rising popularity, here are the XRP future price projections beyond 2030, where Ripple price forecasts suggest that it has become more speculative. Therefore, assuming continued adoption and dominance, XRP may see aggressive valuations in the decades ahead.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | 25.00 | 29.50 | 35.25 |

| 2032 | 31.50 | 36.75 | 41.25 |

| 2033 | 35.75 | 42.25 | 47.75 |

| 2040 | 97.50 | 135.50 | 179.00 |

| 2050 | 219.25 | 331.50 | 526.00 |

A look at this table, highlights the XRP price prediction 2040 and XRP price prediction 2050 potential high ambitious targets but this reflect a transformative vision for XRP as a dominant global payment player.

Market Analysis

| Firm Name | 2025 | 2026 | 2030 |

| Changelly | $2.05 | $3.49 | $17.76 |

| Coincodex | $2.38 | $1.83 | $1.66 |

| Binance | $2.16 | $2.27 | $2.76 |

Institutions XRP Price Target For 2025

| Name | 2025 |

| Standard Chartered | $5.50 |

| Sistine Research | $33 to $50 |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Analysts predict XRP could reach $5.05 by December 2025 if bullish momentum continues and key resistance levels are broken.

XRP price is influenced by ETF approvals, on-chain activity, investor sentiment, legal developments, and broader crypto market trends.

XRP shows bullish signs with strong on-chain activity and ETF interest, but investors should watch key support and resistance levels carefully.

XRP could reach an average of $26.50 by 2030, driven by growing adoption, institutional interest, and market expansion.

XRP’s price could range from $97.50 to $179 by 2040, reflecting potential long-term adoption as a global payment solution.

XRP might reach between $219 and $526 by 2050 if it becomes a dominant digital asset with widespread global usage.

Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go?

The post Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go? appeared first on Coinpedia Fintech News

Story Highlights

- Bitcoin is currently trading at: $ 89,024.81360175

- Predictions suggest BTC could reach $175K in 2025.

- Long-term forecasts estimate BTC prices could hit $900K by 2030.

The Bitcoin price prediction for 2025 is becoming aggressively bullish as in the year’s second half, July, a new ATH has been marked, smashing previous all-time highs of $112K.

As a wave of bullish momentum sweeps into the market, investors and traders are intrigued by its next stop, as it has entered a price discovery mode.

This optimism has been directly fueled by massive inflows into spot Bitcoin ETFs, skyrocketing institutional adoption, much clearer regulations, and unwavering political support from figures like President Trump.

It’s now seen as “a hedge against inflation” more than ever, and the cryptocurrency is capturing global attention. Major players like MicroStrategy, Metaplanet, Trump Media, and several other entities are boldly adding BTC to their balance sheets, signaling unshakable adoption and confidence in its future.

With the Federal Reserve hinting at future rate cuts and market enthusiasm at a fever pitch, investors are buzzing with questions: “Can Bitcoin sustain its meteoric rise?” and “Will it redefine the financial landscape in the next five years?” This Bitcoin price prediction dives deep into the trends driving this historic rally. Read on for the full scoop.

The BTC price may range between $89,586.98 and $92,099.35 today.

Table of Contents

- Story Highlights

- CoinPedia’s Bitcoin (BTC) Price Prediction

- Bitcoin Price Analysis 2025

- Bitcoin Price Prediction December 2025

- Bitcoin AI Price Prediction For December 2025

- Bitcoin Price Prediction 2025: Onchain Outlook

- Bitcoin Crypto Price Prediction 2026 – 2030

- Bitcoin Prediction: Analysts and Influencers’ BTC Price Target

- FAQs

Bitcoin Price Today

| Cryptocurrency | Bitcoin |

| Token | BTC |

| Price | $89,024.8136

|

| Market Cap | $ 1,777,118,047,433.18 |

| 24h Volume | $ 63,133,506,546.7951 |

| Circulating Supply | 19,962,053.00 |

| Total Supply | 19,962,053.00 |

| All-Time High | $ 126,198.0696 on 06 October 2025 |

| All-Time Low | $ 0.0486 on 14 July 2010 |

CoinPedia’s Bitcoin (BTC) Price Prediction

Firstly, at CoinPedia, we feel optimistic about Bitcoin’s price increase. Hence, we expect the BTC price to create a 2025 high of ~$168,000.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $71,827.81 | $119,713.02 | $167,598.22 |

Bitcoin Price Analysis 2025

The Bitcoin price performance observed since 2024 has demonstrated an upward trend within a defined upward channel. However, the initial swing low was reached in 2023 at around the $16,000 area.

Since then, a bull market began that reached 2021’s high around $70,000 by early 2024, with a decent pullback rally that continued flipping this high and reached $108,000 in early 2025, and Q3 of 2025 marked an ATH of $126,296.

This advancement marked a huge 675% surge in 1008 days when it reached ATH, but this price action of multi-year was happening inside a broadening ascending wedge. And Q4 2025 is seeing a decline from the upper border of this reliable old pattern.

Even the two-year parallel ascending channel has also confirmed a breakdown from the lower border, suggesting a significant decline is forthcoming.

Since the price action doesn’t fall straight, the year is also about to conclude next month. So, bulls are trying to show a little fight, even FOMC news didn’t generate any momentum. It appears that bears are still influencing BTC’s price action. The current zone of $90K is key; losing it here will let BTC slide back to $80K, and if this fails too. Then the $70K to $75K range would be retested next, where a demand could arise that might trigger a rebound, and the rally could extend to new highs as well.

However, if bulls fail to present a proper fight around the $70,000 to $75,000 support area, then the BTC will fall further, as it could trigger a price action that traps long buyers, potentially leading to a decline towards $53,489 in the first half of next year.

Bitcoin Price Prediction December 2025

The Bitcoin price forecast December 2025 suggests that this month will play a pivotal role in determining the future direction of BTC. As we in the final days of fourth quarter, Bitcoin has experienced a decline, dropping below the $100K mark to a low of $80,600, prompting investors to be more cautious. At the start of December, Bitcoin faced resistance at $ 94,000, but a slight uptick has only intensified concerns among investors.

Currently, the price is stabilizing within the $ 89,000 to $ 90,000 support range. Even the FOMC meeting on the 10th failed to spark any significant movement. There’s still a lack of new demand in driving price action, indicating that investors remain wary or are anticipating further price corrections.

It’s possible that the price could dip even lower, presenting an opportunity for investors to buy at more favorable levels. While the recent positive price movement might appear encouraging, but it seems temporary, as the bears may soon take full control of the market.

| Month | Potential Low | Potential Average | Potential High |

| December 2025 | $80,000-$95,000 | $100,000 – $108,000 | $115,000 – $118,000 |

Bitcoin AI Price Prediction For December 2025

| Source / Platform | Low Price (USD) | Average Price (USD) | High Price (USD) |

| Gemini (AI-assisted) | $110,000 – $125,000 | $130,000 – $150,000 | $160,000 – $180,000+ |

| ChatGPT (OpenAI) | $92,000 | $117,000 | $138,000 |

| BlackBox AI | $100,000 | $125,000 | $150,000 |

Bitcoin Price Prediction 2025: Onchain Outlook

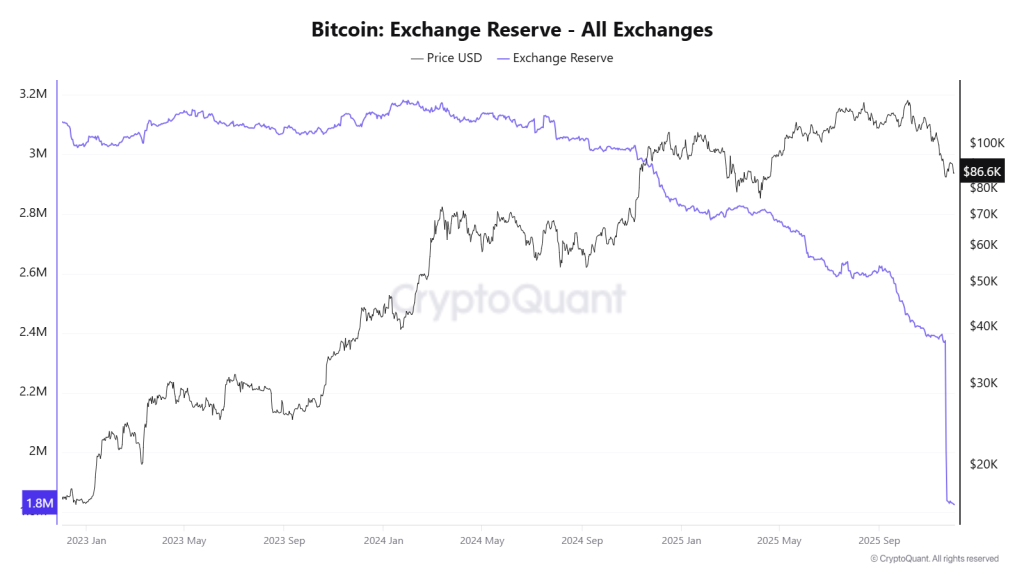

The on-chain data has showed strong accumulation in 2025 and sustained declines in exchange reserves. Crucially, this confirms the elevated institutional commitment, which is evident even in the US Spot ETFs data figures and the corporate adoption also reinforces this trend, with public company holdings nearly doubling since the start of the year.

Ultimately, a Bitcoin price prediction 2025 suggests that the future potential depends strictly on how sustained buying demand remains, as well as geopolitical stability and regulatory clarity.

If the current bullish sentiment persists, the BTC price is expected to reach a cycle high target of $150,000. Conversely, should global uncertainty intensify and sentiment turn negative, the downside risk is projected to find strong support around the $70,000 mark.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $70K | $120K | $175K |

Also Read: What is Bitcoin? An In-Depth Guide To The King Of Digital Currencies

Bitcoin Crypto Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| BTC Price Forecast 2026 | 150K | 200K | 230K |

| BTC Price Prediction 2027 | 170K | 250K | 330K |

| Bitcoin Predictions 2028 | 200K | 350K | 450K |

| BTC Price 2029 | 275K | 500K | 640K |

| Bitcoin Price Prediction 2030 | 380K | 750K | 900K |

BTC Price Forecast 2026

The BTC price range in 2026 is expected to be between $150K and $230K.

BTC Price Prediction 2027

Subsequently, the Bitcoin price range can be between $170K to $330K during the year 2027.

Bitcoin Predictions 2028

With the next Bitcoin halving, the price will see another bullish spark in 2028. Specifically, as per our Bitcoin Price Prediction, the potential BTC price range in 2028 is $200K to $450K.

BTC Price 2029

Thereafter, the BTC price for the year 2029 could range between $275K and $640K.

Bitcoin Price Prediction 2030

Finally, in 2030, the price of Bitcoin is predicted to maintain a positive trend. Indeed, the BTC price is expected to reach a new all-time high, ranging between $380K and $900K.

Bitcoin Price Prediction 2031, 2032, 2033, 2040, 2050

Based on the historic market sentiments and trend analysis of the largest cryptocurrency by market capitalization, here are the possible Bitcoin price targets for the longer time frames.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | $540,830.43 | $901,383.47 | $1,261,936.86 |

| 2032 | $757,162.60 | $1,261,936.86 | $1,766,711.60 |

| 2033 | $1,059,945.80 | $1,766,711.60 | $2,473,477.75 |

| 2040 | $5,799,454.28 | $9,665,757.13 | $13,532,059.98 |

| 2050 | $161,978,188.65 | $269,963,647.74 | $377,949,106.84 |

Bitcoin Prediction: Analysts and Influencers’ BTC Price Target

| Firm Name | 2025 |

| Standard Chartered | $200K |

| VanECk | $180K |

| 10x Reserach | $122K |

| Fundstrat | $250K |

| Blackrock | $700K |

- As per the Bitcoin price forecast by Blockware Solutions, the price of 1 BTC could hit $400,000

- Cathie Wood predicts the price of BTC to achieve the $3.8 million mark by 2030.

- Michael Saylor-led MicroStrategy expects Bitcoin to soar beyond $13 million by 2045.

- ARK Invest has increased its bullish BTC price target to $2.4 million by 2030.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Most forecasts expect Bitcoin to stay bullish in 2025, with potential highs around $175K if strong demand, ETF inflows, and adoption continue.

While some long-term forecasts are extremely bullish, reaching $1 million by 2030 is speculative. Current credible estimates suggest a potential high around $900,000 by 2030.

Yes, Bitcoin is increasingly viewed as a digital inflation hedge. Its fixed supply contrasts with expanding fiat currencies, attracting investors seeking to preserve purchasing power.

Bitcoin could trade significantly higher in 10 years, with some forecasts expecting it to reach several hundred thousand dollars if adoption keeps growing.

Cardano Price Prediction 2025, 2026 – 2030: Will ADA Price Hit $2?

The post Cardano Price Prediction 2025, 2026 – 2030: Will ADA Price Hit $2? appeared first on Coinpedia Fintech News

Story Highlights

- The live price of the Cardano token is $ 0.40004676.

- ADA Price prediction suggests potential to reach $2.05 by year-end 2025.

- Long-term forecasts indicate ADA could hit $10.25 by 2030.

The Cardano price prediction for 2025 is generating significant buzz in the crypto market, particularly as we have entered Q3 2025 with July. The transformative Plomin Hard Fork, implemented in Q1, has played a crucial role in this momentum, especially with the announcement of full decentralized governance.

This landmark upgrade has reinforced Cardano’s commitment to community-driven innovation, leading to a strengthening of its internal ecosystem. Even bigger institutions like Grayscale have been applauding the project’s vision and gave 1/5th allocation in its fund.

Industry leaders like IOHK and EMURGO are also actively advancing the Cardano ecosystem. EMURGO’s partnership with Ctrl Wallet on July 2, 2025, has enhanced Cardano’s interoperability, enabling connections to over 2,300 blockchains.

Moreover, community-driven initiatives focusing on scalability, privacy through the Midnight chain, and integration with Bitcoin DeFi are paving the way for substantial growth.

Additionally, Bloomberg analysts have raised odds of potential spot ADA ETF approvals, and strong technical indicators signaling positive trends, investor enthusiasm is at an all-time high. Questions abound: “Will Cardano spearhead the altcoin movement?” and “What heights can ADA reach by 2050?” Explore this Cardano price prediction for 2025 and beyond, filled with expert insights and ambitious forecasts.

Coinpedia’s Cardano Price Prediction 2025

Cardano (ADA) is predicted to reach a potential high of $2.05 in 2025, driven by hopes of ETF approval, full decentralization after the Plomin Hard Fork, and increasing institutional interest. However, if ADA fails to hold above key support, it may range between $0.85 and $1.25.

Table of Contents

Cardano Price Today

| Cryptocurrency | Cardano |

| Token | ADA |

| Price | $0.4000

|

| Market Cap | $ 14,365,804,077.06 |

| 24h Volume | $ 416,685,766.1630 |

| Circulating Supply | 35,910,312,071.2930 |

| Total Supply | 44,994,648,277.4536 |

| All-Time High | $ 3.0992 on 02 September 2021 |

| All-Time Low | $ 0.0174 on 01 October 2017 |

Cardano Price Prediction December 2025

From January to November 2025, the price of Cardano (ADA) has undergone a significant decline, particularly notable after reaching an impressive peak of $1.32 in December 2024. This sharp decrease highlights the volatility in the market, where prices can fluctuate dramatically.

Upon examining the Cardano price chart, a falling wedge formation has emerged during this downward trend. This pattern often indicates a potential reversal, when all conditions are met to shift the trend with a strong catalyst involved. The pattern itself is suggesting that a bullish trend could follow after the current bear market.

The recent downturn followed a brief attempt to regain a foothold above the vital $1 threshold in August 2025, but Cardano’s price has been on a correction and is now likely to test the support range of $0.27-$0.30 as the year nears its end.

In November, the situation worsened as Cardano fell below the significant support level of $0.50, and by the month’s end, the price hovered around $0.40, highlighting the persistent bearish trend.

As we moved into December after concluding November, the price stabilized around $0.40 in early December. It was expected that the FOMC meeting on 10th December would show a rally, but even in the wake of the FOMC news, it continues to trade within the same demand area. This suggests that demand has yet to fully materialize on the charts, indicating a cautious sentiment among investors at this time.

However, it is crucial to recognize the importance of establishing a robust support zone, now, where the current area feels somewhat lacking in this regard. An expected decline towards the range of $0.27 to $0.30 could solidify that support.

If the price can maintain stability within this zone, it will not only prevent further declines but also set the stage for a potential recovery for Q1 2026. Should Cardano demonstrate resilience in this area, it would signal the beginning of a positive shift, ultimately boosting the confidence of traders and investors alike.

| Price Prediction | Potential Low ($) | Average Price ($) | Potential High ($) |

| December 2025 | $0.25 | $0.92 | $1.32 |

Cardano AI Price Prediction For December 2025

| Source | Low Price | Average Price | High Price |

| Gemini | $0.85 – $0.95 | $1.00 – $1.20 | $1.30 – $1.50+ |

| BlackBox | $0.65 | $1.00 | $1.50 |

| ChatGPT | $0.75 | $0.95 | $1.25 |

ADA Price Prediction 2025

Additionally, if ADA/USD retests the strong demand area at $0.30 by the end of 2025, a reversal could be more pronounced, potentially resulting in a breakout of the weekly falling wedge pattern.

However, the price could regain momentum in the first half of 2026, reaching $2.20, only if it manages to close above the $1.10 range. If this happens, then the odds of ADA’s price intention for a long-term rally would drastically increase.

| Scenario | Potential Low | Average Price | Potential High |

| Without ETF Approval | $0.85 | $1.10 | $1.25 |

| With ETF Approval + Retail Surge | $1.20 | $1.65 | $2.05 |

| Bullish Breakout (with ETF & macro support) | $1.50 | $2.05 | $2.80 |

Cardano (ADA) Price Prediction 2026 – 2030

| Price Prediction | Potential Low ($) | Average Price ($) | Potential High ($) |

| 2026 | 2.75 | 3.00 | 3.25 |

| 2027 | 4.50 | 4.75 | 5.00 |

| 2028 | 5.25 | 5.50 | 5.75 |

| 2029 | 6.75 | 7.25 | 7.75 |

| 2030 | 9.00 | 9.75 | 10.25 |

This table, based on historical movements, shows ADA prices to reach $10.25 by 2030 based on compounding market cap each year. This table provides a framework for understanding the potential Cardano price movements. Yet, the actual price will depend on a combination of market dynamics, investor behavior, and external factors influencing the cryptocurrency landscape.

Cardano Price Prediction 2031, 2032, 2033, 2040, 2050

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | 10.50 | 11.00 | 11.25 |

| 2032 | 13.75 | 14.25 | 14.75 |

| 2033 | 17.50 | 18.50 | 19.75 |

| 2040 | 34.25 | 51.75 | 69.25 |

| 2050 | 128.25 | 228.75 | 329.50 |

Based on the historic market sentiments and trend analysis of the altcoin, here are the possible Cardano price targets for the longer time frames.

Market Analysis

| Firm Name | 2025 | 2026 | 2030 |

| Changelly | $0.752 | $1.18 | $6.05 |

| Coincodex | $0.79 | $0.53 | $0.89 |

| Binance | $0.79 | $0.83 | $1.01 |

*The aforementioned targets are the average targets set by the respective firms.

Coinpedia’s Price Analysis provides you with the latest content on the recent market trend that enables you to get closer to the price movements & actions of the various cryptocurrencies.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

According to our Cardano price prediction, the altcoin’s price could hit a maximum of $2.05 in 2025.

At the time of writing, the price of 1 Cardano ADA token was $ 0.40004676

Cardano is an underrated investment and has a high chance of performing in the next couple of years, considering the plethora of applications.

Cardano is not dead, as it is witnessing major developmental upgrades, which could boost ADA’s price in the near future.

Even the most bullish of Cardano supporters acknowledge that Cardano will only potentially surpass Ethereum within 18 to 20 years.

As per our latest ADA price analysis, Cardano could reach a maximum price of $69.33.

By 2050, a single Cardano price could go as high as $329.56.

At the time of press, the Cardano price CAD is $0.9141.

Singapore Gulf Bank Launches Zero-Fee Stablecoin Minting on Solana Network

The post Singapore Gulf Bank Launches Zero-Fee Stablecoin Minting on Solana Network appeared first on Coinpedia Fintech News

Singapore Gulf Bank has launched a service that allows clients to convert fiat money into stablecoins like USDC and USDT directly on the Solana blockchain with no transaction or gas fees for now.

Announced at Solana Breakpoint 2025 in Abu Dhabi, the move highlights rising institutional confidence in stablecoins for everyday financial operations.

Singapore Gulf Bank Launches Zero-Fee Stablecoin Minting

Singapore Gulf Bank (SGB), regulated by the Central Bank of Bahrain and backed by Whampoa Group and the Mumtalakat sovereign wealth fund, said this new step helps bridge traditional banking and blockchain technology for real-world financial use.

This first phase of the service is designed for corporate clients, especially for treasury management and cross-border business payments, before it expands to personal banking services.

Clients who have verified accounts with SGB can now deposit fiat currencies, such as USD or SGD, and instantly receive USDC or USDT on Solana.

JUST IN: Singapore Gulf Bank launches stablecoin minting and redemption on Solana. pic.twitter.com/z7gWouIVIa

— Whale Insider (@WhaleInsider) December 13, 2025

This approach removes traditional banking delays by allowing clients to interact with blockchain settlement directly, without relying on multiple intermediaries.

Why Solana Was Chosen for Stablecoin Minting

SGB chose Solana for its fast speed and low costs, making it suitable for high-volume, real-time financial flows. Using Solana, the bank aims to cut those costs to under 0.3% and settle in seconds, making cross-border transfers easier for businesses across Asia and the GCC region.

Since entering the market, Singapore Gulf Bank has already processed more than $7 billion in transactions.

The bank says this demand shows growing interest from enterprises looking for seamless links between digital assets and traditional banking.

Security, Compliance, and Future Expansion

To strengthen security, SGB has partnered with Fireblocks to provide institutional-grade digital asset custody. This setup uses advanced cryptography and secure wallet infrastructure to protect client funds while meeting regulatory standards.

With zero-fee stablecoin minting, secure custody, and instant settlement tools, Singapore Gulf Bank is positioning itself as a bridge between traditional finance and decentralized finance.

The move reflects a broader shift as banks adapt to 24/7 global markets and rising demand for faster, cheaper financial services.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

It lets verified clients convert fiat like USD or SGD into USDC or USDT on Solana instantly, with no transaction or gas fees for now.

The service is currently available to corporate clients for treasury and cross-border payments, with plans to expand to personal banking later.

Yes. SGB is regulated by Bahrain’s central bank and uses institutional-grade custody with Fireblocks to ensure security and compliance.

Shiba Inu Burn Rate Crashes Further 62% to New Lows, Now What?

BNB Chain Records 2.4 Million Daily Users: CZ Reveals

2026 Coinbase Crypto Prediction: Here Are Key Factors That Will Define Market

RaveDAO Delivers a Community-First Launch

The post RaveDAO Delivers a Community-First Launch appeared first on Coinpedia Fintech News

RaveDAO’s $RAVE launch turned heads after early buyers entered near $0.20 and the price quickly climbed close to $0.60, marking a clean 3x move. Unlike many recent launches, the chart expanded upward from the start, allowing real participants to enter instead of insiders dumping. This fair structure rewarded the community and boosted confidence. In a market filled with post-launch sell-offs, RaveDAO’s approach stands out as a refreshing and trust-building debut.

Ripple News Today: VivoPower Launches $300M Institutional Ripple Equity Fund

The post Ripple News Today: VivoPower Launches $300M Institutional Ripple Equity Fund appeared first on Coinpedia Fintech News

Ripple is seeing growing attention from large investors as VivoPower International moves forward with a new investment vehicle focused on Ripple’s equity. The company has received approval from Ripple to launch a $300 million fund aimed at institutional investors, with a strong focus on South Korea. The move highlights rising demand for Ripple-related exposure beyond public XRP trading.

How the $300 Million Investment Vehicle Works

The fund will be launched through a joint venture between VivoPower and Lean Ventures, a well-known asset manager based in Seoul. Lean Ventures manages capital for both the South Korean government and private institutions, which adds credibility and local trust to the initiative. VivoPower’s digital asset arm, Vivo Federation, will handle sourcing and purchasing Ripple Labs shares.

Ripple has already given written approval for the first batch of preferred shares. VivoPower is now in talks with existing institutional shareholders to gradually build the fund toward the $300 million target. This structure allows investors to gain exposure to Ripple’s growth without directly buying XRP on the open market.

Why Korea Is Central to the Strategy

South Korea plays a key role in this launch. According to VivoPower’s advisory council chairman, Adam Traidman, Korean investors are showing strong interest in Ripple’s long-term growth. He noted that the fund offers access to Ripple equity at valuations that may be more attractive than current XRP market prices.

Lean Ventures managing partner Chris Kim echoed this view, saying demand for Ripple and XRP-related investments in Korea remains high. The country’s active crypto market and improving regulatory clarity are helping support institutional participation.

Regulatory Progress Adds Confidence

The timing of the fund launch aligns with broader regulatory progress for Ripple. Recent developments, including Ripple securing an OCC banking license in the U.S., have helped strengthen institutional confidence. These steps suggest Ripple is positioning itself for deeper integration with traditional finance.

VivoPower Sees Revenue Upside

VivoPower expects the fund to generate at least $75 million in management and performance fees over the next three years. This estimate is based on the current fund size, meaning future growth or higher Ripple valuations could boost returns further.

Following the announcement, VivoPower’s stock jumped around 13%, reflecting investor optimism. Crypto analyst Crypto Eri noted that the fund offers structured exposure to Ripple and XRP-linked growth, potentially at a discount compared to spot market pricing.

Overall, the launch of this fund signals growing institutional confidence in Ripple’s business model. By opening a regulated pathway for large investors, especially in crypto-friendly markets like Korea, Ripple continues to expand its reach beyond retail trading and into long-term capital markets.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

South Korea has high institutional demand for Ripple, strong local crypto market activity, and improving regulations, making it a key strategic market for this regulated investment vehicle.

It provides structured equity exposure to Ripple’s business performance at potentially attractive valuations, which may differ from the current XRP market price, appealing to long-term growth investors.

It reflects growing institutional confidence in Ripple’s regulatory progress and business model, positioning it for deeper integration with traditional finance and long-term capital markets.

Ethereum Introduces ERC-8092 for Cross-Chain Account Linking

The post Ethereum Introduces ERC-8092 for Cross-Chain Account Linking appeared first on Coinpedia Fintech News

Ethereum’s community has proposed ERC-8092, a draft standard for creating “associated accounts” across blockchains. It allows two accounts to publicly declare, prove, and revoke their relationship using cryptographic signatures. The proposal supports practical uses like sub-account inheritance, delegated authorization, and reputation tracking. By working with EIP-7930, it also enables cross-chain compatibility. If adopted, ERC-8092 could simplify identity management and interactions across multiple blockchains, making decentralized applications more secure and flexible.

Coinpedia Digest: This Week’s Crypto News Highlights | 13th December, 2025

The post Coinpedia Digest: This Week’s Crypto News Highlights | 13th December, 2025 appeared first on Coinpedia Fintech News

It was a pivotal but uneasy week for crypto, with regulators making tangible moves even as markets stayed cautious. A priced-in Fed cut failed to move prices, while new U.S. policy signals and global rate shifts reshaped how investors are thinking about risk.

Here are the top headlines to catch up on!

Third Fed Rate Cut Lands, But Markets Shrug

The Federal Reserve delivered its third rate cut of the year, trimming rates by 25 basis points to a 3.50%-3.75% range, which is a move analysts say the markets had fully priced in. Chair Jerome Powell struck a cautious tone, calling the outlook “challenging” with no “risk-free path” ahead. Bitcoin jumped before the decision, then reversed sharply as reality set in.

Ripple and Circle Win Federal Bank Charters

U.S. regulators crossed a major line this week. The OCC granted conditional national trust bank charters to Ripple, Circle, Paxos, BitGo, and Fidelity Digital Assets, plugging them directly into the Federal Reserve’s payment system.

HUGE news! @Ripple just received conditional approval from the @USOCC to charter Ripple National Trust Bank. This is a massive step forward – first for $RLUSD, setting the highest standard for stablecoin compliance with both federal (OCC) & state (NYDFS) oversight.

— Brad Garlinghouse (@bgarlinghouse) December 12, 2025

To the…

Backed by the GENIUS Act, the move enables 24/7 stablecoin settlement and cuts bank counterparty risk. Critics, including the ABA, warn it “could blur the lines of what it means to be a bank.”

Terra Founder Do Kwon Sentenced to 15 Years

Do Kwon, the architect of the TerraUSD and Luna collapse, was sentenced to 15 years in U.S. prison for fraud – more than prosecutors sought. Judge Paul Engelmayer called it “a fraud of epic generational scale,” citing massive investor harm that helped trigger the 2022 crypto winter.

Kwon admitted responsibility, agreeing to forfeit $19.3 million as part of his plea.

CFTC Launches Digital Assets Pilot

The CFTC has launched a Digital Assets Pilot Program allowing Bitcoin, Ether, and USDC to be used as margin collateral in regulated derivatives markets for the first time. Announced December 8, the pilot creates a tightly monitored framework for tokenized collateral without expanding trading activity.

The shift changes how margin efficiency and risk are managed, integrating crypto deeper into the U.S. market.

Economists See BOJ Rates Reaching 1% by 2026

A strong majority of economists now expect the Bank of Japan to raise rates to 0.75% at its December meeting, with borrowing costs reaching at least 1% by next September, according to a Reuters poll.

Expectations have firmed rapidly as inflation persists and the yen remains weak, reinforcing views that Japan’s long era of ultra-loose monetary policy is steadily ending.

Also Read: BOJ Interest Rate Hike Expected, Raising New Risks for Global Markets

YouTube Enables PYUSD Payouts for U.S. Creators

YouTube has added PayPal’s dollar-pegged stablecoin PYUSD as a payout option for U.S. creators, giving the token its highest-profile consumer use case yet.

“The beauty of what we’ve built is that YouTube doesn’t have to touch crypto,” said PayPal crypto chief May Zabaneh. The move shows how big platforms are testing stablecoins as payment rails without handling digital assets directly.

Tether Moves to Buy Juventus Club in Cash Deal

Tether has proposed a cash-only deal to acquire full control of Juventus, offering to buy out all remaining shares after already securing a 10% stake. The club’s holding structure controls 65.4% of share capital.

If completed, Tether plans to invest €1 billion into Juventus, citing strong finances after posting over $10 billion in profit in the first nine months of 2025.

XRP Becomes Fastest ETF to $1B Since ETH

XRP spot ETFs have crossed $1 billion in assets under management, becoming the fastest crypto ETF to hit the mark since Ethereum. Canary, Grayscale, Bitwise, and Franklin are driving inflows, largely from institutional desks. Ripple CEO Brad Garlinghouse said the surge reflects “pent up demand” for regulated exposure, especially as platforms like Vanguard open crypto ETFs to mainstream retirement accounts.

Coinbase to Launch Prediction Markets on Dec. 17

Coinbase is preparing to launch prediction markets powered by Kalshi at its Dec. 17 “Coinbase System Update” event, alongside plans for tokenized stock trading. The move advances CEO Brian Armstrong’s push to turn Coinbase into an “everything exchange” as crypto sentiment cools.

The partnership signals Coinbase’s bid to compete with Robinhood and Kraken beyond tokens.

New York Adopts UCC Rules for Digital Assets

New York has enacted the 2022 UCC amendments, creating a new legal framework for digital assets like cryptocurrencies, NFTs, and tokenized instruments. Effective June 3, 2026, the changes define how ownership, transfers, and security interests work for “controllable electronic records.”

The update doesn’t regulate crypto directly but lays critical groundwork for tokenization and real-world asset structuring under state law.

Bhutan Launches Gold-Backed Token on Solana

Bhutan has launched TER, a gold-backed digital token built on Solana, linking physical gold with blockchain rails. Announced December 10, the token goes live December 17 and is backed 1:1 by audited gold held at DK Bank. Officials say TER reflects Bhutan’s push to blend traditional value with transparent, low-cost digital infrastructure as part of its broader blockchain strategy.

Gelephu Mindfulness City is launching TER, the world’s first sovereign-backed, physical gold-backed digital token, on Dec 17, 2025. Built on Solana, issued via DK Bank, and powered by Matrixdock tech, TER brings Bhutan’s “Treasure” on-chain with full transparency.… pic.twitter.com/HmJVGh4qPB

— gmcbhutan (@gmcbhutan) December 11, 2025

Weekly Crypto Market Outlook

Crypto enters the week in a watchful mood. The Fed’s latest rate cut failed to spark a rally, while Japan’s path toward higher rates is quietly tightening global conditions. At the same time, U.S. policy signals are turning more constructive for crypto.

If Bitcoin finds its footing, markets may calm, but macro uncertainty still leaves room for sudden moves.

Brazil’s largest private bank advises investors to allocate 3% to Bitcoin in 2026

Brazil’s largest private bank says Bitcoin can improve portfolio diversification and hedge currency risk despite a volatile year for the asset.

The global economy is still paying for big banks’ laziness | Opinion

LUNC price dives after Do Kwon sentence: here’s why it may dive by 45%

Bitcoin Doesn’t Hold Real Value, Says RBI Deputy Governor

The post Bitcoin Doesn’t Hold Real Value, Says RBI Deputy Governor appeared first on Coinpedia Fintech News

Bitcoin, the world’s largest cryptocurrency, came under sharp criticism after the Reserve Bank of India’s Deputy Governor T. Rabi Sankar said the digital asset has no real value and is driven only by speculation.

Despite raising such concerns from the Deputy Governor, crypto adoption in India continues to grow rapidly in spite of strict taxes and regulations.

Bitcoin Doesn’t Hold Real Value

Speaking at the Mint Annual BFSI Conclave 2025, RBI Deputy Governor T. Rabi Sankar said Bitcoin should not be seen as money or a financial asset. He explained that while the blockchain technology behind Bitcoin is innovative, Bitcoin itself was only created to showcase that technology, not to hold real value.

Sankar noted that blockchain proved it is possible to transfer digital tokens between unknown parties without needing a trusted middleman. This breakthrough opened the door to many useful applications across finance and other sectors.

However, he stressed that Bitcoin was never meant to represent value in the same way money does.

Bitcoin Compared to Tulip Mania

Further explaining his point, Sankar compared Bitcoin’s price movement to the famous tulip mania of the 17th century. He said Bitcoin’s price exists only because people are willing to pay for it, not because it has any underlying worth.

He added that Bitcoin is not backed by any issuer, promise to pay, or cash flow. Because of this, he believes it does not qualify as real money. He also argues that cryptocurrencies are not true financial assets since they do not earn income or represent ownership in a business.

Meanwhile, he warned that crypto is highly volatile, which is clear as Bitcoin is nearly 30% below its peak, while many other cryptocurrencies are down 40% to 70%.

India’s Growing Crypto User Base Despite Warnings

Despite these strong warnings from the central bank, India’s crypto market continues to expand. The country now has over 100 million crypto users, making it one of the largest crypto markets globally.

However, the government has maintained a cautious approach. In 2022, India introduced a 30% tax on crypto gains along with a 1% tax deducted at source (TDS) on every trade.

These measures were designed to discourage excessive speculation while allowing authorities to monitor activity in the sector.

XRP Stalls Near $2.05 While Digitap ($TAP) Visa Deal Positions It As Best Compliance-Backed Crypto Presale For 2026

The post XRP Stalls Near $2.05 While Digitap ($TAP) Visa Deal Positions It As Best Compliance-Backed Crypto Presale For 2026 appeared first on Coinpedia Fintech News

The Federal Reserve’s latest 25-basis-point rate cut briefly lifted market sentiment, yet the updated dot plot signaled inflation staying above target until 2028, and that shift triggered immediate pullbacks across major altcoins.

While traders move cautiously between established assets in search of stability, attention is increasingly turning toward early-stage performers such asDigitap ($TAP), which is rapidly emerging as one of the best crypto presales and a top crypto to buy now thanks to its banking-grade compliance, Visa-ready infrastructure, and accelerating demand.

This momentum is building at the perfect moment, as Digitap’s 12 Days of Christmas campaign introduces a festive countdown of twice-daily rewards that keeps investor engagement high and turns the presale into a celebration rather than just another market phase.

MACD Weakness And SMA Drop Put XRP’s Trend Under Pressure