First Ethereum Treasury Firm Sells ETH For Buybacks: Death Spiral Incoming?

Ethereum-focused treasury company ETHZilla said it has sold roughly $40 million worth of ether to fund ongoing share repurchases, a maneuver aimed at closing what it calls a “significant discount to NAV.” In a press statement on Monday, the company disclosed that since Friday, October 24, it has bought back about 600,000 common shares for approximately $12 million under a broader authorization of up to $250 million, and that it intends to continue buying while the discount persists.

ETHZilla Dumps ETH For BuyBacks

The company framed the buybacks as balance-sheet arbitrage rather than a strategic retreat from its core Ethereum exposure. “We are leveraging the strength of our balance sheet, including reducing our ETH holdings, to execute share repurchases,” chairman and CEO McAndrew Rudisill said, adding that ETH sales are being used as “cash” while common shares trade below net asset value. He argued the transactions would be immediately accretive to remaining shareholders.

ETHZilla amplified the message on X, saying it would “use its strong balance sheet to support shareholders through buybacks, reduce shares available for short borrow, [and] drive up NAV per share” and reiterating that it still holds “~$400 million of ETH” on the balance sheet and carries “no net debt.” The company also cited “recent, concentrated short selling” as a factor keeping the stock under pressure.

The market-structure logic is straightforward: when a digital-asset treasury trades below the value of its coin holdings and cash, buying back stock with “coin-cash” can, in theory, collapse the discount and lift NAV per share. But the optics are contentious inside crypto because the mechanism requires selling the underlying asset—here, ETH—to purchase equity, potentially weakening the very treasury backing that investors originally sought.

Death Spiral Incoming?

Popular crypto trader SalsaTekila (@SalsaTekila) commented on X: “This is extremely bearish, especially if it invites similar behavior. ETH treasuries are not Saylor; they haven’t shown diamond-hand will. If treasury companies start dumping the coin to buy shares, it’s a death spiral setup.”

Skeptics also zeroed in on funding choices. “I am mostly curious why the company chose to sell ETH and not use the $569m in cash they had on the balance sheet last month,” another analyst Dan Smith wrote, noting ETHZilla had just said it still holds about $400 million of ETH and thus didn’t deploy it on fresh ETH accumulation. “Why not just use cash?” The question cuts to the core of treasury signaling: using ETH as a liquidity reservoir to defend a discounted equity can be read as rational capital allocation, or as capitulation that undermines the ETH-as-reserve narrative.

Beyond the buyback, a retail-driven storyline has rapidly formed around the stock. Business Insider reported that Dimitri Semenikhin—who recently became the face of the Beyond Meat surge—has targeted ETHZilla, saying he purchased roughly 2% of the company at what he views as a 50% discount to modified NAV. He has argued that the market is misreading ETHZilla’s balance sheet because it still reflects legacy biotech results rather than the current digital-asset treasury model.

The same report cites liquid holdings on the order of 102,300 ETH and roughly $560 million in cash, translating to about $62 per share in liquid assets, and calls out a 1-for-10 reverse split on October 15 that, in his view, muddied the optics for retail. Semenikhin flagged November 13 as a potential catalyst if results show the pivot to ETH generating profits.

The company’s own messaging emphasizes the discount-to-NAV lens rather than a change in strategy. ETHZilla told investors it would keep buying while the stock trades below asset value and highlighted a goal of shrinking lendable supply to blunt short-selling pressure.

For Ethereum markets, the immediate flow effect is limited—$40 million is marginal in ETH’s daily liquidity—but the second-order risk flagged by traders is behavioral contagion. If other ETH-heavy treasuries follow the playbook, selling the underlying to buy their own stock, the flow could become pro-cyclical: coins are sold to close equity discounts, the selling pressures spot, and wider discounts reappear as equity screens rerate to the weaker mark—repeat.

That is the “death spiral” scenario skeptics warn about when the treasury asset doubles as the company’s signal of conviction.

At press time, ETH traded at $4,156.

.jpg)

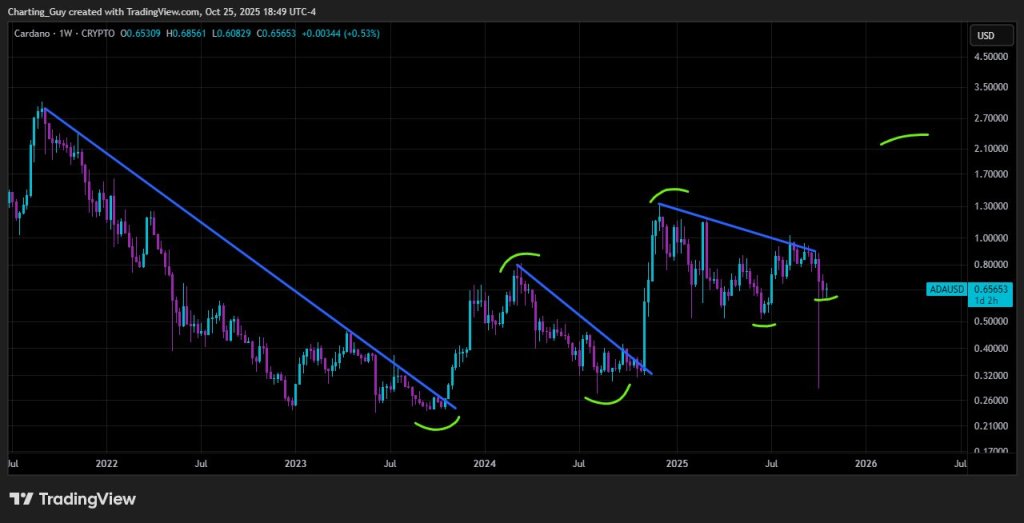

… higher high pending… still targeting 1.272 fib this cycle,” tying the price structure back to the extension grid. The implication is not casual moon-math; it is geometric. If ADA continues to defend the uptrend defined by the channel’s lower rail and, crucially, converts the 0.618 retracement at $1.15694 into support on weekly closes, the path reopens into the upper retracement shelf—$1.43911 at 0.702 and $1.78464 at 0.786—before confronting the 0.888 marker at $2.32189.

… higher high pending… still targeting 1.272 fib this cycle,” tying the price structure back to the extension grid. The implication is not casual moon-math; it is geometric. If ADA continues to defend the uptrend defined by the channel’s lower rail and, crucially, converts the 0.618 retracement at $1.15694 into support on weekly closes, the path reopens into the upper retracement shelf—$1.43911 at 0.702 and $1.78464 at 0.786—before confronting the 0.888 marker at $2.32189.

Trump Family-backed BTC miner American Bitcoin acquires 1,414 Bitcoin.

Trump Family-backed BTC miner American Bitcoin acquires 1,414 Bitcoin.

.jpeg?width=1200&auto=webp&crop=3%3A2)