Cardano price teeters as Hoskinson rebuts mounting criticism

The post Coinpedia Digest: This Week’s Crypto News Highlights | 1st November, 2025 appeared first on Coinpedia Fintech News

It’s been a defining week for crypto. From SBF’s latest attempt to reshape his own history to PayPal’s entry into AI-powered payments, the headlines have been interesting.

If one thing stood out this week, it’s that crypto is entering a more grown-up phase and settling into its role as finance’s disruptor. Missed out on anything? We’ve got you!

Dive right in for the biggest stories.

Sam Bankman-Fried is back in headlines, insisting that FTX’s 2022 collapse wasn’t about insolvency but bad decisions. In a new 15-page statement, he claimed the exchange held $25 billion in assets, enough to repay users, before lawyers and new CEO John J. Ray III “forced” FTX into bankruptcy for profit.

[SBF says:]

— SBF (@SBF_FTX) October 31, 2025

This is where the money went. https://t.co/HVRwEw5Z1k https://t.co/5DrA13L5YE pic.twitter.com/O6q77DvmTn

He also alleged nearly $1 billion in fees were paid while assets worth billions were lost. Court records, however, showed Alameda secretly used customer funds, leading to the $8 billion shortfall.

The long wait for Mt. Gox creditors isn’t over yet. Trustee Nobuaki Kobayashi has extended the repayment deadline to October 31, 2026, citing unfinished procedures and verification delays. Many creditors are still waiting for restitution more than a decade after the exchange’s 2014 collapse.

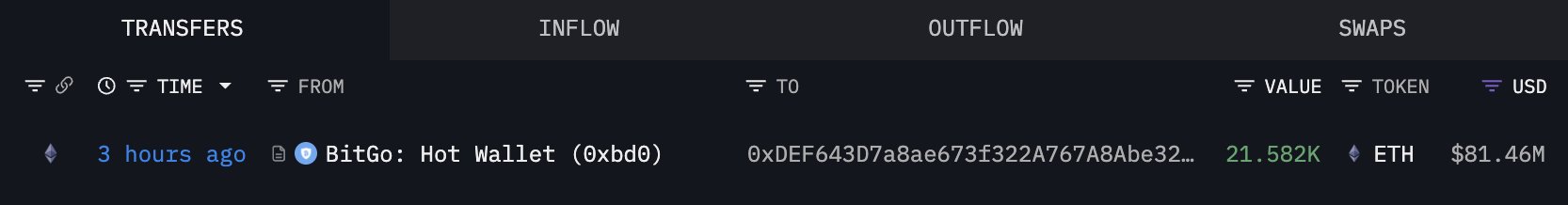

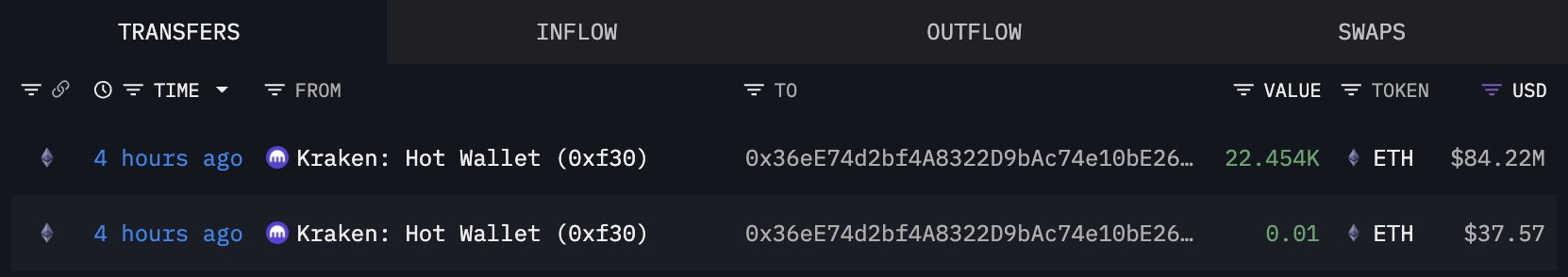

Earlier repayments covered only verified claims, leaving thousands in limbo. Recent blockchain activity, including a $1 billion Bitcoin transfer in March, has fueled fresh speculation about how and when the remaining funds will finally move.

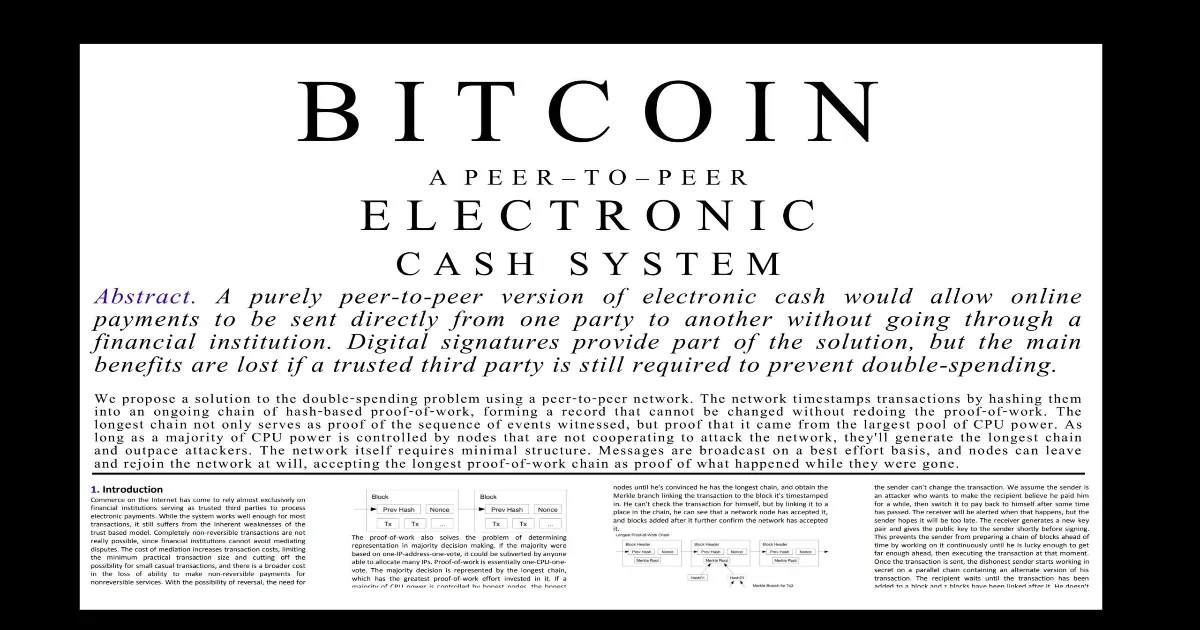

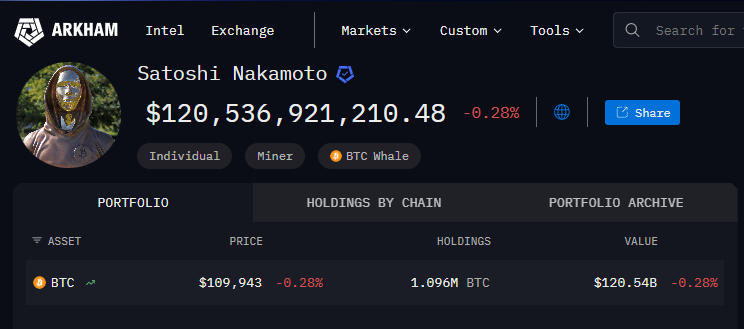

Seventeen years ago, an anonymous name, Satoshi Nakamoto, shared a short paper that changed how the world sees money. On October 31, 2008, the Bitcoin: A Peer-to-Peer Electronic Cash System white paper introduced the idea of a decentralized digital currency.

What started as a technical proposal is now a trillion-dollar industry and a global movement. The nine-page document set the foundation for blockchain technology and a new era of financial freedom that’s still unfolding today.

The Trump-Xi meeting ended with Washington backing off its trade pressure while Beijing barely blinked. The U.S. agreed to cut a fentanyl-related tariff by 10% and delay new ones, while China extended its pause on rare earth export controls – a move experts say keeps it in control.

“It’s more like our surrendering,” wrote Nicholas Kristof in The New York Times. Trump called the meeting “amazing,” but Beijing’s cautious response hinted at who really came out stronger. For crypto markets, the thaw could signal a possible boost in risk appetite.

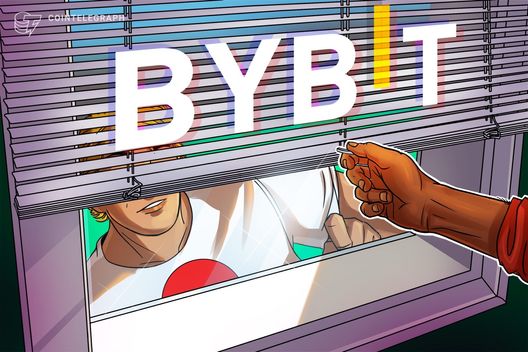

Bybit has stopped accepting new user registrations in Japan from October 31 as it works to meet the Financial Services Agency’s regulatory requirements. The pause, which applies to both individuals and companies, won’t affect existing users for now.

Japan’s regulators have become more watchful of unregistered exchanges, tightening crypto laws over the past year. Interestingly, even as it slows in Japan, Bybit has secured a full license in the UAE, strengthening its position as a compliant global exchange.

Cardano founder Charles Hoskinson has taken aim at gold supporter Peter Schiff, saying his Bitcoin predictions have been wrong time and again. In a post on X, Hoskinson said Schiff’s constant bearish calls “no longer move markets,” noting he’s been off at every major price level – from $100 to $100,000.

Peter continues to be wrong and utterly irrelevant. He was wrong at 100 dollar bitcoin. He was wrong at 1000 dollar bitcoin. He was wrong at 10,000 dollar bitcoin. He is wrong at 100,000 dollar bitcoin.

— Charles Hoskinson (@IOHK_Charles) October 29, 2025

He will be wrong at million dollar bitcoin. https://t.co/hpTVATc1qf

Schiff recently claimed Bitcoin remains over 10% below its all-time high, calling it “a speculative asset.” Hoskinson fired back, saying Schiff’s model has failed four times over.

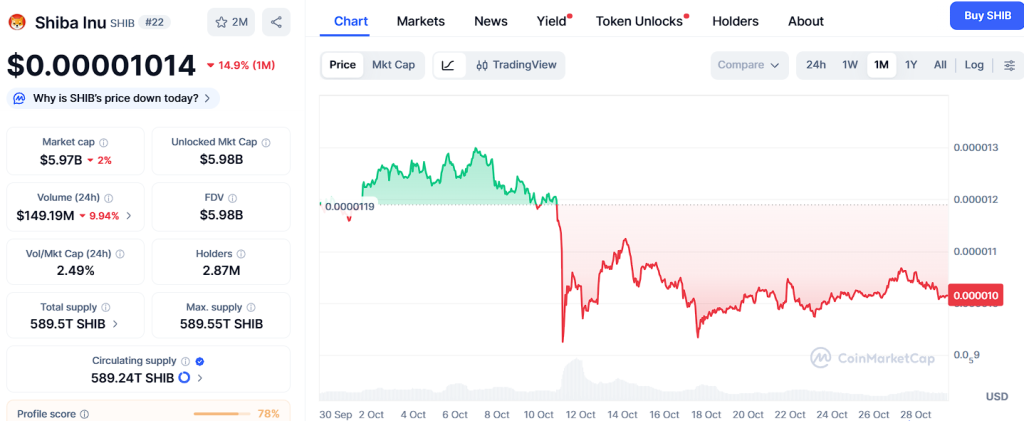

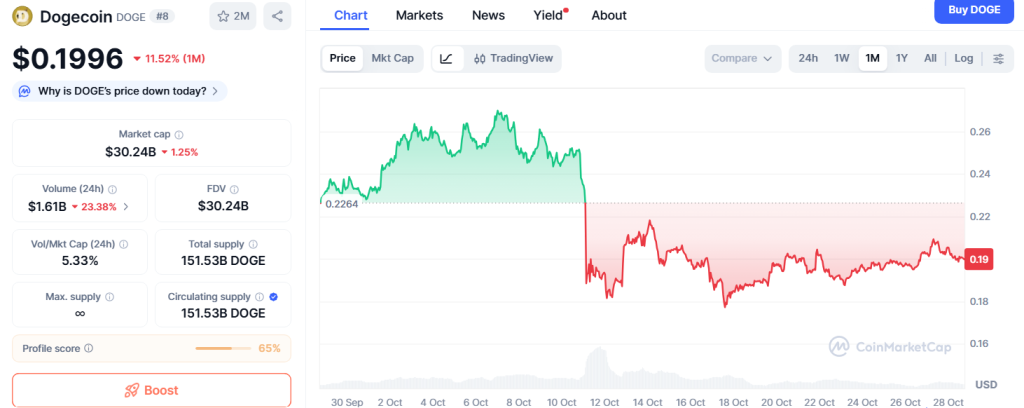

Shiba Inu has taken a big step toward Wall Street. T. Rowe Price, a global investment firm managing over $1.7 trillion, has filed a Form S-1 with the SEC to launch its Active Crypto ETF. The fund will track major digital assets including Bitcoin, Ethereum, Dogecoin, and Shiba Inu.

If approved, it would mark the first U.S. ETF to include SHIB, giving institutional investors regulated exposure to the token. The move adds new credibility to Shiba Inu’s growing ecosystem.

Fight Fight Fight LLC, the company behind the TRUMP token, is in talks to buy the U.S. arm of Republic.com, Bloomberg reported. The move could give the token a bigger real-world use, allowing investors and startups to transact directly in crypto.

Republic.com, backed by Galaxy Digital and Binance’s venture arm, has supported over 3,000 fundraises. If the deal goes through, it could mark a major step in bringing the Trump memecoin into mainstream finance.

Also Read: After 13 Million Tokens and a 90% Drop, Are Meme Coins Finally Done?

JPMorgan CEO Jamie Dimon, long known for his harsh stance on Bitcoin, is finally giving blockchain some credit. Speaking recently, Dimon said stablecoins and JPMorgan’s internal blockchain systems could hold real value in modern finance.

“This technology could replace many of today’s outdated systems – slow, fragmented, and far from 24/7,” he noted. Still, Dimon stressed that decentralization makes coordination difficult, which is why JPMorgan continues building on its private blockchain.

Western Union is stepping further into the crypto space. Just a day after announcing its Solana-based stablecoin USDPT, the company has filed a trademark for “WUUSD.” The filing covers wallet software, payments, and trading services, suggesting a wider digital asset plan in the works.

Analysts say stablecoins could lower settlement costs and speed up cross-border payments – a potential game-changer for remittance markets.

Read More: How Did the Bitwise Solana ETF Perform Compared to Bitcoin and Ethereum?

Here’s a few quick hits you shouldn’t miss!

PayPal Teams Up With OpenAI for ChatGPT Shopping: The tie-up will bring instant checkout inside the chatbot, letting users browse and buy products seamlessly. It also hints at PayPal’s growing digital focus and possible future links between AI payments and crypto.

Ethereum’s Fusaka Hard Fork Set for December 3: The upgrade will boost scalability and efficiency with PeerDAS and a higher gas limit, marking another milestone in Ethereum’s development.

KRWQ Becomes First Korean Won Stablecoin on Base: IQ and Frax launched the fiat-backed token on Base using LayerZero’s tech, bringing the Korean won on-chain with cross-chain transfers and plans for full regulatory compliance.

CZ Statue Memecoin Crashes 99% After Founder’s Warning: The “czstatue” token soared 27,000% before collapsing after CZ told followers, “Don’t buy the meme.” Over 1,100 holders were left with losses as the contract was flagged a honeypot.

Chinese Man Arrested in Bangkok Over $14M Crypto Scam: Thai police arrested Chinese national Liang Ai-Bing, accused of running the FINTOCH Ponzi scheme that defrauded nearly 100 investors. The arrest followed cross-border cooperation with Chinese authorities.

Major shifts to expect ahead

Momentum, regulation, and innovation are finally moving in the same direction. This is an exciting phase for the market. Tune back in next week for another edition of Coinpedia Digest!

The post Aptos Coin Price Prediction 2025, 2026 – 2030: Will APT Price Hit $25? appeared first on Coinpedia Fintech News

Aptos is a next-gen layer-1 blockchain designed to fix scalability and security. Launched in October 2022, it’s built on the Move programming language, which helps developers create safer and more scalable smart contracts.

Unlike other blockchains that struggle with speed and high costs, it uses the Proof-of-Stake (PoS) mechanism, making it one of the fastest blockchains in the space. It also supports a wide range of Web3 applications.

Now, as the crypto market gears up for its next big rally, many are eyeing Aptos’ token APT’s price. Even as the token unlock is scheduled for the current month. If you are one among the many, read our detailed Aptos price prediction to know what’s coming next.

| Cryptocurrency | Aptos |

| Token | APT |

| Price | $3.3004

|

| Market Cap | $ 2,374,572,007.05 |

| 24h Volume | $ 89,342,976.9935 |

| Circulating Supply | 719,487,243.9258 |

| Total Supply | 1,182,335,055.8240 |

| All-Time High | $ 19.9032 on 30 January 2023 |

| All-Time Low | $ 2.2209 on 10 October 2025 |

Aptos (APT) is trading near $3.28, holding below the 20-day SMA at $4.51. Technicals indicate:

Aptos now ranks third in tokenized asset value, with $538 million in TVL. Institutional players like BlackRock’s BUIDL and Franklin Templeton’s BENJI are contributing to this growth. Moreover, the team is also working on a horizontal scaling solution to stabilize 500,000+ TPS by September 2025.

On the technical front, Aptos is developing Shardines, a horizontal scaling upgrade expected by September 2025. While 32.5 percent of APT tokens remain locked until 2028, periodic unlocks may lead to short-term dips.

Successively, this could lead the APT coin price prediction to surge to a maximum of $20.68 in 2025. Conversely, growing dominance and potential rivals could bring the Aptos price down to $4.62. Considering the volatile market situation, the average price could settle at $12.62.

| Year | Potential Low | Average Price | Potential High |

| 2025 | $4.62 | $12.62 | $20.68 |

Curious about the future of crypto AI tokens? Explore our NEAR Token Price Prediction to find out if it will hit $10!

| Year | Potential Low ($) | Average Price ($) | Potential High ($) |

| 2026 | $10.28 | $18.56 | $28.97 |

| 2027 | $15.78 | $25.00 | $33.22 |

APT coin price prediction for the year 2026 could range between $10.28 to $28.97, and the average price of Aptos could be around $18.56.

Apto’s price for the year 2027 could range between $15.78 to $33.22, and the average price of APT could be around $25.00.

| Year | Potential Low ($) | Average Price ($) | Potential High ($) |

| 2028 | $20.36 | $30.91 | $45.61 |

| 2029 | $25.66 | $38.16 | $53.54 |

| 2030 | $30.95 | $45.47 | $60.13 |

APT crypto prediction for the year 2028 could range between $20.36 to $45.61, and the average Aptos coin price could be around $30.91.

Aptos’s forecast for the year 2029 could range between $25.66 to $53.54, and the average APT coin price could be around $38.16.

APT predictions for the year 2030 could range between $30.95 to $60.13, and the average Aptos price could be around $45.47.

| Firm | 2025 | 2026 | 2030 |

| Wallet Investor | $16.25 | $19.92 | – |

| priceprediction.net | $21.84 | $32.36 | $141.41 |

| DigitalCoinPrice | $29.43 | $40.17 | $86.30 |

*The targets mentioned above are the average targets set by the respective firms.

Factors like more projects and collaboration could bring more recognition to Aptos. This will also boost the sentimental belief of investors and traders. Hence, the price prediction of APT could reach $21.62 in 2025.

On the downside, increasing FUD amongst investors and a lack of updates could curb the price to the bottom at $4.62, making an average of $12.62.

| Year | Potential Low | Average Price | Potential High |

| 2025 | $4.62 | $12.62 | $20.62 |

Unlock the potential of AI with Fetch.ai! Dive into our FET price prediction and discover how this AI token could drive innovation in the coming years!

Aptos has shown a very strong potential lately, this could be a good opportunity to invest in this asset.

Yes, Aptos is a layer 1 blockchain with resource objects and Move programming language.

The price of APT could possibly reach its maximum of $20.68 this year.

It has a circulating supply of 486 Million APT coins and a total supply of 1,130,000,000,000 APT tokens.

With a potential surge, the price may go as high as $60.13 by 2030.

Aptos uses a different smart contract programming language than that of Ethereum. As a result, it could be much better equipped to handle Web3 innovations related to apps, games, and the metaverse.

Aptos was founded by Avery Ching and Mo Shaik, on 12th October 2022.

The post XRP Price Prediction November 2025: Traders Eyes $5 Ahead Of Canary’s ETF Approval appeared first on Coinpedia Fintech News

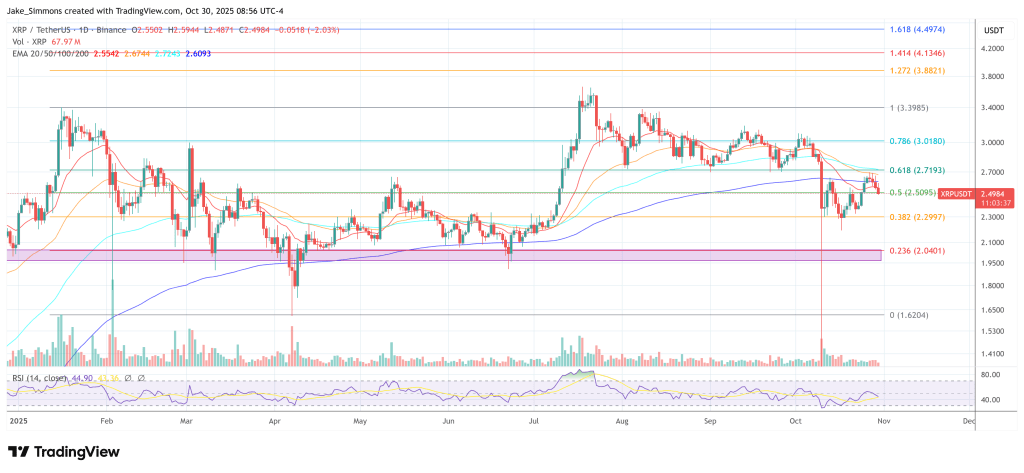

As the XRP price prediction November 2025 gains attention, the token’s outlook is brightening ahead of ETF approval. With the XRP ETF launch date drawing near, Ripple’s expanding payment infrastructure and a surge in on-chain metrics could ignite a significant rally, potentially driving prices toward the long-awaited $5 mark.

After months of anticipation, the XRP community is preparing for a defining moment as Canary Capital’s XRP ETF gears up for a potential November 13, 2025 debut.

This development follows the firm’s amended filing that removed the “delaying amendment,” allowing the ETF to become auto-effective 20 days after submission.

If approved, this ETF would mark a major turning point, potentially mirroring the success of earlier Bitcoin and Ethereum ETF launches. Ripple’s previous legal victory against the SEC already boosted investor confidence earlier this year, and this ETF approval could provide the next wave of momentum.

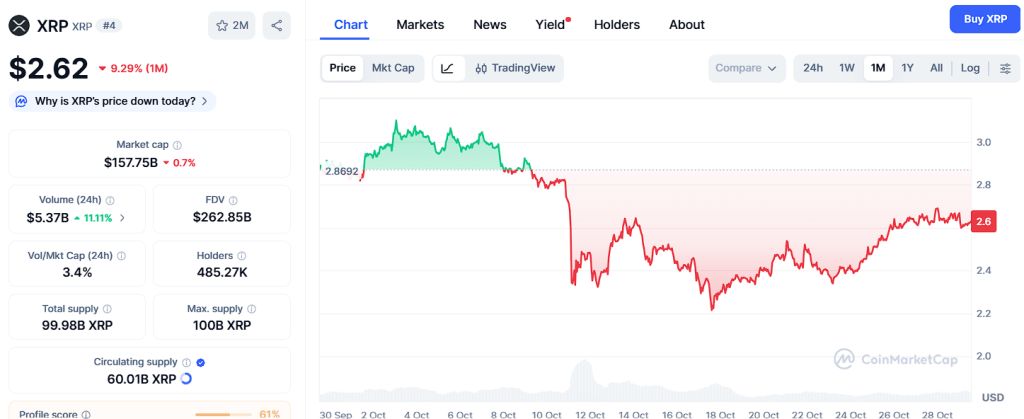

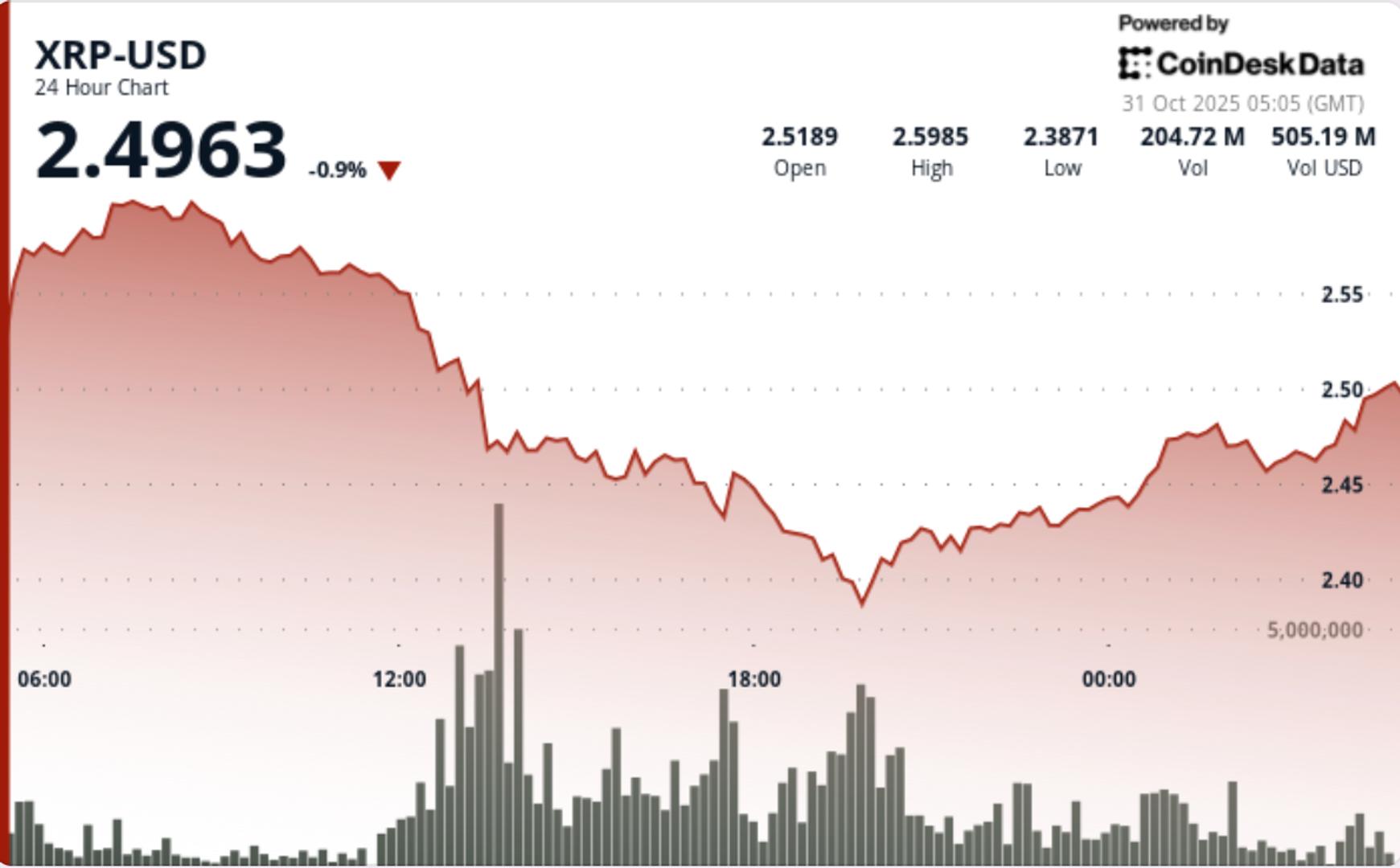

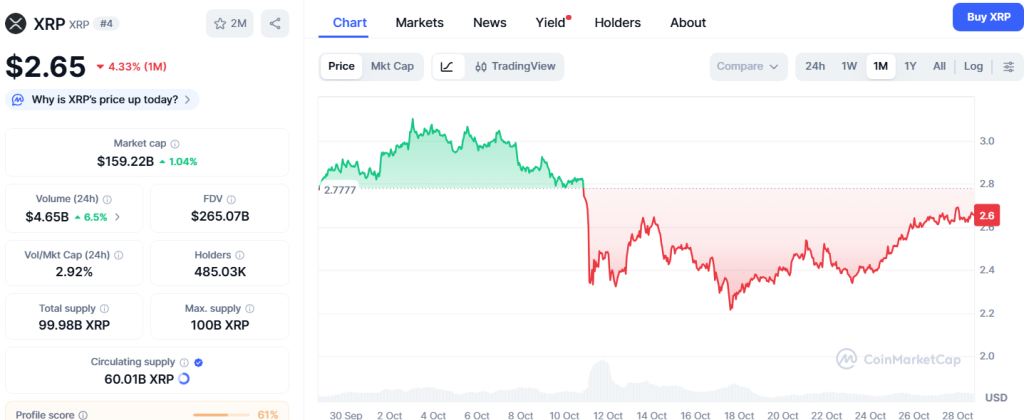

Currently, XRP price today sits near $2.5, recovering steadily from October’s pullback. Analysts believe that confirmation of a U.S.-listed ETF could set off a bullish breakout, supported by increasing speculative activity in XRP derivatives and growing institutional participation.

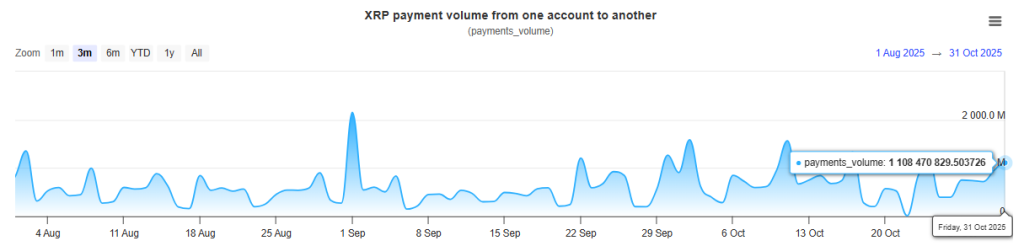

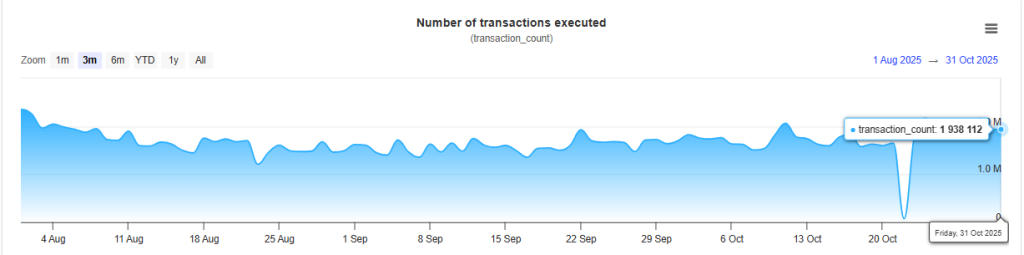

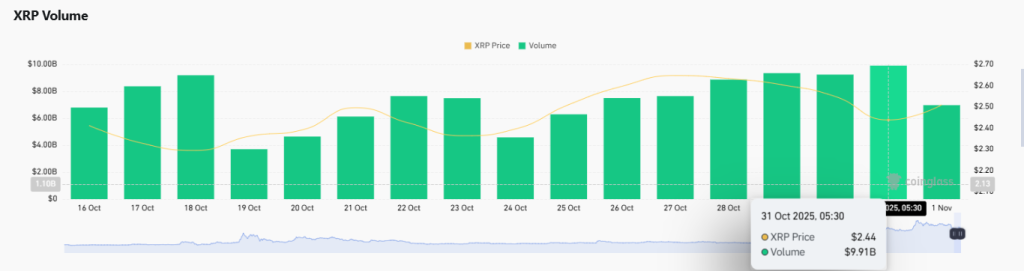

Beyond ETF headlines, Ripple’s ecosystem continues to show powerful on-chain expansion. According to data from XRPSCAN, the number of daily payments jumped from 37,539 in early October to over 1.05 million by month-end. Payment volumes have also skyrocketed from 11.19 million to 1.108 billion, underscoring renewed network demand.

Even the count of active sender accounts surged from just 2,035 to 28,297, while total transactions hit 1.93 million by late October. These metrics suggest growing adoption across Ripple’s payment network, driven by its efficient cross-border infrastructure that continues to bridge traditional finance and blockchain technology.

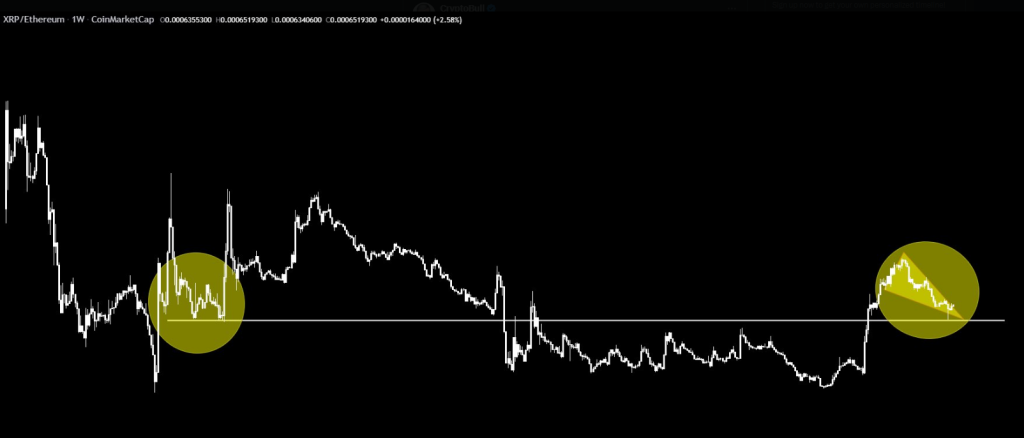

Such utility-driven expansion strengthens the XRP price forecast, reflecting both fundamental and speculative interest. With the weekly XRP price chart showing strong consolidation after a major breakout from a seven-year symmetrical triangle, the pattern indicates bullish accumulation before a potential next leg higher.

In the derivatives market, XRP crypto activity remains robust. Futures open interest now hovers around $4.21 billion, while derivative volumes have surged to $9.91 billion, up sharply from early October’s $3.7 billion lows. These figures highlight that traders are actively positioning for heightened volatility ahead of the ETF launch.

At the same time, competition among major asset managers is heating up. Besides Canary, several firms including WisdomTree, Grayscale, Bitwise, Franklin Templeton, and 21Shares have already filed for XRP ETF approval. The growing institutional race indicates that market confidence in XRP’s long-term utility is at an all-time high.

From a technical standpoint, XRP’s weekly chart suggests strong structural support, pointing to a potential move toward $5–$5.25 by year-end. The first half of 2026 could see prices advancing toward $7, with XRP price prediction models hinting at a $10 potential if institutional demand sustains.

$XRP price is under weekly rally retest phase from symm. tri

— topnotch (@topnotch1309) November 1, 2025patt. that suggest:-

2025: close at $5-$5.25

2026: Q1 will retest $XRP's $4 support

2026: Q2 will rise to $7.0 -$7.50

2026: Q3 will retest $XRP's $5 support

2026: Q4 will increase to $10.#CryptoTrading #XRP_analysis pic.twitter.com/22lCxcGrgj

As November unfolds, the XRP price prediction November 2025 reflects an turning point defined by utility growth, ETF momentum, and market conviction. Also it is signaling that the next breakout may just be around the corner.

The post How Bitcoin Adoption in the U.S. Could Double by 2025 Insights from the Bitcoin Conference appeared first on Coinpedia Fintech News

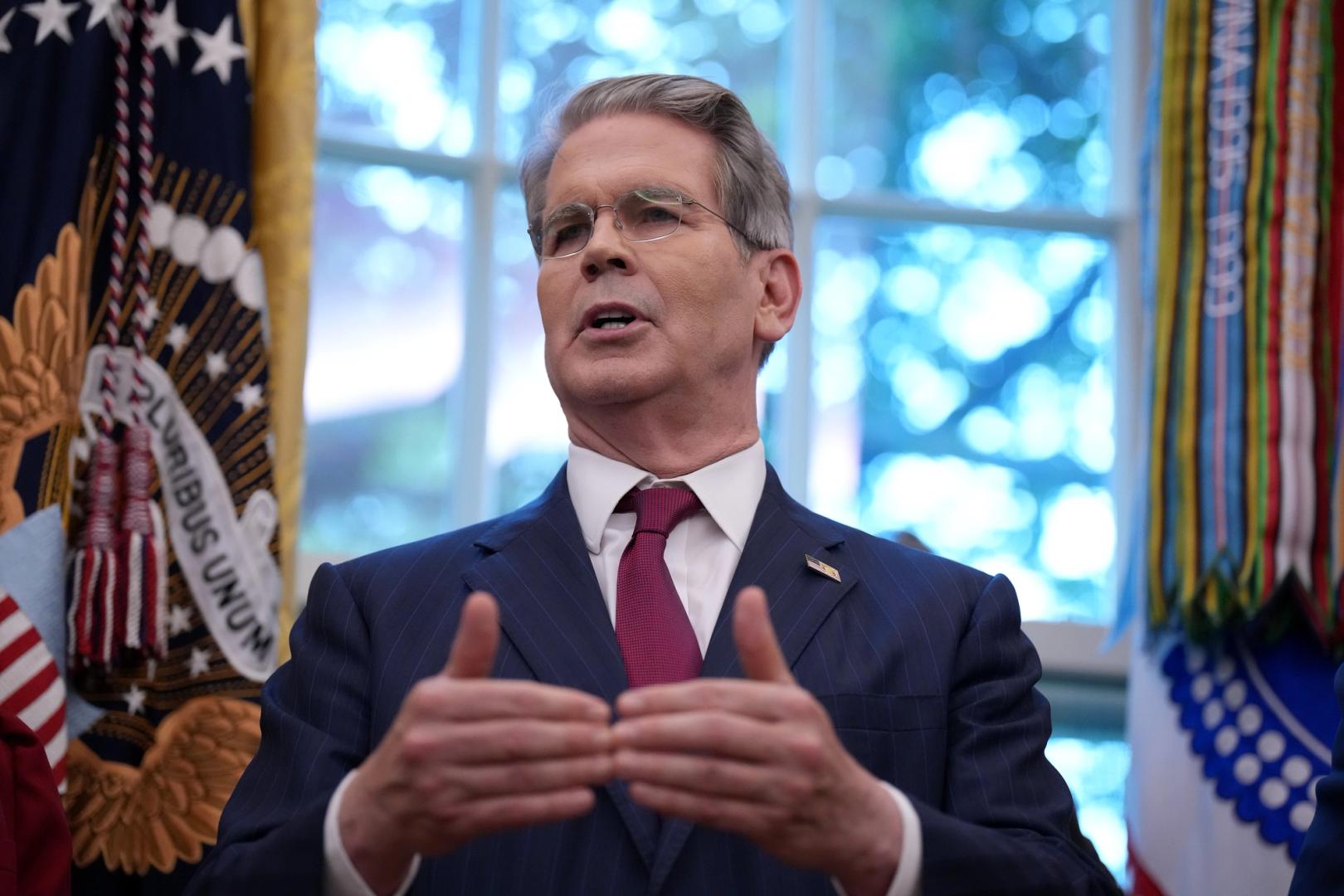

At the Bitcoin 2025 conference, U.S. Senator JD Vance made a bold prediction that the number of Americans owning Bitcoin will double from around 50 million to 100 million in the coming years. He described Bitcoin as a symbol of innovation, financial freedom, and a strong hedge against inflation and government overreach, emphasizing that crypto is no longer a fringe movement but a mainstream reality.

Vance’s comments come as the U.S. moves closer to passing the Clarity Act, a long-awaited bill expected to settle crypto’s biggest legal gray area: who regulates it. For years, the SEC and CFTC have fought over jurisdiction, creating confusion for projects, exchanges, and investors. The Clarity Act aims to fix that by clearly defining which tokens are securities and which are commodities, giving the crypto industry a solid legal foundation to grow.

Analysts at Bitwise estimate there’s now an 80% chance the Clarity Act will pass by early 2026. If approved, it could mark the start of a new era for U.S. crypto markets, paving the way for banks, corporations, and institutional investors to fully embrace blockchain and Bitcoin integration.

The growing wave of Bitcoin ETFs and Wall Street interest has already boosted confidence in digital assets, but regulatory clarity could take that momentum to another level. With clear rules, more institutions are expected to launch crypto products, and more Americans could start viewing Bitcoin as part of their long-term savings or retirement strategies.

Vance’s optimism reflects the broader sentiment that Bitcoin’s best days may still be ahead. As the U.S. edges toward clearer regulation and financial institutions prepare to integrate blockchain into everyday use, the dream of mainstream crypto adoption looks closer than ever.

If the Clarity Act delivers on its promise, 2026 could be remembered as the year Bitcoin truly became a household name, not just an investment, but a cornerstone of the modern financial system.

Bitcoin is currently trading at around $109,956, with nearly 19.94 million BTC in circulation out of the total supply cap of 21 million coins. The top cryptocurrency hit an all-time high of $126,198 on October 7, 2025, and once traded as low as $0.0486 back in July 2010, a massive gain of over 226 million percent since then.

Although Bitcoin is down about 12.8% from its recent peak, it’s still showing strong long-term momentum. With its fixed supply limit, Bitcoin remains a deflationary asset, meaning scarcity could help support its value over time.

For traders, the 50-day moving average sits at $114,076, reflecting short-term price action, while the 200-day average is around $109,491, suggesting Bitcoin is holding steady in a broader uptrend despite the recent dip.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Around 50 million Americans currently own Bitcoin in 2025, and experts predict that number could reach 100 million as adoption and regulation expand.

The Clarity Act defines which crypto assets are securities or commodities, providing long-awaited legal clarity that could boost investor confidence.

The CLARITY Act gives Bitcoin a clear regulatory status as a commodity, helping banks and institutions safely integrate it into financial systems.

Despite short-term volatility, Bitcoin’s fixed supply and rising global adoption make it a long-term store of value for many investors.

The post Virtuals Protocol Price Prediction 2025, 2026 – 2030: Will VIRTUAL Price Hit $5? appeared first on Coinpedia Fintech News

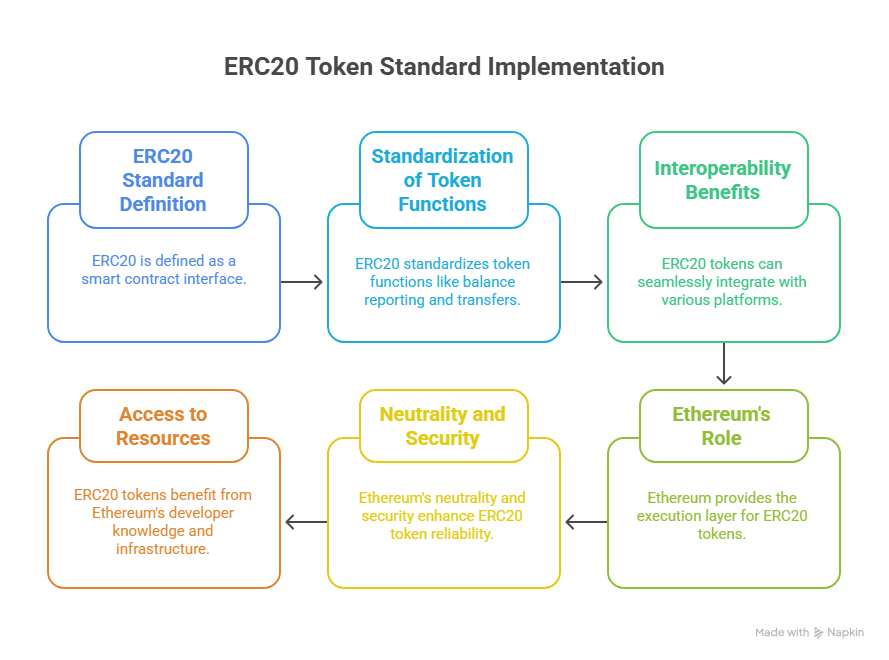

Launched on the Ethereum chain, the Virtuals Protocol is an innovative AI project to revolutionize virtual interactions. Notably, it is at the forefront of integrating AI with virtual atmospheres. Primarily designed to facilitate seamless virtual interactions, it is a key player in the Metaverse space.

Notably, it leverages AI to enhance user experiences in virtual worlds, enabling a more engaged and interactive space. This makes this one-of-a-kind project of this segment in the ever-growing crypto-verse.

Planning on investing in this undervalued AI project? CoinPedia’s expert panel has covered the Virtuals Protocol (VIRTUAL) Price Prediction 2025, 2026-2030.

| Cryptocurrency | Virtuals Protocol |

| Token | VIRTUAL |

| Price | $ 1.83861499  34.11% 34.11% |

| Market cap | $ 1,206,260,399.9583 |

| Circulating Supply | 656,070,141.7701 |

| Trading Volume | $ 989,270,944.2068 |

| All-time high | $5.07 on 02nd January 2025 |

| All-time low | $0.007605 on 24th January 2024 |

VIRTUAL) is trading at $1.79, with strong upward momentum. Technicals indicate:

If the Artificial Intelligence (AI) segment continues gaining momentum, this could result in this category experiencing exponential growth in the near future. Moreover, the token is also under consideration of Grayscale. With this, the VIRTUAL price could surpass its previous high and conclude the year with a new annual high of $4.50.

However, a bearish setback or unfavorable cryptocurrency regulations could pull the price of Virtuals Protocol toward its low of $1.50. Considering the market sentiment, the average price could settle at around the $3.00 mark.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $1.50 | $3.00 | $4.50 |

Wondering about the long-term price targets of ETH token? Read CoinPedia’s Ethereum Price Prediction to unfold the possible mysteries!

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | $2.25 | $4.50 | $6.75 |

| 2027 | $3.38 | $6.75 | $10.13 |

Virtuals could witness increased traction from expanding AI-metaverse adoption, with prices likely stabilizing around $2.25 to $6.75 as investor confidence grows.

Enhanced partnerships and new real-world integrations may push the token’s value between $3.38 and $10.13, reflecting deeper ecosystem engagement.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2028 | $5.06 | $10.13 | $15.19 |

| 2029 | $7.59 | $15.19 | $22.78 |

| 2030 | $11.39 | $22.78 | $34.16 |

As decentralized identity solutions evolve, Virtuals may sustain growth momentum, potentially fluctuating from $5.06 to $15.19 during the year.

With wider adoption of AI avatars and virtual environments, the VIRTUAL token might range between $7.59 and $22.78, driven by rising metaverse demand.

If Virtuals maintains innovation and secures global recognition, the token could achieve long-term stability near $11.39 to $34.16 as market maturity peaks.

Are you considering stacking AIOZ token in your portfolio? Read our Aioz Network Price Prediction until 2030!

| Firm Name | 2025 | 2026 | 2030 |

| CoinCodex | $4.08 | $3.32 | $6.96 |

| Changelly | $1.90 | $2.35 | $10.27 |

*The aforementioned targets are the average targets set by the respective firms.

With more fundamental updates and partnerships with data giants, the Virtuals Protocol crypto token could create a significant impact in the AI segment. With this, the altcoin could push its value toward a new all-time high (ATH) in this AltSeason.

Suppose the crypto market turns extremely greedy, in that case, the VIRTUAL price could reach a high of $4.50. However, under a bearish situation or a pump-and-dump situation, this AI project could plunge toward its annual low of $1.50.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $1.50 | $3.00 | $4.50 |

Planning on investing in JUP crypto token before the altcoin market begins? Read CoinPedia’s Jupiter Price Prediction!

Virtuals Protocol is a unique blockchain-based Artificial Intelligence project that aims to restructure virtual interchanges via its AI and Metaverse protocol.

The VIRTUAL crypto token is available for trading on major centralized cryptocurrency exchanges.

Considering a bullish outlook, this altcoin could conclude the year 2025 with a potential high of $4.50.

Yes, the Virtuals Protocol token is listed on the Coinbase wallet for trading.

With a potential surge, the VIRTUAL coin price may reach a maximum trading price of $34.16 by 2030.

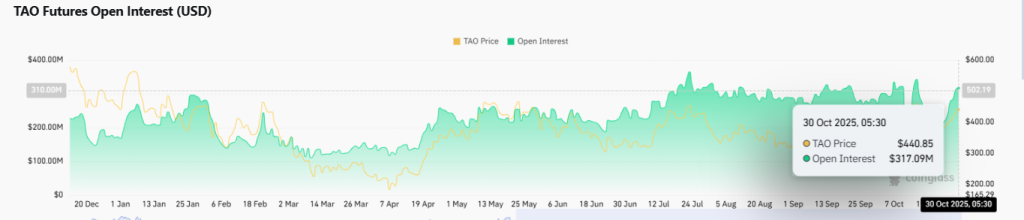

The post Bittensor Price Prediction 2025, 2026 – 2030: Will TAO Price Record A 2X Surge? appeared first on Coinpedia Fintech News

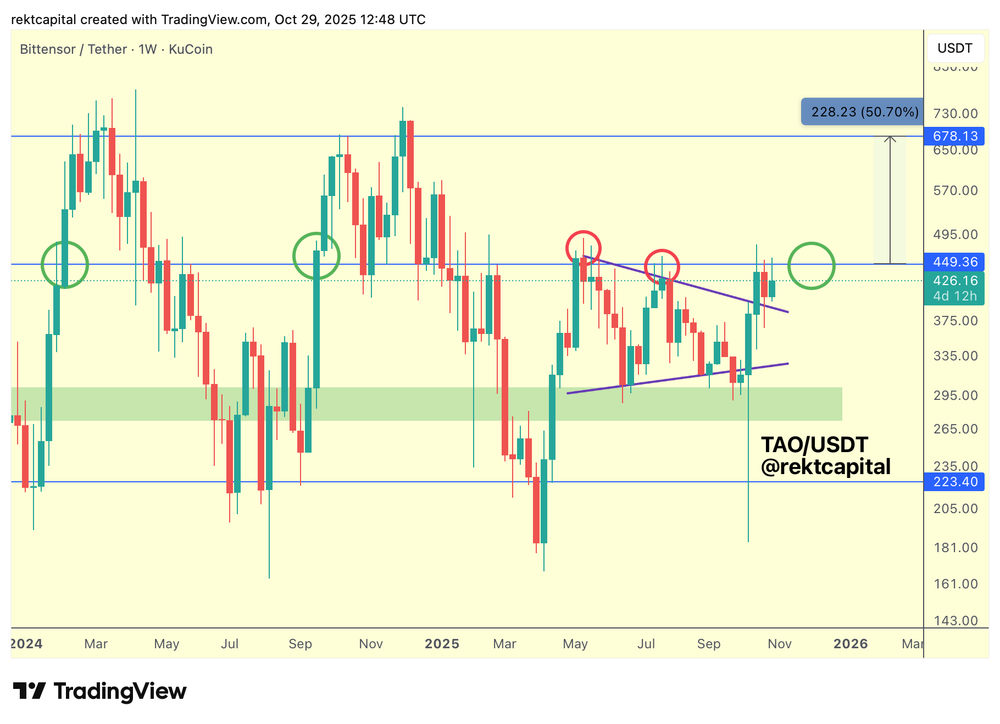

Bittensor is proving to be one of the most exciting projects in the crypto and AI world. After a big price surge in early 2025 during the AI investment boom, TAO’s price dropped back to the same price it had in mid-2024. But despite the volatility, the token continues to push forward, refining its technology and expanding its ecosystem.

Contrarily, Libertex has officially listed TAO in its CFD lineup, making the token easier to trade and more accessible to a wider audience. The listing allows traders to engage with TAO through leveraged products. With CFDs now available, TAO could see stronger liquidity as market participants gain more ways to enter, boosting exposure for the project across global markets.

Read the detailed Bittensor price prediction 2025, 2026-2030 to see where the AI-powered crypto price is headed.

| Cryptocurrency | Bittensor |

| Token | TAO |

| Price | $523.5209

|

| Market Cap | $ 5,347,568,553.73 |

| 24h Volume | $ 1,023,472,038.6224 |

| Circulating Supply | 10,214,622.2964 |

| Total Supply | 21,000,000.00 |

| All-Time High | $ 767.6797 on 11 April 2024 |

| All-Time Low | $ 30.4010 on 14 May 2023 |

TAO is trading near $525.62, holding above the 20-day SMA at $343.9 after a sharp spike. Technicals indicate:

A major event is set for December 2025 when Bittensor will undergo its first halving, cutting daily TAO emissions from 7,200 to 3,600. This scarcity model mirrors Bitcoin but is tailored for AI adoption timelines. Institutional moves, such as Oblong Inc.’s $8 million TAO acquisition and increased staking by TAO Synergies, show confidence in its potential, though such concentrated buying may cause market swings.

A major part of the token lies in its incentive model. Every day, 7,200 TAO are emitted, with 18% flowing directly to subnet creators, which are like mini AI apps or services on the Bittensor network. Big firms are also starting to pay attention: Nasdaq-listed companies like Synaptogenix and Oblong have acquired $17.5 million worth of TAO since June 2025, mirroring the strategic moves MicroStrategy made with Bitcoin.

On an optimistic note, the TAO coin price could surge to a maximum of $779.00 during 2025. However, stricter regulation or a bearish action could result in this AI token losing momentum. With this, the price may conclude the year with a potential low of $259.67. Considering the buying and selling pressure, the average price could land at $519.33.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $259.67 | $519.33 | $779.00 |

Also, read our FET Price Prediction 2025, 2026 – 2030!

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2026 | $389.50 | $779.00 | $1,168.50 |

| 2027 | $584.25 | $1,168.50 | $1,752.75 |

The Bittensor crypto can record a potential high of $1,168.50 in 2026, with a potential low of $389.50. This could result in it experiencing an average price of $779.

Looking forward to 2027, the TAO price may record a low of $584.25, with a potential high of $1,752.75, and an average forecast price of $1,168.50.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2028 | $876.38 | $1,752.75 | $2,629.13 |

| 2029 | $1,314.57 | $2,629.13 | $3,943.69 |

| 2030 | $1,971.85 | $3,943.69 | $5,915.54 |

Furthermore, the Bittensor Price for 2028 projects values between $876.38 and $1,752.75. With this, the average price could land at around $2,629.13.

TAO coin price could conclude 2029 with a potential high of $3,943.69, and a potential low of $1,314.57, with an average price of $2,629.13.

During 2030, the Bittensor token may record its lowest price at $1,971.85, with a potential high of $3,943.69, and an average trading price of $5,915.54.

| Firm Name | 2025 | 2026 | 2030 |

| Wallet Investor | $900.18 | $1,215.11 | – |

| priceprediction.net | $565.20 | $829.31 | $3,625 |

| DigitalCoinPrice | $1,211.42 | $1,672.52 | $3,586.02 |

CoinPedia’s price prediction for the TAO token suggests that this crypto may record a new all-time high (ATH) during the upcoming AltSeason. The Bittensor Price projection for 2025 predicts a high of $259.67, with an average price of $779.00.

| Year | Potential Low | Potential Average | Potential High |

| 2025 | $259.67 | $519.33 | $779.00 |

Read our Gnosis Price Prediction 2025, 2026 – 2030!

One can buy, hold, or sell TAO tokens by creating an account on a centralized or decentralized crypto exchange.

Yes, this project has aligned many exciting upgrades and features. This makes this altcoin a good buy for the long-term perspective.

The Bittensor price could reach a maximum of $779 in 2025.

This Artificial Intelligence (AI) token is available for buying and selling on all major centralized and decentralized platforms.

With a potential surge, this altcoin could range between $2,473 and $3,106 during 2030.

The post Bitcoin, Ethereum, XRP Price Prediction for November 2025, What’s Coming? appeared first on Coinpedia Fintech News

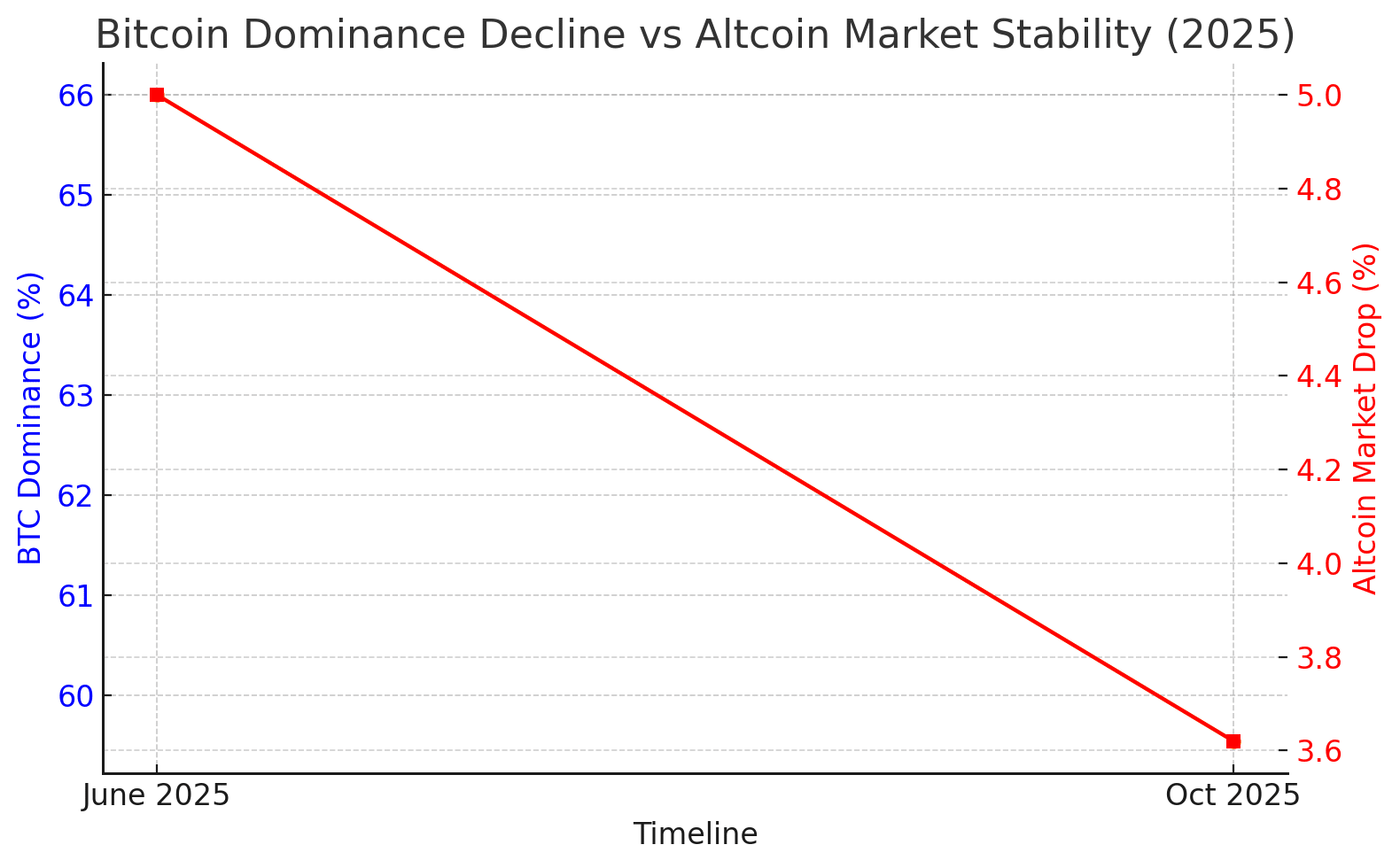

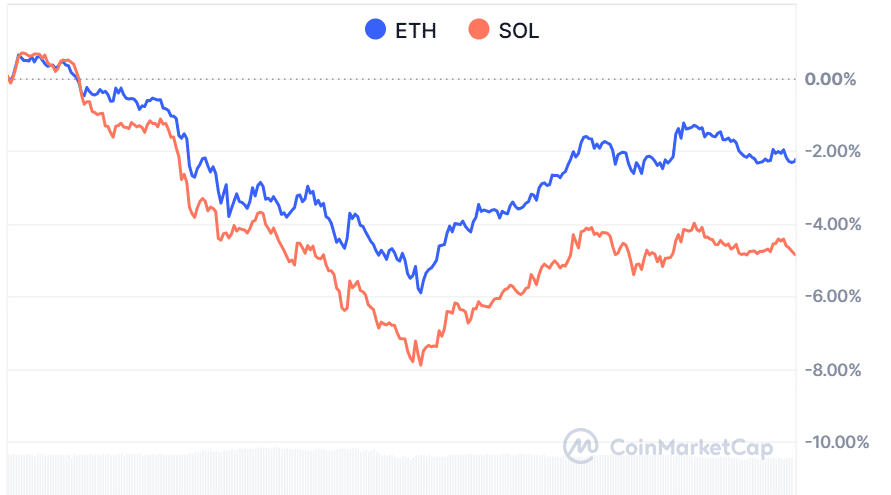

As November 2025 opens, the crypto market posts a 0.58% daily gain, taking global capitalization to $3.71 trillion. Despite the modest uptick, traders face a climate of caution: the market’s 7-day loss stands at -1.01%, even as privacy coins rally and technical indicators show mixed momentum.

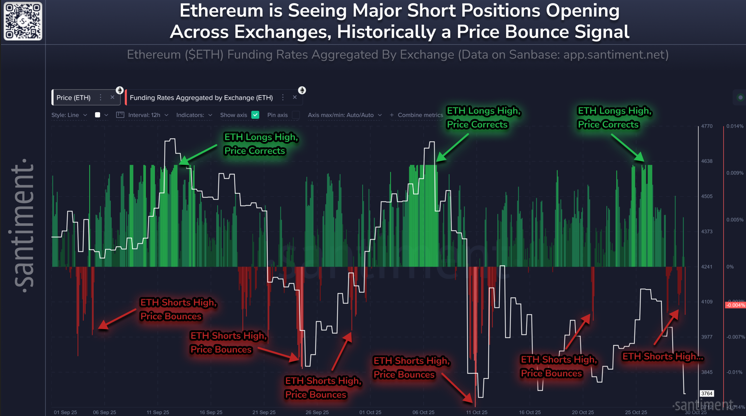

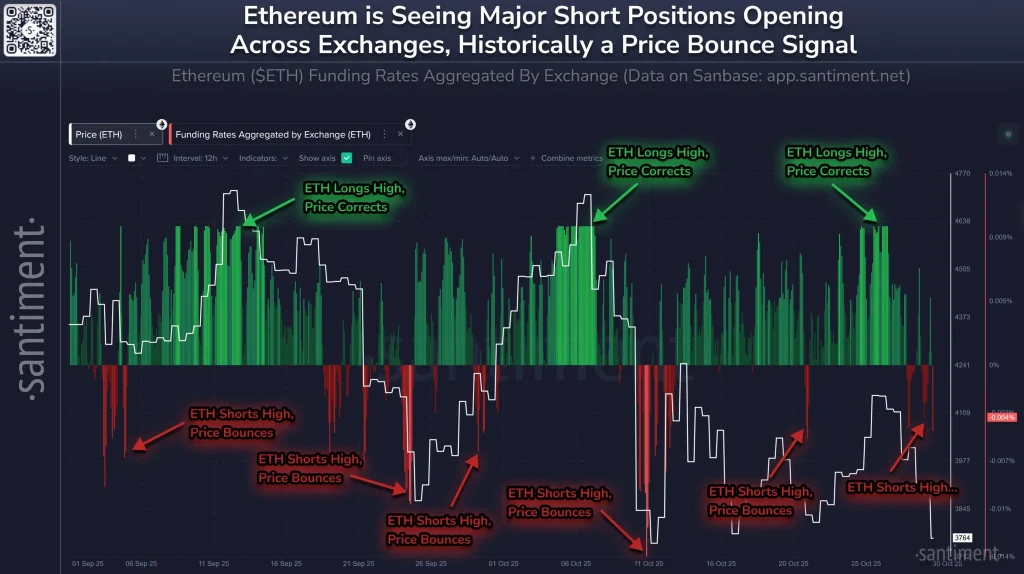

Total 24-hour volume is robust at $143.461 billion, but the Fear & Greed Index reflects skittish sentiment at just 33. The broader Altcoin Season Index prints a tepid 32/100, and with the average crypto RSI at 46.3, most majors sit in neutral territory. Ethereum’s negative funding rates hint at an impending short squeeze, while a 0.45 correlation to the Nasdaq reflects strong macro optimism.

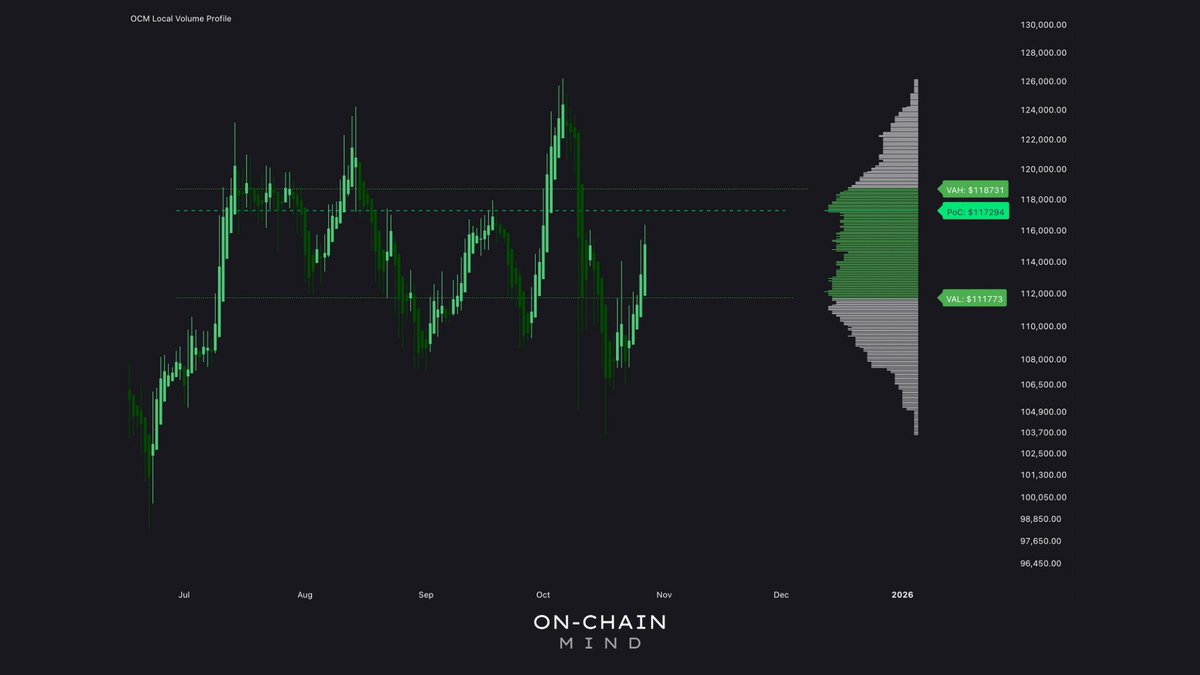

Bitcoin price trades at $110,163.62 after slipping -1.45% for the week, but retains a near-flat 24-hour change. The chart indicates a series of lower highs above $109,200, closely shadowing tightening Bollinger Bands—a classic precursor to heightened volatility. With volume dropping 2.7% over 24 hours, traders are bracing for a large directional move.

Technically, BTC’s daily support holds at $109,208, with secondary cushions at $107,696 and $104,582. Resistance aligns with the mid-band near $110,433 and extends toward $115,600. If BTC breaks above today’s immediate resistance at $110,433, it could target the $115,600-$118,000 region. Conversely, failing to hold $109,200 risks a further dip to $107,696.

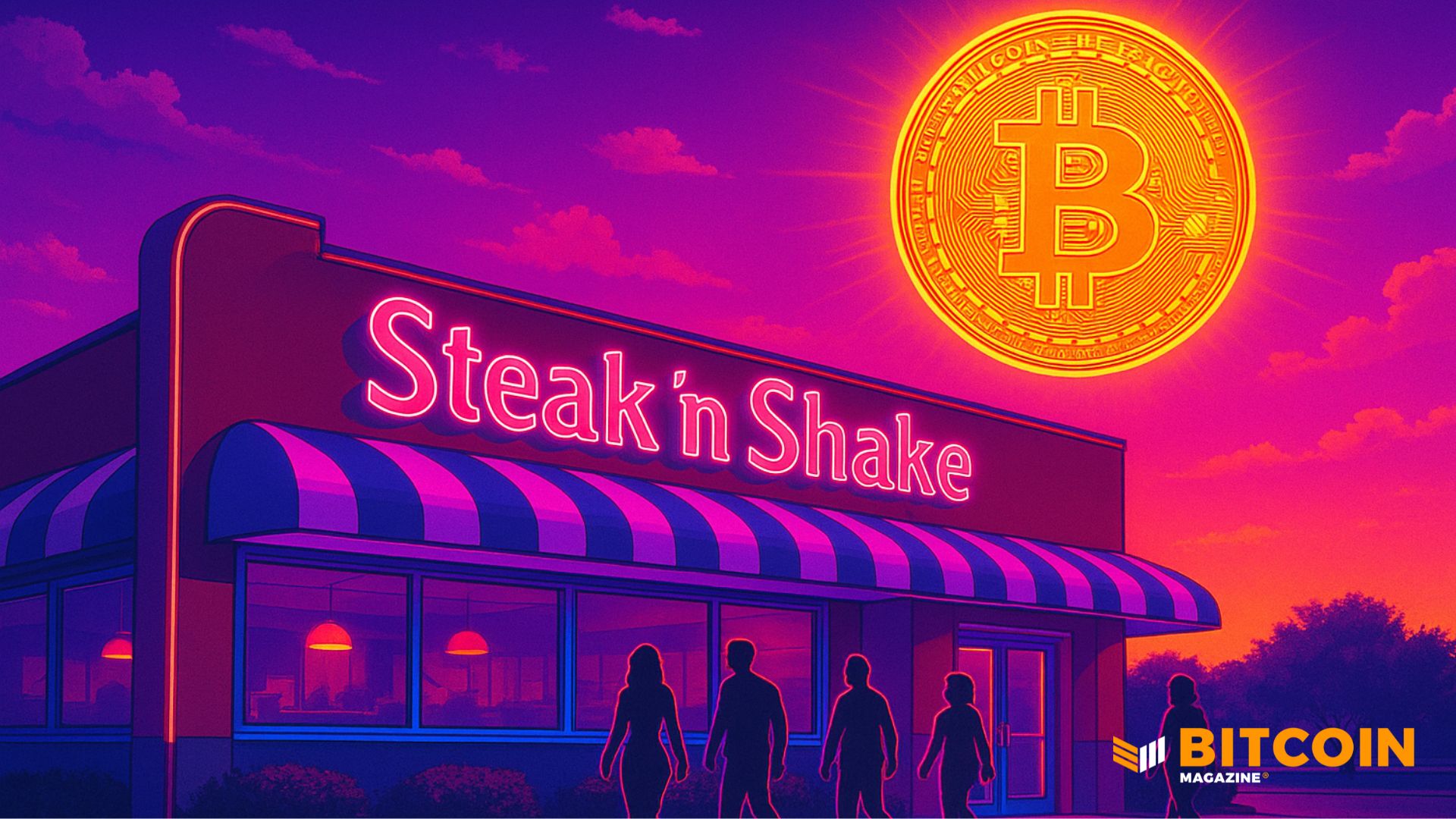

Historically, November delivers outsized Bitcoin gains (42.5% average since 2013). And institutional interest, underscored by Steak ’n Shake’s treasury allocation, bolsters the bullish narrative for a possible late-month surge.

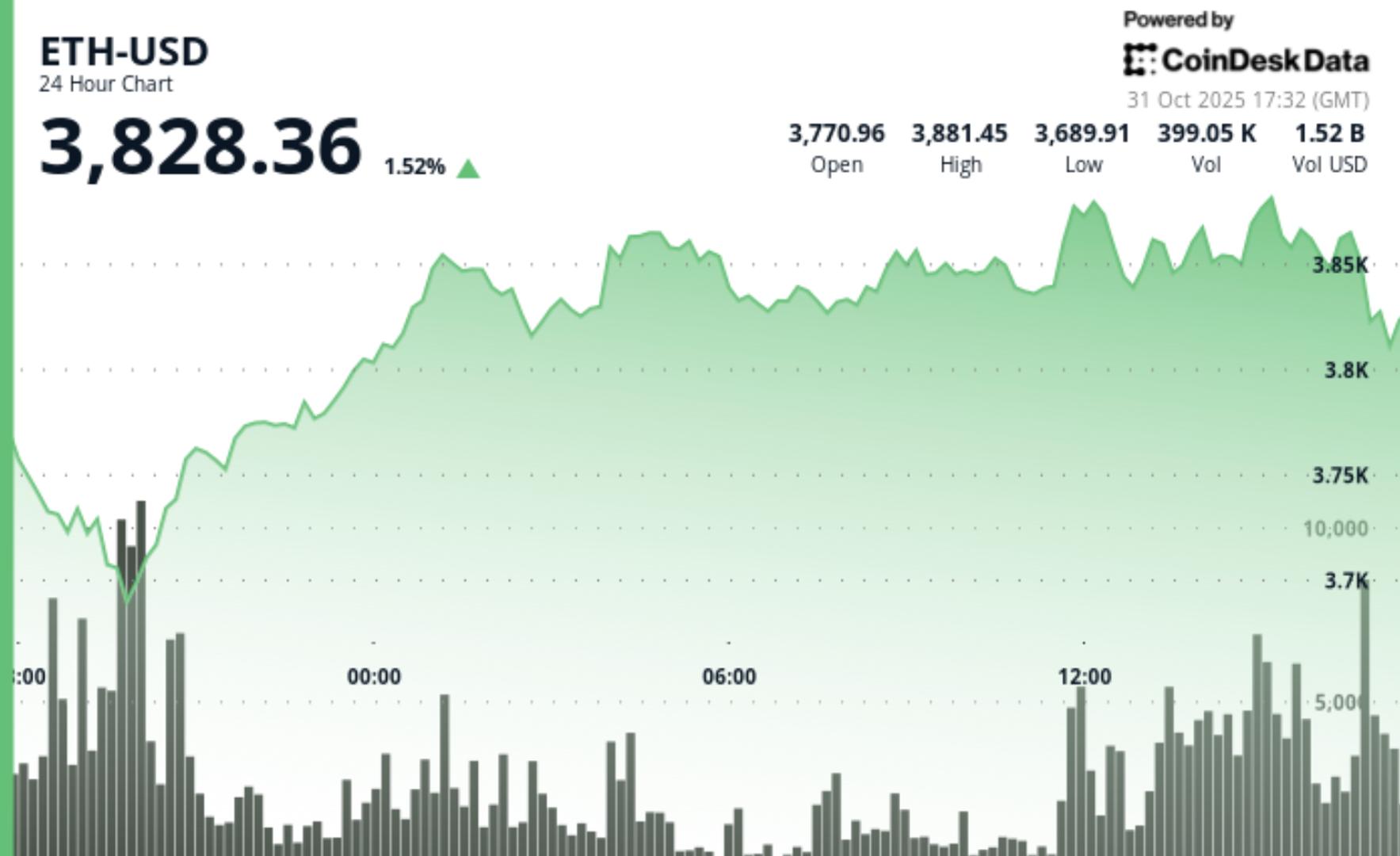

Ethereum hovers at $3,878.86, down slightly for the week but up 0.79% in 24 hours. The daily chart reveals a technical bounce from the $3,713 support, with price rebounding inside a tightening Bollinger Band. Oversold RSI readings and a nascent MACD crossover suggest a short-term momentum reversal is forming.

ETH price faces strong resistance at $4,101 and upper hurdles at $4,194 and $4,265. On the downside, $3,713 remains the pivot to watch, with deeper support near $3,698. This week saw $643 million in ETH exit exchanges, reducing immediate sell pressure, while persistent negative funding rates offer short squeeze fuel. If bulls reclaim $3,950, a move toward $4,100–$4,200 is feasible. However, failure at $3,713 would expose $3,698 and possibly $3,495.

XRP trades at $2.51 with minor daily gains (+1%) despite a -1.29% weekly slip. The chart displays sideways movement around $2.50 as Bollinger Bands tighten and RSI hovers near 45, indicating neither strong overbought nor oversold conditions. Notably, a potential bullish MACD crossover is materializing near the critical $2.50 support.

Bitwise’s XRP ETF progress and RLUSD stablecoin adoption headlines have cheered sentiment, counteracting weak volume (-28.57% in 24 hours). If XRP holds above $2.50, price targets cluster at $2.68 and stretch to $2.83. A breakdown risks $2.37 and, in extension, $2.14. With fundamentals aligning and technicals cautiously optimistic, XRP price could challenge $2.68–$2.83 on positive news flow.

Tightening Bollinger Bands and lower volumes usually precede significant price swings, combined with institutional accumulation, this sets the stage for volatility.

Oversold RSI, strong exchange outflows, and negative funding rates signal conditions are ripe for a short squeeze-driven recovery.

If ETF approval occurs and RLUSD adoption widens, XRP could see renewed upside, targeting the $2.68–$2.83 resistance band.

The post Custodia Bank Loses Appeal as Court Upholds Fed’s Crypto Account Rejection appeared first on Coinpedia Fintech News

The fight between Custodia Bank and the Federal Reserve just took another sharp turn, and it’s not in favor of crypto. A U.S. 10th Circuit Court of Appeals has sided with the Fed’s decision to deny Custodia Bank a master account, a move that effectively keeps crypto-focused banks locked out of the nation’s central banking system for now.

Custodia applied for a Fed master account in 2020 to bridge crypto and traditional banking. After a 19-month wait, the Fed rejected the request in January 2023, citing weak risk management in its crypto-focused model.

Custodia sued, arguing the Fed had no right to deny eligible applicants. However, the appeals court recently ruled in favor of the Fed, upholding its authority to protect financial stability.

In its recent decision, the appeals court sided with the Fed.

Statement of @custodiabank: pic.twitter.com/6U0FPzaKCm

— Custodia Bank(@custodiabank) October 31, 2025

Judge Timothy Tymkovich disagreed with the decision, saying the Fed’s rules require it to give access to all eligible banks. Custodia called the ruling “disappointing” but said it might appeal, as similar cases could set different precedents.

For now, the decision keeps crypto-focused banks locked out of the Fed’s payment system, a setback for those trying to bridge crypto with traditional finance.

Still, change could be coming. Fed Governor Christopher Waller has proposed introducing “skinny master accounts” for fintech and stablecoin firms. These accounts would allow limited, highly regulated access to the Fed’s payment systems, with strict conditions like no overdrafts, no interest, and capped balances.

If implemented, it could represent the Fed’s cautious first move toward engaging with the crypto sector, offering access, but under tight control.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The court ruled the Fed has discretion to deny access, citing weak risk controls in Custodia’s crypto model and its duty to protect financial stability.

The decision keeps crypto-focused banks out of the Fed’s system for now, limiting their ability to directly settle payments or hold reserves.

No. The court clarified that eligibility doesn’t guarantee access — the Fed can deny accounts to safeguard the financial system.

Yes. Custodia plans to consider an appeal, and future cases could shape how courts balance innovation with regulatory oversight.

The post Thodex Founder Found Dead in Prison appeared first on Coinpedia Fintech News

Faruk Fatih Ozer, founder and former CEO of the Turkish cryptocurrency exchange Thodex, was found dead on November 1, 2025, in his prison cell. Authorities are investigating the possibility of suicide. Ozer was serving a staggering 11,196-year sentence, given in 2023 for charges including fraud and money laundering. Thodex, founded in 2017, collapsed suddenly in 2021, leaving thousands of investors with losses around $2.6 billion. Ozer fled to Albania but was arrested and extradited back to Turkey. His death has renewed calls for stronger crypto regulations.

The post Solana vs XRP: Institutional Adoption Battle Heats Up Ahead of Ripple Swell Conference 2025 appeared first on Coinpedia Fintech News

A light-hearted clash broke out on X between Solana and an XRP supporter after Ripple promoted its upcoming Swell conference. The debate centered around which blockchain holds stronger institutional credibility, and Solana didn’t hold back in defending its position.

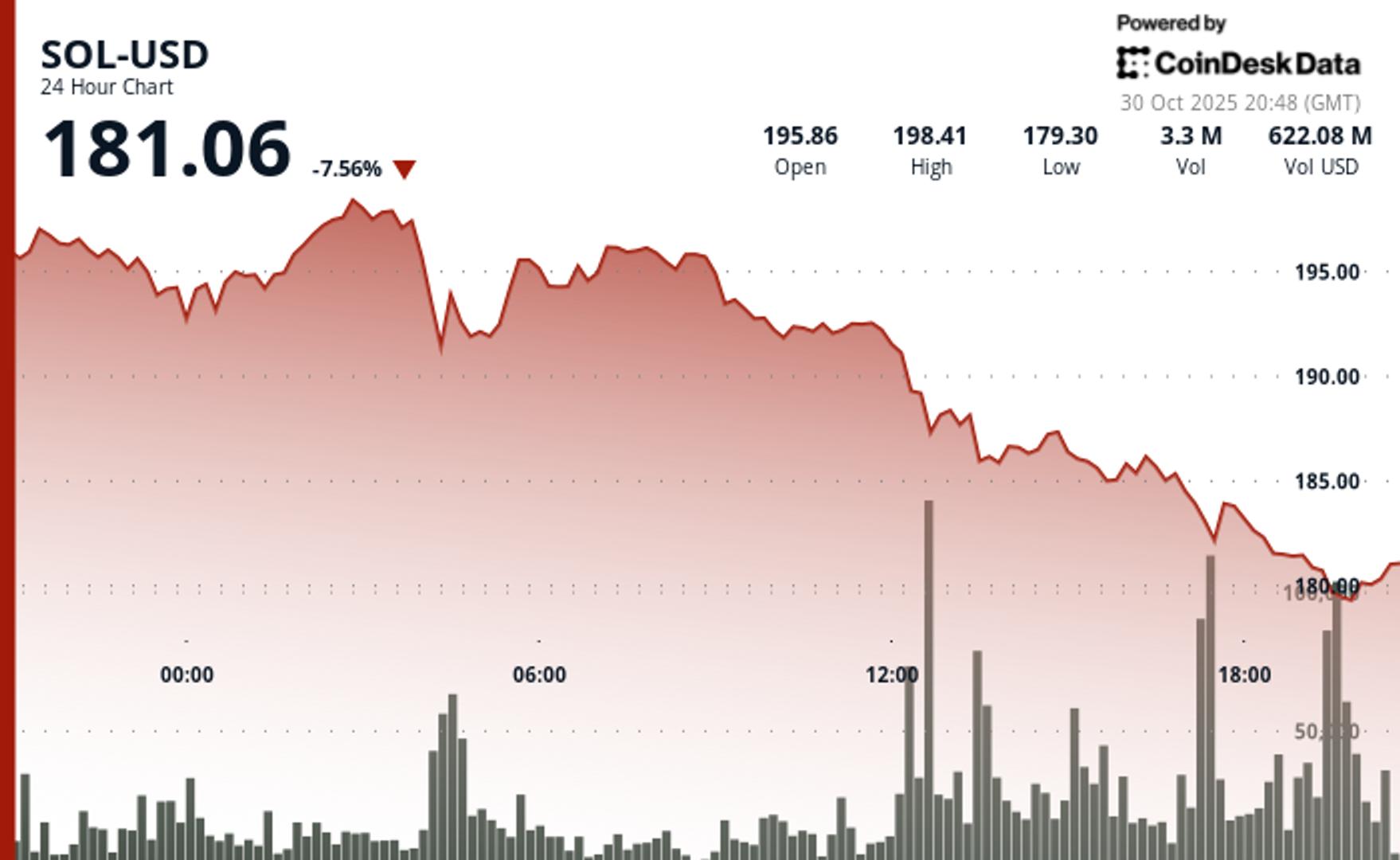

The drama began when an XRP fan commented under Ripple’s Swell promo, claiming that Ripple and XRP “are not on the same level” as Solana, tagging both Solana and Western Union. The comment came after news broke that Western Union would launch its new stablecoin on Solana’s blockchain, a move that caught the attention of both the XRP and Solana communities.

Solana quickly responded, agreeing with the post, but with a twist. “Correct, not on the same level,” the Solana account wrote, before sharing proof of its growing institutional traction. The reply included mentions of major partnerships and endorsements from financial giants like Citi, Franklin Templeton, and Fidelity, along with reminders of recently approved spot Solana ETFs in the U.S.

Western Union’s decision to build on Solana reignited comparisons with Ripple, as the remittance firm had previously explored using Ripple’s technology and XRP for cross-border transfers. Now, with the company choosing Solana instead, XRP supporters expressed disappointment, while Solana fans celebrated the win as a sign of growing trust in its ecosystem.

However, both Ripple and Solana are expanding into institutional finance, but in different ways. Ripple continues to focus on regulated payments and partnerships through events like its Swell conference, which will feature executives from Citi, Franklin Templeton, and Fidelity. Solana, on the other hand, has rapidly gained recognition for its scalability and real-world applications, particularly in stablecoins and tokenized assets.

The playful online exchange highlights how competition between top blockchain projects is heating up, especially as institutions increasingly embrace blockchain technology. For now, Solana’s confident response seems to have given it the upper hand, at least on social media.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Western Union chose Solana for its high speed, low fees, and scalability, ideal for global remittance and real-world payments.

Both have strong ties—Ripple with regulated banks, Solana with asset giants like Fidelity and Franklin Templeton.

Speed, efficiency, and scalability make Solana a preferred choice for stablecoins and tokenized asset projects.

Yes, Solana’s fast and low-cost network could make it more appealing for large-scale financial integrations.

Kronos Research’s Vincent Liu expects Solana ETF inflows to continue next week, noting that rotation from Bitcoin and Ether will likely persist.

Crypto debates DeFi forks while AI companies lock trillions of tokens into proprietary training runs, building permanent data set monopolies. The window closes fast.

Bitcoin fell nearly 4% in October as ETF outflows closed out the month, but Bollinger Bands BTC price volatility odds hit record levels.

zer's death highlights the severe consequences of crypto fraud, raising concerns about security and oversight in the digital currency sector.

The post Thodex exchange founder Faruk Fatih Özer found dead in prison while serving 11,196-year sentence appeared first on Crypto Briefing.

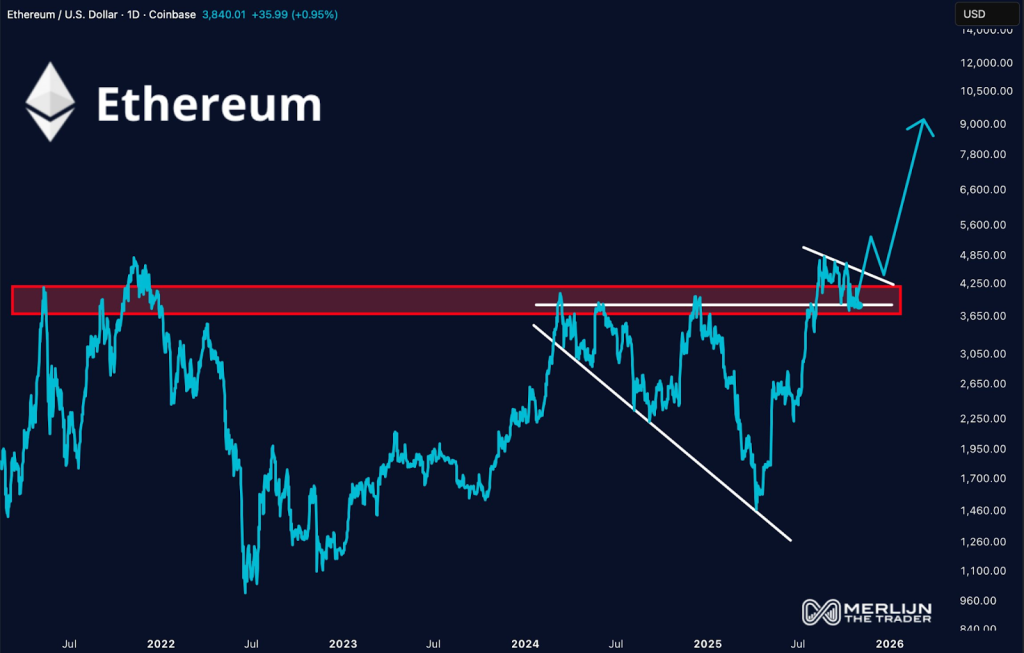

The recent Ethereum price rejection that pushed it back below the $4,000 level has created a concerning trend that could send the price spiraling. The major point of interest lies at the 0.618 Fibonacci retracement level, where the last rejection occurred. Given this, it is likely that the Ethereum price could see more declines in the coming days, although there is still the possibility of the bulls taking over and invalidating the entire bearish setup.

The rejection from the 0.618 Fibonacci retracement level marked the start of the decline from the $4,200 level during the last recovery. This rejection resulted in the formation of a lower high on the 4-hour timeframe, and historically, such lower high formations mean that there is more selling pressure piling up for the digital asset.

As the bullish momentum looks to be fading, it puts the Ethereum price in a precarious position. Crypto analyst The Alchemist Trader explains that the rejection had come with increased bearish volume as investors offloaded their holdings on the market, putting bears in charge once again.

Following this development, the Ethereum price has continued to struggle around $3,900, where the next local support lies. The cryptocurrency has maintained a tentative hold at best on this local support, suggesting that the bulls could indeed be losing ground at this level.

If this corrective phase continues, then the Ethereum price decline is far from over. The current local weakness has put a strain on the support, and if $3,900 fails completely, the next major support lies below $3,400, more specifically at $3,385. This will serve as the next stronghold for the bulls to make their move.

“From a structural perspective, Ethereum’s inability to sustain momentum signals growing bearish pressure across lower timeframes,” the crypto analyst explained.

Despite the mounting bearish pressure, there is still the possibility that the Ethereum price could break out of this downtrend. Just like with the bearish case, the key lies at the $3,900 support and how well it holds.

In the case that bulls are able to reclaim and hold this support with momentum, then it could invalidate the bearish setup that has emerged. In this case, the crypto analyst believes that the Ethereum price could resume its uptrend above the 0.618 Fibonacci retracement level.

Seychelles-based cryptocurrency exchange MEXC found itself in the midst of controversy on Friday as users on social media site X (formerly Twitter) called for immediate withdrawals amid speculation about the exchange’s potential bankruptcy.

Market analyst J.A. Maartun was among the first to draw attention to the situation, sharing a chart on social media that indicated a significant spike in withdrawal transactions around midday.

Researcher Hanzo also shed light on the unfolding drama, revealing the plight of a user known as “The White Whale.” This individual claimed that his account was suspended despite engaging in trading without the use of bots or APIs, leaving him unable to access his funds, which he estimated at between $3 million and $5 million.

The White Whale alleged that customer support was unresponsive and that when he engaged with Cecilia Hsueh, MEXC’s new Chief Strategy Officer, he was pressured to admit to breaking the rules to have his funds released, a claim he firmly denied.

Cecilia later responded that their conversation should have remained private and accused The White Whale of misrepresenting the facts. MEXC subsequently announced its intention to take legal action against him for alleged misinformation.

However, as the situation escalated, a wave of support emerged from the cryptocurrency community, including notable figures like ZachXBT, as many users reported similar issues with MEXC.

This collective response led to warnings on social media urging users to withdraw their funds immediately, fueling the growing unrest.

In a rapid development, Cecilia issued an apology and confirmed that The White Whale’s withdrawal had been processed. She stated:

We fucked up. We apologize to @TheWhiteWhaleV2, and his money is already released. He can claim it at any time. I messed up in communicating with him. I got emotional, and I shouldn’t have. Since I joined MEXC 2 months ago I’ve been fighting behind the scenes to get MEXC to change. We grew really fast—a few years ago, we were a very small exchange, but given our current scale, our risk, operations, and PR teams have not kept up.

She noted that MEXC has experienced rapid growth, but its operational and public relations teams had struggled to keep pace. “We’re going to change that,” she stated, emphasizing that leadership has begun to recognize the need for improvement in transparency and operations.

In response to the swirling rumors of bankruptcy, MEXC took to social media to clarify its financial status. The exchange stated, “Recent online discussions have circulated unverified rumors regarding MEXC’s financial status. We would like to clearly state that these claims are false and misleading.” They assured users that MEXC remains financially healthy, with all user assets fully backed.

Featured image from DALL-E, chart from TradingView.com

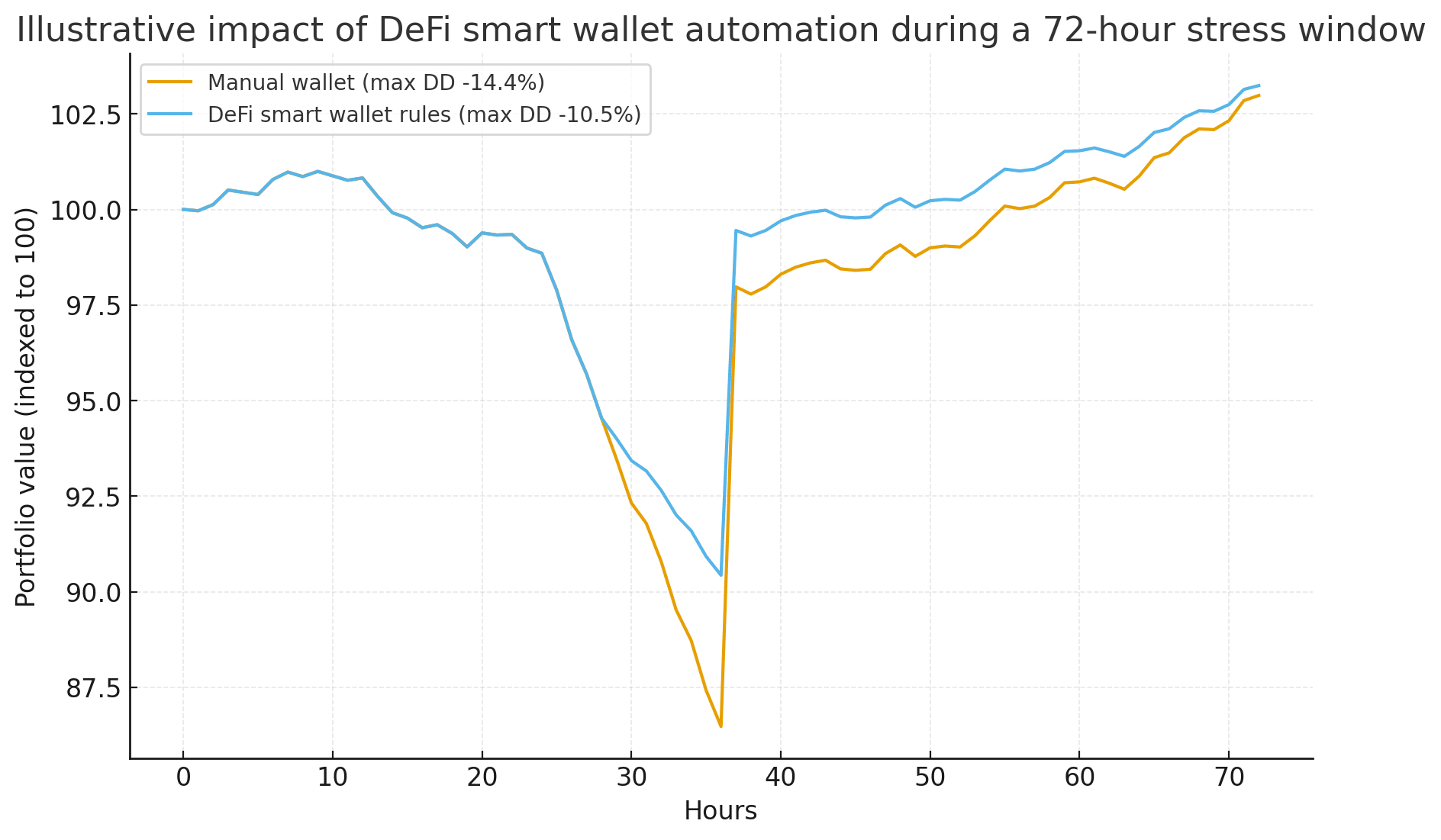

Crypto trades all night, and most wallets still wait for taps and confirmations. That mismatch is the central risk for everyday users. A recent industry op-ed argued that self-custody tools behave like passive vaults and leave people exposed when markets flip at 3 a.m. The author’s thesis is blunt: automation belongs inside the wallet, not bolted on as an afterthought.

The claim resonates because every modern finance stack already uses background rules. Stop losses and scheduled rebalancing are standard on traditional platforms, yet many DeFi interfaces still require manual approval flows that are too slow when volatility spikes.

For proof that minutes matter, the TerraUSD collapse remains a cautionary tale. On Monday, May 9, 2022, around 18:30 GMT, UST fell materially off its peg and swung between ninety-five cents and twenty-five cents over the next three days. Earlier signs had flashed over the weekend, but self-custodied users without pre-defined rules faced a tidal move while asleep.

Timers and thresholds inside the wallet could have trimmed positions or hedged risk automatically. The timeline shows how fast the break unfolded and why manual clicks lose to market speed.

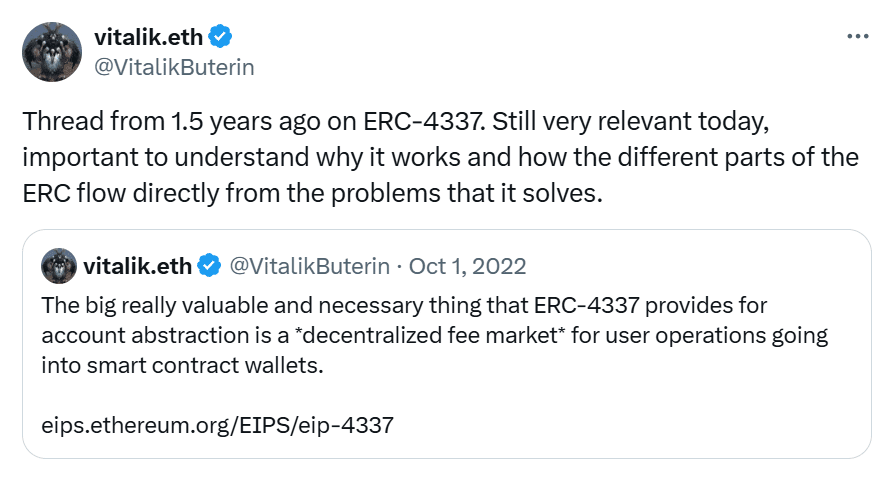

Ethereum’s account abstraction standard, often discussed under ERC-4337, turns a wallet into a programmable smart contract that can enforce custom spending rules, sponsor gas, and run scheduled or conditional actions. The official documentation describes a new transaction flow built on UserOperation objects, a decentralized alt-mempool, and an on-chain EntryPoint that validates and executes rules. In practice it unlocks rule sets a normal person actually wants, such as automatic daily rebalancing or a liquidation guard that pays down debt when a collateral ratio crosses a threshold.

When Ethereum’s co-founder weighed in on this direction, he called the approach “really elegant” and highlighted that account abstraction is a “pretty big deal” for adoption because it lets non-custodial wallets behave like programmable accounts. That view matters because it frames self-custody as more than a seed phrase. It becomes a set of predictable behaviors a user defines once and trusts to run in the background.

The DeFi smart wallets describes wallets that implement account abstraction to provide programmable risk controls, recovery options, and gas handling. DeFi smart wallets collapse multiple steps into one clean action. DeFi smart wallets can hold rules for recurring allocations or borrowing caps.

DeFi smart wallets can also route transactions through paymasters so fees are paid in stablecoins, a minor detail that removes friction in real life. People need DeFi smart wallets that guard downside without sacrificing sovereignty. With DeFi smart wallets, the rules live with the keys. DeFi smart wallets keep the person in command while executing the plan precisely. DeFi smart wallets can finally make “set it and sleep” a reality for self-custody. DeFi smart wallets are not a luxury; they are a safety feature.

DeFi smart wallets also reduce support headaches because users define thresholds instead of relying on frantic approvals. DeFi smart wallets are the practical bridge between crypto’s ideals and normal finance muscle memory. DeFi smart wallets deserve to be the default setting, not the premium tier.

Major builders have rolled out smart wallet flows where a user signs in with a passkey instead of memorizing a seed phrase. The help pages and product posts explain how a passkey based on device biometrics can unlock a non-custodial account, while gas fees can be sponsored or paid in tokens other than ETH.

That combination makes a complex action feel like any mainstream fintech app. It is the usability shift that unlocks the automation shift. If the wallet can sign safely without the user wrestling with seed phrases and gas coins, it can also follow the user’s rules at 2 a.m. without nagging for approval.

Industry research roundups from last year tracked the rise of these features across multiple chains, noting support for passkeys, sponsored transactions, and SDKs that let apps trigger wallet actions behind clean interfaces. The trend line is clear. Smart wallets are maturing from a developer demo into the baseline of consumer crypto.

There is no need to imagine science fiction. The portfolio-automation startups that raised funding in 2025 pitch a simple promise: set allocation rules, risk limits, and timing once, then let the system execute continuously inside a non-custodial setup.

In an interview this year, one founder put it in plain language: “We need to get to a point where we can say, ‘Hey, Mom, do you want to participate in this?’” and described converting a plain-English plan into an automated on-chain portfolio that the user still owns. The same team stated publicly that “your assets should work for you” because the platform runs the portfolio “around the clock,” positioning this as the next evolution of programmable finance.

That is not a radical departure from tradition. It is a reapplication of what brokerage accounts and robo-advisors did years ago. The difference is architectural. Here the rules sit in a smart contract account that the user controls, not in a custodial back office.

Picture a simple spot portfolio with three assets and a lending position that backs a stablecoin. In a smart wallet, the user can store three guardrails. First, a volatility circuit that reduces the high beta allocation by ten percent when a 24-hour move breaches a set band.

Second, a collateral health trigger that automatically repays debt by swapping a slice of spot assets when the ratio falls under a chosen number.

Third, a periodic rebalance that nudges allocations back to target on a fixed cadence. None of that requires a person to watch charts at night. It requires rules that live where the assets live.

The mechanics exist. ERC-4337 lets wallets validate UserOperation packages against spending policies. Paymasters can sponsor gas or accept stablecoins for fees. Developers can wire a scheduler that submits a UserOperation at set intervals. Smart recovery can use guardians so a lost device does not equal a lost life savings. The entire experience looks less like a trader’s terminal and more like a modern banking app that quietly follows instructions.

Automation does not remove all risk. It changes the shape of risk. A poorly written rule can sell a long-term position at the exact bottom. A misconfigured paydown could create taxable events. Implementation bugs in smart accounts or paymasters can create novel failure cases.

Those realities argue for transparent audits, conservative defaults, and clear logs inside the wallet so users can see every rule and every action in human-readable form. The goal is not blind trust. The goal is visible, predictable behavior that beats panic clicking.

The next wave of wallet design should revolve around plain-English rule templates backed by battle-tested contracts. A user should be able to select “Protect from liquidation,” choose a ratio, pick which asset funds the paydown, and preview the worst-case spend before enabling it.

The wallet should show a timeline of upcoming scheduled ops. If the market moves sharply, the user should see which safeguard fired, with a link to the on-chain transaction. That level of clarity is table stakes in regulated finance and should be normal in open finance too.

“It is time for crypto to catch up and deliver what users actually need to thrive. Sleepless traders will not lead the next wave of adoption.” The argument is that built-in automation improves sovereignty rather than undermines it because the user defines the rules.

“The big really valuable and necessary thing that ERC-4337 provides for account abstraction is the ability for smart contract wallets to be first-class citizens.”

The position underscores that programmability is essential infrastructure, not a nice-to-have gadget.

“Your assets should work for you. The platform executes your portfolio strategy around the clock so you can focus on ideas, not transactions.” That is a direct line from a founder who is betting on automation as the default.

Developer posts this year have predicted hundreds of millions of smart accounts over time as chain-level upgrades and wallet defaults tilt toward account abstraction. Forecasts point to chain abstraction and new transaction infrastructure as catalysts. Whether those precise numbers arrive is less important than the direction. Simpler onboarding plus programmable accounts equals an environment where everyday savers can use guardrails without becoming power users.

Education matters too. Clear explainers and help pages on passkeys, gas sponsorship, and recovery patterns are improving. People can now authenticate with a passkey, skip seed-phrase anxiety, and let the wallet sponsor gas or accept stablecoin fees. That seemingly small change breaks a major barrier for first-time users.

The first wallet to offer easy liquidation guards, threshold hedges, and set-and-review rebalancing will not just win users. It will reduce support costs and regulatory friction because fewer people will suffer preventable blowups. In that world, the phrase DeFi smart wallets signals more than a feature list. It signals a philosophy that self-custody should be safe by default and flexible by design. The best implementations will publish transparent audits, use minimal permissions, and expose simple toggles for every background rule so nothing happens without explicit consent.

Stablecoin depegs remain rare, but recent years have delivered several big ones. Education portals have documented those episodes and explained how to think about depeg risk across different collateral models. A wallet that lets a user set a rule like “exit if this stablecoin trades two percent below peg for more than thirty minutes” provides a clear, human tool for managing that rare scenario without drama. In self-custody, that kind of rule belongs in-wallet, not in a separate bot that might lose a key or go offline.

Self-custody should not require sleepless nights. The industry finally has the building blocks to embed risk rules, scheduled tasks, and emergency safeguards directly inside wallets. Account abstraction, passkeys, sponsored gas, and clean recovery flows form the plumbing.

Clear rule templates and readable logs form the user experience. The result is a class of DeFi smart wallets that act as intelligent stewards of a user’s plan. If the sector delivers that standard, volatility becomes less frightening, participation becomes more durable, and crypto starts to look like a place where everyday people can invest with confidence.

What exactly is a smart wallet in this context?

A smart wallet is a non-custodial wallet implemented as a smart contract account. It can enforce user-defined rules for spending, scheduling, and security, and it can accept sponsored gas or alternative fee tokens. It brings automation into self-custody.

How does account abstraction help normal users?

Account abstraction lets wallets behave like programmable accounts. That means passkey sign-ins, recovery helpers, and background actions that follow a person’s instructions. It reduces the number of manual steps needed to perform safe operations.

Can automation harm users if configured poorly?

Yes. Bad rules can trigger at the wrong time. The mitigation is conservative defaults, clear previews, and simple logs so users know what will happen and what did happen. Independent audits and minimal permissions also matter.

Are big builders actually shipping this, or is it theory?

Large teams shipped passkey logins, gas sponsorship, and SDKs for smart wallets this year. Research roundups tracked multi-chain support and developer adoption. The shift is underway.

Account Abstraction (ERC-4337)

A framework that lets wallets act as smart contract accounts. It introduces UserOperation objects, a decentralized alt-mempool, and an on-chain EntryPoint that validates and executes programmable rules for spending and security.

UserOperation

A data structure defined by ERC-4337 that carries a user’s intent to the EntryPoint. Bundlers collect these operations, and the EntryPoint verifies rules before execution. It enables features such as sponsored gas and batched actions.

Programmatic Rebalancing

A wallet rule set that shifts portfolio weights back to target allocations on a schedule or when thresholds are crossed. In smart wallets it can run without manual confirmations.

Liquidation Guard

A rule inside a smart wallet that pays down debt or adds collateral when a lending position approaches a risk threshold. It helps reduce forced liquidations during sharp market moves.

Depeg Risk

The risk that a stablecoin trades away from its peg. Past incidents demonstrate how quickly a peg can fail. Wallet rules that watch price bands and durations can limit exposure.

Editor’s note for clarity: Direct quotations in this article are attributed to identifiable public figures or company posts, and each quotation includes a source link via the citations.

Read More: How DeFi Smart Wallets Cut Liquidations Overnight">How DeFi Smart Wallets Cut Liquidations Overnight

What if the next big crypto bull could leap from peanuts to a power-house overnight? In a market crowded with iconic names like Bitcoin and XRP, the dream remains the same: landing a 1000x altcoin before it moves. Meanwhile, new plays are charging from the sidelines, and one fresh contender is gaining real traction.

The focus now turns to MoonBull, which promises that exact shot at a 1000x altcoin. With the MoonBull presale live in Stage 5, the $MOBU presale is attracting meme-coin fans and crypto developers alike. The question is: will MoonBull deliver where giants like Bitcoin and XRP show less runway?

MoonBull is engineered for the meme-coin crowd with real structure behind the hype. Its Stage 5 presale price is $0.00006584, and the listing price is projected at $0.00616, translating to a current ROI of over 9,256% for Stage 5 entrants. MoonBull early entry yields big token counts: for example, $1 into 15,188.34 tokens, $100 into 1,518,833.54 tokens, $1,000 into 15,188,335.36 tokens.

Here’s the vibe: this 1000x altcoin opportunity isn’t just a catchy phrase, MoonBull is built on that promise. The whitelist is first-come, first-served and once slots fill, they’re gone. Tokenomics include reflections, liquidity boosts and burns to back value.

Imagine grabbing the ground-floor ticket while others are still circling the building. That’s the essence of the 1000x altcoin play with MoonBull. It’s not for the faint of heart, but if the herd charges, the momentum could be wild.

MoonBull empowers every holder to shape its destiny. Each $MOBU equals one vote — no barriers, no lockups. From Stage 12 onward, community members can decide on key proposals like burns, features, and development priorities. All votes are transparent and recorded publicly, ensuring fairness and accountability. This is true decentralized control, giving every investor a voice in the project’s evolution. MoonBull’s governance system turns holders into decision-makers, building a project that’s led by conviction and community power.

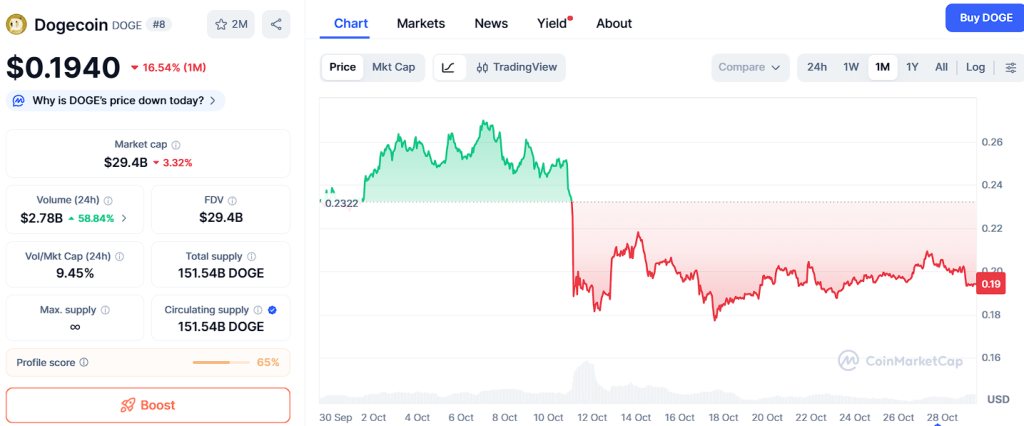

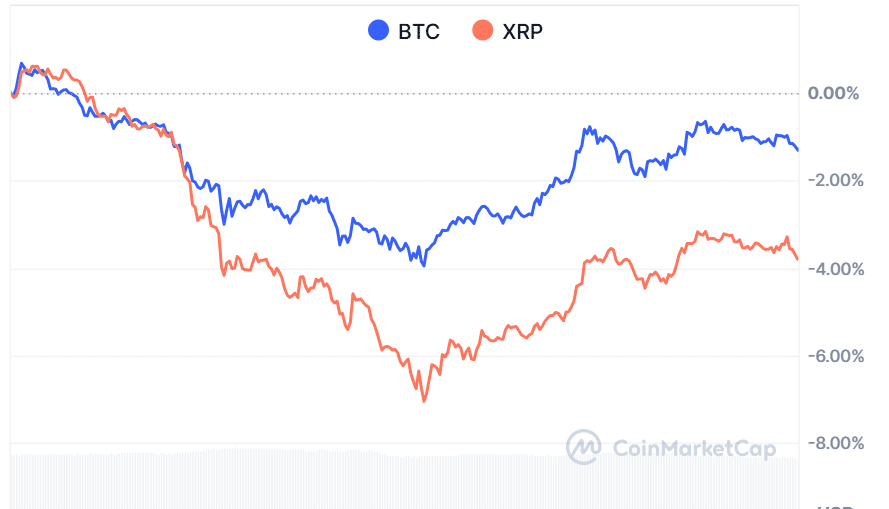

Bitcoin (BTC) is currently trading at $110,117.08, marking a 5.3% decline over the past month as the broader crypto market enters a cooling phase. The leading cryptocurrency maintains a market capitalization of $2.19 trillion, down 0.48%, with 24-hour trading volume at $65.05 billion, an 8.25% increase as traders reposition their holdings.

The recent BTC price dip comes amid investor profit-taking after weeks of sustained gains, along with minor outflows from Bitcoin ETFs. Macroeconomic factors, including shifting interest rate expectations and global market uncertainty, have also contributed to cautious sentiment.

XRP is trading at $2.48, down 14.62% over the past month amid market volatility weighing on major altcoins. The project has a market capitalization of $149.17 billion, down 3.65%, while 24-hour trading volume stands at $5.38 billion, down 10.14%.

The recent XRP price drop can be attributed to profit-taking after its prior rally, coupled with broader crypto market corrections. Additionally, ongoing uncertainty surrounding Ripple’s regulatory situation in the U.S. continues to influence investor sentiment.

XRP and Bitcoin have their place in the crypto zoo, but for bulls chasing the next big breakout, neither stacks up as a true 1000x altcoin from here. Bitcoin is mature and has limited upside, while XRP is solid but lacks the potential for a wild explosion. Now the rocket may rest with MoonBull, which is built for that breakthrough jump.

MoonBull’s presale is live, the Stage 5 entry price is ultra-low, and the token mechanics are structured for early-mover advantage. If the herd catches this now, the upside could match the dream of a 1000x altcoin ride. Don’t sit still, secure your spot, lock in your entry and ride the bull.

Website: Visit the Official MOBU Website

Telegram: Join the MOBU Telegram Channel

Twitter: Follow MOBU ON X (Formerly Twitter)

MoonBull is expected to be one of the top performers in 2025, driven by its presale momentum, strong liquidity rewards, and scarcity-based model.

MoonBull’s early-stage investors are eyeing 1000x returns as the project expands its ecosystem and gains traction among mainstream crypto communities.

MoonBull currently leads as one of the fastest-growing presales, attracting massive investor attention for its utility-driven token and high APY rewards.

MoonBull stands out as the best buy right now due to its presale discount and growth potential compared to established but slower-moving coins.

MoonBull is predicted to dominate 2025, with analysts highlighting its unique reward system and sustainable tokenomics as catalysts for massive long-term gains.

Missed the early moonshots like Bitcoin and XRP? The 1000x altcoin dream might still be alive with MoonBull’s Stage 5 presale. Bitcoin and XRP offer stability, but limited upside. MoonBull offers urgency, discounted entry, structured rewards and meme-power combined. If timing, hype and mechanics align, the next big move may be on the table.

This article is for informational purposes only and does not constitute financial, investment or trading advice. Always carry out your own research and consult a professional advisor before investing in cryptocurrencies.

Read More: 1000x Altcoin? MoonBull Says Yes – As Bitcoin and XRP Slow Down, MOBU Leads as Top Analysts’ Pick">1000x Altcoin? MoonBull Says Yes – As Bitcoin and XRP Slow Down, MOBU Leads as Top Analysts’ Pick

The post Coinbase Close to $2B Deal to Buy BVNK Stablecoin Platform appeared first on Coinpedia Fintech News

Coinbase is reportedly in talks to buy BVNK, a stablecoin infrastructure firm, for nearly $2 billion. The deal is said to be in its final stages and could be completed by the end of this year or early next year. If successful, this would be one of Coinbase’s biggest acquisitions yet and a major step toward expanding its role in the stablecoin market.

According to Bloomberg, Coinbase has already begun the final due diligence process ahead of closing the deal with BVNK, a London-based fintech startup. The company helps businesses handle both crypto and traditional currency payments. Coinbase Ventures, the exchange’s investment arm, is already one of BVNK’s early backers, alongside Citi Ventures, Visa, and Haun Ventures.

People close to the matter say Coinbase won exclusive rights to negotiate the acquisition after a tough bidding process. The company hopes this deal will strengthen its position in the global payments market, especially after new U.S. laws were passed this year to regulate stablecoins.

Stablecoins have become an important part of Coinbase’s business. They now make up nearly 20% of the company’s total revenue, mainly thanks to its partnership with Circle, the issuer of USDC. Coinbase earns a share of the interest from USDC reserves and has also helped integrate USDC payments into Shopify, making it easier for businesses to accept crypto.

Buying BVNK would give Coinbase access to more tools and infrastructure to grow its stablecoin business. It would also allow the exchange to help more companies handle both fiat and crypto payments easily, boosting adoption worldwide.

Founded in 2021, BVNK has quickly become a key player in the stablecoin space. It has raised about $90 million and built a strong payment network that connects crypto and traditional finance. Through this deal, Coinbase would gain BVNK’s technology and network, allowing it to expand into stablecoin-based corporate payments.

This comes after Coinbase recently partnered with Citigroup to test stablecoin payments for corporate clients, aiming to modernize how money moves between banks and crypto wallets.

Coinbase CEO Brian Armstrong recently said he expects the U.S. crypto market structure bill to pass before the end of the year, calling it a big step for regulatory clarity. If the BVNK deal goes through, Coinbase could become a major force in digital payments, combining stablecoins, regulatory oversight, and global merchant access into a powerful ecosystem.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The post XRP ETF Launch Could Happen This November After Bitwise SEC Filing appeared first on Coinpedia Fintech News

The long-awaited XRP exchange-traded fund (ETF) from Bitwise could soon become a reality. Bitwise, the $15 billion asset management giant, has just submitted Amendment No. 4 to its XRP ETF filing with the U.S. Securities and Exchange Commission (SEC), revealing two crucial details.

Experts believe such updates usually signal the final step before approval. If cleared by the SEC, the XRP ETF could go live within just 20 days.

On Oct 31, Bitwise filed an Amendment No. 4 with the SEC to update its S-1 form. The latest updated document includes two crucial details: first, the listing venue will be the New York Stock Exchange (NYSE); and second, the management fee will be 0.34%.

Eric Balchunas, senior ETF analyst at Bloomberg, believes Bitwise’s latest filing marks a major step forward for XRP’s entry into traditional finance. “Adding the NYSE and fee means Bitwise has checked nearly all boxes.”

Bitwise just updated their XRP ETF filing to include exchange (NYSE) and fee of 0.34%, which are typically the last boxes to check. Amendment #4. pic.twitter.com/BUnkasSQY5

— Eric Balchunas (@EricBalchunas) October 31, 2025

Historically, once issuers include exchange and fee details in their S-1 forms, it usually means they’re just waiting for the final green light from the SEC.

Following the update news, ETF expert James Seyffart of Bloomberg Intelligence added more context to it, noting that Bitwise’s latest filing contains “shorter language” that could allow the product to go live within just 20 days, pending SEC clearance.

Seyffart noted that Bitwise isn’t alone, major players like VanEck, Fidelity, and Canary Funds have also updated their filings, signaling that the race to launch an XRP ETF is heating up fast.

Meanwhile, Crypto America host Eleanor Terrett revealed that Canary Funds removed the “delaying amendment” from its S-1 filing, which gives the SEC control over timing.

This sets Canary’s XRP ETF up for a launch date of November 13, if the Nasdaq approves its 8-A filing.

After the latest XRP ETF updates, XRP’s price saw a small uptick, trading around $2.51, showing growing optimism among traders.

Analysts say that if the XRP ETF gets approved, it would mark the first-ever U.S. spot ETF for XRP, a historic moment that could push the token toward its all-time high price.

At present, XRP faces strong resistance near the $2.75 level. A breakout above this could open the door for a test of the $3 psychological mark.

However, if selling pressure continues, XRP might correct by up to 19%, retesting the $2 support zone within its long-term channel pattern.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The Bitwise XRP ETF is a proposed investment fund tracking XRP’s price, awaiting SEC approval. It would trade on the NYSE, making it easier for traditional investors to gain exposure to the asset.

The XRP ETF could launch as soon as 20 days after SEC approval. One issuer, Canary Funds, has a potential launch date of November 13, but this is still pending final regulatory and exchange clearance.

An XRP ETF approval is widely expected to boost the price by increasing demand and institutional legitimacy. This could help it break key resistance levels and challenge its all-time high.

Yes, once approved and live, retail investors can buy shares of the XRP ETF through any standard brokerage account, just like a stock, making investment accessible without holding XRP directly.

When the XRP ETF launches, you can purchase it through your usual online broker by searching for its ticker symbol. It will be listed on major exchanges like the NYSE for easy access.

Key risks include XRP’s inherent price volatility, regulatory uncertainty, and market sentiment shifts. An ETF carries fund-specific risks like fees but simplifies exposure compared to direct ownership.

The post Bittensor TAO Price Surges Past $510, Eyes on $540 and $580? appeared first on Coinpedia Fintech News

Bittensor (TAO) price has set the crypto scene abuzz with a dramatic +21.35% price pump in the past 24 hours. It is now climbing to a 2025 peak of $536.88 on surging volumes. Riding a wave of fresh institutional interest from the debut of the Safello Bittensor Staked TAO ETP, TAO’s price action has turned decisively bullish.

This move comes as attention intensifies ahead of Bittensor’s much-anticipated first halving, fueling speculation and positioning TAO for a technically charged rally.

Bittensor price has delivered an explosive breakout from its multi-week range, chugging past the crucial $510 resistance. Bulls pushed the price as high as $536.88, a level unseen since early 2025, dramatically shifting near-term sentiment. The 4-hour chart shows firmly escalating momentum:

Short-term volatility is likely as traders secure gains near the $540 zone, raising the risk of sharp pullbacks if momentum hampers. However, TAO’s ability to hold above $510 on closing intervals may open a path for another attempt at its all-time high around $767. That being said, if profit-taking intensifies, corrections lie at $478 and $433, both recent support levels.

TAO’s price spike is linked to the Safello Bittensor Staked TAO ETP’s launch, unlocking institutional inflows and daily trading volume up 59%.

The RSI shows overbought conditions, but price momentum is intact. Sudden pullbacks are possible, so traders should be watchful.

If TAO remains above $510, technical signals point to $580.5 as the next resistance, with a longer-term target at the ATH near $767 if bullish flows persist.

The post Malaysia Asset Tokenisation Roadmap: BNM’s 3-Year Plan to Build a Digital Asset Innovation Hub appeared first on Coinpedia Fintech News

Bank Negara Malaysia (BNM) has kicked off a three-year programme to test real-world asset tokenisation. A newly released roadmap aims to understand how blockchain-based tokenization can transform Malaysia’s financial landscape, from Islamic finance to supply chain management, with industry feedback open until March 1, 2026.

BNM has released a Discussion Paper on Asset Tokenisation to collect feedback from the financial and technology sectors. The goal is to create a Digital Asset Innovation Hub and an industry working group that will explore how tokenization can be used in real-world financial systems.

The plan follows a clear three-year roadmap

BNM’s working group will explore use cases in areas such as:

However, BNM has made it clear that not every idea qualifies, projects must show tangible real-world benefits, use blockchain only when it’s the right fit, and remain technically feasible within current infrastructure.

BNM wants tokenization to fix real-world challenges, starting with Malaysia’s RM101 billion SME financing gap by turning invoices into digital tokens, helping small businesses get quicker and cheaper loans.

The central bank also plans to apply this to Islamic finance, where Malaysia already leads globally. Using tokenized sukuk & smart contracts to automate payments, increase liquidity, and improve Malaysia’s RM2.4 trillion Islamic market, while following Shariah rules.

For sustainability, tokenized green bonds could tie payments to verified climate results, reducing greenwashing and boosting investor trust in Malaysia’s fast-growing ESG sector.

With this structured plan, BNM aims to bridge innovation and practicality, positioning Malaysia as a regional leader in regulated digital finance.

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

It’s a guide for industry feedback on how tokenization can be safely applied in finance, forming the base for Malaysia’s digital asset framework.

By converting invoices or assets into tokens, SMEs can access faster, lower-cost financing and improve cash flow transparency.

Yes. Tokenised sukuk and smart contracts can streamline trading, cut settlement time, and boost liquidity in Malaysia’s Islamic markets.

BNM pilots begin in 2026, testing tokenized finance for SMEs, supply chains, and Islamic products before scaling nationwide in 2027.

The post MEXC Confirms 100% Asset Backing Amid Withdrawal Surge appeared first on Coinpedia Fintech News

MEXC exchange has reassured users that it remains financially strong despite recent record withdrawals. The platform confirmed all user assets are fully backed, with Proof of Reserves data showing major assets covered over 100%. To boost transparency, MEXC will update its Merkle tree data tonight, enabling users to verify their holdings independently. The exchange called solvency rumors false and emphasized its commitment to security and trust in the crypto community.

The post Bitcoin Price Prediction: $50,000 Or $500,000 — What Does The Future Hold For BTC As XRP Price Slides appeared first on Coinpedia Fintech News

The market just closed October on edge, and the Bitcoin price prediction debate is boiling. If policy stays tight and risk fades again, the next move could be violent. Traders want clarity, and a growing crowd is already gravitating toward real utility plays. Consider this your heads up: a payments-first project with a live wallet beta and third exchange in view is catching smart money for a reason.

Here is what to watch now, why XRP keeps wobbling, and why a utility coin with bank payout rails is getting serious attention. This is not the day to get comfortable. It is the day to position before the crowd does.

Bitcoin trades at around $109,203 today, with an intraday range of $106,463 to $110,905. The cautious Bitcoin price prediction identifies the first stress zone as ranging from $100,000 to $104,000. Lose that, and liquidity gaps can pull the price toward sub-$90,000.

The optimistic Bitcoin price prediction hinges on 2025 easing and a reversal to ETF inflows, which could put prior highs back in play and keep the multi-year $500,000 path on the table. Catalysts that could flip the script are straightforward: clearer Fed guidance, a reversal in ETF inflows, and stabilizing yields. Until those arrive, funding, basis, and treasury moves keep the Bitcoin price prediction tug-of-war alive.

XRP slipped again into the month-end and trades near $2.51 today after ranging between $2.39 and $2.54 intraday. Bulls still point to payment narratives and improved legal optics, but the tape is unforgiving. If ETF outflows cool and broader risk steadies, XRP can bounce.

If macro tightens again, XRP likely lags higher beta leaders. For now, momentum belongs to catalysts, not hopes. Traders should mark breakdown levels and respect the tape. XRP needs real bids, not wishful thinking.